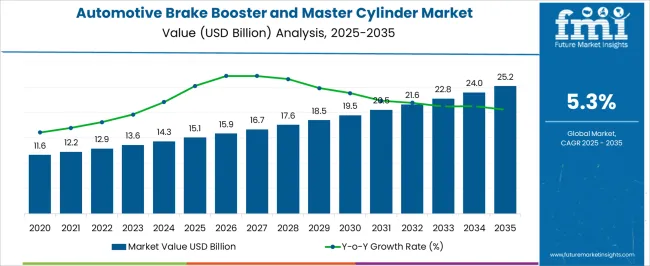

The automotive brake booster and master cylinder market is projected to expand from USD 15.1 billion in 2025 to USD 25.2 billion by 2035, advancing at a CAGR of 5.3%. The CAGR curve shows consistent growth, with values moving from 15.1 billion in 2025 to 17.6 billion in 2028 and 19.5 billion by 2030. Demand is being driven by increasing vehicle production, stricter safety standards, and growing consumer preferences for advanced braking systems in passenger and commercial vehicles.

The steady climb suggests a reliable and robust expansion, driven by the essential role of brake boosters and master cylinders in vehicle safety and performance. From 2031 onward, the market value progresses from 20.5 billion to 21.6 billion in 2032, reaching 22.8 billion in 2033 and 24.0 billion in 2034 before closing at 25.2 billion by 2035.

This sustained growth is expected to come from continued investment in new vehicle models, advancements in braking technologies, and global adoption of electronic and vacuum brake systems. The growth trajectory indicates that while the rate is moderate, it is firmly grounded in long-term demand, with suppliers benefiting from consistent upgrades and replacement cycles in the automotive sector.

| Metric | Value |

|---|---|

| Automotive Brake Booster and Master Cylinder Market Estimated Value in (2025 E) | USD 15.1 billion |

| Automotive Brake Booster and Master Cylinder Market Forecast Value in (2035 F) | USD 25.2 billion |

| Forecast CAGR (2025 to 2035) | 5.3% |

The automotive brake booster and master cylinder segment is estimated to account for about 10% of the automotive brake systems market, around 5% of the automotive component market, nearly 12% of the automotive aftermarket market, about 7% of the automotive safety systems market, and roughly 6% of the commercial vehicle components market. These proportions total approximately 40% across the listed parent categories. This proportion underscores the critical role of brake boosters and master cylinders in vehicle braking systems, as they are essential in providing optimal braking performance, enhancing safety, and improving driver control. Their importance has been solidified in both light passenger vehicles and commercial fleets, where braking reliability and response time are critical.

Analysts consider these components not just functional parts but as key enablers of vehicle safety standards that ensure vehicles meet both regulatory requirements and consumer expectations. Demand has been driven by ongoing regulatory pressures to improve braking systems, advances in vehicle safety technologies, and the growing importance of electric and hybrid vehicles, which require specialized braking systems. As such, brake boosters and master cylinders are seen as integral to the broader automotive market, influencing everything from original equipment manufacturing to aftermarket services. Their presence in parent markets is expected to remain stable as vehicle technology continues to evolve, particularly with the growing emphasis on advanced braking systems for autonomous and electric vehicles.

The automotive brake booster and master cylinder market is witnessing strong growth, supported by increasing production volumes of passenger and commercial vehicles and the rising adoption of advanced braking technologies. Growing emphasis on vehicle safety regulations across regions such as North America, Europe, and the Asia Pacific is driving the integration of high-performance braking systems in both entry-level and premium vehicles.

The rising penetration of anti-lock braking systems, electronic stability control, and autonomous emergency braking is creating consistent demand for efficient brake boosters and master cylinders. Advancements in materials and manufacturing techniques are enhancing product durability, reducing weight, and improving braking response times, aligning with industry trends toward fuel efficiency and reduced emissions.

Expanding automotive production in emerging economies, coupled with the replacement demand from the aftermarket sector, is further strengthening market growth. As vehicle electrification advances, brake system manufacturers are focusing on compatibility with regenerative braking systems and hybrid propulsion technologies, positioning the market for sustained expansion in the coming decade.

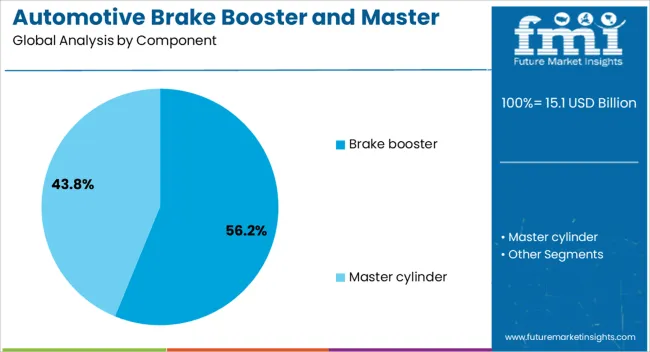

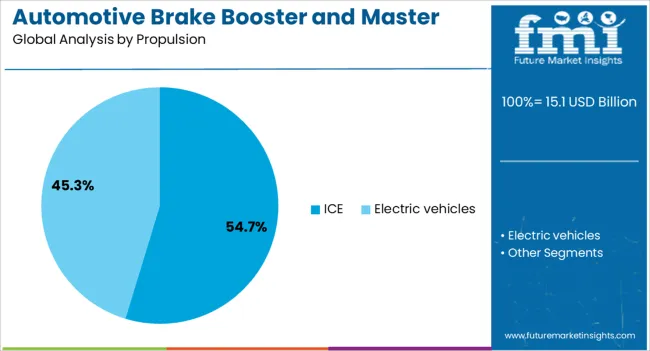

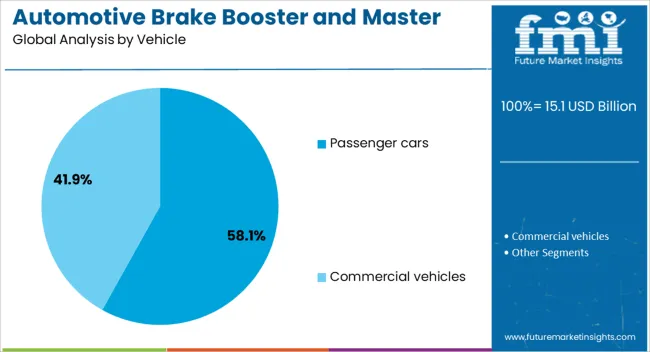

The automotive brake booster and master cylinder market is segmented by component, propulsion, vehicle, technology, sales channel, and geographic regions. By component, automotive brake booster and master cylinder market is divided into Brake booster and Master cylinder. In terms of propulsion, automotive brake booster and master cylinder market is classified into ICE and Electric vehicles. Based on vehicle, automotive brake booster and master cylinder market is segmented into Passenger cars and Commercial vehicles. By technology, automotive brake booster and master cylinder market is segmented into Vacuum-assisted, Hydraulic assisted, and Electronic brake boosters. By sales channel, automotive brake booster and master cylinder market is segmented into OEMs and Aftermarket. Regionally, the automotive brake booster and master cylinder industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The brake booster component segment is projected to hold 56.2% of the automotive brake booster and master cylinder market revenue share in 2025, making it the leading component category. This dominance is being supported by the critical role brake boosters play in reducing pedal effort and enhancing braking efficiency, which significantly improves driving comfort and safety.

The rising demand for vehicles equipped with advanced driver assistance systems is accelerating the adoption of brake boosters that can seamlessly integrate with electronic braking and collision avoidance systems. Hydraulic and vacuum-assisted brake boosters remain widely preferred for their reliability and cost-effectiveness, while demand for electronic brake boosters is increasing in vehicles with hybrid and electric propulsion systems. Ongoing innovations in booster design are enabling better packaging within compact engine bays and enhancing compatibility with lightweight vehicle architectures The segment’s strong market position is reinforced by stringent safety regulations, growing consumer awareness about braking performance, and the continuous shift toward more sophisticated braking technologies in mass-market and premium vehicles alike.

The internal combustion engine propulsion segment is anticipated to account for 54.7% of the automotive brake booster and master cylinder market revenue share in 2025, positioning it as the dominant propulsion type. This leadership is being driven by the sustained global demand for ICE-powered vehicles, particularly in regions where charging infrastructure for electric vehicles remains underdeveloped.

The established presence of ICE platforms provides a large installed base for conventional vacuum-assisted brake boosters and hydraulic master cylinders, ensuring continued demand. Advancements in ICE vehicle designs, including turbocharging and downsized engines, have increased the requirement for efficient and responsive braking systems. The affordability, range, and refueling convenience of ICE vehicles further contribute to their high production volumes, directly influencing brake system demand Although the electric and hybrid vehicle market is growing rapidly, ICE vehicles continue to dominate fleet sizes in developing economies, ensuring that brake booster and master cylinder suppliers retain a significant share of their business from this propulsion category in the medium term.

The passenger cars vehicle segment is expected to represent 58.1% of the automotive brake booster and master cylinder market revenue share in 2025, making it the largest vehicle category. Its dominance is being fueled by the high global production volumes of passenger cars and the increasing integration of safety and performance features across this segment.

Passenger cars, ranging from compact hatchbacks to luxury sedans, require braking systems that offer a balance of efficiency, comfort, and safety, driving consistent demand for advanced brake boosters and master cylinders. Rising consumer expectations for enhanced driving experience, along with strict safety compliance requirements, are encouraging automakers to incorporate premium-grade braking components even in entry-level models.

Urbanization, increasing disposable incomes, and the growth of personal mobility have led to a surge in passenger car ownership, particularly in Asia-Pacific markets Additionally, the trend toward electrification in passenger cars is driving the adoption of brake systems that are compatible with regenerative braking technologies, ensuring this segment maintains its leadership in the overall market.

The automotive brake booster and master cylinder market is expected to grow at a measured but durable pace as active safety, electrified platforms, and fleet uptime requirements are prioritized. Demand is being reinforced by OEM fitment of ABS, ESC, and automated emergency braking that rely on rapid pressure build and stable pedal feel. Opportunities are anticipated in electric brake boosters, tandem master cylinders with sensors, and remanufactured units for the aftermarket. Trends point to brake-by-wire readiness, integrated hydraulic control units, and lightweight housings. Challenges persist around unit cost, warranty exposure, regulatory testing, counterfeit components, and supply volatility in critical electronics.

Demand has been supported by broad fitment of ABS, ESC, EBD, and AEB, where consistent line pressure and quick pressure ramp are viewed as nonnegotiable. Vacuum servo boosters, hydroboost units, and electric brake boosters are being specified to stabilize pedal travel while meeting stopping distance targets. Hybrids and battery vehicles have required vacuumless assistance and precise blending with regenerative braking, which has elevated the role of the booster and tandem master cylinder. Taxi and delivery fleets have reinforced replacement cycles as caliper refreshes and rotor changes are paired with new master cylinders for firmer pedal feel. Emerging markets will keep vacuum boosters prevalent, while premium segments migrate toward electronically assisted units with integrated pressure sensors. With inspection regimes tightening, leakage, spongy pedals, and long stroke complaints are being addressed through higher quality sealing and better bench bleed procedures.

Opportunities are opening as electric brake boosters enable stable assistance on engines without manifold vacuum and allow precise coordination with ADAS features. Suppliers are being favored when pedal simulators, pressure transducers, and fail-safe logic are delivered as a calibrated assembly with the master cylinder and reservoir. Remanufacturing of vacuum boosters and master cylinders is being expanded for the professional aftermarket, where core-return programs and certified hone-and-seal processes lower total cost of ownership for fleets.

Localization near OEM plants is being pursued to reduce logistics risk and support just-in-sequence delivery. The most attractive upside lies in service bundles that include electronic vacuum pumps, booster check valves, proportioning valves, and prefilled lines, simplifying dealer installs. Partnerships with brake friction brands and diagnostic tool vendors are creating cross-sell pathways, while training on correct pushrod length and stroke verification is improving fit-first-time outcomes.

Trends are pointing to compact boosters paired with integrated hydraulic control units so stability control, pressure modulation, and residual pressure checks are coordinated in one module. Electric assistance with redundant motor windings, improved gearsets, and on-board diagnostics is being adopted to meet functional safety requirements. Low-viscosity DOT formulations and revised seal compounds are being used to stabilize response at low temperatures. Composite booster shells and optimized brackets are being selected to reduce mass while maintaining stiffness and low NVH. Multi-constellation GNSS is not relevant here, but precise wheel-speed correlation and pressure sensors inside the master cylinder are being logged for AEB traceability. EV packaging constraints are encouraging slim-line boosters and vertical master cylinder reservoirs. Readiness for brake-by-wire migration with clean diagnostics and serviceable subcomponents is being treated as the real differentiator, not headline assist ratio claims alone.

Challenges have been observed in pricing pressure from OEM sourcing teams that compare vacuum boosters to e-boosters without acknowledging sensor redundancy and software validation costs. Product liability risk is elevated, with recall exposure arising from internal bypass, reservoir cap venting issues, or check valve failures. Supply uncertainty in microcontrollers and pressure sensors has affected lead times for electronically assisted units. Workshop errors remain common, including incorrect pushrod free play, contaminated brake fluid, or inadequate bench bleeding that mask true product performance. Compliance with FMVSS 135, ECE R13H, and endurance tests requires investment, while counterfeit boosters and master cylinders undermine trust in price-sensitive channels. Transition hurdles are evident in fleets moving from vacuum to vacuumless systems where technician training and diagnostic procedures must be updated. Transparent test data, authenticated parts, and robust service documentation will decide repeat purchases.

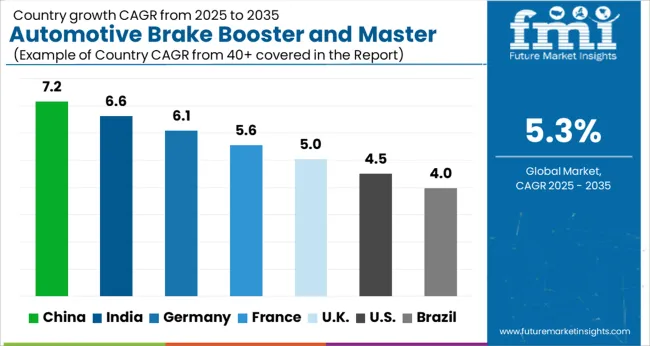

| Country | CAGR |

|---|---|

| China | 7.2% |

| India | 6.6% |

| Germany | 6.1% |

| France | 5.6% |

| UK | 5.0% |

| USA | 4.5% |

| Brazil | 4.0% |

The global automotive brake booster and master cylinder market is projected to grow at 5.3% from 2025 to 2035. China leads at 7.2%, followed by India 6.6% and France 5.6%; the United Kingdom 5% and United States 4.5% follow. Demand is being pulled by higher ABS/ESC fitment, brake-by-wire pilots, and calibration targets for pedal feel, stopping distance, and NVH. Vacuum boosters, hydraulic tandem master cylinders, and compact electro-hydraulic units are expected to co-exist as powertrain mixes evolve. Regenerative braking blend requirements are steering e-booster adoption in hybrids and EVs, while ICE programs continue to favor diaphragm boosters paired with dual-circuit masters. Suppliers that balance cost, packaging, and software tuning will secure platform awards across volume segments and premium trims. This report includes insights on 40+ countries; the top markets are shown here for reference.

Airline technology integration is being accelerated by the need for operational efficiency across global carriers. Flight management systems, predictive maintenance, and integrated data analytics are driving adoption, enabling airlines to reduce delays, optimize fuel usage, and lower maintenance costs. Airlines are increasingly dependent on connected systems that allow real-time communication between aircraft and ground operations, ensuring improved decision-making. The pressure to maintain profitability in a competitive industry will continue to push operators toward integrated technologies. This efficiency-driven approach makes technology integration not just an enhancement but a necessity for long-term competitiveness in the aviation sector.

The automotive brake booster and master cylinder market in China is expected to expand at 7.2%. Growth is being supported by broad ABS/ESC penetration, rapid model refresh cycles, and rising EV and hybrid volumes that demand precise regen-friction blending. Tandem diaphragm boosters remain prevalent on ICE lines, while compact e-boosters are being specified for ADAS stop-and-go and smoother pedal mapping. Local tier-1s have been favored on value, packaging agility, and short validation timelines, with export programs supplied from coastal plants. Pedal-feel targets are being tightened, so master cylinder bore sizing and servo ratios are seeing closer coordination with pad compounds and caliper designs. China’s vertically integrated ecosystems and fast calibration loops will keep momentum high across mass-market sedans, SUVs, and logistics vans.

The automotive brake booster and master cylinder market in India is projected to grow at 6.6%. Expansion is being shaped by rising passenger-vehicle output, mandatory ABS in core segments, and steady upgrades in pedal feel expectations. Value-focused trims continue to use vacuum boosters with optimized linkage, while higher variants are trialing compact e-boosters for smoother city driving and hill-hold behavior. Aftermarket and service volumes remain meaningful, encouraging standardization of master cylinder bore sizes and repair kits. Duty cycles featuring heat, dust, and stop-start traffic are pushing preference toward robust seals, corrosion-resistant pushrods, and stable servo ratios. India’s supplier parks and calibrated cost controls will keep adoption steady across hatchbacks, compact SUVs, and expanding CNG portfolios.

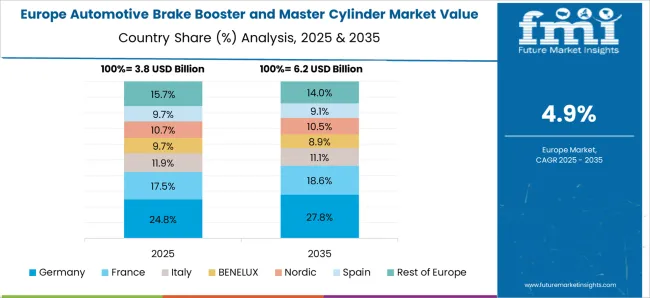

The automotive brake booster and master cylinder market in Germany is forecast to grow at 6.1%. The market growth is driven by the country’s strong automotive sector, particularly in luxury and electric vehicles, which require precise braking performance. German OEMs are increasingly focusing on electronic brake boosters, as these systems offer advantages in weight reduction, energy efficiency, and integration with regenerative braking systems. Strict EU regulations regarding emissions, safety standards, and energy efficiency are pushing manufacturers to adopt advanced braking systems. Germany's automotive industry is poised to maintain its leadership, focusing on innovation, quality, and meeting stringent regulatory standards.

The automotive brake booster and master cylinder market in the UK is expected to rise at 5%. The growth is driven by the increased production of both conventional and electric vehicles, along with the growing importance of safety features like ABS and ESC. The UK automotive industry is focusing on the adoption of electronic brake boosters to meet stricter emissions and performance standards. As vehicle manufacturers aim to reduce overall vehicle weight and increase braking efficiency, the demand for high-performance and cost-efficient braking systems will continue to rise. Steady demand will persist, fueled by regulatory pressures and the continued shift towards electric mobility.

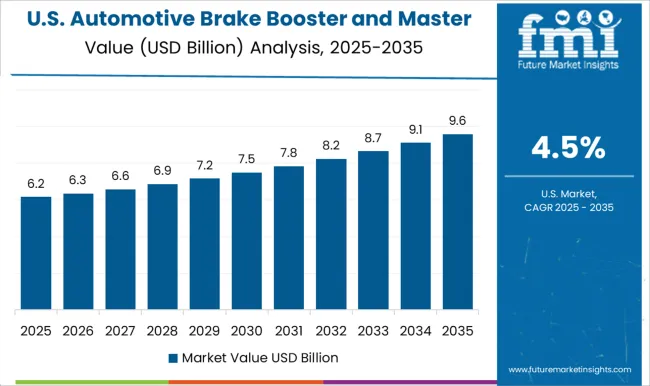

The automotive brake booster and master cylinder market in the United States is projected to grow at 4.6%. The market is driven by an increase in vehicle production, especially in light of the growing demand for electric vehicles (EVs), where braking performance and system efficiency are essential. Manufacturers are increasingly adopting electronic brake boosters for better efficiency and integration with advanced safety features such as collision avoidance and autonomous driving. The USA automotive market is highly focused on high-quality, durable brake systems, with increasing demand for advanced safety features, including electronic stability control (ESC) and regenerative braking. Steady growth will continue, fueled by increasing vehicle sales, advanced braking technologies, and stricter safety regulations.

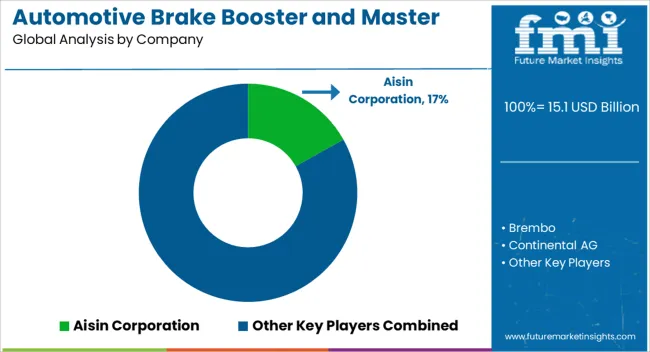

Leading players such as Bosch, Aisin Seiki, Denso, Continental, and ZF Friedrichshafen dominate the market with advanced hydraulic and vacuum-assisted systems, leveraging scale, engineering expertise, and integrated supply chains. Competition is largely defined by the ability to deliver high-performance, reliable, and durable braking components while maintaining cost efficiency for OEM partners. Differentiation among players is driven by technological innovations in brake-by-wire solutions, lightweight materials, corrosion-resistant coatings, and modular designs that simplify integration across vehicle platforms. Service programs, aftermarket support, and regional production footprints also influence competitive positioning, with companies emphasizing localized manufacturing to reduce lead times and logistics costs.

Strategic partnerships with automotive manufacturers, investments in R&D for electric and hybrid vehicle applications, and compliance with stringent safety regulations are additional factors shaping market rivalry. Mid-sized and emerging suppliers focus on niche product segments, such as compact brake boosters for passenger vehicles or high-pressure master cylinders for commercial vehicles, further intensifying competition.

| Item | Value |

|---|---|

| Quantitative Units | USD 15.1 Billion |

| Component | Brake booster and Master cylinder |

| Propulsion | ICE and Electric vehicles |

| Vehicle | Passenger cars and Commercial vehicles |

| Technology | Vacuum-assisted, Hydraulic assisted, and Electronic brake boosters |

| Sales Channel | OEMs and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Aisin Corporation, Brembo, Continental AG, DENSO Corporation, Hitachi Astemo, Hyundai Mobis, Knorr-Bremse AG, Magneti Marelli, Robert Bosch GmbH, and ZF Friedrichshafen AG |

| Additional Attributes | Dollar sales by cell format (prismatic, cylindrical, pouch), Dollar sales by application (electric vehicles, stationary energy storage, e buses, two wheelers, industrial), Dollar sales by integration level (cell, module, pack, BESS), Trends in cost per kWh and lithium carbonate sensitivity, Role in long cycle life and thermal stability, Regional manufacturing across Asia Pacific, Europe, North America. |

The global automotive brake booster and master cylinder market is estimated to be valued at USD 15.1 billion in 2025.

The market size for the automotive brake booster and master cylinder market is projected to reach USD 25.2 billion by 2035.

The automotive brake booster and master cylinder market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in automotive brake booster and master cylinder market are brake booster, _vacuum brake booster, _hydraulic brake booster, master cylinder, _tandem master cylinder and _single master cylinder.

In terms of propulsion, ice segment to command 54.7% share in the automotive brake booster and master cylinder market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Extraction Hose Reels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electroplating Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA