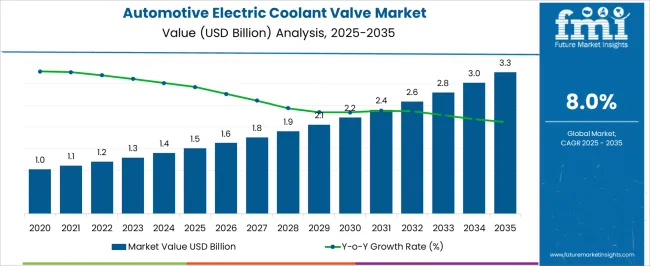

The automotive electric coolant valve market is projected to grow from USD 1.5 billion in 2025 to USD 3.3 billion in 2035, reflecting a CAGR of 8.0%. This expansion represents an absolute dollar opportunity of USD 1.8 billion over the forecast period. Growth will be consistent, with the market reaching USD 1.6 billion in 2026, USD 1.9 billion in 2029, USD 2.2 billion in 2031, and USD 3.0 billion in 2034.

The steady rise underscores increasing integration of coolant valves in vehicles, offering manufacturers and investors ample potential to capture incremental revenue and reinforce their positions in this expanding market. From an absolute dollar perspective, annual incremental growth starts at around USD 0.1–0.2 billion in the earlier years and increases toward USD 0.3 billion in the later stages, resulting in USD 1.8 billion in added value by 2035. Intermediate benchmarks, such as USD 1.4 billion in 2025, USD 2.1 billion in 2030, and USD 2.8 billion in 2033, highlight a predictable growth trajectory.

This progression allows stakeholders to plan investments, scale production, and optimize distribution effectively. Leveraging both the steady yearly increments and the cumulative expansion provides a clear path to capture opportunities in the automotive electric coolant valve market.

| Metric | Value |

|---|---|

| Automotive Electric Coolant Valve Market Estimated Value in (2025 E) | USD 1.5 billion |

| Automotive Electric Coolant Valve Market Forecast Value in (2035 F) | USD 3.3 billion |

| Forecast CAGR (2025 to 2035) | 8.0% |

Between 2025 and 2027, the market increases from USD 1.5 billion to USD 1.6 billion, reflecting the early adoption stage where steady demand drives modest gains. A stronger breakpoint occurs in 2029–2031, as the market expands from USD 1.9 billion to USD 2.2 billion, showcasing higher incremental revenue growth compared to earlier years. These breakpoints are critical for manufacturers and suppliers to align capacity, enhance partnerships, and capture incremental opportunities in a steadily maturing market.

A major breakpoint is observed between 2033 and 2035, when the market grows from USD 2.8 billion to USD 3.3 billion, marking the strongest absolute dollar increase in a two-year span. Intermediate years, such as 2030–2032, illustrate consistent expansion from USD 2.1 billion to USD 2.6 billion, acting as bridging stages that sustain growth momentum. Identifying these breakpoints enables stakeholders to optimize strategies, scale production capabilities, and maximize profitability.

The automotive electric coolant valve market is experiencing robust growth driven by increasing demand for enhanced thermal management systems in vehicles. The rising adoption of electric and hybrid vehicles, along with stringent emission regulations, is accelerating the need for efficient coolant valve technologies that optimize engine and battery temperature control.

Additionally, the shift towards smarter vehicle components with better integration into overall vehicle electronics systems supports the market expansion. The future outlook remains positive as automakers continue to focus on improving fuel efficiency, reducing emissions, and enhancing vehicle performance through advanced thermal management.

The growing trend of electrification across the automotive sector is further contributing to the increased deployment of electric coolant valves, presenting substantial opportunities for innovation and product development.

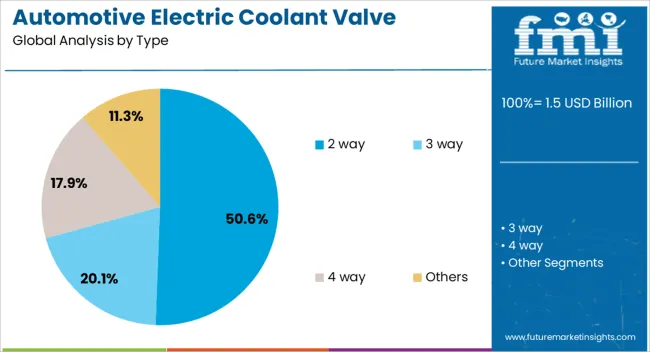

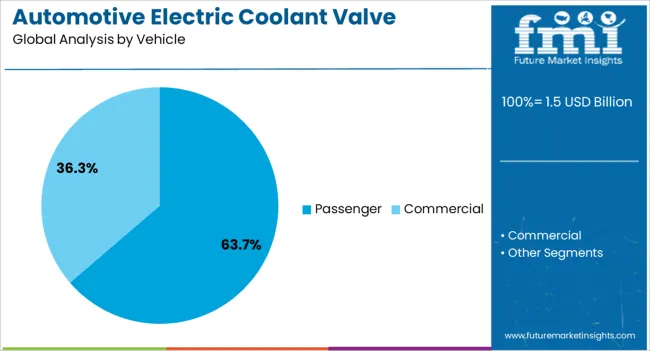

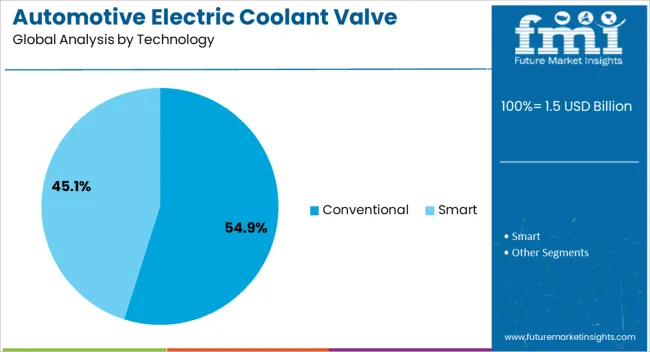

The automotive electric coolant valve market is segmented by type, vehicle, technology, sales channel, and geographic regions. By type, the automotive electric coolant valve market is divided into 2-way, 3-way, 4-way, and Others. In terms of vehicles, the automotive electric coolant valve market is classified into Passenger and Commercial. Based on technology, the automotive electric coolant valve market is segmented into Conventional and Smart.

By sales channel, the automotive electric coolant valve market is segmented into OEM, Construction companies, and the Aftermarket. Regionally, the automotive electric coolant valve industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 2 way type is projected to hold 50.6% of the Automotive Electric Coolant Valve market revenue share in 2025, establishing it as the leading valve type. This dominance is attributed to its simpler design, reliability, and cost-effectiveness, which make it well-suited for a wide range of automotive applications.

The 2 way valve facilitates efficient coolant flow control with fewer components, reducing potential points of failure and enabling easier integration into existing vehicle architectures. Its widespread use in passenger vehicles and compatibility with conventional cooling systems have supported its market growth.

Additionally, the ability of the 2 way valve to meet performance requirements in both traditional and electrified powertrains has reinforced its leading position within the market.

The passenger vehicle segment is expected to account for 63.7% of the market revenue in 2025, positioning it as the largest vehicle category within the Automotive Electric Coolant Valve market. The growth of this segment is driven by increased production and sales of passenger cars globally, coupled with the growing electrification of this vehicle category.

The rising consumer demand for fuel-efficient and low-emission passenger vehicles has encouraged the integration of advanced coolant valve technologies that optimize engine and battery temperature management. Furthermore, stringent regulatory standards targeting emissions and fuel economy have incentivized automakers to adopt electric coolant valves to enhance thermal system efficiency.

The conventional technology segment is anticipated to hold 54.9% of the Automotive Electric Coolant Valve market revenue share in 2025. This segment’s prominence is linked to the established presence of conventional internal combustion engine vehicles and their widespread use across global markets.

Conventional coolant valve technologies continue to be favored for their proven performance, cost-effectiveness, and compatibility with existing vehicle designs. The segment’s growth has been supported by gradual improvements in conventional valve systems to meet evolving emission norms and fuel efficiency standards.

While electrification gains momentum, the persistent demand for conventional vehicles, particularly in emerging markets, ensures sustained adoption of conventional technology in coolant valve applications.

The automotive electric coolant valve market is expanding as vehicles increasingly adopt advanced thermal management systems. Electric coolant valves regulate coolant flow between radiators, heaters, batteries, and power electronics to maintain optimal operating temperatures. The shift toward electric vehicles (EVs), hybrid models, and high-efficiency internal combustion engines is driving demand.

Growing emphasis on energy efficiency, emission reduction, and passenger comfort further supports adoption. Manufacturers offering lightweight, compact, and electronically controlled valves with fast response times gain competitive advantages. Additionally, integration with intelligent vehicle control systems, such as thermal energy management and predictive diagnostics, enhances performance. Rising investments in EV infrastructure, government incentives, and consumer preference for sustainable mobility reinforce long-term growth in the automotive electric coolant valve market.

The market faces challenges from high costs and system integration complexities associated with automotive electric coolant valves. Compared to conventional mechanical valves, electric variants involve advanced materials, precision electronics, and control software, making them more expensive. Integrating these valves into modern vehicle platforms requires coordination with multiple subsystems, including battery thermal management, HVAC, and engine cooling. Compatibility issues, electrical load considerations, and durability under varying temperature and pressure conditions add complexity. For manufacturers, ensuring reliability while keeping costs manageable is critical. Until economies of scale reduce prices and integration processes become standardized, adoption may remain concentrated in premium vehicles, electric models, and advanced hybrid platforms.

Market trends are shaped by technological innovation and the rising adoption of electric vehicles. Automakers are integrating advanced electric coolant valves with smart actuators, thermal sensors, and electronic control units to achieve precise thermal regulation. Trends toward modular thermal management units combine multiple valves and pumps for compact design and greater efficiency. The rapid growth of battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) is accelerating demand, as effective thermal management is essential for battery safety, charging speed, and longevity. Manufacturers are also adopting lightweight materials, low-friction seals, and noise-reduction technologies to meet evolving performance standards. These advancements reflect the growing role of innovation in meeting efficiency, reliability, and sustainability goals across the automotive industry.

The rapid growth of electric and hybrid vehicles drives opportunities in the automotive electric coolant valve market. Battery packs, inverters, and onboard chargers require efficient thermal management, which increases the need for precise coolant flow regulation. Expanding EV production in Asia-Pacific, Europe, and North America provides significant opportunities for component suppliers. Government incentives and stricter emission regulations further accelerate adoption.

Manufacturers offering scalable, customizable, and cost-effective coolant valve solutions tailored for different vehicle platforms can strengthen their market presence. Collaborations with OEMs and Tier-1 suppliers to develop integrated thermal management systems enhance long-term opportunities. The increasing focus on sustainability, vehicle efficiency, and consumer comfort ensures continued demand growth for electric coolant valves.

The market faces restraints from intense competition, durability concerns, and regulatory requirements. Global and regional suppliers compete on cost, performance, and integration capabilities, impacting margins. Ensuring long-term durability of valves under continuous thermal cycling, vibration, and exposure to coolant fluids remains a challenge. Failure of thermal management components can affect vehicle performance and safety, creating high reliability standards for suppliers.

Compliance with automotive regulations, quality certifications, and environmental standards further adds complexity and costs. Additionally, ongoing shifts toward solid-state thermal management systems and emerging alternatives may create long-term competition. Until manufacturers address durability, cost, and compliance while offering innovation, growth in the automotive electric coolant valve market may face constraints.

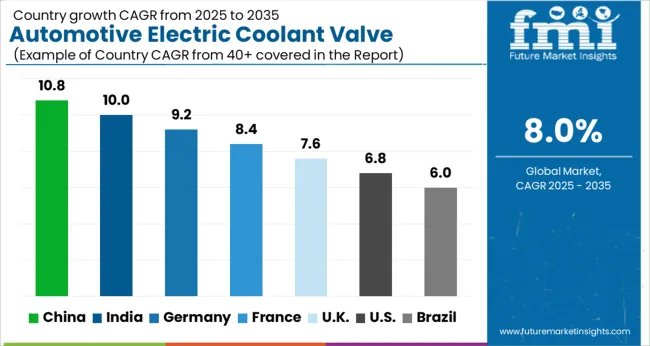

| Country | CAGR |

|---|---|

| China | 10.8% |

| India | 10.0% |

| Germany | 9.2% |

| France | 8.4% |

| UK | 7.6% |

| USA | 6.8% |

| Brazil | 6.0% |

The global automotive electric coolant valve market was projected to expand at an 8.0% CAGR through 2035, supported by rising adoption of efficient thermal management systems in vehicles. In BRICS, China recorded 10.8% growth as large-scale production facilities were commissioned and regulatory oversight on vehicle efficiency standards was enforced, while India at 10.0% growth demonstrated expansion driven by demand from domestic automakers. In the OECD region, Germany at 9.2% maintained strong market participation through adherence to safety and performance protocols across the automotive supply chain. The United Kingdom, advancing at 7.6%, focused on regulated integration of coolant valve systems within passenger and commercial vehicles. The USA, growing at 6.8%, remained a steady market where deployments were governed by federal and state-level efficiency and emission guidelines. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The automotive electric coolant valve market in China is expanding at a CAGR of 10.8%, supported by the rapid growth of electric and hybrid vehicles. Automakers are increasingly adopting electric coolant valves to improve thermal management, enhance engine efficiency, and extend battery life in new energy vehicles. Suppliers are offering valves that provide precise flow control, long operational life, and compatibility with various vehicle platforms. Growth is further supported by large-scale automotive production, strong consumer demand for electric mobility, and supportive government policies. Manufacturers are investing in product development to enhance durability, reduce energy losses, and improve reliability under different driving conditions. Distribution networks, including direct partnerships with vehicle manufacturers and component suppliers, ensure wide accessibility. As China remains the largest electric vehicle market globally, adoption of advanced coolant valve solutions continues to expand, making it a critical region for long-term market growth.

India is witnessing strong growth in the automotive electric coolant valve market at a CAGR of 10.0%, driven by the expansion of electric and hybrid vehicle production. These valves play an important role in optimizing engine temperature, extending battery performance, and ensuring efficient thermal management systems. Automakers are adopting coolant valves in both passenger and commercial vehicles to improve efficiency and meet regulatory requirements. Suppliers provide durable, cost effective, and energy efficient valves suitable for diverse climatic conditions. Growth is further supported by government initiatives promoting clean mobility and rising consumer interest in electric vehicles. Manufacturers are focusing on local production to meet growing demand and reduce supply chain costs. Distribution through partnerships with automotive OEMs and component suppliers ensures availability across regions. Increasing investment in electric vehicle infrastructure and production makes India a high potential market for coolant valve adoption.

Germany is expanding at a CAGR of 9.2% in the automotive electric coolant valve market, supported by its strong automotive manufacturing base and increasing adoption of electric mobility solutions. Electric coolant valves are widely used in passenger and commercial vehicles to regulate temperature, enhance efficiency, and extend component lifespan. Suppliers are offering advanced valves with precise control, long durability, and compatibility with modern vehicle architectures. Growth is further supported by regulatory requirements for efficiency and consumer demand for electric and hybrid models. Manufacturers are focusing on innovative product designs that reduce energy losses and improve thermal system reliability. Distribution through established OEM partnerships and automotive suppliers ensures wide accessibility. As Germany continues to lead in electric vehicle adoption within Europe, demand for electric coolant valves is expected to rise steadily, making it an important market for long-term industry expansion.

The United Kingdom market is growing at a CAGR of 7.6% as demand for electric and hybrid vehicles increases. Electric coolant valves are being adopted to optimize battery performance, enhance fuel efficiency, and ensure long-term engine reliability. Automakers are integrating these valves across a range of vehicle categories, from compact cars to commercial fleets. Suppliers provide valves with high durability, precise temperature control, and energy efficient performance. Market expansion is supported by government policies promoting clean transportation, rising consumer demand for electric vehicles, and increasing investment in automotive innovation. Manufacturers are focusing on cost effective solutions to make these valves more accessible across various price segments. Distribution partnerships with OEMs and component providers ensure steady availability. As the electric mobility sector grows in the United Kingdom, adoption of advanced coolant valve technologies continues to expand.

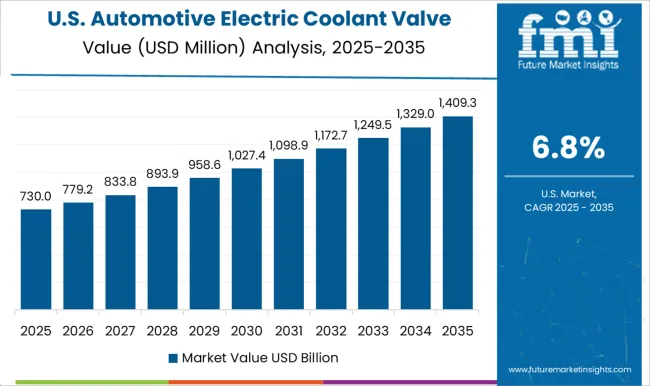

The United States market is expanding at a CAGR of 6.8%, supported by demand from electric, hybrid, and advanced internal combustion vehicles. Electric coolant valves are widely used to improve thermal management, optimize fuel efficiency, and enhance battery performance in electric models. Automotive manufacturers are adopting these valves across passenger and commercial vehicles to meet efficiency requirements and consumer expectations. Suppliers provide durable, precise, and cost effective valve solutions suitable for varied driving conditions. Growth is supported by rising investment in electric mobility, expansion of charging infrastructure, and consumer preference for energy efficient vehicles. Manufacturers are focusing on product innovation to improve reliability, reduce energy consumption, and extend component life. Distribution networks through OEM partnerships and suppliers ensure market accessibility. As electric and hybrid vehicle adoption increases, demand for advanced coolant valves is expected to continue growing across the United States.

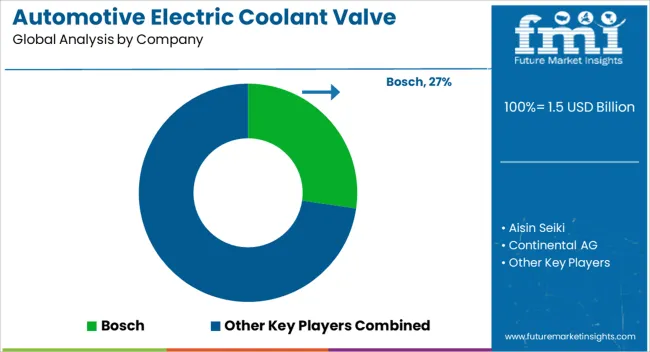

The automotive electric coolant valve market is shaped by leading suppliers, including Bosch, Aisin Seiki, Continental AG, Cummins Inc., Denso Corporation, Hanon Systems, Hitachi, Mahle GmbH, Parker-Hannifin Corporation, and PV Clean Mobility Technologies. These companies develop precision-controlled valves designed to regulate coolant flow in advanced powertrains, enabling optimized thermal management for internal combustion engines, hybrid systems, and electric vehicles. Brochures and technical specifications emphasize benefits such as fast response times, reduced energy loss, and compatibility with electronic control units (ECUs). Their products address rising demand for efficient heat management to meet fuel economy targets and comply with increasingly stringent emissions standards. Competition in this market centers on innovation in thermal management efficiency, integration with smart cooling systems, and material durability. Bosch and Continental AG highlight integrated coolant valve solutions compatible with high-voltage EV systems, while Denso Corporation and Hanon Systems emphasize compact, lightweight designs that support next-generation battery electric and hybrid electric vehicles. Aisin Seiki and Mahle GmbH focus on cost-effective solutions optimized for mass production, whereas Hitachi and Parker-Hannifin leverage their expertise in fluid dynamics to develop valves capable of withstanding high-pressure, high-temperature operating conditions.

PV Clean Mobility Technologies positions itself in specialized electric coolant valves designed for zero-emission vehicles, reflecting the market shift toward sustainable mobility. Supplier strategies reflect a push toward digitalization, modularity, and environmental compliance. Technical documentation typically provides detailed flow control curves, valve response rates, integration compatibility with vehicle control systems, and lifecycle durability test results. Companies like Cummins Inc. and Bosch invest in connected coolant valves with sensor integration for predictive maintenance and real-time monitoring, supporting vehicle OEMs in adopting smarter, more reliable thermal management systems. Hanon Systems and Denso highlight multi-port and variable-flow valve architectures, allowing flexible coolant routing between batteries, inverters, and motors in EV platforms. Industry-wide, manufacturers are expanding R&D collaborations with automotive OEMs to ensure coolant valves are adaptable to evolving architectures, from traditional ICE vehicles to fully electric drivetrains.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.5 Billion |

| Type | 2 way, 3 way, 4 way, and Others |

| Vehicle | Passenger and Commercial |

| Technology | Conventional and Smart |

| Sales Channel | OEM, Construction companies, and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bosch, Aisin Seiki, Continental AG, Cummins Inc., Denso Corporation, Hanon Systems, Hitachi, Mahle GmbH, Parker-Hannifin Corporation, and PV Clean Mobility Technologies |

| Additional Attributes | Dollar sales vary by valve type, including two-way, three-way, and four-way coolant valves; by vehicle type, spanning passenger cars, light commercial vehicles, and heavy commercial vehicles; by application, such as battery thermal management, engine cooling, and HVAC systems; by region, led by Asia-Pacific, Europe, and North America. Growth is driven by EV adoption, demand for advanced thermal management, and stricter emission regulations. |

The global automotive electric coolant valve market is estimated to be valued at USD 1.5 billion in 2025.

The market size for the automotive electric coolant valve market is projected to reach USD 3.3 billion by 2035.

The automotive electric coolant valve market is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types in automotive electric coolant valve market are 2 way, 3 way, 4 way and others.

In terms of vehicle, passenger segment to command 63.7% share in the automotive electric coolant valve market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Extraction Hose Reels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electroplating Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA