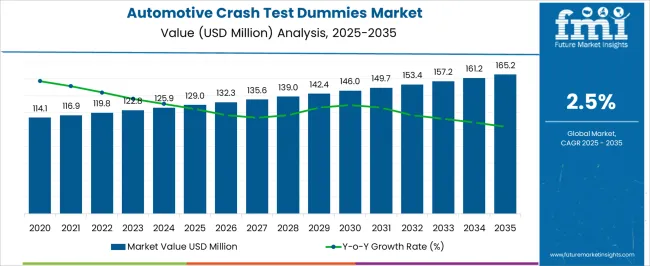

The automotive crash test dummies market is expected to grow from USD 129.0 million in 2025 to USD 165.2 million by 2035, registering a 2.5% CAGR and generating an absolute dollar opportunity of USD 36.2 million. Crash test dummies remain critical in vehicle safety testing, enabling accurate simulation of human responses during collisions for regulatory compliance, product development, and consumer safety ratings. Advancements in sensor integration, biofidelic designs, and digital modeling are sustaining steady demand despite a relatively modest growth outlook.

Peak-to-trough analysis highlights the cyclical dynamics in market performance across the forecast period. Peaks are observed during phases of heightened automotive production, regulatory updates, and technological transitions such as electric and autonomous vehicle safety validation, which require new dummy designs and expanded testing protocols. Conversely, troughs emerge during periods of slowed vehicle production, economic downturns, or increased reliance on computer-based crash simulations, which temporarily reduce demand for physical dummies. Regional variations also influence the cycle, with North America and Europe experiencing steady peaks tied to stringent regulatory testing, while Asia Pacific shows sharper fluctuations aligned with automotive production shifts.

| Metric | Value |

|---|---|

| Automotive Crash Test Dummies Market Estimated Value in (2025 E) | USD 129.0 million |

| Automotive Crash Test Dummies Market Forecast Value in (2035 F) | USD 165.2 million |

| Forecast CAGR (2025 to 2035) | 2.5% |

The automotive crash test dummies market is primarily shaped by the automotive manufacturing sector, which holds about 40% of the market share, as automakers rely on advanced dummies for vehicle safety testing. The regulatory and compliance testing sector contributes around 25%, driven by government safety standards and certification requirements. Research and development in universities and institutes represents nearly 15%, where crash dummies are used to study biomechanics and injury prevention. Aerospace and defense account for approximately 10%, applying similar technologies in safety testing. The remaining 10% comes from insurance and safety organizations conducting independent crash evaluations.

The automotive crash test dummies market is progressing through innovations in digital integration and material design. Smart crash dummies equipped with advanced sensors and data acquisition systems are becoming more common, providing detailed insights into impact forces and injury risks. Virtual crash testing is being paired with physical dummies to reduce costs and improve testing accuracy.

Lightweight materials that mimic human tissue more accurately are being incorporated to enhance biofidelity. Companies are focusing on developing specialized dummies for diverse demographics, including children and elderly populations. Partnerships between automakers, safety organizations, and technology providers are expanding research capabilities and global adoption.

The market is experiencing strong momentum, primarily driven by increasing emphasis on vehicle safety standards and occupant protection regulations across both developed and emerging economies. Heightened awareness regarding road safety, along with the rising frequency of automotive crash tests mandated by safety authorities, is contributing to sustained demand.

The integration of advanced sensor technologies into dummies has allowed for more accurate measurement of crash impacts, enhancing vehicle design improvements and safety benchmarking. Growing automotive production volumes and the continual evolution of crash testing protocols are also supporting market expansion.

In addition, the global shift toward electric and autonomous vehicles is generating new crash test scenarios, which require advanced dummies capable of simulating a range of human body types and conditions. As vehicle manufacturers invest in safer car designs and comply with increasingly stringent global safety norms, the market for crash test dummies is expected to see continued growth.

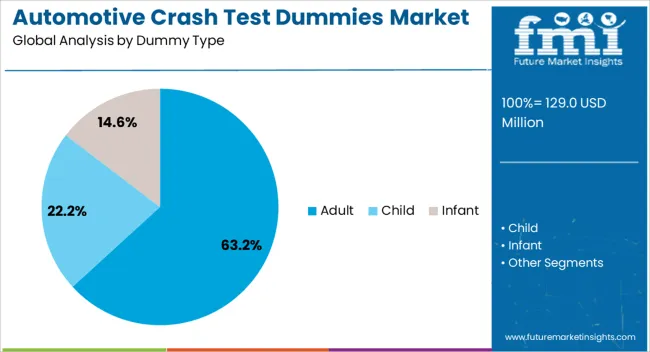

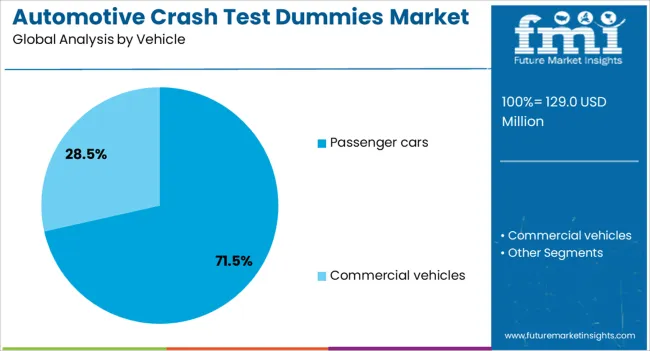

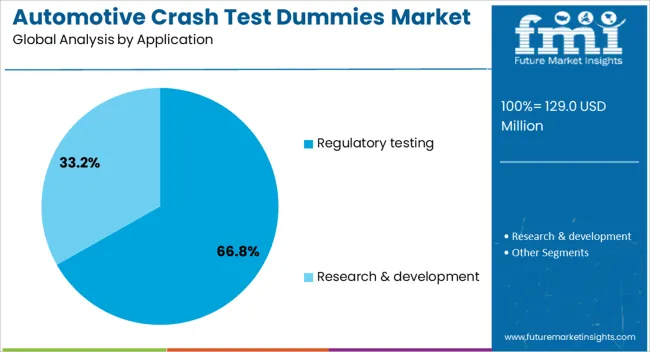

The automotive crash test dummies market is segmented by dummy type, vehicle, application, and geographic regions. By dummy type, automotive crash test dummies market is divided into Adult, Child, and Infant. In terms of vehicle, automotive crash test dummies market is classified into Passenger cars and Commercial vehicles. Based on application, automotive crash test dummies market is segmented into Regulatory testing and Research & development. Regionally, the automotive crash test dummies industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The adult dummy type is projected to hold 63.2% of the Automotive Crash Test Dummies market revenue in 2025, positioning it as the dominant category within the segment. This prominence is being attributed to regulatory frameworks that prioritize safety evaluation for adult occupants, who represent the largest proportion of vehicle users globally.

Adult dummies are widely utilized in frontal, side, and rear impact testing scenarios to assess injury risks and guide improvements in vehicle structures and restraint systems. The segment's growth has been reinforced by the standardization of adult dummy models in global safety assessments, enabling consistent data collection and benchmarking.

Advances in biofidelic design and sensor integration have further improved the reliability of adult dummies in simulating human response during high-impact events. The widespread implementation of adult dummy testing by automotive manufacturers and safety authorities is expected to continue driving demand as part of comprehensive crashworthiness evaluation protocols.

Passenger cars are expected to account for 71.5% of the Automotive Crash Test Dummies market revenue in 2025, emerging as the leading vehicle type within this domain. This dominant share is being driven by the high volume of passenger car production globally and the growing emphasis on achieving high safety ratings to meet consumer expectations.

Regulatory testing requirements across key automotive markets mandate comprehensive crash simulations specifically for passenger vehicles, further reinforcing the use of crash test dummies in this segment. Increased demand for occupant safety validation during the design and prototyping stages has led to frequent utilization of dummies in both physical and virtual crash tests.

Moreover, the competitive automotive landscape is pushing manufacturers to achieve superior safety credentials, where rigorous crash testing involving dummies plays a critical role. As innovation in vehicle safety systems continues, the need for precise crash impact analysis in passenger cars is expected to sustain this segment’s leading position.

The regulatory testing segment is estimated to contribute 66.8% of the Automotive Crash Test Dummies market revenue in 2025, establishing itself as the most significant application area. This leading position is being attributed to the requirement of compliance with national and international vehicle safety standards, which necessitate the use of crash test dummies in certified testing protocols.

Regulatory bodies mandate the evaluation of crashworthiness using standardized dummies to ensure vehicle manufacturers meet minimum safety performance levels before market entry. The segment has witnessed sustained growth as automotive safety regulations become more stringent and widespread, particularly in markets prioritizing road safety reforms.

The reliance on physical crash tests for certification purposes, coupled with routine testing by safety agencies, has ensured consistent demand for high-fidelity dummies. As countries continue to align their safety benchmarks with global best practices, the regulatory testing segment is expected to remain a central pillar in the market’s overall expansion.

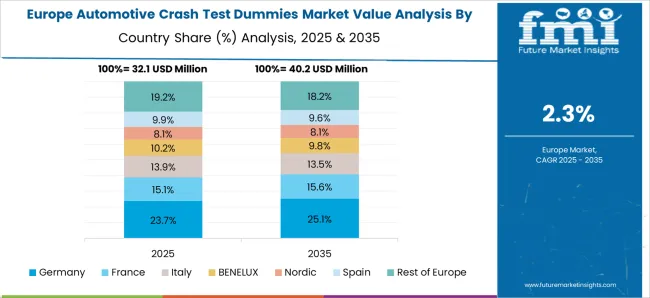

The automotive crash test dummies market is expanding with rising investments in vehicle safety, regulatory standards, and advanced testing systems. Global revenue surpassed USD 1.1 billion in 2024, with North America contributing 38% due to strict safety protocols and major automotive OEM presence. Europe accounts for 31%, supported by Germany, France, and Sweden implementing NCAP standards. Asia Pacific holds 24%, led by China, Japan, and India with rising vehicle production. Adult frontal impact dummies dominate with 40% share, followed by side-impact dummies at 22%. Increasing adoption of digital sensors, biomechanics-based dummy designs, and virtual crash test integration continues to strengthen global demand.

Rising vehicle production and regulatory compliance drive demand for crash test dummies worldwide. Passenger vehicles account for 60% of applications, while commercial vehicles contribute 25%. North America leads with 38% share, where USA regulations require multi-impact test dummies across different weight classes. Europe contributes 31%, with Euro NCAP focusing on pedestrian protection and child dummy testing. Asia Pacific holds 24%, with growth in China and India driven by mandatory safety assessments for new models. Adoption of dummies with 50th percentile male and 5th percentile female representation ensures testing accuracy across demographics. Growing EV production further increases the scope for safety validation.

Technological progress is improving the biofidelity of crash test dummies, making them more accurate in simulating human injury risk. Modern dummies incorporate over 150 sensors to measure head, chest, and limb impacts, with data collection speeds exceeding 20,000 samples per second. Europe leads in biofidelity innovation with hybrid III and THOR dummies used in Euro NCAP testing. North America emphasizes sensor-equipped models for advanced frontal, side, and rollover simulations. Asia Pacific is investing in cost-efficient digital-integrated dummies to serve growing OEM demand. These advancements ensure compliance with evolving safety standards while enhancing precision in crash testing outcomes globally.

Crash test dummies are increasingly being used beyond automotive, with aerospace and defense sectors adopting them for occupant safety studies. Aerospace applications account for 10% of demand, focusing on aircraft crash simulations and ejection seat testing. Defense contributes another 7%, where dummies are used to evaluate blast and vehicle crash resistance. North America leads with 42% share due to strong aerospace and defense investment. Europe follows with 30%, while Asia Pacific grows with increasing defense modernization in China and India. This cross-industry expansion is diversifying revenue streams and strengthening the global demand base for high-precision crash test dummies.

Development of crash test dummies involves high capital costs, typically ranging between USD 200,000 and USD 600,000 per unit, depending on model and instrumentation. Certification processes for new dummies require 18–24 months of regulatory validation, adding to time-to-market challenges. Maintenance is also expensive, as calibration and sensor replacement can account for 15–20% of annual testing costs. Smaller OEMs and tier-2 suppliers face affordability constraints, particularly in emerging markets. Despite modular designs reducing replacement expenses, the high upfront investment and complex regulatory pathways remain barriers. Manufacturers are addressing these challenges with digital twin models and hybrid physical-virtual crash testing solutions.

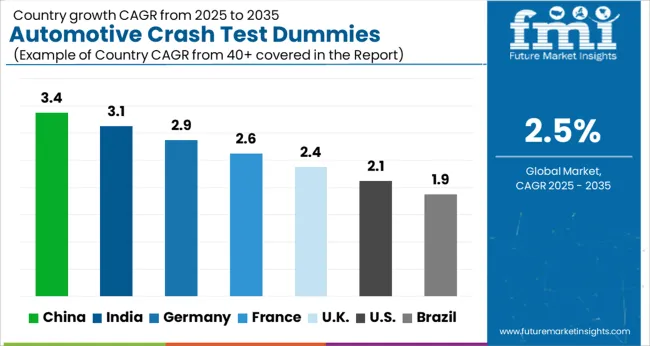

| Country | CAGR |

|---|---|

| China | 3.4% |

| India | 3.1% |

| Germany | 2.9% |

| France | 2.6% |

| UK | 2.4% |

| USA | 2.1% |

| Brazil | 1.9% |

The automotive crash test dummies market is projected to grow at a global CAGR of 2.5% through 2035, supported by rising demand for advanced safety testing, regulatory compliance, and innovation in vehicle design. China leads at 3.4%, 36% above the global benchmark, driven by BRICS-led expansion in automotive manufacturing, crash testing infrastructure, and investments in vehicle safety programs. India follows at 3.1%, 24% above the global average, reflecting growing vehicle production, adoption of safety testing standards, and development of research facilities. Germany records 2.9%, 16% above the benchmark, shaped by OECD-driven advancements in crash simulation, precision testing equipment, and integration with premium automotive brands. The United Kingdom posts 2.4%, 4% below the global rate, with selective use in regulatory testing, specialized research centers, and niche automotive development. The United States stands at 2.1%, 16% below the benchmark, with consistent demand in regulatory compliance, defense applications, and limited automotive innovation programs. BRICS economies account for the fastest growth in testing volume, OECD countries emphasize technology, accuracy, and quality standards, while ASEAN nations contribute through expanding automotive assembly and gradual integration of safety testing protocols.

The automotive crash test dummies market in China is projected to grow at a CAGR of 3.4%, surpassing the global CAGR of 2.5%, with demand rising from expanding passenger and commercial vehicle testing programs. In 2024, domestic production centers in Jiangsu, Guangdong, and Zhejiang increased capacity to support vehicle safety testing and research institutes. Suppliers such as Humanetics, Cellbond, and local players introduced advanced sensor-enabled dummies for side-impact, frontal, and rollover assessments. Increasing electric vehicle launches and government-backed safety mandates are driving adoption of next-generation crash test dummies capable of precise biomechanical data capture. li>Side-impact dummies adoption rose by 15% in 2024

India’s automotive crash test dummies market is expected to record a CAGR of 3.1%, higher than the global CAGR of 2.5%, driven by increased vehicle safety regulations and adoption of NCAP standards. In 2024, demand for precision dummies grew in Maharashtra, Tamil Nadu, and Haryana, primarily for small car and commercial vehicle testing. Domestic firms collaborated with international suppliers such as Humanetics and Cellbond to access advanced frontal, side, and pedestrian dummies. Research institutions also contributed to testing protocols, facilitating higher accuracy in crash simulations.

The automotive crash test dummies market in Germany is projected to grow at a CAGR of 2.9%, above the global CAGR of 2.5%, due to strong regulatory requirements and a mature automotive sector. In 2024, installations rose with OEMs emphasizing precise evaluation of EV and autonomous vehicles. Manufacturers such as 4a Engineering, Bosch, and global suppliers expanded deliveries of advanced side-impact, frontal, and pedestrian dummies. Investment in research and testing facilities contributed to adoption of high-fidelity models with improved sensor arrays.

The United Kingdom’s automotive crash test dummies market is expected to grow at a CAGR of 2.4%, slightly below the global CAGR of 2.5%, supported by adoption in hybrid and EV testing facilities. In 2024, installation volumes increased moderately, with key activity in London, Midlands, and Northern England. Suppliers such as IPG Photonics and Coherent provided models integrated with advanced force and motion sensors, enhancing crash data collection. Safety agencies emphasized adoption of child and pedestrian dummies to comply with Euro NCAP protocols.

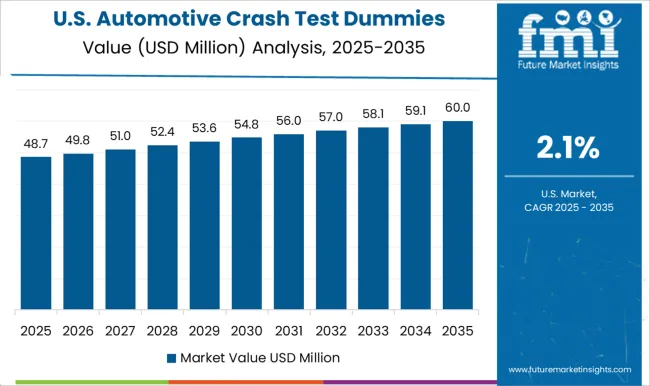

The automotive crash test dummies market in the United States is projected to grow at a CAGR of 2.1%, below the global CAGR of 2.5%, reflecting a mature industry with selective adoption. In 2024, usage increased mainly in automotive and defense crash testing programs. Suppliers such as Humanetics, Lincoln Electric, and Cellbond focused on specialized adult, child, and elderly dummies with integrated force measurement and data acquisition systems. Adoption was driven by federal regulations and compliance testing, with limited expansion due to a stable existing fleet of test facilities.

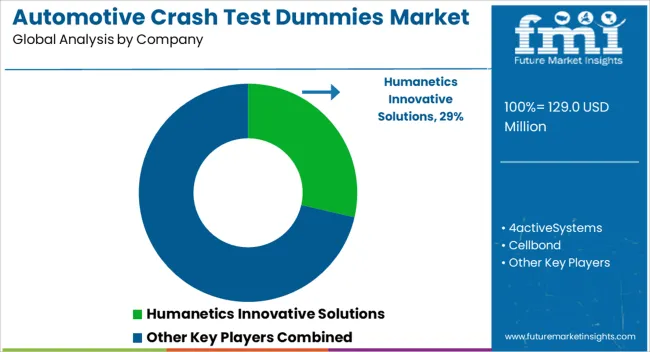

Competition in the automotive crash test dummies market is being shaped by regulatory testing requirements, biofidelity standards, and adaptability to advanced crash simulations. Market presence is being sustained through certified dummy models, calibration services, and technical support networks that ensure compliance with global safety protocols. Humanetics Innovative Solutions is being represented with a comprehensive range of crash test dummies engineered for frontal, side, rear, and rollover crash assessments. 4activeSystems is being promoted with pedestrian and cyclist dummies designed for active safety and autonomous vehicle testing. Cellbond is being applied with barrier and dummy components structured for compatibility with global testing facilities.

CTS is being showcased with customized dummy solutions tailored to regional safety requirements. Dynamic Research is being recognized with instrumented dummy systems optimized for high-resolution crash data collection. GESAC is being advanced with solutions designed for biomechanical accuracy and material durability. JASTI is being promoted with affordable dummies structured for global research and regulatory use. Kistler is being applied with sensor-integrated systems engineered for precise measurement of impact forces. MGA Research is being represented with testing facilities and support services for dummy evaluation. TASS International is being showcased with simulation software integrated with physical dummy testing to create hybrid validation models. Strategies are being directed toward improving dummy sensor technology, enhancing biofidelity, and integrating physical testing with digital simulations.

| Item | Value |

|---|---|

| Quantitative Units | USD 129.0 Million |

| Dummy Type | Adult, Child, and Infant |

| Vehicle | Passenger cars and Commercial vehicles |

| Application | Regulatory testing and Research & development |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Humanetics Innovative Solutions, 4activeSystems, Cellbond, CTS, Dynamic Research, GESAC, JASTI, Kistler, MGA Research, and TASS International |

| Additional Attributes | Dollar sales by dummy type and vehicle testing application, demand dynamics across frontal, side, and rollover crash tests, regional trends in automotive safety regulations, innovation in biofidelity and sensor integration, environmental impact of material use and disposal, and emerging use cases in electric and autonomous vehicle testing. |

The global automotive crash test dummies market is estimated to be valued at USD 129.0 million in 2025.

The market size for the automotive crash test dummies market is projected to reach USD 165.2 million by 2035.

The automotive crash test dummies market is expected to grow at a 2.5% CAGR between 2025 and 2035.

The key product types in automotive crash test dummies market are adult, child and infant.

In terms of vehicle, passenger cars segment to command 71.5% share in the automotive crash test dummies market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA