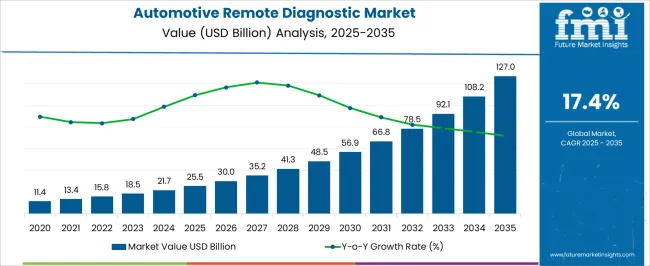

The Automotive Remote Diagnostic Market is estimated to be valued at USD 25.5 billion in 2025 and is projected to reach USD 127.0 billion by 2035, registering a compound annual growth rate (CAGR) of 17.4% over the forecast period.

The automotive remote diagnostic market is expanding steadily. Rising demand for connected vehicles, predictive maintenance systems, and advanced telematics solutions is driving growth. Current industry dynamics reflect growing adoption of digital platforms that enable real-time monitoring of vehicle performance and component efficiency.

Regulatory initiatives supporting emission control and safety compliance are further influencing the need for remote diagnostics. Increasing integration of Internet of Things (IoT) and artificial intelligence (AI) in automotive systems is enhancing diagnostic precision and operational reliability. The future outlook remains positive as automakers continue to invest in smart vehicle ecosystems and remote service capabilities.

Expansion of electric and hybrid vehicle fleets is expected to accelerate demand for advanced diagnostic systems designed to manage complex electronic architectures The market’s growth rationale is underpinned by enhanced vehicle uptime, reduced maintenance costs, and improved customer satisfaction, positioning remote diagnostics as a critical enabler of next-generation automotive service and performance management frameworks.

| Metric | Value |

|---|---|

| Automotive Remote Diagnostic Market Estimated Value in (2025 E) | USD 25.5 billion |

| Automotive Remote Diagnostic Market Forecast Value in (2035 F) | USD 127.0 billion |

| Forecast CAGR (2025 to 2035) | 17.4% |

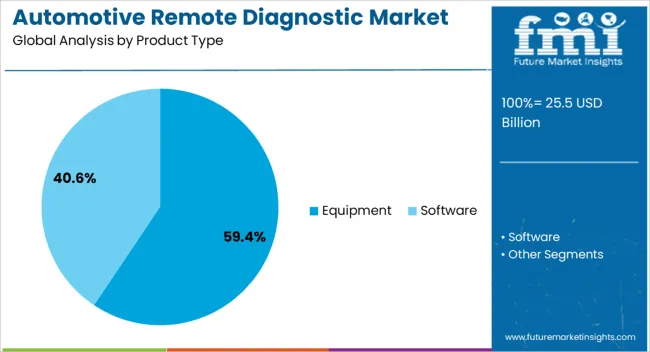

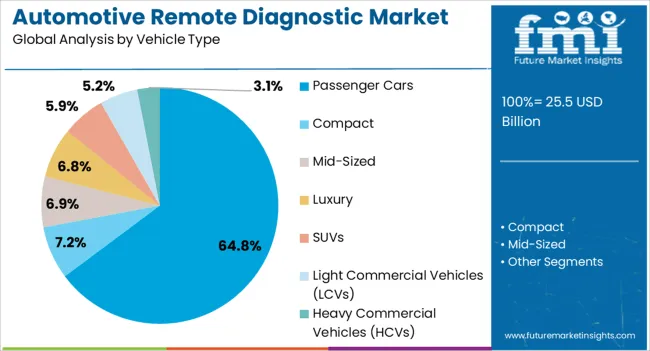

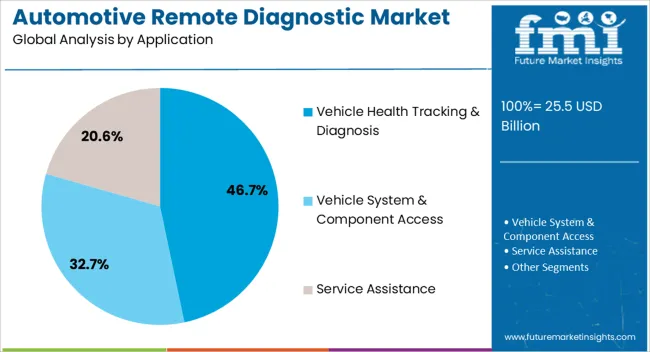

The market is segmented by Product Type, Vehicle Type, and Application and region. By Product Type, the market is divided into Equipment and Software. In terms of Vehicle Type, the market is classified into Passenger Cars, Compact, Mid-Sized, Luxury, SUVs, Light Commercial Vehicles (LCVs), and Heavy Commercial Vehicles (HCVs). Based on Application, the market is segmented into Vehicle Health Tracking & Diagnosis, Vehicle System & Component Access, and Service Assistance. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The equipment segment, accounting for 59.40% of the product type category, has been leading due to its essential role in enabling real-time fault detection and system analysis. Increased deployment of diagnostic hardware integrated with cloud-based platforms has strengthened its adoption across vehicle service centers and OEM facilities.

The segment’s growth is supported by continuous improvements in sensor technology, connectivity modules, and data processing capabilities that ensure high diagnostic accuracy. Demand has been reinforced by manufacturers’ focus on minimizing downtime and enhancing post-sale support through remote troubleshooting.

The scalability and compatibility of modern diagnostic equipment with multiple vehicle models have further improved operational efficiency With growing emphasis on standardization and interoperability across automotive systems, this segment is expected to maintain its leading position through innovation in hardware design and integration with software-based analytics platforms.

The passenger cars segment, representing 64.80% of the vehicle type category, dominates the market due to the rapid adoption of connected technologies in personal vehicles. Increasing consumer expectations for vehicle safety, performance transparency, and predictive maintenance have been central to this trend.

Automakers are integrating advanced diagnostic modules to provide users with real-time health updates and maintenance alerts, enhancing ownership experience and brand loyalty. Growth in electric and hybrid passenger cars has further expanded the need for remote diagnostics that monitor battery performance and energy efficiency.

The segment’s leadership is also supported by regulatory requirements for onboard diagnostics (OBD) and emission control compliance With expanding smart mobility initiatives and connectivity infrastructure, passenger cars are expected to remain the primary contributor to revenue generation within the automotive remote diagnostic market.

The vehicle health tracking and diagnosis segment, holding 46.70% of the application category, has emerged as the core application due to its direct impact on vehicle reliability and lifecycle management. The segment benefits from the integration of telematics and predictive analytics tools that enable early identification of potential mechanical issues.

Fleet operators and individual users are increasingly relying on these solutions to optimize maintenance scheduling and reduce operational costs. Continuous data collection from sensors and control units has improved the precision of fault detection and performance analysis.

Market expansion has been driven by OEM initiatives to offer subscription-based diagnostic services, ensuring recurring revenue and customer retention As vehicle connectivity ecosystems mature, the vehicle health tracking and diagnosis segment is expected to sustain its leadership, supported by continuous innovation in AI-driven diagnostics and cloud-enabled maintenance platforms.

Market Growth Catapults Due to the Rise of Connected and Autonomous Vehicles

The automotive remote diagnostics industry is expanding rapidly as connected and autonomous vehicles become more prevalent. The incorporation of advanced sensors and communication technologies in these vehicles generates a plethora of data, creating an ideal setting for enhanced remote monitoring and diagnostics for vehicles.

This trend offers companies profitable prospects to position themselves strategically by providing innovative solutions that address the particular difficulties presented by these intricate, highly developed automotive systems.

Developing Customized Solutions for Fleets and Commercial Vehicles Unlock New Opportunities

There is a significant business opportunity to provide remote vehicle diagnostic solutions that are specifically targeted to the requirements of fleet operators and commercial vehicle suppliers. This category has specific issues that can be resolved by offering services, including fleet health monitoring, commercial vehicle predictive maintenance, and specialized analytics.

The demand for customized fleet solutions is expanding, and companies specializing in this area can profit from the rising need for effective fleet management. With this tactical move, the companies establish themselves as specialist suppliers, satisfying the particular demands of fleet managers and cultivating enduring relationships in a market with certain diagnostic requirements.

Artificial Intelligence (AI) and Machine Learning Integration Surges in the Market

An emerging trend in remote diagnostics for automobiles is the integration of machine learning (ML) with artificial intelligence (AI). These cutting-edge technologies improve the precision and complexity of problem identification and prediction.

Automotive remote diagnostic systems are getting smarter as AI and machine learning (ML) capabilities advance, exhibiting an adaptive ability to learn from past data. This trend puts companies at the forefront of innovation by providing solutions that match the demands of contemporary automotive diagnostics and adapt dynamically to suit the ever-more-complex needs of the modern diagnostic industry.

| Attributes | Details |

|---|---|

| Trends |

|

| Opportunities |

|

| Challenges |

|

| Segment | Equipment (Product Type) |

|---|---|

| Value Share (2025) | 74.00% |

Based on product type, the equipment segment holds 74.00% of automotive remote diagnostic market shares in 2025.

| Segment | LCV (Vehicle Type) |

|---|---|

| Value Share (2025) | 71.90% |

Based on vehicle type, the LCV segment captured 71.90% of automotive remote diagnostic market shares in 2025.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 17.00% |

| Germany | 17.30% |

| India | 22.70% |

| Japan | 16.30% |

| South Korea | 23.70% |

The demand for automotive remote diagnostics in the United States is projected to rise at a 17.00% CAGR through 2035.

The automotive remote diagnostic industry in Germany is expected to expand at a 17.30% CAGR through 2035.

The automotive remote diagnostic market growth in India is estimated at a 22.70% CAGR through 2035.

The demand for automotive remote diagnostics in Japan is anticipated to rise at a 16.30%V CAGR through 2035.

The automotive remote diagnostics industry in South Korea is predicted to thrive at a 23.70% CAGR through 2035.

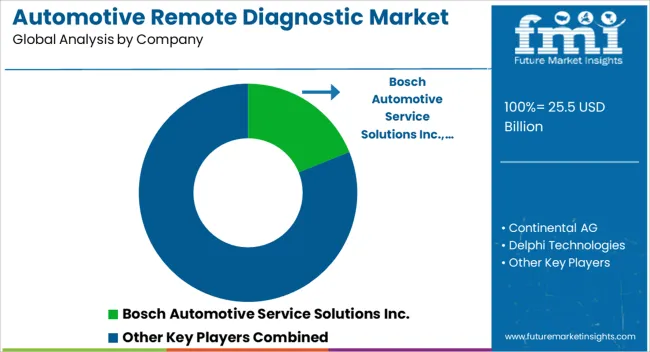

The competitive environment of the automotive remote diagnostic market is marked by fierce competition among leading competitors striving for market share and technical leadership. Prominent automotive technology and solution suppliers, like Delphi Technologies, Continental AG, and Bosch Automotive Service Solutions Inc., engage in carefully considered risks to position themselves as leaders in this sector.

These businesses provide complete remote diagnostic solutions that are specifically suited to the changing demands of the automobile industry by utilizing their vast industry knowledge, research and development skills, and worldwide reach.

Recent Developments

The global automotive remote diagnostic market is estimated to be valued at USD 25.5 billion in 2025.

The market size for the automotive remote diagnostic market is projected to reach USD 127.0 billion by 2035.

The automotive remote diagnostic market is expected to grow at a 17.4% CAGR between 2025 and 2035.

The key product types in automotive remote diagnostic market are equipment and software.

In terms of vehicle type, passenger cars segment to command 64.8% share in the automotive remote diagnostic market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Extraction Hose Reels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electroplating Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Automotive Vacuum Brake Booster Market Size and Share Forecast Outlook 2025 to 2035

Automotive Smart Antenna Market Size and Share Forecast Outlook 2025 to 2035

Automotive Actuator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Manifold Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Resonator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Counter Shaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Wheel Coating Market Size and Share Forecast Outlook 2025 to 2035

Automotive Water Separation Systems Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA