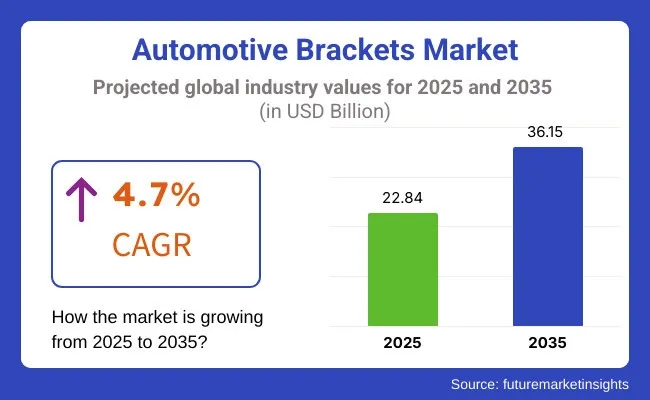

The global automotive brackets market is estimated at USD 22.84 billion in 2025 and is projected to reach USD 36.15 billion by 2035, reflecting a CAGR of 4.7% during the forecast period. Growth is being fueled by rising vehicle complexity, increasing integration of modular electronic systems, and the need for lightweight, corrosion-resistant mounting solutions across OEM and aftermarket applications.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 22.84 Billion |

| Industry Value (2035F) | USD 36.15 Billion |

| CAGR (2025 to 2035) | 4.7% |

In late 2024, Redarc Electronics introduced a series of mounting brackets specifically designed for its BCDC in-vehicle DC-DC chargers. Manufactured from 304 stainless steel, the brackets were tailored to the engine bays of popular 4x4 vehicles such as the Toyota LandCruiser and Isuzu D-MAX. These units were engineered to enhance airflow exposure and reduce installation complexity. According to Anthony Kittel, Managing Director at Redarc, development was guided by installer feedback to ensure precise vehicle-specific fitment and included all required hardware.

In the lighting segment, LED Autolamps released multi-fit mounting brackets in early 2025, designed to support a variety of work, flood, and marker lamps. Fabricated from painted 304 steel, these brackets incorporated quick-fit geometry and pre-drilled holes to support numerous lamp types and chassis configurations. They were positioned for efficient retrofitting in tray-back utilities and utility trailers.

The market has increasingly embraced bracket solutions engineered for modular accessories-including chargers, lighting units, radar sensors, and camera mounts-across both factory-built and customized vehicles. In particular, overlanding and recreational vehicle upfitting trends in Australia and the USA have expanded demand for compact, thermally optimized, and structurally rigid brackets.

Design innovation has shifted toward universal and vehicle-specific systems. Redarc’s brackets allow thermal zone optimization without compromising rigidity, while Autolamps’ designs offer quick installation using standard fasteners. This has improved compatibility for aftermarket upgrades while retaining warranty and performance standards.

To streamline adoption, bracket kits are now bundled with pre-fitted wiring accommodations, vehicle-specific fasteners, and step-by-step installation guides. This trend supports DIY installations and reduces technician time in professional garages.

Strong demand persists across commercial fleets, off-road 4x4s, and specialty trailers, where bracket durability under vibration, thermal load, and fluid exposure is essential. Materials such as low-gauge stainless steel or painted steel have been favored for weight optimization while retaining structural stiffness. Product documentation frequently confirms the use of corrosion-resistant coatings, particularly for engine bay and underbody applications.

Hydraulic brackets are estimated to account for approximately 42% of the global automotive brackets market share in 2025 and are projected to grow at a CAGR of 4.9% through 2035. Their ability to dampen engine-induced vibrations and absorb dynamic road loads makes them ideal for engine mounts and chassis integration in passenger cars and light commercial vehicles. In 2025, OEMs continue to favor hydraulic brackets for their superior NVH (noise, vibration, and harshness) performance, especially in mid- to premium vehicle segments.

These brackets are used extensively in engine and suspension assemblies where ride comfort and component isolation are critical. Manufacturers are focusing on enhancing bracket durability, thermal resistance, and compactness to support space-constrained engine bay layouts, particularly in hybrid and downsized turbocharged powertrains.

Engine-related applications are projected to account for nearly 47% of the global automotive brackets market share in 2025 and are expected to grow at a CAGR of 4.8% through 2035. Brackets used in engine compartments must withstand continuous vibrations, temperature fluctuations, and multi-directional stress while ensuring stable positioning of components such as the engine block, compressors, and transmission elements.

In 2025, both internal combustion engine (ICE) and hybrid vehicle platforms continue to rely on precision-engineered brackets for load-bearing support, particularly for powertrain-mounted subassemblies. Tier-1 suppliers are developing lightweight yet high-strength bracket solutions using advanced steel and composite materials to meet durability and efficiency targets. As engine bay complexity increases with the integration of emission control and electrification components, engine applications are expected to remain the primary driver of structural bracket demand.

High Costs and Regulatory Complexities

The Automotive Brackets Market contends with challenges such as increasing material costs, stringent regulatory compliance, and supply chain disruptions. It requires high-strength materials, including aluminium, steel, and composite alloys to manufacture brackets, leading to higher production costs.

Manufacturers also face stiff regulations for vehicle safety and emissions that affect the manufacturing and design of vehicles, such as the EU's CO2 emission targets and National Highway Traffic Safety Administration (NHTSA) standards. This is a challenge for OEMs to invest in lightweight yet high-performance brackets that meet performance along with the regulatory and durability requirements - balancing the overall cost.

Market Saturation and Competitive Pricing Pressures

Automotive brackets are used in high volume, and their mass market has pushed manufacturers to fight for price, leaving narrow profit margins. Competition is also increased by the availability of low-cost substitutes especially in developing countries. Changes in the availability of raw materials also have an effect on supply chain stability and production costs.

In order to compete, manufacturers will need to develop durable, corrosion-resistant, and weight-optimized brackets as well as increase supply chain resilience.

Rising Demand for Lightweight and High-Performance Brackets

Some of the industries that are increasingly more focused on vehicle weight reduction and fuel efficiency demand bracket assembly being made from advanced materials to reduce vehicle weight. Auto manufacturers are using aluminium and composite replacements for conventional steel brackets to provide additional structural integrity without adding weight.

Demand for battery packs and electronics results in specialized brackets for EVs Business with high tech manufacturing method like as additive manufacturing and exactness building will get business advantage in changing over business.

Advancements in Smart Brackets and Modular Designs

The industry is experiencing a transition phase, with technological breakthroughs, such as smart sensor integration and modular designs, changing the dynamics of automotive brackets market. Automakers are creating tough brackets with vibration-dampening technologies, real-time performance monitoring, and AI-assisted structural optimization.

This will continue to create growth opportunities due to the growing expansion of modular bracket designs that provide ease of assembly and maintenance. Market leaders will consolidate their position using newly developed advanced material compositions, AI-driven design enhancements, and adaptive bracket configurations.

Increasing vehicle production and technological advancements in lightweight materials are sustaining the growth of the USA automotive brackets market. The key manufacturers involved in the global Automotive Bracket market include:

The increasing adoption of electric vehicles (EVs) is driving the demand for this market, as manufacturers are incorporating lightweight brackets for a better range and battery efficiency. Moreover, the adoption of advanced designs for brackets to uphold safety standards has led to the implementation of safety regulations.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.0% |

UK Automotive Brackets Market: Growth Overview and Predictions 2020 to 2030 Although managed, the huge demand factor associated with automotive brackets can be accredited to the changing automotive industry with the transition to electric and hybrid vehicles. With automakers seeking to reduce weight and energy consumption to register substantial gains in fuel economy, the need for aluminium and composite brackets is growing.

However, changes to bracket production are also being informed by advances in additive manufacturing and 3D printing technologies that are helping to shape new custom and high performance parts. This demand for lightweight and recyclable materials in automobile production is being further fuelled by the demand for sustainability.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.5% |

According to Europe Automotive Brackets Market 2023, the European Union presents a promising automotive brackets market, with Germany, France, and Italy at the forefront of advanced vehicle component production during this period. The transition to electric mobility and roaming vehicles gives rise to the demand for brackets that are high-strength but low-weight.

To comply with strict emissions regulations, automakers are making investments in high-performance materials that reduce vehicle weight, like carbon fiber composites and aluminium alloys. The increasing trend of modular vehicle architectures is also leading to innovative designs released for the brackets to make manufacturing efficient and cost-effective.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.7% |

Japan is steadily growing in its automotive brackets market due to a rising number of R&D initiatives relevant to the light weighting of automotive and optimizing the vehicle structure. These advanced brackets are being integrated by automakers to improve aerodynamics and crash safety performance in vehicles.

The growth of hybrid and electric vehicle production is driving the demand for precision-engineered brackets that can accommodate electronic components and battery enclosures. Moreover, developing robots and automated production systems improve their ability to produce efficiently.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.3% |

Robust automotive manufacturing base and growing demands from next-generation vehicle platforms are driving the market for automotive brackets in South Korea. Production increase of EVs and smart vehicles technologies are boosting the demand for lightweight and high strength brackets.

Leading automakers innovate with magnesium alloys and reinforced plastics materials in vehicles for better performance. In addition, 3D printing, as well as automated fabrication methods, support market growth by lowering production costs.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.9% |

Industry Overview

Increased vehicle production together with technical material development and superior structural component requirements drive the steady growth of the automotive brackets market. Automobile parts require brackets for security applications in engines as well as chassis components in addition to transmission systems and electronic elements.

The drive toward efficient fuel consumption and electric vehicles has prompted bracket development from aluminium combined with magnesium along with composite materials. High-strength bracket solutions with corrosion resistance at affordable costs become possible through the implementation of 3D printing and advanced manufacturing approaches.

The market leading companies place their emphasis on developing advanced designs and manufacturing brackets which meet durability requirements as well as integration capabilities for electric and autonomous vehicles.

Various firms in the market provide lightweight bracket solutions which maintain durability at affordable costs across multiple automobile applications. Notable players include:

The overall market size for Automotive Brackets Market was USD 22.84 Billion in 2025.

The Automotive Brackets Market expected to reach USD 36.15 Billion in 2035.

The demand for the automotive brackets market will grow due to increasing vehicle production, rising adoption of lightweight materials for fuel efficiency, advancements in electric and autonomous vehicles, and the growing need for durable and high-performance structural components in modern automobiles.

The top 5 countries which drives the development of Automotive Brackets Market are USA, UK, Europe Union, Japan and South Korea.

Active Engine Brackets lead market growth to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Extraction Hose Reels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electroplating Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA