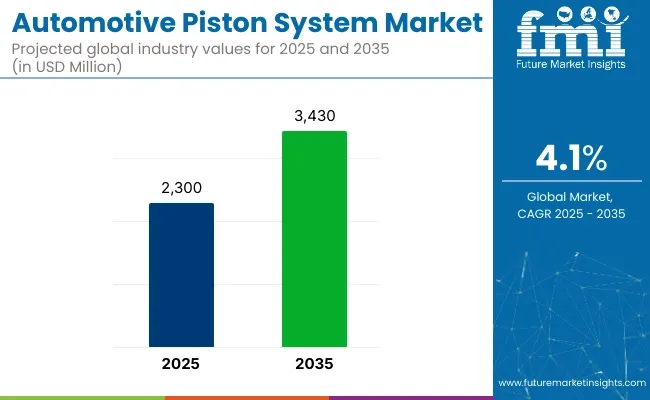

The global automotive piston system market is anticipated to reach a valuation of USD 2,300 million by 2025 and is projected to grow to USD 3,430 million by 2035, registering a compound annual growth rate (CAGR) of 4.1% over the forecast period. This growth is being supported by the sustained production of internal combustion engine (ICE) vehicles, expansion of aftermarket demand, and advancements in lightweight materials for thermal efficiency and performance.

In 2024, Piston Automotive, a major Tier 1 supplier, announced its selection of Avon, Ohio, for a new manufacturing and distribution facility. The new site is expected to support OEM and aftermarket clients with critical powertrain components, including pistons and related assemblies. As reported by the Northeast Ohio Region Development Alliance, this investment reflects the company's commitment to innovation and proximity to OEM production hubs in the Midwest.

Material innovation has also contributed to the evolution of piston design. In a 2024 interview with EngineLabs, representatives from CP-Carrillo discussed the growing adoption of forged aluminum and hybrid steel-aluminum pistons for high-performance and heavy-duty applications.

| Attributes | Key Insights |

|---|---|

| Market Value, 2025 | USD 2,300 million |

| Market Value, 2035 | USD 3,430 million |

| CAGR (2025 to 2035) | 4.1% |

The company highlighted its development of low-friction coatings and variable crown geometries tailored for boosted engines. According to CP-Carrillo, “advancements in thermal resistance and weight reduction continue to redefine piston durability in demanding engine environments”.

The aftermarket segment is also witnessing a shift toward modularity and personalization. A 2024 article by ATRAC Parts emphasized the increasing demand for CNC-machined pistons with custom dome profiles and optimized ring lands. These trends are being driven by engine rebuilders, motorsport teams, and retrofit enthusiasts aiming to balance performance with emissions compliance.

With increasing focus on ICE-hybrid configurations and ongoing replacement needs in commercial fleets, the demand for precision pistons is expected to remain strong. The market is being further supported by technological investments, supply chain expansion, and the pursuit of combustion efficiency through piston engineering. As hybrid and performance applications persist, the global piston market is set to maintain its growth through 2035

The table below presents the annual growth rates of the global automotive piston systems market from 2025 to 2035. With a base year of 2024 extending to the current year 2025, the report examines how the sector's growth trajectory evolves from the first half of the year (January to June, H1) to the second half (July to December, H2). This analysis offers stakeholders insights into the industry's performance over time, highlighting potential developments that may emerge.

These figures indicate the growth of the sector in each half-year, between the years 2024 and 2025. The industry is expected to grow at a CAGR of 4.1% from 2025 to 2035. In H2, the growth rate increases.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 3.7% |

| H2 (2024 to 2034) | 3.9% |

| H1 (2025 to 2035) | 4.0% |

| H2 (2025 to 2035) | 4.1% |

Moving into the subsequent period, from H1 2025 to H2 2025, the CAGR is projected to slightly decrease to 4.0% in the first half and relatively increase to 4.2% in the second half. In the first half (H1), the sector saw an increase of 30 BPS, while in the second half (H2), there was a slight increase of 20 BPS.

Gasoline engines accounted for 48% of the global market in 2025 and are projected to grow at a CAGR of 4.3% through 2035. Their continued dominance was supported by high production volumes in the passenger vehicle segment, cost-effectiveness, and well-established fueling infrastructure.

In 2025, gasoline-powered vehicles remained the preferred choice in Asia-Pacific and North America due to fuel availability, lower initial vehicle cost, and reduced NVH (noise, vibration, and harshness) compared to diesel counterparts.

Automakers focused on optimizing gasoline engines through variable valve timing, turbocharging, and lightweight piston materials to improve thermal efficiency and meet evolving emission standards. Integration with mild hybrid systems and compatibility with ethanol-blended fuels further extended the operational relevance of gasoline engines in regulatory-conscious markets.

Dish pistons held 45% of the global piston head market in 2025 and are forecast to grow at a CAGR of 4.2% through 2035. These piston heads were widely adopted in gasoline and diesel engine configurations for their ability to promote efficient air-fuel mixing and stable flame propagation. In 2025, OEMs continued to utilize dish piston designs across passenger cars, light commercial vehicles, and hybrid engines to maintain performance consistency and fuel economy.

The concave surface design supported reduced knocking tendencies and enhanced compatibility with multi-valve engine configurations. Dish pistons were manufactured using forged aluminum alloys and coated for wear resistance, ensuring durability under high combustion pressures. The design’s adaptability to variable compression ratios and cylinder geometries made it suitable for downsized turbocharged engines, reinforcing its widespread use across global vehicle platforms.

Aluminium piston, enhancing engine power and lightweight efficiency

Aluminium alloys are essential to piston manufacturing. They offers perfect strength, thermal conductivity. The standard aluminium piston system comprises of 12% Si alloy, which result in excellent castability and thermal conductivity. To enhance high-temperature strength and wear resistance, hypereutectic alloys with silicon content exceeding 12% are used. These alloys show reduced thermal expansion and improved wear resistance.

However, they may have lower strength compared to standard eutectic alloys. The choice between eutectic and hypereutectic alloys depends on specific engine requirements, balancing factors such as thermal performance, strength, and durability. Advancements in alloy compositions and manufacturing processes continue to optimize piston performance, addressing the increasing demands of modern engine technologies.

Rising performance standards driving demand for advanced piston systems

Rising performance standards in the automotive industry are driving the demand for advanced piston systems. As engine technologies is evolving, especially with the rise of turbocharged and high-performance vehicles, there is a growing need for pistons that can withstand temperature as well as pressure.

Turbocharged engines, known for their ability to generate more power from smaller engine sizes, place greater thermal and mechanical stress on pistons. Advanced piston designs, help in improving the efficiency of any vehicle. These innovations guarantee that pistons can maintain optimal performance under demanding conditions, contributing to the overall performance and longevity of the engine.

Rising vehicle production fuelling demand for durable and high performance piston system

The rise in vehicle production globally, is one of the important driver which leads to the rise in demand for the automotive piston system. In 2024, global vehicle production reached approximately 80 million units, which automatically leads to rise in demand for piston system. Pistons are essential components in ICEs as they convert the energy generated from fuel combustion into mechanical motion, which powers the vehicle.

The demand for advanced pistons is driven by the need for greater engine efficiency, improved durability, and the ability to perform in diverse climates and driving conditions. As automakers look to improve engine performance and meet regulatory standards, high-performance piston systems made from materials like aluminum alloys and forged steel are becoming more essential. This trend is expected to continue, with global vehicle production projected to grow at a rate of 2-3% annually over the next decade, further fuelling piston system demand.

Engine innovations driving demand for high performance pistons with enhanced properties

The engine technology are continuously undergoing research and development. The innovations are leading the manufacturers to decreasing the turbocharged engine size. This has resulted in the surge in demand for high-performance automotive pistons which have advanced thermal and mechanical properties. Downsizing engine displacement while maintaining or even increasing power output is becoming a key strategy to improve fuel efficiency and meet stringent emissions standards.

Turbocharging allows engines to generate more power, which places additional stress on the pistons. These engines require pistons that can bear high temperature, pressures, and mechanical stresses. Turbocharged engines typically operate at temperatures up to 900°C, which exerts more strain on the pistons compared to naturally aspirated engines.

In order to bear high pressure, piston are manufactured with the high and lightweight material (aluminium or steel). The global turbocharged engine market is projected to grow at a CAGR of 5.4% in 2024, further driving the demand for pistons.

Tier-1 companies account for around 50-55% of the overall market with a product revenue from the automotive piston system market of more than USD 50 million. Rheinmetall Automotive AG, Tenneco Inc., Aisin Seiki Co., Ltd., Hitachi Automotive Systems, Ltd., and other players.

Tier-2 and other companies such as Shriram Pistons & Rings Ltd., Federal-Mogul, India Pistons Limited and other players are projected to account for 45-50% of the overall market with the estimated revenue under the range of USD 50 million through the sales of automotive piston system.

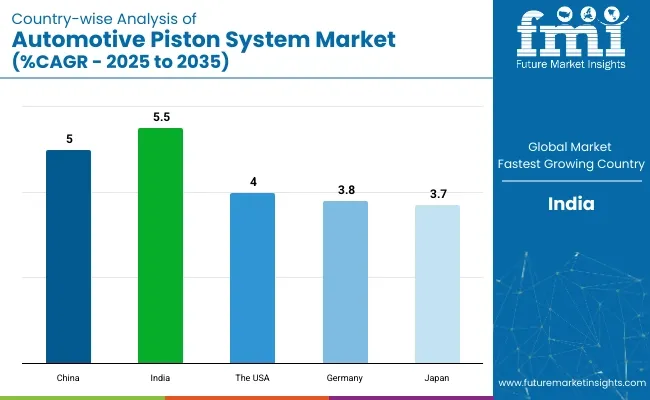

The section below covers the industry analysis for automotive piston system in different countries. The demand analysis on key countries in several regions of the globe, including North America, Latin America, East Asia, South Asia Pacific, Western Europe, Eastern Europe, Middle East, and Africa is provided. This data helps investors to keenly observe and go through the recent trends and examine them in an ordered manner.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| China | 5.0% |

| India | 5.5% |

| The USA | 4.0% |

| Germany | 3.8% |

| Japan | 3.7% |

China's motor vehicle production reached a remarkable 30,160,966 units in December 2023, marking a significant increase from the previous year’s 27,020,615 units. This growth reflects a consistent upward trend in China’s automotive manufacturing sector, which has averaged 18,264,761 units from 1997 to 2023.

The surge in production is expected to fuel the demand for high-performance automotive piston systems. As the production of both passenger and commercial vehicles rises, the need for advanced pistons capable of handling greater engine loads and improving fuel efficiency becomes critical. The shift towards more fuel-efficient, turbocharged engines in Chinese vehicles places additional strain on pistons, which must withstand higher temperatures and mechanical pressures.

Moreover, China’s focus on enhancing piston technology, including advancements in materials such as high-strength aluminum alloys and steel, is further boosting market growth. These innovations, along with a growing demand for durable, high-performance components, are positioning China as a key player in the global automotive piston systems market. This ongoing expansion in vehicle production coupled with advancements in piston technology continues to support the growth of the automotive piston system market in China.

The surge in aftermarket demand for high-performance automotive piston systems is driven by two main factors: vehicle longevity and the growing focus on performance. As vehicles age, the need for replacement parts like pistons increases. The average age of vehicles on USA roads now exceeds 12 years, contributing to a rising demand for automotive parts.

According to the Automotive Aftermarket Suppliers Association (AASA), the USA automotive aftermarket industry is expected to reach USD 400 billion by 2026, fueled by the growing need for replacement parts and maintenance.

In addition, as consumer demand for improved vehicle performance rises, especially in high-performance and sports cars, there is a greater emphasis on pistons that can withstand higher pressures and temperatures. This combination of aging vehicles and the desire for better performance is driving the demand for high-quality automotive piston systems in the aftermarket sector.

Germany is renowned for its engineering excellence, is increasingly adopting cutting-edge technologies like 3D printing, advanced casting methods, and precision forging to develop high-performance piston systems. These innovations allow manufacturers to create pistons with improved strength, reduced weight, and better thermal resistance, essential for meeting the demanding performance standards of modern engines.

Germany’s push for sustainability and reduced emissions in the automotive sector has led to a demand for pistons designed to enhance fuel efficiency and lower carbon footprints. The introduction of low-emission engine technologies and the shift towards more efficient internal combustion engines, including turbocharged variants, are driving the need for pistons that can withstand higher temperatures and pressure while maintaining low emissions.

The promotion of e-fuels in Germany enhances the sustainability of piston engine systems by offering a renewable fuel alternative. E-fuels, produced from renewable energy sources, help reduce CO? emissions while utilizing existing combustion engines, supporting the transition towards climate-neutral transportation.

This aligns with Germany’s ambition to meet climate protection targets and ensure that the 1.5 billion piston engines worldwide can contribute to reducing emissions. As e-fuels become more integrated into automotive systems, piston engines will remain integral, driving continued demand for advanced, high-performance piston systems that can operate effectively with these sustainable fuels.

Technological advancements in the automotive piston system industry are driving performance, durability, and efficiency improvements. The shift toward lightweight, high-strength materials like advanced aluminum alloys and composite materials is gaining momentum due to their superior thermal conductivity, reduced weight, and enhanced durability. Manufacturers are increasingly focused on developing pistons that can withstand higher pressures and temperatures, particularly for turbocharged and downsized engines.

Innovations in coating technologies, such as friction-reducing surface treatments and heat-resistant coatings, are improving piston longevity and reducing wear. The growing emphasis on fuel efficiency and emissions reduction has led to the development of pistons with lower friction and better sealing capabilities.

These advancements are fueling demand for high-performance pistons in passenger cars, commercial vehicles, and high-performance vehicles, making them a critical component for enhancing engine efficiency and meeting stringent regulatory standards in the automotive industry.

Recent Industry Developments

The Automotive Piston System was valued at USD 2,150 million in 2024

The demand for Automotive Piston System is set to reach USD 2,300 million in 2025

The global automotive piston system market is driven by rising engine efficiency, downsizing trends and performance upgrades.

The automotive piston system demand is projected to reach USD 3,430 Million in 2035.

The passenger cars are expected to lead during the forecasted period due to engine downsizing, performance upgrades, and stricter emissions regulations. These factors require highly durable, efficient pistons for improved fuel efficiency and power output.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Brake System Market Growth - Trends & Forecast 2025 to 2035

Automotive Brake System & Components Market Growth - Trends & Forecast 2025 to 2035

Automotive Washer System Market Trends - Growth & Forecast 2025 to 2035

Automotive Seating Systems Market Analysis - Size, Share & Forecast 2025 to 2035

Automotive Exhaust Systems Market Trends - Growth & Forecast 2025 to 2035

Automotive Starting System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Ignition Systems Market Size and Share Forecast Outlook 2025 to 2035

Automotive Steering System Market Growth - Trends & Forecast 2025 to 2035

Automotive Embedded System Market Growth - Trends & Forecast 2024 to 2034

Automotive Defogger System Market

Automotive Platooning System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Gear Shift System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Navigation System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Automotive Suspension System Market Growth - Trends & Forecast 2025 to 2035

Automotive Night Vision System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Fuel Delivery System Market Trends - Growth & Forecast 2025 to 2035

Automotive Energy Storage System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Engine Cooling System Market

Automotive Brake Actuation Systems Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA