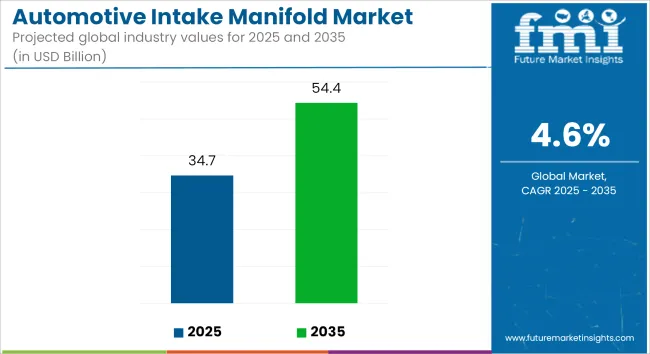

The global automotive intake manifold market is estimated at USD 34.7 billion in 2025 and is projected to reach USD 54.4 billion by 2035, reflecting a CAGR of 4.6% over the forecast period. Growth is being supported by increased vehicle production, stricter emissions legislation, and material shifts favoring lightweight and sustainable engine components.

In July 2024, an intake manifold made entirely from recycled nylon was awarded the SPE Automotive Innovation Award. The part, developed by Marelli using RadiciGroup’s Renycle® polyamide, was validated through burst pressure, thermal cycling, vibration, and NVH tests. A 70% reduction in CO₂ emissions was reported compared to conventional virgin-material designs, as noted in official documentation published by Assembly Magazine.

Later in 2024, Federal-Mogul (Fel-Pro) released PermadryPlus intake manifold gaskets, engineered for turbocharged gasoline engines. The gaskets were confirmed to include multi-layer steel cores and advanced surface coatings, offering resistance to detachment under thermal and mechanical loads. According to the company's release, these upgrades were designed to meet high-performance sealing needs and extend service intervals.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 34.7 billion |

| Industry Value (2035F) | USD 54.4 billion |

| CAGR (2025 to 2035) | 4.6% |

In November 2023, Performance Design launched the Carbon TRc intake manifold, featuring a carbon-fiber plenum and CNC-machined aluminum runners. The unit was specified for boosted applications up to 50 psi and engineered to fit under OEM hoods on select Ford, GM, and Stellantis V8 platforms.

Across recent introductions, material diversification has been emphasized. Polymer composites, carbon-fiber modules, and metal-plastic hybrids have been used to reduce intake manifold weight by up to 30%, while enabling improved thermal management and recyclability.

Design enhancements have also focused on thermal control. Integrated coolant passages and heat shields have been incorporated to manage intake air temperatures, reducing knock risk in downsized turbo engines. These modifications are being adopted to align with Euro 7 and EPA Tier 3 targets.

In the aftermarket segment, plug-and-play modular intake kits have been launched for performance upgrades. These systems have been supplied with pre-bundled hardware to support high-flow configurations in pickup trucks and muscle cars.

Regulatory compliance has remained a decisive factor, with components designed to meet REACH and ELV directives, focusing on recyclability and mono-material construction for simplified disassembly.

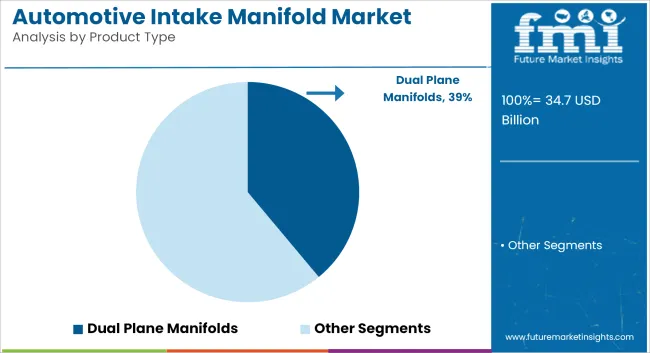

Dual plane intake manifolds are estimated to account for approximately 39% of the global automotive intake manifold market in 2025 and are projected to grow at a CAGR of 4.8% through 2035. These manifolds are preferred in naturally aspirated internal combustion engines where low-end torque, throttle response, and fuel distribution uniformity are prioritized-particularly in V6 and V8 configurations used across pickup trucks and utility vehicles.

In 2025, OEMs and aftermarket suppliers continue to offer dual plane configurations to support performance tuning, emission compliance, and improved drivability. Their design allows for the separation of intake pulses, reducing charge robbing and optimizing cylinder filling at moderate engine speeds. As emission norms tighten and fuel efficiency expectations grow, dual plane manifolds remain integral to engine platforms in North America and select Asia-Pacific markets.

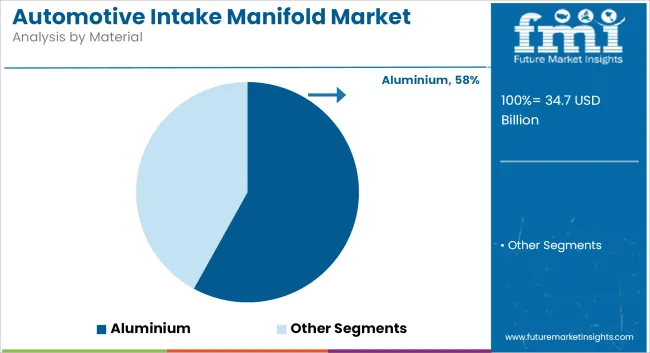

Aluminium intake manifolds are projected to account for nearly 58% of the global market share in 2025 and are expected to grow at a CAGR of 4.9% through 2035. Their selection is supported by superior heat dissipation, corrosion resistance, and structural integrity under varying thermal loads. In 2025, aluminium continues to be widely used in performance and high-temperature engine applications, including supercharged and turbocharged powertrains.

Manufacturers prefer cast or billet aluminium designs for precision control of airflow paths and consistent wall thickness across complex manifold geometries. While composite materials are gaining ground in low-cost and hybrid powertrains, aluminium remains dominant in mainstream and specialty vehicle applications due to its machinability and long-term reliability.

Fast-pace Growth in the Electric Vehicles (EV) Sector

The automobile intake manifold defining sector to the major part of the challenges it is the one posing the rise of electric vehicles (EVs) which come without using normal resonance or air intake systems. Various countries are mostly inclined towards producing EVs by phasing out internal combustion engines (ICE) which can have a major impact on the long-term intake manfold demand.

On the other hand, that is why the manufacturers are promoting hybrid powertrains and the fuel-efficient ICE technologies which demand advanced intake manifold designs for proper combustion.

Instability in the Prices of Raw Materials, Manufacturing Costs

Some raw materials like aluminium, composites, and high-performance polymers used in intake manifolds are subject to price fluctuations associated with market demand and supply chain disruptions. Moreover, high manufacturing costs increasingly create a challenge for precision manufacturing and material processing.

To address this, companies are investing in cost-saving production methods, which include 3D printing technology and automatic casting processes.

Improvements in the Lightweight Composite Intake Manifold

The lightweight composite intake manifolds being developed, which are characterized by high-temperature resistance, lower engine weight and long service life, are promising new business opportunities. Industry partners are detecting a trend of substituting traditional casting iron and aluminium manifolds with high-strength polymer-based tapping.

Continuous progress in highly-composite materials and hybrid designs leads manufacturers to focus on the development of products, which combine efficiency improvement with weight reduction.

Growth of Aftermarket Performance Intake Manifolds

Increasing aftermarket intake manifold modifications and demand for performance-rich strips have great growth potential. Demand for high-flow intake manifolds, stratified air distribution, and variable intake geometry designs in view of further power and throttle response gains is primarily driven by car enthusiasts and motorsport professionals.

Moreover, the aftermarket sector is also expected to experience rise in demand due to motorsports events, audience inquiry about engine tuning, and finally, the introduction of more customizing options for the intake manifold.

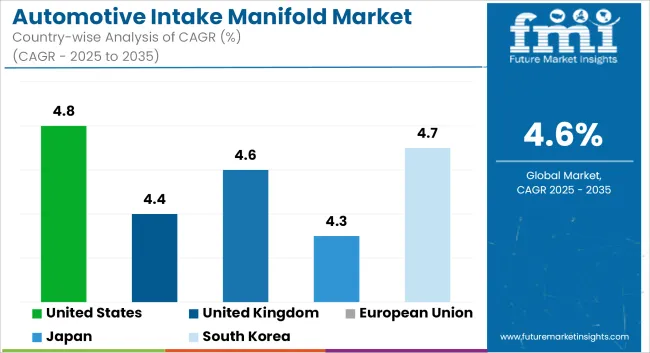

The USA automotive branch is quite vibrant; the primary factors are the rising production of fuel-efficient cars, the enhancement of engine optimization technologies, and the transition toward lightweight automotive components. The surge of turbo engines and hybrids in the market that are more and more used by car manufacturers interest’s intake manifolds aimed to improve airflow efficiency and combustion, which are the newest running ideas that tell man to become smarter, eco-friendlier, and efficient.

Moreover, tough fuel economy laws prescribed by the Environmental Protection Agency (EPA) are persuading carmakers to adopt alternate lightweight intake manifold materials like aluminium and composite polymers in the pursuit of engine efficiency and lower emissions. The upsurge in both performance and aftermarket vehicle modifications is also a key factor that brings about a rising requirement for the custom intake manifold solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.8% |

The UK automotive intake manifold market is experiencing a steady growth, which is backed up by the growing popularity of hybrid and fuel-efficient vehicle technologies, added to the force of emission regulations, and the rise of lightweight engine components.

The UK strategy to eliminate all internal combustion engine (ICE) cars by 2035 is the main factor driving the investment in hybrid and plug-in hybrid electric vehicles (PHEVs), the latter of which need the high-efficiency intake manifold designs for the airflow optimization and combustion performance improvement. Besides that, the demand for motorsport and performance automotive products is growing accordingly, and the burden of finding high-performance and carbon-fibre intake manifolds is put heavily on sports and luxury vehicles.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.4% |

Furthermore, the growth of the European Union automobile refrigerating and condensing covers market is a result of the increasing regulatory pressure on emissions, new innovations in fuel-efficient engine designs, and additional investments in hybrid powertrains. The introduction of the Euro 7 emissions standard has compelled motor manufacturers to come up with high-efficiency intake manifolds that will optimize combustion and decrease the fuel consumption of the engines.

Likewise, the development of the PHEVs car type and the huge gain in sales of turbocharged vehicles in Europe is driving the demand for special intake manifolds that can carry out the dynamic air intake optimization process. The expansion of automotive part manufacturing in countries like Germany, France, and Italy also facilitates the development of intake manifold designs for both passenger and commercial vehicles.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.6% |

The Japan automotive intake manifold industry is witnessing moderate expansion, which is primarily taking place due to the increasing prevalence of hybrid and turbocharged engine technologies, along with the rising investment in lightweight engine components, and the latest developments in precision manufacturing.

The pre-eminence of Japan in hybrid car manufacturing, which is powered by Toyota, Honda, and Nissan, has led to the demand for highly-efficient intake manifolds, designed for the purpose of optimizing fuel consumption and better combustion. Also, the funds aimed at the development of aluminium and composite materials are assisting the production of heat-resistant and lightweight intake manifolds for fuel-savvy cars. The upward trend of Japan's automotive R&D sector is also encouraging the breakthrough in the variable-length intake manifold technology which supports the improved efficiency of air distribution and better performance of the engine at different load conditions.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.3% |

The South Korea automotive intake manifold market is expanding due to the country’s leadership in fuel-efficient automotive technologies, increasing investments in hybrid and alternative fuel vehicles, and the presence of strong domestic automakers such as Hyundai and Kia. With South Korea's rapid growth in hybrid and plug-in hybrid vehicle production, demand for lightweight and high-performance intake manifolds is increasing.

Additionally, government incentives for green mobility solutions are driving investments in engine efficiency improvements, including intake manifold designs that optimize air distribution and fuel combustion. The growth of South Korea’s automotive parts manufacturing industry is also supporting innovations in cost-effective, high-durability intake manifold materials, particularly composite polymers and aluminium alloys.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.7% |

The worldwide automotive intake manifold sector has been gaining steady-edge growth owing to factors like the significant rise in vehicle production, the ever-present desire for fuel efficiency, and overall development of advanced materials. The intake manifold is fundamental in the air-fuel mixture equation for optimal combustion in internal combustion engines (ICEs), it is somewhat essential in raising the engine's effectiveness and reducing emissions.

The market is influenced by technological hitches like changeable intake manifolds (VIM), the growing use of composite and lightweight aluminium materials, and the rise in turbocharged engines. Major manufacturers rely on techniques' improvements are fuel economy, enhanced performance, and durability for compliance with automotive industry standards and stricter emission regulations.

The global automotive intake manifold market is projected to reach USD 34.7 billion by the end of 2025.

The market is anticipated to grow at a CAGR of 4.6% over the forecast period.

By 2035, the automotive intake manifold market is expected to reach USD 54.4 billion.

The EFI manifolds segment is expected to dominate due to the increasing adoption of electronic fuel injection systems in modern vehicles, which enhance fuel efficiency, improve engine performance, and reduce emissions.

Key players in the market include Magneti Marelli S.p.A., Röchling Group, MAHLE GmbH, Aisin Seiki Co., Ltd., and Honda Foundry Co., Ltd.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Air Intake Manifold Market

Automotive Smart Antenna Market Size and Share Forecast Outlook 2025 to 2035

Automotive Actuator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Vacuum Brake Booster Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Resonator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Counter Shaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Wheel Coating Market Size and Share Forecast Outlook 2025 to 2035

Automotive Water Separation Systems Market Size and Share Forecast Outlook 2025 to 2035

Automotive Refinish Coating Market Size and Share Forecast Outlook 2025 to 2035

Automotive Emission Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Tire Market Size and Share Forecast Outlook 2025 to 2035

Automotive Glass Market Size and Share Forecast Outlook 2025 to 2035

Automotive Wire & Cable Material Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive DC-DC Converter Market Size and Share Forecast Outlook 2025 to 2035

Automotive Key Blank Market Size and Share Forecast Outlook 2025 to 2035

Automotive Tensioner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Cabin Air Quality Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Fuel Accumulator Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA