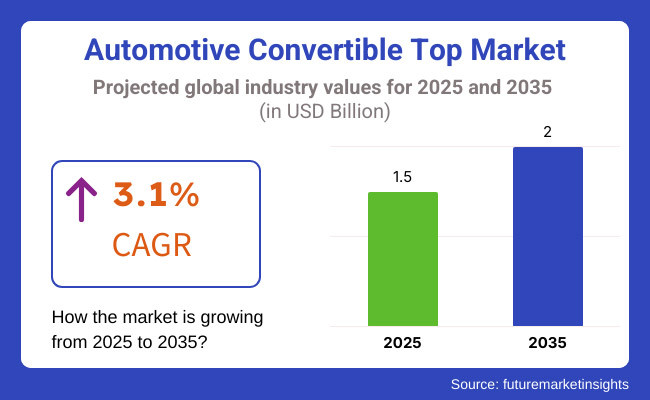

The global automotive convertible top market is valued at USD 1.5 billion in 2025. The market is projected to reach USD 2 billion by 2035, registering a CAGR of 3.1% over the forecast period. This growth is being observed in alignment with evolving consumer preferences toward open-air driving options integrated into mid- and high-end vehicle segments.

Demand has been recorded across luxury OEM platforms in North America and Europe, where the offering of retractable roof systems remains aligned with segment-specific brand differentiation strategies. Soft-top and hardtop systems have been deployed based on vehicle class, styling intent, and climate considerations. Component suppliers have continued to collaborate with OEMs for both factory installations and authorized retrofitting.

GAHH Automotive, a USA-based supplier, has continued offering convertible replacement tops made from advanced Haartz Stayfast and Twillfast materials, supporting restorations of BMW, Porsche, and Mercedes-Benz models. The company’s product documentation highlights adherence to OEM engineering tolerances, allowing for direct-fit solutions for aftermarket replacement demand.

In 2024, Newport Convertible Engineering confirmed expanded capacity to convert SUVs and sedans into convertibles under license agreements. Models such as the Cadillac Escalade and Tesla Model S were equipped with full-length power convertible roof systems. The company’s engineering services were directed toward select luxury vehicle customers across the USA, Middle East, and Asia, according to public statements on its platform.

OEMs including Mercedes-Benz, BMW, and Mazda have retained convertible models in their portfolios, with units such as the C-Class Cabriolet, Z4, and MX-5 Miata reflecting stable production volumes. According to an overview published by Car and Driver, these models have been maintained with updated safety features, automated top operation, and roll bar reinforcements.

Integration of convertible top systems has required coordination across body structure, aerodynamics, and sealing technologies. Convertible module vendors have been tasked with addressing wind noise, hydraulic or electric actuation, and rear visibility optimization, especially in compact designs.

Development contracts issued by automotive OEMs have specified performance metrics for open-close cycles, material weather resistance, and compatibility with sensor layouts. Lightweight construction using aluminum frame elements and composite top materials has been prioritized to meet vehicle efficiency goals without compromising cabin experience. Growth in aftermarket retrofitting and vehicle personalization programs is expected to contribute to steady volume addition across target markets

In 2025, hardtop rooftops hold an estimated 68% share of the global automotive rooftop market, with the segment projected to expand at a CAGR of 3.3% through 2035. Demand is supported by durability, better weather protection, and improved safety in rollover conditions. Automakers continue to prefer hardtop formats for integration with panoramic roofs, sunroofs, and ADAS modules.

The format remains widely used across sedans, SUVs, and sports cars, with design enhancements focused on acoustic insulation, sealing performance, and structural load handling. The segment sees strong adoption across North America, Europe, and Asia, aligning with consumer preference for solid-roofed vehicle designs and higher perceived quality.

Aluminum is expected to account for 36% of the global rooftop material market in 2025, with the segment growing at a projected CAGR of 3.4% through 2035. Growth is driven by automakers’ push to reduce overall vehicle mass and improve energy efficiency, particularly in electric and hybrid vehicle platforms.

Aluminum rooftops are used in both fixed and retractable formats due to their corrosion resistance and favorable strength-to-weight ratio. Manufacturers are combining aluminum panels with composite cores to meet structural and thermal insulation standards. Continued investments in advanced surface treatments and bonding techniques further position aluminum as a preferred choice for performance vehicles, electric SUVs, and premium crossovers.

High Manufacturing Costs, Weather Resistance, and Complex Mechanism Maintenance

High production costs and complex mechanical designs are some of the major challenges affecting the automotive convertible top market. The use of optimized multi-layer fabrics, polymers, and advanced materials in the production of convertible tops, for example, is costly as they need to be weather-resistant and durable.

Convertible tops also need to resist extreme conditions including UV exposure, rain, wind, and snow which requires constant R&D in material engineering. The maintenance complexity is another serious challenge, since electric and hydraulic roof-based systems require regular inspection and repair, and ultimately, a high ownership cost for the consumers.

Advancements in Lightweight Materials, Smart Convertible Roof Systems, and EV Integration

Availability of lightweight materials, smart roof technology, and rising luxury vehicle sales are driving automotive convertible top market growth. Automated retractable hardtops with AI-based sensors are advancing efficiency, reduction of noise, and durability.

Manufacturers are also focusing on electric and hybrid vehicles (EVs), where integration and drone aerodynamics and energy efficiency are more interdependent. Cabin acoustics and aesthetic customization trends are further driving the demand for convertible roofs in the premium car segment.

In the USA, automotive convertible top market is experiencing moderate growth, as there is an increase in demand for luxury and performance vehicles. In order to improve vehicles, automakers are incorporating new fabric and retractable roof technology. The increasing demand for premium vehicles and the presence of major convertible car manufacturers are propelling the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.2% |

The automotive convertible top market in the United Kingdom is expanding as consumers are becoming increasingly interested in premium and sports cars. It has solid luxury auto brands in the local market and growing demand for open-roof driving experiences especially in the summer. Automakers are also working on lightweight materials and improved insulation to improve performance.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.0% |

Automotive convertible top market in the European Union, is expected to witness steady growth, for the presence of the top-tier premium car manufacturers in the region, which is driving consumers toward luxury vehicles. Three major markets for convertibles Germany, France and Italy represent a niche but stable demand for these vehicles.

The growing influence of retractable hardtop and smart roof technologies has also been impactful across the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 3.1% |

Automotive convertible top market in Japan slow but steady development with high demand from luxury and sports car segments the market size may not be as large as in other regions, but car manufacturers are already adding high-function textile-fabric materials, as well as high-performance retractable roof top mechanisms to appeal to a niche of buyers.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.0% |

The automotive convertible top market in South Korea is gradually growing on account of increasing interest for premium cars among the consumers. Moreover, the presence of a robust automotive industry, along with the development of lightweight and durable convertible top materials, will further accelerate the market growth in this region.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.2% |

Increasing demand for luxury vehicles, high-end fabric materials, and smart au AI-driven material innovations, light-weight retractable roof mechanism, and advanced sealing technology are paving the way for aesthetics, durability, and weather-proofing prowess.

The landscape encompasses automotive OEMs, manufacturers of convertible top systems, and fabric providers, all advancements to technologies of soft tops, hardtops, AI-powered roof automation, and noise-reducing materials.

Other Key Players

Next-generation retractable rooftop technologies are being advanced by various automobile top system suppliers, convertible cloth manufacturers, and high-end automobile elements providers, as are AI-driven material quality assessments and low-weight convertible system innovations. These include:

The overall market size for automotive convertible top market was USD 1.5 Billion in 2025.

The automotive convertible top market is expected to reach USD 2 Billion in 2035.

The demand for automotive convertible tops is expected to rise due to increasing consumer preference for luxury and high-performance vehicles, advancements in lightweight and durable roofing materials, and the growing popularity of open-air driving experiences. Additionally, rising disposable incomes, technological innovations in retractable roof mechanisms, and expanding sales of premium and sports cars are driving market growth.

The top 5 countries which drives the development of automotive convertible top market are USA, UK, Europe Union, Japan and South Korea.

Soft Tops and PVC Materials to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Extraction Hose Reels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electroplating Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Automotive Vacuum Brake Booster Market Size and Share Forecast Outlook 2025 to 2035

Automotive Smart Antenna Market Size and Share Forecast Outlook 2025 to 2035

Automotive Actuator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Manifold Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA