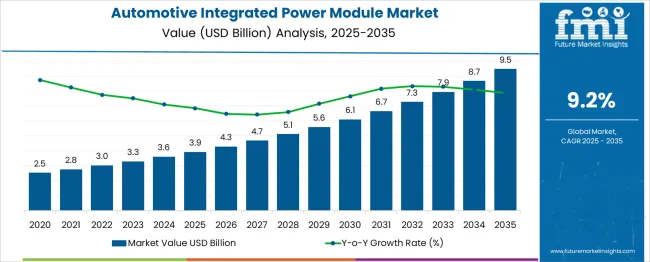

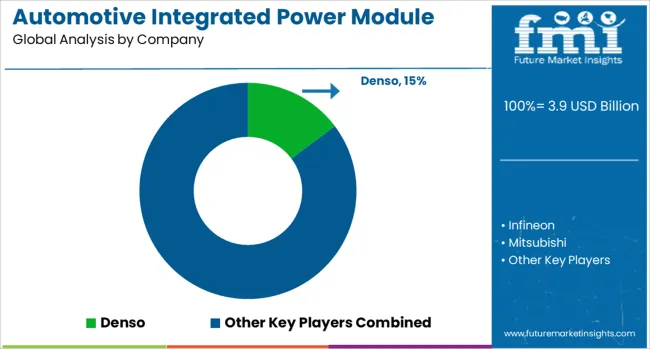

The Automotive Integrated Power Module Market is estimated to be valued at USD 3.9 billion in 2025 and is projected to reach USD 9.5 billion by 2035, registering a compound annual growth rate (CAGR) of 9.2% over the forecast period.

Between 2025 and 2030, the market rises from USD 2.5 billion to USD 4.3 billion, a gain of USD 1.8 billion, indicating robust mid-decade growth. Annual increments accelerate gradually: USD 2.5B (2025), USD 2.8B (2026), USD 3.0B (2027), USD 3.3B (2028), USD 3.6B (2029), and USD 3.9B (2030). This reflects a strong correlation with rising EV production volumes, the adoption of high-voltage architectures, and OEM strategies to consolidate power electronic components into more efficient integrated modules.

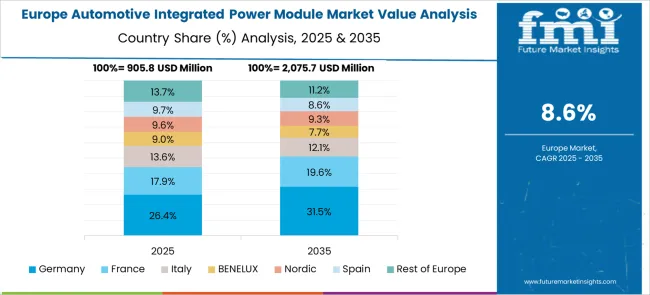

In the second half of the decade (2030–2035), growth accelerates further as demand reaches USD 9.5 billion, driven by next-gen 800V platforms, cost-optimized silicon carbide (SiC) deployment, and global BEV adoption. According to SAE International and IEEE Transactions on Power Electronics, integrated modules offer superior thermal management and space efficiency, which are critical for compact EV platforms. Asia-Pacific leads volume growth, while Europe and North America dominate high-spec applications. As OEMs push for performance gains and cost reduction, the integrated power module is poised to become a default standard in EV powertrains.

| Metric | Value |

|---|---|

| Automotive Integrated Power Module Market Estimated Value in (2025 E) | USD 3.9 billion |

| Automotive Integrated Power Module Market Forecast Value in (2035 F) | USD 9.5 billion |

| Forecast CAGR (2025 to 2035) | 9.2% |

The Automotive Integrated Power Module (IPM) Market is primarily driven by the growing electrification of vehicles and the need for compact, energy-efficient power management systems. Powertrain systems represent the largest application segment, accounting for approximately 55% of market demand. In electric and hybrid vehicles, IPMs control and manage high-voltage components such as inverters, electric motors, and battery interfaces, ensuring efficient energy transfer and system protection. On-board chargers contribute around 20%, as automakers integrate charging control within vehicle electronics to reduce weight and improve space efficiency. HVAC systems and auxiliary power units hold a combined 10%, managing secondary systems like compressors, fans, and electronic pumps that demand stable, controlled power delivery. Medium-power IPMs are widely adopted in hybrid and plug-in hybrid vehicles, offering a balance between size and functionality, while low-power modules serve conventional electrical systems. OEMs dominate the market with a 74% share, but the aftermarket segment, at around 26%, is growing due to increasing repair and upgrade needs, especially in aging vehicle fleets.

Qualitatively, IPMs offer better thermal performance, reduced electromagnetic interference, and simplified assembly by integrating multiple power components into a single module. Their rising importance reflects the broader shift toward modular vehicle architectures and the drive for higher energy efficiency in automotive design.

As automotive OEMs increasingly shift toward higher efficiency and miniaturization in power electronics, integrated power modules have emerged as essential components in managing voltage conversion, distribution, and switching across power-hungry systems.

These modules are being deployed widely due to their ability to consolidate multiple functions into a single, compact unit, leading to weight reduction, thermal efficiency, and improved reliability. The industry’s pivot to electric and hybrid powertrains has further intensified the demand for scalable and cost-effective power architectures, making integrated solutions more attractive.

Continued innovation in silicon carbide and gallium nitride technologies is enabling greater power density, which supports the module’s long-term adaptability in both high-voltage and low-voltage environments. As supply chain collaborations strengthen between automotive tier-one suppliers and semiconductor companies, the market is expected to benefit from improved design modularity, robust thermal management capabilities, and real-time monitoring features integrated into next-generation modules.

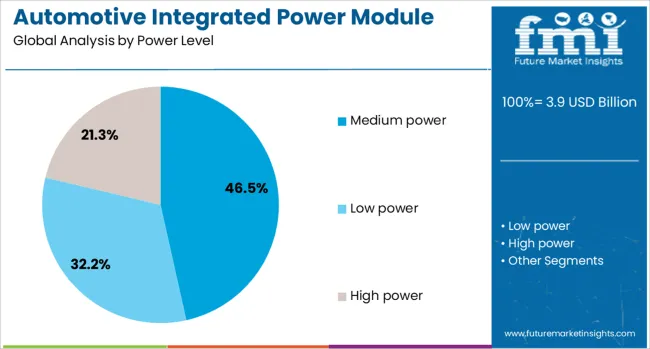

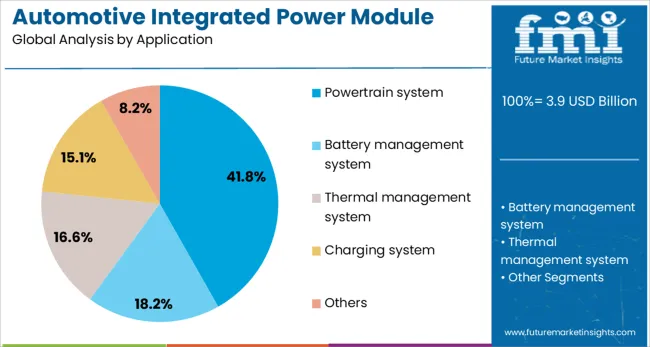

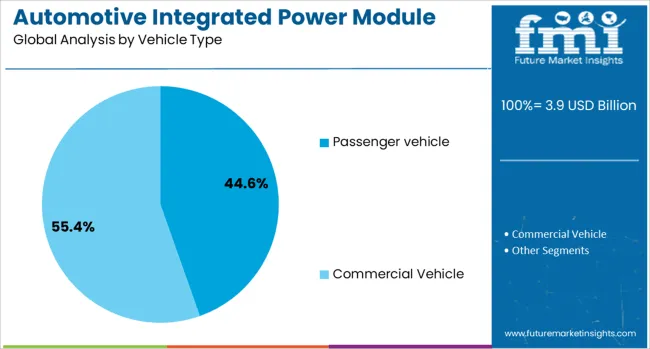

The automotive integrated power module market is segmented by power level, application, vehicle type, end use, and geographic regions. The automotive integrated power module market is divided by power level into Medium power, Low power, and High power. The automotive integrated power module market is classified into Powertrain system, Battery management system, Thermal management system, Charging system, and Others. Based on vehicle type, the automotive integrated power module market is segmented into Passenger vehicles and Commercial vehicles. The automotive integrated power module market is segmented by end use into OEM and Aftermarket. Regionally, the automotive integrated power module industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The medium power segment is anticipated to account for 46.5% of the total revenue share in the automotive integrated power module market in 2025. This segment has gained preference due to its optimal balance between cost, thermal stability, and application versatility. Medium power modules have been increasingly utilized in electrified systems where compactness and moderate voltage control are essential, especially in hybrid and plug-in hybrid vehicles.

Their ability to deliver efficient power switching and distribution across various subcomponents, without exceeding thermal thresholds, has contributed to their widespread adoption. As mid-power demands dominate auxiliary and chassis systems, these modules are being integrated to enhance energy efficiency while maintaining mechanical flexibility.

The segment’s growth is also supported by the increasing integration of advanced driver assistance systems and infotainment units, which require efficient power management at medium levels. The robust performance of medium power modules in fluctuating temperature and load conditions has made them the preferred choice for OEMs aiming for performance consistency and cost-effectiveness.

The powertrain system segment is projected to represent 41.8% of the total market share in 2025, highlighting its critical role in driving demand for integrated power modules. This dominance is supported by the growing shift toward electrified propulsion technologies where precise power control and high-speed switching are essential for optimizing torque and energy flow.

Integrated modules have become essential in powertrain architectures due to their ability to manage inverters, converters, and motor control systems from a unified platform. As thermal and electromagnetic requirements become more stringent, the use of modularized power electronics in powertrain systems is enabling better packaging efficiency and enhanced operational stability.

The segment's expansion is also fueled by the increasing production of electric vehicles, where inverter-integration within the module plays a pivotal role in energy conversion efficiency. Additionally, the ability to accommodate regenerative braking and dual-direction power flow has positioned integrated modules as indispensable to next-generation powertrain design strategies.

The passenger vehicle segment is forecasted to hold 44.6% of the total market share in 2025, underscoring its leading role in the adoption of integrated power modules. This growth is being driven by the rising production of electric and hybrid passenger vehicles, which require compact and thermally efficient power electronics to support expanding onboard functions.

Integrated modules have been increasingly implemented in these vehicles to optimize the operation of electric power steering, climate control, battery management systems, and traction inverters. OEMs have prioritized modular power integration to improve reliability, reduce system weight, and enhance energy usage across these subsystems.

The evolution of consumer expectations for vehicle connectivity, automation, and energy efficiency has reinforced the need for scalable and software-compatible power solutions. As more premium and mid-range passenger vehicles adopt electrified platforms, the demand for robust and intelligent power modules is projected to intensify, securing the segment’s sustained dominance within the broader automotive electronics landscape.

Increasing electric and hybrid vehicle production is expanding the demand for integrated power modules that combine inverters, converters, and chargers into compact, efficient units. This trend is supported by growing adoption of advanced semiconductor materials.

The rise in electric and hybrid vehicle manufacturing is driving demand for integrated power modules that improve powertrain efficiency while reducing system size and weight. Materials such as silicon carbide and gallium nitride are favored for their high voltage handling, reduced energy loss, and superior thermal management. These factors contribute to longer driving ranges and enhanced vehicle performance. Strong growth is observed in Asia Pacific, with regulatory incentives in Europe and North America further supporting market expansion. Partnerships between automakers and semiconductor firms allow customization of modules to meet varied vehicle requirements, fostering innovation and global adoption.

Manufacturers are establishing regional production hubs close to major EV markets to cut costs and shorten delivery times. Offering leasing options and monitoring services enables automakers to lower upfront investments and manage risks. Supplier collaborations allow module customization tailored to specific vehicle platforms and voltage needs. Pilot programs and comprehensive aftermarket support enhance module reliability and customer confidence. These approaches help deepen integration within automotive supply chains, facilitating scalable deployment and strengthening market presence worldwide. Growing EV adoption and semiconductor innovation are expanding the automotive integrated power module market. Regional manufacturing and flexible service models are improving accessibility and supporting broader industry acceptance.

Between 2025 and 2030, auto OEMs and module suppliers face challenges integrating Silicon Carbide (SiC) and Gallium Nitride (GaN) components into power modules. SiC offers higher switching efficiency and thermal conductivity, but it also demands improved thermal management and packaging precision. Modules using SiC or GaN require complex cooling designs and tight dielectric control to avoid overheating under high voltage loads. Compared to silicon-based modules, production yields are more sensitive, increasing cycle defect risks. OEMs working with mixed-powertrain platforms must ensure reliability across ambient temperature extremes without compromising module longevity. Without effective integration methods and supplier collaboration, module performance can suffer in real-world EV usage. Managing the tradeoff between higher energy density and manufacturing complexity remains a major challenge for module suppliers targeting premium electrified vehicles and fast charging systems

The move toward electrified vehicle platforms across OEMs is creating strong demand for integrated power modules that combine inverter, DC-DC converter, and onboard charger functions. By consolidating these components, OEMs reduce wiring harness complexity, save space, and improve energy efficiency. Integrated modules allow for tighter control of thermal distribution, more accurate system diagnostics, and simplified installation within EV architectures. Automakers pursuing common electric platforms across multiple vehicle types are favoring scalable power modules that can be easily calibrated for different power outputs. Module suppliers offering platform-aligned solutions can lock in long-term contracts across entire vehicle lineups. Additionally, standardization enables bulk procurement, design reuse, and simplified homologation across markets. This trend is especially impactful in supporting fast ramp-up of electric vehicle production, allowing OEMs to respond quickly to regional shifts in demand. Suppliers who align module architecture with OEM platform roadmaps stand to gain significantly from this opportunity.

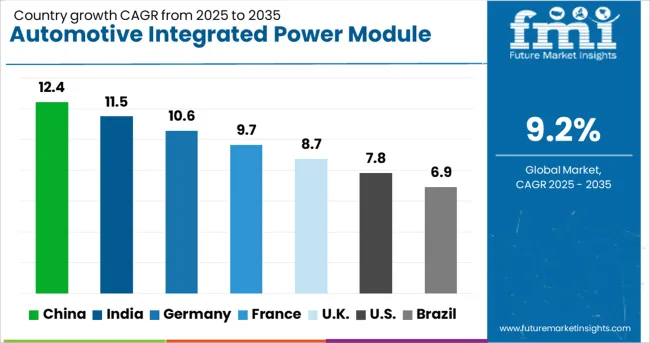

| Country | CAGR |

|---|---|

| China | 12.4% |

| India | 11.5% |

| Germany | 10.6% |

| France | 9.7% |

| UK | 8.7% |

| USA | 7.8% |

| Brazil | 6.9% |

China, a key BRICS country, is projected to grow at a 12.4% CAGR from 2025 to 2035, supported by rapid expansion of electric vehicle (EV) production lines and increased domestic sourcing of power electronics for drivetrain systems. India follows at 11.5%, where growing adoption of hybrid vehicles and government-backed EV infrastructure boosts demand for integrated power modules in both passenger and commercial vehicles. Within the OECD, Germany shows 10.6% growth, fueled by strong OEM investments in powertrain electrification and supplier partnerships for modular electronic components. France, at 9.7%, sees steady growth driven by replacement cycles in passenger fleets and rising usage in light commercial EV platforms. The United Kingdom, growing at 8.7%, experiences gradual uptake due to increasing integration of power modules in urban mobility solutions and specialized electric vehicles. The report covers detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

A CAGR of 12.4% is being recorded in China, driven by growing demand for efficient power management systems in electric and hybrid vehicles. Manufacturing facilities are being expanded to support integration of power electronics with battery management systems. Domestic companies are focusing on improving thermal management and durability of modules for automotive use. Increased production of electric passenger vehicles and commercial trucks is creating higher component requirements. Supply chains are being optimized to reduce costs and improve assembly speed. Standards for electromagnetic compatibility and safety compliance are guiding product development. Collaboration with battery manufacturers is enabling better integration and performance.

In India, the market is growing at a CAGR of 11.5 %, supported by expanding electric vehicle manufacturing and rising use of hybrid powertrains. Local manufacturers are adopting modular designs to reduce assembly complexity and improve reliability. Integration of power control circuits with charging systems is increasing. Infrastructure developments such as EV charging stations are driving module demand. Suppliers are working to meet automotive industry standards for voltage handling and thermal stability. Component sourcing is being localized to reduce dependency on imports. Research into cost-effective materials is supporting wider adoption in domestic vehicle models.

Germany is witnessing a CAGR of 10.6 %, with a focus on high-performance power modules for premium electric and hybrid vehicles. Manufacturers are emphasizing compact, lightweight designs with enhanced heat resistance. Advanced packaging techniques are being utilized to improve power density and efficiency. Strict automotive safety and emission regulations are pushing adoption of integrated modules. Collaboration between automotive OEMs and suppliers is leading to rapid development cycles. Local production is being enhanced to reduce lead times and support just-in-time manufacturing. Modules for powertrain control and energy recovery systems are gaining traction.

A CAGR of 9.7 % is observed in France, driven by growing demand in electric mobility and automotive electronics. Power modules with improved energy efficiency and fault tolerance are being developed. Manufacturers are responding to government incentives promoting electric vehicles by increasing module output. Focus is placed on enhancing thermal management and reducing electromagnetic interference. Supply chains are being diversified to mitigate risks from global disruptions. Modules tailored for public transport and commercial electric vehicles are becoming common. Research partnerships are supporting improvements in module reliability under varying environmental conditions.

The United Kingdom market is growing at a CAGR of 8.7 %, supported by rising adoption of electric vehicles and electrified transport solutions. Power modules are being developed with enhanced integration of control electronics and battery interfaces. Manufacturers are focusing on reducing module size while maintaining power output. Retrofitting of existing vehicles with integrated power modules is contributing to demand. Compliance with building fire safety and electromagnetic standards is shaping product design. Collaboration with automotive Tier 1 suppliers is increasing to accelerate module deployment. Demand is rising for modules in light commercial and passenger electric vehicles.

The automotive integrated power module (IPM) market is defined by the collaboration between advanced semiconductor manufacturers and automotive component suppliers, segmented into Tier 1 and Tier 2 players. Tier 1 suppliers are major system integrators that deliver complete power module solutions directly to OEMs, playing a crucial role in the electrification of modern vehicles.

These companies develop IPMs that combine high-voltage control, thermal management, and compact packaging to manage power flow efficiently within electric, hybrid, and increasingly complex internal combustion engine (ICE) architectures. Their offerings typically integrate multiple functions such as inverter control, voltage regulation, and motor drive into a single module, optimizing space, reducing weight, and improving vehicle energy efficiency. These modules are critical in managing the transition to electrified platforms, enabling rapid power switching, better cooling performance, and improved EMI shielding for high-speed applications. Tier 2 suppliers support the IPM ecosystem by supplying essential subcomponents like gate drivers, power transistors, current sensors, and analog/mixed-signal control ICs.

These companies often focus on specific semiconductor innovations, such as silicon carbide (SiC) and gallium nitride (GaN) technologies, to enhance power density, switching speeds, and thermal resilience. Their contributions allow Tier 1 integrators to design highly customized and application-specific modules for various automotive domains, from battery management and motor control to ADAS and infotainment power supply.

As the industry shifts toward software-defined vehicles and centralized electronic architectures, suppliers across both tiers are emphasizing modularity, scalability, and compliance with automotive safety standards like ISO 26262. This convergence of power electronics and vehicle systems is critical to enabling next-generation mobility.

On February 25, 2025, LG Innotek announced the launch of its Automotive Application Processor Module (AP Module), marking its entry into the automotive semiconductor component market. The company aims for mass production in the second half of 2025, focusing on expanding its electronic components business into the automotive sector. This strategic move is expected to strengthen LG Innotek's position in the global automotive semiconductor market.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.9 Billion |

| Power Level | Medium power, Low power, and High power |

| Application | Powertrain system, Battery management system, Thermal management system, Charging system, and Others |

| Vehicle Type | Passenger vehicle and Commercial Vehicle |

| End Use | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Denso, Infineon, Mitsubishi, STMicroelectronics, ON Semiconductor, Renesas, NXP Semiconductors, Texas, Fuji, and Rohm |

| Additional Attributes | Dollar sales by module type including Totally Integrated Power Modules (TIPM) and Intelligent Power Modules (IPM), by application in electric vehicles, hybrid vehicles, and internal combustion engine vehicles, and by region; demand driven by electrification, energy efficiency, and regulatory compliance; innovation in wide bandgap semiconductors and thermal management; cost influenced by semiconductor material costs and manufacturing complexity; and emerging use in autonomous and connected vehicle systems. |

The global automotive integrated power module market is estimated to be valued at USD 3.9 billion in 2025.

The market size for the automotive integrated power module market is projected to reach USD 9.5 billion by 2035.

The automotive integrated power module market is expected to grow at a 9.2% CAGR between 2025 and 2035.

The key product types in automotive integrated power module market are medium power, low power and high power.

In terms of application, powertrain system segment to command 41.8% share in the automotive integrated power module market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA