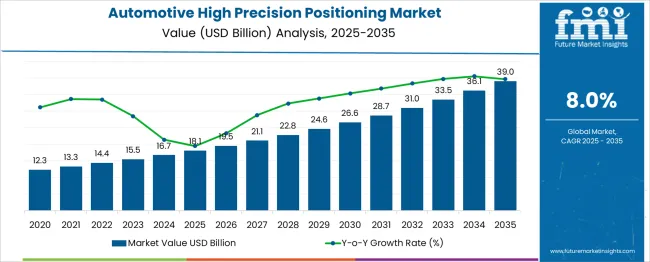

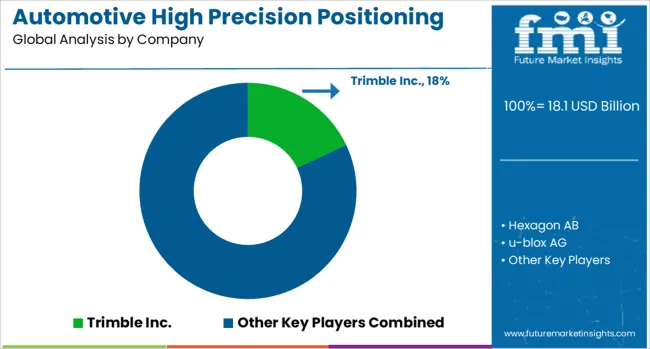

The automotive high precision positioning market is estimated to be valued at USD 18.1 billion in 2025. It is projected to reach USD 39.0 billion by 2035, registering a compound annual growth rate (CAGR) of 8.0% over the forecast period.

The automotive high-precision positioning market is anticipated to witness steady year-on-year (YoY) growth, expanding from USD 12.3 billion in 2020 to an estimated USD 39.0 billion by 2035, marking a significant increase over the 16 years. From 2020 to 2025, the market value grows from USD 12.3 billion to USD 18.1 billion, driven by rapid advancements in autonomous driving technologies, enhanced vehicle safety features, and the rising integration of precise positioning systems within navigation and advanced driver assistance systems (ADAS). The deployment of high-precision GPS, LiDAR, and sensor fusion technologies significantly enhances vehicle localization, enabling improved path planning essential for autonomous and connected vehicles.

Between 2026 and 2030, the market further advances from USD 19.5 billion to USD 26.6 billion, benefiting from escalating investments by automotive manufacturers and technology firms focused on developing next-generation positioning solutions that comply with stringent regulatory frameworks and meet growing consumer demand for safer, more efficient vehicles. Developments in vehicle-to-everything (V2X) communication and real-time mapping technologies also contribute to growth. From 2031 to 2035, the market accelerates from USD 28.7 billion to USD 39.0 billion, propelled by the wider adoption of Level 4 and Level 5 autonomous vehicles, integration of artificial intelligence, and smart city infrastructure connectivity. Expanding applications in fleet management, traffic flow optimization, and mobility-as-a-service platforms further drive demand. Consistent YoY growth throughout this period highlights the critical role of precision positioning in enabling advanced automotive functionalities, operational efficiency, and enhanced user experience. Overall, the market is positioned for sustained growth through 2035, fueled by continuous innovation, evolving regulations, and shifting consumer expectations.

| Metric | Value |

|---|---|

| Automotive High Precision Positioning Market Estimated Value in (2025 E) | USD 18.1 billion |

| Automotive High Precision Positioning Market Forecast Value in (2035 F) | USD 39.0 billion |

| Forecast CAGR (2025 to 2035) | 8.0% |

The automotive high precision positioning market occupies a pivotal role within the connected mobility and intelligent transportation ecosystem, offering critical capabilities for autonomous driving and advanced navigation systems. Within the overall automotive positioning systems market, high precision positioning accounts for approximately 22–25%, demonstrating its growing importance for achieving lane-level accuracy in real-time navigation. In the autonomous vehicle technology segment, its share rises to around 55–60%, as precise localization is indispensable for safety and decision-making in self-driving applications. Within the advanced driver assistance systems (ADAS) category, the market represents about 18–20%, driven by the integration of GNSS-based augmentation with real-time kinematic (RTK) and precise point positioning (PPP) techniques to improve reliability. In vehicle-to-everything (V2X) communication systems, high precision positioning contributes nearly 15–18%, underpinning connected vehicle ecosystems where centimeter-level accuracy ensures secure and efficient data exchange.

The aftermarket segment accounts for around 10–12%, driven by adoption in fleet tracking, logistics optimization, and telematics. Growth prospects are reinforced by rising adoption of 5G connectivity, satellite augmentation services, and cloud-based correction models, which together enhance positioning accuracy across varied terrains. Manufacturers are focusing on integrating sensor fusion technologies combining GNSS, LiDAR, and IMU solutions, while partnerships with OEMs and mobility service providers are being prioritized to secure early deployment in Level 3 and Level 4 autonomous platforms. These factors collectively position high precision positioning as a foundational enabler for next-generation automotive mobility solutions worldwide.

Growth is being driven by the increasing integration of advanced driver assistance systems and the evolution of autonomous mobility solutions. Automakers and technology providers are prioritizing the deployment of precise positioning technologies to enhance vehicle safety, lane-level navigation, and route optimization.

Regulatory pressure for vehicle safety standards and the global push for intelligent transport systems are further accelerating the adoption of high-precision positioning systems. Strategic collaborations between automotive OEMs and satellite service providers are reinforcing the ecosystem's ability to deliver reliable, real-time location data.

In both urban and rural environments, the need for consistent positioning accuracy is expanding, particularly as electric and connected vehicles become mainstream. The long-term outlook remains strong, supported by continued investments in next-generation GNSS technology, real-time correction services, and AI-powered mapping algorithms tailored for automotive applications..

The automotive high precision positioning market is segmented by component, technology, vehicle, application, and geographic regions. The automotive high precision positioning market is divided into Solutions and Services. In terms of technology, the automotive high-precision positioning market is classified into Global Navigation Satellite Systems (GNSS), Inertial Measurement Units (IMUs), LiDAR, and Others. The automotive high precision positioning market is segmented into Passenger vehicles and Commercial vehicles. The automotive high precision positioning market is segmented into Advanced driver assistance systems (ADAS), Autonomous driving, Navigation and mapping, and Others. Regionally, the automotive high precision positioning industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

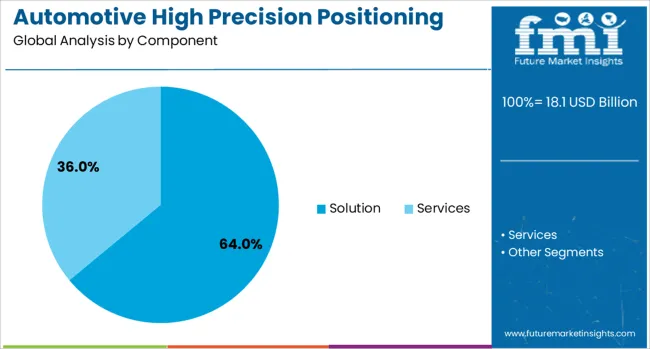

The solution subsegment within the component segment is expected to account for 64% of the Automotive High Precision Positioning market revenue share in 2025, marking it as the dominant category. This growth has been driven by the rising demand for integrated systems that combine hardware and software capabilities to deliver real-time, high-accuracy positioning for vehicles.

Solutions that offer end-to-end functionality, including satellite signal correction, map alignment, and sensor fusion, have been preferred by automotive manufacturers for their ability to reduce latency and enhance positioning reliability. The adoption of such solutions has been further encouraged by the need to support both autonomous and semi-autonomous driving applications, where even minor positional deviations can result in system errors.

Additionally, solution-based offerings provide greater flexibility in adapting to varied road environments, dynamic signal conditions, and complex urban landscapes. As vehicle platforms increasingly depend on data fusion for accurate localization, comprehensive solution packages are being prioritized for their scalability, safety compliance, and seamless integration into vehicle electronics systems..

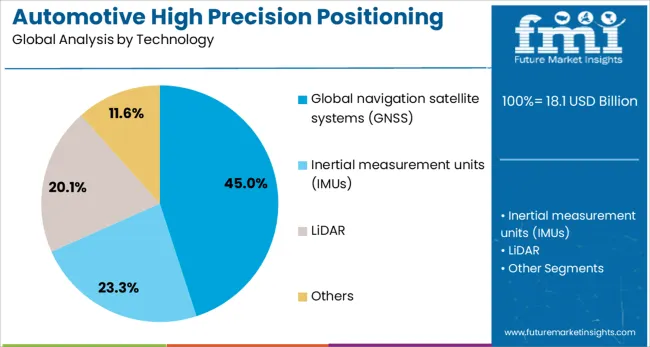

The global navigation satellite systems subsegment within the technology segment is anticipated to hold 45% of the Automotive High Precision Positioning market revenue share in 2025. This leadership is being supported by the widespread reliance on GNSS as the foundational layer for positioning data across modern vehicle platforms. GNSS technology has been favored due to its global coverage, mature infrastructure, and compatibility with real-time correction networks that enhance its accuracy to meet automotive-grade requirements.

The increasing use of multi-frequency and multi-constellation receivers has further boosted the reliability and precision of GNSS in dynamic driving environments. Integration with vehicle sensors and software-defined correction services has also played a significant role in maintaining stable and precise positioning.

Moreover, advancements in GNSS chipsets and their cost-effective deployment are contributing to their widespread adoption across both premium and mass-market vehicles. As the automotive sector transitions toward higher levels of autonomy, GNSS remains central to ensuring safe and accurate localization, reinforcing its dominant position in the technology landscape..

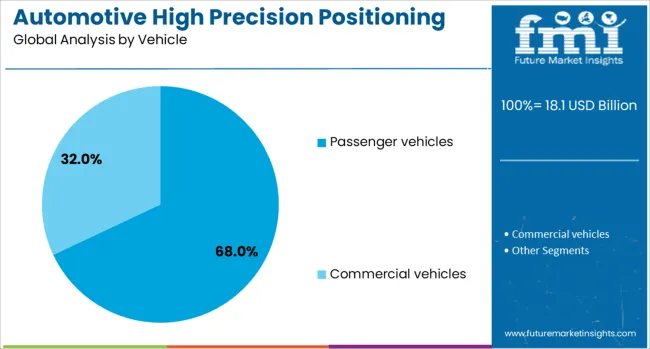

The passenger vehicles subsegment within the vehicle segment is projected to command 68% of the Automotive High Precision Positioning market revenue share in 2025, emerging as the most significant end-use category. The growth of this segment has been driven by the proliferation of driver assistance systems and connected vehicle technologies in consumer cars. Precision positioning has become essential for lane-level navigation, geofencing, smart routing, and advanced safety systems that are increasingly integrated into passenger vehicles.

Consumer demand for enhanced driving experiences and real-time navigation services has accelerated the adoption of high accuracy positioning systems. Additionally, government regulations promoting vehicle safety and the deployment of intelligent transport infrastructure have contributed to increased integration of positioning technologies in this segment.

Automakers are equipping passenger vehicles with GNSS-enabled modules that are paired with onboard sensors to enable centimeter-level accuracy under varying driving conditions. The emphasis on automation, especially in urban mobility and ride-sharing fleets, has also supported this segment's dominance in the overall market..

The automotive high precision positioning market is propelled by autonomous driving adoption, ADAS integration, connectivity upgrades, and regulatory compliance. Strategic alliances and technological synergies ensure its role as a core enabler for next-generation vehicle systems.

The automotive high precision positioning market is primarily driven by the rapid integration of autonomous driving technologies and connected vehicle ecosystems. These systems require lane-level accuracy to ensure safe navigation and collision avoidance in complex traffic environments. High precision GNSS-based solutions, supported by real-time kinematic (RTK) and precise point positioning (PPP), have become essential for enabling Level 3 and Level 4 autonomy. Vehicle manufacturers and mobility service providers are increasingly investing in positioning modules that can seamlessly integrate with onboard sensors like LiDAR and cameras. This trend is reinforced by government approvals for semi-autonomous functions in premium and commercial fleets, which highlights the crucial role of precise positioning in future mobility frameworks.

Advanced driver assistance systems (ADAS) depend heavily on high precision positioning to enhance functionality in features like adaptive cruise control, automated lane changes, and collision mitigation. These systems rely on centimeter-level accuracy for reliable performance in varied road conditions. The telematics industry is also witnessing significant integration of these technologies, supporting applications in fleet monitoring, route optimization, and predictive maintenance. OEMs and technology providers are investing in multi-constellation GNSS solutions to reduce signal interruptions in urban and rural areas. The convergence of ADAS with precise positioning modules is expected to elevate safety compliance and improve user experience, ultimately positioning these systems as a standard requirement in future automotive platforms.

The expansion of 5G networks and regional satellite augmentation systems has greatly enhanced the capabilities of automotive positioning technologies. These connectivity upgrades enable low-latency data exchange between vehicles and cloud-based correction services, ensuring real-time accuracy even in challenging terrains. Satellite-based augmentation systems like SBAS and advancements in RTK corrections have improved the reliability of GNSS positioning solutions. OEM collaborations with telecom providers are becoming more frequent as manufacturers seek to optimize the synergy between connectivity and navigation performance. This interconnected approach is establishing a strong foundation for achieving seamless communication across V2X platforms, which is a critical component for the success of high precision positioning in autonomous and connected vehicles.

Government regulations mandating advanced safety systems in vehicles are accelerating the adoption of high precision positioning solutions. Compliance with stringent safety norms has pushed OEMs and tier-one suppliers to integrate positioning technology into their ADAS and automated systems. Strategic partnerships between technology companies, automotive OEMs, and mapping solution providers have become a key trend to fast-track development and deployment. These collaborations often focus on cost optimization, system reliability, and achieving scalability in mass-market models. Regulatory support in North America, Europe, and parts of Asia-Pacific is also stimulating investments in GNSS augmentation infrastructure, further driving the commercial viability of high precision positioning for automotive applications globally.

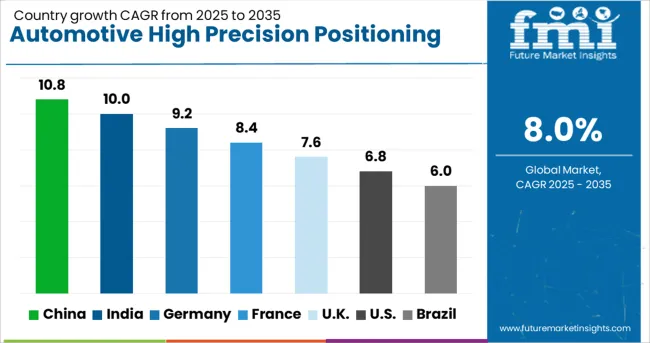

| Country | CAGR |

|---|---|

| China | 10.8% |

| India | 10.0% |

| Germany | 9.2% |

| France | 8.4% |

| UK | 7.6% |

| USA | 6.8% |

| Brazil | 6.0% |

The automotive high precision positioning market is projected to grow at a global CAGR of 8.0% from 2025 to 2035, driven by the increasing adoption of autonomous vehicles, advanced driver assistance systems (ADAS), and integration of GNSS-based positioning technologies. China leads with a CAGR of 10.8%, supported by large-scale investments in connected mobility infrastructure, government-backed pilot projects for autonomous fleets, and active participation of domestic OEMs in developing high-accuracy navigation systems. India follows at 10.0%, fueled by demand for precision solutions in commercial fleet management, rising penetration of ADAS in passenger cars, and government initiatives promoting intelligent transportation systems. Germany records 9.2% growth, driven by strong integration of high-accuracy GNSS modules in premium vehicles and partnerships between automotive and mapping technology firms. The United Kingdom grows at 7.6%, reflecting progress in connected vehicle projects, enhanced regulatory frameworks, and collaboration with technology providers for V2X solutions, while the United States posts 6.8%, shaped by infrastructure challenges but driven by demand from advanced mobility platforms and logistics optimization applications.

The CAGR for the automotive high precision positioning market in the United Kingdom was approximately 4.2% during 2020–2024 and increased to 7.6% for 2025–2035, indicating a strong upward trajectory. The earlier phase exhibited moderate growth as adoption was mainly limited to premium vehicles with basic GNSS-assisted ADAS systems. The following decade recorded a surge due to accelerating deployment of connected vehicle projects, demand for lane-level accuracy in advanced driving assistance, and wider availability of 5G-enabled telematics infrastructure. Strategic collaborations between OEMs and navigation technology firms further stimulated integration across mid-range vehicle segments. Regulatory frameworks mandating driver safety features also contributed to rapid growth, positioning the UK as a key European hub for automotive precision positioning solutions.

China experienced a CAGR of nearly 6.1% during 2020–2024, which advanced sharply to 10.8% for 2025–2035, driven by aggressive implementation of autonomous mobility projects and nationwide infrastructure upgrades for intelligent transportation systems. The early period saw strong adoption primarily in premium automotive categories and fleet management applications. By the next decade, a combination of government-driven EV programs, rapid integration of GNSS augmentation services, and expansion of V2X ecosystems catalyzed positioning technology demand. Domestic manufacturers leveraged state-backed initiatives to scale RTK-based solutions, improving accuracy for advanced navigation systems. These efforts have made China a strategic base for global positioning module exports as well.

India recorded a CAGR of approximately 5.7% during 2020–2024, which improved significantly to 10.0% between 2025 and 2035, highlighting its rapid technological leap in mobility services. The earlier phase was marked by slow adoption, primarily confined to fleet monitoring and logistics optimization due to infrastructure limitations. In the subsequent decade, government-led policies promoting intelligent transport systems, combined with rising demand for ADAS features in mid-range cars, stimulated the market. Strong emphasis on precision navigation for commercial fleets and electric vehicles contributed to greater integration of RTK and GNSS modules. Strategic alliances with mapping and IoT firms further strengthened market penetration, enabling India to emerge as a high-growth automotive technology market.

Germany posted a CAGR of about 5.0% during 2020–2024, advancing to 9.2% for 2025–2035, driven by premium automotive manufacturers’ push toward autonomy and precision safety solutions. During the earlier phase, demand focused on high-end segments, with positioning technology integrated into adaptive cruise control and navigation systems. In the following decade, strong government backing for smart mobility corridors, combined with the rollout of multi-constellation GNSS networks, amplified adoption. Collaborative efforts between OEMs, mapping solution providers, and 5G network operators enabled advanced real-time navigation features. Germany’s expertise in engineering and compliance-focused automotive design will continue to anchor its leadership in Europe’s high precision positioning landscape.

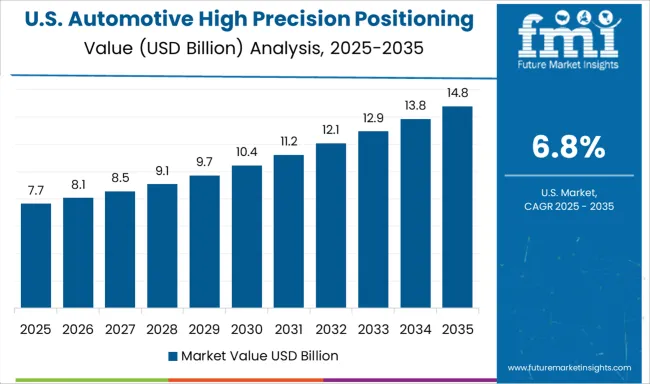

The United States achieved a CAGR of 4.3% during 2020–2024, rising to 6.8% for 2025–2035, reflecting gradual but steady progress in adopting positioning systems. Initial adoption was primarily led by premium brands incorporating ADAS in passenger cars and long-haul fleet operators optimizing logistics routes. In the next decade, enhanced infrastructure for 5G and V2X communication, coupled with regulatory momentum on safety compliance, encouraged greater integration across mid-range vehicles. However, challenges related to GNSS signal interruptions in urban canyons and interoperability delays slowed faster penetration. Strategic collaborations with tech players and cloud-based correction service providers are expected to resolve these constraints, making the USA a consistent growth market in positioning solutions.

The automotive high precision positioning market is evolving rapidly as demand intensifies for advanced navigation accuracy to support autonomous driving and next-generation ADAS functionalities. The competitive landscape not only includes Trimble Inc., Hexagon AB, u-blox AG, Topcon Positioning Systems, Qualcomm Technologies, and Septentrio NV but also several emerging players leveraging niche technologies to capture market share. These companies are differentiating through innovations in GNSS augmentation techniques such as RTK and PPP, which enable centimeter-level accuracy critical for lane-level guidance and safety compliance.

Trimble Inc. maintains a leading edge by offering scalable positioning platforms designed for integration into connected vehicle ecosystems and autonomous applications. Hexagon AB has reinforced its portfolio with sensor fusion technologies that combine GNSS, inertial navigation systems (INS), and visual odometry for performance in challenging environments like urban canyons. u-blox AG focuses on developing ultra-compact, energy-efficient modules ideal for telematics and mid-tier ADAS applications, while Topcon Positioning Systems capitalizes on multi-constellation GNSS infrastructure to deliver high reliability in real-time navigation. Qualcomm Technologies leverages its chipset leadership to integrate V2X connectivity with precision positioning, enabling robust communication within intelligent transport networks. Septentrio NV remains focused on robust GNSS receivers optimized for fleets and automated mobility platforms.

Strategic moves across the sector include partnerships with mapping service providers, adoption of cloud correction services, and investments in 5G-enabled positioning solutions. These dynamics underscore an increasingly collaborative approach, where hardware excellence is combined with digital augmentation to meet the growing regulatory and safety demands of modern automotive ecosystems.

On January 7, 2025, Hexagon announced plans to acquire Septentrio NV, aiming to expand coverage in resilient, assured positioning for mission‑critical autonomy applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 18.1 Billion |

| Component | Solution and Services |

| Technology | Global navigation satellite systems (GNSS), Inertial measurement units (IMUs), LiDAR, and Others |

| Vehicle | Passenger vehicles and Commercial vehicles |

| Application | Advanced driver assistance systems (ADAS), Autonomous driving, Navigation and mapping, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Trimble Inc., Hexagon AB, u-blox AG, Topcon Positioning Systems, Qualcomm Technologies, Septentrio NV, and Others |

The global automotive high precision positioning market is estimated to be valued at USD 18.1 billion in 2025.

The market size for the automotive high precision positioning market is projected to reach USD 39.0 billion by 2035.

The automotive high precision positioning market is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types in automotive high precision positioning market are solution and services.

In terms of technology, global navigation satellite systems (gnss) segment to command 45.0% share in the automotive high precision positioning market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Smart Antenna Market Size and Share Forecast Outlook 2025 to 2035

Automotive Actuator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Manifold Market Size and Share Forecast Outlook 2025 to 2035

Automotive Vacuum Brake Booster Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Resonator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Counter Shaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Wheel Coating Market Size and Share Forecast Outlook 2025 to 2035

Automotive Water Separation Systems Market Size and Share Forecast Outlook 2025 to 2035

Automotive Refinish Coating Market Size and Share Forecast Outlook 2025 to 2035

Automotive Emission Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Tire Market Size and Share Forecast Outlook 2025 to 2035

Automotive Glass Market Size and Share Forecast Outlook 2025 to 2035

Automotive Wire & Cable Material Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive DC-DC Converter Market Size and Share Forecast Outlook 2025 to 2035

Automotive Key Blank Market Size and Share Forecast Outlook 2025 to 2035

Automotive Tensioner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Cabin Air Quality Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Fuel Accumulator Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA