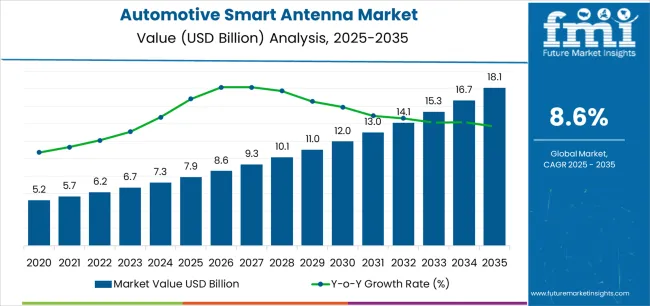

The Automotive Smart Antenna Market is estimated to be valued at USD 7.9 billion in 2025 and is projected to reach USD 18.1 billion by 2035, registering a compound annual growth rate (CAGR) of 8.6% over the forecast period.

The Automotive Smart Antenna market is experiencing significant growth driven by the increasing integration of connected vehicle technologies, advanced driver assistance systems, and in-vehicle communication solutions. The future outlook for this market is shaped by the rising adoption of 5G and ultra-high frequency communication networks that enhance vehicle connectivity, navigation, and safety. Growing demand for enhanced infotainment systems, real-time traffic management, and vehicle-to-everything communication is contributing to the expansion of smart antenna deployment in the automotive sector.

Additionally, automotive manufacturers are investing heavily in connected and autonomous vehicle technologies, further supporting the market growth. The need for reliable, high-speed data transmission and robust signal reception in modern vehicles is propelling the adoption of smart antennas, especially in regions with increasing vehicle density and infrastructure development.

Continuous advancements in antenna design, including multi-band and ultra-high frequency capabilities, are enabling optimized performance for both urban and long-distance driving conditions As automotive connectivity becomes a critical differentiator, the smart antenna market is expected to sustain strong growth across global markets.

| Metric | Value |

|---|---|

| Automotive Smart Antenna Market Estimated Value in (2025 E) | USD 7.9 billion |

| Automotive Smart Antenna Market Forecast Value in (2035 F) | USD 18.1 billion |

| Forecast CAGR (2025 to 2035) | 8.6% |

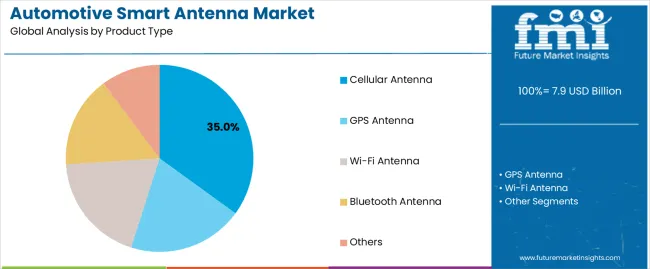

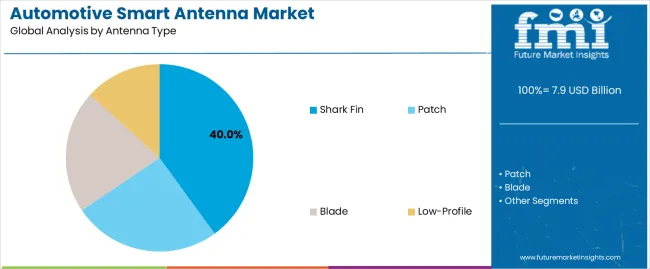

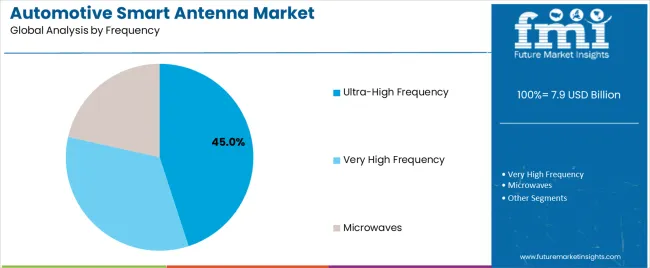

The market is segmented by Product Type, Antenna Type, Frequency, Vehicle Type, Application, and Sales Channel and region. By Product Type, the market is divided into Cellular Antenna, GPS Antenna, Wi-Fi Antenna, Bluetooth Antenna, and Others. In terms of Antenna Type, the market is classified into Shark Fin, Patch, Blade, and Low-Profile. Based on Frequency, the market is segmented into Ultra-High Frequency, Very High Frequency, and Microwaves. By Vehicle Type, the market is divided into Passenger Cars, LCVs, HCVs, and Electric Vehicles. By Application, the market is segmented into Interior and Exterior. By Sales Channel, the market is segmented into OEM and Aftermarket. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The cellular antenna segment is projected to hold 35.0% of the Automotive Smart Antenna market revenue share in 2025, establishing it as the leading product type. This growth is driven by the increasing reliance on mobile connectivity within vehicles for telematics, infotainment, and real-time navigation applications. Cellular antennas support seamless communication across multiple frequency bands, providing consistent signal reception in both urban and rural areas.

The integration of advanced network technologies such as 5G and LTE has further strengthened the adoption of cellular antennas, enabling high-speed data transfer and low-latency connectivity. Automotive manufacturers are prioritizing these antennas to ensure optimal vehicle-to-network communication and enhanced user experience.

The scalability, reliability, and compatibility of cellular antennas with existing automotive systems have reinforced their position as the preferred choice for connected vehicles This segment continues to benefit from the growing trend of connected and autonomous vehicles that demand uninterrupted mobile communication.

The shark fin antenna segment is expected to capture 40.0% of the Automotive Smart Antenna market revenue share in 2025, making it the leading antenna type. The adoption of shark fin antennas is driven by their aerodynamic design, which reduces drag and integrates seamlessly with the vehicle exterior. These antennas support multiple communication functions, including GPS, cellular, and satellite connectivity, enhancing overall vehicle performance and connectivity.

Their compact design and robust construction make them suitable for a wide range of vehicle models, supporting both aesthetic and functional requirements. The rising emphasis on advanced driver assistance systems, telematics, and connected car features has accelerated the deployment of shark fin antennas.

Additionally, their ability to support multi-band and ultra-high frequency communication contributes to superior signal quality and reliability The combination of aesthetic appeal, multi-functionality, and performance efficiency has positioned shark fin antennas as the leading type in the market.

The ultra-high frequency segment is anticipated to account for 45.0% of the Automotive Smart Antenna market revenue in 2025, establishing it as the dominant frequency category. The growth of this segment is driven by the increasing need for high-speed data transmission, low-latency communication, and reliable signal performance in connected and autonomous vehicles. Ultra-high frequency antennas enable precise navigation, improved telematics, and robust vehicle-to-vehicle and vehicle-to-infrastructure communication.

The widespread adoption of advanced safety and driver assistance systems relies heavily on UHF communication, further propelling this segment. Automotive manufacturers are investing in ultra-high frequency antennas to ensure seamless connectivity and enhanced performance of infotainment and telematics systems.

Additionally, the scalability and compatibility of UHF antennas with multi-band systems allow for flexible integration across vehicle platforms The rising focus on smart mobility solutions and the growing deployment of connected vehicles globally continue to support the dominance of ultra-high frequency antennas in the market.

The annual growth rates of the global automotive smart antenna market from 2025 to 2035 are illustrated in the table below. Starting with the base year 2025 and going up to the present year 2025, the report examines how the growth trajectory changes from the first half of the year, i.e. January through June (H1) to the second half consisting of July through December (H2). This gives stakeholders a comprehensive picture of the industry’s performance over time and insights into potential future developments.

The figures provided below show the growth rate for each half-year between 2025 and 2025. The industry was projected to increase at a CAGR of 8.7% in the first half (H1) of 2025. However, in the second half (H2), there is a noticeable increase in the growth rate of 9.5%.

| Particulars | Value CAGR |

|---|---|

| H1 | 8.7% (2025 to 2035) |

| H2 | 9.5% (2025 to 2035) |

| H1 | 8.9% (2025 to 2035) |

| H2 | 9.3% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2025, the CAGR is projected to slightly decrease to 8.9% in the first half and relatively surge to 9.3% in the second half. In the first half (H1), the industry saw an increase of 20 BPS while in the second half (H2), there was a slight decrease of 20 BPS.

Growing Need for Personalized In-vehicle Experience Fuels Demand

Modern users now seek a personalized experience in their vehicles. They want infotainment systems that can automatically remember their preferences, right from music playlists to climate settings.

Connectivity plays a crucial role in delivering personalized content and services. It is also needed to provide real-time information, such as traffic updates, weather forecasts, and live news. Drivers and passengers rely on this information for convenience, safety, and entertainment.

Advanced connectivity and user-friendly interfaces are likely to contribute to both safety and convenience. Users seek systems that allow them to make hands-free calls, use voice commands, and access important information without taking their eyes off the road.

The need for a dependable and steady internet connection is at the center of connectivity expectations. Users anticipate being able to access information, communicate, and use digital services from anywhere at any time, whether by Wi-Fi, mobile data, or other connection methods.

To achieve these expectations, high-speed internet, minimal latency, and wide network coverage are necessary. Consumers' expectations for seamless and safe device operation within interconnected ecosystems are set to surge amid the proliferation of the Internet of Things (IoT) devices.

Integration of 5G Technology to be a Key Trend Globally

The advent of 5G technology is revolutionizing the automotive industry by providing ultra-fast, low-latency connectivity, which is essential for various unique automotive applications. This technology enables instantaneous communication crucial for vehicle-to-everything (V2X) interactions, including vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communications. With 5G, cars can communicate in real time, enhancing safety and efficiency by enabling features like collision avoidance, traffic management, and autonomous driving.

5G further facilitates high-definition video streaming and responsive telematics services within vehicles. Passengers can enjoy seamless entertainment experiences, such as high-quality video streaming and online gaming with minimal delay. This capability not only enhances the in-car experience but also supports the development of connected car ecosystems, where vehicles are part of an intelligent transportation network.

The integration of 5G technology into automotive smart antennas ensures that vehicles are equipped to handle the vast amounts of data required for these cutting-edge functionalities. Smart antennas, with their ability to dynamically adjust and optimize signal reception, are important for maintaining the reliability and efficiency of 5G connectivity in vehicles.

Data Security and Privacy Concerns Create Challenges for Manufacturers

Incorporating cutting-edge smart antenna technology poses significant cost challenges for both car manufacturers and customers. The integration of features like multiple input multiple output (MIMO), 5G support, and sophisticated signal processing can substantially increase the production costs of these antennas.

This, in turn, bolsters the overall price of vehicles, potentially limiting their accessibility to a broad industry. The high costs associated with designing and manufacturing these antennas may also deter manufacturers from adopting them widely, slowing down penetration.

Increasing connectivity of vehicles brings privacy and data security concerns. Smart antennas are crucial for collecting and transmitting vast amounts of vehicle data, which can be sensitive and personal. This data transmission raises significant regulatory and privacy issues, as consumers and regulatory bodies become more vigilant about data protection.

The risk of data breaches, unauthorized access, and misuse of personal information poses serious challenges that can hinder the widespread adoption of smart antenna technology.

Stringent regulations and the need for compliance with data protection laws can create barriers for manufacturers, necessitating additional investments in security measures. This further increases the overall costs and complexity of deploying smart antennas, making it an important restraint.

The global market witnessed a CAGR of 2% between 2020 and 2025. Total revenue reached about USD 6,643.2 million in 2025. During the forecast period, sales are projected to fetch a CAGR of 9.1%.

During the historical period, the industry experienced significant fluctuations due to economic downturns. The global economy encountered several challenges, such as trade disputes, currency fluctuations, and geopolitical conflicts, which further affected the automotive industry dependent on these antennas.

The COVID-19 pandemic further disrupted global supply chains and industrial activities, leading to a temporary downturn. Supply chain disruptions affected raw material availability and manufacturing operations, thereby hampering the dynamics. The pandemic caused a slowdown in the automotive industry, resulting in reduced demand for automotive components, including smart antennas.

Production activities had to be halted, which resulted in a significant drop in Y-O-Y growth. A V-shape recovery rate is projected for the global industry as economic activities get back to normal levels in the post-pandemic era.

During the assessment period, the global industry is poised for significant growth, propelled by rising demand for entertainment, navigation, and communication in vehicles. In key countries like India, China, and Brazil, demand is anticipated to remain high due to increasing sales of passenger cars.

Tier 1 companies include key leaders with annual revenues exceeding USD 250 million. These companies are currently capturing a significant share of 40% to 50% globally. These frontrunners are characterized by high production capacity and a wide product portfolio.

They are distinguished by extensive expertise in manufacturing and a broad geographical reach, underpinned by a robust consumer base. The firms provide a wide range of products and utilize the latest technology to meet regulatory standards. Prominent companies within Tier 1 include TE Connectivity, Continental AG, Harada, Yageo Corporation, and TDK Corporation.

Tier 2 and 3 companies encompass mid-sized and small-scale participants, respectively, with revenues ranging from less than USD 250 million. These companies are currently holding a robust presence in specific regions and exerting significant influence in local economies.

They possess strong technological capabilities and adhere strictly to regulatory requirements. However, the firms may not wield cutting-edge technology or maintain an extensive global reach. Noteworthy entities in Tier 2 and 3 include Antenova, Autotalks, Taoglas, Yageo Corporation, Linx Technologies, Schaffner Group, Harman International (a Samsung Company), Rosenberger, Kyocera Corporation, Anokiwave, and Calearo Antenne S.p.A.

The table below highlights key countries’ automotive smart antenna market revenues. China, the United States, and Japan are projected to be the three significant consumers of smart antennas.

| Countries | CAGR 2025 to 2035 |

|---|---|

| China | 8.9% |

| United States | 4.6% |

| Japan | 9% |

| India | 8.6% |

| Germany | 10.2% |

China’s automotive smart antenna market size is projected to reach USD 2,405.2 million by 2035. Over the assessment period, demand in China is set to rise at an 8.9% CAGR.

China has taken a leading role in the rollout of 5G technology, boasting a robust network infrastructure. 5G technology offers exceptionally fast and low-latency connectivity, which perfectly suits automotive applications. Smart antennas harness the power of 5G networks to guarantee swift and dependable communication, establishing their indispensability in the age of 5G-connected vehicles.

China holds a prominent position on the global stage when it comes to the electric vehicle (EV) industry. With the increasing adoption of EVs, the need for smart antennas in these cars is also witnessing a surge. Smart antennas play an essential role in EVs, delivering connectivity for functionalities such as over-the-air (OTA) updates and remote diagnostics.

Sales of smart antennas in the United States are projected to soar at a CAGR of around 4.6% during the evaluation period. Total value in the country is anticipated to reach USD 1,189.6 million by 2035.

A key driver behind the expansion of the automotive smart antenna market in the United States is the increasing need for in-vehicle connectivity. Consumers anticipate effortless access to a broad spectrum of digital services while driving. This encompasses functions, such as real-time navigation, top-tier infotainment, and the ability to maintain connectivity with smart devices.

Consumer inclination in the United States has changed in favor of vehicles equipped with unique connectivity and entertainment systems. Contemporary car purchasers need their vehicles to seamlessly integrate with their connected way of life, and this has notably boosted the uptake of smart antennas.

The automotive smart antenna market value in Japan is anticipated to rise to USD 378.2 million by 2035. Over the forecast period, demand in the country is set to increase at a robust CAGR of 9%.

Automotive smart antenna demand in Japan is experiencing significant growth. It is mainly driven by a unique combination of factors that reflect the country's compact vehicle industry and technological innovations focused on vehicle safety.

Japan's reputation for compact and city-adaptable vehicle designs aligns perfectly with the compatibility of smart antennas. These antennas are an excellent fit for small-sized cars, given their compactness, multi-functionality, and seamless integration potential.

With the ongoing trend of urbanization, the desire for efficient and compact vehicles equipped with cutting-edge connectivity features is on the rise. This is gradually underscoring the indispensable role of smart antennas in Japan’s automotive industry.

India’s automotive smart antenna industry is poised to exhibit a CAGR of 8.6% during the assessment period. It is set to attain a value of USD 366.5 million by 2035.

India's varied geographical terrain encompasses bustling cities as well as remote and less densely populated areas. Smart antennas are likely to play a critical role in ensuring uninterrupted connectivity even in challenging and remote areas. They are projected to effectively fill the connectivity void by delivering dependable and consistent communication, thereby enriching the driving experience throughout the country.

India boasts a flourishing technological ecosystem that places a strong emphasis on innovation, research, and development. Local tech companies and start-ups in the country are constantly engaged in advancing smart antenna technologies. This indigenous innovation is expediting the integration of smart antennas into the country's domestic automotive industry.

A wide range of traffic scenarios, each with its complexities, characterizes the road conditions in India. Smart antennas play a key role in enhancing road safety and traffic management by facilitating functions, such as collision avoidance systems and instantaneous traffic updates. These capabilities are of paramount importance for ensuring safe and effective travel on roads.

Germany’s automotive smart antenna market size is projected to reach USD 274.5 million by 2035. Over the assessment period, the country is estimated to rise at a 10.2% CAGR. This growth is boosted by several factors that underscore the country's distinguished automotive industry, focus on technological prowess, and unwavering dedication to vehicle sustainability.

Germany also places significant importance on environmental sustainability. Hence, smart antennas are projected to be adopted as these help in promoting fuel efficiency and reducing emissions. They do so by facilitating functionalities, such as adaptive cruise control and effective traffic management. These go in harmony with Germany's dedication to reducing the environmental footprint of transportation.

Germany's stature as a significant exporter of automobiles and automotive components provides an avenue for the global dissemination of smart antennas, further catalyzing their uptake in the international automotive industry. The country’s worldwide acclaim for its technological prowess, especially in the automotive industry, is well-recognized.

The section explains the growth trajectories of the leading segments in the industry. In terms of vehicle type, the passenger car category will likely dominate and generate a share of around 56.9% in 2025.

Based on product type, the GPS antenna segment is set to surge at a CAGR of 9.1% during the forecast period. The analysis would enable potential clients to make effective business decisions for investment purposes.

| Segment | Passenger Cars (Vehicle Type) |

|---|---|

| Value Share (2025) | 56.9% |

By vehicle type, passenger cars are anticipated to hold a significant share of 56.9% in 2025. Over the forecast period, demand for passenger cars is set to rise at a CAGR of 8.8%, and by 2035, it is estimated to reach USD 9,492.6 million.

Modern consumers anticipate their vehicles to seamlessly integrate with their connected lifestyles, offering unhindered access to a diverse range of digital services while in transit. Owners of passenger cars are in pursuit of an improved in-car entertainment experience.

Smart antennas facilitate functionalities, such as music and video streaming, along with interactive content, enhancing the overall entertainment environment for passengers during their travels. The growing desire for these entertainment features in passenger cars is propelling the uptake of smart antennas.

| Segment | GPS Antenna (Product Type) |

|---|---|

| Value Share (2025) | 39.5% |

By product type, the GPS antenna segment is projected to remain at the forefront with the evolving landscape of vehicle connectivity and the shifting needs of contemporary vehicles. The segment is projected to thrive at a 9.1% CAGR during the assessment period. It is set to attain a value of USD 6,694.8 million by 2035.

GPS antennas provide critical navigation and location-based services, which are integral to the functionality of connected and autonomous vehicles. With the increasing reliance on real-time data for navigation, fleet management, and several telematics applications, GPS antennas are set to be indispensable.

The integration of GPS with other cutting-edge technologies, such as driver assistance systems and vehicle-to-everything (V2X) communication further boosts demand. The widespread adoption of GPS in consumer vehicles, commercial fleets, and logistics solutions solidifies its significant share, making it a cornerstone of the automotive smart antenna market.

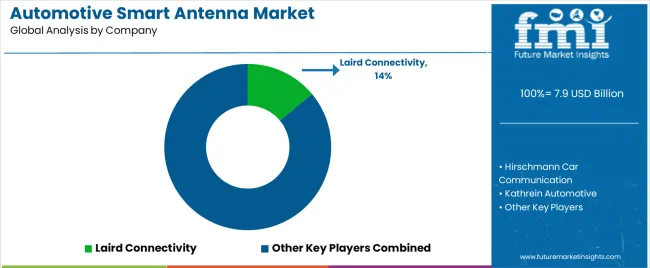

The global automotive smart antenna market is highly fragmented, with leading players accounting for around 40% to 45% share. Kathrein Automotive, Continental AG, Harada, TE Connectivity, Antenova, Autotalks, Taoglas, Yageo Corporation, Schaffner Group, TDK Corporation, Harman International, NXP Semiconductors, Rosenberger, Ficosa, Anokiwave, and Calearo Antenne S.p.A. are the leading manufacturers and suppliers of automotive smart antennas listed in the report.

Key automotive smart antenna manufacturers are focusing on launching novel products with new features to attract a large client base. They are set to embrace strategies like acquisitions, mergers, and partnerships to broaden their existing product portfolios and gain a competitive edge.

Leading players are further focusing on making progress in production standards and technology to save money and time, thereby raising effectiveness and efficiency. The rising miniaturization trend globally is projected to fuel the need for small automotive antennas. Key companies are striving to capitalize on this trend by developing small-sized yet effective antennas for smooth communication.

Industry Updates

A few types of products included in the study are cellular antenna, GPS antenna, Wi-Fi antenna, Bluetooth antenna, and others.

Leading types of antennas are shark fin, patch, blade, and low-profile antennas.

By frequency, the industry is segmented into ultra-high frequency, very high frequency, and microwaves.

A few leading types of vehicles are passenger cars, LCVs, HCVs, and electric vehicles.

Interior and exterior are the two key applications.

OEM and aftermarket are the two significant sales channels.

Important regions considered in the study include North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa.

The global automotive smart antenna market is estimated to be valued at USD 7.9 billion in 2025.

The market size for the automotive smart antenna market is projected to reach USD 18.1 billion by 2035.

The automotive smart antenna market is expected to grow at a 8.6% CAGR between 2025 and 2035.

The key product types in automotive smart antenna market are cellular antenna, gps antenna, wi-fi antenna, bluetooth antenna and others.

In terms of antenna type, shark fin segment to command 40.0% share in the automotive smart antenna market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Antenna Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Smart Surface Market Size and Share Forecast Outlook 2025 to 2035

Automotive Intelligent Antenna Module Market Size and Share Forecast Outlook 2025 to 2035

5G in Automotive and Smart Transportation Market by Solution ,Application,Industry , Warehousing & Logistics, Warehousing & Logistics, Public Safety and Others & Region Forecast till 2025 to 2035

Smart Meeting Pod Market Size and Share Forecast Outlook 2025 to 2035

Smart Electrogastrogram Recorder Market Size and Share Forecast Outlook 2025 to 2035

Smart Aerial Work Robots Market Size and Share Forecast Outlook 2025 to 2035

Smart Bladder Scanner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Smart School Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Wireless Smoke Detector Market Size and Share Forecast Outlook 2025 to 2035

Smart Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Smart Vision Processing Chips Market Size and Share Forecast Outlook 2025 to 2035

Smart Touch Screen Scale Market Size and Share Forecast Outlook 2025 to 2035

Smart Magnetic Drive Conveyor System Market Size and Share Forecast Outlook 2025 to 2035

Smart Wheelchair market Size and Share Forecast Outlook 2025 to 2035

Smart Mining Technologies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA