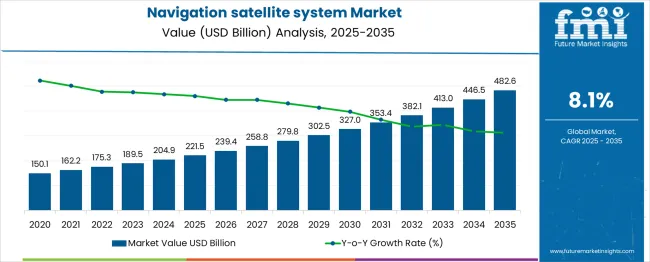

The Navigation satellite system Market is estimated to be valued at USD 221.5 billion in 2025 and is projected to reach USD 482.6 billion by 2035, registering a compound annual growth rate (CAGR) of 8.1% over the forecast period.

The stainless steel valve tag market is expanding steadily as industrial sectors prioritize asset management, safety compliance, and equipment traceability. Increasing investments in infrastructure and process automation have heightened demand for robust and clear identification solutions capable of withstanding harsh environments.

The shift toward digital transformation in industries such as oil and gas, manufacturing, and utilities is encouraging the adoption of advanced tagging systems that support maintenance and audit operations. Growing awareness around regulatory compliance for equipment labeling and enhanced safety protocols is also influencing market expansion.

The rise of e-commerce platforms has facilitated easier procurement of valve tags, increasing accessibility for small to medium enterprises and broadening geographic reach. Material innovations and customization options continue to enhance product longevity and visibility, creating opportunities for market penetration across diverse industrial applications.

The market is segmented by Application and Satellite Technology and region. By Application, the market is divided into Location-Based Services (LBS), Agriculture, Aviation, Maritime, Road, Rail, Surveying, and Timing and Synchronization.

In terms of Satellite Technology, the market is classified into GPS, Constellations, Satellite-Based Augmentation Systems (SBAS), GLONASS, Galileo, and BeiDou. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The less than 30 mm thickness segment is expected to hold 41.3% of the revenue share in 2025 within the thickness category. This segment’s leadership is supported by its suitability for a wide range of valve sizes and equipment types, providing sufficient durability while minimizing material costs.

The thinner tags offer flexibility in installation, especially in tight spaces and complex piping systems, making them preferable for industries where compactness is critical. Their compatibility with standard mounting hardware and ability to endure corrosion and wear have reinforced demand in sectors emphasizing both performance and cost efficiency.

This balance between robustness and adaptability has contributed to the segment’s dominant position.

Within the product type category, engraved valve tags are projected to command 57.8% of the market revenue share in 2025, marking them as the leading product form. The prominence of engraved tags is due to their superior legibility, permanence, and resistance to environmental degradation such as fading, scratching, and chemical exposure.

Engraving allows precise and customizable marking, meeting stringent industry standards for traceability and safety. The technique supports complex information including serial numbers, barcodes, and QR codes, enhancing integration with digital asset management systems.

Manufacturers’ emphasis on delivering long-lasting, tamper-proof tags that reduce maintenance costs has reinforced the adoption of engraved tags in heavy industries.

Space infrastructure is required to deliver GNSS signals to end users. Therefore, more space infrastructure is necessary to increase the signal's availability, such as upgraded satellites, advanced network stations, and associated components.

A new space network station requires a large initial investment, so market growth will be slowed by the high costs associated with the upstream components. While this may be the case, upcoming technologies such as artificial intelligence, the Internet of Things, 5G, and industrial automation are anticipated to create lucrative market size opportunities.

Consumer electronics devices such as smartphones, smart wearables, digital cameras, and tablets are widely used for mapping, marketing, and navigation purposes. The adoption rate of various location-based service (LBS) applications has increased as a result of this development.

The global navigation satellite system market is expected to grow as location-based services such as online food delivery, online medicinal drug delivery, asset tracking applications, online cab services, and online product delivery become more prevalent.

The advent of 5G network technology has also increased the development of 5G-enabled smartphones. Advanced navigation chips are also being developed for smartphones in this new 5G era. A more accurate positioning system would be possible if advanced navigation components were integrated into consumer electronics devices. This would improve the current LBS application capabilities regarding network speed, performance, and accuracy.

It is estimated that over 221.5 billion devices will be sold by 2025, according to the European GNSS Agency. It is expected that this development will create numerous opportunities for the GNSS market to grow quickly.

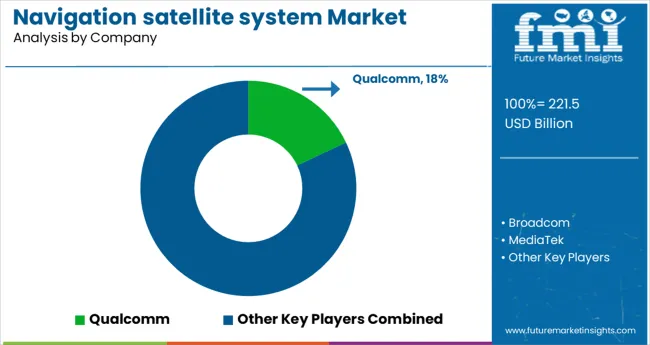

The navigation satellite system market is fragmented due to the strong product portfolios of major companies in developed and emerging countries. Nevertheless, moderate entry barriers will cause domestic players to enter the global market, resulting in a highly fragmented market by 2035.

Globally, there are a number of manufacturing companies operating in the market. Qualcomm Plc., Texas Instrument, Trimble, and Rockwell Collins, for example, are some of the leading companies. Other key vendors include Harris Corporation, Cobham Plc., and Laird Plc., which has a strong presence through its products and services in this market.

A few of the key strategies OEMs in this market use include the introduction of innovative products, services, software, new product launches, strategic acquisitions, partnerships, and collaborations.

In recent times, manufacturers of navigation satellite systems have identified new growth avenues stemming from the adoption of GNSS commercial applications. Since these systems are packed with the ability to determine position, velocity, and local time, it plays a key role in the defense of a country. Given this influence, it is anticipated that new revenue channels will open up from the defense sector.

Global navigation satellite systems are seeing an increase in demand from industrial, military, commercial, and government users due to the increased emphasis on positioning, navigation, and timing tools. Continuous advancement in technology is leading to the advancement of superior and highly efficient GNSS devices. In addition to ease of access leading to cyber threats, storing unstructured data is a challenge that restricts the growth of the navigation satellite system (GNSS) market.

The USA is expected to dominate the navigation satellite system (GNSS) market with an anticipated share of 33.2% by the end of 2025. This rise can be attributed to its highly used multi-sensor tracking data acquisition system. North American growth is expected to be driven by the growth of Driver Advisory Systems (DAS) in Mexico and Canada, which optimize traffic flow, use less energy, and are low-cost devices.

Due to the strong presence of component manufacturers in the market, the European market is expected to grow at a moderate rate of 23.7% in the next few years. The significant growth of the component manufacturers can be found in road, surveying, and maritime applications, these factors are propelling sales of navigation satellite systems (GNSS) in the global market.

To help in the tracing of suspected infections, Sygic and other technology companies are developing smartphone applications with GNSS and Bluetooth sensors. Travel restrictions and the reduction in cars parked near ground stations have influenced the quality of improvised reflectometry measurements, reported Science Daily in September 2024. This development has reduced signal scattering and improved measurement quality.

Although the global 5G rollouts have been impacted by the pandemic, the post-pandemic market continues to grow due to the high demand for navigation satellite systems (GNSS), the adoption rate of 5G technological infrastructure, and the development of network spectrum distribution auctions.

The global navigation satellite system (GNSS) solutions play an integral role in determining the position, local time, and velocity of satellites in space. During the historical assessment of the navigation satellite system, it has been found that the adoption of navigation satellite systems or commercial applications is rising.

In recent years, positioning, navigation, and timing (PNT) tools have become increasingly important for industrial, military, commercial, and governmental applications, contributing to the growth of the navigation satellite system (GNSS) market. The relentless development of new technologies has led to the production of superior and highly efficient GNSS devices.

Due to the low entry barrier in the navigation satellite system market, numerous start-ups are surfacing, which, in itself, is intensifying the competition.

However, the demand for navigation satellite systems is likely to turn sluggish during the forecast period, owing to cyber threats and security concerns. In addition to this, the difficulty to store unstructured data

A few limitations that restrict the growth of the navigation satellite system (GNSS) market include easy accessibility, which leads to cyber threats, and difficulty storing unstructured data.

Over the forecast period, Asia Pacific is expected to have the fastest-growing global navigation satellite systems market. Revenue growth is primarily driven by China, Japan, India, and Australia. The significant increase in China has been attributed to the large population of consumers, including electronic devices, smartphones, positioning devices, and other essential applications.

The Indian government has made significant developments in navigation satellite technology, such as NAVIC, which has been developed for aviation, marine, automotive, and other critical applications.

How is the Performance of North America in the Navigation Satellite System Market?

The USA is projected to dominate the navigation satellite system (GNSS) market with a significant share value of 33.2% in 2025. This is likely due to the widespread use of the multi-sensor data acquisition system for track mapping prevalent in the country.

It is expected that the Driver Advisory System (DAS) market in North America will see significant growth due to its high adoption in Mexico and Canada, which optimize traffic flow, use less energy, and are inexpensive.

How will the Europe Navigation satellite system Market Grow?

There is strong competition in the European market, which is expected to grow at a modest market share of 23.7% due to the strong presence of component manufacturers. The significant growth in the road, surveying, and maritime applications is expected to drive the navigation satellite system (GNSS) market's growth.

Some of the leading companies operating in the global navigation satellite system market include Qualcomm, Broadcom, MediaTek, SkyTraq, Intel, STMicroelectronics, FURUNO, Raytheon Company, Rockwell Collins, TomTom NV, Topcon Corporation, Trimble Navigation Ltd., u-blox.

The improvement in the quality of improvised reflectometry measurements has been attributed to road restrictions and a reduction in the number of cars parked near ground stations in September 2024. This has significantly reduced the signal scattering and improved the quality of measurements.

Some of the leading companies operating in the global navigation satellite system market include Qualcomm, Broadcom, MediaTek, SkyTraq, Intel, STMicroelectronics, FURUNO, Raytheon Company, Rockwell Collins, TomTom NV, Topcon Corporation, Trimble Navigation Ltd., u-blox.

A growing number of small and large players entering the market and offering products at competitive prices is leading to competitive prices for GNSS/GPS receivers. Thus, this factor is expected to boost the growth of the navigation satellite system (GNSS) market.

Despite the consequences of the pandemic on 5G deployments globally, the post-pandemic market has seen growth due to high demand and adoption rates of the technology-relevant infrastructure for 5G. Countries worldwide have also seen the development of network spectrum distribution auctions.

A report in Science Daily stated that improvised reflectometry measurements were affected by travel restrictions and a reduction in cars parked near ground stations in September 2024. This development significantly reduced signal scattering and improved the data's quality.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 8.1% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Application, Satellite Technology, Region |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; Asia-Pacific; Japan; Middle East and Africa |

| Key Countries Profiled | United States of America, Canada, Brazil, Mexico, Germany, United Kingdom, France, Spain, Italy, Russia, Poland, Australia, New Zealand, China, India, Japan, GCC Countries, South Africa, North Africa |

| Key Companies Profiled | Qualcomm; Broadcom; MediaTek; SkyTraq; Intel; STMicroelectronics; FURUNO; Raytheon Company; Rockwell Collins; TomTom NV; Topcon Corporation; Trimble Navigation Ltd.; u-blox |

| Customization | Available Upon Request |

The global navigation satellite system market is estimated to be valued at USD 221.5 billion in 2025.

It is projected to reach USD 482.6 billion by 2035.

The market is expected to grow at a 8.1% CAGR between 2025 and 2035.

The key product types are location-based services (lbs), agriculture, aviation, maritime, road, rail, surveying and timing and synchronization.

gps segment is expected to dominate with a 34.0% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Navigation SDK for Automotive Market Size and Share Forecast Outlook 2025 to 2035

Navigation Switches Market Size and Share Forecast Outlook 2025 to 2035

Navigation, Imaging and Positioning Solutions Market - Trends & Forecast 2025 to 2035

Neuronavigation Systems Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Subsea Navigation and Tracking Market Size and Share Forecast Outlook 2025 to 2035

Cranial Navigation Systems Market Size and Share Forecast Outlook 2025 to 2035

Personal Navigation Devices Market Size and Share Forecast Outlook 2025 to 2035

Surgical Navigation System Market Analysis - Growth & Forecast 2025 to 2035

Military Navigation Systems Market

Inertial Navigation System Market

Lane-level Navigation Market Size and Share Forecast Outlook 2025 to 2035

Automotive Navigation Solutions Market Growth - Trends & Forecast 2025 to 2035

Automotive Navigation System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Orthopedic Navigation Systems Market Analysis – Trends, Growth & Forecast 2025 to 2035

Mixed Reality Navigation Platforms Market Forecast and Outlook 2025 to 2035

Handheld Robotic Navigation Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Automotive Personal Navigation Systems Market Size and Share Forecast Outlook 2025 to 2035

Assured PNT (Positioning, Navigation, and Timing) Market Size and Share Forecast Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Satellite Launch Vehicle Market Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA