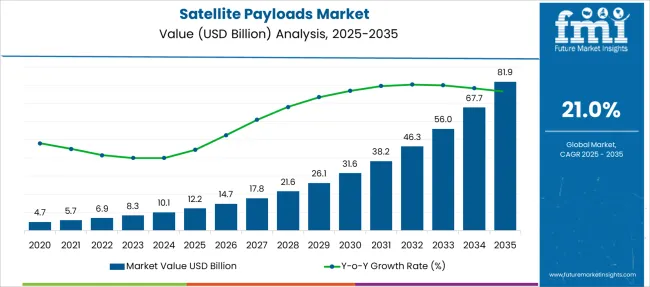

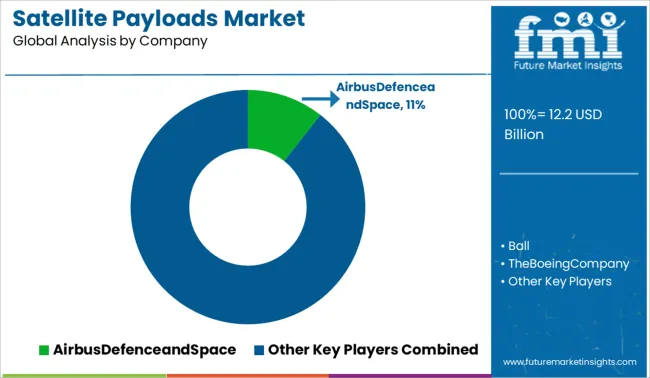

The Satellite Payloads Market is estimated to be valued at USD 12.2 billion in 2025 and is projected to reach USD 81.9 billion by 2035, registering a compound annual growth rate (CAGR) of 21.0% over the forecast period.

| Metric | Value |

|---|---|

| Satellite Payloads Market Estimated Value in (2025 E) | USD 12.2 billion |

| Satellite Payloads Market Forecast Value in (2035 F) | USD 81.9 billion |

| Forecast CAGR (2025 to 2035) | 21.0% |

The satellite payloads market is experiencing accelerated growth due to the rising global need for high-capacity communication, Earth observation, and navigation services. Investments from public and private space programs are enabling the deployment of advanced payloads that support flexible missions and on-demand reconfigurability. Innovations in satellite miniaturization, software-defined payload architectures, and frequency hopping technologies are further expanding the market's scope.

The growing role of low Earth orbit satellite constellations in global broadband initiatives has reshaped demand toward lightweight, power-efficient payloads. Concurrently, rising requirements from defense, disaster recovery, and remote connectivity initiatives are strengthening procurement of satellites equipped with adaptable payloads.

As space becomes increasingly commercialized, demand for modular payload solutions is anticipated to grow significantly, backed by reduced launch costs and favorable public-private collaboration models. Emerging opportunities are expected to arise from cross-spectrum payload development, increased 5G satellite backhaul usage, and expanded applications in mobility, maritime, and agriculture.

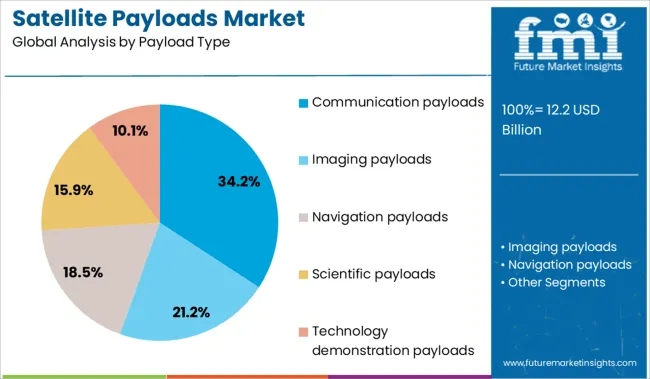

The market is segmented by Payload Type, Frequency Band, Application, Satellite Type, and End-User and region. By Payload Type, the market is divided into Communication payloads, Imaging payloads, Navigation payloads, Scientific payloads, and Technology demonstration payloads.

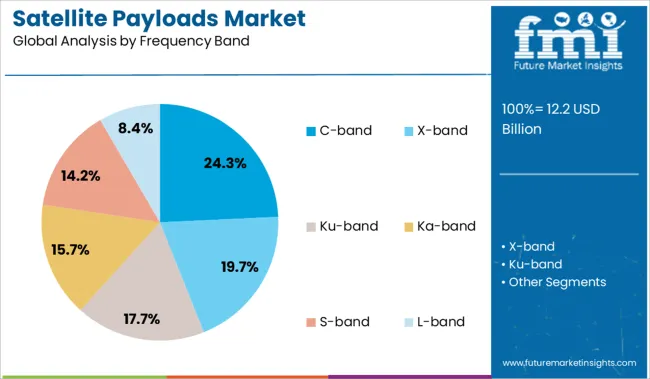

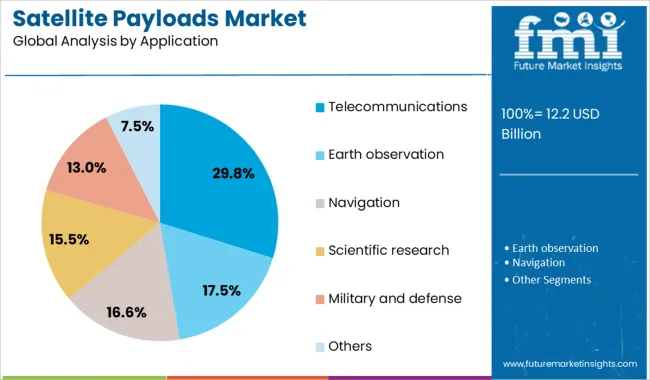

In terms of Frequency Band, the market is classified into C-band, X-band, Ku-band, Ka-band, S-band, and L-band. Based on Application, the market is segmented into Telecommunications, Earth observation, Navigation, Scientific research, Military and defense, and Others. By Satellite Type, the market is divided into Geostationary satellites (GEO), Medium earth orbit satellites (MEO), Low earth orbit satellites (LEO), Small satellites (SmallSats), and CubeSats. By End-User, the market is segmented into Commercial, Government & military, and Scientific & research institutions. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Communication payloads are expected to hold 34.2% of total revenue in the satellite payloads market by 2025, making them the leading payload type. Their dominance is driven by the escalating need for broadband connectivity, especially in underserved regions, where ground-based infrastructure remains limited.

The growing penetration of direct-to-home television, mobile backhaul, and enterprise networking services has amplified the demand for high-throughput communication payloads. Technological advancements have enabled greater bandwidth efficiency, frequency reuse, and on-board signal processing, allowing satellites to deliver improved coverage with fewer resources.

Additionally, the deployment of satellite mega-constellations for global internet access is fueling demand for scalable and low-latency communication payloads. Government and defense agencies have also prioritized satellite-based communication for secure and resilient data transfer, reinforcing the segment’s leadership.

The C-band frequency segment is projected to contribute 24.3% of total revenue in 2025, positioning it as a key spectrum in the satellite payloads market. Its continued relevance is attributed to its reliability in adverse weather conditions and its widespread use in broadcasting and fixed satellite services.

The band’s resistance to signal degradation makes it highly suitable for mission-critical communication in tropical and high-humidity environments. Despite the growing shift toward higher frequency bands, C-band remains indispensable for telecom operators and broadcasters due to its broad coverage capabilities and established ground infrastructure.

Additionally, spectrum reallocation in several countries has opened opportunities for hybrid payload designs that balance C-band stability with higher-band throughput, ensuring its continued integration in satellite planning strategies.

The telecommunications segment is forecast to account for 29.8% of satellite payloads market revenue in 2025, securing its role as the leading application area. The expansion of 5G networks, cloud-based communications, and remote area connectivity programs has heightened the demand for satellite support in both urban and rural contexts.

Satellites equipped with telecom payloads have become critical in addressing last-mile connectivity challenges, particularly in geographically dispersed or infrastructure-deficient regions. Telecommunication service providers are increasingly incorporating satellite links into hybrid network architectures to ensure service continuity, disaster recovery, and global coverage.

Furthermore, commercial and governmental initiatives focused on digital inclusion, maritime connectivity, and in-flight broadband are reinforcing investment in telecom payloads. As bandwidth demand surges worldwide, telecommunications will remain the primary driver of satellite payload development and deployment.

The satellite payloads market is expanding due to rising demand for satellite communication, Earth observation, and defense applications. However, challenges such as high production costs, regulatory barriers, and dependency on government funding are limiting market scalability and growth.

The satellite payloads market is growing due to the increasing demand for satellite communication and Earth observation data. Payloads, which include sensors, communication equipment, and imaging devices, are essential components for satellites used in telecommunication, weather forecasting, and environmental monitoring. As industries such as defense, broadcasting, and disaster management require more reliable and global coverage, the need for advanced payloads has risen. This trend is further fueled by the expansion of commercial satellite constellations, driving the continued growth of the satellite payloads market.

Despite the growing demand, the satellite payloads market faces significant challenges from high production costs and regulatory hurdles. The development and manufacturing of payloads require significant investments in research, specialized materials, and skilled labor. Furthermore, regulatory approval processes for launching satellites are stringent, and international agreements must be adhered to. These factors create barriers for smaller companies looking to enter the market, making it difficult to scale production and maintain profitability, especially for emerging private-sector satellite providers.

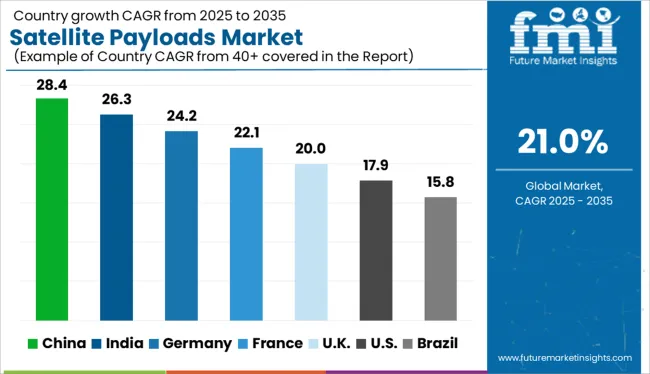

| Country | CAGR |

|---|---|

| India | 26.3% |

| Germany | 24.2% |

| France | 22.1% |

| UK | 20.0% |

| USA | 17.9% |

| Brazil | 15.8% |

Global satellite payloads market demand is projected to rise at a 21% CAGR from 2025 to 2035. Of the five profiled markets out of 40 covered, China leads at 28.4%, followed by India at 26.3%, and Germany at 24.2%, while the United Kingdom posts 20.0% and the United States records 17.9%. These rates translate to a growth premium of +35% for China, +25% for India, and +16% for Germany versus the baseline, while the United States and the United Kingdom show slower growth. Divergence reflects local catalysts: strong government and private sector investment in satellite technology and payloads in China and India, while more mature markets like the United States and the United Kingdom experience slower growth due to established market presence and intense competition.

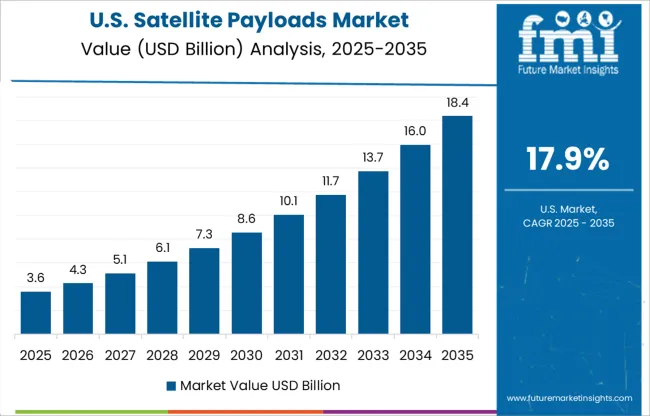

The satellite payloads market in the United States is forecast to register a CAGR of 17.9% from 2025 to 2035. Growth is being led by extensive military contracts and private-sector partnerships aimed at expanding national space defense and communication assets. Investment flows into low-Earth orbit (LEO) constellations, particularly for broadband and data relay, have reinforced the country's satellite launch cadence. Payloads supporting geospatial intelligence and space-based ISR (Intelligence, Surveillance, Reconnaissance) are prioritized under government funding. Although cost competition remains stiff, the reliability of launch systems and policy support have established the USA as a critical node in global payload deployment.

TIn the United Kingdom, the satellite payloads market is expected to rise at a CAGR of 20.0% through 2035. The government’s investment in spaceport infrastructure and Earth observation capabilities has given rise to payload miniaturization trends. Universities and aerospace startups are securing public grants to develop scientific payloads for climate monitoring and resource mapping. Demand for sovereign launch capacity post-Brexit has accelerated homegrown satellite programs with dedicated payload integration. The market benefits from collaborative research under ESA umbrella while maintaining local policy autonomy in satellite applications.

China leads this segment with an expected CAGR of 28.4% from 2025 to 2035. The country’s payload ecosystem is being driven by its multi-pronged space objectives, including lunar telemetry, 6G testing satellites, and dual-use navigation payloads. Agencies like CASC and CASIC are designing experimental payloads for interplanetary missions and satellite swarms. Payload delivery timelines have shortened due to vertically integrated manufacturing models. China’s space-tech sector is prioritizing onboard computing, spectrum optimization, and AI-enabled payload modules. This has strengthened its global position in satellite contract delivery.

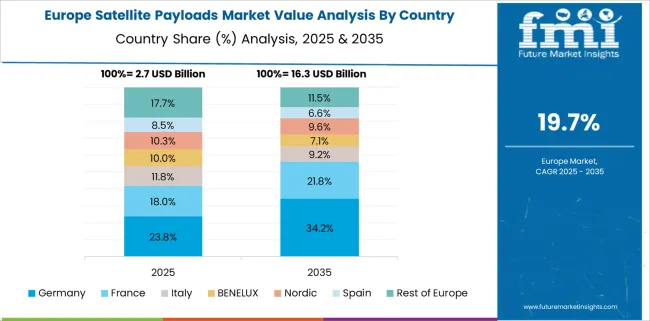

Germany is poised to experience a CAGR of 24.2% in its satellite payloads market by 2035. Dominance in precision engineering and component reliability continues to support payload assembly and testing facilities across regions like Bavaria and Baden-Württemberg. The government is emphasizing data-gathering payloads focused on climate analytics, industrial tracking, and rural connectivity. Academic institutions are developing low-mass payloads under public-private frameworks to serve in scientific missions. Local space-tech startups are being incentivized to enhance payload compatibility for global launch providers.

India’s satellite payloads market is forecast to grow at a CAGR of 26.3% during the forecast timeline. The market is supported by ISRO’s expanding satellite roadmap across communication, navigation, and disaster response sectors. Payloads are being designed with localized objectives such as soil moisture analysis, crop pattern tracking, and defense-grade surveillance. Private firms under IN-SPACe are participating in payload development for CubeSats and remote sensing applications. With increased launch cadence and robust domestic payload manufacturing, India is aiming for global contract payload missions.

In the satellite payloads market, demand is shaped by payload complexity, orbit-specific applications, and integration capacity. Airbus Defence and Space holds a leading position through advanced imaging, communication, and LEO/GEO payload systems—supported by a strong European presence and contracts like the BADR-8 telecom satellite. Boeing, Lockheed Martin, Honeywell, Ball, Maxar, and Thales Alenia Space compete with specialized modules, propulsion-integrated buses, and secure comms. GomSpace and Surrey Satellite Technology Ltd target small-sat constellations via agile manufacturing; Intuitive Machines and Astrobotic focus on lunar payload delivery. Payload offerings are navigated under regulatory regimes like ITAR, EC export control, and mission assurance certifications across the USA, EU, India, and ASEAN.

| Item | Value |

|---|---|

| Quantitative Units | USD 12.2 Billion |

| Payload Type | Communication payloads, Imaging payloads, Navigation payloads, Scientific payloads, and Technology demonstration payloads |

| Frequency Band | C-band, X-band, Ku-band, Ka-band, S-band, and L-band |

| Application | Telecommunications, Earth observation, Navigation, Scientific research, Military and defense, and Others |

| Satellite Type | Geostationary satellites (GEO), Medium earth orbit satellites (MEO), Low earth orbit satellites (LEO), Small satellites (SmallSats), and CubeSats |

| End-User | Commercial, Government & military, and Scientific & research institutions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AirbusDefenceandSpace, Ball, TheBoeingCompany, GomSpaceA/S., GeneralDynamicsCorporation, HoneywellInternationalInc, L3HarrisTechnologies,Inc., LockheedMartinCorporation, MaxarTechnologiesInc, MitsubishiElectricCorporation, NorthropGrummanCorporation, OHBSystemAG, PlanetLabsInc., RaytheonTechnologiesCorporation, RUAGInternationalHoldingAG, RussianSatelliteCommunicationsCompany(RSCC), SierraNevadaCorporation, SpireGlobal,Inc., SurreySatelliteTechnologyLimited, SpaceX, and ThalesAleniaSpaceS.A |

| Additional Attributes | Dollar sales concentrated in telecommunications, Earth observation, and defense sectors, share led by multispectral imaging sensors and high-throughput communication transponders, demand fueled by AI-enabled on-board processing and autonomous payload reconfiguration, retrofitting evident in modular CubeSat platforms upgrading legacy bus systems, ergonomic integration critical for thermal, vibration, and mass-constrained spacecraft designs, and trend shifting toward all-solid-state phased-array antennas over traditional parabolic reflectors for enhanced agility, reliability, and reduced deployment complexity. |

The global satellite payloads market is estimated to be valued at USD 12.2 billion in 2025.

The market size for the satellite payloads market is projected to reach USD 81.9 billion by 2035.

The satellite payloads market is expected to grow at a 21.0% CAGR between 2025 and 2035.

The key product types in satellite payloads market are communication payloads, imaging payloads, navigation payloads, scientific payloads and technology demonstration payloads.

In terms of frequency band, c-band segment to command 24.3% share in the satellite payloads market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Satellite Launch Vehicle Market Forecast Outlook 2025 to 2035

Satellite Simulator Market Size and Share Forecast Outlook 2025 to 2035

Satellite Communication Components Market Size and Share Forecast Outlook 2025 to 2035

Satellite Vessel Tracking Market Size and Share Forecast Outlook 2025 to 2035

Satellite IoT Market Size and Share Forecast Outlook 2025 to 2035

Satellite Laser Communication Market Size and Share Forecast Outlook 2025 to 2035

Satellite Phased Array Antenna Market Size and Share Forecast Outlook 2025 to 2035

Satellite Solar Cell Materials Market Size and Share Forecast Outlook 2025 to 2035

Satellite-based 5G Network Market Size and Share Forecast Outlook 2025 to 2035

Satellite Launch Vehicle (SLV) Market Size and Share Forecast Outlook 2025 to 2035

Satellite Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Satellite Cables And Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Satellite Component Market Size and Share Forecast Outlook 2025 to 2035

Satellite As A Service Market Size and Share Forecast Outlook 2025 to 2035

Satellite Modem Market Size and Share Forecast Outlook 2025 to 2035

Satellite Ground Station Market Trends – Growth & Forecast 2024-2034

Satellite Antenna Market

4K Satellite Broadcasting Market Size and Share Forecast Outlook 2025 to 2035

LEO Satellite Market Size and Share Forecast Outlook 2025 to 2035

UAV Satellite Communication Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA