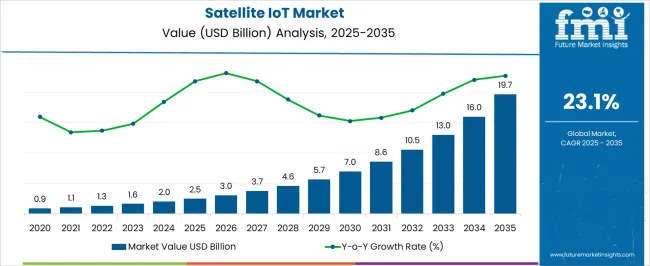

The satellite IoT sector is projected to expand from USD 2.5 billion in 2025 to USD 19.7 billion in 2035, recording a CAGR of 23.1%. The market growth curve shape displays a steep upward trend, with values moving from 2.5 billion in 2025 to 5.7 billion in 2029 and 8.6 billion in 2031. This trajectory reflects heightened reliance on satellite-based connectivity for applications in remote monitoring, logistics, agriculture, and defense operations.

The curve signifies rapid acceptance of satellite IoT as a necessity in areas where terrestrial networks underperform. The curve highlights both acceleration and strategic transformation across industries. By 2032, the industry is expected to reach 10.5 billion, advancing to 16.0 billion in 2034 before closing at 19.7 billion in 2035. The shape of the curve suggests exponential adoption, where enterprises and governments prioritize uninterrupted coverage and resilient communication infrastructure.

Market observers consider this trajectory a sign that satellite IoT is moving from niche to mainstream, with the ability to strengthen supply chains, enhance monitoring, and secure global data exchange. The sharp rise validates long-term confidence, positioning satellite IoT as a pivotal enabler of connectivity expansion across critical industries and global operations.

| Metric | Value |

|---|---|

| Satellite IoT Market Estimated Value in (2025 E) | USD 2.5 billion |

| Satellite IoT Market Forecast Value in (2035 F) | USD 19.7 billion |

| Forecast CAGR (2025 to 2035) | 23.1% |

The satellite IoT segment is estimated to contribute nearly 14% of the satellite communication market, about 9% of the internet of things market, close to 18% of the machine-to-machine communication market, nearly 15% of the remote asset monitoring market, and around 11% of the telecommunications infrastructure market. Collectively, this equals an aggregated share of approximately 67% across its parent sectors. This proportion highlights the central role of satellite IoT in extending connectivity to regions and assets that remain unreachable through terrestrial networks. Its value has been demonstrated in industries such as shipping, oil and gas, defense, utilities, and agriculture, where reliable monitoring and uninterrupted data exchange are crucial. Analysts view satellite IoT not simply as an extension of satellite communication but as a transformative element that reshapes how enterprises optimize operations, manage fleets, and ensure compliance with safety standards. The demand has been accelerated by global requirements for asset visibility and predictive analytics, with satellite IoT offering a resilient backbone where cellular coverage is absent. Its integration is increasingly regarded as a core enabler of efficiency and risk management in critical industries. As a result, the satellite IoT market is viewed as a powerful catalyst within its parent markets, setting new benchmarks in connectivity solutions and reinforcing its position as a decisive factor in the evolution of the global communication and monitoring ecosystem.

The Satellite IoT market is experiencing strong expansion, supported by rising demand for ubiquitous connectivity across remote and underserved regions. Growth in 2025 is being driven by increasing adoption of IoT solutions in sectors such as transportation, energy, agriculture, and defense, where terrestrial networks are insufficient.

The integration of advanced low Earth orbit constellations with high-throughput satellites is enabling faster, more reliable, and cost-effective communication for IoT devices. Growing investment in satellite infrastructure, coupled with advancements in miniaturized sensors and low-power communication protocols, is enhancing the scalability of IoT deployments over satellite networks.

Future opportunities are being shaped by the convergence of satellite and terrestrial systems, enabling seamless global coverage With the proliferation of connected devices and the need for real-time monitoring in critical applications, the market is positioned for sustained growth, driven by technological innovation, declining launch costs, and expanding satellite network capacity.

The satellite iot market is segmented by services type, frequency band, organization size, application, and geographic regions. By services type, satellite iot market is divided into Direct-to-satellite and Satellite IoT backhaul. In terms of frequency band, satellite iot market is classified into Ku-and-ka-band, L-Band, S-band, and Others. Based on organization size, satellite iot market is segmented into Large enterprises and SMEs. By application, satellite iot market is segmented into Energy & utilities, Maritime, Oil & gas, Transportation & logistics, Healthcare, Agriculture, Military & defense, and Others. Regionally, the satellite iot industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

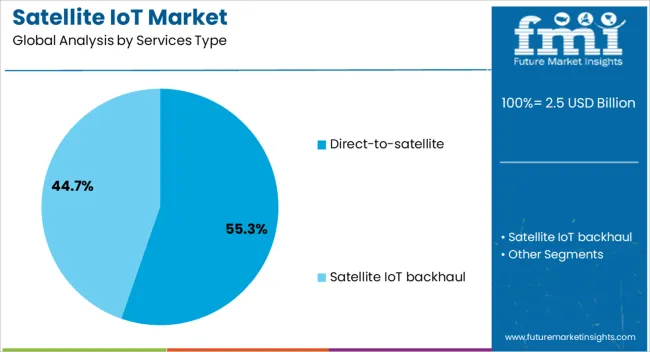

The Direct-to-satellite services type segment is projected to account for 55.3% of the overall Satellite IoT market revenue in 2025, making it the dominant services category. This leadership is being attributed to its ability to bypass terrestrial infrastructure, enabling direct communication between IoT devices and satellites.

The approach has been increasingly adopted for mission-critical applications in maritime, mining, and remote asset management where network coverage is otherwise unavailable. The growth of this segment has been reinforced by advancements in low Earth orbit satellite networks, which reduce latency and enhance bandwidth availability.

The capability to connect devices globally without dependence on local ground networks has improved operational efficiency and data accessibility for enterprises Additionally, scalability and flexibility in deployment have made direct-to-satellite services the preferred choice for organizations seeking reliable, high-coverage IoT solutions that can be rapidly implemented across geographies.

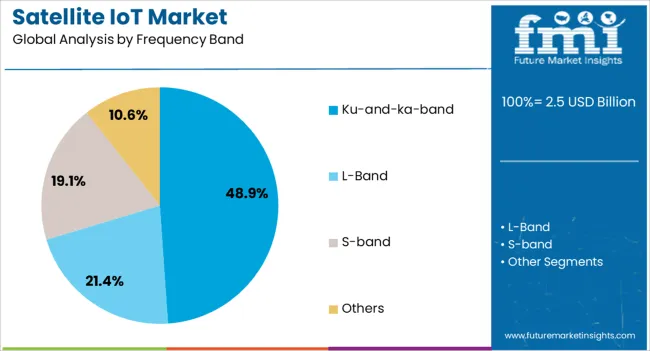

The Ku-and-ka-band frequency band segment is expected to capture 48.9% of the overall Satellite IoT market revenue in 2025, positioning it as the leading frequency range for IoT applications. This dominance is being driven by its high data throughput capabilities, which support bandwidth-intensive IoT applications such as video-enabled monitoring, real-time analytics, and high-volume telemetry.

The segment has benefited from increasing deployment of high-throughput satellites capable of delivering consistent performance even in challenging weather conditions. Its suitability for both fixed and mobile applications has expanded its adoption in sectors such as aviation, maritime, and energy.

The ability to support multiple IoT devices with stable connectivity over large geographic areas has made the Ku-and-ka-band frequency range highly attractive for global IoT networks As demand for faster data transmission and low-latency connections continues to rise, this segment is expected to maintain its leadership through advancements in satellite technology and spectrum efficiency.

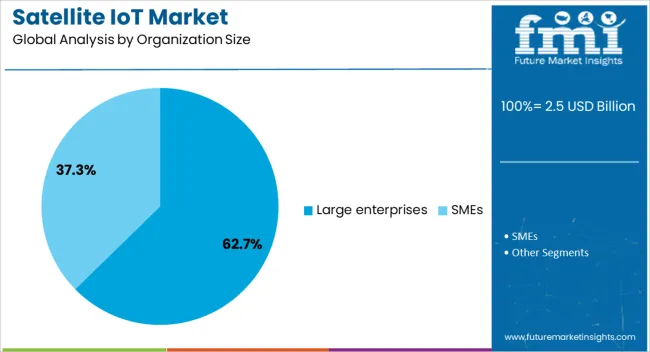

The large enterprises organization size segment is anticipated to hold 62.7% of the Satellite IoT market revenue in 2025, making it the most significant end-user category. This leadership is being supported by substantial investment capacity, enabling large enterprises to deploy satellite IoT networks for extensive operational coverage. The segment’s growth is being reinforced by the need for integrated, real-time monitoring solutions across diverse and geographically dispersed assets.

Large enterprises often operate in industries such as logistics, energy, defense, and mining, where satellite IoT ensures uninterrupted connectivity in remote areas. The capacity to implement customized, high-performance solutions with dedicated bandwidth and security protocols has further enhanced adoption.

Moreover, large enterprises have been at the forefront of integrating satellite IoT with AI and analytics platforms, enabling predictive maintenance, operational optimization, and enhanced decision-making capabilities This trend is expected to continue as organizations prioritize resilient and scalable communication infrastructure.

The satellite IoT market is projected to grow strongly, fueled by expanding demand for remote connectivity, asset tracking, and global data exchange. Adoption is being reinforced by industries such as agriculture, logistics, maritime, and energy, where terrestrial networks are insufficient. Opportunities are opening in low-Earth orbit constellations, precision farming, and cross-border fleet monitoring. Trends emphasize miniaturized terminals, hybrid satellite-terrestrial models, and data-driven service platforms. However, challenges including high service costs, limited bandwidth, and regulatory complexities continue to shape the pace of adoption and overall market competitiveness.

Demand for satellite IoT has been reinforced by industries operating in remote or infrastructure-limited areas. Agriculture, oil and gas, maritime, and mining rely on satellite IoT for asset monitoring, predictive maintenance, and data-driven decision-making. Logistics and fleet management firms are adopting satellite IoT for cross-border tracking where cellular networks fail. Opinions suggest that demand is strongest in regions with poor terrestrial infrastructure, where satellites offer reliable and wide-area coverage. Emergency response and disaster recovery operations have also reinforced adoption, highlighting the non-negotiable role of satellite IoT in critical situations. With enterprises prioritizing operational continuity, the demand for uninterrupted connectivity has placed satellite IoT as a strategic enabler of global communication systems, making it indispensable for industries that depend on resilience and reliability in remote environments.

Opportunities in the satellite IoT market are expanding through low-Earth orbit constellations, precision farming, and smart logistics. LEO satellite deployments are creating opportunities for faster, low-latency connectivity at reduced costs compared to traditional GEO systems. Precision agriculture is adopting satellite IoT for soil monitoring, crop health assessment, and irrigation control, improving yield optimization. Opinions highlight that strong opportunities exist in cross-border supply chains, where real-time cargo monitoring enables predictive planning. Integration with renewable energy infrastructure and offshore projects has created further opportunities for growth. Small and medium enterprises, previously constrained by cost, are now accessing satellite IoT services through subscription-based models. These developments illustrate how satellite IoT is evolving from niche applications to mainstream adoption, unlocking opportunities across both established industries and emerging smart infrastructure projects.

Trends in the satellite IoT market focus on hybrid connectivity, compact terminals, and service diversification. Hybrid models combining terrestrial and satellite IoT are trending, as they provide cost efficiency while ensuring redundancy. Compact and energy-efficient IoT terminals are being developed for deployment in agriculture, logistics, and maritime sectors. Opinions suggest that service diversification is becoming a major trend, with providers offering analytics, cloud integration, and end-to-end asset monitoring instead of just connectivity. Partnerships between satellite operators and telecom firms are also trending, enabling seamless handoffs between networks. The rise of nanosatellites and standardized communication protocols has further influenced adoption patterns. Collectively, these trends signal a shift from satellite IoT being a premium connectivity option to becoming a vital component of integrated, global IoT ecosystems tailored for industry-specific applications.

Challenges in the satellite IoT market stem from high service costs, bandwidth limitations, and regulatory barriers. Subscription and equipment costs remain a hurdle for small enterprises, slowing adoption in cost-sensitive industries. Limited bandwidth in satellite communication restricts high-volume data transfer, confining applications to essential monitoring and reporting. Opinions emphasize that regulatory complexities around spectrum allocation, cross-border data policies, and orbital management create delays and compliance risks for providers. Competition from terrestrial IoT and expanding 5G networks further adds pressure, especially in regions with robust ground-based infrastructure. Supply chain disruptions in satellite manufacturing and launch services present additional challenges. These structural barriers underscore that while satellite IoT delivers unmatched coverage and reliability, its mass adoption will require cost optimization, stronger regulatory coordination, and competitive service differentiation.

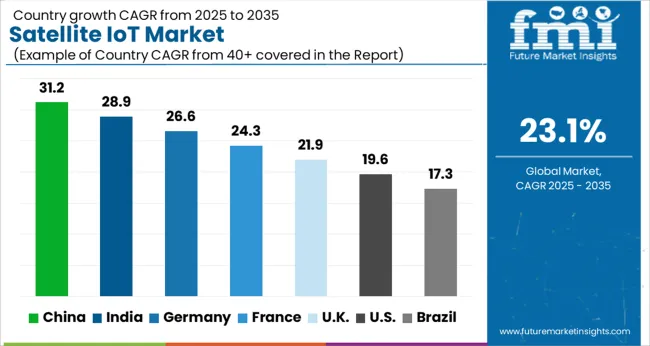

| Country | CAGR |

|---|---|

| China | 31.2% |

| India | 28.9% |

| Germany | 26.6% |

| France | 24.3% |

| UK | 21.9% |

| USA | 19.6% |

| Brazil | 17.3% |

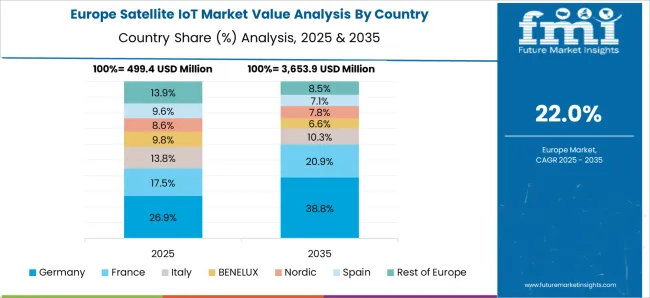

The global satellite IoT market is projected to expand at a CAGR of 23.1% between 2025 and 2035. China leads with 31.2%, followed by India at 28.9% and Germany at 26.6%. The United Kingdom is forecast to grow at 21.9%, while the United States records 19.6%. Growth is driven by demand for global connectivity in logistics, maritime, agriculture, energy, and defense. Asian countries surge ahead with large scale investments in satellite constellations and integration with IoT platforms, while Germany leverages its role in industrial automation and automotive telematics. The UK emphasizes satellite enabled trade and monitoring services, whereas the USA maintains slower but steady growth through defense contracts and integration with private satellite operators. This report spans 40 plus countries, though the leading five are highlighted below.

The satellite IoT market in China is projected to grow at a CAGR of 31.2%. Expansion is driven by strong government backed satellite programs, integration with national IoT platforms, and emphasis on remote connectivity for mining, energy, and logistics. Chinese satellite operators deploy large constellations to strengthen global coverage, while local IoT providers integrate services into agriculture and transport. Export of satellite enabled IoT modules positions China as both a supplier and service provider in global markets. With rapid industrial adoption and policy support, China secures leadership in this field.

The satellite IoT market in India is expected to grow at a CAGR of 28.9%. Growth is underpinned by rising demand in agriculture, fisheries, and rural logistics where terrestrial networks remain limited. Government initiatives encourage development of satellite communication systems to support national digitalization and rural inclusion programs. Domestic startups and ISRO backed collaborations push innovation in IoT modules tailored for low cost applications. With strong public private partnerships and fast growing demand for remote connectivity, India emerges as one of the most dynamic markets globally.

The satellite IoT market in Germany is projected to grow at a CAGR of 26.6%. Expansion is driven by integration of satellite IoT in automotive telematics, industrial automation, and logistics. German companies collaborate with European satellite operators to develop advanced IoT applications, including cross border fleet management and smart manufacturing. Strong government emphasis on digital infrastructure and compliance with EU wide connectivity standards further support adoption. With its industrial base and export orientation, Germany plays a leading role in applying satellite IoT for advanced manufacturing and mobility.

The satellite IoT market in the UK is forecast to expand at a CAGR of 21.9%. Growth is supported by strong participation in European satellite programs, maritime connectivity services, and defense applications. UK based companies develop IoT solutions for trade logistics, shipping, and offshore monitoring. Government backed initiatives promote digital trade corridors and satellite connectivity for smart ports. The UK’s role as a hub for satellite services and data analytics ensures steady growth, though at a more moderate pace compared to Asia and Germany.

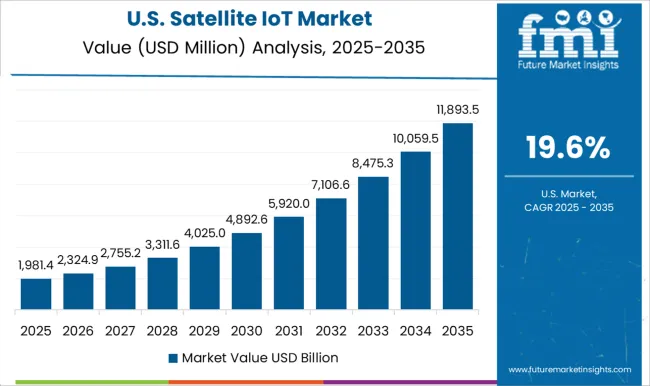

The satellite IoT market in the US is projected to grow at a CAGR of 19.6%. Growth is steady, supported by strong defense spending, private satellite operator networks, and industrial adoption. USA firms prioritize IoT integration for aviation, energy, and supply chain monitoring. Private players deploy constellations tailored for IoT connectivity, expanding coverage for commercial applications. While slower than Asia and Europe, the USA maintains global relevance through high value contracts, defense applications, and leadership in private space ventures.

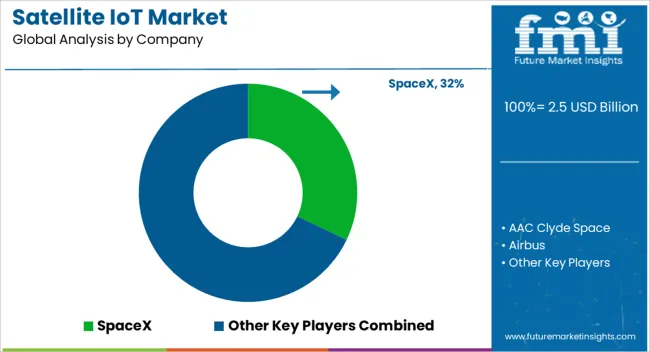

Competition in satellite IoT has been framed by how persuasively brochures present constellation capacity, coverage, and integration options. SpaceX and OneWeb lead with brochures that emphasize low Earth orbit constellations, stressing latency advantages, global reach, and scalable IoT device backhaul. Airbus and Thales Alenia Space distribute brochures that detail end-to-end solutions, from satellites and ground stations to IoT data services, highlighting security, redundancy, and tailored payloads. Lockheed Martin, Northrop Grumman, and RTX package brochures around modular satellite buses and IoT payload integration, targeting defense, logistics, and infrastructure clients. Blue Origin and Sierra Nevada position brochures on launch services and flexible spacecraft platforms, tying IoT to broader orbital ecosystems. AAC Clyde Space, GomSpace, OHB, and Millennium Space Systems compete with brochures that stress nanosatellite and microsatellite constellations, affordable capacity, and fast deployment. Mitsubishi Electric and China Aerospace Science and Technology Corporation present brochures on reliability, geostationary presence, and regional IoT coverage models. Maxar Technologies highlights imagery-enabled IoT support in its brochures, connecting satellite sensors with analytics for industrial monitoring. Strategy has been executed through brochure clarity that makes orbital complexity easy to digest. Brochures feature constellation diagrams, latency comparisons, frequency bands, and integration with terrestrial networks, allowing buyers to make side-by-side evaluations. Exolaunch strengthens competitiveness with brochures showing deployment systems for IoT satellites, emphasizing reliability and scalability for smallsat operators. Competitive edge rests less on brand heritage and more on how brochures demonstrate spectrum access, device compatibility, and data throughput. Decision-makers compare service-level guarantees, regulatory compliance notes, and deployment timelines directly from brochures. In this market, the product brochure is not a supporting detail but the battleground itself, where orbital capabilities, IoT integration pathways, and reliability metrics are condensed into persuasive evidence that shapes procurement and partnership decisions.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.5 Billion |

| Services Type | Direct-to-satellite and Satellite IoT backhaul |

| Frequency Band | Ku-and-ka-band, L-Band, S-band, and Others |

| Organization Size | Large enterprises and SMEs |

| Application | Energy & utilities, Maritime, Oil & gas, Transportation & logistics, Healthcare, Agriculture, Military & defense, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | SpaceX, AAC Clyde Space, Airbus, BAE Systems, Blue Origin, China Aerospace Science and Technology Corporation, Exolaunch, GomSpace, Lockheed Martin, Maxar Technologies, Millennium Space Systems, Mitsubishi Electric, Northrop Grumman, OHB, OneWeb, RTX, Sierra Nevada, and Thales Alenia Space |

| Additional Attributes | Dollar sales by service type (connectivity, data management, device management), Dollar sales by application (maritime, agriculture, logistics, energy, defense, environmental monitoring), Trends in integration of low-Earth orbit constellations for IoT coverage, Role of satellite IoT in extending connectivity to remote and underserved regions, Growth in demand for asset tracking, predictive maintenance, and smart farming, Regional adoption patterns across North America, Europe, and Asia Pacific. |

The global satellite IoT market is estimated to be valued at USD 2.5 billion in 2025.

The market size for the satellite IoT market is projected to reach USD 19.7 billion by 2035.

The satellite IoT market is expected to grow at a 23.1% CAGR between 2025 and 2035.

The key product types in satellite IoT market are direct-to-satellite and satellite IoT backhaul.

In terms of frequency band, ku-and-ka-band segment to command 48.9% share in the satellite IoT market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Geostationary Orbit Satellite IoT Market Size and Share Forecast Outlook 2025 to 2035

Medium Earth Orbit (MEO) Satellite IoT Market Size and Share Forecast Outlook 2025 to 2035

Satellite Launch Vehicle Market Forecast Outlook 2025 to 2035

Satellite Simulator Market Size and Share Forecast Outlook 2025 to 2035

Satellite Communication Components Market Size and Share Forecast Outlook 2025 to 2035

Satellite Vessel Tracking Market Size and Share Forecast Outlook 2025 to 2035

Satellite Laser Communication Market Size and Share Forecast Outlook 2025 to 2035

Satellite Phased Array Antenna Market Size and Share Forecast Outlook 2025 to 2035

Satellite Solar Cell Materials Market Size and Share Forecast Outlook 2025 to 2035

Satellite-based 5G Network Market Size and Share Forecast Outlook 2025 to 2035

Satellite Launch Vehicle (SLV) Market Size and Share Forecast Outlook 2025 to 2035

Satellite Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Satellite Cables And Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Satellite Component Market Size and Share Forecast Outlook 2025 to 2035

Satellite As A Service Market Size and Share Forecast Outlook 2025 to 2035

Satellite Payloads Market Size and Share Forecast Outlook 2025 to 2035

Satellite Modem Market Size and Share Forecast Outlook 2025 to 2035

Satellite Ground Station Market Trends – Growth & Forecast 2024-2034

Satellite Antenna Market

4K Satellite Broadcasting Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA