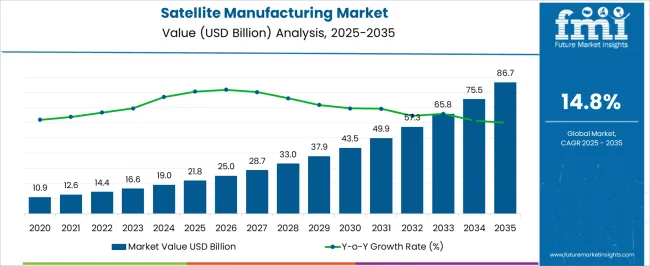

The satellite manufacturing market is projected to grow from USD 21.8 billion in 2025 to USD 86.7 billion by 2035, registering a remarkable CAGR of 14.8% during the forecast period. Between 2025 and 2030, the market is expected to rise from USD 21.8 billion to USD 43.5 billion, driven by the increasing demand for satellite services in communications, navigation, earth observation, and defense. Year-on-year analysis shows significant growth, with values reaching USD 25.0 billion in 2026 and USD 28.7 billion in 2027, supported by advancements in miniaturization technologies and the growing adoption of low-Earth orbit (LEO) satellites. By 2028, the market is forecasted to reach USD 33.0 billion, advancing to USD 37.9 billion in 2029 and USD 43.5 billion by 2030. Growth is expected to be further fueled by increasing private sector investments, the development of small satellite constellations, and advancements in propulsion systems and payload technologies. These dynamics position satellite manufacturing as a rapidly expanding segment within the aerospace industry, with significant opportunities driven by the increasing reliance on space-based solutions for global connectivity, data gathering, and national security applications.

| Metric | Value |

|---|---|

| Satellite Manufacturing Market Estimated Value in (2025 E) | USD 21.8 billion |

| Satellite Manufacturing Market Forecast Value in (2035 F) | USD 86.7 billion |

| Forecast CAGR (2025 to 2035) | 14.8% |

The satellite manufacturing market is witnessing accelerated expansion, driven by rising global investments in space infrastructure, telecommunications, and defense modernization. The push for real-time Earth observation, broadband connectivity, and global positioning services has intensified satellite demand, particularly in low-latency orbits.

Strategic alliances among space agencies, private aerospace firms, and national governments have contributed to increased R&D in propulsion systems, miniaturization, and high-throughput payloads. Cost efficiencies gained through modular satellite platforms and reusable launch systems are enhancing scalability across civil, commercial, and military applications.

As geopolitical tensions influence surveillance requirements and space becomes an extension of terrestrial digital infrastructure, the manufacturing ecosystem is expected to advance through high-precision engineering, AI-driven production lines, and the integration of electric propulsion technologies.

The satellite manufacturing market is segmented by orbit, satellite mass, propulsion technology, application, end use, and geographic region. By orbit, the market is divided into Low Earth Orbit (LEO), Medium Earth Orbit (MEO), and Geostationary Earth Orbit (GEO). In terms of satellite mass, categories include above 1000 kg, less than 100 kg, 100–500 kg, and 500–1000 kg. Based on propulsion technology, the market is segmented into electric, gas-based, and liquid fuel systems. By application, the market is divided into communication, Earth observation, navigation, and others. By end use, the market is segmented into commercial and government programs. Regionally, the satellite manufacturing industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The satellite manufacturing market is experiencing rapid growth, driven by increasing demand for advanced communication, remote sensing, and defense applications. In 2024 and 2025, the market growth drivers include expanding satellite launches and the rise of commercial space ventures. Opportunities are emerging in the development of small and cost-effective satellites for various industries. Emerging trends include the rise of mega constellations and the miniaturization of satellite technology. However, market restraints like high production costs and complex regulatory requirements limit broader adoption.

The major growth drivers in the satellite manufacturing market stem from the rising demand for communication and defense satellites. In 2024, both government and private sector investments in space exploration and communications led to a significant increase in satellite production. Satellites are being utilized for broadband services, earth observation, and military applications. As these industries continue to expand globally, satellite manufacturers are seeing heightened demand, contributing to the overall growth of the market.

Opportunities in the satellite manufacturing market lie in the production of smaller, more cost-effective satellites. In 2025, advancements in miniaturization technology and the demand for low Earth orbit (LEO) satellites opened new possibilities for businesses and governments. Small satellites, offering lower costs and faster deployment, are increasingly favored by startups and research institutions for communication, imaging, and scientific purposes. The demand for these compact solutions is expected to drive innovation and market growth, presenting significant opportunities for satellite manufacturers.

Emerging trends in the market include the miniaturization of satellite components and the development of mega constellations. In 2024, the launch of satellite constellations like Starlink was a significant milestone, contributing to the demand for mass satellite production. Miniaturization allows for more affordable and efficient satellites, while mega constellations enable global connectivity. These trends indicate a shift towards more widespread satellite deployment, particularly in communication and internet services, which are expected to redefine the space industry.

Key market restraints include high production costs and complex regulatory challenges. In 2024 and 2025, the high costs associated with satellite development, testing, and launch logistics remained a significant barrier for new players. Additionally, regulatory hurdles such as satellite licensing, frequency allocation, and compliance with international space treaties posed challenges for expansion. These barriers make it difficult for smaller companies to enter the market and contribute to slow adoption, especially in emerging markets where space infrastructure is still in its infancy.

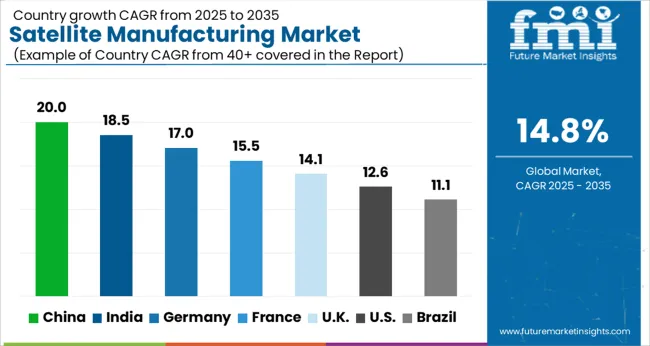

The global satellite manufacturing market is projected to grow at 14.8% CAGR from 2025 to 2035. China leads with 20.0% CAGR, driven by the country's significant investments in space exploration, telecommunications, and national security. India follows at 18.5%, supported by its expanding space programs and growing demand for communication and Earth observation satellites. France records 15.5% CAGR, reflecting strong demand for satellite manufacturing driven by Europe’s commitment to space exploration and national security. The United Kingdom grows at 14.1%, while the United States posts 12.6%, reflecting steady demand in mature markets with a focus on advanced satellite technology and commercial applications. Asia-Pacific leads the market growth, while Europe and North America focus on technological advancements and international collaborations. This report includes insights on 40+ countries; the top markets are shown here for reference.

The satellite manufacturing market in China is forecasted to grow at 20.0% CAGR, driven by the country's rapid advancements in space exploration, communication technologies, and national security initiatives. With increasing investments in satellite infrastructure, China’s demand for communication satellites, Earth observation systems, and scientific research satellites continues to rise. The government’s emphasis on technological innovation and space industry development further accelerates the market.

The satellite manufacturing market in India is projected to grow at 18.5% CAGR, supported by the country's expanding space programs and increasing demand for communication, Earth observation, and remote sensing satellites. India’s ambitious space exploration missions, combined with its growing satellite launch capabilities, contribute to the rising demand for high-performance satellite manufacturing solutions. Furthermore, government initiatives to support space technology development drive the adoption of advanced satellite systems.

The satellite manufacturing market in France is expected to grow at 15.5% CAGR, fueled by Europe’s strong commitment to space exploration and telecommunications. France’s leadership in satellite manufacturing, particularly in the fields of Earth observation and communications, supports the rising demand for high-quality satellites. Additionally, collaborations with international space agencies and private entities further drive the growth of satellite manufacturing technologies.

The satellite manufacturing market in the United Kingdom is projected to grow at 14.1% CAGR, driven by the country’s growing focus on satellite communications, space research, and security applications. The UK’s commitment to expanding its space sector, coupled with investments in satellite manufacturing infrastructure, supports the demand for high-performance satellites. Additionally, partnerships between the government and private entities to promote space innovation further accelerate market growth.

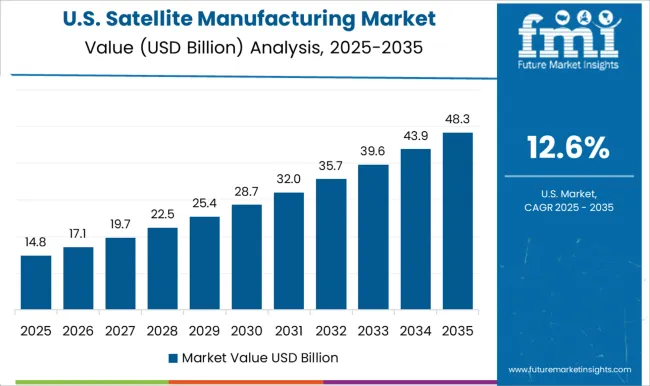

The satellite manufacturing market in the United States is projected to grow at 12.6% CAGR, reflecting steady demand in a mature and highly advanced market. The USA continues to lead in space innovation, with significant investments in commercial satellite manufacturing, space exploration, and telecommunications. The growth of satellite constellations, particularly for broadband and global communications, contributes to increased demand for high-tech satellite solutions.

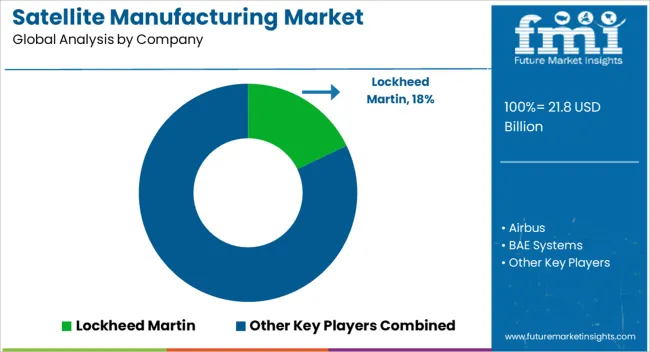

The satellite manufacturing market is dominated by Lockheed Martin, which leads through its extensive portfolio of high-performance satellite systems for commercial, military, and scientific applications. Lockheed Martin’s dominance is supported by its cutting-edge technology, R&D investments, and strong partnerships with government agencies and private sector clients.

Key players such as Airbus, Boeing, BAE Systems, and Northrop Grumman also hold significant market shares by providing advanced satellite solutions, including geostationary and low Earth orbit (LEO) satellites, designed for communication, navigation, and Earth observation. These companies focus on building reliable, cost-effective satellite systems while integrating innovative technologies such as propulsion systems, sensors, and payloads to meet the evolving demands of the space industry.

In addition to these dominant players, emerging companies like SpaceX, Thales Alenia Space, Maxar Technologies, and Telesat are expanding their market presence with specialized satellite systems, focusing on next-generation broadband, Earth observation, and space exploration projects. Companies like Blue Canyon Technologies, Dhruva Space, and INVAP are strengthening their positions by offering smaller, cost-effective satellite solutions for emerging space markets, including remote sensing and communication services.

The market growth is driven by increasing demand for satellite-based services, advancements in miniaturization, and government and private sector investments in space technology. Technological innovations in reusable launch vehicles, satellite constellations, and global connectivity will continue to shape competitive dynamics within the satellite manufacturing market.

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Orbit | LEO (Low Earth Orbit), MEO (Medium Earth Orbit), and GEO (Geostationary Earth Orbit) |

| Satellite Mass | Above 1000 kg, Less than 100 kg, 100 -500 kg, and 500 -1000 kg |

| Propulsion Technology | Electric, Gas-based, and Liquid fuel |

| Application | Communication, Earth observation, Navigation, and Others |

| End Use | Commercial and Government |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Lockheed Martin, Airbus, BAE Systems, Beijing Smart Satellite, Blue Canyon Technologies, Boeing, Dhruva Space, EnduroSat, Indian Space Research Organisation, INVAP, Maxar Technologies, Mitsubishi Electric, Northrop Grumman, OHB, Sierra Nevada, SpaceX, Telesat, and Thales Alenia Space |

| Additional Attributes | Dollar sales by satellite type and application, demand dynamics across communication, defense, and Earth observation sectors, regional trends in satellite manufacturing adoption, innovation in miniaturization and propulsion technologies, impact of regulatory standards on satellite deployment, and emerging use cases in space tourism and satellite-based IoT services. |

The global satellite manufacturing market is estimated to be valued at USD 21.8 billion in 2025.

The market size for the satellite manufacturing market is projected to reach USD 86.7 billion by 2035.

The satellite manufacturing market is expected to grow at a 14.8% CAGR between 2025 and 2035.

The key product types in satellite manufacturing market are leo (low earth orbit), meo (medium earth orbit) and geo (geostationary earth orbit).

In terms of satellite mass, above 1000 kg segment to command 47.2% share in the satellite manufacturing market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Manufacturing on Demand for Medical Market Size and Share Forecast Outlook 2025 to 2035

Satellite Launch Vehicle Market Forecast Outlook 2025 to 2035

Satellite Simulator Market Size and Share Forecast Outlook 2025 to 2035

Satellite Communication Components Market Size and Share Forecast Outlook 2025 to 2035

Satellite Vessel Tracking Market Size and Share Forecast Outlook 2025 to 2035

Satellite IoT Market Size and Share Forecast Outlook 2025 to 2035

Manufacturing Scale Electrostatic Precipitator Market Size and Share Forecast Outlook 2025 to 2035

Satellite Laser Communication Market Size and Share Forecast Outlook 2025 to 2035

Satellite Phased Array Antenna Market Size and Share Forecast Outlook 2025 to 2035

Satellite Solar Cell Materials Market Size and Share Forecast Outlook 2025 to 2035

Satellite-based 5G Network Market Size and Share Forecast Outlook 2025 to 2035

Satellite Launch Vehicle (SLV) Market Size and Share Forecast Outlook 2025 to 2035

Satellite Cables And Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Satellite Component Market Size and Share Forecast Outlook 2025 to 2035

Satellite As A Service Market Size and Share Forecast Outlook 2025 to 2035

Manufacturing Logistics Market Size and Share Forecast Outlook 2025 to 2035

Satellite Payloads Market Size and Share Forecast Outlook 2025 to 2035

Satellite Modem Market Size and Share Forecast Outlook 2025 to 2035

Manufacturing Execution Systems (MES) Market Analysis - Growth, Demand & Forecast 2025 to 2035

Satellite Ground Station Market Trends – Growth & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA