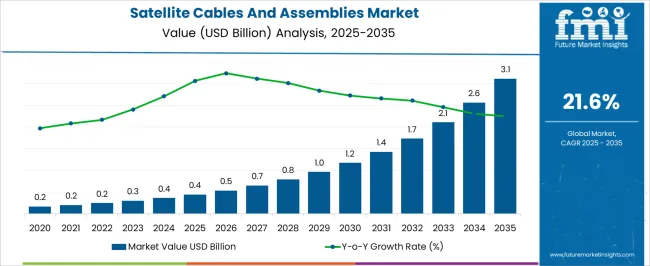

The Satellite Cables And Assemblies Market is estimated to be valued at USD 0.4 billion in 2025 and is projected to reach USD 3.1 billion by 2035, registering a compound annual growth rate (CAGR) of 21.6% over the forecast period. A rolling CAGR analysis provides deeper insight into how the annualized growth rate evolves across different time frames within the forecast horizon. From 2025 to 2028, the market grows from USD 0.4 billion to USD 0.8 billion, yielding a rolling CAGR of roughly 26%, indicating an aggressive early expansion phase driven by increasing satellite launches, miniaturized satellite deployments, and heightened demand for high-frequency data transmission.

Between 2028 and 2031, the CAGR moderates slightly to about 20%, as the market enters a phase of more structured procurement cycles and supply chain stabilization. Between 2031 and 2035, the rolling CAGR is around 22%, highlighting renewed acceleration as next-generation satellite constellations and deep-space exploration projects expand demand for specialized cabling solutions.

This pattern demonstrates that while adoption surges and infrastructure build-outs fuel early-stage growth, mid-term pacing is steadier before picking up again toward the end of the forecast period due to technological advancements. The rolling CAGR analysis thus reveals a balanced growth trajectory where consistent technological and operational developments sustain high initial expansion.

| Metric | Value |

|---|---|

| Satellite Cables And Assemblies Market Estimated Value in (2025 E) | USD 0.4 billion |

| Satellite Cables And Assemblies Market Forecast Value in (2035 F) | USD 3.1 billion |

| Forecast CAGR (2025 to 2035) | 21.6% |

The satellite cables and assemblies market is witnessing steady expansion due to the rise in satellite launches for broadband connectivity, earth observation, and navigation systems. Increasing demand for high-speed data transmission and low-latency communication has led to significant investments in satellite hardware infrastructure, boosting the requirement for reliable interconnects and shielded cable assemblies.

Government-backed defense and commercial satellite programs, as well as public-private collaborations for space exploration, are further accelerating market adoption. The proliferation of low-earth orbit (LEO) satellite constellations and small satellite deployment has created a continuous need for durable, lightweight, and radiation-resistant cabling systems.

As system complexity grows, enhanced performance expectations in terms of signal integrity, power handling, and EMI shielding are reshaping design standards for cable assemblies. Continued advancements in miniaturization, thermal resistance, and data transfer efficiency are expected to define the next phase of product innovation in this industry.

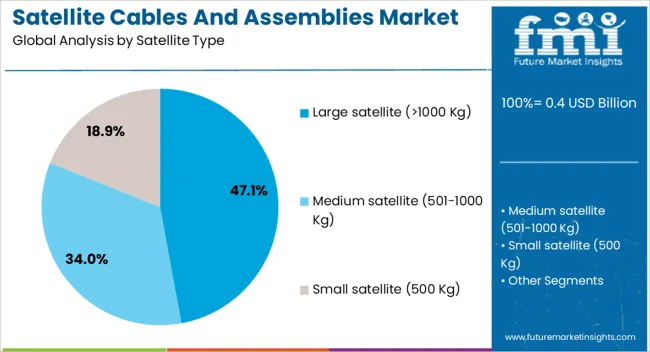

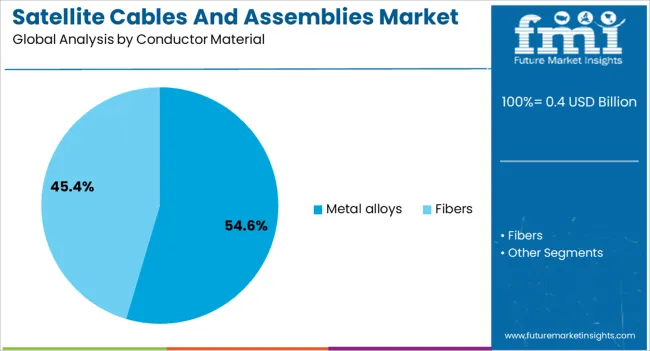

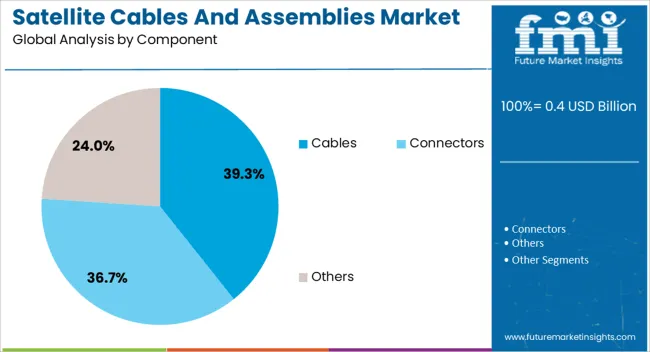

The satellite cables and assemblies market is segmented by satellite type, conductor material, component insulation type, and geographic regions. By satellite type, the satellite cables and assemblies market is divided into Large satellite (>1000 Kg), Medium satellite (501-1000 Kg), and Small satellite (500 Kg). In terms of conductor material, the satellite cables and assemblies market is classified into Metal alloys and Fibers. Based on component of the satellite cables and assemblies market is segmented into Cables, Connectors, and Others.

By insulation type of the satellite cables and assemblies market is segmented into Thermosetting and Thermoplastic. Regionally, the satellite cables and assemblies industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Large satellites, defined as those exceeding 1000 kg, are anticipated to account for 47.10% of the total market revenue in 2025, making this the leading satellite type segment. Their dominance is being driven by large-scale geostationary and high-throughput satellite missions that demand complex, high-capacity payloads and extensive internal wiring.

These satellites require robust cable assemblies to handle higher electrical loads and maintain signal fidelity across larger structures. Reliability, thermal management, and radiation shielding are critical performance requirements met by advanced cabling solutions specifically designed for heavy-duty configurations.

Continued investments in national security, telecommunications, and scientific observation projects are sustaining demand for large satellite platforms, thereby reinforcing the segment’s leadership.

Metal alloys are projected to lead the conductor material category, contributing 54.60% of the total market share in 2025. This leadership is supported by their superior conductivity-to-weight ratio, mechanical strength, and resistance to temperature fluctuations and radiation qualities that are essential in satellite operating environments.

Unlike pure metals, engineered alloys offer greater durability while maintaining low mass, making them ideal for high-density satellite architectures. The segment’s growth is also driven by the need for long-term reliability in missions requiring multi-year service life under extreme conditions.

Enhanced formability and compatibility with advanced insulation materials further support the integration of alloy-based conductors in complex assemblies.

Cables are expected to hold 39.30% of the total revenue share in the satellite cables and assemblies market by 2025, leading the component segment. This leadership is attributed to their critical role in power distribution, signal transmission, and thermal regulation across satellite systems.

The demand for shielded, flexible, and lightweight cabling solutions has grown alongside advances in satellite miniaturization and increased subsystem integration. Cables must meet stringent aerospace standards, including vacuum compatibility and outgassing resistance, which are being met through innovations in fluoropolymer insulations and braiding techniques.

As satellite payloads become more multifunctional and data-intensive, the need for high-speed, low-loss cable infrastructure continues to reinforce this segment’s prominence.

The market has experienced significant momentum due to the rising demand for space-based communication, navigation, and remote sensing applications. Large-scale deployment of low Earth orbit constellations by both private and government agencies has accelerated procurement cycles. Advanced materials, improved thermal performance, and reduced mass designs have strengthened reliability in harsh space conditions. The market is also benefiting from defense investments and emerging commercial satellite internet projects. However, high manufacturing costs, precision engineering requirements, and complex certification processes pose notable barriers for new entrants and smaller suppliers.

The surge in low Earth orbit (LEO) satellite deployments has been a critical driver for the satellite cables and assemblies market. Global broadband connectivity initiatives by companies and space agencies have created large-scale procurement of high-performance cabling systems capable of withstanding microgravity, radiation, and extreme temperature cycles. LEO constellations demand high-density interconnect solutions that maintain signal integrity while minimizing weight. This has pushed manufacturers toward advanced materials and miniaturized designs without compromising durability. Increased funding for satellite internet services in rural and underserved regions has further amplified demand. Continuous replenishment cycles for LEO networks ensure consistent orders, making this segment a stable revenue stream for suppliers despite cost competitiveness challenges.

Innovation in aerospace-grade materials is reshaping product performance standards in satellite cables and assemblies. Developments in fluoropolymer insulation, lightweight aluminum conductors, and enhanced shielding technologies have improved radiation tolerance, thermal stability, and electromagnetic compatibility. These advancements enable satellites to operate efficiently in deep space orbits and extended missions. Manufacturers are focusing on reducing cable weight while increasing bandwidth capacity to meet modern high-throughput satellite requirements. Such material innovations also address challenges associated with space debris impact resistance and thermal cycling fatigue. The ability to customize cable assemblies for specific payload architectures is becoming a competitive differentiator, particularly for missions demanding high flexibility and low mass integration.

Defense modernization programs worldwide have increased investments in secure military satellite networks, driving demand for specialized cable assemblies. These assemblies require heightened durability, encryption-friendly signal paths, and resistance to electronic warfare interference. Military communication, reconnaissance, and navigation satellites rely on robust cabling solutions that can withstand operational threats such as jamming and directed energy attacks. The need for redundancy and fault-tolerant architectures further elevates cable system complexity. Governments are awarding multi-year contracts to manufacturers with proven capabilities in aerospace defense projects, creating predictable revenue opportunities. The rising geopolitical focus on space security has also encouraged collaborative procurement between allied nations, expanding market scope for compliant and certified suppliers.

Despite strong demand, the satellite cables and assemblies market faces notable manufacturing and logistical challenges. Precision engineering requirements, rigorous testing protocols, and space-grade certification standards extend production timelines and increase costs. Raw material shortages, particularly in specialty conductors and insulation compounds, have impacted supply continuity. Delays in satellite launches due to integration bottlenecks can further disrupt cash flows for suppliers. The shift toward just-in-time production in aerospace components increases vulnerability to geopolitical trade restrictions and transport disruptions. To mitigate risks, leading manufacturers are investing in in-house testing facilities, diversifying supplier bases, and adopting additive manufacturing for certain connectors and housings. Efficient supply chain strategies will remain a competitive necessity as launch schedules intensify globally.

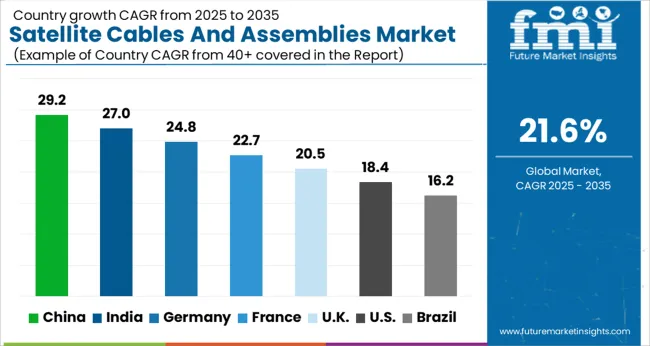

The market is forecast to grow at a CAGR of 21.6% between 2025 and 2035, supported by increasing satellite launches, advanced communication systems, and higher demand for high-frequency data transmission. China, with a 29.0% CAGR, is leading due to extensive satellite manufacturing programs and domestic space missions. India follows at 27.0%, driven by government-backed space exploration and commercial satellite services expansion.

Germany, at 25.0%, benefits from aerospace innovation and collaborative European space projects. The UK, growing at 21.0%, is enhancing its satellite production capabilities for defense and commercial applications, while the USA, at 18.0%, continues to invest in next-generation communication satellites and deep-space connectivity projects. This report includes insights on 40+ countries; the top markets are shown here for reference.

The industry in China is expected to grow at a CAGR of 29% from 2025 to 2035, driven by a robust increase in satellite launches and advancements in aerospace manufacturing. Significant state investment in space programs has enabled domestic firms to scale production of high-performance, lightweight cables designed for harsh space environments. Collaboration between satellite manufacturers and cable suppliers is accelerating innovation in radiation-resistant materials and high-speed data transmission capabilities. The growing commercial satellite sector and defense applications are contributing to the expanding demand for reliable interconnection solutions, positioning China as a major player in the global aerospace supply chain.

India is anticipated to register a CAGR of 27% between 2025 and 2035, propelled by escalating participation in global space missions and domestic satellite manufacturing. The Indian Space Research Organisation’s expanding satellite portfolio is driving demand for sophisticated cable systems with enhanced durability and signal integrity. Increased collaboration with international aerospace agencies is supporting technology transfer and quality improvements. Private aerospace enterprises are gaining momentum by catering to export markets and supplying components for small and medium-sized satellites, reflecting a diversifying and competitive landscape within India’s aerospace industry.

Demand for satellite cables and assemblies in Germany is projected to grow at a CAGR of 25% from 2025 to 2035, underpinned by investments in next-generation satellite constellations and communication networks. German aerospace firms focus on producing lightweight, high-reliability cable assemblies that can withstand extreme environmental conditions encountered in space. Partnerships between manufacturers and research institutions are fostering innovations in materials and assembly techniques, enhancing operational safety and performance. Government funding and participation in European space initiatives further accelerate the sector’s expansion and competitiveness on the global stage.

The United Kingdom is expected to grow at a CAGR of 21% during 2025 to 2035, driven by rising commercial space ventures and government support for satellite manufacturing. Tax incentives and grants have attracted private investments, boosting production of high-performance, reliable cable systems for small satellite platforms. Collaborations with international spaceports and technology firms are expanding export opportunities. The increasing number of satellite launches from UK spaceports necessitates advanced cable solutions, further strengthening the industry’s growth prospects.

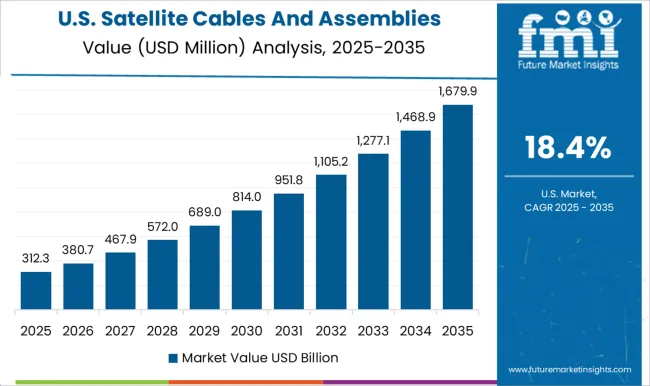

Sales of satellite cables and assemblies in the United States are forecast to grow at a CAGR of 18% between 2025 and 2035, driven by the expansion of commercial and defense satellite fleets. The US aerospace sector focuses on integrating miniaturized, lightweight cable assemblies to enhance satellite performance and reduce launch costs. Increased competition among satellite internet providers is boosting demand for high-capacity and durable interconnection systems. Substantial government contracts and private investments support continued innovation and production capacity increases, positioning the US as a critical hub in the global satellite supply chain.

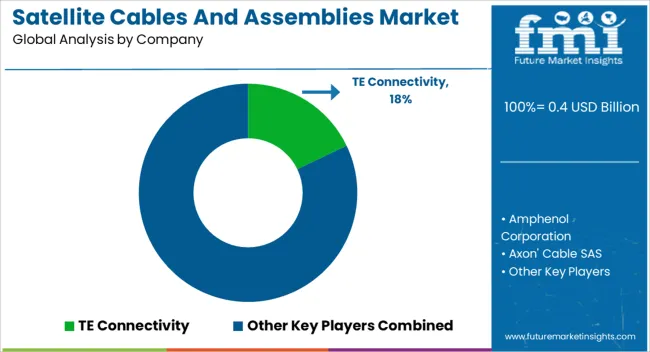

The market is led by established manufacturers that deliver high-reliability solutions for spacecraft, launch vehicles, and ground stations. TE Connectivity and Amphenol Corporation dominate through extensive product portfolios, covering RF cables, harnesses, and interconnect systems tailored for aerospace-grade performance. Axon' Cable SAS and Cicoil Flat Cables specialize in lightweight, flexible solutions that meet stringent spaceflight standards.

Cinch Connectivity Solutions and Eaton Corporation supply mission-critical cabling components with emphasis on durability in extreme temperature and vibration conditions. Huber+Suhner and Meggitt PLC offer advanced coaxial and fiber optic assemblies for high-frequency data transmission in satellite communication systems. Nexans SA and Prysmian Group have expanded their aerospace divisions, leveraging large-scale manufacturing to meet the growing demand for satellite deployment projects.

Smiths Group PLC and W.L. Gore & Associates, Inc. are recognized for proprietary materials and shielding technologies that enhance signal integrity and reduce electromagnetic interference. Market growth strategies include developing radiation-resistant cables, expanding partnerships with satellite OEMs, and increasing participation in commercial space programs.

Production scalability, compliance with international aerospace standards, and the ability to pass rigorous space qualification tests remain critical success factors. Entry is limited by high certification costs, specialized engineering expertise requirements, and the necessity of long-term reliability validation before integration into satellite systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 0.4 Billion |

| Satellite Type | Large satellite (>1000 Kg), Medium satellite (501-1000 Kg), and Small satellite (500 Kg) |

| Conductor Material | Metal alloys and Fibers |

| Component | Cables, Connectors, and Others |

| Insulation Type | Thermosetting and Thermoplastic |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | TE Connectivity, Amphenol Corporation, Axon' Cable SAS, Cicoil Flat Cables, Cinch Connectivity Solutions, Eaton Corporation, Huber+Suhner, Meggitt PLC, Nexans SA, Prysmian Group, Smiths Group PLC, and W.L. Gore & Associates, Inc. |

| Additional Attributes | Dollar sales by cable type and end use, demand dynamics across commercial satellite communication, defense satellite systems, and scientific research missions, regional trends in launches and satellite network expansions, innovation in lightweight materials, radiation-resistant insulation, and high-frequency signal transmission, environmental impact of manufacturing processes and end-of-life disposal of cable materials, and emerging use cases in low Earth orbit constellations, deep space exploration, and high-speed global broadband connectivity. |

The global satellite cables and assemblies market is estimated to be valued at USD 0.4 billion in 2025.

The market size for the satellite cables and assemblies market is projected to reach USD 3.1 billion by 2035.

The satellite cables and assemblies market is expected to grow at a 21.6% CAGR between 2025 and 2035.

The key product types in satellite cables and assemblies market are large satellite (>1000 kg), medium satellite (501-1000 kg) and small satellite (500 kg).

In terms of conductor material, metal alloys segment to command 54.6% share in the satellite cables and assemblies market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nanosatellite And Microsatellite Market

Demand for Small Satellite in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Small Satellite in USA Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Hose Assemblies Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Power And Signal Cables Market

Demand for Ceramic to Metal Assemblies in UK Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Hoses and Assemblies for OEM in USA Size and Share Forecast Outlook 2025 to 2035

Aircraft Tube and Duct Assemblies Market Growth - Trends & Forecast 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Handbrake And Clutch Cables Market

Waveguide Components and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Brake Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Power Steering Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Satellite Launch Vehicle Market Forecast Outlook 2025 to 2035

Android Automotive OS (AAOS) Market Size and Share Forecast Outlook 2025 to 2035

Satellite Simulator Market Size and Share Forecast Outlook 2025 to 2035

Satellite Communication Components Market Size and Share Forecast Outlook 2025 to 2035

Satellite Vessel Tracking Market Size and Share Forecast Outlook 2025 to 2035

Satellite IoT Market Size and Share Forecast Outlook 2025 to 2035

Satellite Laser Communication Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA