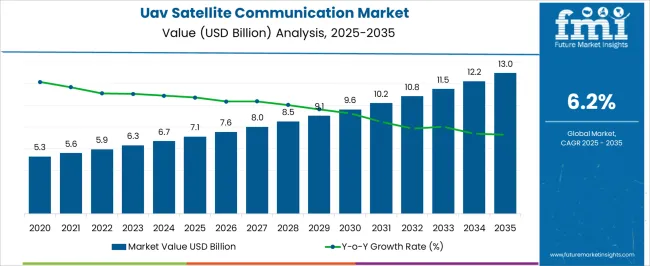

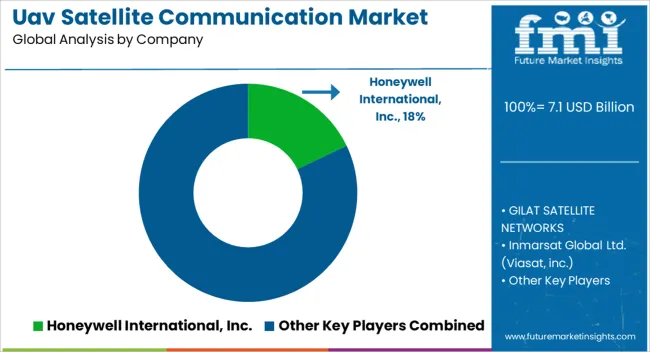

The UAV Satellite Communication Market is estimated to be valued at USD 7.1 billion in 2025 and is projected to reach USD 13.0 billion by 2035, registering a compound annual growth rate (CAGR) of 6.2% over the forecast period. The market exhibits a consistent upward trend without significant dips or volatility, indicating stability in demand and technology adoption over the decade. Examining the peak-to-trough movement, the market’s lowest value is at the beginning of the period, USD 7.1 billion in 2025, while the peak is reached in 2035 at USD 13.0 billion.

There are no notable troughs or declines within the timeline, showing a smooth, gradual rise. This lack of downturn reflects resilience against market shocks or disruptions. The incremental growth year over year remains positive, with values increasing steadily by approximately USD 0.5 billion in the earlier years and accelerating modestly to nearly USD 0.8 billion between 2034 and 2035.

The peak-to-trough ratio essentially measures the relative stability and growth momentum, and in this market, the ratio favors steady gain without pronounced volatility. This steady growth pattern demonstrates growing acceptance of UAV satellite communication solutions driven by rising security, defense, and commercial UAV applications. The absence of significant troughs highlights the market’s robustness, making it an attractive space for investment focused on long-term, stable expansion.

| Metric | Value |

|---|---|

| UAV Satellite Communication Market Estimated Value in (2025 E) | USD 7.1 billion |

| UAV Satellite Communication Market Forecast Value in (2035 F) | USD 13.0 billion |

| Forecast CAGR (2025 to 2035) | 6.2% |

The UAV satellite communication market is undergoing accelerated development, fueled by expanding defense budgets, the integration of low-Earth orbit (LEO) satellites, and advancements in miniaturized satellite terminals. Increased global focus on secure, real-time aerial intelligence is enhancing the deployment of beyond visual line of sight (BVLOS) UAVs that require uninterrupted connectivity.

Military modernization programs, cross-border surveillance needs, and climate monitoring initiatives are pushing demand for SATCOM-enabled UAVs across multiple geographies. Regulatory approvals for long-range commercial UAV operations and the proliferation of dual-use UAV systems are further opening the market for strategic investment.

As satellite networks become more resilient, lightweight, and cost-effective, the UAV SATCOM ecosystem is poised for sustained growth, driven by rising demand in tactical communication, disaster response, and high-altitude intelligence gathering.

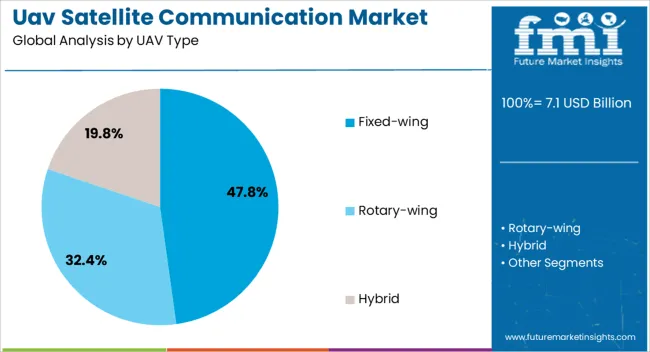

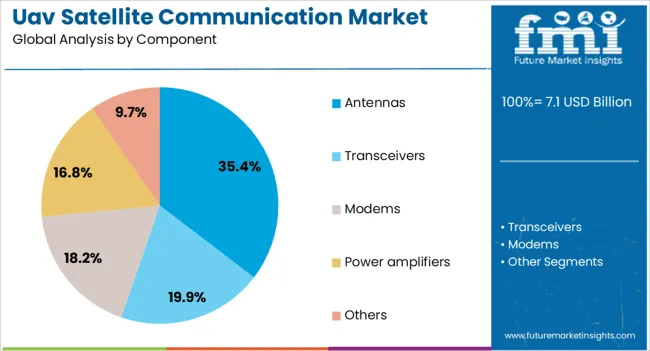

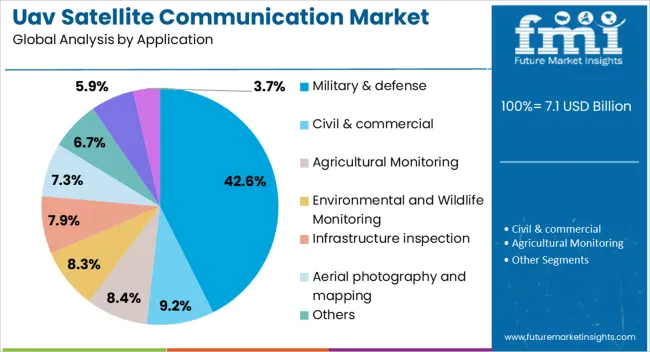

The UAV satellite communication market is segmented by UAV type, component application, and geographic regions. By UAV type, the UAV satellite communication market is divided into Fixed-wing, Rotary-wing, and Hybrid. In terms of components, the UAV satellite communication market is classified into Antennas, Transceivers, Modems, Power amplifiers, and Others.

Based on the application, the UAV satellite communication market is segmented into Military & defense, Civil & commercial, Agricultural Monitoring, Environmental and Wildlife Monitoring, Infrastructure inspection, Aerial photography and mapping, Others, Government, and Others. Regionally, the uav satellite communication industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Fixed-wing UAVs are expected to dominate the market with a projected 47.8% revenue share in 2025. This segment’s leadership is attributed to their extended flight endurance, higher payload capacities, and suitability for long-range surveillance and reconnaissance missions.

Fixed-wing platforms have demonstrated operational efficiency in wide-area coverage scenarios, where continuous SATCOM connectivity is essential. The ability to integrate larger satellite terminals, coupled with superior aerodynamic performance, allows for stable communication links over complex terrains.

Defense agencies and strategic command units have favored these UAVs for persistent intelligence, surveillance, and reconnaissance (ISR) applications, especially in regions with limited terrestrial infrastructure. As military doctrines increasingly emphasize real-time situational awareness and cross-theater command, fixed-wing UAVs remain integral to modern network-centric operations.

Antennas are projected to account for 35.4% of the total UAV SATCOM market revenue in 2025, leading the component segment. Their prominence is being driven by rapid innovations in compact, high-gain, and low-profile antenna systems that enable stable connectivity in high-mobility UAV platforms.

Technological advancements such as electronically steerable antennas (ESAs) and phased-array configurations are being adopted to improve link reliability, even under dynamic flight conditions. The growing reliance on high-bandwidth data transmission such as real-time video feeds, encrypted communications, and sensor fusion data has made antennas a critical enabler of satellite integration.

Military and enterprise UAV platforms require antennas that can adapt to multi-band, multi-orbit communication needs, which has elevated their strategic importance in the component value chain.

Military & defense applications are anticipated to contribute 42.6% of the total revenue in 2025, making this the most dominant application segment in the UAV satellite communication market. This leadership is supported by increasing demand for secure aerial ISR, target acquisition, and communication relay functions across hostile or remote environments.

Defense forces globally are expanding their unmanned aerial capabilities to ensure persistent situational awareness, border security, and tactical command connectivity. SATCOM-enabled UAVs are playing a critical role in real-time decision-making, especially where terrestrial networks are compromised or non-existent.

Strategic imperatives such as autonomous mission execution, encrypted battlefield communication, and multi-theater data transmission are reinforcing the centrality of UAV SATCOM in modern warfare and national security doctrines.

The UAV satellite communication market has witnessed substantial growth due to the rising demand for reliable, long-range connectivity in unmanned aerial vehicle (UAV) operations. Satellite communication enables UAVs to operate beyond the line of sight, providing real-time data transmission and command control in remote or inaccessible areas. Increasing applications in defense, agriculture, disaster management, and logistics have propelled market expansion. Technological advancements in satellite payloads, antennas, and signal processing have improved communication quality and reduced latency.

The expansion of UAV applications requiring beyond visual line of sight (BVLOS) operations has significantly driven the adoption of satellite communication systems. BVLOS capability allows UAVs to perform missions over vast distances, enabling activities such as border surveillance, pipeline inspection, and environmental monitoring. Satellite communication facilitates uninterrupted, secure data exchange and control commands even in areas lacking terrestrial network coverage. This capability is critical for commercial sectors like agriculture, where precision farming relies on real-time data collection and analysis. Increasing regulatory acceptance of BVLOS operations further boosts demand for satellite communication-enabled UAV systems, fostering industry growth.

Advancements in satellite communication technologies have enhanced the reliability, bandwidth, and efficiency of UAV connectivity. The development of compact, lightweight satellite transceivers and phased array antennas optimized for UAV integration has improved signal quality while minimizing payload weight. Innovations in modulation techniques and adaptive coding have increased data throughput and reduced latency, essential for real-time video streaming and command responsiveness. The deployment of low earth orbit (LEO) satellite constellations has reduced communication delays and expanded coverage areas. Integration with other communication protocols enables hybrid systems that improve link robustness and redundancy, supporting diverse UAV mission profiles.

The increasing utilization of UAVs in defense and commercial sectors has been a key factor propelling satellite communication market growth. Defense agencies leverage UAV satellite links for intelligence, surveillance, reconnaissance, and secure communication in conflict zones and remote locations. In commercial fields, applications such as precision agriculture, disaster response, infrastructure inspection, and logistics rely on reliable long-range connectivity to optimize operations. The ability to transmit high-resolution imagery and sensor data in real time enhances decision-making and operational efficiency. Government investments and public-private partnerships focused on UAV technology development further stimulate market demand for advanced satellite communication solutions.

The UAV satellite communication market faces challenges related to regulatory approvals, spectrum allocation, and the high costs associated with satellite services and equipment. Complex licensing requirements and varying regulations across countries can delay deployment and increase compliance costs. Spectrum congestion and allocation conflicts may affect communication quality and availability. Additionally, the cost of satellite bandwidth and specialized communication hardware can be prohibitive, especially for small and medium-sized enterprises and emerging markets. Vendors are addressing these issues by developing cost-effective, scalable solutions and collaborating with regulatory bodies to streamline approvals.

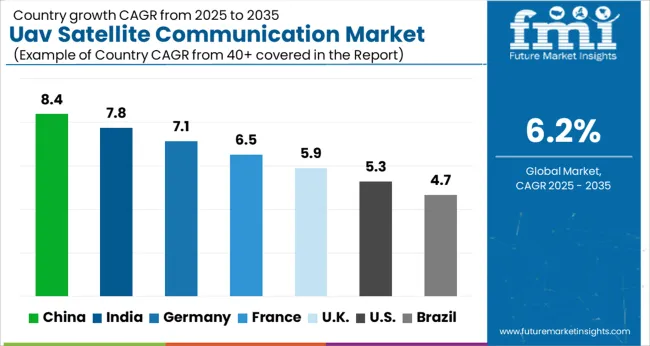

The market is expected to grow at a CAGR of 6.2% from 2025 to 2035, driven by rising demand for reliable, long-range communication solutions in defense, agriculture, and commercial UAV applications. China leads with an 8.4% CAGR, supported by significant investments in satellite infrastructure and UAV technology. India follows at 7.8%, fueled by expanding drone usage and government initiatives for smart agriculture and surveillance.

Germany, growing at 7.1%, benefits from advanced aerospace technologies and regulatory support. The UK, at 5.9%, experiences steady adoption in defense and emergency response sectors. The USA, with a 5.3% CAGR, reflects continuous innovation in satellite communication and drone integration. This report includes insights on 40+ countries; the top markets are shown here for reference.

The UAV satellite communication market in China is forecast to grow at a CAGR of 8.4% from 2025 to 2035. Growth is driven by extensive government funding in defense and civilian drone applications requiring reliable beyond-line-of-sight communication. Domestic firms like CASC and Commsat are enhancing satellite modem and antenna technologies to support extended UAV flight missions. Expansion of satellite constellations and ground station infrastructure supports stable connectivity across remote regions. Integration with 5G and IoT platforms further increases demand in agriculture, logistics, and surveillance sectors.

India’s UAV satellite communication market is expected to advance at a CAGR of 7.8% through 2035, fueled by rising drone adoption in agriculture, mining, and disaster management. Companies such as Data Patterns and L&T Technology Services focus on integrating satellite links with UAV platforms for improved real-time data transmission. Government initiatives to enhance remote sensing and surveillance capabilities promote market expansion. Collaborative efforts with satellite providers enable better coverage and reduce latency challenges.

The UAV satellite communication market in Germany is projected to expand at a CAGR of 7.1%, supported by robust aerospace technology development and drone usage in industrial inspection and environmental monitoring. Leading technology providers such as Airbus Defence and Space and Rohde & Schwarz develop high-performance satellite communication modules tailored for UAVs. Investments in low-earth orbit satellite networks enhance communication reliability. Industrial and governmental drone programs contribute to steady market growth.

The United Kingdom is anticipated to grow at a CAGR of 5.9% in the UAV satellite communication market, driven by expanding use of drones in defense, security, and logistics sectors. Companies such as Inmarsat and Cobham Wireless provide satellite communication solutions optimized for UAV operations. Government support for drone corridor testing and remote area connectivity enhances adoption. The rising demand for BVLOS (beyond visual line of sight) operations increases the need for reliable satellite links.

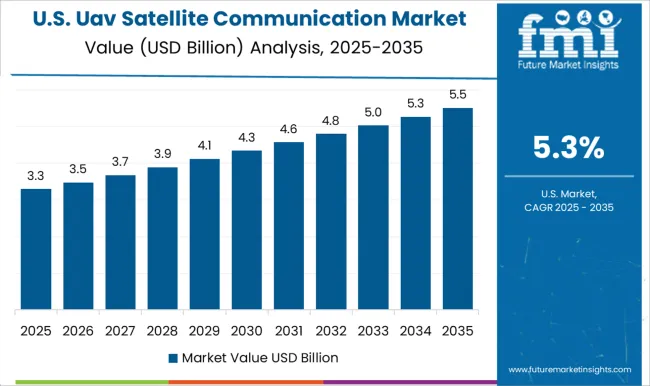

Sales of UAV satellite communication systems in the United States are forecast to increase at a CAGR of 5.3% between 2025 and 2035. The market is driven by demand from defense contractors, agricultural monitoring, and emergency response agencies. Providers like L3Harris Technologies and Viasat focus on enhancing data encryption and bandwidth efficiency for UAV satellite links. The expansion of satellite broadband services improves network availability. Federal research programs promote innovation in satellite-enabled UAV communication technologies.

Leading providers such as Honeywell, Gilat Satellite Networks, Inmarsat (Viasat), Iridium, Orbit, SKYTRAC, and Thales have been identified as dominant participants. Product differentiation is being achieved through miniaturization, low-power consumption, and global coverage. Competitive positioning is being driven by claims of the smallest and lightest UAV-specific SATCOM units, with emphasis on real-time video streaming and dependable performance. Technology modularity is being pursued, with proprietary global networks leveraged across multiple domains. Partnerships are being formed with satellite operators, and integration into existing satellite infrastructures has been emphasized. Pricing competitiveness is being implied through high-performance references at specific sizes and cost brackets. Channels are being extended through global service divisions and digital platforms designed for scalability and efficiency.

Strategic direction is oriented toward scalability across UAV classes. A roadmap is implied through continued miniaturization and integration of air-to-ground video, mobility support, and weight optimization. Market expansion is being targeted toward military surveillance, agricultural monitoring, and civil UAV operations. Regulatory compliance and spectrum management are being acknowledged as key challenges that require ongoing investment. Go-to-market emphasis is placed on embedded solutions for beyond-visual-line-of-sight operations, enabled by broadband connectivity. Scalability is being addressed through modular product designs that can be adapted to small, medium, and large UAV categories. Global coverage remains a priority, reinforced through partnerships and network readiness initiatives.

Honeywell highlights the world’s smallest SATCOM for UAVs, marketed for real-time surveillance, high-speed broadband, and low power consumption combined with reliability. Gilat promotes its SkyEdge platform, rugged satellite modems, and VSAT terminals along with high-efficiency solid-state amplifiers. Features across providers are described in terms of lightweight design, antenna and modem integration, low-power draw, and seamless network connectivity. Cloud-based management systems and global network readiness are consistently emphasized, presenting these solutions as optimized for both defense and commercial drone applications. Key selling points include mobility, dependable performance, and ease of integration, with brochures clearly structured to highlight technical advantages that reinforce market competitiveness.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.1 Billion |

| UAV Type | Fixed-wing, Rotary-wing, and Hybrid |

| Component | Antennas, Transceivers, Modems, Power amplifiers, and Others |

| Application | Military & defense, Civil & commercial, Agricultural Monitoring, Environmental and Wildlife Monitoring, Infrastructure inspection, Aerial photography and mapping, Others, Government, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Honeywell International, Inc., GILAT SATELLITE NETWORKS, Inmarsat Global Ltd. (Viasat, inc.), Iridium Communications Inc., Orbit Communications Systems Ltd., SKYTRAC SYSTEMS LTD., and Thales |

| Additional Attributes | Dollar sales by communication technology and UAV type, demand dynamics across military, commercial, and agricultural applications, regional trends in adoption across North America, Europe, and Asia-Pacific, innovation in low-latency satellite links, adaptive beamforming, and secure data encryption, environmental impact of satellite network energy use and electronic waste, and emerging use cases in real-time disaster monitoring, remote area connectivity, and autonomous UAV fleet coordination. |

The global uav satellite communication market is estimated to be valued at USD 7.1 billion in 2025.

The market size for the uav satellite communication market is projected to reach USD 13.0 billion by 2035.

The uav satellite communication market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in uav satellite communication market are fixed-wing, rotary-wing and hybrid.

In terms of component, antennas segment to command 35.4% share in the uav satellite communication market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Satellite Communication Components Market Size and Share Forecast Outlook 2025 to 2035

Satellite Laser Communication Market Size and Share Forecast Outlook 2025 to 2035

Maritime Satellite Communication Market Size and Share Forecast Outlook 2025 to 2035

Satellite Launch Vehicle Market Forecast Outlook 2025 to 2035

Satellite Simulator Market Size and Share Forecast Outlook 2025 to 2035

Communication Test and Measurement Market Size and Share Forecast Outlook 2025 to 2035

Satellite Vessel Tracking Market Size and Share Forecast Outlook 2025 to 2035

Satellite IoT Market Size and Share Forecast Outlook 2025 to 2035

Satellite Phased Array Antenna Market Size and Share Forecast Outlook 2025 to 2035

Satellite Solar Cell Materials Market Size and Share Forecast Outlook 2025 to 2035

Satellite-based 5G Network Market Size and Share Forecast Outlook 2025 to 2035

Satellite Launch Vehicle (SLV) Market Size and Share Forecast Outlook 2025 to 2035

Satellite Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Satellite Cables And Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Satellite Component Market Size and Share Forecast Outlook 2025 to 2035

Satellite As A Service Market Size and Share Forecast Outlook 2025 to 2035

Satellite Payloads Market Size and Share Forecast Outlook 2025 to 2035

Satellite Modem Market Size and Share Forecast Outlook 2025 to 2035

Communication Platform as a Service (CPaaS) Market Analysis - Size, Share & Forecast 2025 to 2035

Communications Platform as a Service (CPaaS) Market in Korea Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA