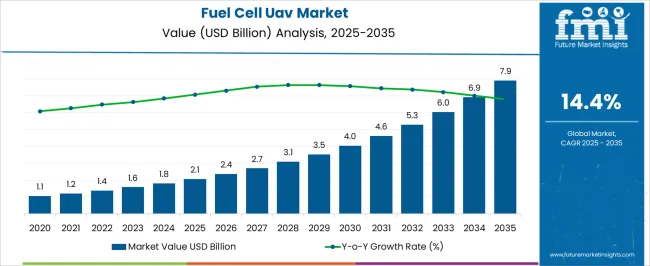

The fuel cell UAV market is estimated to be valued at USD 2.1 billion in 2025 and is projected to reach USD 7.9 billion by 2035, registering a compound annual growth rate (CAGR) of 14.4% over the forecast period.

Between 2025 and 2030, the market expands steadily from USD 2.1 billion to around USD 3.5–4.0 billion, offering incremental opportunities of over USD 1.5–2.0 billion. This growth is supported by scaling production, wider deployment in commercial and defense applications, and increasing acceptance of longer endurance UAV systems across multiple regions and industries. From 2030 to 2035, the market accelerates further, rising from approximately USD 4.0 billion to USD 7.9 billion, creating an additional opportunity of nearly USD 3.9 billion.

This phase reflects consolidation, as fuel cell UAVs gain wider industry integration, and procurement cycles expand. The absolute opportunity over the full forecast horizon underscores strong revenue potential for manufacturers, integrators, and supporting ecosystem players. By 2035, the USD 7.9 billion valuation highlights how the sector transitions from a relatively small-scale market in 2025 into a sizable, established industry with a stable demand base and a proven long-term growth path.

| Metric | Value |

|---|---|

| Fuel Cell UAV Market Estimated Value in (2025 E) | USD 2.1 billion |

| Fuel Cell UAV Market Forecast Value in (2035 F) | USD 7.9 billion |

| Forecast CAGR (2025 to 2035) | 14.4% |

The fuel cell UAV market, growing from USD 2.1 billion in 2025 to USD 7.9 billion by 2035 at a CAGR of 14.4%, shows clear breakpoints in its adoption path. The first breakpoint occurs around 2025, when the market value of USD 2.1 billion marks the transition from early pilot deployments to scaling adoption. This stage is driven by increased confidence in endurance and reliability, along with expanding commercial and defense use cases. The scaling period (2025–2030) sees the market rising toward USD 3.5–4.0 billion, supported by investments in manufacturing capacity, supply chain readiness, and broader integration into unmanned systems. A second breakpoint emerges between 2030 and 2032, as the market climbs past USD 5.0–6.0 billion.

By this stage, adoption has become widespread, and the market enters consolidation. Major suppliers strengthen their competitive positions, partnerships mature, and procurement cycles stabilize. Industry practices and standards also become more uniform, reducing barriers for large-scale deployment. By 2035, reaching USD 7.9 billion, the market reflects full consolidation, with fuel cell UAVs established as a mainstream option across commercial, defense, and industrial sectors. This stage signals maturity, where demand stabilizes and growth shifts toward efficiency and operational optimization.

The market is experiencing sustained growth as organizations prioritize long-endurance, high-efficiency unmanned aerial platforms for diverse applications. Advancements in hydrogen fuel cell technology are enabling UAVs to achieve longer flight times, reduced refueling requirements, and quieter operations compared to conventional propulsion systems. Adoption is being supported by strategic investments in renewable energy integration, lightweight materials, and compact fuel cell designs that enhance payload capacity without compromising performance.

Rising demand from sectors such as defense, environmental monitoring, and infrastructure inspection is reinforcing the market's trajectory. Regulatory support for cleaner aerial technologies and growing operational cost pressures are further accelerating the shift toward fuel cell-powered UAVs.

The capability to perform extended missions with reduced carbon emissions is positioning these UAVs as a preferred choice in both civilian and defense markets With continuous innovation in fuel efficiency, energy storage, and hybrid configurations, the market is set to maintain strong momentum in the coming years.

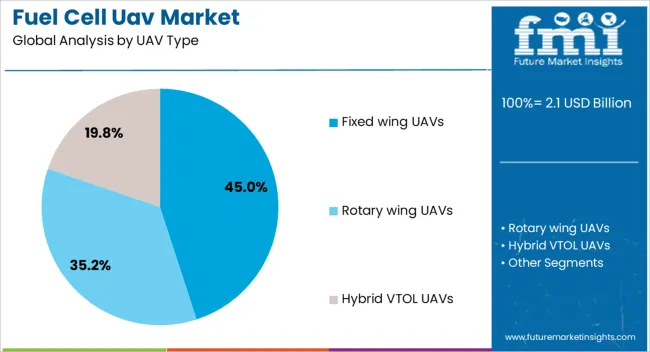

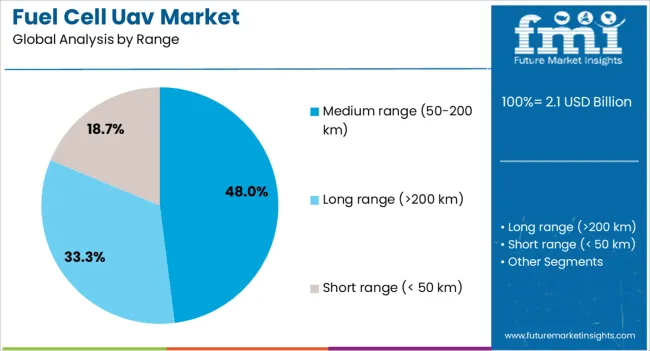

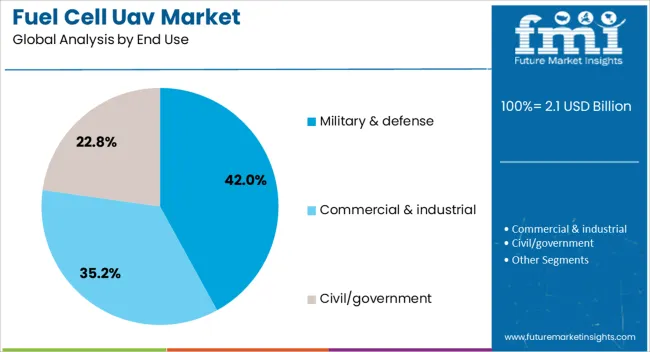

The fuel cell UAV market is segmented by UAV type, range, end use, and geographic regions. By UAV type, fuel cell UAV market is divided into fixed wing UAVs, rotary wing UAVs, and hybrid VTOL UAVs. In terms of range, fuel cell UAV market is classified into medium range (50-200 km), long range (>200 km), and short range (< 50 km). Based on end use, fuel cell UAV market is segmented into military & defense, commercial & industrial, and civil/government. Regionally, the fuel cell UAV industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The fixed wing UAVs segment is expected to hold 45% of the market revenue share in 2025, making it the leading UAV type. This dominance has been supported by their ability to cover longer distances with greater fuel efficiency compared to other UAV configurations. Fixed wing designs have been preferred in operations requiring high endurance and expansive area coverage, such as border surveillance, maritime patrol, and agricultural mapping. The integration of fuel cell systems into these platforms has enabled extended flight times, reduced operational costs, and minimized downtime for refueling. The aerodynamic efficiency of fixed wing UAVs allows for greater payload capacity and adaptability to various mission profiles. Their suitability for both military and civilian applications, coupled with improved durability and lower lifecycle costs, has reinforced their market position Continuous technological improvements in fuel cell energy density and lightweight airframe materials are expected to further strengthen the competitive advantage of this segment.

The medium range segment is projected to command 48% of the market revenue share in 2025, making it the largest range category. Growth in this segment has been attributed to its balance between operational flexibility and endurance, enabling missions that require substantial distance coverage without excessive energy consumption. Medium range UAVs powered by fuel cells are being increasingly deployed for applications such as pipeline inspection, coastal monitoring, and tactical reconnaissance. The range capability allows operators to execute missions beyond the line of sight while maintaining efficiency and compliance with airspace regulations. Fuel cell technology enhances this operational profile by enabling consistent power output and extended loiter times over target areas. The scalability of medium range UAVs for various payload configurations and environmental conditions has made them attractive to both defense agencies and commercial operators Advancements in compact hydrogen storage and refueling infrastructure are anticipated to further boost adoption in this category.

The military and defense segment is anticipated to account for 42% of the market revenue share in 2025, solidifying its position as the dominant end-use sector. This growth has been driven by the increasing need for silent, long-endurance reconnaissance and surveillance platforms capable of operating in contested or remote environments. Fuel cell UAVs provide extended operational durations with minimal acoustic and thermal signatures, which are critical for stealth missions. Military agencies are adopting these platforms for applications such as border security, intelligence gathering, and target acquisition, where persistent aerial presence is essential. The reduced logistical footprint of fuel cell-powered UAVs, combined with the ability to operate from austere locations, has further increased their appeal. Additionally, ongoing defense modernization programs and budget allocations for advanced unmanned systems are creating a favorable environment for adoption Continuous improvements in refueling infrastructure, mission endurance, and payload integration are expected to sustain the strong demand in this segment.

The fuel cell UAV market is expanding as industries and defense forces seek longer flight endurance, higher payload capacity, and eco-friendly power alternatives compared to traditional batteries or combustion engines. Fuel cells enable UAVs to operate efficiently with extended mission times, making them highly attractive for surveillance, logistics, mapping, and commercial applications. Rising adoption of hydrogen infrastructure, advancements in lightweight fuel cell systems, and increased demand for sustainable aerial solutions are driving market growth. Companies that integrate compact, durable, and high-efficiency fuel cell technologies are well-positioned to capture opportunities across defense, agriculture, logistics, and emergency response applications.

Fuel cell UAVs face significant challenges linked to production costs, hydrogen storage, and operational safety. Fuel cells remain more expensive than lithium-ion battery systems, limiting adoption in cost-sensitive sectors. Hydrogen storage requires specialized tanks, strict handling protocols, and safety measures, which add complexity to UAV design. Limited hydrogen refueling infrastructure restricts large-scale deployment, especially in remote or developing regions. Durability of fuel cell stacks under varying temperatures and environmental conditions is another technical hurdle. Safety concerns related to hydrogen’s flammability and regulatory restrictions in certain airspaces create barriers to wider adoption. Manufacturers must address these challenges through cost reduction, improved storage technology, and adherence to global aviation and safety standards.

The fuel cell UAV market is trending toward advancements in hydrogen infrastructure, compact stack integration, and hybrid power solutions. Research is focused on lightweight, durable fuel cells that extend flight endurance while minimizing overall UAV weight. Integration of hybrid systems that combine fuel cells with batteries or solar panels is gaining traction, providing redundancy and enhanced efficiency. Expansion of green hydrogen production and mobile refueling stations is supporting adoption in defense and commercial applications. UAVs powered by fuel cells are increasingly used in precision agriculture, border surveillance, package delivery, and environmental monitoring. Partnerships between UAV manufacturers, energy providers, and research institutions are accelerating innovation, while government initiatives supporting hydrogen energy ecosystems further strengthen market growth.

Fuel cell UAVs present strong opportunities in defense, commercial logistics, and emergency services. Defense organizations are adopting them for long-range surveillance, reconnaissance, and tactical missions where endurance and stealth are critical. Commercial sectors such as logistics and e-commerce are exploring UAVs with fuel cells for faster and greener last-mile delivery solutions. In emergency services, fuel cell UAVs provide critical advantages for disaster relief, firefighting support, and search and rescue operations by enabling extended aerial monitoring without frequent recharging. Agriculture also benefits from UAVs with fuel cells by enabling precision spraying and long-duration crop monitoring. Market players investing in versatile UAV designs, multi-domain operations, and collaborations with hydrogen infrastructure providers can unlock opportunities across a wide range of industrial and government applications.

The fuel cell UAV market faces restraints related to infrastructure gaps and technical complexity. Hydrogen production and distribution infrastructure is still limited in many regions, making widespread adoption of fuel cell UAVs difficult. Establishing fueling and maintenance networks requires significant investment and long-term government or private sector support. Technical complexity of integrating compact, lightweight fuel cells with UAV systems raises costs and slows mass production. Supply chain limitations for fuel cell components, including membranes and catalysts, further affect scalability. Regulatory uncertainty surrounding hydrogen use and UAV airspace permissions also creates delays in adoption. Until infrastructure matures and production processes become more cost-effective, fuel cell UAVs may remain concentrated in specialized applications rather than mainstream commercial deployment.

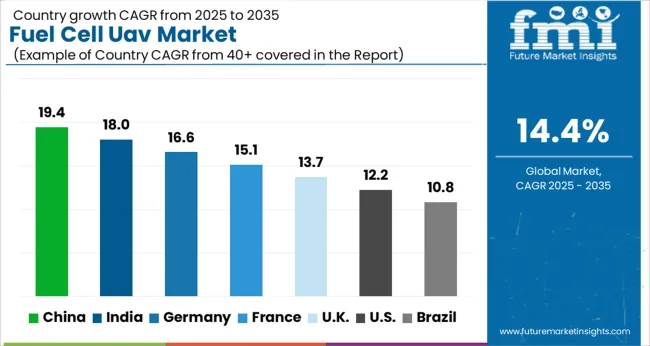

| Country | CAGR |

|---|---|

| China | 19.4% |

| India | 18.0% |

| Germany | 16.6% |

| France | 15.1% |

| UK | 13.7% |

| USA | 12.2% |

| Brazil | 10.8% |

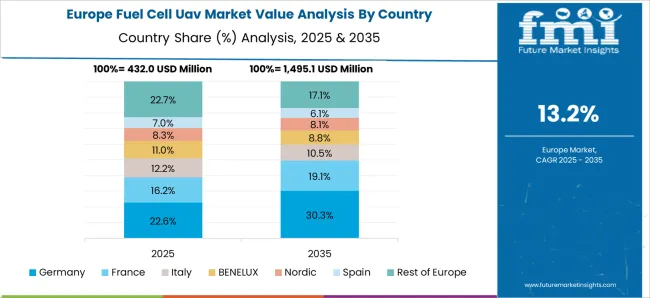

The global fuel cell UAV market is projected to grow at a CAGR of 14.4% through 2035, supported by increasing demand for long-endurance, lightweight, and low-emission drone solutions. Among BRICS nations, China has been recorded with 19.4% growth, driven by large-scale deployment in surveillance, logistics, and defense applications, while India has been observed at 18.0%, supported by rising use in agriculture, monitoring, and military operations. In the OECD region, Germany has been measured at 16.6%, where adoption in defense, infrastructure inspection, and commercial delivery systems has been consistently expanded. The United Kingdom has been noted at 13.7%, reflecting steady utilization across defense, research, and commercial sectors, while the USA has been recorded at 12.2%, with adoption in defense, border security, and logistics applications being gradually increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The fuel cell UAV market in China is expanding at a CAGR of 19.4%, supported by advancements in hydrogen fuel cell technology and growing adoption in defense, logistics, and infrastructure monitoring. Chinese manufacturers are investing in lightweight, high-efficiency fuel cells to extend UAV flight endurance compared to traditional battery-powered drones. Government initiatives promoting clean energy and unmanned systems are driving R&D investment and commercialization. Applications in agriculture, border surveillance, and delivery services are gaining traction. Collaborations between aerospace firms, research institutes, and fuel cell developers are fostering rapid innovation and cost reduction. Pilot projects in smart city monitoring and disaster response highlight operational feasibility. Increasing investment in hydrogen infrastructure and supportive policies position China as a global leader in fuel cell UAV adoption.

Fuel cell UAV market in India is recording strong momentum at a CAGR of 18.0%, driven by defense modernization, agricultural applications, and clean energy initiatives. UAVs powered by hydrogen fuel cells are gaining interest for long-range surveillance, precision farming, and infrastructure inspection. Government programs supporting hydrogen energy and Make in India initiatives are encouraging domestic development and manufacturing. Startups and aerospace firms are focusing on scalable UAV platforms with extended endurance and payload capacity. Partnerships between universities, defense agencies, and technology firms are advancing material innovation and fuel efficiency. Pilot projects in pipeline monitoring, border control, and delivery services demonstrate feasibility. The growing need for sustainable UAV operations is expected to accelerate adoption across multiple sectors in India.

Fuel cell UAV market in Germany is advancing at a CAGR of 16.6%, supported by strong R&D capacity, clean energy policies, and industrial adoption. Fuel cell powered UAVs are being used in logistics, precision agriculture, infrastructure inspection, and defense. Manufacturers are focusing on efficiency, payload optimization, and regulatory compliance. Government funding programs for hydrogen technologies and renewable energy transition are supporting adoption. Research institutions and aerospace firms are collaborating on advanced UAV platforms with extended flight endurance. Pilot projects in power line inspection, disaster response, and logistics highlight operational potential. Growing environmental awareness and demand for sustainable UAV solutions continue to strengthen the German market.

The United Kingdom is witnessing a CAGR of 13.7% in the fuel cell UAV market, driven by demand for extended-endurance drones in defense, border control, and logistics. The country is focusing on integrating UAVs into national hydrogen strategies and renewable energy programs. Manufacturers are advancing compact and efficient fuel cell designs to meet operational needs across defense and commercial sectors. Pilot projects in maritime surveillance, agricultural monitoring, and emergency services are validating the benefits of fuel cell UAVs over battery-operated alternatives. Academic and industrial collaborations are enhancing innovation, reliability, and scalability. Government policies promoting green technologies and UAV adoption are further supporting growth.

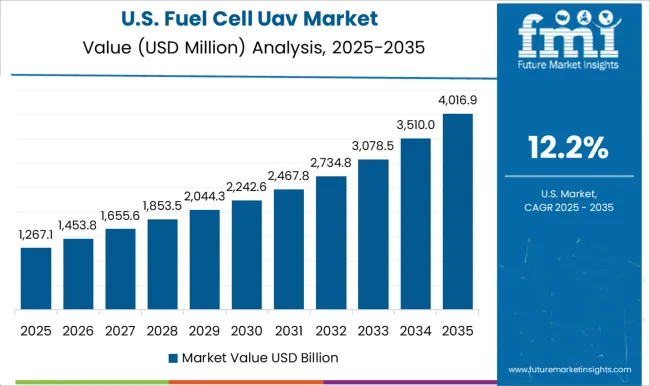

The United States fuel cell UAV market is growing at a CAGR of 12.2%, supported by defense, homeland security, and commercial applications. UAVs powered by hydrogen fuel cells are increasingly deployed in long-range surveillance, infrastructure inspection, and logistics. Government agencies are investing in advanced UAV platforms for military and emergency response missions. Aerospace firms are focusing on lightweight designs, fuel efficiency, and longer flight endurance. Collaborations with research institutions and hydrogen technology companies are advancing system integration and material innovation. Pilot projects in disaster management, package delivery, and agriculture demonstrate operational feasibility. Increasing investment in clean energy initiatives and demand for extended-endurance UAVs are expected to strengthen market adoption across the USA

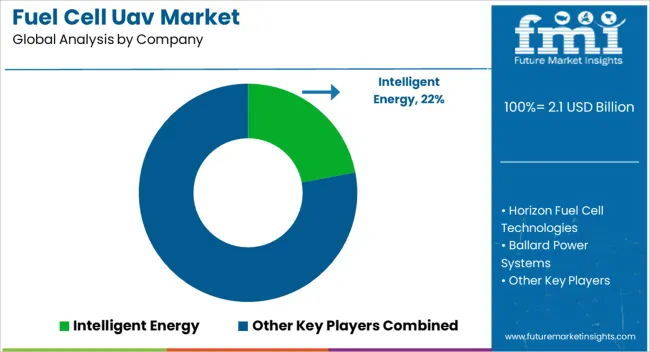

The fuel cell UAV market is defined by intense rivalry among specialized fuel cell developers and UAV integrators, with competition shaped by power density, endurance, and integration flexibility. Intelligent Energy is positioned with lightweight hydrogen fuel cell systems that extend flight duration significantly beyond battery alternatives. Horizon Fuel Cell Technologies competes by offering scalable systems designed for long-endurance surveillance and mapping missions. Ballard Power Systems emphasizes reliability and certification-ready PEM stacks adapted for UAV applications. SFC Energy promotes direct methanol fuel cells for smaller UAVs, marketed for tactical and commercial missions where simple refueling is valued. Protonex, a Ballard subsidiary, highlights ruggedized military-grade solutions with proven deployment history. Other OEMs and integrators pursue hybrid concepts that combine fuel cells with batteries, emphasizing endurance gains and payload optimization.

Strategies are centered on advancing fuel efficiency, reducing weight, and improving system integration with UAV airframes. Partnerships with UAV manufacturers are being formed to accelerate adoption in defense, logistics, and commercial monitoring sectors. Investment is being directed toward compact, modular systems that allow flexibility across multiple UAV platforms. Observed industry patterns suggest a focus on hybrid architectures to address mission profiles requiring both long endurance and high power bursts. Market positioning is reinforced by demonstrating proven flight performance, compatibility with aviation standards, and readiness for large-scale deployment. Competitive advantage is gained when systems can be scaled quickly across both rotary and fixed-wing UAV categories without significant customization costs. Product brochures are used as primary communication tools, with technical data presented in concise tables and clear graphics. Key metrics such as power output, energy density, hydrogen or methanol storage compatibility, and mission endurance are highlighted prominently. Brochures from Intelligent Energy emphasize compact form factor and modularity.

Horizon materials provide detailed performance curves and hydrogen storage configurations. Ballard and Protonex brochures focus on durability, reliability, and compliance with aviation-grade requirements. SFC Energy emphasizes ease of refueling, low acoustic signature, and compact size. Visual layouts are designed to convey technical reliability and mission-specific benefits clearly. Brochures increasingly adopt digital interactive formats, allowing UAV developers and procurement specialists to model performance scenarios. Success in this market is determined not only by engineering performance but also by how effectively brochures and datasheets communicate integration readiness, reliability, and operational value.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.1 billion |

| UAV Type | Fixed wing UAVs, Rotary wing UAVs, and Hybrid VTOL UAVs |

| Range | Medium range (50-200 km), Long range (>200 km), and Short range (< 50 km) |

| End Use | Military & defense, Commercial & industrial, and Civil/government |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Intelligent Energy, Horizon Fuel Cell Technologies, Ballard Power Systems, SFC Energy, Protonex, and Other OEMs / integrators |

| Additional Attributes | Dollar sales vary by UAV type, including fixed-wing, rotary-wing, and hybrid UAVs; by power type, spanning hydrogen fuel cells, direct methanol fuel cells, and solid oxide fuel cells; by application, such as military & defense, commercial, agriculture, and logistics; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising demand for long-endurance drones, clean energy solutions, and advanced surveillance capabilities. |

The global fuel cell UAV market is estimated to be valued at USD 2.1 billion in 2025.

The market size for the fuel cell UAV market is projected to reach USD 7.9 billion by 2035.

The fuel cell UAV market is expected to grow at a 14.4% CAGR between 2025 and 2035.

The key product types in fuel cell UAV market are fixed wing uavs, _fixed wing uavs sub-type a, _fixed wing uavs sub-type b, rotary wing uavs, _rotary wing uavs sub-type a, _rotary wing uavs sub-type b, hybrid vtol uavs, _hybrid vtol uavs sub-type a and _hybrid vtol uavs sub-type b.

In terms of range, medium range (50-200 km) segment to command 48.0% share in the fuel cell UAV market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fuel Storage Tank Market Size and Share Forecast Outlook 2025 to 2035

Fuel Capacitance Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fuel Gas Heater Market Size and Share Forecast Outlook 2025 to 2035

Fuel Management Software Market Size and Share Forecast Outlook 2025 to 2035

Fuel Injection System Market Growth - Trends & Forecast 2025 to 2035

Fuel Additives Market Segmentation based on Type, Application, and Region: Forecast for 2025 and 2035

Fuel Analyzer Market

Fuel Vending Machines Market

Fuel Operated Heaters Market

Fuel Resistant Sealant Market

Fuel Feed Pumps Market

Fuel Measuring Devices Market

Fuel Cell Powertrain Market Size and Share Forecast Outlook 2025 to 2035

Fuel Cell Stack Market Size and Share Forecast Outlook 2025 to 2035

Fuel Cell Electric Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Fuel Cell Commercial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Fuel Cell Market Growth – Trends & Forecast 2025 to 2035

Fuel Cell for Data Center Market - Trends & Forecast 2025 to 2035

Fuel Cell for Stationary Power Market Growth - Trends & Forecast 2025 to 2035

Biofuel Testing Services Market Growth – Trends & Forecast 2018-2028

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA