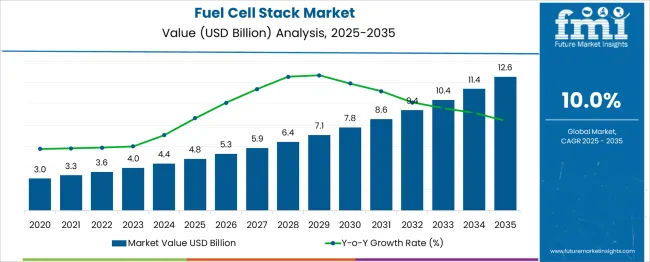

The Fuel Cell Stack Market is estimated to be valued at USD 4.8 billion in 2025 and is projected to reach USD 12.6 billion by 2035, registering a compound annual growth rate (CAGR) of 10.0% over the forecast period. The market is forecasted to expand from USD 4.8 billion in 2025 to USD 12.6 billion by 2035, indicating significant value creation over the decade. The CAGR calculation is derived from the progressive annual increments in market value, starting at USD 4.8 billion in 2025 and increasing to USD 5.3 billion in 2026. Subsequent years show steady growth to USD 5.9 billion in 2027 and USD 6.4 billion in 2028, reflecting consistent market momentum. This pattern continues with the market reaching USD 7.8 billion by 2030 and accelerating to USD 10.4 billion by 2033.

The 10.0% CAGR suggests that the market is experiencing sustained expansion driven by increased adoption of clean energy technologies and rising demand for efficient power sources. The market’s value nearly triples within the forecast period, demonstrating strong investor confidence and technology advancement. This CAGR underlines the market’s capacity for continuous year-over-year growth without significant volatility. Stakeholders can expect the market to maintain this steady growth trajectory, fueled by regulatory support and expanding applications in transportation, stationary power generation, and portable power systems. The market’s compound annual growth rate reflects promising potential and long-term profitability.

| Metric | Value |

|---|---|

| Fuel Cell Stack Market Estimated Value in (2025 E) | USD 4.8 billion |

| Fuel Cell Stack Market Forecast Value in (2035 F) | USD 12.6 billion |

| Forecast CAGR (2025 to 2035) | 10.0% |

The Fuel Cell Stack market is experiencing significant growth supported by increasing demand for clean energy solutions and advancements in hydrogen fuel technologies. The current market landscape is being shaped by rising environmental concerns, regulatory mandates to reduce carbon emissions, and ongoing investments in fuel cell research and infrastructure, as indicated in corporate statements, technology press releases and industry-focused news articles.

This growth trajectory is further strengthened by improvements in durability and efficiency of fuel cell stacks, making them more commercially viable across sectors. Adoption is also being encouraged by government initiatives and funding programs aimed at accelerating the deployment of sustainable energy technologies.

Looking ahead, the market is expected to benefit from continued advancements in material sciences and manufacturing processes, which enhance performance while reducing costs. The convergence of sustainability goals, technological innovation and supportive policy frameworks is expected to sustain the market’s upward momentum globally in the coming years.

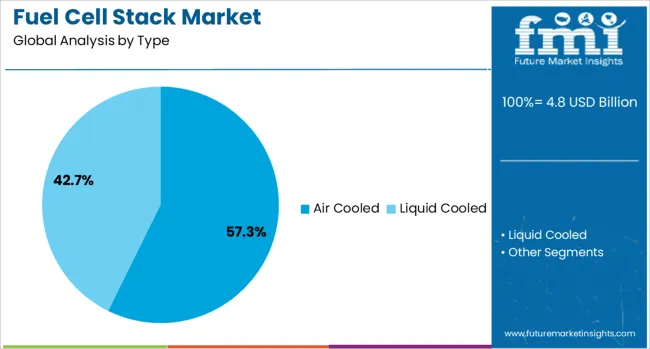

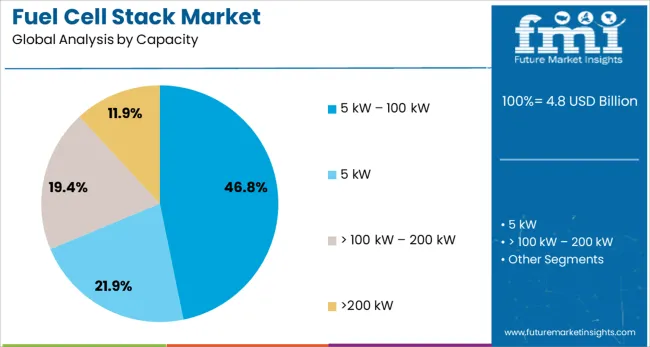

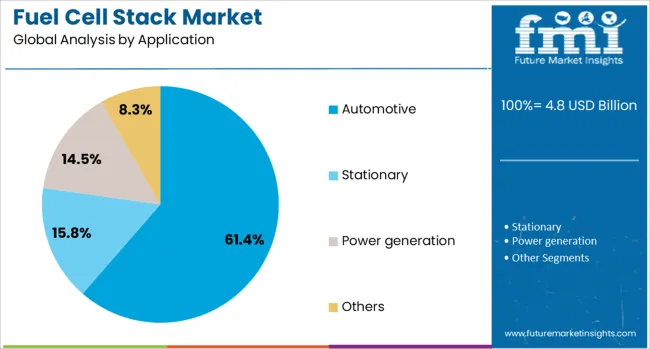

The fuel cell stack market is segmented by type, capacity, application, and geographic regions. The fuel cell stack market is divided into air-cooled and liquid-cooled. In terms of capacity of the fuel cell stack market is classified into 5 kW - 100 kW, 5 kW, > 100 kW - 200 kW>200 kW. Based on the application, the fuel cell stack market is segmented into Automotive, Stationary, Power generation, and Others. Regionally, the fuel cell stack industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The air-cooled type segment is projected to account for 57.3% of the Fuel Cell Stack market revenue share in 2025, making it the leading type segment. This dominance is being attributed to its lower system complexity, cost-effectiveness, and suitability for a wide range of applications, as highlighted in technical documents and product announcements.

Air-cooled stacks have been favored due to their simpler design, which eliminates the need for elaborate cooling circuits and reduces maintenance requirements. Industry updates have noted that these systems are particularly advantageous in applications where compactness and lightweight design are critical factors.

The segment’s growth has also been supported by their higher reliability in moderate climate conditions and ease of integration into various systems without significant engineering modifications. Furthermore, the reduced operational costs and robust performance characteristics of air-cooled stacks have contributed to their strong adoption across sectors, thereby solidifying their leadership position in the market.

The 5 kW - 100 kW capacity segment is expected to hold 46.8% of the Fuel Cell Stack market revenue share in 2025 maintaining its position as the dominant capacity segment. This growth has been driven by its optimal balance between power output and compactness which suits a variety of commercial and industrial applications as reported in investor presentations and industry-focused publications.

Fuel cell stacks within this capacity range have been widely adopted because they meet the power requirements of medium duty vehicles backup power systems and distributed energy solutions efficiently. It has been observed that manufacturers prefer this segment due to its scalability and cost competitiveness which align well with customer demands for sustainable yet economical solutions.

Additionally its adaptability for integration into both mobile and stationary settings has supported its widespread deployment. These attributes together have reinforced its leadership in the market by offering versatility reliability and affordability to end users.

The automotive application segment is forecasted to dominate the Fuel Cell Stack market with a 61.4% revenue share in 2025 driven by robust adoption in the transportation sector. Industry statements and automotive manufacturer announcements have highlighted that growing investments in zero emission vehicles and stringent regulatory frameworks promoting clean mobility have supported this segment’s prominence.

Fuel cell stacks have been increasingly deployed in cars buses and trucks due to their ability to provide long driving ranges fast refueling times and lower emissions compared to conventional engines. The segment’s growth has also been reinforced by partnerships between automakers and energy companies aimed at building hydrogen refueling infrastructure which facilitates wider adoption.

Furthermore corporate disclosures have noted that the automotive industry’s focus on reducing dependency on fossil fuels and achieving sustainability targets has been instrumental in driving demand. These factors collectively have positioned the automotive segment as the primary application area for fuel cell stacks in 2025.

The market has been growing consistently as fuel cells become a pivotal technology for clean and efficient energy conversion. Fuel cell stacks, comprising multiple cells connected in series, have been widely used in automotive, stationary power generation, and portable power applications. Market expansion has been driven by an increasing focus on reducing greenhouse gas emissions and dependence on fossil fuels. Technological advancements in membrane electrode assemblies, bipolar plates, and catalyst materials have enhanced fuel cell stack efficiency, durability, and cost-effectiveness.

Significant progress has been made in developing advanced materials and designs to improve the efficiency and longevity of fuel cell stacks. Innovations in proton exchange membranes, catalyst coatings, and bipolar plate materials have reduced energy losses and enhanced conductivity. Durability improvements have been achieved by addressing catalyst degradation and membrane hydration management. Manufacturing techniques such as automated assembly and precision coating have increased stack uniformity and quality. These technological improvements have lowered the total cost of ownership by extending operational life and reducing maintenance needs. The advancements in thermal and water management within stacks have optimized performance under varying operating conditions. Continuous research efforts are expected to drive further enhancements, making fuel cell stacks more competitive and reliable across automotive and stationary power applications.

Fuel cell stacks have been increasingly integrated into transportation sectors, including passenger vehicles, buses, and commercial trucks, due to their zero-emission profile and high energy density. The growing deployment of fuel cell electric vehicles (FCEVs) has stimulated demand for robust and scalable stack solutions. Stationary power applications, such as backup power systems, remote power supply, and microgrids, have also adopted fuel cell stacks to ensure clean and uninterrupted electricity. These systems benefit from fuel cells’ quick start-up, low noise, and modular design. Infrastructure developments for hydrogen production, storage, and refueling have further facilitated market growth. Collaborations between automotive manufacturers, energy companies, and governments have accelerated fuel cell stack commercialization, supporting a transition toward sustainable energy and transportation ecosystems globally.

Government policies and funding programs have played a crucial role in advancing the fuel cell stack market. Incentives such as tax credits, subsidies, and grants have encouraged research, development, and deployment of fuel cell technologies. National hydrogen strategies and clean energy targets have prioritized fuel cells for decarbonization efforts across transportation and power sectors. Public-private partnerships have fostered innovation ecosystems, facilitating pilot projects and demonstration programs. Regulatory frameworks promoting low-emission vehicles and renewable energy integration have further incentivized adoption. The standardization efforts and safety regulations have provided guidelines ensuring reliability and consumer confidence. These supportive policies are expected to continue driving market growth by reducing financial risks and accelerating technology commercialization in multiple regions.

Cost remains a significant challenge in the fuel cell stack market, with high material and manufacturing expenses limiting large-scale adoption. The reliance on precious metal catalysts and complex fabrication processes contributes to elevated prices. Efforts have been made to develop alternative catalysts and scalable production methods to reduce costs. Infrastructure development for hydrogen production, storage, and refueling is also a critical factor influencing market expansion. Insufficient refueling networks and limited hydrogen availability pose barriers to fuel cell vehicle adoption. However, these challenges have created opportunities for investment in green hydrogen generation, distributed production systems, and advanced fueling technologies. Market players are focusing on integrated solutions combining fuel cell stacks with renewable energy sources. The ongoing drive toward cost reduction and infrastructure enhancement is expected to unlock substantial growth potential in the fuel cell stack market.

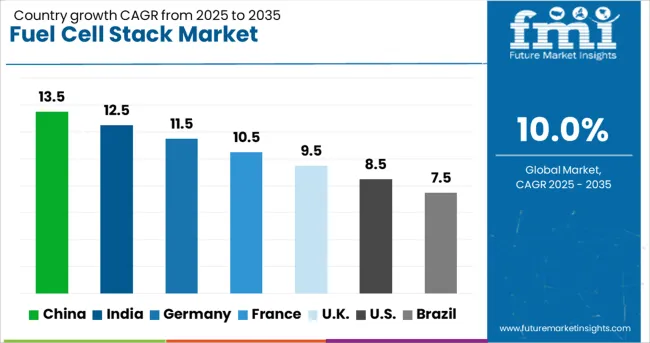

| Country | CAGR |

|---|---|

| China | 13.5% |

| India | 12.5% |

| Germany | 11.5% |

| France | 10.5% |

| UK | 9.5% |

| USA | 8.5% |

| Brazil | 7.5% |

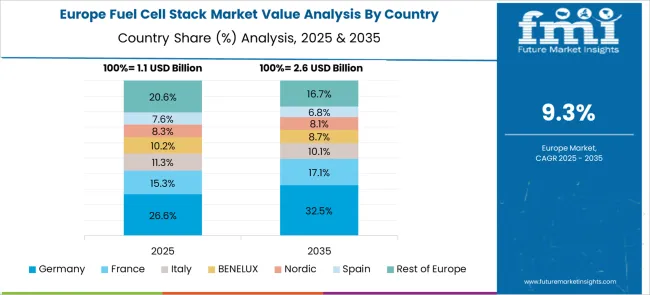

The market is expected to grow at a CAGR of 10.0% between 2025 and 2035, driven by rising demand for clean energy solutions, advancements in hydrogen technologies, and government incentives for decarbonization. China leads with a 13.5% CAGR, supported by substantial investments in hydrogen infrastructure and manufacturing capacity. India follows at 12.5%, propelled by initiatives in renewable energy integration and clean transportation. Germany, at 11.5%, benefits from strong research and development and policies favoring green technologies. The UK, growing at 9.5%, sees progress in fuel cell applications across transport and industry. The USA, with an 8.5% CAGR, experiences growth due to innovation in fuel cell efficiency and expanding adoption. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to grow at a CAGR of 13.5% from 2025 to 2035, driven by strong governmental support for clean energy technologies. Major manufacturers such as Ballard Power Systems China and Weichai Power are investing heavily in stack durability and efficiency improvements. The rising adoption of fuel cell electric vehicles and backup power systems fuels market expansion. Strategic partnerships with hydrogen suppliers facilitate integrated solutions for transport and industrial applications. Policy incentives targeting emission reduction support technology commercialization, positioning China as a leader in fuel cell innovation.

India’s market is expected to expand at a CAGR of 12.5% through 2035, propelled by increasing focus on alternative energy sources. Domestic companies such as Tata Motors and Reliance Industries are exploring fuel cell applications for commercial vehicles and off-grid power solutions. Government initiatives promoting hydrogen infrastructure are facilitating adoption. Rising energy demand from industrial sectors and emerging clean transportation projects further stimulate sales. Collaborations with international technology providers enhance capabilities and market reach.

Germany is forecasted to grow at a CAGR of 11.5% between 2025 and 2035, driven by advancements in automotive and stationary power applications. Leading companies such as Siemens Energy and Bosch are developing high-performance stacks with enhanced reliability. The country’s strong focus on clean mobility and decentralized energy solutions supports demand. Federal incentives for fuel cell research and commercial demonstration projects accelerate technology uptake. Integration with renewable hydrogen production strengthens market prospects.

The United Kingdom’s fuel cell stack demand is expected to grow at a CAGR of 9.5% through 2035, supported by government programs promoting hydrogen economy development. Companies like Ceres Power and ITM Power focus on modular stack technologies for transport and industrial use. Investment in hydrogen refueling infrastructure and pilot projects enhances adoption. Market expansion is further supported by growing interest in zero-emission commercial vehicles and backup power systems. Public-private partnerships foster innovation and commercialization.

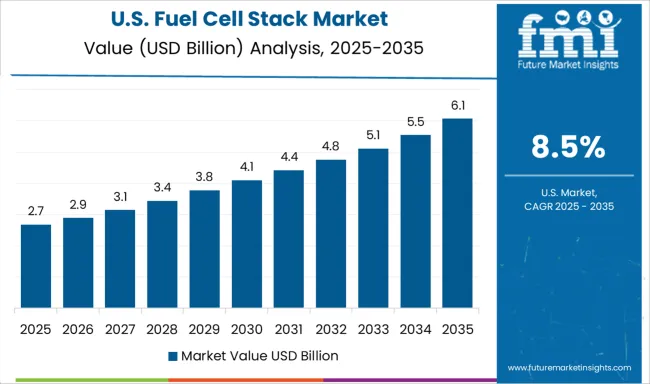

The industry in the United States is projected to grow at a CAGR of 8.5% from 2025 to 2035, driven by investments from companies such as Plug Power and Bloom Energy. The demand is supported by increasing use in material handling equipment and distributed power generation. Regulatory incentives and clean energy mandates encourage adoption across multiple sectors. Research in improved membrane technologies and cost reduction strategies is accelerating commercialization. Expanding hydrogen production infrastructure and collaboration between public and private sectors reinforce market development.

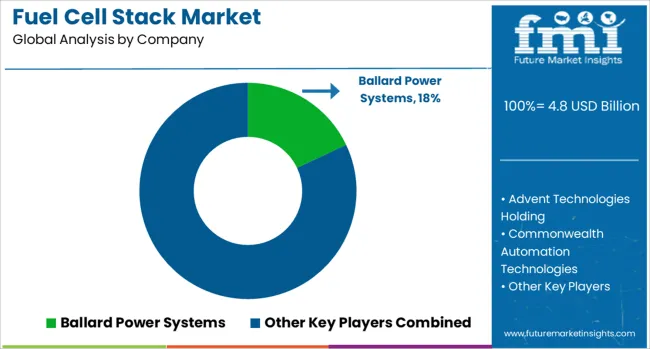

The market features a diverse group of leading companies and emerging players focused on developing efficient, durable, and scalable fuel cell solutions for various applications including transportation, stationary power, and portable energy. Ballard Power Systems stands out as a global pioneer, known for its advanced proton exchange membrane (PEM) fuel cell technology used in heavy-duty vehicles and power generation. Advent Technologies Holding emphasizes high-performance stacks with a focus on durability and power density, supporting industrial and mobility sectors. Commonwealth Automation Technologies integrates automation to enhance stack manufacturing efficiency and quality. Dana Incorporated advances fuel cell technology through partnerships and integrated powertrain solutions. ElringKlinger offers modular stack designs suited for automotive and stationary use, leveraging lightweight materials and system integration expertise. FuelCell Energy Solutions delivers molten carbonate and solid oxide fuel cell stacks for large-scale power plants. Freudenberg Group focuses on membrane electrode assembly (MEA) components critical to stack performance.

Horizon Fuel Cell Technologies and TW Horizon Fuel Cell Technologies specialize in compact and portable fuel cell stacks targeting niche markets. Intelligent Energy Limited works on scalable PEM stacks with applications in automotive and drone industries. Nedstack Fuel Cell Technology and Nuvera Fuel Cells provide customized stack solutions for commercial vehicles and industrial equipment. PowerCell Sweden and Plug Power lead innovations in PEM fuel cells with expanding deployments in logistics and transport. Robert Bosch and Schunk Bahn-und Industrietechnik contribute with system integration and advanced manufacturing capabilities. Entry barriers include high capital investment, technical complexity, and rigorous testing requirements. Market players focus on R&D, strategic collaborations, and product optimization to meet evolving performance standards and customer needs.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.8 Billion |

| Type | Air Cooled and Liquid Cooled |

| Capacity | 5 kW – 100 kW, 5 kW, > 100 kW – 200 kW, and >200 kW |

| Application | Automotive, Stationary, Power generation, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ballard Power Systems, Advent Technologies Holding, Commonwealth Automation Technologies, Dana Incorporated, ElringKlinger, FuelCell Energy Solutions, Freudenberg Group, Horizon Fuel Cell Technologies, Intelligent Energy Limited, Nedstack Fuel Cell Technology, Nuvera Fuel Cells, PowerCell Sweden, Plug Power, Robert Bosch, Schunk Bahn-und Industrietechnik, and TW Horizon Fuel Cell Technologies |

| Additional Attributes | Dollar sales by fuel cell type and application sector, demand dynamics across transportation, stationary power, and portable devices, regional trends in deployment across Asia-Pacific, North America, and Europe, innovation in proton exchange membrane (PEM) technology, catalyst durability, and stack design optimization, environmental impact of raw material sourcing, manufacturing emissions, and end-of-life recycling, and emerging use cases in backup power systems, hydrogen-powered vehicles, and off-grid energy solutions. |

The global fuel cell stack market is estimated to be valued at USD 4.8 billion in 2025.

The market size for the fuel cell stack market is projected to reach USD 12.6 billion by 2035.

The fuel cell stack market is expected to grow at a 10.0% CAGR between 2025 and 2035.

The key product types in fuel cell stack market are air cooled and liquid cooled.

In terms of capacity, 5 kw – 100 kw segment to command 46.8% share in the fuel cell stack market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fuel rail for CNG Systems Market Size and Share Forecast Outlook 2025 to 2035

Fuel Storage Tank Market Size and Share Forecast Outlook 2025 to 2035

Fuel Capacitance Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fuel Gas Heater Market Size and Share Forecast Outlook 2025 to 2035

Fuel Management Software Market Size and Share Forecast Outlook 2025 to 2035

Fuel Injection System Market Growth - Trends & Forecast 2025 to 2035

Fuel Additives Market Segmentation based on Type, Application, and Region: Forecast for 2025 and 2035

Fuel Analyzer Market

Fuel Vending Machines Market

Fuel Operated Heaters Market

Fuel Resistant Sealant Market

Fuel Feed Pumps Market

Fuel Measuring Devices Market

Fuel Cell Powertrain Market Size and Share Forecast Outlook 2025 to 2035

Fuel Cell UAV Market Size and Share Forecast Outlook 2025 to 2035

Fuel Cell Electric Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Fuel Cell Commercial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Fuel Cell Market Growth – Trends & Forecast 2025 to 2035

Fuel Cell for Data Center Market - Trends & Forecast 2025 to 2035

Fuel Cell for Stationary Power Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA