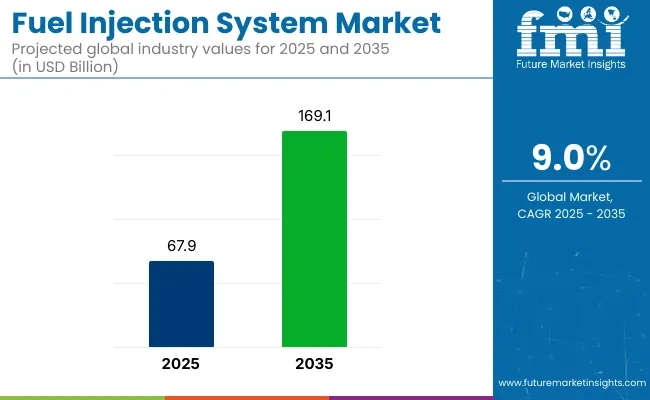

The global fuel injection system market was valued at USD 67.9 billion in 2025 and is projected to grow to USD 169.1 billion by 2035, registering a compound annual growth rate (CAGR) of 9% over the assessment period. This growth is being driven by the continuous evolution of fuel delivery technologies, emission regulations, and demand for engine efficiency across commercial, agricultural, and off-road vehicle platforms.

Phinia Inc., a key player in fuel systems innovation, confirmed in its 2024 product portfolio that diesel injection systems have been engineered to operate at higher pressures with advanced timing control. These systems are designed for cleaner combustion and reduced particulate matter, making them compliant with Euro VII and Tier 5 emission norms. As per Phinia, their systems use electronically controlled high-speed solenoids and pressure amplifiers to deliver precise fuel metering across varied load conditions.

| Attributes | Key Insights |

|---|---|

| Market Value, 2025 | USD 67.9 billion |

| Market Value, 2035 | USD 169.1 billion |

| Value CAGR (2025 to 2035) | 9% |

In 2024, Woodward Inc. disclosed the development of a next-generation fuel injection system for large-bore engines. According to Power Progress, these systems are being tailored for natural gas and hydrogen-capable engines and will support off-road, marine, and power generation markets. The system architecture is being refined to achieve dynamic injection timing and multiple injection events per cycle. As stated by Woodward engineers, this innovation enables improved thermal efficiency and reduced NOx formation.

Further advancements were detailed in a 2025 SAE technical paper titled “Electrified Fuel Injection Control in Variable Load Applications.” The study examined adaptive control mechanisms using machine learning to regulate injection volume and pressure in real-time. This approach was demonstrated to enhance transient response and lower soot emissions in hybridized diesel platforms. The research also noted compatibility with biofuels and e-fuels, aligning with long-term carbon reduction goals.

With emission regulations tightening globally and OEMs investing in engine optimization, fuel injection systems are being upgraded for broader fuel compatibility, electronic control precision, and reduced maintenance cycles. As hybrid powertrains continue to incorporate combustion elements, fuel injection technologies will remain critical to the next generation of energy-efficient mobility through 2035.

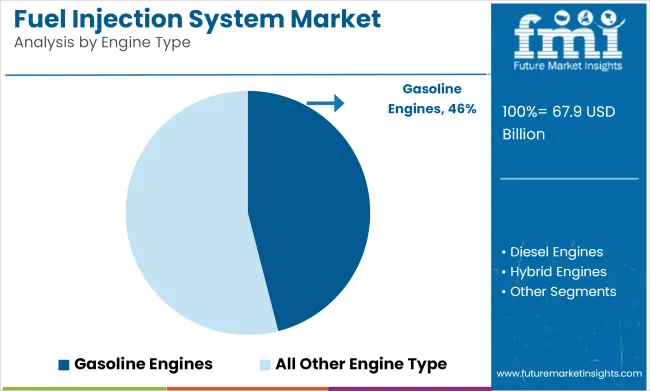

Gasoline engines accounted for 46% of the global market in 2025 and are projected to grow at a CAGR of 9.2% through 2035. Their widespread use in passenger vehicles and two-wheelers was driven by lower upfront costs, favorable refinement characteristics, and ongoing improvements in fuel efficiency.

In 2025, OEMs in Asia-Pacific, North America, and Latin America continued to rely on gasoline platforms while integrating emission control technologies to comply with evolving Euro 6, BS-VI, and EPA standards. Turbocharging, engine downsizing, and advanced thermal management strategies were increasingly adopted to reduce fuel consumption and CO₂ emissions.

Gasoline engines also served as the base architecture in many hybrid and plug-in hybrid vehicle platforms, enabling flexibility in powertrain configurations. Strong aftersales support and established fueling infrastructure further supported sustained deployment in both urban and rural regions.

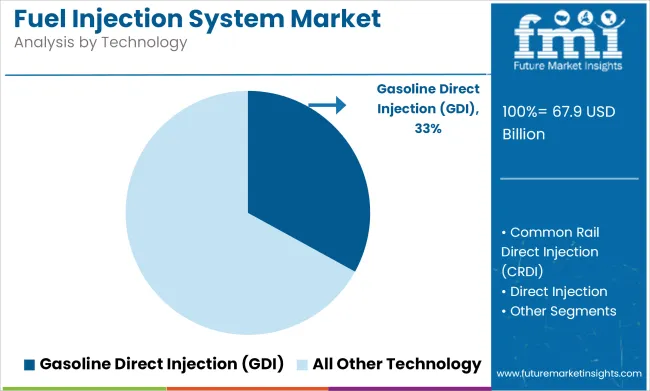

Gasoline direct injection (GDI) technology held 33% of the market by injection system type in 2025 and is expected to grow at a CAGR of 9.4% through 2035. GDI systems were adopted to improve combustion efficiency, enable higher compression ratios, and reduce unburned fuel emissions in gasoline-powered vehicles.

In 2025, passenger cars and light commercial vehicles with small-displacement turbocharged engines used GDI to meet stricter regulatory targets without compromising power output. OEMs focused on integrating dual-injection strategies-combining GDI with port fuel injection-to optimize fuel atomization and reduce particulate emissions.

GDI-equipped vehicles gained traction in Europe, China, and the USA, particularly in mid-size and premium vehicle segments. Component suppliers advanced injector design, fuel pump durability, and spray pattern optimization to meet evolving engine calibration requirements and real-world driving conditions.

The table below presents the annual growth rates of the global fuel injection systems market from 2025 to 2035. With a base year of 2024 extending to the current year 2025, the report examines how the sector's growth trajectory evolves from the first half of the year (January to June, H1) to the second half (July to December, H2). This analysis offers stakeholders insights into the industry's performance over time, highlighting potential developments that may emerge.

These figures indicate the growth of the sector in each half-year, between the years 2024 and 2025. The industry is expected to grow at a CAGR of 9% from 2025 to 2035. In H2, the growth rate increases.

| Particulars | Value CAGR |

|---|---|

| H1 2024 | 8.5% (2024 to 2034) |

| H2 2024 | 8.7% (2024 to 2034) |

| H1 2025 | 8.8% (2025 to 2035) |

| H2 2025 | 9.0% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2025, the CAGR is projected to slightly decrease to 8.8% in the first half and increase to 9.0% in the second half. In the first half (H1), the sector saw an increase of 30 BPS, while in the second half (H2), there was a slight increase of 30 BPS.

Fuel Injection System Ensures Reliable Cold Starts and Smooth Performance in Variable Weather

Fuel injection systems significantly enhance cold start performance, especially in two-wheelers, by optimizing fuel delivery in challenging weather conditions. Unlike carburettors, which struggle with adjusting fuel mixtures during cold starts, fuel injection systems use precise sensors to regulate fuel flow and air intake. This ensures that the engine receives the right mixture for ignition, even in low temperatures.

Studies show that fuel injection systems reduce cold-start emissions by up to 50% compared to carburettors, making them not only more efficient but also environmentally friendly. For example, motorcycles equipped with EFI (Electronic Fuel Injection) can start more reliably in temperatures as low as -5°C (23°F), whereas carburetted models often fail or require manual adjustments.

Additionally, the system adapts fuel delivery based on external conditions, ensuring smoother starts in varying temperatures, reducing strain on the battery and starter motor. This results in better engine longevity and improved overall performance.

Fuel Injection System Delivers Precise Throttle Control for Smoother Acceleration and Safer Riding

Fuel injection systems in two-wheelers offer precise throttle control, enabling smoother acceleration and quicker response times. By continuously adjusting the fuel-air mixture based on real-time data from sensors, the system allows for instantaneous throttle adjustments when riders accelerate or decelerate. This leads to improved ride quality, with transitions between different throttle positions feeling seamless, especially in high-performance motorcycles.

Studies show that motorcycles with fuel injection systems experience up to 15-20% faster throttle response compared to earlier models. This increased responsiveness enhances rider safety, allowing them to react faster in critical situations, such as overtaking or avoiding obstacles.

Additionally, the system adjusts fuel delivery for more consistent power output, reducing engine stuttering during deceleration. This makes riding smoother and more controlled, contributing to overall safety and a better riding experience in diverse road conditions.

Fuel Injection Systems Help in Reducing Hydrocarbon Emissions and Meet Environmental Standards

Fuel injection systems have revolutionized engine technology by delivering precise amounts of fuel into the combustion chamber. This technology minimizes unburned fuel and significantly reduces hydrocarbon emissions, ensuring engines adhere to stricter environmental standards.

Bosch has introduced advanced electronic control units and innovative injectors, enhancing combustion efficiency. Recent developments, such as gasoline direct injection (GDI) and high-pressure injectors, further lower emissions. Such innovations play a crucial role in addressing regulatory requirements and the global demand for cleaner transportation.

The adoption of fuel injection systems reduces pollutants, aligns with global sustainability goals, and promotes cleaner air, offering long-term environmental benefits. By continuously innovating, companies ensure vehicles are both high-performing and environmentally responsible.

Growth of Compact, High-Efficiency Engines in Emerging Markets Fuels Demand for Precision Injection Systems

The rise of compact, high-efficiency engines in emerging markets is driving the demand for advanced fuel injection systems. In countries like India and Brazil, the automotive sector is witnessing a shift toward small, fuel-efficient vehicles due to growing urban populations and increasing fuel costs.

These compact engines require precise fuel injection systems to ensure optimal performance and lower emissions, meeting the expectations of both consumers and regulatory bodies.

For instance, Continental, a leading supplier of automotive technologies, has developed advanced multi-hole fuel injectors designed for small-displacement engines. Their piezoelectric injectors are capable of delivering precise amounts of fuel at high pressure, improving combustion efficiency and reducing particulate emissions.

In 2023, Continental’s automotive technologies segment saw a 6% growth in sales, largely driven by demand for fuel-efficient solutions in emerging markets. This innovation in fuel injection technology is helping automakers like Suzuki and Renault meet both performance goals and stringent emission standards in their compact vehicle lines.

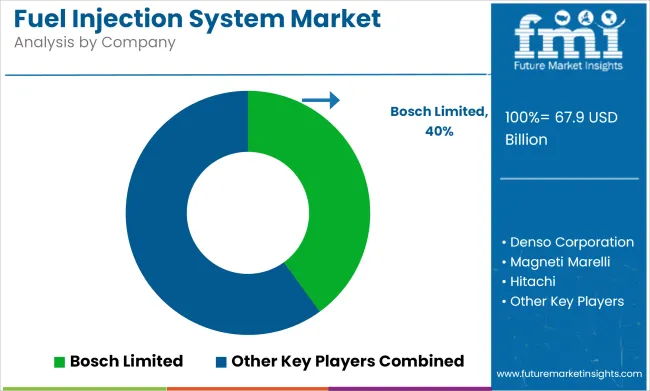

Tier-1 companies account for around 50-55% of the overall market with a product revenue from the fuel injection system market of more than USD 50 million. Bosch Limited, Delphi Technologies, Denso Corporation, and other players.

Tier-2 and other companies such as Stanadyne, PHINIA Inc. and other players are projected to account for 45-50% of the overall market with the estimated revenue under the range of USD 50 million through the sales of fuel injection system.

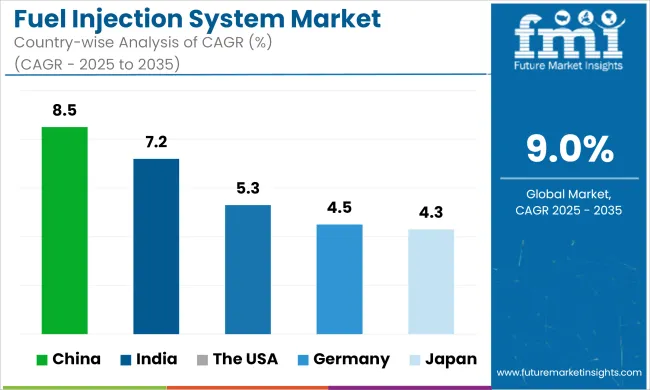

The section below covers the industry analysis for fuel injection system in different countries. The demand analysis on key countries in several regions of the globe, including North America, Latin America, East Asia, South Asia Pacific, Western Europe, Eastern Europe, Middle East, and Africa is provided. This data helps investors to keenly observe and go through the recent trends and examine them in an ordered manner.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| China | 8.5% |

| India | 7.2% |

| The USA | 5.3% |

| Germany | 4.5% |

| Japan | 4.3% |

Rising demand for diesel engines in China is a significant driver for fuel injection system growth. As China focuses on expanding its industrial and transportation sectors, diesel engines, known for their fuel efficiency and durability, are increasingly favored in commercial vehicles, trucks, and buses. To meet stricter emissions standards and enhance fuel economy, advanced fuel injection technologies are essential for optimizing diesel engine performance.

A key development in this sector is the introduction of high-pressure common rail injection systems, which provide precise fuel delivery at various engine loads. In 2023, Denso launched a next-generation common rail system designed specifically for heavy-duty diesel engines in China, which helped increase their operational efficiency by 10%.

The adoption of Direct Fuel Injection (DFI) and Variable Valve Timing (VVT) systems in the USA has significantly boosted fuel injection system growth. DFI technology optimizes fuel delivery by precisely controlling the amount and timing of fuel injected into the combustion chamber, improving engine efficiency and reducing fuel consumption.

This has become crucial as American consumers seek vehicles that offer both power and fuel economy. Simultaneously, VVT technology adjusts the timing of the valve openings, enhancing engine performance across various speeds and reducing emissions.

Company such as Ford and General Motors, have integrated these technologies into their latest engine models to meet stricter EPA fuel efficiency standards. Ford introduced turbocharged EcoBoost engines, which have the integrated the Direct Fuel Injection (DFI) and Variable Valve Timing (VVT) systems in their vehicles.

These systems enhance performance and fuel efficiency, becoming essential in vehicle designs and fueling continued growth in the fuel injection market.

High-performance German sports cars, particularly from brands like Porsche and Audi, are driving innovation in fuel injection technology to enhance both engine performance and efficiency.

As demand for faster, more powerful vehicles grows, automakers are turning to advanced fuel injection systems to optimize fuel delivery and ensure peak engine performance. For instance, Porsche's use of Direct Fuel Injection (DFI) in its 911 models ensures precise fuel atomization, leading to more efficient combustion, increased power output, and reduced emissions.

German manufacturers are also integrating turbocharging with advanced fuel injection systems, which require precise control to manage the increased air and fuel mixture effectively.

These innovations not only meet consumer performance demands but also help German manufacturers comply with environmental standards, solidifying fuel injection systems as a key factor in the country’s automotive technology evolution.

Technological advancements in the fuel injection system market are enhancing precision, durability, and performance. The shift toward high-pressure systems, such as direct fuel injection and common rail technology, is gaining traction due to their ability to improve fuel atomization, combustion efficiency, and power output.

Manufacturers are focusing on developing systems that can withstand extreme pressures, particularly for turbocharged and downsized engines, which require precise fuel delivery for optimal performance. Innovations in injector design, such as multi-hole and piezoelectric injectors, are improving fuel spray patterns, ensuring better combustion and reducing emissions.

With the growing demand for fuel efficiency and lower emissions, these advancements are driving the adoption of high-performance fuel injection systems across passenger cars, commercial vehicles, making them indispensable in modern automotive engineering.

Recent Industry Developments

The fuel injection system was valued at USD 62.3 billion in 2024.

The demand for fuel injection system is set to reach USD 67.9 billion in 2025.

The global fuel injection system is driven by rising demand for fuel efficient engines, growing adoption of turbo-charged engines, to drive vehicle performance.

The fuel injection system demand is projected to reach USD 169.1 billion in 2035.

The passenger vehicle are expected to lead during the forecasted period due to demand for fuel efficiency, advanced engine technologies.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Marine Fuel Injection System Market Size and Share Forecast Outlook 2025 to 2035

Two Wheeler Fuel Injection System Market Size and Share Forecast Outlook 2025 to 2035

Fuel Storage Tank Market Size and Share Forecast Outlook 2025 to 2035

Fuel Capacitance Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fuel Gas Heater Market Size and Share Forecast Outlook 2025 to 2035

Fuel Management Software Market Size and Share Forecast Outlook 2025 to 2035

Fuel Cell Powertrain Market Size and Share Forecast Outlook 2025 to 2035

Fuel Cell UAV Market Size and Share Forecast Outlook 2025 to 2035

Fuel Cell Stack Market Size and Share Forecast Outlook 2025 to 2035

Fuel Cell Electric Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Fuel Cell Commercial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Fuel Additives Market Segmentation based on Type, Application, and Region: Forecast for 2025 and 2035

Fuel Cell Market Growth – Trends & Forecast 2025 to 2035

Fuel Cell for Data Center Market - Trends & Forecast 2025 to 2035

Fuel Cell for Stationary Power Market Growth - Trends & Forecast 2025 to 2035

Fuel Analyzer Market

Fuel Vending Machines Market

Fuel Operated Heaters Market

Fuel Resistant Sealant Market

Fuel Feed Pumps Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA