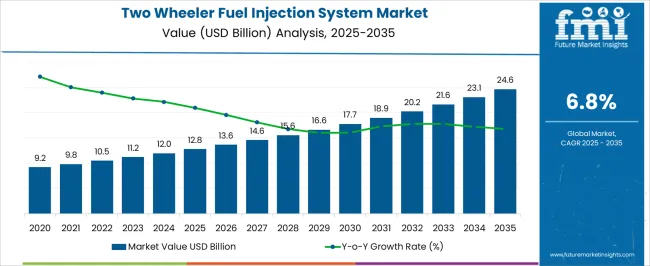

The Two Wheeler Fuel Injection System Market is estimated to be valued at USD 12.8 billion in 2025 and is projected to reach USD 24.6 billion by 2035, registering a compound annual growth rate (CAGR) of 6.8% over the forecast period.

| Metric | Value |

|---|---|

| Two Wheeler Fuel Injection System Market Estimated Value in (2025 E) | USD 12.8 billion |

| Two Wheeler Fuel Injection System Market Forecast Value in (2035 F) | USD 24.6 billion |

| Forecast CAGR (2025 to 2035) | 6.8% |

The two wheeler fuel injection system market is experiencing significant growth, driven by increasing demand for efficient, low-emission, and high-performance two wheelers across both developed and emerging economies. Government regulations on emission standards, rising fuel costs, and the shift from carbureted engines to fuel injection technology are influencing the adoption of fuel injection systems.

Consumers are prioritizing vehicles with better fuel economy, smoother throttle response, and reduced environmental impact, which is accelerating the transition to fuel injection technology. Technological advancements in electronic fuel management systems, sensors, and engine control units are enhancing the performance, reliability, and efficiency of fuel-injected two wheelers.

The market is further supported by increasing sales of scooters and motorcycles as urban mobility solutions, alongside growing awareness of long-term maintenance benefits associated with fuel injection over conventional carburetor systems Expansion in distribution networks, investments by original equipment manufacturers, and integration of advanced features in entry-level and premium models are positioning the market for sustained growth in the coming decade.

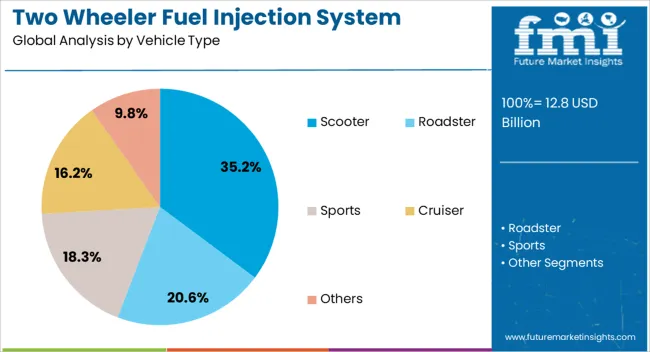

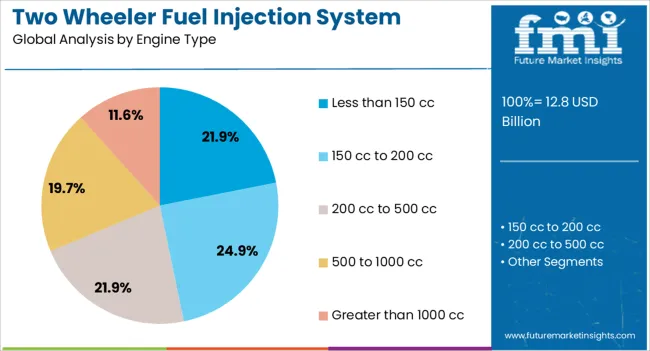

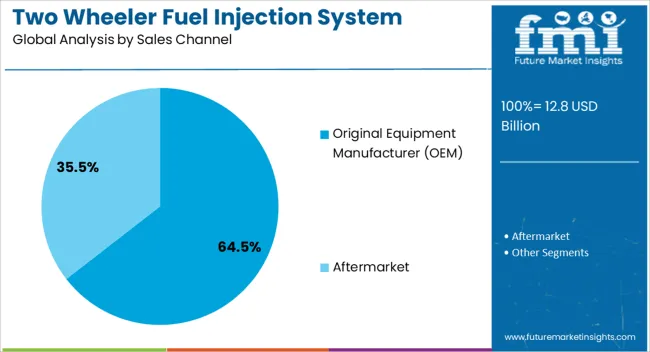

The two wheeler fuel injection system market is segmented by vehicle type, engine type, sales channel, and geographic regions. By vehicle type, two wheeler fuel injection system market is divided into Scooter, Roadster, Sports, Cruiser, and Others. In terms of engine type, two wheeler fuel injection system market is classified into Less than 150 cc, 150 cc to 200 cc, 200 cc to 500 cc, 500 to 1000 cc, and Greater than 1000 cc. Based on sales channel, two wheeler fuel injection system market is segmented into Original Equipment Manufacturer (OEM) and Aftermarket. Regionally, the two wheeler fuel injection system industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The scooter segment is projected to hold 35.2% of the two wheeler fuel injection system market revenue share in 2025, making it the leading vehicle type. This leadership is driven by the growing popularity of scooters as affordable and convenient urban mobility solutions, especially in densely populated areas.

Scooters equipped with fuel injection systems offer improved fuel efficiency, reduced emissions, and enhanced ride quality, meeting consumer preferences for low-maintenance and eco-friendly options. The segment benefits from widespread adoption among both first-time buyers and daily commuters, as fuel-injected scooters provide consistent performance under varied traffic and road conditions.

Manufacturers are increasingly introducing models with advanced fuel management systems to comply with regulatory standards while enhancing overall performance The combination of affordability, ease of operation, and superior fuel economy is reinforcing the dominance of scooters within the two wheeler segment, supporting continued market growth.

The less than 150 cc engine type segment is anticipated to account for 21.9% of the market revenue share in 2025, establishing itself as the leading engine category. This segment is being driven by the high demand for lightweight, fuel-efficient vehicles suitable for urban commuting and short-distance travel.

Engines under 150 cc offer a balance between affordability, efficiency, and ease of maintenance, which aligns with consumer preferences in emerging markets. The integration of fuel injection technology in these smaller engines enhances combustion efficiency, reduces emissions, and provides smoother acceleration compared to carbureted variants.

Additionally, regulatory pressure to meet stringent emission standards is accelerating the adoption of fuel injection systems in this category The segment’s popularity is further supported by favorable pricing, ease of ownership, and compatibility with existing infrastructure, making it a preferred choice for both manufacturers and consumers seeking cost-effective and environmentally compliant two wheeler options.

The original equipment manufacturer sales channel segment is projected to hold 64.5% of the market revenue share in 2025, establishing it as the dominant sales channel. This leadership is being reinforced by the preference of consumers to purchase vehicles directly from authorized dealers, ensuring warranty coverage, certified installation, and access to after-sales support.

Fuel injection systems installed through OEM channels are validated for quality, compliance with emission standards, and long-term reliability, which strengthens consumer confidence. The dominance of OEM channels is also driven by the integration of advanced technologies during the manufacturing process, eliminating the need for aftermarket retrofits and enhancing vehicle performance from the outset.

Manufacturers are increasingly leveraging OEM channels to introduce new fuel injection models in response to regulatory requirements and consumer expectations, providing bundled solutions that combine performance, efficiency, and warranty assurance Strong dealer networks, promotional support, and financing options further reinforce the dominance of the OEM sales channel in driving fuel injection system adoption globally.

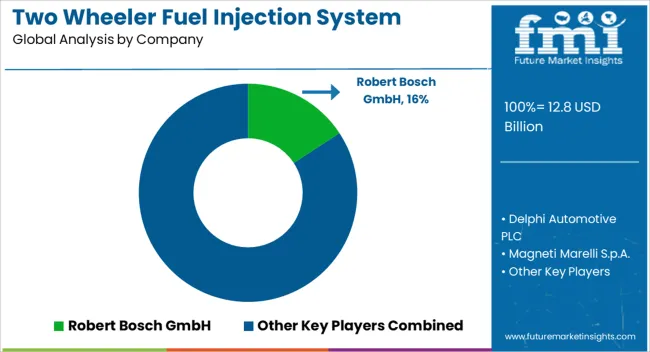

Increasing demand for premium two-wheelers is boosting the two-wheeler fuel injection system market growth, with the top 5 key players holding 44% of the global two-wheeler fuel injection system market by the end of 2025.

The market is propelled by the increasing sales of scooters. The demand for scooters has increased significantly as they are easy to handle, compact, and provide more fuel efficiency when compared to motorcycles. Young individuals and females are opting for scooters owing to their numerous advantages. In many countries, the issue of traffic congestion is on the rise and thus many working professionals are moving towards scooters as an efficient way of commuting.

As the demand for two-wheelers increases, the demand for fuel injection systems also increases. A new forecast by FMI analysis estimates that two-wheeler fuel injection system sales will augment during 2025-2035 and is anticipated to create a growth opportunity of US$ 7.1 Bn.

The Global Two Wheeler Fuel Injection System Market witnessed a CAGR of 2.1%& during the historic period with a market value of US$ 10.8 Bn in 2025.

The demand for two-wheeler fuel injection systems is growing, owing to the increasing demand for motorcycles in rural areas. Increasing disposable income of the middle-class population in the developing region is expected to propel the demand for two-wheelers in the market which is projected to increase the sales and production of new two-wheelers. The rising adoption of two-wheelers by teenagers and young working professionals mainly because of the affordability, ease of accessibility, and less expenditure on service and spare parts as compared to cars has bolstered the demand for motorcycles. Increasing motorcycle sales are anticipated to directly affect the demand for two-wheeler fuel injection systems across the globe during the forecast period.

Motorcycles are now being increasingly preferred for adventure and touring activities. In a bid to get an open-air feel and avoid traffic overcrowding, tourists favor motorcycles and scooters over four-wheelers as their mode of transportation. This factor is one of the prime factors responsible for the high sales of two-wheelers, thereby prompting the growth of fuel injection systems in the market. The local citizens also prefer scooters and motorcycles for daily commuting over four-wheelers, which is another factor driving the two-wheelers market, thereby boosting the sales of the fuel injection system.

The global Two Wheeler Fuel Injection System Market is expected to grow by 1.6X during the forecast period.

The global market for two-wheeler fuel injection systems is being driven by rising government regulations for a clean economy and ecosystem balance. The global market for two-wheeler fuel injection systems will expand owing to environmental concerns, the cost savings factor, and lower fuel consumption when compared to conventional fuel injection systems.

Some of the driving factors for fuel injection systems, which in turn are driving the worldwide two-wheeler fuel injection system market, are simple to install, fantastic engine performances, and improved fuel efficiency. The potential for the worldwide two-wheeler fuel injection system market is increasing as a result of the ongoing technical improvements made by companies like Bosch (the most recent EFI systems that can be installed on any two-wheeler).

The global market for two-wheeler fuel injection systems is expected to be dominated by OEM (Original Equipment Manufacturer). The global two-wheeler fuel injection system market by OEM segment is anticipated to grow at 4.9% CAGR by volume over the forecast period. The Europe and Asia region contributes a prominent share by OEM. Key players in the market are partnering with prominent automotive manufacturers to achieve significant profitability and penetrate several regions.

China is one of the largest motorcycle producers in the globe. High motorcycle demand on a domestic and worldwide level has fueled the growth of motorcycle manufacturing in China. Moreover, China's motorcycle exports have experienced sustained growth since the Belt and Road Initiative (BRI) infrastructure project which began in 2025. Today, in China, manufacturing of various sorts of motorbikes is done, in both models and functionality. The increasing production of two-wheelers in China is anticipated to boost the growth of the two-wheeler fuel injection system. China is estimated to hold around 46.8% value share of the East Asia Two Wheeler Fuel Injection System Market in 2025.

Increasing awareness regarding lower carbon emissions, the ease of maneuvering through road congestion, higher fuel efficiency, and providing an inexpensive mode of conveyance in comparison to four or three-wheeled vehicles are some of the factors driving the demand for motorcycles in India. In both urban and rural India, two-wheelers are one of the most significant and practical forms of mobility. Motorcycles are the most popular type of vehicle followed by scooters The increasing demand for motorcycles is indirectly fueling the demand for fuel injection systems. India two wheeler fuel injection system market is anticipated to grow at 4.4% CAGR during the forecast period.

The key players operating in the Two Wheeler Fuel Injection System Market are focusing on expanding their market presence to meet the growing demand for two-wheelers during the projected period. Also, the key players are adopting collaboration & joint venture strategies with vehicle manufacturers to expand their revenue.

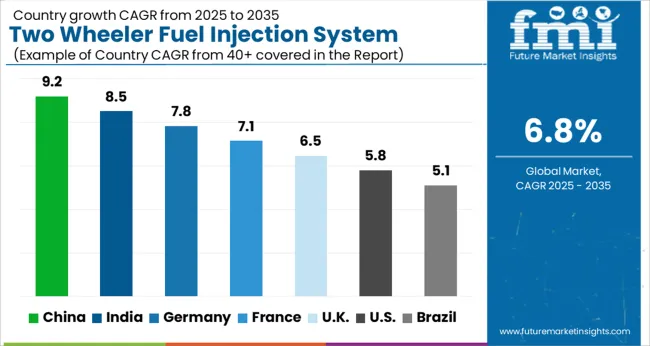

| Country | CAGR |

|---|---|

| China | 9.2% |

| India | 8.5% |

| Germany | 7.8% |

| France | 7.1% |

| UK | 6.5% |

| USA | 5.8% |

| Brazil | 5.1% |

The Two Wheeler Fuel Injection System Market is expected to register a CAGR of 6.8% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 9.2%, followed by India at 8.5%. Developed markets such as Germany, France, and the UKcontinue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 5.1%, yet still underscores a broadly positive trajectory for the global Two Wheeler Fuel Injection System Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 7.8%. The USA Two Wheeler Fuel Injection System Market is estimated to be valued at USD 4.4 billion in 2025 and is anticipated to reach a valuation of USD 7.7 billion by 2035. Sales are projected to rise at a CAGR of 5.8% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 699.0 million and USD 426.0 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 12.8 Billion |

| Vehicle Type | Scooter, Roadster, Sports, Cruiser, and Others |

| Engine Type | Less than 150 cc, 150 cc to 200 cc, 200 cc to 500 cc, 500 to 1000 cc, and Greater than 1000 cc |

| Sales Channel | Original Equipment Manufacturer (OEM) and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Robert Bosch GmbH, Delphi Automotive PLC, Magneti Marelli S.p.A., Mikuni Corporation, Keihien Corporation, Continental AG, Ucal Fuel systems Ltd., Ducati Energia, Sedemac, Edelbrock LLC, and Delphi Automotive |

The global two wheeler fuel injection system market is estimated to be valued at USD 12.8 billion in 2025.

The market size for the two wheeler fuel injection system market is projected to reach USD 24.6 billion by 2035.

The two wheeler fuel injection system market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in two wheeler fuel injection system market are scooter, roadster, sports, cruiser and others.

In terms of engine type, less than 150 cc segment to command 21.9% share in the two wheeler fuel injection system market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fuel Injection System Market Growth - Trends & Forecast 2025 to 2035

Two Wheeler Suspension System Market Size and Share Forecast Outlook 2025 to 2035

Two Wheeler Anti-lock Braking System Market Size and Share Forecast Outlook 2025 to 2035

Marine Fuel Injection System Market Size and Share Forecast Outlook 2025 to 2035

Gas & Dual-Fuel Injection Systems Market Size and Share Forecast Outlook 2025 to 2035

Demand for Gas & Dual-Fuel Injection Systems in USA Size and Share Forecast Outlook 2025 to 2035

Two-Wheeler Lubricants Market Size and Share Forecast Outlook 2025 to 2035

Two Wheeler Rental Market Size and Share Forecast Outlook 2025 to 2035

Two-Wheeler Aftermarket Components & Consumables Market Size and Share Forecast Outlook 2025 to 2035

Two Wheeler Safety Solutions Market Size and Share Forecast Outlook 2025 to 2035

Two Wheeler Handlebars Market Size and Share Forecast Outlook 2025 to 2035

Two Wheeler Crash Guard Market Size and Share Forecast Outlook 2025 to 2035

Two-Wheeler Lead Acid Batteries Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Two Wheeler Accessories Aftermarket Growth - Trends & Forecast 2025 to 2035

Two Wheeler Crankshaft Market Growth – Trends & Forecast 2024-2034

Two Wheeler Backrest Market

Two Wheeler Electric Starter Magnet Market

Two Wheeler Chain Sprocket Kit Market

Two Wheeler Footrest Market

Two-wheeler ECU Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA