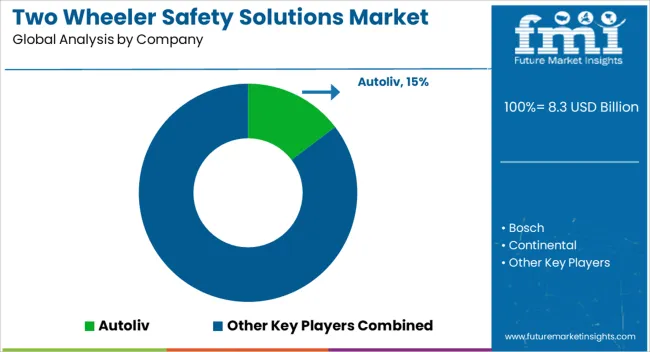

The global two wheeler safety solutions market is projected at USD 8.3 billion in 2025 and is anticipated to reach USD 14.5 billion by 2035, expanding at a compound annual growth rate (CAGR) of 5.8% during the forecast period. Analyzing the market growth curve reveals a steadily ascending trajectory, reflecting gradual but sustained adoption of safety solutions across two-wheeler segments. The early phase of the curve, from USD 6.2 billion to USD 7.8 billion, exhibits moderate growth as awareness regarding rider safety, regulatory enforcement, and basic safety gear adoption drives incremental demand.

The curve begins to steepen around USD 8.3 billion to USD 10.3 billion, highlighting an acceleration in market penetration due to rising consumer preference for advanced helmets, protective gear, ABS systems, and smart safety technologies. The mid-to-late phase of the growth curve, spanning USD 10.9 billion to USD 13.7 billion, indicates consistent momentum as urbanization, increased traffic density, and government-led safety initiatives promote the adoption of electronic stability systems, anti-lock brakes, and connected safety solutions.

By the final stage, reaching USD 14.5 billion in 2035, the curve approaches maturity yet maintains upward inclination, driven by premium two-wheeler segments, awareness campaigns, and integration of IoT-enabled safety devices. Overall, the market growth curve illustrates a steady climb with an inflection around the mid-decade period, emphasizing how regulatory support, technological enhancements, and shifting consumer priorities collectively sustain long-term expansion within the two-wheeler safety solutions sector.

| Metric | Value |

|---|---|

| Two Wheeler Safety Solutions Market Estimated Value in (2025 E) | USD 8.3 billion |

| Two Wheeler Safety Solutions Market Forecast Value in (2035 F) | USD 14.5 billion |

| Forecast CAGR (2025 to 2035) | 5.8% |

The two-wheeler safety solutions market is closely influenced by five interconnected parent markets that collectively drive its adoption and long-term growth. The largest contributor is the two-wheeler manufacturing market, which accounts for about 35% share, as safety solutions such as advanced braking systems, airbags, and stability controls are increasingly integrated into new motorcycles and scooters to meet regulatory standards and consumer expectations. The personal protective equipment (PPE) and rider gear sector contributes around 25%, supported by rising demand for helmets, jackets, gloves, and smart wearables that enhance rider safety and reduce accident severity.

The automotive electronics and telematics market holds close to 15% influence, driven by innovations in anti-lock braking systems (ABS), electronic stability control, collision avoidance sensors, and connectivity features that improve real-time safety management. The insurance and risk management sector adds nearly 12%, as insurance providers incentivize the adoption of safety technologies through premium discounts, accident risk mitigation programs, and awareness campaigns.

The road infrastructure and traffic management market contributes close to 8%, as intelligent transportation systems, lane-assist monitoring, and urban safety initiatives support the effectiveness of two-wheeler safety technologies. The distribution of market influence shows that two-wheeler manufacturing and rider protective gear form the backbone of the market, while electronics, insurance, and infrastructure developments continue to enhance adoption and commercial viability.

The two-wheeler safety solutions market is advancing steadily, driven by rising road accident rates, growing safety awareness, and tightening vehicle safety regulations across emerging and developed markets. As two-wheelers continue to serve as a primary mode of transportation in many regions, the need for advanced safety technologies has become a critical priority for manufacturers and regulatory bodies alike.

Governments are increasingly mandating safety features, while consumer demand for technologically equipped models is accelerating adoption. Moreover, the expansion of electric two-wheelers has created opportunities to integrate smart and connected safety systems from the design stage.

The market outlook remains favorable as investments in R&D push the boundaries of adaptive and preventive safety mechanisms. Increased OEM collaborations, digital innovation, and alignment with global safety standards are expected to sustain market momentum and foster wider integration of safety features across vehicle classes.

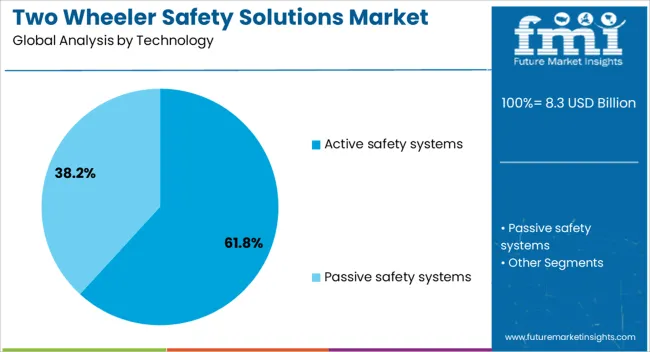

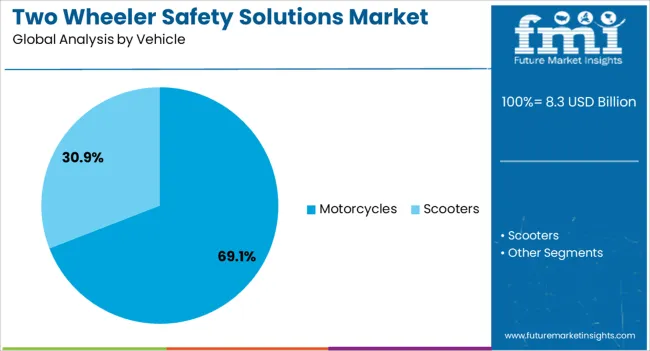

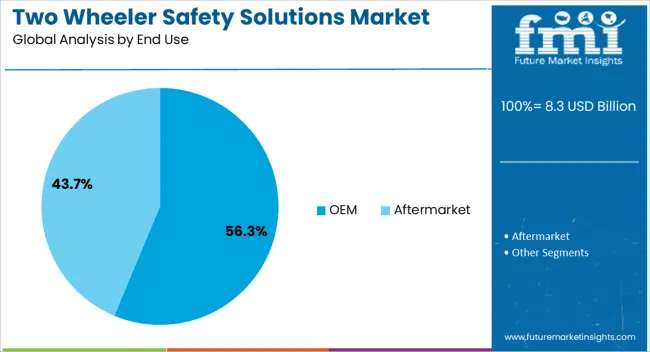

The two wheeler safety solutions market is segmented by technology, vehicle, end use, and geographic regions. By technology, two wheeler safety solutions market is divided into Active safety systems and Passive safety systems. In terms of vehicle, two wheeler safety solutions market is classified into Motorcycles and Scooters. Based on end use, two wheeler safety solutions market is segmented into OEM and Aftermarket. Regionally, the two wheeler safety solutions industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The active safety systems segment dominates the technology category with a 62% market share, driven by increasing reliance on features that proactively prevent accidents and improve vehicle handling. Technologies such as anti-lock braking systems (ABS), traction control, electronic stability programs, and advanced rider assistance systems have gained traction as standard offerings in modern two-wheelers.

These systems enhance rider confidence, particularly in challenging road conditions, and have proven effectiveness in reducing collision risks. Government regulations in key markets mandating ABS for motorcycles above specific engine capacities have further accelerated adoption.

Continuous development of real-time sensor integration and AI-driven safety analytics is expected to strengthen this segment. With OEMs placing greater emphasis on safety as a core differentiator, active safety systems are projected to maintain dominance as a central component in future two-wheeler safety architectures.

Motorcycles accounted for a leading 69% share within the vehicle segment, driven by their widespread use in both urban commuting and recreational activities. This dominance is supported by a large base of motorcycle owners globally, especially in Asia-Pacific and Latin America, where two-wheelers serve as essential transport.

Higher speeds and heavier weights make motorcycles more vulnerable to severe accidents, underscoring the importance of robust safety solutions. OEMs are increasingly incorporating advanced safety technologies into new motorcycle models, enhancing both rider protection and vehicle performance.

The segment has also benefited from growing adoption of premium motorcycles, which often feature cutting-edge safety systems as standard. As awareness of rider safety increases and technology becomes more affordable, demand for comprehensive motorcycle-specific safety solutions is expected to strengthen further across all major regions.

The OEM segment holds a strong 56% share within the end-use category, reflecting the growing preference for factory-installed safety systems in two-wheelers. OEMs are prioritizing safety technology integration during vehicle design and assembly to meet evolving regulatory standards and consumer expectations.

This approach ensures optimal system performance, reduces aftermarket installation complexities, and enhances product appeal in competitive markets. Increased collaboration between OEMs and technology providers has accelerated the deployment of adaptive and intelligent safety features in both entry-level and high-end models.

Additionally, early integration of safety systems enables better data analytics and system calibration, improving long-term reliability and user satisfaction. As global safety mandates become more stringent and consumers increasingly favor ready-to-use, feature-rich vehicles, the OEM segment is poised to remain the primary channel for safety solution deployment in the two-wheeler market.

The two-wheeler safety solutions market is being shaped by increasing focus on rider protection, integration with smart technologies, rising demand from commercial and delivery segments, and regional expansion supported by government regulations. Growing awareness of road safety and accident prevention is driving adoption of helmets, protective gear, and advanced safety systems. Technological integration enhances monitoring, alerting, and emergency response capabilities. Commercial fleets and delivery services are fueling consistent demand, while regulatory mandates across regions strengthen compliance and product penetration. These combined dynamics are driving steady market growth, enhancing rider safety, and positioning safety solutions as a critical component of the two-wheeler ecosystem.

The market is witnessing growth due to rising awareness of road safety among motorcyclists and scooter riders. Governments and regulatory authorities are enforcing safety standards and mandating the use of helmets, reflective gear, and protective clothing. Rising traffic accidents and fatalities have prompted manufacturers and safety solution providers to develop advanced protective gear and rider assistance technologies. Insurance companies are also promoting safety compliance through incentives and premium discounts. The growing emphasis on reducing injury risk and enhancing rider protection is driving adoption of helmets, airbags, anti-lock braking systems, and other safety accessories, making safety solutions a critical market segment.

Two-wheeler safety solutions are increasingly being integrated with smart technologies such as IoT-based sensors, GPS tracking, and connectivity-enabled helmets. Advanced braking systems, collision avoidance sensors, and rider alert mechanisms are being incorporated to enhance safety and prevent accidents. Manufacturers are developing connected safety devices that can communicate with vehicles, infrastructure, and mobile applications. Integration of these technologies improves real-time monitoring, emergency response, and overall rider awareness.

The commercial and delivery sectors are significantly contributing to the growth of the two-wheeler safety solutions market. Ride-hailing services, courier companies, and food delivery platforms rely on two-wheelers, increasing the focus on rider protection and regulatory compliance. Companies are providing fleet safety programs that include helmets, reflective jackets, and GPS-enabled tracking devices. Adoption of these solutions minimizes accident risk, reduces liability, and ensures efficient operations. The rapid growth of last-mile delivery services in urban areas is boosting demand for integrated safety solutions. This commercial application is creating consistent revenue streams and supporting market expansion, particularly in emerging economies with high two-wheeler penetration.

The market is witnessing regional expansion due to rising two-wheeler sales and supportive government policies in Asia-Pacific, Europe, and North America. Authorities are implementing regulations for mandatory helmet usage, ABS systems, and safety compliance standards. Awareness campaigns and road safety initiatives are promoting adoption of protective gear and advanced safety technologies. Local distributors and manufacturers are collaborating with OEMs to ensure widespread availability of safety products. The increasing focus on regulatory adherence, road safety infrastructure, and urban mobility solutions is driving market penetration. Regional initiatives, combined with rising consumer awareness, are creating opportunities for continuous growth in the two-wheeler safety solutions sector.

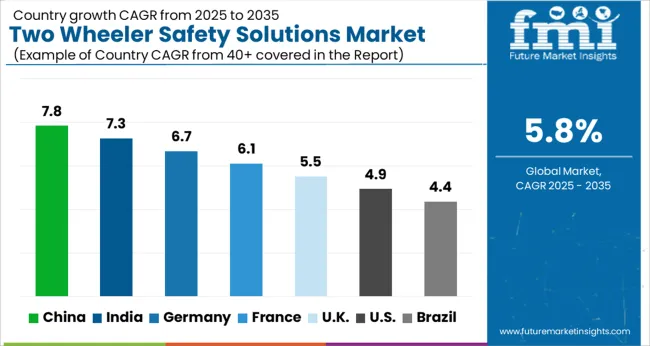

| Country | CAGR |

|---|---|

| China | 7.8% |

| India | 7.3% |

| Germany | 6.7% |

| France | 6.1% |

| UK | 5.5% |

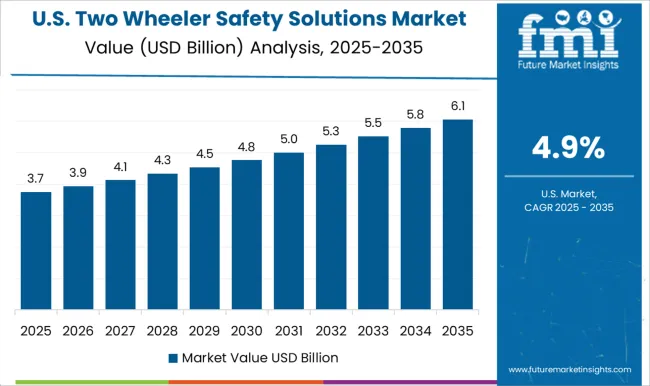

| USA | 4.9% |

| Brazil | 4.4% |

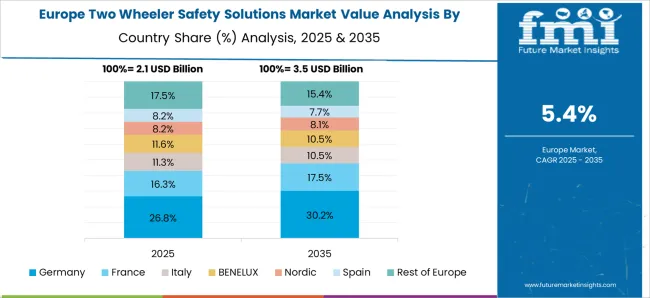

The global two-wheeler safety solutions market is projected to grow at a CAGR of 5.8% from 2025 to 2035. China leads with 7.8%, followed by India at 7.3%, Germany at 6.7%, the UK at 5.5%, and the USA at 4.9%. Growth is driven by rising two-wheeler sales, stricter traffic safety regulations, and increasing consumer awareness of protective gear and safety technologies. BRICS countries, particularly China and India, are focusing on helmet adoption, advanced braking systems, and road safety campaigns to reduce accidents. OECD nations such as Germany, the UK, and the USA emphasize intelligent safety systems, compliance with standards, and integration of connected technologies to enhance rider protection. The analysis spans over 40+ countries, with the leading markets detailed below.

The two-wheeler safety solutions market in China is projected to grow at a CAGR of 7.8% from 2025 to 2035, driven by increasing two-wheeler ownership and government initiatives to enhance road safety. Advanced safety technologies, including anti-lock braking systems (ABS), electronic stability control, and rider-assist features, are being integrated into both scooters and motorcycles. Consumer awareness regarding protective gear such as helmets, jackets, and gloves is rising, further contributing to market growth. Domestic manufacturers are investing in R&D to develop cost-effective safety solutions suitable for high-volume two-wheelers. Expansion of urban infrastructure and road safety campaigns by the government also support adoption across both urban and semi-urban regions.

The two-wheeler safety solutions market in India is expected to grow at a CAGR of 7.3% between 2025 and 2035, supported by increasing motorcycle and scooter usage in urban and semi-urban areas. Road safety regulations mandating ABS and helmet usage are driving adoption of both vehicle-integrated and aftermarket safety solutions. Manufacturers are introducing affordable safety technologies, including anti-slip braking systems and smart rider-assist features, to address price-sensitive segments. Consumer awareness regarding protective gear and connected safety solutions is increasing, while government programs promoting safer commuting infrastructure further strengthen market growth. Rising two-wheeler penetration, especially among young adults, ensures sustained demand for advanced safety solutions.

The two-wheeler safety solutions market in Germany is projected to grow at a CAGR of 6.7% from 2025 to 2035, driven by high safety awareness among riders and strict road safety regulations. Premium motorcycles and scooters increasingly incorporate ABS, traction control, and advanced rider-assist systems. The market benefits from a strong focus on protective gear, including certified helmets, jackets, and gloves, as well as electronic safety devices. Continuous innovation by manufacturers in smart connectivity and integrated safety solutions enhances performance and reduces accident risk. Germany’s well-developed road infrastructure and regulatory environment further support adoption of comprehensive safety solutions for two-wheelers.

The two-wheeler safety solutions market in the UK is expected to grow at a CAGR of 5.5% from 2025 to 2035, supported by urban commuting and recreational motorcycling trends. ABS, electronic braking systems, and rider-assist technologies are being adopted to reduce accident risks. Protective equipment compliance with European safety standards enhances consumer confidence. Manufacturers are focusing on lightweight, durable, and ergonomic safety solutions suitable for both scooters and motorcycles. Government campaigns promoting road safety and incentives for adopting technologically advanced vehicles contribute to market expansion. Growth is also supported by the rising popularity of electric scooters and motorcycles in urban areas.

The two-wheeler safety solutions market in the USA is projected to grow at a CAGR of 4.9% from 2025 to 2035, driven by increasing motorcycle ownership, especially among recreational riders. Safety awareness campaigns and insurance incentives promote the adoption of helmets, jackets, gloves, and ABS-equipped motorcycles. Advanced rider-assist technologies and electronic stability systems are increasingly integrated into mid- and high-end motorcycles. Manufacturers are developing innovative, lightweight, and durable safety gear tailored for long-distance and urban commuting. Expansion of motorcycle clubs, organized events, and training programs further enhance safety adoption. Regulatory compliance and consumer preference for protective gear ensure steady market growth.

Competition in the two-wheeler safety solutions market is influenced by technology integration, regulatory compliance, and aftermarket service depth. Autoliv, Bosch, Continental, Delphi, Denso, Harman, Magneti Marelli, NXP, Valeo, and ZF dominate by offering comprehensive safety systems, including advanced braking modules, rider-assist electronics, airbags, smart helmets, and sensor-driven collision avoidance systems. Product differentiation is achieved through integration of electronic stability control, telematics, and ADAS-compatible modules, as well as lightweight, durable, and weather-resistant materials designed for two-wheeler dynamics. Mid-tier and regional players focus on modular ABS kits, aftermarket helmets with IoT-enabled alerts, and retrofit smart lighting, catering to emerging markets and budget-conscious consumers. These companies emphasize rapid prototyping, compatibility across popular two-wheeler models, and affordable integration of advanced safety features. Strategies across leading players include global footprint expansion, partnerships with OEMs, and comprehensive service support, including installation assistance, rider education programs, and regulatory guidance.

Advanced simulation, digital twin testing, and predictive maintenance analytics are leveraged to enhance product reliability and consumer trust. Differentiation is further strengthened through branded, user-friendly interfaces, smart connectivity for mobile apps, and anti-theft or emergency alert systems. Companies aim to balance cost efficiency with high safety performance, ensuring compliance with local standards while meeting consumer expectations for convenience and protection. The market demonstrates a strong focus on functional innovation, technological precision, and operational scalability, reflecting a competitive landscape where global leaders maintain dominance through product excellence, service programs, and continuous technological enhancements.

| Item | Value |

|---|---|

| Quantitative Units | USD 8.3 Billion |

| Technology | Active safety systems and Passive safety systems |

| Vehicle | Motorcycles and Scooters |

| End Use | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Autoliv, Bosch, Continental, Delphi, Denso, Harman, Magneti Marelli, NXP, Valeo, and ZF |

| Additional Attributes | Dollar sales, share, product adoption, regional demand, vehicle type segmentation, safety regulations, competitor landscape, pricing trends, consumer awareness, technology integration, after-sales services, distribution channels. |

The global two wheeler safety solutions market is estimated to be valued at USD 8.3 billion in 2025.

The market size for the two wheeler safety solutions market is projected to reach USD 14.5 billion by 2035.

The two wheeler safety solutions market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in two wheeler safety solutions market are active safety systems, _anti-lock braking systems (abs), _traction control systems (tcs), _adaptive cruise control (acc), _advanced rider assistance systems (aras), passive safety systems, _airbags, _smart helmets and _protective clothing.

In terms of vehicle, motorcycles segment to command 69.1% share in the two wheeler safety solutions market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Two Winding Air Insulated Transformer Market Size and Share Forecast Outlook 2025 to 2035

Two Winding Cast Resin Transformer Market Size and Share Forecast Outlook 2025 to 2035

Two Winding Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Two-wheeled Containers Market

Two Piece Metal Containers Market

Two-Wheeler Lubricants Market Size and Share Forecast Outlook 2025 to 2035

Two Wheeler Anti-lock Braking System Market Size and Share Forecast Outlook 2025 to 2035

Two Wheeler Rental Market Size and Share Forecast Outlook 2025 to 2035

Two-Wheeler Aftermarket Components & Consumables Market Size and Share Forecast Outlook 2025 to 2035

Two Wheeler Suspension System Market Size and Share Forecast Outlook 2025 to 2035

Two Wheeler Handlebars Market Size and Share Forecast Outlook 2025 to 2035

Two Wheeler Fuel Injection System Market Size and Share Forecast Outlook 2025 to 2035

Two Wheeler Crash Guard Market Size and Share Forecast Outlook 2025 to 2035

Two-Wheeler Lead Acid Batteries Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Two Wheeler Accessories Aftermarket Growth - Trends & Forecast 2025 to 2035

Two Wheeler Crankshaft Market Growth – Trends & Forecast 2024-2034

Two Wheeler Backrest Market

Two Wheeler Electric Starter Magnet Market

Two Wheeler Chain Sprocket Kit Market

Two Wheeler Footrest Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA