The global two wheeler accessories aftermarket is booming due to the increasing trend of using motorcycles and scooters for commuting and recreational purposes. Market growth in automobile performance, appearance, and safety owing to growing consumer interest is expected to propel market growth. The major products are safety accessories, luggage carriers, crash guards, lighting accessories, and advanced TFT instrument clusters.

E-commerce platforms have also contributed to accessibility, allowing consumers to access a variety of accessories easily. In addition, the rising trends toward customization and personalization are compelling aftermarket sales as younger riders and enthusiasts seek to enhance their vehicles' functionality and appearance.

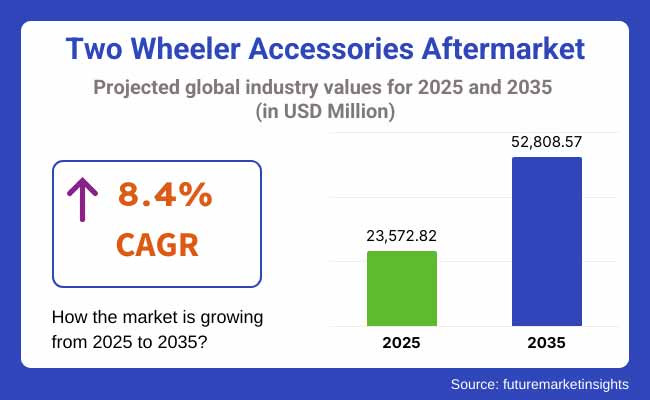

In 2025, the two-wheeler accessories aftermarket was valued at approximately USD 23,572.82 million. By 2035, it is projected to reach USD 52,808.57 million, reflecting a compound annual growth rate (CAGR) of 8.4%. The market growth is significantly influenced by the increasing penetration of high-performance motorcycles and electric two-wheelers.

Rising concerns about rider safety and comfort have propelled demand for advanced safety gear, smart helmets, and ergonomic seat modifications. Furthermore, government regulations emphasizing road safety standards are encouraging riders to invest in high-quality accessories. Market players are continuously innovating, integrating IoT and smart connectivity solutions in accessories, which is further propelling market adoption across various regions.

Based on region, North America holds a considerable share in the two-wheeler accessories aftermarket owing to high motorcycle ownership and rising inclination towards touring and adventure biking. In the USA and Canada demand continues to be strong for its premium accessories like high-tech navigation systems, ultra-advanced LED lighting solutions and heated grips for riders in extreme climate `conditions.

The growing number of established motorcycle companies in the region and a good number of aftermarket service providers also boost market growth. Increasing awareness about motorcycle safety gear, coupled with strict government regulations on the compulsory usage of personal protective equipment are also contributing to the upsurge in sales in this region.

Skinny Jeans and Small Suits Europe's two-wheeler accessories aftermarket is largely fueled by the presence of a motorcycle culture anchored in motorcycle touring and sports biking, especially in Germany, Italy, France and the UK. With the growing use of electric 2-wheelers and rising focus on sustainable mobility solutions, manufacturers are developing innovative accessories tailored for electric bikes and scooters.

The increasing popularity of high-performance riding apparel, such as armored jackets, gloves, and knee guards, is driving the growth of the market. Moreover, initiatives are being taken to ease access for road safety and sustainable mobility solutions and to encourage their buying choices throughout the region.

With high ownership rates of two-wheeler in China, India, Indonesia, and Vietnam, Asia-Pacific is the fastest-growing market for two-wheeler accessories. Increasing disposable incomes, increasing urbanization, and the availability of a progressively growing middle-class population is boosting the demand for the overall premium motorcycle accessories.

There is a rise in the smart helmets, anti-theft and mobile phone holders with USB charges in the market. Furthermore, local manufacturers and aftermarket suppliers are progressively enhancing their product OEM solution portfolios, catering to independence, affordability, and high durability for the variably-consuming clients in the region. Customization trends in this market are also driven by the rising influence of motorsports and biking communities.

Owing to the persistent development of safety technologies, biases among consumers towards personalization, and rising e-commerce penetration, the two-wheeler accessories aftermarket will witness significant growth. Smart connectivity, increased durability and sustainable materials in accessory development will also give direction to future trends in the market and ensure a steady demand in the global market.

Challenge

Price Sensitivity and Competition from Counterfeit Products

High price sensitivity on the part of consumers and competition from counterfeit or low-quality accessories are challenges for the two wheeler accessories aftermarket. A majority of shoppers buy cheap imitation products, resulting in the growing presence of fake consumer goods on the market that often sacrifice safety and quality.

These unauthorized sellers offer extra options at reduced prices, disrupting the revenue streams of traditional brands. As a solution, organizations need to pay attention to competitive pricing strategies, implement robust quality control and educate buyers regarding the hazards of counterfeit products.

Supply Chain Disruptions and Availability of Raw Materials

There are significant challenges in the two wheeler accessories aftermarket because the price of raw materials can fluctuate, and supply chains also face a disruption. Price increases for key materials like metals, plastics, and electronic components affect manufacturing costs and cause delays in production.

Supply chain is further complicated by geopolitical tensions, transportation hurdles and laws and regulations restrictions. His call for action highlights the importance of investing in supply chain resilience through diversified sourcing, strategic partnerships, and leveraging predictive analytics to preempt potential disruptions.

Opportunity

Rising Demand for Customization and Performance Upgrades

The increase in demand for vehicle personalization and performance upgrades have emerged as opportunities for the two wheeler accessories aftermarket. The accessories segment was probably the largest application in the motorcycle market and included a huge range of products, including custom exhaust systems, advanced lighting solutions, ergonomic seats, and smart connectivity devices. Companies that target innovative and aesthetically pleasing aftermarket accessories will create loyal customer bases and lead market growth.

Expansion of E-Commerce and Digital Sales Channels

The aftermarket accessories sector is undergoing a transformation through e-commerce platforms and digital sales channels. The customers can access any number of products with great ease due to online marketplaces and direct to consumer sales. Brands leverage digital marketing strategies, tie-ups with influencers, and personalized recommendations to increase their visibility and improve customer engagement. Those that do it well, then, will gain an edge over competitors through optimization of their center of online presence, use of data-driven marketing, and provision of seamless e-commerce experiences.

2020 to 2024 and 2025 to 2035: Post 2020, two wheeler accessories aftermarket continued to witness growth owing to above factors including the market structure where branded components were integrated t the two wheeler accessories aftermarket. It became clear that the trend is toward premium-quality accessories, sustainable materials, and smart technologies. Yet market dynamics were affected by issues such as disruptions in the supply chain, the rise and fall of the price of raw materials, and regulatory constraints.

The market will continue to evolve from smart accessories to new materials, with eco-friendly options gaining momentum, and AI-powered predictive maintenance solutions being popularized between 2025 and 2035. Futuristic additions like IoT enabled accessories, augmented reality based customization tools, and blockchain driven supply chain transparency are taking place in the Indie Fashion Sphere. Expect relative outperformance from firms that are investing heavily in digital transformation, product innovation and sustainability, which will drive market-leading performance and strong customer loyalty.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with safety and emission regulations |

| Technological Advancements | Growth in LED lighting, mobile connectivity, and smart helmets |

| Industry Adoption | Increased demand for performance-enhancing accessories |

| Supply Chain and Sourcing | Dependence on traditional raw material suppliers |

| Market Competition | Dominance of established brands and regional players |

| Market Growth Drivers | Rising urbanization and two-wheeler ownership |

| Sustainability and Energy Efficiency | Shift towards eco-friendly and recycled materials |

| Integration of Smart Monitoring | Limited use of digital tracking in accessories |

| Advancements in Product Innovation | Development of ergonomic seats, touring accessories, and safety gear |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Integration of AI-driven compliance monitoring |

| Technological Advancements | Expansion of IoT-enabled accessories and AI-powered diagnostics |

| Industry Adoption | Rise of AR-based customization and digital twin modeling |

| Supply Chain and Sourcing | Blockchain-enabled transparency and resilient supply chains |

| Market Competition | Growth of niche brands and direct-to-consumer models |

| Market Growth Drivers | Smart mobility trends and increasing focus on sustainability |

| Sustainability and Energy Efficiency | Large-scale adoption of biodegradable and energy-efficient components |

| Integration of Smart Monitoring | AI-driven predictive maintenance and real-time diagnostics |

| Advancements in Product Innovation | Introduction of adaptive and self-healing accessories |

Increasing usage of motorcycles for commuting and recreational activities is driving the USA two-wheeler accessories aftermarket. Stringent road safety regulations are also driving up demand for safety gears can include helmets, gloves, and riding jackets.

Moreover, aftermarket exhaust systems and performances parts, and lighting are becoming increasingly popular, which in turn is fueling the market growth. There are many e-commerce platforms and specialty stores that further provide custom-made and premium accessories. Factors like technological options, such as GPS systems in smart helmets along with communication devices, are also leading to the market trends.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 8.6% |

Factors such as growth in motorcycle ownership and delivery services using scooters and bikes in the United Kingdom market propel the demand for two-wheeler accessories in the country. Protective gear continues to be the number-one category, with brands concentrating on lightweight and impact-resistant fabrics.

The increasing popularity of adventure touring and weekend rides have spiked demand for accessories like saddlebags, crash guards and navigation accessories. Online retail channels are rapidly growing, as they feature a wide variety of both luxury and inexpensive accessories. Rising environmental concerns are also contributing to the demand for electric two-wheeler accessories such as battery charger and storage.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 8.2% |

Development of the European two-wheeler accessories aftermarket is some country, such as Germany, France and Italy, in which motorcycle & scooter is an essential part of daily commuting. The demand for high-performance accessories is fueled by high disposable incomes and a strong motorcycle touring culture.

Safety standards are driving the use of advanced helmets and riding gear. With electric two-wheelers becoming more popular, we have also seen an increase in demand for smart accessories like smartphone mounts, charging station, anti-theft devices, etc. Sustainable and eco-friendly materials are increasingly notable across luggage and protective gear categories.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 8.5% |

Japan's two-wheeler accessories market is driven by a significant culture of commuting by scooters and motorcycles. Smart helmets with augmented reality (AR) displays and built-in communication systems are among the technologically advanced accessories that are in increasing demand.

Enthusiasts want high-quality, durable performance parts-brake pads, exhausts, suspension systems, anything. Japan's growing adoption of certified protective gear also plays a part from the nation's strict safety requirements. Just as automotive electric scooters are driving demand for battery management systems, portable charges and aerodynamic accessories.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 8.7% |

Due to the growing utilization of motorcycles and scooters for delivery as well as personal commuting, the two-wheeler accessories aftermarket in South Korea is evolving. A key driver of this trend is the emergence of online platforms that offer college/alma mater-themed customizable and fashionable accessories. Some aspects, like the safety factor, are still a high priority, driving demand for high-impact helmets, knee guards, and riding jackets.

With motorcycle touring on the rise, it's only natural that demand for travel accessories has also increased, including saddle panniers, tank bags, and solutions. Smart locks, dash cams and LED lighting are also powering market growth from the smart home and connected home technology end.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 8.9% |

| Product | Market Share (2025) |

|---|---|

| Protective Gear | 39% |

Due to increasing safety regulations and rising rider awareness about the prevention of road accidents, the two-wheeler accessories aftermarket is dominated by protective gear. As road traffic accidents are increasing across the globe and the law for protective gear is being strictly imposed on riders, helmets, body armor and riding glove have become a necessity.

Mock helmets, during that time, had been emphasized compared to aesthetic accessories but collaborated by the makers and consumers to provide more safety gear without warning. This, along with the influx of smart technology, such as Bluetooth enabled helmets and impact resistant materials, is fueling growth in the segment. The growing popularity of adventure motorcycling and sports biking is also influencing the demand for advanced protective gear.

Manufacturers are continuously ramping up investments in R&D for innovative protective solutions with characteristics such as higher durability, breathability, and style, which further solidifies the space-predominating share of this segment. The budding wave of safety certifications and standardized performance testing for riding gear will further drive consumer confidence and accelerate adoption of the high-mobility protective wear category of premium gear.

| Two-Wheeler Type | Market Share (2025) |

|---|---|

| Standard Motorcycle | 46% |

Due to their widespread use for urban and suburban commuting, standard motorcycles have the largest market share in the two-wheeler accessories aftermarket. These motorcycles are popular for their low cost, fuel economy, and the ability to traverse a variety of terrain, making them the most common type of bike.

Standard motorcycles are more practical for everyday use than cruiser or sports motorcycles from the perspective of the riding community, thus there will always be consistent demand for essential and performance-related accessories. As cities increasingly face challenges of congestion and pollution, the growth of electric two-wheelers in the standard segment is opening new opportunities in the market, catering to environmental-friendly consumers that look for green mobility alternatives.

Moreover, makers are providing customizable components for regular road motorcycles, including upgraded seats, more advanced security solutions as well as ergonomic handlebars to increase comfort and riding. Increasing demand for robust and functional accessories for standard motorcycles is fueled by the rising presence of ride-sharing services and delivery platforms.

We're not quite done here! With urbanization becoming the norm all over the world, cities looking to improve two-wheeler infrastructure, the case for affordable standard motorcycles and their accessories is only set to grow and solidifying their market position.

The two-wheeler accessories aftermarket is witnessing the steady growth as consumers demand more as they seek customization products, safety upgrades, and performance-enhancing components. With the emergence of electric two-wheelers, advanced connectivity features, and durable aftermarket solutions, the market is witnessing noteworthy growth.

Due to a worldwide Compound Annual Growth Rate (CAGR) of 8.4%, firms are prioritizing ergonomic patterns, light materials, and invention accessories for an enhanced riding experience as well as increased security. The increasing adoption of GPS tracking systems, anti-theft solutions, and aerodynamic components is additionally propelling market growth.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Bosch GmbH | 18-22% |

| Shoei Co., Ltd. | 14-18% |

| GIVI Srl | 12-16% |

| Steelbird Helmets | 10-14% |

| HJC Helmets | 8-12% |

| Other Companies(combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| Bosch GmbH | In 2025, Bosch GmbH introduced advanced ABS systems and smart connectivity solutions, enhancing two-wheeler safety and rider assistance features. |

| Shoei Co., Ltd. | In 2024, Shoei Co., Ltd. launched aerodynamic and lightweight helmet designs, improving rider comfort and reducing wind resistance. |

| GIVI Srl | In 2025, GIVI Srl expanded its premium luggage solutions, integrating anti-theft and weatherproof technologies for touring enthusiasts. |

| Steelbird Helmets | In 2024, Steelbird Helmets developed dual-visor helmets with improved ventilation, catering to long-distance riders and urban commuters. |

| HJC Helmets | In 2025, HJC Helmets introduced smart helmets with Bluetooth communication features, enhancing connectivity for riders. |

Key Company Insights

Bosch GmbH (18-22%)

Bosch already has a commanding presence in the aftermarket with high-tech safety and electronic add-ons, like ABS, traction control, and intelligent rider-assist systems. With investments in sensor-based solutions and AI-driven performance improvements, the company provides the latest innovations to greatly enhance rider safety.

Shoei Co., Ltd. (14-18%)

Shoei makes high-end motorcycle helmets focusing on aerodynamics, impact resistance and light weight. Maintaining a solid presence globally, the company is constantly improving comfort, noise reduction and ventilation systems.

GIVI Srl (12-16%)

For secure and waterproof storage, look no further than GIVI, the leader in motorcycle luggage and touring accessories. Year after year, the company was expanding its offerings to also include modular and smart luggage systems, which feature anti-theft protection and ergonomic designs.

Steelbird Helmets (10-14%)

Steelbird is a company that believes in affordable yet quality helmets, and it was the first one to release dual visor, impact resistant helmets for city riders. It is expanding its safety certification programs and also putting an emphasis on rider comfort and durability.

HJC Helmets (8-12%)

HJC is a pioneer in cutting-edge smart helmet technology, with Bluetooth communication, noise cancellation, and HUD (heads-up display) technology. This results in better user experience as the company is working on aerodynamics and lightweight designs.

Other Key Players (25-35% Combined)

A few other manufacturers create a competitive two-wheeler accessories after market with focused & innovative solutions:

The overall market size for two wheeler accessories aftermarket was USD 23,572.82 million in 2025.

The two wheeler accessories aftermarket expected to reach USD 52,808.57 million in 2035.

Rising two-wheeler sales, increasing consumer preference for customization, growing demand for safety and comfort accessories, expanding e-commerce distribution, and advancements in durable and stylish aftermarket products will drive market demand.

The top 5 countries which drives the development of two wheeler accessories aftermarket are USA, UK, Europe Union, Japan and South Korea.

Standard motorcycles driving market growth to command significant share over the assessment period.

Table 1: Global Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Value (US$ Million) Forecast by Product, 2018 to 2033

Table 4: Global Volume (Units) Forecast by Product, 2018 to 2033

Table 5: Global Value (US$ Million) Forecast by Two wheeler type, 2018 to 2033

Table 6: Global Volume (Units) Forecast by Two wheeler type, 2018 to 2033

Table 7: Global Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 8: Global Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 9: North America Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Value (US$ Million) Forecast by Product, 2018 to 2033

Table 12: North America Volume (Units) Forecast by Product, 2018 to 2033

Table 13: North America Value (US$ Million) Forecast by Two wheeler type, 2018 to 2033

Table 14: North America Volume (Units) Forecast by Two wheeler type, 2018 to 2033

Table 15: North America Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 16: North America Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 17: Latin America Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Value (US$ Million) Forecast by Product, 2018 to 2033

Table 20: Latin America Volume (Units) Forecast by Product, 2018 to 2033

Table 21: Latin America Value (US$ Million) Forecast by Two wheeler type, 2018 to 2033

Table 22: Latin America Volume (Units) Forecast by Two wheeler type, 2018 to 2033

Table 23: Latin America Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 24: Latin America Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 25: Western Europe Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Value (US$ Million) Forecast by Product, 2018 to 2033

Table 28: Western Europe Volume (Units) Forecast by Product, 2018 to 2033

Table 29: Western Europe Value (US$ Million) Forecast by Two wheeler type, 2018 to 2033

Table 30: Western Europe Volume (Units) Forecast by Two wheeler type, 2018 to 2033

Table 31: Western Europe Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 32: Western Europe Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 33: Eastern Europe Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Value (US$ Million) Forecast by Product, 2018 to 2033

Table 36: Eastern Europe Volume (Units) Forecast by Product, 2018 to 2033

Table 37: Eastern Europe Value (US$ Million) Forecast by Two wheeler type, 2018 to 2033

Table 38: Eastern Europe Volume (Units) Forecast by Two wheeler type, 2018 to 2033

Table 39: Eastern Europe Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 40: Eastern Europe Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 41: South Asia and Pacific Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Value (US$ Million) Forecast by Product, 2018 to 2033

Table 44: South Asia and Pacific Volume (Units) Forecast by Product, 2018 to 2033

Table 45: South Asia and Pacific Value (US$ Million) Forecast by Two wheeler type, 2018 to 2033

Table 46: South Asia and Pacific Volume (Units) Forecast by Two wheeler type, 2018 to 2033

Table 47: South Asia and Pacific Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 48: South Asia and Pacific Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 49: East Asia Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Value (US$ Million) Forecast by Product, 2018 to 2033

Table 52: East Asia Volume (Units) Forecast by Product, 2018 to 2033

Table 53: East Asia Value (US$ Million) Forecast by Two wheeler type, 2018 to 2033

Table 54: East Asia Volume (Units) Forecast by Two wheeler type, 2018 to 2033

Table 55: East Asia Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 56: East Asia Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 57: Middle East and Africa Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Value (US$ Million) Forecast by Product, 2018 to 2033

Table 60: Middle East and Africa Volume (Units) Forecast by Product, 2018 to 2033

Table 61: Middle East and Africa Value (US$ Million) Forecast by Two wheeler type, 2018 to 2033

Table 62: Middle East and Africa Volume (Units) Forecast by Two wheeler type, 2018 to 2033

Table 63: Middle East and Africa Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 64: Middle East and Africa Volume (Units) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Value (US$ Million) by Two wheeler type, 2023 to 2033

Figure 3: Global Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 4: Global Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 10: Global Volume (Units) Analysis by Product, 2018 to 2033

Figure 11: Global Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 12: Global Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 13: Global Value (US$ Million) Analysis by Two wheeler type, 2018 to 2033

Figure 14: Global Volume (Units) Analysis by Two wheeler type, 2018 to 2033

Figure 15: Global Value Share (%) and BPS Analysis by Two wheeler type, 2023 to 2033

Figure 16: Global Y-o-Y Growth (%) Projections by Two wheeler type, 2023 to 2033

Figure 17: Global Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 18: Global Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 19: Global Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 20: Global Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 21: Global Attractiveness by Product, 2023 to 2033

Figure 22: Global Attractiveness by Two wheeler type, 2023 to 2033

Figure 23: Global Attractiveness by Sales Channel, 2023 to 2033

Figure 24: Global Attractiveness by Region, 2023 to 2033

Figure 25: North America Value (US$ Million) by Product, 2023 to 2033

Figure 26: North America Value (US$ Million) by Two wheeler type, 2023 to 2033

Figure 27: North America Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 28: North America Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 34: North America Volume (Units) Analysis by Product, 2018 to 2033

Figure 35: North America Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 36: North America Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 37: North America Value (US$ Million) Analysis by Two wheeler type, 2018 to 2033

Figure 38: North America Volume (Units) Analysis by Two wheeler type, 2018 to 2033

Figure 39: North America Value Share (%) and BPS Analysis by Two wheeler type, 2023 to 2033

Figure 40: North America Y-o-Y Growth (%) Projections by Two wheeler type, 2023 to 2033

Figure 41: North America Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 42: North America Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 43: North America Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 44: North America Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 45: North America Attractiveness by Product, 2023 to 2033

Figure 46: North America Attractiveness by Two wheeler type, 2023 to 2033

Figure 47: North America Attractiveness by Sales Channel, 2023 to 2033

Figure 48: North America Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Value (US$ Million) by Product, 2023 to 2033

Figure 50: Latin America Value (US$ Million) by Two wheeler type, 2023 to 2033

Figure 51: Latin America Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 52: Latin America Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 58: Latin America Volume (Units) Analysis by Product, 2018 to 2033

Figure 59: Latin America Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 60: Latin America Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 61: Latin America Value (US$ Million) Analysis by Two wheeler type, 2018 to 2033

Figure 62: Latin America Volume (Units) Analysis by Two wheeler type, 2018 to 2033

Figure 63: Latin America Value Share (%) and BPS Analysis by Two wheeler type, 2023 to 2033

Figure 64: Latin America Y-o-Y Growth (%) Projections by Two wheeler type, 2023 to 2033

Figure 65: Latin America Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 66: Latin America Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 67: Latin America Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 68: Latin America Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 69: Latin America Attractiveness by Product, 2023 to 2033

Figure 70: Latin America Attractiveness by Two wheeler type, 2023 to 2033

Figure 71: Latin America Attractiveness by Sales Channel, 2023 to 2033

Figure 72: Latin America Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Value (US$ Million) by Product, 2023 to 2033

Figure 74: Western Europe Value (US$ Million) by Two wheeler type, 2023 to 2033

Figure 75: Western Europe Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 76: Western Europe Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 82: Western Europe Volume (Units) Analysis by Product, 2018 to 2033

Figure 83: Western Europe Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 84: Western Europe Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 85: Western Europe Value (US$ Million) Analysis by Two wheeler type, 2018 to 2033

Figure 86: Western Europe Volume (Units) Analysis by Two wheeler type, 2018 to 2033

Figure 87: Western Europe Value Share (%) and BPS Analysis by Two wheeler type, 2023 to 2033

Figure 88: Western Europe Y-o-Y Growth (%) Projections by Two wheeler type, 2023 to 2033

Figure 89: Western Europe Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 90: Western Europe Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 91: Western Europe Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 92: Western Europe Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 93: Western Europe Attractiveness by Product, 2023 to 2033

Figure 94: Western Europe Attractiveness by Two wheeler type, 2023 to 2033

Figure 95: Western Europe Attractiveness by Sales Channel, 2023 to 2033

Figure 96: Western Europe Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Value (US$ Million) by Product, 2023 to 2033

Figure 98: Eastern Europe Value (US$ Million) by Two wheeler type, 2023 to 2033

Figure 99: Eastern Europe Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 100: Eastern Europe Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 106: Eastern Europe Volume (Units) Analysis by Product, 2018 to 2033

Figure 107: Eastern Europe Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 108: Eastern Europe Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 109: Eastern Europe Value (US$ Million) Analysis by Two wheeler type, 2018 to 2033

Figure 110: Eastern Europe Volume (Units) Analysis by Two wheeler type, 2018 to 2033

Figure 111: Eastern Europe Value Share (%) and BPS Analysis by Two wheeler type, 2023 to 2033

Figure 112: Eastern Europe Y-o-Y Growth (%) Projections by Two wheeler type, 2023 to 2033

Figure 113: Eastern Europe Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 114: Eastern Europe Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 115: Eastern Europe Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 116: Eastern Europe Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 117: Eastern Europe Attractiveness by Product, 2023 to 2033

Figure 118: Eastern Europe Attractiveness by Two wheeler type, 2023 to 2033

Figure 119: Eastern Europe Attractiveness by Sales Channel, 2023 to 2033

Figure 120: Eastern Europe Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Value (US$ Million) by Product, 2023 to 2033

Figure 122: South Asia and Pacific Value (US$ Million) by Two wheeler type, 2023 to 2033

Figure 123: South Asia and Pacific Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 124: South Asia and Pacific Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 130: South Asia and Pacific Volume (Units) Analysis by Product, 2018 to 2033

Figure 131: South Asia and Pacific Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 132: South Asia and Pacific Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 133: South Asia and Pacific Value (US$ Million) Analysis by Two wheeler type, 2018 to 2033

Figure 134: South Asia and Pacific Volume (Units) Analysis by Two wheeler type, 2018 to 2033

Figure 135: South Asia and Pacific Value Share (%) and BPS Analysis by Two wheeler type, 2023 to 2033

Figure 136: South Asia and Pacific Y-o-Y Growth (%) Projections by Two wheeler type, 2023 to 2033

Figure 137: South Asia and Pacific Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 138: South Asia and Pacific Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 139: South Asia and Pacific Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 140: South Asia and Pacific Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 141: South Asia and Pacific Attractiveness by Product, 2023 to 2033

Figure 142: South Asia and Pacific Attractiveness by Two wheeler type, 2023 to 2033

Figure 143: South Asia and Pacific Attractiveness by Sales Channel, 2023 to 2033

Figure 144: South Asia and Pacific Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Value (US$ Million) by Product, 2023 to 2033

Figure 146: East Asia Value (US$ Million) by Two wheeler type, 2023 to 2033

Figure 147: East Asia Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 148: East Asia Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 154: East Asia Volume (Units) Analysis by Product, 2018 to 2033

Figure 155: East Asia Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 156: East Asia Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 157: East Asia Value (US$ Million) Analysis by Two wheeler type, 2018 to 2033

Figure 158: East Asia Volume (Units) Analysis by Two wheeler type, 2018 to 2033

Figure 159: East Asia Value Share (%) and BPS Analysis by Two wheeler type, 2023 to 2033

Figure 160: East Asia Y-o-Y Growth (%) Projections by Two wheeler type, 2023 to 2033

Figure 161: East Asia Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 162: East Asia Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 163: East Asia Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 164: East Asia Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 165: East Asia Attractiveness by Product, 2023 to 2033

Figure 166: East Asia Attractiveness by Two wheeler type, 2023 to 2033

Figure 167: East Asia Attractiveness by Sales Channel, 2023 to 2033

Figure 168: East Asia Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Value (US$ Million) by Product, 2023 to 2033

Figure 170: Middle East and Africa Value (US$ Million) by Two wheeler type, 2023 to 2033

Figure 171: Middle East and Africa Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 172: Middle East and Africa Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 178: Middle East and Africa Volume (Units) Analysis by Product, 2018 to 2033

Figure 179: Middle East and Africa Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 180: Middle East and Africa Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 181: Middle East and Africa Value (US$ Million) Analysis by Two wheeler type, 2018 to 2033

Figure 182: Middle East and Africa Volume (Units) Analysis by Two wheeler type, 2018 to 2033

Figure 183: Middle East and Africa Value Share (%) and BPS Analysis by Two wheeler type, 2023 to 2033

Figure 184: Middle East and Africa Y-o-Y Growth (%) Projections by Two wheeler type, 2023 to 2033

Figure 185: Middle East and Africa Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 186: Middle East and Africa Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 187: Middle East and Africa Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 188: Middle East and Africa Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 189: Middle East and Africa Attractiveness by Product, 2023 to 2033

Figure 190: Middle East and Africa Attractiveness by Two wheeler type, 2023 to 2033

Figure 191: Middle East and Africa Attractiveness by Sales Channel, 2023 to 2033

Figure 192: Middle East and Africa Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Two-Wheeler Aftermarket Components & Consumables Market Size and Share Forecast Outlook 2025 to 2035

Two-Wheeler Lubricants Market Size and Share Forecast Outlook 2025 to 2035

Two Wheeler Anti-lock Braking System Market Size and Share Forecast Outlook 2025 to 2035

Two Wheeler Rental Market Size and Share Forecast Outlook 2025 to 2035

Two Wheeler Suspension System Market Size and Share Forecast Outlook 2025 to 2035

Two Wheeler Safety Solutions Market Size and Share Forecast Outlook 2025 to 2035

Two Wheeler Handlebars Market Size and Share Forecast Outlook 2025 to 2035

Two Wheeler Fuel Injection System Market Size and Share Forecast Outlook 2025 to 2035

Two Wheeler Crash Guard Market Size and Share Forecast Outlook 2025 to 2035

Two-Wheeler Lead Acid Batteries Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Two Wheeler Crankshaft Market Growth – Trends & Forecast 2024-2034

Two Wheeler Backrest Market

Two Wheeler Electric Starter Magnet Market

Two Wheeler Chain Sprocket Kit Market

Two Wheeler Footrest Market

Two-wheeler ECU Market

Two Wheeler Fenders Market

Two Wheeler Seats Market

Two-wheeler Battery Market

Electric Two-Wheelers MRO Market: Optimizing Performance and Durability in the Electric Vehicle Age

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA