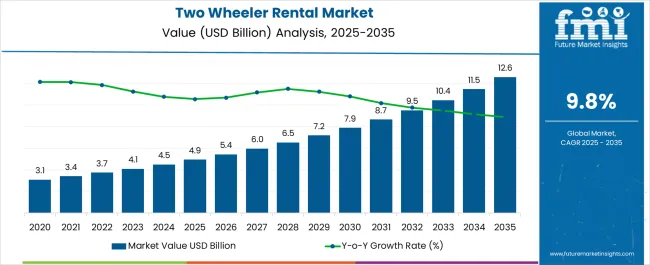

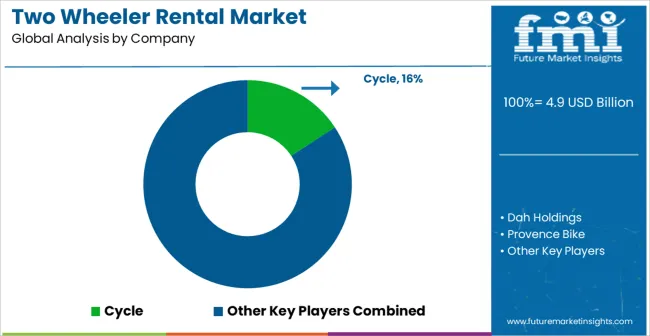

The Two Wheeler Rental Market is estimated to be valued at USD 4.9 billion in 2025 and is projected to reach USD 12.6 billion by 2035, registering a compound annual growth rate (CAGR) of 9.8% over the forecast period.

| Metric | Value |

|---|---|

| Two Wheeler Rental Market Estimated Value in (2025 E) | USD 4.9 billion |

| Two Wheeler Rental Market Forecast Value in (2035 F) | USD 12.6 billion |

| Forecast CAGR (2025 to 2035) | 9.8% |

The Two Wheeler Rental market is experiencing robust growth, driven by increasing urbanization, rising traffic congestion, and growing demand for cost-effective mobility solutions. Consumers are increasingly preferring short-term rental options for convenience, affordability, and flexibility in urban commuting. The adoption of technology-enabled rental platforms, including mobile applications and desktop-based booking systems, is enhancing accessibility and customer experience.

The market is further supported by rising penetration of two-wheelers in emerging economies, growing disposable incomes, and increasing awareness of alternative transportation options. Self-driven rental services are gaining traction as they provide end-users with autonomy and flexibility, while fleet operators benefit from efficient asset utilization. Partnerships between rental companies, mobility service providers, and fintech platforms are facilitating seamless transactions and expanding customer reach.

Regulatory support for organized rental services, along with increasing focus on shared mobility to reduce carbon emissions, is expected to sustain market expansion Continuous innovation in booking systems, payment solutions, and vehicle tracking is positioning the Two Wheeler Rental market for long-term growth across urban and semi-urban regions.

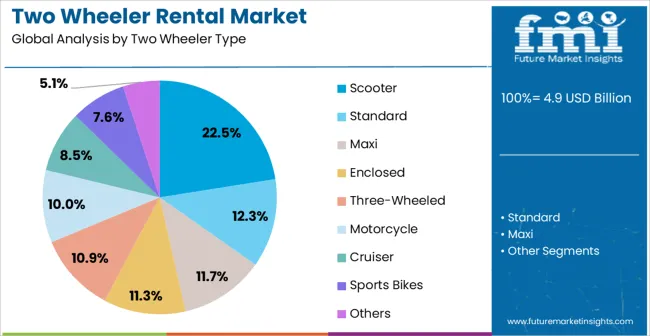

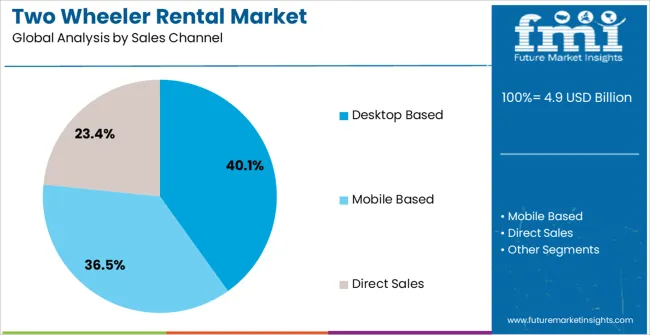

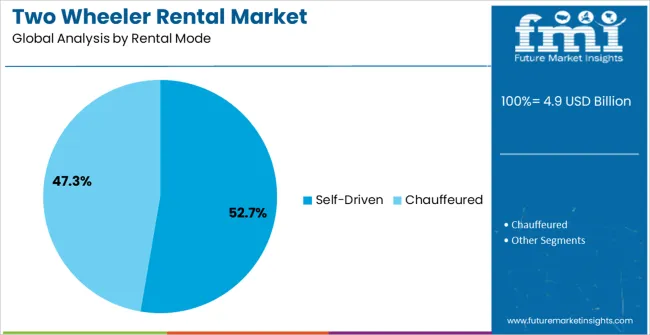

The two wheeler rental market is segmented by two wheeler type, sales channel, rental mode, and geographic regions. By two wheeler type, two wheeler rental market is divided into Scooter, Standard, Maxi, Enclosed, Three-Wheeled, Motorcycle, Cruiser, Sports Bikes, and Others. In terms of sales channel, two wheeler rental market is classified into Desktop Based, Mobile Based, and Direct Sales. Based on rental mode, two wheeler rental market is segmented into Self-Driven and Chauffeured. Regionally, the two wheeler rental industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The scooter segment is projected to hold 22.5% of the market revenue in 2025, establishing it as the leading two-wheeler type. Its growth is being driven by affordability, ease of maneuverability in congested urban areas, and suitability for short-distance commuting. Scooters offer low fuel consumption and maintenance costs, making them attractive for both rental companies and end-users seeking economical mobility solutions.

The availability of electric and conventional scooters enhances adoption across environmentally conscious consumers. Fleet operators prefer scooters due to their reliability, compact design, and ability to cater to a diverse customer base. Integration with digital booking platforms and GPS tracking improves fleet management and operational efficiency.

Rising awareness of sustainable and shared mobility solutions, coupled with increasing urban traffic challenges, further strengthens the scooter segment’s market position As urban populations grow and demand for flexible transportation increases, scooters are expected to maintain their leading share in the two-wheeler rental market, supported by operational efficiency and customer convenience.

The desktop-based sales channel segment is expected to account for 40.1% of the market revenue in 2025, making it the leading booking platform. Growth is driven by the increasing preference for organized rental services with structured pricing, reservation management, and customer support capabilities. Desktop-based platforms provide comprehensive interfaces for fleet operators to manage availability, bookings, and payments efficiently, ensuring seamless rental operations.

These systems also allow end-users to compare options, plan rentals in advance, and access detailed vehicle information, enhancing user experience. Integration with enterprise management software, CRM systems, and payment gateways further strengthens operational efficiency.

The platform’s ability to handle large volumes of bookings, maintain accurate records, and support analytics for decision-making has reinforced its adoption among operators As rental companies seek scalable, reliable, and feature-rich solutions to manage expanding fleets, desktop-based channels are expected to remain a primary driver of growth, providing both operational efficiency and improved customer satisfaction.

The self-driven rental mode segment is projected to hold 52.7% of the market revenue in 2025, establishing it as the leading rental mode. Growth is being fueled by the increasing demand for autonomous mobility experiences, flexibility in travel planning, and independence from drivers or third-party services. Customers prefer self-driven rentals for short-term commutes, leisure trips, and urban mobility needs, as they provide control over schedules and routes.

Fleet operators benefit from reduced operational costs and simplified service delivery while maintaining high asset utilization. Digital platforms enable real-time booking, vehicle tracking, and secure transactions, supporting seamless adoption of self-driven rentals.

Rising urban traffic congestion, increased awareness of cost-efficient travel, and growing preference for shared mobility further reinforce this segment’s market dominance As urban populations continue to expand and demand for convenient, independent transportation solutions rises, the self-driven rental mode is expected to remain the primary growth driver of the Two Wheeler Rental market.

Renting a two wheeler can be considered as an extension to the car rental system, wherein the lessee of two wheelers leases it to customers on per-day basis. Renting of such transportation vehicles has grown considerably over the years, especially within the working-class population who require two wheelers on an immediate basis.

Rise in tourism and international travel are the fundamental areas providing the necessary support for the growth of the two wheeler rental market. Cheap and easy availability of two wheelers supported by increasing number of small-sized start-ups also contribute to the sustenance of the market. Customers usually tend to avoid the purchase of two wheelers so as to avoid extra investment hence rent it out on smaller budgets.

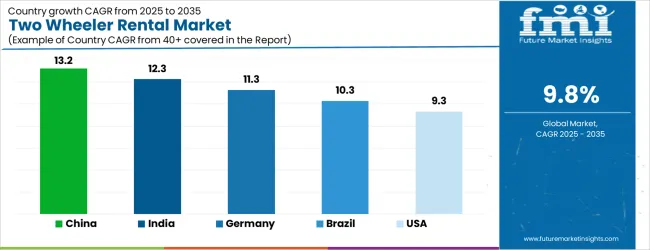

| Country | CAGR |

|---|---|

| China | 13.2% |

| India | 12.3% |

| Germany | 11.3% |

| Brazil | 10.3% |

| USA | 9.3% |

| UK | 8.3% |

| Japan | 7.4% |

The Two Wheeler Rental Market is expected to register a CAGR of 9.8% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 13.2%, followed by India at 12.3%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 7.4%, yet still underscores a broadly positive trajectory for the global Two Wheeler Rental Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 11.3%. The USA Two Wheeler Rental Market is estimated to be valued at USD 1.9 billion in 2025 and is anticipated to reach a valuation of USD 1.9 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 240.5 million and USD 139.9 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.9 Billion |

| Two Wheeler Type | Scooter, Standard, Maxi, Enclosed, Three-Wheeled, Motorcycle, Cruiser, Sports Bikes, and Others |

| Sales Channel | Desktop Based, Mobile Based, and Direct Sales |

| Rental Mode | Self-Driven and Chauffeured |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cycle, Dah Holdings, Provence Bike, EagleRider, Vegas Motorcycle Rentals, Moab Tour, Aloha Motorsports, AdMo-Tours, Dubbelju Motorcycle Rentals, Auto Europe, IMTBike, and GTA Exotics |

The global two wheeler rental market is estimated to be valued at USD 4.9 billion in 2025.

The market size for the two wheeler rental market is projected to reach USD 12.6 billion by 2035.

The two wheeler rental market is expected to grow at a 9.8% CAGR between 2025 and 2035.

The key product types in two wheeler rental market are scooter, standard, maxi, enclosed, three-wheeled, motorcycle, cruiser, sports bikes and others.

In terms of sales channel, desktop based segment to command 40.1% share in the two wheeler rental market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Two-Wheeler Lubricants Market Size and Share Forecast Outlook 2025 to 2035

Two Wheeler Anti-lock Braking System Market Size and Share Forecast Outlook 2025 to 2035

Two-Wheeler Aftermarket Components & Consumables Market Size and Share Forecast Outlook 2025 to 2035

Two Wheeler Suspension System Market Size and Share Forecast Outlook 2025 to 2035

Two Wheeler Safety Solutions Market Size and Share Forecast Outlook 2025 to 2035

Two Wheeler Handlebars Market Size and Share Forecast Outlook 2025 to 2035

Two Wheeler Fuel Injection System Market Size and Share Forecast Outlook 2025 to 2035

Two Wheeler Crash Guard Market Size and Share Forecast Outlook 2025 to 2035

Two-Wheeler Lead Acid Batteries Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Two Wheeler Accessories Aftermarket Growth - Trends & Forecast 2025 to 2035

Two Wheeler Crankshaft Market Growth – Trends & Forecast 2024-2034

Two Wheeler Backrest Market

Two Wheeler Electric Starter Magnet Market

Two Wheeler Chain Sprocket Kit Market

Two Wheeler Footrest Market

Two-wheeler ECU Market

Two Wheeler Fenders Market

Two Wheeler Seats Market

Two-wheeler Battery Market

Electric Two-Wheelers MRO Market: Optimizing Performance and Durability in the Electric Vehicle Age

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA