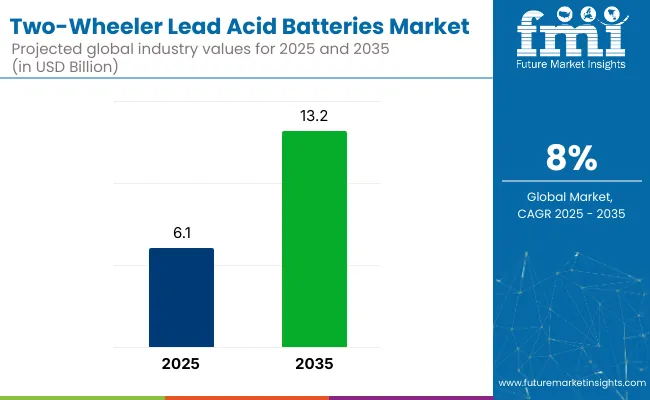

The two-wheeler lead acid batteries market is set to grow at a CAGR of 8%, rising from USD 6.1 billion in 2025 to USD 13.2 billion by 2035. Growth has been driven by the increasing adoption of two-wheelers in developing economies, where cost-sensitive consumers prefer reliable and affordable energy solutions. Lead acid batteries have continued to serve as the primary power source in both internal combustion and electric two-wheelers due to their established recycling processes, low upfront cost, and compatibility with entry-level vehicle models.

Innovations in the global market are focusing on improving energy density, lifespan, and charging efficiency. Advances in VRLA technology have made these batteries more compact and maintenance-free, enhancing their appeal for urban commuting.

Additionally, smart battery systems integrated with IoT allow for real-time monitoring of battery health and performance. New recycling technologies are also being developed to improve the sustainability of lead acid batteries, while lightweight materials are being used to reduce overall battery weight, enhancing vehicle performance.

| Metric | Value |

|---|---|

| Market Size (2025) | USD 6.1 billion |

| Market Size (2035) | USD 13.2 billion |

| CAGR (2025 to 2035) | 8% |

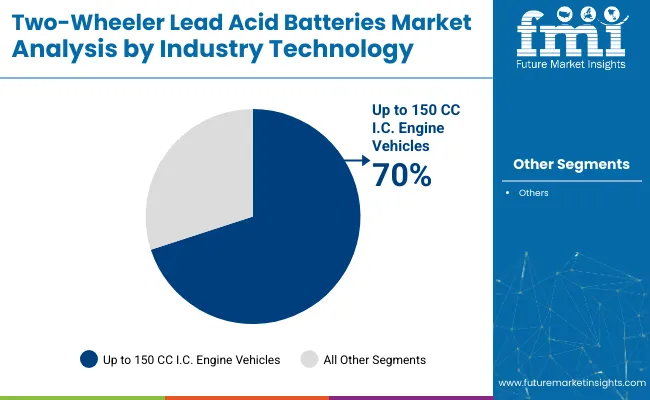

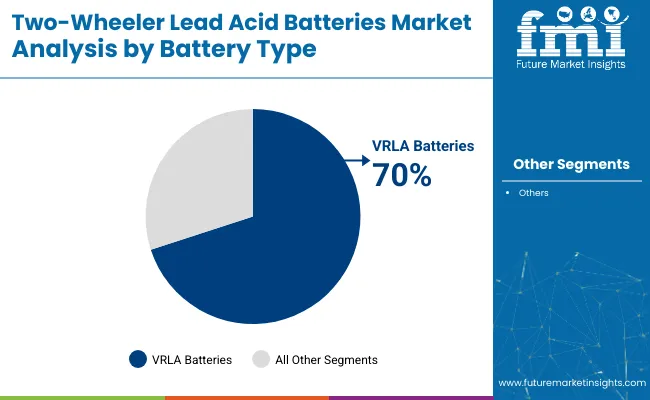

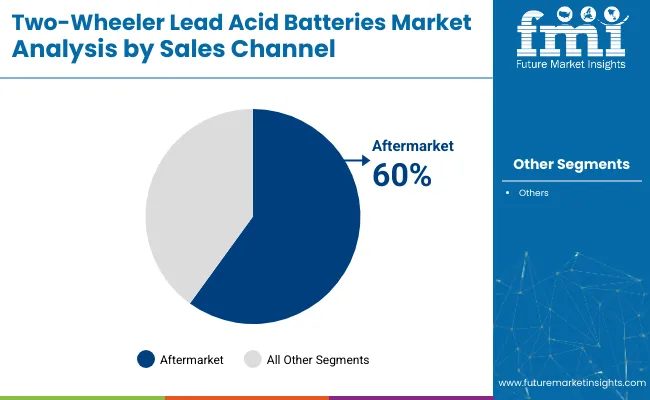

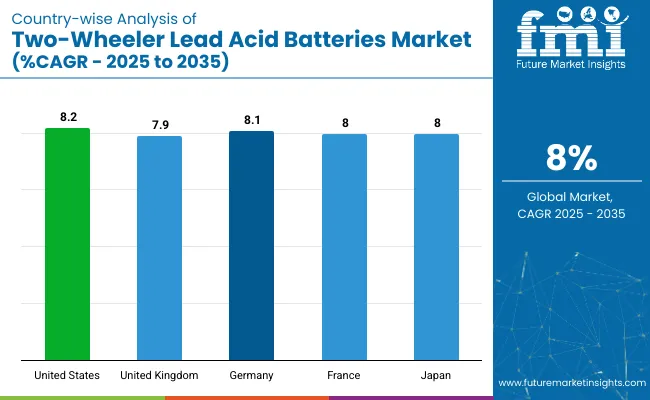

The USA is expected to be the fastest-growing market with a projected CAGR of 8.2%. I.C. Engine (up to 150 CC) vehicles will lead the industry technology segment with a 70% market share by 2025. VRLA batteries will dominate the battery type segment, capturing 70% of the market. Germany and France are also expected to witness significant growth, with CAGRs of 8.1% and 8.0%, respectively.

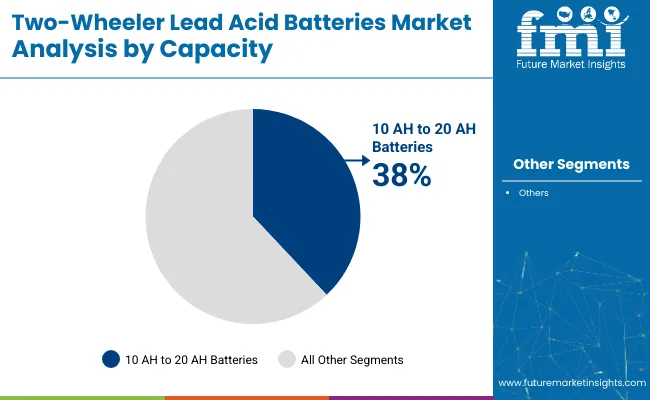

The two-wheeler lead acid batteries market is segmented into capacity, industry technology, two-wheeler type, battery type, sales channel, and region. By capacity, the market is divided into less than 5 AH, 5 AH to 10 AH, 10 AH to 20 AH, and above 20 AH. By industry technology, the market is classified into I.C. engine (up to 150 CC, 151-300 CC, 301-500 CC, and above 500 CC) and electric.

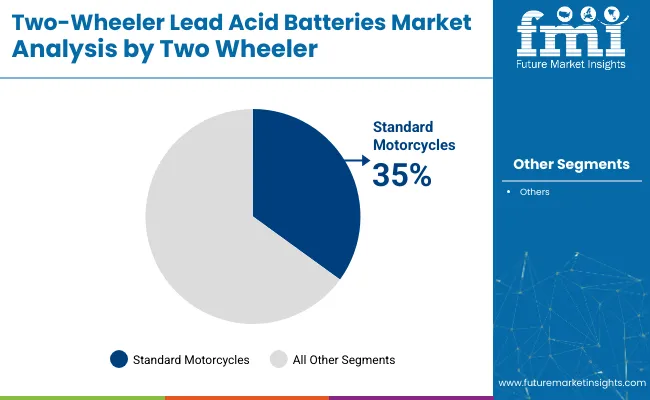

By two wheeler type, the market is categorized into motorcycles (standard, cruisers, sports, mopeds, and electric), scooters (standard, maxi, enclosed, three-wheeled, and electric). Based on battery type, the market is bifurcated into VRLA batteries and flooded.

By sales channel, the market is segmented into OEMs and aftermarket. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and the Middle East and Africa.

The capacity segment is expected to be led by 10 AH to 20 AH batteries, capturing approximately 38% of the global market share in 2025.

The standard motorcycles segment in the two wheeler lead acid batteries market is estimated to hold nearly 35% of the total market share in 2025.

The industry technology segment is expected to be LED by I.C. engine vehicles with up to 150 CC capacity, accounting for approximately 70% of the global market share in 2025.

The battery type segment is projected to be led by VRLA (Valve-Regulated Lead Acid) batteries, capturing nearly 70% of the global market share in 2025.

The sales channel segment is anticipated to be led by the aftermarket, accounting for approximately 60% of the global market share in 2025.

The two-wheeler lead acid batteries market is being driven by steady growth, fueled by the widespread adoption of cost-effective energy storage solutions, the sustained use of lead-acid batteries in electric scooters and motorcycles across emerging economies, and continued advancements in battery recycling and sealed maintenance-free technologies.

Recent Trends in the Two-Wheeler Lead Acid Batteries Market

Challenges in the Two-Wheeler Lead Acid Batteries Market

The global two-wheeler lead acid batteries market is growing steadily due to rising urbanization, increasing adoption of electric two-wheelers, and advancements in battery technology. The market benefits from low upfront costs, recycling processes, and innovations in VRLA technology for improved performance.

The two-wheeler lead acid batteries market in the USA is projected to grow at a CAGR of 8.2% from 2025 to 2035. Growth has been supported by the expanding use of motorcycles and e-scooters in delivery services and urban transportation.

The UK two-wheeler lead acid batteries market is expected to grow at a CAGR of 7.9% from 2025 to 2035. Market expansion has been fueled by the rising adoption of e-scooters and motorcycles for personal and last-mile mobility.

Germany’s two-wheeler lead acid batteries market is forecasted to grow at a CAGR of 8.1% through 2035. Strong demand for two-wheelers in both commuter and leisure categories has been observed, with lead acid batteries being preferred for their affordability and compliance with EU recycling standards.

France’s two-wheeler lead acid batteries market is anticipated to expand at a CAGR of 8.0% from 2025 to 2035. Urban e-mobility trends have boosted the demand for scooters and electric mopeds, supported by lead acid batteries.

Japan two-wheeler lead acid batteries demand is projected to register a CAGR of 8.0% during the 2025 to 2035 forecast period. The market has been shaped by technological advancements and growing deployment of electric two-wheelers.

The two-wheeler lead acid batteries market is moderately consolidated, with major suppliers holding significant shares while smaller firms compete across regions. Tier-one players like EnerSys, Banner Batteries, and Tianneng Power focus on competitive pricing, innovation in VRLA and Thin Plate Pure Lead (TPPL) technologies, and strategic partnerships.

These companies prioritize maintenance-free VRLA technology advancements and explore partnerships for battery recycling and aftermarket distribution. Pricing remains competitive through economies of scale and regional integration, while manufacturing capabilities are expanded with strategic plant relocations and facility upgrades to strengthen market presence and increase capacity.

Recent Two-Wheeler Lead Acid Batteries Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 6.1 billion |

| Projected Market Size (2035) | USD 13.2 billion |

| CAGR (2025 to 2035) | 8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameters | Revenue in USD billions/Volume in million units |

| By Capacity Analyzed | Less than 5 AH, 5 AH to 10 AH, 10 AH to 20 AH, Above 20 AH |

| By Industry Technology Analyzed | I.C. Engine (Up to 150 CC, 151-300 CC, 301-500 CC, Above 500 CC), Electric |

| By Two-Wheeler Analyzed | Motorcycles (Standard, Cruisers, Sports), Mopeds, Scooters (Standard, Maxi, Enclosed, Three-Wheeled), Electric |

| By Battery Type Analyzed | VRLA Batteries and Flooded |

| By Sales Channel Analyzed | OEMs and Aftermarket |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East, and Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Banner Batteries, Dynavolt Renewable Energy Technology Co., Ltd., Tianneng Power International Ltd., Leoch International Technology Limited, Batterie Unibat, EnerSys Inc., Chaowei Power Holdings Limited, Southern Batteries Pvt. Ltd., BS-BATTERY, KOYO BATTERY. |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis. |

The global market is valued at USD 6.1 billion in 2025.

The market is forecasted to reach USD 13.2 billion by 2035, reflecting a CAGR of 8%.

I.C. Engine (up to 150 CC) vehicles will lead the market by industry technology, holding a 70% market share in 2025.

VRLA batteries will dominate the market by battery type, capturing a 70% market share in 2025.

The USA is projected to grow at the fastest rate, with a CAGR of 8.2% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lead-free Brass Rods Market Size and Share Forecast Outlook 2025 to 2035

Lead Smelting and Refining Market Size and Share Forecast Outlook 2025 to 2035

Lead Management Market Size and Share Forecast Outlook 2025 to 2035

Lead Mining Software Market Size and Share Forecast Outlook 2025 to 2035

Lead Intelligence Software Market Size and Share Forecast Outlook 2025 to 2035

Lead Capture Software Market Size and Share Forecast Outlook 2025 to 2035

Lead Scoring Software Market Size and Share Forecast Outlook 2025 to 2035

Lead-to-Account Matching and Routing Software Market Size and Share Forecast Outlook 2025 to 2035

Leadership Development Program Market Analysis - Size, Share, and Forecast 2025 to 2035

Lead Market Growth - Trends & Forecast 2025 to 2035

Examining Market Share Trends in Leadership Development Programs

Lead Zirconate Titanate Market Size & Trends 2025

Lead Stearate Market

Leadscrew Market

Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Lead Acid Battery Recycling Market Size and Share Forecast Outlook 2025 to 2035

KNN Lead-free Piezoelectric Ceramics Market Size and Share Forecast Outlook 2025 to 2035

BNT Lead-free Piezoelectric Ceramics Market Size and Share Forecast Outlook 2025 to 2035

Online Leadership Development Program Market Forecast and Outlook 2025 to 2035

Custom Leadership Development Program Market Growth, Trends and Forecast from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA