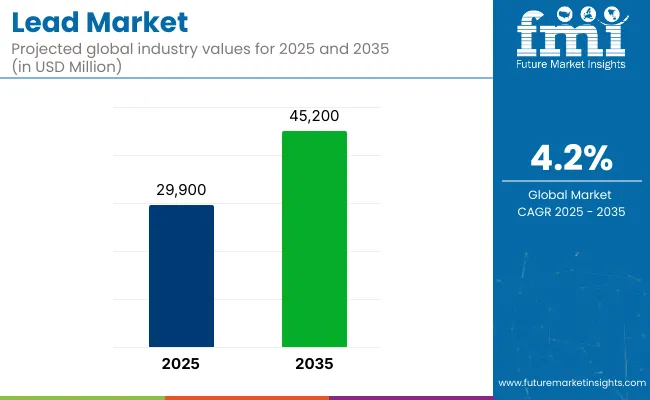

The global lead market is estimated to be valued at USD 29,900 million in 2025 and is forecast to reach USD 45,200 million by 2035, registering a compound annual growth rate of 4.2% during the forecast period.

Growth in the lead market is being influenced by the global shift toward energy security and electrification, with rising investments in renewable energy and electric vehicle infrastructure. In this context, lead-acid batteries are being retained as a preferred energy storage solution in developing economies due to their recycling potential and existing infrastructure compatibility.

A large portion of the global refined lead supply, estimated to exceed 85 percent, is being sourced from secondary production routes, reducing dependency on primary mining and aligning with sustainability mandates.

Environmental compliance and occupational safety standards are imposing stricter controls on lead smelting and battery handling operations, especially in regions such as North America and Western Europe.

These regions are witnessing modernization of production facilities and the integration of closed-loop recycling systems to minimize emissions and material losses. In contrast, capacity expansions for both primary and secondary lead production are being undertaken in Asia Pacific, particularly in China and India, where demand is reinforced by infrastructure development and industrial battery requirements.

Applications in radiation protection for healthcare and nuclear facilities, along with continued use in ammunition and specialty alloys, are supporting stable demand across strategic sectors. While regulatory frameworks have phased out lead from paints, fuels, and other consumer-facing applications, industrial use cases remain resilient.

Compliance with EPR mandates is driving efforts to enhance traceability and modernize supply chains. Capital is being allocated toward battery recycling innovation and digital infrastructure to improve material recovery rates. Competitive focus is shifting toward low-impact operations and regional self-sufficiency in refined lead supply.

Substitutes such as lithium, zinc, and tin are being explored in battery chemistries, shielding, and alloys to reduce dependence on lead, especially in regions with stringent environmental and health regulations.

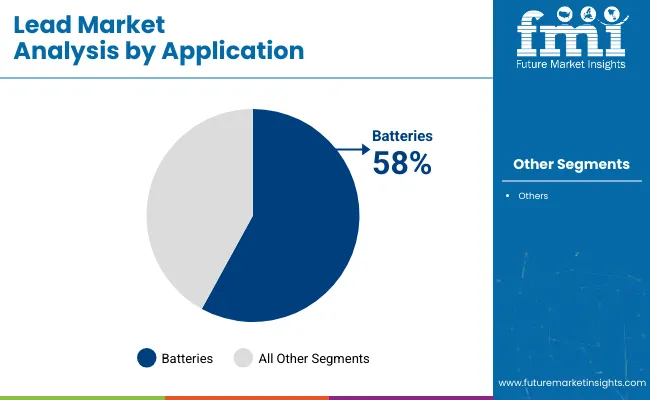

The battery application segment is projected to account for approximately 58% of the global lead market share in 2025 and is expected to grow at a CAGR of 4.3% through 2035. Lead-acid batteries remain the primary application, widely used in automotive starting, lighting, and ignition (SLI) systems, uninterruptible power supplies (UPS), electric bikes, and industrial energy storage.

As vehicle electrification and backup power systems expand globally, particularly in emerging economies, demand for lead-acid batteries continues to rise. Recycling infrastructure is also well-developed in this segment, enabling sustainable sourcing of secondary lead, which supports cost efficiency and supply continuity for battery manufacturers.

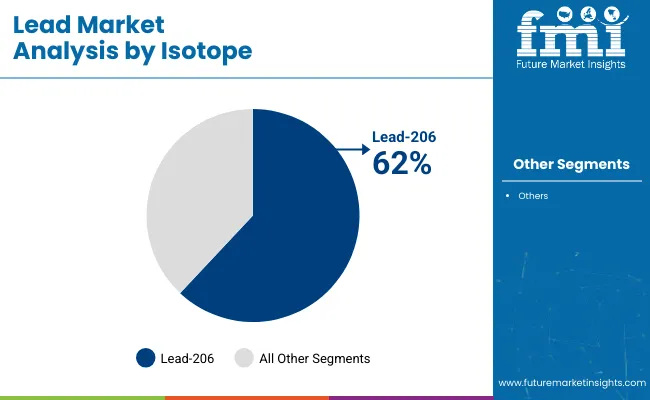

Lead 206 is estimated to hold approximately 62% of the global lead market share in 2025 and is projected to grow at a CAGR of 4.1% through 2035. This isotope, characterized by its stable molecular structure and refined purity, is commonly used in high-precision alloys and in lead-acid battery electrodes due to its superior electrical conductivity and corrosion resistance.

As industrial standards shift toward more consistent material performance, the use of Lead 206 in grid manufacturing and radiation shielding is expected to continue. Its adoption remains strongest in energy storage, telecommunications infrastructure, and medical shielding components, where purity and reliability are essential.

Supply Chain Disruptions and Resource Constraints

Mining restrictions, supply chain inefficiencies, and resource depletion are some of the issues plaguing the lead market. The volatility in the availability of raw materials for lead, along with stringent environmental regulations concerning lead mining and processing, has driven up operational costs for lead manufacturers.

Moreover, the influence of geopolitics, and limitations on trade impact the free procession of lead across the world market. To address such obstacles, firms have to allocate capital in effective distribution channels, sustainable material acquisition practices, and alternative lead extraction methods.

Environmental and Health Concerns

One of the biggest threats to industry comes from the growing awareness of the toxic effects of lead exposure. Strict legislation on lead use in paints, batteries, and industrial applications further limits market growth. Environmental concerns stemming from lead contamination and poor recycling also affect production. In order for this response to be effective, companies must begin to implement lead recycling initiatives, meet environmental safety standards, and produce lead-free alternatives.

Rising Demand for Lead-Acid Batteries

Widespread adoption of lead-acid batteries across automotive, industrial, and renewable energy applications The demand for lead-acid battery has been driven by the growing deployment of electric vehicles (EVs), uninterrupted power supply (UPS) systems, and grid energy storage systems. Furthermore, businesses that focus on the development of innovative battery technologies, recycling solutions, and sustainable manufacturing processes will be better positioned to thrive in this rapidly changing industry.

Technological Innovations in Lead Recycling

Lead acid batteries are one of the most recycled products globally, with well-established recycling technologies in place. This trend of adopting efficient lead recovery processes, is driven by the increasing importance placed on circular economy principles in industry. Advanced recycling technologies, automated processing plants, and green refining processes can hold the key to improved profitability, within regulatory limits to which the sector typically adheres.

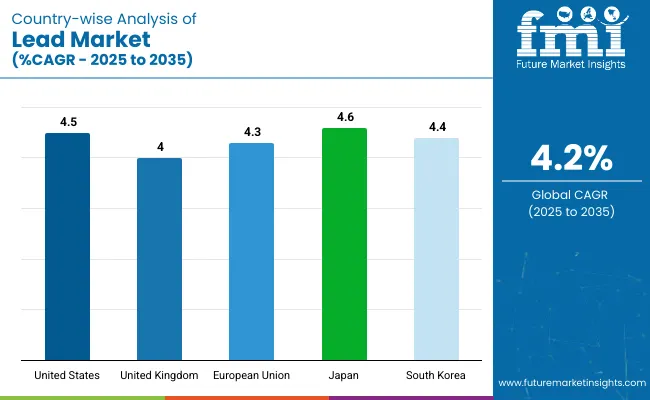

The demand for lead in battery production is driving the USA lead market due to the growing demand in automotive and industrial applications. Increasing usage of lead-acid batteries in renewable energy applications is one of the most important driving forces towards the growth of the market.

Moreover, growing investments in recycling programs, along with government regulation encouraging sustainable lead use, are driving the market dynamics. Infrastructure projects are expanding and driving up lead demand as is the construction industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.5% |

The UK lead market continues to grow steadily owing to the development of battery & technology as well as growing use in the healthcare, telecom & other industry. Increasing electric vehicle (EV) charging infrastructure and backup power system demand is driving the need for lead-based energy systems.

Moreover, stringent environmental regulations are driving investments in lead recycling and sustainable sourcing practices, further driving market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.0% |

Some of the factors driving the market include surging demand in automotive, energy storage and industrial sectors. Demand for lead-acid batteries is propelled as Germany, France, and Italy are focusing on sustainable battery technologies.

At the same time, the European Union’s circular economy efforts are prioritizing lead recycling, lessening reliance on raw material extraction. Additionally, the growth of the market can be attributed to the significant utilization of lead for protective shielding from exposure to radiation, especially in the medical sector.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.3% |

The need for energy storage solutions resulting in adoption of energy efficient solutions is driving the core market of Japan. A focus in the country on research and development of battery technologies, including hybrid and electric vehicles, is spurring lead demand.

Also, the trend in market prevailing is being impacted as the medical industry to rely on lead for shielding against radiation in diagnostic imaging equipment. Rising demand for lead-acid batteries in backup power systems, such as those for data centers and communication networks, is also fueling demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.6% |

They are primarily driven in the South Korean market for the growing electronics and energy storage industries. Growing adoption of UPS (uninterruptible power supply) systems in commercial buildings, data centers, and industrial facilities is a key growth driver.

Another example of how trends and market forces are being influenced is through the government’s push toward battery recycling initiatives and eco-friendly lead production processes. Demand is also being bolstered by the incorporation of lead into protective coatings and specialized building materials.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.4% |

The global lead market is moderately fragmented, with a strong presence of integrated producers that control both mining and recycling assets. Key players are focusing on sustainable practices and investing in eco-friendly smelting, battery recycling plants, and emission control technologies to comply with tightening regulations. Asia-Pacific remains the epicenter of production and consumption, with China leading in both primary and secondary lead production.

Market participants are entering into long-term contracts with battery OEMs and infrastructure developers to secure consistent demand. The emergence of ESG-focused investors is reshaping the industry, prompting transparency in sourcing and production practices. As the circular economy gains momentum, companies capable of offering closed-loop solutions from scrap collection to refined lead delivery will enjoy a competitive edge.

The overall market size for lead market was USD 29,900 million in 2025.

The lead market expected to reach USD 45,200 million in 2035.

Increasing demand from the automotive sector, expanding battery production, infrastructure development, and rising applications in radiation shielding will drive the lead market during the forecast period.

The top 5 countries which drives the development of lead market are USA, UK, Europe Union, Japan and South Korea.

Lead-206 segment driving market growth to command significant share over the assessment period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lead-free Brass Rods Market Size and Share Forecast Outlook 2025 to 2035

Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Lead Acid Battery Recycling Market Size and Share Forecast Outlook 2025 to 2035

Lead Smelting and Refining Market Size and Share Forecast Outlook 2025 to 2035

Lead Management Market Size and Share Forecast Outlook 2025 to 2035

Lead Mining Software Market Size and Share Forecast Outlook 2025 to 2035

Lead Intelligence Software Market Size and Share Forecast Outlook 2025 to 2035

Lead Capture Software Market Size and Share Forecast Outlook 2025 to 2035

Lead Scoring Software Market Size and Share Forecast Outlook 2025 to 2035

Lead-to-Account Matching and Routing Software Market Size and Share Forecast Outlook 2025 to 2035

Leadership Development Program Market Analysis - Size, Share, and Forecast 2025 to 2035

Examining Market Share Trends in Leadership Development Programs

Lead Zirconate Titanate Market Size & Trends 2025

Lead Stearate Market

Leadscrew Market

KNN Lead-free Piezoelectric Ceramics Market Size and Share Forecast Outlook 2025 to 2035

BNT Lead-free Piezoelectric Ceramics Market Size and Share Forecast Outlook 2025 to 2035

Online Leadership Development Program Market Forecast and Outlook 2025 to 2035

Custom Leadership Development Program Market Growth, Trends and Forecast from 2025 to 2035

Europe Leadership Development Program Market - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA