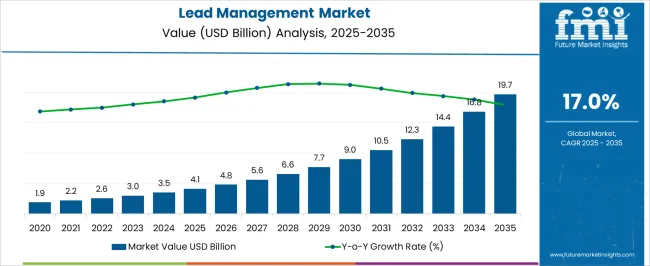

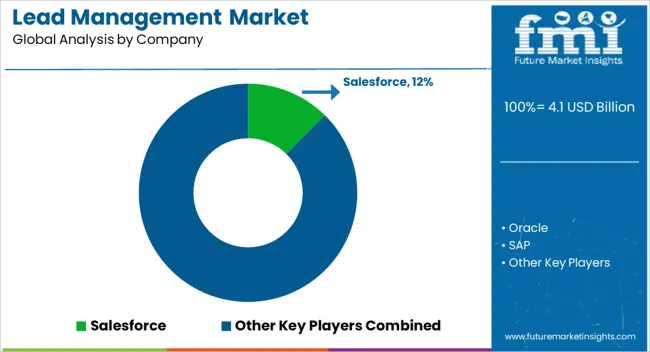

The Lead Management Market is estimated to be valued at USD 4.1 billion in 2025 and is projected to reach USD 19.7 billion by 2035, registering a compound annual growth rate (CAGR) of 17.0% over the forecast period.

| Metric | Value |

|---|---|

| Lead Management Market Estimated Value in (2025 E) | USD 4.1 billion |

| Lead Management Market Forecast Value in (2035 F) | USD 19.7 billion |

| Forecast CAGR (2025 to 2035) | 17.0% |

The lead management market is expanding steadily, propelled by the growing emphasis on structured customer acquisition and conversion strategies across both B2B and B2C environments. Enterprises are increasingly leveraging advanced technologies to streamline lead qualification, scoring, distribution, and nurturing processes. The market's growth is also being accelerated by the integration of AI-driven analytics, CRM platforms, and omnichannel marketing tools that enable real-time engagement and customer segmentation.

Demand for lead management solutions has further increased as businesses seek to shorten sales cycles and improve customer targeting with data-driven decisions. The proliferation of cloud-based platforms has allowed greater scalability and seamless integration with enterprise applications, supporting remote operations and cross-functional alignment.

In parallel, the rising importance of compliance with data privacy regulations and accountability in lead tracking continues to shape platform development As companies prioritize lead quality over volume, the market is expected to evolve with more predictive, automated, and insight-driven solutions tailored to industry-specific needs.

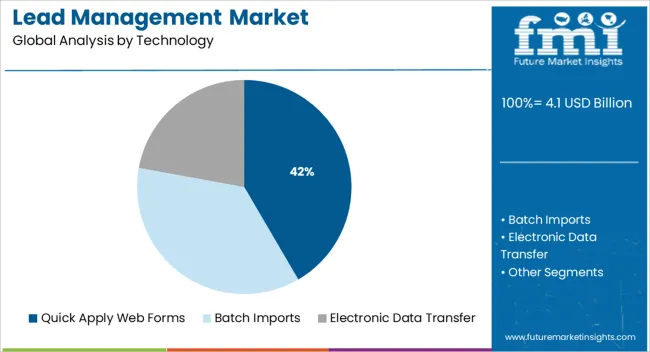

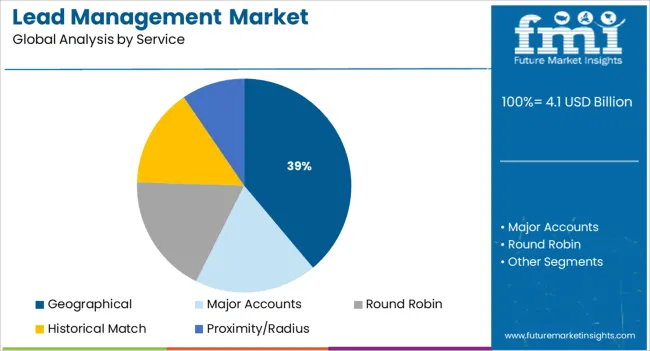

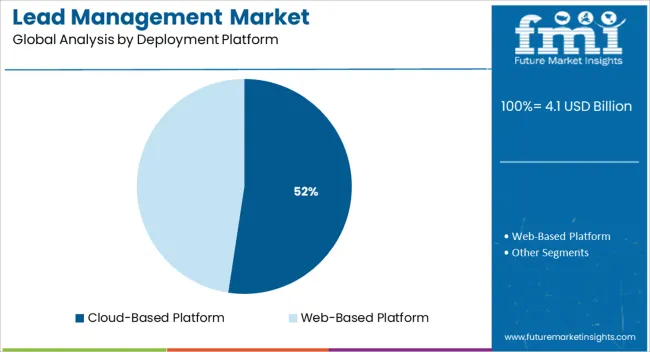

The market is segmented by Technology, Service, Deployment Platform, and End User and region. By Technology, the market is divided into Quick Apply Web Forms, Batch Imports, and Electronic Data Transfer. In terms of Service, the market is classified into Geographical, Major Accounts, Round Robin, Historical Match, and Proximity/Radius. Based on Deployment Platform, the market is segmented into Cloud-Based Platform and Web-Based Platform. By End User, the market is divided into Financial Services Sector, Healthcare, Professional Services Sector, Sports & Entertainment, Non-Profit Organizations, Education Sector, and Hospitality, Travel & Tourism. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The quick apply web forms segment is expected to contribute 41.6% of the total revenue share in the lead management market in 2025, making it the leading technology segment. This growth has been supported by the increasing preference for user-friendly, responsive, and conversion-optimized lead capture mechanisms across websites and landing pages.

Businesses have adopted quick apply forms as a primary method to reduce drop-off rates and improve lead collection efficiency, especially in time-sensitive sectors such as recruitment, insurance, and education. The segment’s rise has also been influenced by advancements in form personalization, embedded analytics, and seamless CRM integrations that allow instant data flow into sales pipelines.

The compatibility of web forms with dynamic content and multi-device formats has enabled businesses to adapt their engagement strategies across digital touchpoints The ability to configure, A/B test, and optimize these forms through no-code interfaces has further contributed to their widespread implementation in modern lead generation ecosystems.

The geographical segment is projected to hold 38.9% of the revenue share within the service category of the lead management market in 2025, establishing it as the leading service type. This segment’s dominance is being driven by the increasing need for location-based targeting, localized campaigns, and regional sales team enablement.

Enterprises operating across multiple markets have prioritized geographically segmented lead routing and qualification processes to align with regional customer behavior and regulatory frameworks. The rise of hyperlocal marketing, supported by geotargeting tools and AI-driven prospecting engines, has enhanced the relevance and conversion of leads based on geographic attributes.

Additionally, multilingual content delivery, regional compliance considerations, and proximity-based personalization have improved the effectiveness of service-level engagements Businesses leveraging geographical segmentation have seen measurable improvements in lead relevance, response rates, and pipeline velocity, making this service category essential in modern, distributed sales operations.

The cloud based platform segment is forecast to capture 52.4% of the total revenue share in the deployment platform category of the lead management market in 2025, securing its position as the most adopted deployment model. This growth is being influenced by the rising demand for scalable, flexible, and remotely accessible lead management solutions. Cloud based platforms offer seamless integration with CRM systems, marketing automation tools, and communication suites, enabling holistic and real-time lead tracking.

Enterprises have increasingly turned to cloud infrastructure to support hybrid workforces, reduce IT overhead, and accelerate digital transformation strategies. The ability to deploy platform updates instantly, ensure high availability, and maintain data integrity across distributed teams has reinforced the preference for cloud models.

Enhanced security protocols, user access control, and compliance alignment with global standards have further strengthened cloud adoption in sectors with stringent data governance needs As sales and marketing convergence continues, cloud based lead management platforms are expected to remain the foundation for agile and insight-driven customer acquisition strategies.

As new industries or businesses are being established around the world, and large global companies are being acquired, the demand for lead management is expected to grow rapidly in the near future.

Additionally, the demand for lead management is anticipated to increase with the increased adoption of lead management by small and medium-sized businesses (SMBs) in the market.

Marketing and sales teams are increasingly collaborating, which drives the demand for lead management in the market. Furthermore, incorporating conversational artificial intelligence into lead management software enhances the ability of marketers to automate lead nurturing and lead enrichment activities.

Further, it reduces sales costs, makes it easier for businesses to reach more people, as well as helps sales teams focus their efforts on the best leads to generate sales in the market. In the near future, Chabot will become an integral part of customer interaction, driving the growth of the lead management software sector in the market.

One of the keys to success for many businesses over the long term is the implementation of an effective and efficient sales pipeline. Modern tools offer powerful lead management solutions to help sales managers make the most of their existing prospects and new leads.

Lead management tools that automate the process of monitoring prospect behavior can help companies increase revenue by engaging in timely, individual interactions with prospects. By removing duplicates and merging customer data from disparate sources, automation enhances the quality of customer data.

Lead management markets are having difficulty convincing channel partners of fair lead distribution systems. The process of following up with leads is difficult because it's challenging to get their attention, and thus losing out on potential sales opportunities in the market. Reporting problems, such as multi-line partners selling their products at a lower rate than their competitors, will hinder the growth of the market.

Additionally, channel managers need to be convinced to avoid manually revising leads before they are allotted, which is yet another factor that will hinder the market from expanding. It is expected that the global lead management market will be restrained by strategies that include complex combinations of direct sales offices and resellers in the market.

However, leading management software can be very expensive to implement, which may lead to a decline in market growth. Using an outdated lead management system or a manual system can lead to losing sales opportunities as the number of leads grows. The most common cause is the failure to complete tasks or the failure to address them properly for a period of time. These factors are all set to hinder the growth of the market in the coming years.

The mortgage market in North America has changed positively, making this region the market leader in the global lead management market. This region is expected to hold 32.2% of the global market share in 2025.

The demand for cloud-based solutions, as well as the increase in social interaction, has propelled the growth of the market for lead management in this region. Furthermore, this region also has a highly developed infrastructure and is home to many leading software companies which has added to the growth of this market.

Lead management software is most commonly used in Canada and the United States. In addition, lead management is also expected to grow in this region as chronic diseases like cancer and diabetes will drive greater utilization of health care services, in turn promoting the growth of lead management services.

Due to increasing digital connectivity in these regions, the APAC accounts for a considerable share of the global lead management market. The economies of the Asia-Pacific region are also estimated to have a positive impact on the future growth of the region. A significant increase in IT-enabled service (ITeS) providers in this region have led to an increase in demand for lead management software in the market.

A majority of lead management software throughout the region is consumed by developing countries such as India and China. The top five revenue-generating companies in the lead management software market are Adobe, IBM, Salesforce, Oracle, and Microsoft. Amidst fierce competition, these companies are focusing on inorganic growth to keep their businesses afloat.

Lead management services based on the cloud are expected to grow in the near future. As a result of their lower costs and greater flexibility, businesses prefer SaaS and cloud-based applications over on-premises applications.

Lead tracking, lead sorting, and lead distribution are among the key functions that cloud-based lead management systems serve to facilitate the organization. The demand for inbound lead tracking has also contributed to cloud-based lead management's growth.

As technology becomes more complex, customers are seeking more flexible, high-performance cloud platforms in the market. It is also of crucial importance for customers to be able to access the same cloud platform options conveniently and intuitively in order to take advantage of them. These factors have therefore led to an increase in demand for cloud-based lead management in the market.

Hospitals from various regions are contributing to the growth of lead management in the market. Due to the rising number of patients and chronic diseases around the world, hospitals are gaining a competitive advantage by optimizing their lead management strategies in the market.

A growing digital transformation in the healthcare sector, as well as the use of hospital apps for online consultation, has further contributed to the growth in lead management. With the increase in patient volume, it has become increasingly difficult for hospitals in the market to monitor patients and ensure appointments are managed in a timely manner.

While securely managing patient information, organizations must centralize leads across different regions. Thus, it is expected that market demand for lead management in hospitals will grow significantly over the next few years.

Business models constantly change over time, mainly due to technological advancements and market fluctuations, triggering exciting new trends in the market.

The cloud-based platforms offered by these technology-based start-ups are complemented by a wide range of lead tracking and management activities. Since numerous patient tracking platforms utilize lead management, most cloud-based lead management applications are deployed within hospitals.

fSeveral leading lead management service providers have implemented strategies such as mergers and acquisitions, as well as providing cloud-based platforms and mobile applications which are facilitating user adoption.

Key players in the global lead management market include Salesforce, Oracle, SAP, IBM, Microsoft, Siebel CRM Systems, Inc., MarketNet, Vovici-Verint, Pipedrive, Inside sales box, Drishti, Sales optimize, ProsperWorks, Zoho, Nutshell, Marketo, Hubspot, DemandGen International, Inc., VanillaSoft, NAVIS, SalesLoft, Drift, Outreach, LeadSquared and Others.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 17% from 2025-2035 |

| Market Value in 2025 | USD 4.1 billion |

| Market Value in 2035 | USD 19.7 billion |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and CAGR from 2025-2035 |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Technology, Service, Deployment, End User, Region |

| Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East and Africa |

| Key Countries Profiled | USA, Canada, Brazil, Mexico, Germany, UK, France, Spain, Italy, China, Japan, South Korea, Malaysia, Singapore, Australia, GCC, South Africa, Israel |

| Key Companies Profiled |

Salesforce; Oracle; SAP; IBM; Microsoft; Siebel CRM Systems, Inc.; MarketNet; Vovici-Verint; Pipedrive; Inside Sales Box; Drishti; Sales Optimize; ProsperWorks; Zoho; Nutshell; Marketo; Hubspot; DemandGen International, Inc.; VanillaSoft; NAVIS |

| Customization | Available Upon Request |

The global lead management market is estimated to be valued at USD 4.1 billion in 2025.

The market size for the lead management market is projected to reach USD 19.7 billion by 2035.

The lead management market is expected to grow at a 17.0% CAGR between 2025 and 2035.

The key product types in lead management market are quick apply web forms, batch imports and electronic data transfer.

In terms of service, geographical segment to command 38.9% share in the lead management market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Key Opinion Leader Management Market Size, Growth, and Forecast for 2025–2035

Lead-free Brass Rods Market Size and Share Forecast Outlook 2025 to 2035

Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Lead Acid Battery Recycling Market Size and Share Forecast Outlook 2025 to 2035

Lead Smelting and Refining Market Size and Share Forecast Outlook 2025 to 2035

Lead Mining Software Market Size and Share Forecast Outlook 2025 to 2035

Lead Intelligence Software Market Size and Share Forecast Outlook 2025 to 2035

Lead Capture Software Market Size and Share Forecast Outlook 2025 to 2035

Lead Scoring Software Market Size and Share Forecast Outlook 2025 to 2035

Lead-to-Account Matching and Routing Software Market Size and Share Forecast Outlook 2025 to 2035

Leadership Development Program Market Analysis - Size, Share, and Forecast 2025 to 2035

Lead Market Growth - Trends & Forecast 2025 to 2035

Examining Market Share Trends in Leadership Development Programs

Lead Zirconate Titanate Market Size & Trends 2025

Lead Stearate Market

Leadscrew Market

KNN Lead-free Piezoelectric Ceramics Market Size and Share Forecast Outlook 2025 to 2035

BNT Lead-free Piezoelectric Ceramics Market Size and Share Forecast Outlook 2025 to 2035

Online Leadership Development Program Market Forecast and Outlook 2025 to 2035

Custom Leadership Development Program Market Growth, Trends and Forecast from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA