The custom leadership development program market globally was USD 6.1 billion in 2025 and is set to grow with a 9.4% CAGR rate from 2025 to 2035. Global custom leadership development programs industry size is set to reach USD 15 billion by the year 2035. Growing demand from companies for customized, strategic talent solutions linking leadership competencies to changing business needs is one of the major driving factors for such growth.

Custom programs, in contrast to off-the-shelf offerings, give companies the flexibility to tackle targeted leadership issues-whether managing digital change, navigating multigenerational workforces, or creating inclusive decision-making environments. Custom programs are crafted with company objectives in mind and feature customized content, delivery strategies, and competency models that can change in synchronization with business imperatives.

The increased popularity of virtual and blended styles of work has fueled the demand for tailored leadership programs harder than ever before. Simulation training, virtual coaching, and geography-enabled asynchronous modules that are responsive to the decentralized forces of leadership in the contemporary age are all at the top of organizational minds these days.

As the world adopts globally dispersed workforces, culturally sensitive and geography-enabled leadership training is more imperative than ever before.Technology is also coming. AI-powered evaluation, behavioral insights, and real-time performance tracking are being integrated into bespoke leadership programs, making data-driven personalization at scale possible. These features not only make programs more effective but also enable L&D teams to track ROI and connect leadership development to business outcomes.

The heightened emphasis on sustainability, ESG leadership, and ethical governance is transforming the definition of leadership for industries. Firms are looking for programs that prepare leaders to work in complexity, catalyze responsible innovation, and establish stakeholder trust. This remapping is compelling providers to develop integrated programs that demonstrate emotional intelligence, resilience, and systems thinking in addition to core management skills.

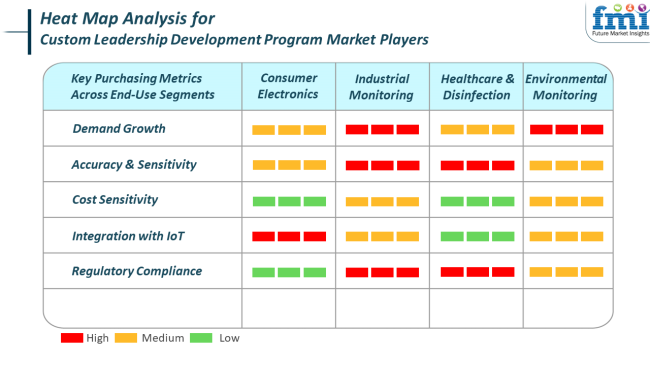

Strategic commercial goals and the operational realities of each end-user industry mainly inform custom-made leadership development programs. The consumer electronics sector requires constant flexibility in leadership development as product volume changes rapidly, new needs emerge and timeliness, creativity, plus cross-functionality are hot issues today.

Technical excellence and compliance with the regulations are the main driving forces for using the industrial monitoring and environmental segments concerning custom development programs. On the requirement for precision, conformance, and integration within the digital ecosystems, companies maintain very high expectations, which means such bespoke programs focus on operational excellence and safety leadership are the most relevant.

While healthcare and disinfection areas are similar in compliance requirements, they also care about aspects like emotional intelligence, resilience, and communication-especially in high-stress situations. This cost sensitivity is indicative of the requirement for quality outcomes that would make investment worthwhile but also within the reach of mid-sized organizations and public institutions looking to develop leadership capacity in mission-critical roles.

The industry, though growing, faces specific risks based on economic, organizational, and delivery complexities. Scalability is a prime among them. Customization tends to increase the resources needed, capping scalability for providers and pricing limits for buyers, especially in emerging markets or mid-sized companies.

There is also the risk of misalignment between program design and true business issues. Badly scoped leadership initiatives may not provide quantifiable returns, promoting stakeholder disengagement and budget reductions. This risk is intensified when leadership development is isolated from other talent or business strategies, and integration becomes the key to long-term success.

Finally, over-reliance on electronic delivery risks diluting the interpersonal and experiential aspects of leadership development. Technology supports reach and customization but cannot fully replace the dynamics of peer-to-peer conversation, mentoring, and moment-by-moment feedback. The balance between digital convenience and humanness is a critical challenge for providers who want to stay engaged and effective in the forecast period.

Between 2020 and 2024, the industry experienced growth as there was increased emphasis on employee development, leadership development, and talent retention within companies. The transition to remote work and online learning platforms created demand for leadership programs that accommodated individual or organizational needs.

Firms more and more realized the importance of creating adaptable, resilient leaders to manage volatile business worlds, and hence bespoke programs were a priority. In addition, the emergence of digital transformation resulted in greater emphasis on virtual leadership development, which made it easier and more accessible for the workforce to reskill.

Customized leadership programs were incorporated into talent management programs across different domains of leadership, including emotional intelligence, strategic thinking, and communication. Organizations also looked to create programs that supported their corporate culture, values, and objectives, and personalization was a major driver for program development.

Between 2025 and 2035, the time leading up to it, leadership development programs tailored specifically will transform yet again with the adoption of emerging technologies such as AI and data analysis. As the need for continuous learning becomes the call of the day, there will be a growing focus on adaptive, tailored learning streams in line with the performance and potential of the individual.

Upcoming training programs will likely encompass hybrid learning experiences, where face-to-face classes are complemented by virtual reality (VR) or augmented reality (AR) for more experiential and immersive training. The greater emphasis on sustainability and ethical leadership will inform program content, with business organizations wanting to develop leaders to address global issues, foster conditions of diversity and inclusion, and lead with an ethos of honesty. Gamification and peer education will also play a larger share in engaging employees and making all-around more effective leadership development programs.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Rise of remote work, increasing focus on leadership adaptability, and digital transformation. | Continued learning, individualization through AI, and ethical leadership emphasis. |

| Virtual leadership training, online mentoring, and digital leadership technologies. | AI, VR/AR for immersive experience, data analytics for customized growth, and gamification. |

| Customized programs attuned to corporate culture and employee needs. | Flexible learning pathways, feedback in real-time, and blended learning experiences. |

| Emphasizing strategic leadership, communication, and emotional intelligence competencies. | Emphasizing inclusive, ethical, and sustainable leadership behaviors. |

| Blending customization with scalability in delivering effective programs. | Addressing diverse leadership needs, operating with evolving technology, and incorporating sustainability. |

| Growing need for digital, flexible, and tailored leadership programs. | Growing application of gamification, peer-to-peer, and virtual experience for leadership development. |

Managers will be the greatest shared group of participants within the industry place in 2025. Managers would account for 28% of the total industry, with Mid-Level Employees close behind, representing 20%.

In addition to this, managers remain the first focus of any organization's leadership training initiative since customers believe that creating a leadership pipeline and skills that are important for today's managers would help in navigating difficult business environments. They will often focus on strategic thinking and decision-making, cross-functional collaboration, and managing change.

Such companies as FranklinCovey, Harvard Business Publishing Corporate Learning, and the CCL are highly customized programs, aligning leadership development with organizational goals, very often engaging in real-time problem-solving, executive coaching, and action-learning projects.

The next tier of future leaders is made up of Mid-Level Employees who are very important targets in succession planning. It constitutes 20% of the industry share and consists of programs that develop core competencies such as team leading, project execution, and communication. Organizations like Dale Carnegie, Korn Ferry, or Skillsoft have broadened the offerings that specifically cater to middle-level professionals to ease their movement into senior roles.

Mid-level-specific solutions have also been developed by added providers such as LinkedIn Learning, BTS, and DDI (Development Dimensions International)-with an emphasis on agility in leadership, innovation, and data-driven decision-making.

One example is DDI's "Frontline Leader Impact," which aims to close the skill gap between individual contributors and the leadership role. Similarly, EY's programs for mid-level employees are custom-designed and include simulations with real-life business scenarios and coaching from senior mentors.

Investment in mid-levels is increasing due to the focus on being succession-ready and retaining talent for an organization. Strong middle management is vital to operational excellence and scalable growth, as organizations have come to realize this. Future Proof, as said, is a segment that would gain traction because companies would continue to develop their leadership pipeline against the future.

In 2025, programs lasting 1 to 3 months are forecasted to snatch the largest 30% industry share, followed by those that last 6 months to 1 year at 28%.

Short-term leadership programs are starting to evolve towards 1-3, where companies see a great need for speed, low-cost, and immediate resolution of specific ones, making them the right programs for the fast development of potential emerging leaders by fast-paced business models. Many organizations are using these intensified formats for onboarding new managers or preparing high-potential employees for emerging leadership roles.

Providers like Coursera for Business, Udemy Business, and General Assembly have structured, competency-based short-term programs that lead to measurable outcomes. Others, such as CCL and FranklinCovey, provide fast-track leadership boot camps oriented to the culture and performance objectives of organizations.

Longer-duration programs (6 months to 1 year) that capture a 28% industry share are generally chosen by organizations that invest in deep, transformative leadership development. These programs usually comprise a blend of onsite workshops, executive coaching, real-time business projects, and digital learning modules.

Normally designed for senior and mid-level leaders, these allow the participants to have emotional intelligence, strategic thinking, and innovative skills developed over time. Organizations such as IMD, INSEAD, or Harvard Business

Publishing Corporate Learning offer custom-designed leadership journeys that are phased over several months to make a lasting impact. Programs like the "Aspiring Leaders Program" or "Future-ready Leaders track" from Korn Ferry include company-specific strategy, behavioral assessments, and mentorship to achieve long-term change.

In all, while shorter programs are for agility and focused learning, longer ones promise sustained development and behavior change. Typically, depending on the level of the leader, the maturity of the business, and the culture of learning in the organization, companies deploy a combination of the two, signaling strong growth in all program timelines.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 11.2% |

| UK | 9.6% |

| France | 8.9% |

| Germany | 9.2% |

| Italy | 8.3% |

| South Korea | 8.7% |

| Japan | 9% |

| China | 12.6% |

| Australia-New Zealand | 9.4% |

The USA industry is expected to record an 11.2% CAGR during the study period. The USA industry is witnessing robust growth because of corporate investment in human capital at high levels, maintaining leadership pipelines, and organizational adaptability. The region has a high concentration of global firms that appreciate customized learning experiences to equip existing and emerging leaders with adaptive, digital-age capabilities.

Increasing focus on diversity, equity, and inclusion (DEI) and shifting leadership paradigms are fueling the need for adaptable and modular learning paths. Cross-industry digital transformation initiatives are making agile leadership with the capability to manage distributed teams and disruptive innovation more of a requirement.

With organizations shifting to hybrid working styles, training programs that focus on strategic thinking, cross-functional collaboration, and emotional intelligence have gained more prominence. On top of that, learning and development solution providers with experienced access and advanced infrastructure technology allow scalable program delivery.

The requirements are also increasing in industries such as healthcare, technology, finance, and professional services. All these trends are set to contribute to custom leadership development solutions industry growth in the USA over the long term.

The UKindustry is also predicted to grow at 9.6% CAGR over the research term. The bespoke leadership development industry in the UK is experiencing stable growth, inspired by the vibrant change in work culture, executive dreams, and agendas of governance. Economic modernization, owing to global competitiveness as well as post-Brexit strategies, is compelling organizations to adopt leadership frameworks responsive to local and international business contexts. Tailor-made programs are being utilized increasingly to create next-generation leaders with strong contextual intelligence, crisis management capability, and stakeholder alignment.

There is a growing demand for customized development initiatives in government agencies, non-profit organizations, and mid-sized firms alongside large multinationals. Blended learning formats and electronic delivery models are seeing increased uptake, which allows increased reach through organizational hierarchies.

In addition, UK consultancy firms and business schools are working actively with firms to design bespoke solutions that align with specific frameworks of leadership competencies. This customization ensures greater applicability, behavioral impact, and talent retention, an increasingly acute imperative in a limited labor industry. With maturity in corporate governance and sustainability practices, leadership development programs that emphasize ESG practices and ethical decision-making will increasingly drive industry growth in the UK

The French industry is expected to grow at an 8.9% CAGR during the forecast period. The French industry for leadership development programs is transforming gradually, being led by the country's focus on strategic innovation and an emerging startup economy. French multinational firms increasingly emphasize tailored leadership programs to improve cross-border management skills and support digital transformation initiatives.

The use of leadership to propel agile working arrangements and lead intergenerational teams has become a vital component of talent strategies. Institutional demand for leadership development programs with cultural intelligence, change management, and digital fluency is growing. The French industry also favors collaborative development models, in which industry leaders and academic institutions team up to co-create bespoke training material relevant to sector issues.

Regulatory and HR policy reforms aimed at boosting workplace flexibility and talent building are also compelling the deployment of custom training approaches. Apart from this, the growing prominence of ESG frameworks is also motivating businesses to train executives in values-driven leadership, ethical governance, and sustainability-oriented business practices. With learning solutions rapidly becoming immersive and AI-driven, the French industry is expected to witness consistent growth during the forecast period.

The German industry is expected to grow at 9.2% CAGR during the study period. Germany's industrial and corporate backbone is undergoing renewal, and corporations are making significant investments in highly specialized leadership development solutions. The business culture is influenced by an underlying emphasis on precision, technological excellence, and methodical implementation-attributes also seen in the preferred design for development programs for senior and middle-level leaders.

The application of leadership development as one of the organizational effectiveness and innovation priorities is especially strong in Germany's manufacturing, engineering, and IT sectors. German companies increasingly emphasize upskilling for digital leadership and cross-cultural communication in preparation for internationalization and workforce diversification. The country's established vocational training culture also extends into leadership domains as corporate academies and in-house programs gain more power.

Furthermore, there is a growing demand for individualized leadership diagnostics and feedback systems that enhance the personalization of learning paths. With digital transformation and sustainability at the forefront of boardroom agendas, leadership training is being increasingly closely linked to long-term strategic imperatives. These trends add to the continued industry potential for customized leadership programs in Germany.

The Italian industry will expand at an 8.3% CAGR during the study period. Italy is experiencing gradual but considerable improvement in leadership development as organizations seek creative solutions to improve management performance and organizational capability. Customized leadership development programs are becoming more popular among medium and large organizations, revising their operating and talent strategies.

Economic recovery efforts, founded on digitalization and EU funding programs, have brought about new interest in leadership capacity building. Industry sectors such as manufacturing, retail, and tourism are investing in tailored training programs that account for sectoral dynamics and client engagement models.

Leadership development in Italy typically emphasizes interpersonal effectiveness, succession planning, and entrepreneurial orientations. Management schools and universities also join forces with private institutions to offer programs that bridge the gap between theoretical knowledge and actual leadership challenges.

With Italian businesses expanding regionally and globally, adaptive leadership skills become more in demand. These trends, along with growing investments in future preparedness and employee experience, are likely to drive the industry onto a healthy growth trajectory.

The South Korean industry is expected to expand at 8.7% CAGR during the period of study. South Korea's leadership industry is evolving amid cultural modernization, business globalization, and faster technological adoption. As companies aim to transition from hierarchical to more participative modes of management, the demand for leadership development products focusing on agility, creativity, and emotional intelligence is increasing.

Local conglomerates and foreign multinationals are driving this shift with heavy investment in tailored solutions. South Korean firms are focusing on identifying top talent at an early point in time and nurturing it through experiential and mentorship learning models. Online learning platforms are being largely utilized with increased scalability and learner engagement across geographies.

South Korean leadership development also focuses on cross-border management capabilities to support regional integration with ASEAN countries and global stakeholders. In addition, government programs supporting entrepreneurship and digital leadership among young professionals are indirectly contributing to industry expansion. With the evolving corporate culture and strong emphasis on technology-driven solutions, South Korea presents a promising image for tailored leadership development programs.

Japan's industry is expected to grow at a 9% CAGR during the forecast period. Japan is shifting away from traditional seniority-based models of leadership to competency-based and merit-based models. This cultural and organizational transformation is creating demand for tailored leadership development solutions that blend existing leadership competencies with heritage values.

Tailored training programs are now being used in the development of critical thinking, resilience, and adaptability toward dealing with messy and uncertain circumstances. More Japanese businesses are now investing in globalization and emerging markets-focused leadership pathways.

AI-enabled leadership programs, including sustainability and ESG goals, also influence content and program delivery. In addition, the requirement for organizations to reconcile the effects of aging employees and the changing career goals of young adults is also compelling leadership pipelines to evolve.

Combined patterns of learning through a mix of traditional classroom training, online simulations, and immediate feedback are more sought after. These programs are most relevant to those industries such as manufacturing, finance, and healthcare that are under transformational stress. With Japan placing greater emphasis on innovation and global competitiveness, the industry for adaptive, customized leadership training is likely to continue growing steadily.

The China industry will expand at 12.6% CAGR during the forecast period. China is the fastest-expanding regional marketplace for customized leadership development initiatives due to aggressive business expansion, digitization, and high-quality growth ambitions.

Big state and private enterprises are rapidly investing in leadership capabilities to support innovation-led strategies and global competitiveness. Tailored programs are now being viewed as strategic investments to build strong, tech-savvy, and visionary leaders capable of driving complex organizational change.

With an extremely high emphasis on self-directed learning and leadership ownership, tailored programs in China often incorporate AI technologies, real-time analytics, and mobile-first platforms to personalize learning at scale. Companies are also aligning their leadership models with global best practices through collaborations with global consultancies and business schools.

China's strategic drive towards ESG adoption and the government's digital economy policies have further underscored the need for ethical, innovative, and inclusive leadership. With economic reforms in progress and corporate governance structures evolving, the need for creative, adaptable, and scalable leadership development programs is expected to persist in all major sectors.

The Australia-New Zealand industry will develop at 9.4% CAGR during the period of study. Organizations in Australia and New Zealand are increasingly recognizing the importance of tailored leadership development as a source of competitive advantage, talent retention, and business resilience in the long term.

The shift towards agile and inclusive workplaces has fueled demand for leadership programs that facilitate psychological safety, digital literacy, and collaborative decision-making. With growing needs in healthcare, education, mining, and technology sectors, custom leadership programs are being created to tackle industry-specific concerns and strategic imperatives.

Inclusive leadership is a greater focus area, with programs incorporating indigenous principles, gender balance, and sustainability. Blended learning frameworks and modular design approaches are prevalent, allowing customization while maintaining business objective alignment.

Besides, cross-industry partnerships among universities, business leaders, and learning providers are creating vibrant innovation ecosystems in leadership. The intersection of business culture and experimentation-supporting mindset makes the Australia-New Zealand industry a fertile ground for sustained growth in leadership development solutions.

The industry is blooming as organizations realize the importance of tailored solutions in aligning leadership training with goals. Major players involved in such a booming business include Capita, City & Guilds, D2L Corporation, Franklin Covey Co., and GP Strategies Corporation, with multiple programs meeting specific leadership needs.

Also undertaking the creation of digital, hybrid, and full-time solutions, these companies are ensuring that leaders undergo holistic development. At the same time, the launch of specialized programs such as change management and executive leadership coaching has enabled these big players in the industry to penetrate niche markets.

Capita and City & Guilds are the most dominant companies in flexible and industry-specific leadership training; D2L Corporation is focusing significantly on digital learning. Franklin Covey Co. offers award-winning corporate transformation strategies that integrate leadership development with performance improvement. GP Strategies Corporation attracts clients with different leadership programs that help align leadership training with business performance.

Smaller businesses like Interaction Associates and Learning Technologies Group are carving niches for themselves through innovative digital learning platforms as practices in cutting-edge leadership methodology. Meanwhile, prestigious names such as Harvard Business School, MIT Sloan School of Management, and INSEAD continue to remain pretty strong in the premium segment in providing executive-level programs for leadership development.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Capita | 12-15% |

| City & Guilds | 10-12% |

| D2L Corporation | 9-11% |

| Franklin Covey Co. | 8-10% |

| GP Strategies Corporation | 7-9% |

| Other Players | 47-56% |

| Company Name | Offerings & Activities |

|---|---|

| Capita | Provides a wide range of leadership development solutions, including both virtual and in-person training programs that are tailored to specific industries. |

| City & Guilds | Specializes in vocational and industry-specific leadership training, offering flexible, customizable leadership programs to meet unique organizational needs. |

| D2L Corporation | Offers scalable digital learning platforms that support leadership development and allow organizations to implement and manage training programs effectively. |

| Franklin Covey Co. | Delivers leadership development solutions that integrate organizational change strategies and focus on transforming leadership performance across enterprises. |

| GP Strategies Corporation | Provides leadership training solutions focused on aligning leadership development with business performance goals, including change management. |

Key Company Insights

Capita (12-15%)

Focuses on delivering tailored leadership development solutions, including both digital and in-person training, to meet the unique needs of diverse industries.

City & Guilds (10-12%)

Known for its vocational and industry-specific leadership training, City & Guilds offers flexible and customizable leadership programs that cater to the specific demands of each industry, ensuring effective skill development.

D2L Corporation (9-11%)

Specializes in scalable digital learning platforms that allow organizations to implement and manage leadership development programs efficiently.

Franklin Covey Co. (8-10%)

Focuses on leadership development programs that integrate organizational change strategies, emphasizing performance improvement and leadership transformation across enterprises.

GP Strategies Corporation (7-9%)

Offers a broad range of leadership development solutions, with a strong focus on organizational change management and aligning leadership training with business performance goals.

Other Key Players

By program participants, the industry is segmented by program participants, including business owners, junior/entry-level employees, managers, mid-level employees, senior executives, and students.

By mode of learning, the industry is categorized by mode of learning into classroom, virtual (live online and pre-recorded), and blended formats.

By duration, the industry is divided by duration into 1 to 3 months, 3 to 6 months, 6 months to 1 year, and more than 1 year.

By country, the industry includes the United States, Canada, Argentina, Mexico, Brazil, the United Kingdom, Spain, Italy, France, Germany, Benelux, Ireland, Switzerland, Poland, Hungary, Belarus, Russia, Japan, China, South Korea, India, Australia & New Zealand, Malaysia, Singapore, Thailand, Indonesia, United Arab Emirates, Kingdom of Saudi Arabia, Kuwait, Oman, Bahrain, South Africa, and the rest of the world.

The industry is expected to reach USD 6.1 billion in 2025.

The industry is projected to grow to USD 15 billion by 2035.

Key players include Capita, City & Guilds, D2L Corporation, Franklin Covey Co., GP Strategies Corporation, Interaction Associates, Learning Technologies Group, Harvard Business School, MIT Sloan School of Management, INSEAD, Miller Heiman Group, Skillsoft Corp, Coventry University, Cegos Group, and Dale Carnegie.

China, with a projected CAGR of 12.6%, is expected to see the fastest growth in this industry.

Managers are currently the most widely targeted segment for leadership development initiatives.

Table 1: Global Market Value (US$ Million) Forecast, by Learner Type, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast, by Program Participants, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast, by Mode of Learning, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast, by Duration, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast, by Country, 2018-203

Table 6: Global Market Value (US$ Million) Forecast, by Country, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast, by Country, 2018 to 2033

Table 8: USA Market Value (US$ Million) Forecast, by Learner Type, 2018 to 2033

Table 9: USA Market Value (US$ Million) Forecast, by Program Participants, 2018 to 2033

Table 10: USA Market Value (US$ Million) Forecast, by Mode of Learning, 2018 to 2033

Table 11: USA Market Value (US$ Million) Forecast, by Duration, 2018 to 2033

Table 12: Canada Market Value (US$ Million) Forecast, by Learner Type, 2018 to 2033

Table 13: Canada Market Value (US$ Million) Forecast, by Program Participants, 2018 to 2033

Table 14: Canada Market Value (US$ Million) Forecast, by Mode of Learning, 2018 to 2033

Table 15: Canada Market Value (US$ Million) Forecast, by Duration, 2018 to 2033

Table 16: Argentina Market Value (US$ Million) Forecast, by Learner Type, 2018 to 2033

Table 17: Argentina Market Value (US$ Million) Forecast, by Program Participants, 2018 to 2033

Table 18: Argentina Market Value (US$ Million) Forecast, by Mode of Learning, 2018 to 2033

Table 19: Argentina Market Value (US$ Million) Forecast, by Duration, 2018 to 2033

Table 20: Mexico Market Value (US$ Million) Forecast, by Learner Type, 2018 to 2033

Table 21: Mexico Market Value (US$ Million) Forecast, by Program Participants, 2018 to 2033

Table 22: Mexico Market Value (US$ Million) Forecast, by Mode of Learning, 2018 to 2033

Table 23: Mexico Market Value (US$ Million) Forecast, by Duration, 2018 to 2033

Table 24: Brazil Market Value (US$ Million) Forecast, by Learner Type, 2018 to 2033

Table 25: Brazil Market Value (US$ Million) Forecast, by Program Participants, 2018 to 2033

Table 26: Brazil Market Value (US$ Million) Forecast, by Mode of Learning, 2018 to 2033

Table 27: Brazil Market Value (US$ Million) Forecast, by Duration, 2018 to 2033

Table 28: UK Market Value (US$ Million) Forecast, by Learner Type, 2018 to 2033

Table 29: UK Market Value (US$ Million) Forecast, by Program Participants, 2018 to 2033

Table 30: UK Market Value (US$ Million) Forecast, by Mode of Learning, 2018 to 2033

Table 31: UK Market Value (US$ Million) Forecast, by Duration, 2018 to 2033

Table 32: Benelux Market Value (US$ Million) Forecast, by Learner Type, 2018 to 2033

Table 33: Benelux Market Value (US$ Million) Forecast, by Program Participants, 2018 to 2033

Table 34: Benelux Market Value (US$ Million) Forecast, by Mode of Learning, 2018 to 2033

Table 35: Benelux Market Value (US$ Million) Forecast, by Duration, 2018 to 2033

Table 36: Spain Market Value (US$ Million) Forecast, by Learner Type, 2018 to 2033

Table 37: Spain Market Value (US$ Million) Forecast, by Program Participants, 2018 to 2033

Table 38: Spain Market Value (US$ Million) Forecast, by Mode of Learning, 2018 to 2033

Table 39: Spain Market Value (US$ Million) Forecast, by Duration, 2018 to 2033

Table 40: France Market Value (US$ Million) Forecast, by Learner Type, 2018 to 2033

Table 41: France Market Value (US$ Million) Forecast, by Program Participants, 2018 to 2033

Table 42: France Market Value (US$ Million) Forecast, by Mode of Learning, 2018 to 2033

Table 43: France Market Value (US$ Million) Forecast, by Duration, 2018 to 2033

Table 44: Germany Market Value (US$ Million) Forecast, by Learner Type, 2018 to 2033

Table 45: Germany Market Value (US$ Million) Forecast, by Program Participants, 2018 to 2033

Table 46: Germany Market Value (US$ Million) Forecast, by Mode of Learning, 2018 to 2033

Table 47: Germany Market Value (US$ Million) Forecast, by Duration, 2018 to 2033

Table 48: Japan Market Value (US$ Million) Forecast, by Learner Type, 2018 to 2033

Table 49: Japan Market Value (US$ Million) Forecast, by Program Participants, 2018 to 2033

Table 50: Japan Market Value (US$ Million) Forecast, by Mode of Learning, 2018 to 2033

Table 51: Japan Market Value (US$ Million) Forecast, by Duration, 2018 to 2033

Table 52: China Market Value (US$ Million) Forecast, by Learner Type, 2018 to 2033

Table 53: China Market Value (US$ Million) Forecast, by Program Participants, 2018 to 2033

Table 54: China Market Value (US$ Million) Forecast, by Mode of Learning, 2018 to 2033

Table 55: China Market Value (US$ Million) Forecast, by Duration, 2018 to 2033

Table 56: S Korea Market Value (US$ Million) Forecast, by Learner Type, 2018 to 2033

Table 57: S Korea Market Value (US$ Million) Forecast, by Program Participants, 2018 to 2033

Table 58: S Korea Market Value (US$ Million) Forecast, by Mode of Learning, 2018 to 2033

Table 59: S Korea Market Value (US$ Million) Forecast, by Duration, 2018 to 2033

Table 60: India Market Value (US$ Million) Forecast, by Learner Type, 2018 to 2033

Table 61: India Market Value (US$ Million) Forecast, by Program Participants, 2018 to 2033

Table 62: India Market Value (US$ Million) Forecast, by Mode of Learning, 2018 to 2033

Table 63: India Market Value (US$ Million) Forecast, by Duration, 2018 to 2033

Table 64: Australia Market Value (US$ Million) Forecast, by Learner Type, 2018 to 2033

Table 65: Australia Market Value (US$ Million) Forecast, by Program Participants, 2018 to 2033

Table 66: Australia Market Value (US$ Million) Forecast, by Mode of Learning, 2018 to 2033

Table 67: Australia Market Value (US$ Million) Forecast, by Duration, 2018 to 2033

Table 68: New Zealand Market Value (US$ Million) Forecast, by Learner Type, 2018 to 2033

Table 69: New Zealand Market Value (US$ Million) Forecast, by Program Participants, 2018 to 2033

Table 70: New Zealand Market Value (US$ Million) Forecast, by Mode of Learning, 2018 to 2033

Table 71: New Zealand Market Value (US$ Million) Forecast, by Duration, 2018 to 2033

Table 72: United Arab Emirates Market Value (US$ Million) Forecast, by Learner Type, 2018 to 2033

Table 73: United Arab Emirates Market Value (US$ Million) Forecast, by Program Participants, 2018 to 2033

Table 74: United Arab Emirates Market Value (US$ Million) Forecast, by Mode of Learning, 2018 to 2033

Table 75: United Arab Emirates Market Value (US$ Million) Forecast, by Duration, 2018 to 2033

Table 76: Kingdom of Saudi Arabia Market Value (US$ Million) Forecast, by Learner Type, 2018 to 2033

Table 77: Kingdom of Saudi Arabia Market Value (US$ Million) Forecast, by Program Participants, 2018 to 2033

Table 78: Kingdom of Saudi Arabia Market Value (US$ Million) Forecast, by Mode of Learning, 2018 to 2033

Table 79: Kingdom of Saudi Arabia Market Value (US$ Million) Forecast, by Duration, 2018 to 2033

Table 80: Kuwait Market Value (US$ Million) Forecast, by Learner Type, 2018 to 2033

Table 81: Kuwait Market Value (US$ Million) Forecast, by Program Participants, 2018 to 2033

Table 82: Kuwait Market Value (US$ Million) Forecast, by Mode of Learning, 2018 to 2033

Table 83: Kuwait Market Value (US$ Million) Forecast, by Duration, 2018 to 2033

Table 84: Oman Market Value (US$ Million) Forecast, by Learner Type, 2018 to 2033

Table 85: Oman Market Value (US$ Million) Forecast, by Program Participants, 2018 to 2033

Table 86: Oman Market Value (US$ Million) Forecast, by Mode of Learning, 2018 to 2033

Table 87: Oman Market Value (US$ Million) Forecast, by Duration, 2018 to 2033

Figure 01: Historical Market Size (US$ Million) Analysis By Training Type, 2018 to 2022

Figure 02: Current and Future Market Size (US$ Million) Analysis and Forecast By Training Type, 2023 to 2033

Figure 03: Market Attractiveness Analysis By Training Type

Figure 04: Global Market Value (US$ Million), 2018 to 2022

Figure 05: Global Market Value (US$ Million) Forecast, 2023 to 2033

Figure 06: Global Market Absolute $ Opportunity (US$ Million), 2023 to 2033

Figure 07: Global Market Share by Learner Type, 2023 to 2033

Figure 08: Global Market Attractiveness by Learner Type, 2023 to 2033

Figure 09: Global Market Share by Program Participants, 2023 to 2033

Figure 10: Global Market Attractiveness by Program Participants, 2023 to 2033

Figure 11: Global Market Share by Mode of Learning, 2023 to 2033

Figure 12: Global Market Attractiveness by Mode of Learning, 2023 to 2033

Figure 13: Global Market Share by Duration, 2023 to 2033

Figure 14: Global Market Attractiveness by Duration, 2023 to 2033

Figure 15: Global Market Share by Country, 2023 to 2033

Figure 16: Global Market Attractiveness by Country, 2023 to 2033

Figure 17: US Market Share by Program Participants, 2023 to 2033

Figure 18: US Market Attractiveness by Program Participants, 2023 to 2033

Figure 19: US Market Share by Learner Type, 2023 to 2033

Figure 20: US Market Attractiveness by Learner Type, 2023 to 2033

Figure 21: US Market Share by Mode of Learning, 2023 to 2033

Figure 22: US Market Attractiveness by Mode of Learning, 2023 to 2033

Figure 23: US Market Share by Duration, 2023 to 2033

Figure 24: US Market Attractiveness by Duration, 2023 to 2033

Figure 25: Canada Market Share by Program Participants, 2023 to 2033

Figure 26: Canada Market Attractiveness by Program Participants, 2023 to 2033

Figure 27: Canada Market Share by Learner Type, 2023 to 2033

Figure 28: Canada Market Attractiveness by Learner Type, 2023 to 2033

Figure 29: Canada Market Share by Mode of Learning, 2023 to 2033

Figure 30: Canada Market Attractiveness by Mode of Learning, 2023 to 2033

Figure 31: Canada Market Share by Duration, 2023 to 2033

Figure 32: Canada Market Attractiveness by Duration, 2023 to 2033

Figure 33: Argentina Market Share by Program Participants, 2023 to 2033

Figure 34: Argentina Market Attractiveness by Program Participants, 2023 to 2033

Figure 35: Argentina Market Share by Learner Type, 2023 to 2033

Figure 36: Argentina Market Attractiveness by Learner Type, 2023 to 2033

Figure 37: Argentina Market Share by Mode of Learning, 2023 to 2033

Figure 38: Argentina Market Attractiveness by Mode of Learning, 2023 to 2033

Figure 39: Argentina Market Share by Duration, 2023 to 2033

Figure 40: Argentina Market Attractiveness by Duration, 2023 to 2033

Figure 41: Mexico Market Share by Program Participants, 2023 to 2033

Figure 42: Mexico Market Attractiveness by Program Participants, 2023 to 2033

Figure 43: Mexico Market Share by Learner Type, 2023 to 2033

Figure 44: Mexico Market Attractiveness by Learner Type, 2023 to 2033

Figure 45: Mexico Market Share by Mode of Learning, 2023 to 2033

Figure 46: Mexico Market Attractiveness by Mode of Learning, 2023 to 2033

Figure 47: Mexico Market Share by Duration, 2023 to 2033

Figure 48: Mexico Market Attractiveness by Duration, 2023 to 2033

Figure 49: Brazil Market Share by Program Participants, 2023 to 2033

Figure 50: Brazil Market Attractiveness by Program Participants, 2023 to 2033

Figure 51: Brazil Market Share by Learner Type, 2023 to 2033

Figure 52: Brazil Market Attractiveness by Learner Type, 2023 to 2033

Figure 53: Brazil Market Share by Mode of Learning, 2023 to 2033

Figure 54: Brazil Market Attractiveness by Mode of Learning, 2023 to 2033

Figure 55: Brazil Market Share by Duration, 2023 to 2033

Figure 56: Brazil Market Attractiveness by Duration, 2023 to 2033

Figure 57: UK Market Share by Program Participants, 2023 to 2033

Figure 58: UK Market Attractiveness by Program Participants, 2023 to 2033

Figure 59: UK Market Share by Learner Type, 2023 to 2033

Figure 60: UK Market Attractiveness by Learner Type, 2023 to 2033

Figure 61: UK Market Share by Mode of Learning, 2023 to 2033

Figure 62: UK Market Attractiveness by Mode of Learning, 2023 to 2033

Figure 63: UK Market Share by Duration, 2023 to 2033

Figure 64: UK Market Attractiveness by Duration, 2023 to 2033

Figure 65: Benelux Market Share by Program Participants, 2023 to 2033

Figure 66: Benelux Market Attractiveness by Program Participants, 2023 to 2033

Figure 67: Benelux Market Share by Learner Type, 2023 to 2033

Figure 68: Benelux Market Attractiveness by Learner Type, 2023 to 2033

Figure 69: Benelux Market Share by Mode of Learning, 2023 to 2033

Figure 70: Benelux Market Attractiveness by Mode of Learning, 2023 to 2033

Figure 71: Benelux Market Share by Duration, 2023 to 2033

Figure 72: Benelux Market Attractiveness by Duration, 2023 to 2033

Figure 73: Spain Market Share by Program Participants, 2023 to 2033

Figure 74: Spain Market Attractiveness by Program Participants, 2023 to 2033

Figure 75: Spain Market Share by Learner Type, 2023 to 2033

Figure 76: Spain Market Attractiveness by Learner Type, 2023 to 2033

Figure 77: Spain Market Share by Mode of Learning, 2023 to 2033

Figure 78: Spain Market Attractiveness by Mode of Learning, 2023 to 2033

Figure 79: Spain Market Share by Duration, 2023 to 2033

Figure 80: Spain Market Attractiveness by Duration, 2023 to 2033

Figure 81: France Market Share by Program Participants, 2023 to 2033

Figure 82: France Market Attractiveness by Program Participants, 2023 to 2033

Figure 83: France Market Share by Learner Type, 2023 to 2033

Figure 84: France Market Attractiveness by Learner Type, 2023 to 2033

Figure 85: France Market Share by Mode of Learning, 2023 to 2033

Figure 86: France Market Attractiveness by Mode of Learning, 2023 to 2033

Figure 87: France Market Share by Duration, 2023 to 2033

Figure 88: France Market Attractiveness by Duration, 2023 to 2033

Figure 89: Germany Market Share by Program Participants, 2023 to 2033

Figure 90: Germany Market Attractiveness by Program Participants, 2023 to 2033

Figure 91: Germany Market Share by Learner Type, 2023 to 2033

Figure 92: Germany Market Attractiveness by Learner Type, 2023 to 2033

Figure 93: Germany Market Share by Mode of Learning, 2023 to 2033

Figure 94: Germany Market Attractiveness by Mode of Learning, 2023 to 2033

Figure 95: Germany Market Share by Duration, 2023 to 2033

Figure 96: Germany Market Attractiveness by Duration, 2023 to 2033

Figure 97: Japan Market Share by Program Participants, 2023 to 2033

Figure 98: Japan Market Attractiveness by Program Participants, 2023 to 2033

Figure 99: Japan Market Share by Learner Type, 2023 to 2033

Figure 100: Japan Market Attractiveness by Learner Type, 2023 to 2033

Figure 101: Japan Market Share by Mode of Learning, 2023 to 2033

Figure 102: Japan Market Attractiveness by Mode of Learning, 2023 to 2033

Figure 103: Japan Market Share by Duration, 2023 to 2033

Figure 104: Japan Market Attractiveness by Duration, 2023 to 2033

Figure 105: China Market Share by Program Participants, 2023 to 2033

Figure 106: China Market Attractiveness by Program Participants, 2023 to 2033

Figure 107: China Market Share by Learner Type, 2023 to 2033

Figure 108: China Market Attractiveness by Learner Type, 2023 to 2033

Figure 109: China Market Share by Mode of Learning, 2023 to 2033

Figure 110: China Market Attractiveness by Mode of Learning, 2023 to 2033

Figure 111: China Market Share by Duration, 2023 to 2033

Figure 112: China Market Attractiveness by Duration, 2023 to 2033

Figure 113: South Korea Market Share by Program Participants, 2023 to 2033

Figure 114: South Korea Market Attractiveness by Program Participants, 2023 to 2033

Figure 115: South Korea Market Share by Learner Type, 2023 to 2033

Figure 116: South Korea Market Attractiveness by Learner Type, 2023 to 2033

Figure 117: South Korea Market Share by Mode of Learning, 2023 to 2033

Figure 118: South Korea Market Attractiveness by Mode of Learning, 2023 to 2033

Figure 119: South Korea Market Share by Duration, 2023 to 2033

Figure 120: South Korea Market Attractiveness by Duration, 2023 to 2033

Figure 121: India Market Share by Program Participants, 2023 to 2033

Figure 122: India Market Attractiveness by Program Participants, 2023 to 2033

Figure 123: India Market Share by Learner Type, 2023 to 2033

Figure 124: India Market Attractiveness by Learner Type, 2023 to 2033

Figure 125: India Market Share by Mode of Learning, 2023 to 2033

Figure 126: India Market Attractiveness by Mode of Learning, 2023 to 2033

Figure 127: India Market Share by Duration, 2023 to 2033

Figure 128: India Market Attractiveness by Duration, 2023 to 2033

Figure 129: Australia Market Share by Program Participants, 2023 to 2033

Figure 130: Australia Market Attractiveness by Program Participants, 2023 to 2033

Figure 131: Australia Market Share by Learner Type, 2023 to 2033

Figure 132: Australia Market Attractiveness by Learner Type, 2023 to 2033

Figure 133: Australia Market Share by Mode of Learning, 2023 to 2033

Figure 134: Australia Market Attractiveness by Mode of Learning, 2023 to 2033

Figure 135: Australia Market Share by Duration, 2023 to 2033

Figure 136: Australia Market Attractiveness by Duration, 2023 to 2033

Figure 137: New Zealand Market Share by Program Participants, 2023 to 2033

Figure 138: New Zealand Market Attractiveness by Program Participants, 2023 to 2033

Figure 139: New Zealand Market Share by Learner Type, 2023 to 2033

Figure 140: New Zealand Market Attractiveness by Learner Type, 2023 to 2033

Figure 141: New Zealand Market Share by Mode of Learning, 2023 to 2033

Figure 142: New Zealand Market Attractiveness by Mode of Learning, 2023 to 2033

Figure 143: New Zealand Market Share by Duration, 2023 to 2033

Figure 144: New Zealand Market Attractiveness by Duration, 2023 to 2033

Figure 145: United Arab Emirates Market Share by Program Participants, 2023 to 2033

Figure 146: United Arab Emirates Market Attractiveness by Program Participants, 2023 to 2033

Figure 147: United Arab Emirates Market Share by Learner Type, 2023 to 2033

Figure 148: United Arab Emirates Market Attractiveness by Learner Type, 2023 to 2033

Figure 149: United Arab Emirates Market Share by Mode of Learning, 2023 to 2033

Figure 150: United Arab Emirates Market Attractiveness by Mode of Learning, 2023 to 2033

Figure 151: United Arab Emirates Market Share by Duration, 2023 to 2033

Figure 152: United Arab Emirates Market Attractiveness by Duration, 2023 to 2033

Figure 153: Kingdom of Saudi Arabia Market Share by Program Participants, 2023 to 2033

Figure 154: Kingdom of Saudi Arabia Market Attractiveness by Program Participants, 2023 to 2033

Figure 155: Kingdom of Saudi Arabia Market Share by Learner Type, 2023 to 2033

Figure 156: Kingdom of Saudi Arabia Market Attractiveness by Learner Type, 2023 to 2033

Figure 157: Kingdom of Saudi Arabia Market Share by Mode of Learning, 2023 to 2033

Figure 158: Kingdom of Saudi Arabia Market Attractiveness by Mode of Learning, 2023 to 2033

Figure 159: Kingdom of Saudi Arabia Market Share by Duration, 2023 to 2033

Figure 160: Kingdom of Saudi Arabia Market Attractiveness by Duration, 2023 to 2033

Figure 161: Kuwait Market Share by Program Participants, 2023 to 2033

Figure 162: Kuwait Market Attractiveness by Program Participants, 2023 to 2033

Figure 163: Kuwait Market Share by Learner Type, 2023 to 2033

Figure 164: Kuwait Market Attractiveness by Learner Type, 2023 to 2033

Figure 165: Kuwait Market Share by Mode of Learning, 2023 to 2033

Figure 166: Kuwait Market Attractiveness by Mode of Learning, 2023 to 2033

Figure 167: Kuwait Market Share by Duration, 2023 to 2033

Figure 168: Kuwait Market Attractiveness by Duration, 2023 to 2033

Figure 169: Oman Market Share by Program Participants, 2023 to 2033

Figure 170: Oman Market Attractiveness by Program Participants, 2023 to 2033

Figure 171: Oman Market Share by Learner Type, 2023 to 2033

Figure 172: Oman Market Attractiveness by Learner Type, 2023 to 2033

Figure 173: Oman Market Share by Mode of Learning, 2023 to 2033

Figure 174: Oman Market Attractiveness by Mode of Learning, 2023 to 2033

Figure 175: Oman Market Share by Duration, 2023 to 2033

Figure 176: Oman Market Attractiveness by Duration, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Leadership Development Program Market Analysis - Size, Share, and Forecast 2025 to 2035

Examining Market Share Trends in Leadership Development Programs

Online Leadership Development Program Market Forecast and Outlook 2025 to 2035

Europe Leadership Development Program Market - Growth & Demand 2025 to 2035

Singapore Leadership Development Program Market Trends- Growth to 2035

Australia Leadership Development Program Market Analysis by Growth, Trends and Forecast from 2025 to 2035

United States Leadership Development Program Market Size and Share Forecast Outlook 2025 to 2035

Custom Supplement Formulation Service Market Size and Share Forecast Outlook 2025 to 2035

Custom Packaging Box Market Size and Share Forecast Outlook 2025 to 2035

Custom Face Care Market Forecast Outlook 2025 to 2035

Customized Skincare Market Size and Share Forecast Outlook 2025 to 2035

Custom Peptide Synthesis Services Market Size and Share Forecast Outlook 2025 to 2035

Customer Service Software Market Size and Share Forecast Outlook 2025 to 2035

Custom Vacation Planning Market Size and Share Forecast Outlook 2025 to 2035

Customer Revenue Optimization (CRO) Software Market Size and Share Forecast Outlook 2025 to 2035

Customer Communications Management Market Size and Share Forecast Outlook 2025 to 2035

Developmental and Epileptic Encephalopathies (DEE) Treatment Market Size and Share Forecast Outlook 2025 to 2035

Programmable Robots Market Size and Share Forecast Outlook 2025 to 2035

Customer Experience Management (CEM) In Telecommunication Market Size and Share Forecast Outlook 2025 to 2035

Custom Dry Ingredients Blends Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA