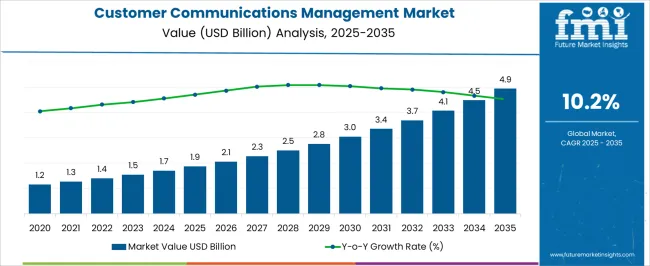

The Customer Communications Management Market is estimated to be valued at USD 1.9 billion in 2025 and is projected to reach USD 4.9 billion by 2035, registering a compound annual growth rate (CAGR) of 10.2% over the forecast period.

| Metric | Value |

|---|---|

| Customer Communications Management Market Estimated Value in (2025 E) | USD 1.9 billion |

| Customer Communications Management Market Forecast Value in (2035 F) | USD 4.9 billion |

| Forecast CAGR (2025 to 2035) | 10.2% |

The customer communications management market is expanding steadily as enterprises prioritize personalized engagement, omnichannel communication, and compliance with data protection standards. Rising customer expectations for seamless digital experiences across industries such as banking, insurance, and healthcare are reinforcing the demand for intelligent communication solutions.

Integration of advanced analytics, artificial intelligence, and cloud technology is enabling enterprises to optimize content delivery while maintaining regulatory compliance. Increasing adoption of automation in communication workflows is also supporting efficiency and cost reduction.

The future outlook remains strong, as organizations focus on enhancing customer satisfaction, improving brand loyalty, and driving operational excellence through modernized communication platforms.

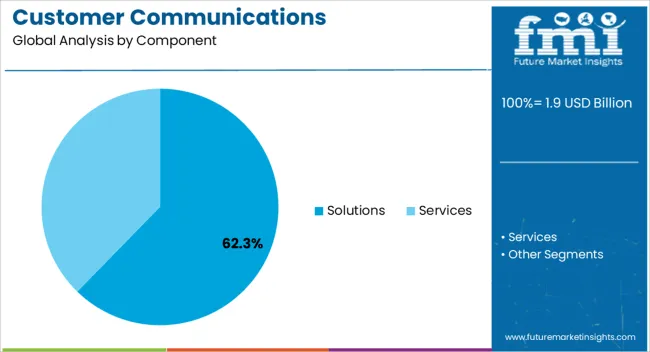

The solutions segment is projected to account for 62.30% of the overall market revenue in 2025, positioning it as the dominant component category. Growth in this segment is supported by enterprises increasingly adopting comprehensive platforms that allow for automated document generation, interactive communication, and personalization at scale.

Solutions are being favored over standalone services due to their ability to integrate with core business systems and deliver measurable improvements in customer engagement.

As organizations seek to unify communications across multiple touchpoints, the role of robust solutions continues to expand, reinforcing their leadership within the component category.

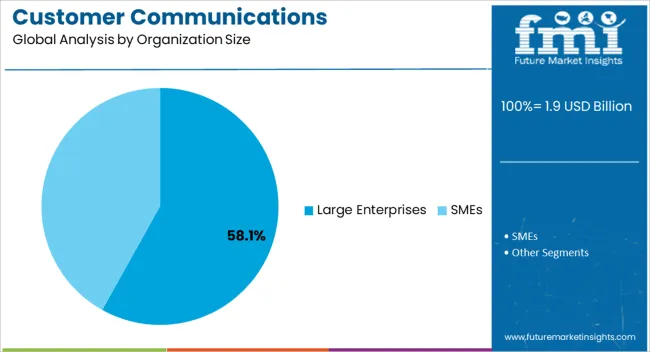

The large enterprises segment is anticipated to contribute 58.10% of overall market revenue by 2025, making it the leading organization size category. This dominance is being driven by the ability of large enterprises to invest in advanced communication platforms and align them with digital transformation initiatives.

Large organizations require scalable systems to manage high volumes of customer interactions across multiple geographies and channels. Additionally, enterprise level commitments to customer experience enhancement and compliance management have reinforced adoption.

With greater financial and technical resources, large enterprises continue to set benchmarks in the deployment of comprehensive customer communications management systems, thereby sustaining their leadership in this segment.

The increasing demand for customer communication management systems is one of the primary factors driving the customer communication management market. To maintain a strong customer connection, businesses must give necessary documentation and promotional offers to customers regularly. As a result, the sales of customer communication management systems are anticipated to grow significantly during the forecast period.

The global demand for customer communication management systems is predicted to grow as customers in this technology-driven world want to communicate with businesses via their preferred channels, such as:

Companies are encouraging client interactions across these many channels to stay competitive, which is further boosting the sales of customer communication management systems.

The demand for customer communication management systems is constantly growing, allowing software applications to be deployed without the hassle and expense of managing and obtaining the underlying software and hardware layers.

SMEs are emphasizing improved client interactions to add value to their goods, which, in turn, is propelling the sales of customer communication management systems.

The demand for customer communication management systems is projected to rise as it utilizes cloud-based environments to serve both large and small businesses. As a result, businesses are expected to migrate to a cloud environment to increase communication system flexibility. This is a key factor propelling the sales of customer communication management systems and the overall customer communication management market.

The demand for a customer communication management system offering a seamless CX may get hampered by the fact that these many channels remain in silos, preventing an organization from providing an Omni channel experience to customers.

Customers can choose between several channels without having to worry about losing knowledge or having to repeat what they already know. Over the course of the forecast period, several organizations migrating to Omni channels are expected to be multifold. As a result, the sales of customer communication management system is projected to rise throughout the forecast period.

From 2020 to 2025, the market expanded at a CAGR of 8.1%. In 2020, the market reached USD 1,038.3 million, and in 2025, the market witnessed a revenue generation of USD 1,420.5 million.

The demand for customer communication management systems is growing significantly. It is due to almost all financial institutions and other sectors have invested in customer communications management (CCM) systems in the last ten years to better manage their client contacts.

Organizations are finding it challenging to manage many digital clients and create a real multi-channel customer journey with old CCM platforms as new communication channels emerge. This factor is projected to affect the sales of customer communication management systems during the forecast period.

Organizations require a CCM capability that can do more than just get work done fast. It must be able to adapt, scale, and evolve quickly to meet the demands of the digital customer.

The demand for customer communication management systems spiked as organizations want communications that are consistent across numerous channels from a single source, as well as content that adjusts to the context of the customer.

In the estimated period, the market is predicted to register CAGR of 10.2%. In 2025, the market gained revenue of USD 1,542.7 million and by 2035, the market is forecasted to attain USD 4,086.9 million.

The BFSI sector accounted for the majority of the customer communication management market share in 2025. The BFSI segment is anticipated to dominate the customer communication management market during the forecast period. This is mostly due to the need to capitalize on market opportunities across many geographies.

Outsourcing service benefits the BFSI sector since it lowers operational costs and improves customer service, allowing enterprises in this area to focus on their primary business.

| Segment | On-premise |

|---|---|

| Market Share (2025) | 63.2% |

In 2025, the on-premise deployment segment held a significant share of the customer communication management market. This segment expanded at a CAGR of 9.2%. The value share accumulated by the segment was 63.2% in 2025.

On-premises deployment is frequently utilized in industries such as banking, finance, and insurance, as well as government and defense, to secure

The typical method of deploying CCM solutions across businesses is on-premise deployment. This deployment mode is opted for by enterprises whose user credentials are critical for business operations. This is because it gives them much control over their IT systems.

The cloud deployment segment is predicted to increase at an exponential rate during the forecast period due to the increasing acceptance of cloud-based solutions.

| Regions/ Countries | Value Share (2025) |

|---|---|

| North America | 26.5% |

| Europe | 23.4% |

| The United States | 18.2% |

| Germany | 7.3% |

| Japan | 5.1% |

| Australia | 2.4% |

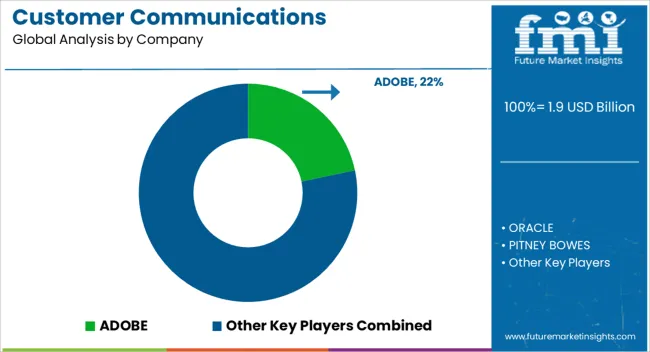

North America is likely to hold a significant share of the global customer communication management market with a CAGR of 9.8%. It is due to different prominent businesses in the industry like Open Text Corporation, Adobe, and others in the region.

The customer communication management market opportunity is growing due to the increased usage of technologies like social media and mobility for customer relationship management in these countries.

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 9.8% |

| India | 11.2% |

| The United Kingdom | 9.1% |

Customer communication management projects are becoming increasingly popular in Asia Pacific countries. China, Japan, India, and the rest of Asia Pacific are the sub-segments of the CCM market in Asia Pacific. These countries are key contributors to the region's customer communication management market expansion.

Organizations have increased their offers in the customer communication management market as internet penetration and per-user online consumption have increased. To compete in the market and seize additional chances, SMEs in the region have boosted their investment in new technologies. These technologies include AI, machine learning, and data analytics. For these companies, implementing CCM solutions has become feasible.

Organizations in the region's industrialized economies, such as Japan, Australia, New Zealand, and Singapore, have embraced cloud computing on a big scale. As cloud technology is employed as a data store for subsequent analysis, the customer communication management market is likely to increase as a result of its growing popularity.

Key players in the customer communication management market are concentrating their efforts on growing their consumer base in new countries. To improve their market share and profitability, these companies are relying on strategic collaborative initiatives.

Recent Developments in the Customer Communications Management Market

The global customer communications management market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the customer communications management market is projected to reach USD 4.9 billion by 2035.

The customer communications management market is expected to grow at a 10.2% CAGR between 2025 and 2035.

The key product types in customer communications management market are solutions and services.

In terms of deployment mode, on-premises segment to command 47.6% share in the customer communications management market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Customer Experience Management (CEM) In Telecommunication Market Size and Share Forecast Outlook 2025 to 2035

Customer Service Software Market Size and Share Forecast Outlook 2025 to 2035

Customer Revenue Optimization (CRO) Software Market Size and Share Forecast Outlook 2025 to 2035

Customer Engagement Hub (CEH) Market Size and Share Forecast Outlook 2025 to 2035

Customer Journey Analytics Software Market Size and Share Forecast Outlook 2025 to 2035

Customer-To-Customer (C2C) Community Marketing Software Market Size and Share Forecast Outlook 2025 to 2035

Customer Journey Mapping Software Market Size and Share Forecast Outlook 2025 to 2035

Customer-Facing Technology Market Size and Share Forecast Outlook 2025 to 2035

Communications Platform as a Service (CPaaS) Market in Korea Growth – Trends & Forecast 2025 to 2035

Customer Experience Platforms Market by Interaction Points, Deployment, Enterprise Size, Region-Forecast through 2035

Customer Analytics in E-commerce Market by Component by Application & Region Forecast till 2035

Customer Engagement Solutions Market Analysis - Demand & Growth through 2034

Customer Advocacy Software Market - Enhancing Brand Loyalty

Tax Management Market Size and Share Forecast Outlook 2025 to 2035

Telecommunications Services Market - Growth & Forecast 2025 to 2035

Key Management as a Service Market

Cash Management Supplies Packaging Market Size and Share Forecast Outlook 2025 to 2035

Fuel Management Software Market Size and Share Forecast Outlook 2025 to 2035

Risk Management Market Size and Share Forecast Outlook 2025 to 2035

SBOM Management and Software Supply Chain Compliance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA