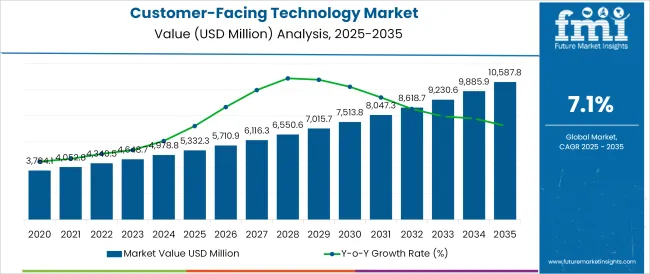

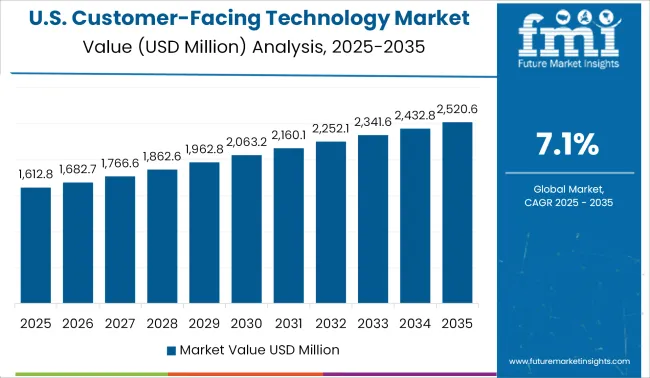

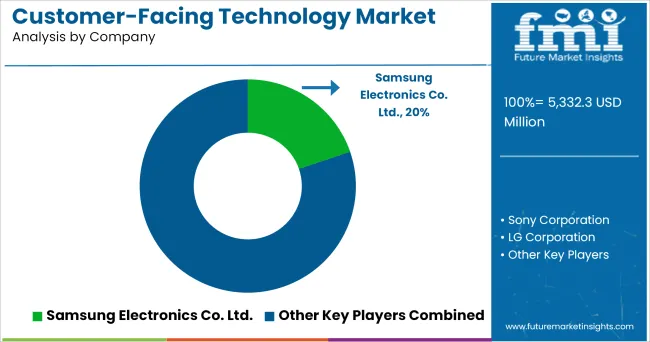

The Customer-Facing Technology Market is estimated to be valued at USD 5,332.3 million in 2025 and is projected to reach USD 10,587.8 million by 2035, registering a compound annual growth rate (CAGR) of 7.1% over the forecast period.

The customer-facing technology market is expanding steadily, driven by businesses’ growing focus on enhancing customer experience and engagement through digital touchpoints. Industry publications and company earnings calls have highlighted increasing investments in front-end technologies such as self-service kiosks, interactive displays, and digital signage across retail, hospitality, and banking sectors.

Enterprises are leveraging these solutions to streamline transactions, personalize customer interactions, and gather actionable consumer insights. Technology vendors have introduced scalable and integrated platforms that enable omnichannel experience, driving further adoption across industries.

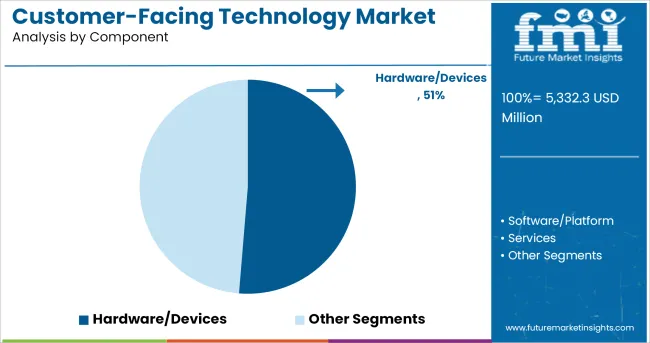

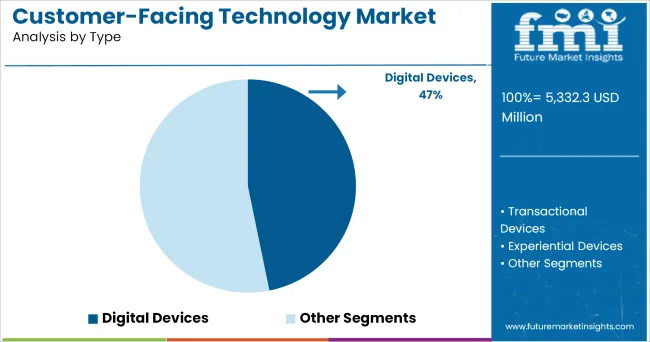

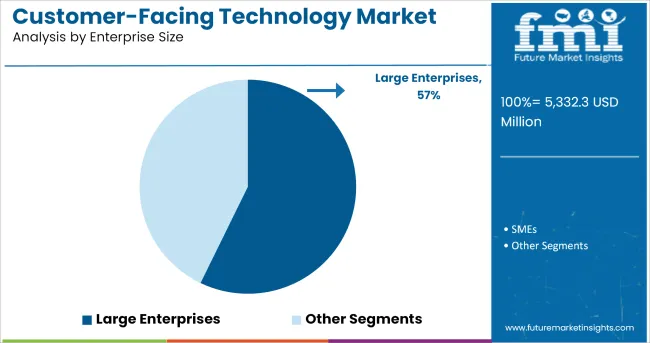

Rising consumer expectations for seamless, contactless, and real-time service experiences have reinforced the demand for advanced digital interfaces. Future market growth is anticipated to be fueled by innovations in artificial intelligence, facial recognition, and IoT-enabled devices that enhance operational efficiency and customer satisfaction. Segmental momentum is being led by Hardware/Devices as the key component, Digital Devices as the leading type, and Large Enterprises as the dominant enterprise size, reflecting enterprise-level deployments and capital investments in digital transformation.

The market is segmented by Component, Type, Enterprise Size, and End-use Industry and region. By Component, the market is divided into Hardware/Devices, Software/Platform, and Services. In terms of Type, the market is classified into Digital Devices, Transactional Devices, and Experiential Devices.

Based on Enterprise Size, the market is segmented into Large Enterprises and SMEs. By End-use Industry, the market is divided into Retail, BFSI, Travel and Hospitality, Automotive, Healthcare, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Hardware/Devices segment is projected to account for 51.3% of the customer-facing technology market revenue in 2025, maintaining its leadership among component categories. Growth in this segment has been driven by the rising adoption of physical interfaces such as kiosks, POS terminals, and digital signage that enable direct consumer interaction.

Businesses have prioritized investments in hardware solutions to support self-service capabilities, streamline checkout processes, and deliver dynamic content. Technological advancements have improved the durability, energy efficiency, and design aesthetics of these devices, enhancing their suitability for high-traffic commercial environments.

Additionally, hardware upgrades are often necessitated by evolving software compatibility and security requirements, supporting recurring enterprise investments. As industries like retail, hospitality, and transport continue to modernize their customer engagement infrastructure, the Hardware/Devices segment is expected to remain integral to delivering consistent and scalable user experiences.

The Digital Devices segment is projected to contribute 46.8% of the customer-facing technology market revenue in 2025, solidifying its position as the leading type segment. Growth of this segment has been fueled by increasing demand for interactive digital solutions that provide real-time information, personalized recommendations, and seamless transactional capabilities.

Enterprises have adopted digital devices such as tablets, touchscreens, and smart displays to replace static interfaces and manual service interactions, improving customer engagement and operational efficiency. Product innovation in user interface design, connectivity, and remote management has further expanded the usability of digital devices across diverse industry applications.

Moreover, businesses have embraced these technologies as part of omnichannel strategies, ensuring consistent customer experiences across physical and digital environments. As enterprises continue to prioritize responsive and engaging customer interactions, the Digital Devices segment is expected to sustain its leadership in the market.

The Large Enterprises segment is projected to hold 57.2% of the customer-facing technology market revenue in 2025 maintaining its dominant share among enterprise size categories. Growth of this segment has been driven by the extensive digital transformation initiatives undertaken by large corporations seeking to enhance brand differentiation and customer loyalty.

Large enterprises have financial and technical resources to deploy scalable customer facing solutions across multiple geographies and business units. Strategic IT roadmaps within these organizations have prioritized investments in advanced technologies, integrating AI, analytics, and cloud platforms with front end devices to create seamless customer journeys.

Furthermore, regulatory compliance and cybersecurity considerations have prompted large enterprises to upgrade their customer engagement infrastructure with secure and standardized solutions. As global brands continue to enhance their physical and digital customer touchpoints the Large Enterprises segment is expected to lead the market, reflecting enterprise-scale deployment capabilities and long-term digital experience strategies.

Growing demand for digital signage systems and mPOS happens to be one of the primary growth drivers of the customer-facing technology market. There has been an exponential rise in demand for digital visual merchandising, way finding, etc. Furthermore, there has been an upsurge in the demand for Mobile Point of Sale devices for accelerating transactions.

Companies operating in the market are implementing customer-facing technology in order to control the sensory experience of their customers, incorporating ideas in their minds, and gauging their behavioral trends.

Customer-facing technology involves customers at the point of making purchase decisions which is focused on driving its demand. Companies are utilizing customer facing technology as an effective data capturing tool for marketing initiatives such as surveys and loyalty schemes.

However, with the growing adoption of customer-facing devices, the issues of security and privacy are gaining greater importance. Security and privacy concerns happen to be one of the factors hampering the market growth.

Digital devices include printers, tablets, digital signage, digital kiosks, multimedia displays, and other devices. Growing popularity of digital devices among consumers is one of the major factors influencing the market growth of customer facing technology. However, transactional devices are expected to grow at the highest CAGR over the forecast period. This is owing to the increasing demand for mobile payments and other mobile transactions.

USA happens to be one of the largest markets for customer-facing technology across the globe. The growth in USA is attributed to the presence of established players such as NEC Display Solutions, Capgemini, and Diebold Nixdorf Incorporated, in the region.

Moreover, USA happens to be the most rapidly changing and competitive market across the globe. Besides, the region is also anticipated to adopt new technologies at a faster pace as compared to other countries in the world.

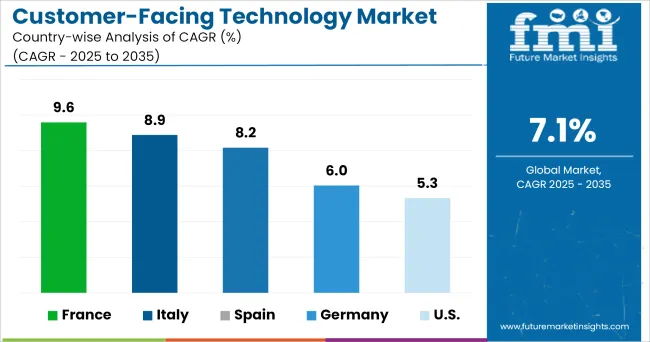

In Europe, the technologies that command the most investments are those related to customer-facing channels, such as self-service, and channel optimization. Furthermore, the rising need for customer-facing devices and services across different industry verticals in the countries like Germany, Italy, France, and UK in the Europe region is enabling the market for customer-facing technology to grow at a substantial rate over the forecast period.

Some of the leading providers of customer-facing technology include

The market appears to be highly fragmented and established companies are focused on augmenting their product portfolio for customer-facing technologies.

By offering customer-facing services and features, these companies are connecting directly with shoppers in order to provide a richer and more seamless retail experiences for the customers. The companies operating in the market are focused on offering, innovative, differentiated, and interactive experience for customers in order to make shopping enhanced for the consumers in retail.

For instance, AT&T's flagship store on Michigan, features an internet enabled car that can be instructed to “hold calls” and provide trip information and car diagnostics. This helps in improving customer engagement and provides the company with the customer information. Interactive exhibits in the customer facing technology provide information about the customers. With the help of this data, the company can easily track the customers with most interaction and improve and adjust their exhibits content as per customer demand, thereby offering enhanced customer experience.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global customer-facing technology market is estimated to be valued at USD 5,332.3 million in 2025.

The market size for the customer-facing technology market is projected to reach USD 10,587.8 million by 2035.

The customer-facing technology market is expected to grow at a 7.1% CAGR between 2025 and 2035.

The key product types in customer-facing technology market are hardware/devices, software/platform and services.

In terms of type, digital devices segment to command 46.8% share in the customer-facing technology market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

4K Technology Market Size and Share Forecast Outlook 2025 to 2035

5G technology market Analysis by Technology Type, Application, Vertical, and Region – Growth, trends and forecast from 2025 to 2035

8K Technology Market

Nanotechnology Photocatalysis Surface Coating Industry Analysis in AMEA Size and Share Forecast Outlook 2025 to 2035

Nanotechnology Packaging Market Size and Share Forecast Outlook 2025 to 2035

Key Players & Market Share in GDS Technology Market

GDS Technology Market Insights - Growth & Forecast 2025 to 2035

Nanotechnology for food packaging Market

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Smart-Technology Anti-Wrinkle Peptides Market Size and Share Forecast Outlook 2025 to 2035

Laser Technology Market Size and Share Forecast Outlook 2025 to 2035

Green Technology And Sustainability Market Size and Share Forecast Outlook 2025 to 2035

Camera Technology Market Analysis – Trends & Forecast 2025 to 2035

Battery Technology Market Size and Share Forecast Outlook 2025 to 2035

Airline Technology Integration Market Size and Share Forecast Outlook 2025 to 2035

Food Biotechnology Market Size and Share Forecast Outlook 2025 to 2035

IO-Link technology Market Size and Share Forecast Outlook 2025 to 2035

Scaffold Technology Market Size and Share Forecast Outlook 2025 to 2035

Ablation Technology Market Size, Share, and Forecast Outlook 2025 to 2035

Sapphire Technology Market Trends – Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA