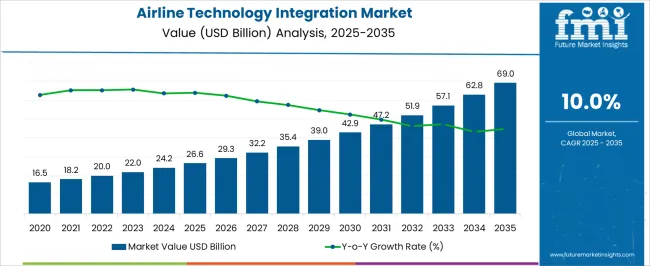

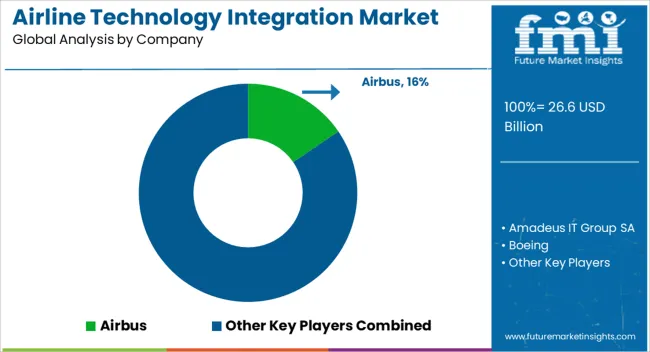

The airline technology integration market is projected to reach USD 26.6 billion in 2025 and expand to USD 69.0 billion by 2035, advancing at a CAGR of 10.0% during this period. Growth is anticipated to be driven by continuous investment in digital systems, connected aircraft solutions, and the integration of next-generation passenger services. Year-on-year progression highlights a steady climb from USD 16.5 billion in the early phase to USD 69.0 billion by the end of the forecast window.

Airlines are prioritizing integration platforms for flight operations, predictive maintenance, and real-time data exchange between aircraft and ground systems. Passenger-centric applications such as biometric boarding, digital in-flight entertainment, and seamless connectivity also contribute to adoption. Industry stakeholders are focusing on cybersecurity frameworks, regulatory compliance, and vendor partnerships to ensure scalable technology rollouts. Expansion reflects not only airlines’ push for operational efficiency but also the demand from airports, regulators, and passengers for safe, transparent, and digitally enhanced travel experiences. The compounded effect of regulatory mandates, customer expectations, and aviation modernization will make this segment a cornerstone of the future aviation ecosystem.

| Metric | Value |

|---|---|

| Airline Technology Integration Market Estimated Value in (2025 E) | USD 26.6 billion |

| Airline Technology Integration Market Forecast Value in (2035 F) | USD 69.0 billion |

| Forecast CAGR (2025 to 2035) | 10.0% |

The airline technology integration market is influenced by several interconnected parent markets that define its overall growth and adoption pathways. The aviation software and digital systems sector accounts for the largest share at nearly 38 percent, since integration relies heavily on advanced platforms for flight management, predictive maintenance, and real-time data analytics. The passenger services technology market contributes around 25%, as biometric systems, in-flight entertainment, and digital boarding solutions shape consumer-facing adoption. The airport infrastructure technology market holds nearly 15%, driven by collaborative integration between airlines and airports to enhance efficiency and regulatory compliance.

The aerospace cybersecurity and data protection sector adds about 12%, ensuring safe and compliant operations across integrated digital ecosystems. The remaining 10% comes from aircraft connectivity, communication systems, and miscellaneous aviation support technologies, which strengthen interoperability across stakeholders. This distribution highlights that airline technology integration is not a standalone category but a layered domain shaped by software ecosystems, passenger-centric services, airport modernization, and secure data frameworks. Its reliance on digital transformation ensures steady growth, while its diversified nature reduces exposure to cyclical risks. Companies that innovate in integration frameworks, form partnerships with airports, and invest in compliance-driven digital platforms are positioned to secure higher market share in this expanding segment.

The airline technology integration market is undergoing rapid transformation as carriers increasingly prioritize operational efficiency, passenger experience, and data-driven decision-making. The adoption of advanced digital systems is being fueled by the need to streamline flight operations, optimize resource allocation, and enhance safety through predictive analytics and real-time monitoring.

Growth is further supported by the aviation industry’s focus on recovery and competitiveness in the post-pandemic era, with investments being directed toward scalable and interoperable solutions. Advancements in artificial intelligence, cloud infrastructure, and software platforms are enabling airlines to integrate various operational systems into unified frameworks, improving efficiency across scheduling, maintenance, customer service, and fuel management.

Regulatory emphasis on safety, environmental performance, and data compliance is also influencing the integration of advanced technologies. With global air travel demand steadily rising and competitive pressures intensifying, technology integration is emerging as a strategic imperative for airlines, positioning the market for sustained growth over the next decade.

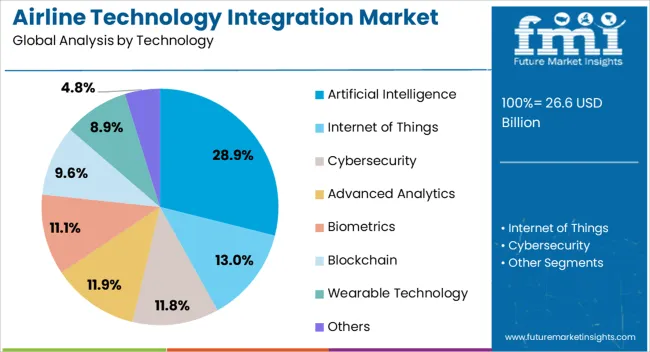

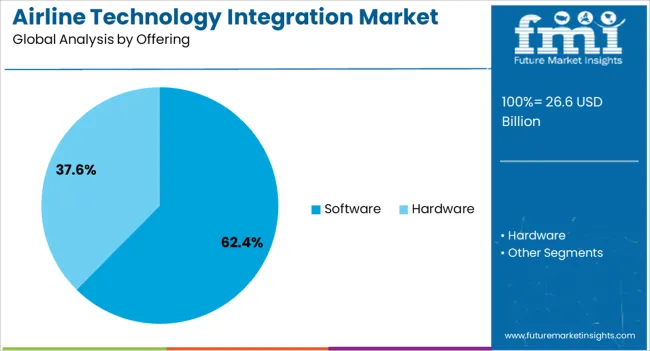

The airline technology integration market is segmented by technology, offering, deployment, and geographic regions. By technology, airline technology integration market is divided into Artificial Intelligence, Internet of Things, Cybersecurity, Advanced Analytics, Biometrics, Blockchain, Wearable Technology, and Others. In terms of offering, airline technology integration market is classified into Software and Hardware.

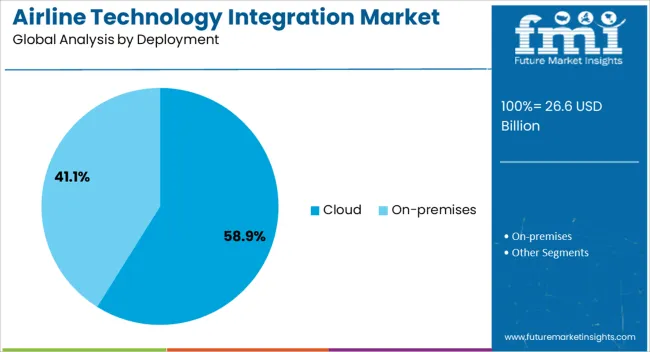

Based on deployment, airline technology integration market is segmented into Cloud and On-premises. Regionally, the airline technology integration industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The artificial intelligence technology segment is expected to hold 28.9% of the airline technology integration market revenue share in 2025, making it the leading technology type. Its dominance is being driven by the ability to process vast amounts of operational and passenger data to deliver predictive, automated, and optimized outcomes. Artificial intelligence is being applied to enhance flight scheduling, predict maintenance requirements, improve crew allocation, and personalize passenger interactions, thereby increasing efficiency and service quality.

Airlines are leveraging AI algorithms to improve fuel management and operational safety by analyzing patterns in historical and real-time data. The segment is also benefiting from its role in enabling adaptive decision-making during dynamic operational scenarios, such as weather disruptions or air traffic congestion.

As competition intensifies in the aviation sector, AI-driven systems are being adopted to reduce costs, improve punctuality, and strengthen customer loyalty Continuous advancements in machine learning models and natural language processing are expected to further expand AI’s capabilities, reinforcing its position as the most impactful technology in airline integration strategies.

The software offering segment is projected to account for 62.4% of the airline technology integration market revenue share in 2025, positioning it as the leading offering category. Its leadership is being reinforced by the growing demand for flexible, upgradeable, and interoperable platforms that can integrate seamlessly with diverse airline operational systems. Software solutions enable real-time data sharing, system automation, and predictive analytics, which are critical for improving efficiency across ticketing, baggage handling, maintenance scheduling, and crew management.

The ability to scale capabilities through software updates without significant hardware investments is providing airlines with cost-effective pathways to modernization. Increasing adoption of software-as-a-service models is further driving segment growth by offering subscription-based access to advanced functionalities.

The segment is also supported by the rising need for compliance with aviation safety and cybersecurity regulations, which software solutions can address through continuous updates As airlines prioritize digital transformation, software will continue to be central to achieving operational resilience, efficiency, and enhanced passenger service delivery.

The cloud deployment segment is anticipated to capture 58.9% of the airline technology integration market revenue share in 2025, making it the dominant deployment model. This preference is being driven by the cloud’s scalability, cost efficiency, and ability to support real-time collaboration across geographically dispersed airline operations. Cloud-based systems facilitate seamless integration of flight scheduling, maintenance tracking, customer service platforms, and revenue management systems into unified frameworks accessible from any location.

The segment is benefiting from improved data security measures, redundancy capabilities, and disaster recovery features offered by leading cloud providers. Airlines are increasingly adopting hybrid and multi-cloud strategies to enhance flexibility while meeting regulatory compliance requirements in different jurisdictions.

The ability to deploy updates and enhancements across the entire operational network without downtime is further reinforcing adoption. As airlines seek to harness big data analytics, artificial intelligence, and IoT-enabled monitoring, the cloud is emerging as the most effective deployment environment, ensuring agility and competitiveness in a rapidly evolving aviation landscape.

Airline technology integration is being propelled by operational efficiency needs, passenger expectations, regulatory mandates, and collaborative ecosystems. Together, these dynamics ensure steady adoption and long-term growth across the aviation sector.

Airline technology integration is being accelerated by the need for operational efficiency across global carriers. Flight management systems, predictive maintenance, and integrated data analytics are driving adoption, enabling airlines to reduce delays, optimize fuel usage, and lower maintenance costs. Airlines are increasingly dependent on connected systems that allow real-time communication between aircraft and ground operations, ensuring improved decision-making. Pressure to maintain profitability in a competitive industry will continue to push operators toward integrated technologies. This efficiency-driven approach makes technology integration not just an enhancement but a necessity for long-term competitiveness in the aviation sector.

Integration of passenger-centric technologies is shaping demand across airlines. Digital boarding, biometric security, and in-flight entertainment systems have become crucial to enhancing customer satisfaction and loyalty. Passengers now expect seamless connectivity and personalized travel experiences, making integration an essential service differentiator. Airlines investing in digital platforms gain an advantage by offering smoother journeys that address convenience and security. Carriers treating technology integration as a strategic tool for customer retention will outperform those that treat it as a compliance exercise. The passenger journey has become a primary driver for technology deployment across global aviation networks.

The market is also influenced by regulatory bodies mandating technology adoption to ensure aviation safety and data security. Compliance frameworks such as data protection rules, safety monitoring standards, and cybersecurity protocols have made integration unavoidable. Airlines are integrating solutions to meet these standards, avoiding fines and ensuring operational approval. Vendors with proven compliance track records are gaining preference as airline partners. Regulatory-driven integration provides stability to the market by making adoption compulsory, giving manufacturers and software providers a predictable growth trajectory. This environment ensures long-term demand, even in times of financial pressure across airlines.

Technology integration in aviation is heavily shaped by strategic alliances between airlines, airports, and technology providers. Partnerships enable large-scale deployment of integrated platforms, spreading costs while ensuring interoperability. Vendors that collaborate with airlines on customized systems for flight operations and passenger management create stronger positions in the market.

Airports also play a critical role in enabling seamless integration across check-in, boarding, and security systems. Ecosystem-driven growth highlights the importance of collaboration in aviation, where no single player can drive transformation alone. The partnership model ensures scalable adoption and industry-wide consistency across global operations.

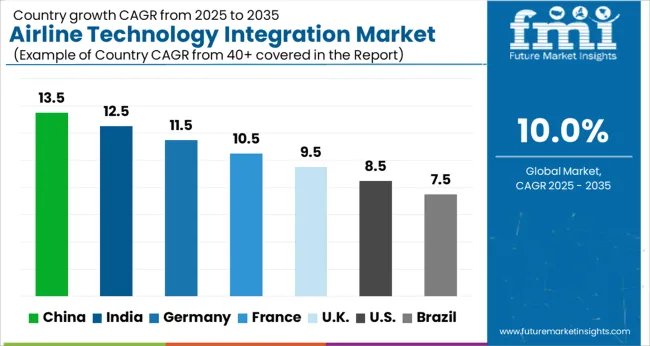

| Country | CAGR |

|---|---|

| China | 13.5% |

| India | 12.5% |

| Germany | 11.5% |

| France | 10.5% |

| UK | 9.5% |

| USA | 8.5% |

| Brazil | 7.5% |

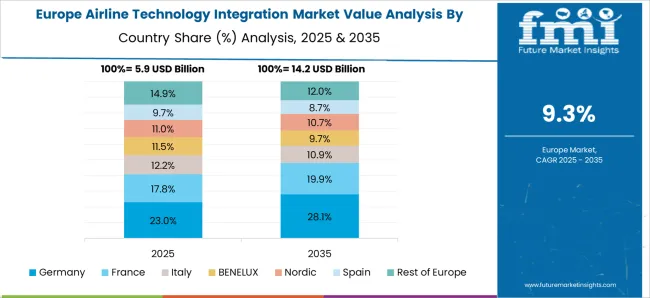

The global airline technology integration market is projected to grow at a CAGR of 10.0% between 2025 and 2035. China leads with an impressive 13.5% CAGR, fueled by large-scale investments in connected aircraft systems, airport digitization, and passenger service automation. India follows at 12.5%, supported by rapid aviation expansion, rising passenger volumes, and government-backed digital air travel initiatives. Germany, with 11.5% CAGR, benefits from regulatory-driven safety compliance, advanced industrial engineering, and integration of digital maintenance frameworks. France posts 10.5%, focusing on modernization of airports, improved passenger management systems, and digital security infrastructure. The UK, growing at 9.5%, emphasizes seamless integration across airport operations, passenger biometrics, and digital flight management, while the USA, at 8.5%, continues advancing through retrofitting programs, cyber protection in aviation, and large-scale airline partnerships with technology providers. Asia dominates in scale and adoption speed, while Europe and North America emphasize compliance, safety, and integration of premium digital aviation systems. The analysis spans 40+ countries, with the leading markets shown below.

The airline technology integration market in China is projected to grow at a CAGR of 13.5% from 2025 to 2035, supported by the country’s ambitious aviation expansion and heavy investments in digital air travel infrastructure. China is prioritizing biometric boarding, AI-driven flight operations, and integrated airport platforms to manage growing passenger traffic. Domestic airlines are adopting predictive maintenance and real-time analytics to optimize fleet efficiency, while airports are accelerating digital security systems to meet international standards. Partnerships between Chinese carriers and technology providers are reinforcing adoption, ensuring large-scale rollouts. China’s role as a global aviation hub will be strengthened by its ability to merge scale with speed, positioning it as the top driver of integration worldwide.

The airline technology integration market in India is expected to expand at a CAGR of 12.5% from 2025 to 2035, driven by rising passenger volumes, infrastructure modernization, and government-led digitalization programs. Airports are adopting biometric identification and e-gates to reduce congestion, while airlines are integrating cloud-based systems for flight operations and customer engagement. India’s strong IT sector is facilitating partnerships between aviation stakeholders and technology providers, enabling rapid deployment of solutions. Domestic carriers are also implementing digital tools for fuel management and fleet optimization. India’s growth trajectory reflects both its expanding passenger base and a policy-driven focus on modernization, making it a pivotal market in Asia’s aviation digital ecosystem.

The airline technology integration market in Germany is anticipated to grow at a CAGR of 11.5% between 2025 and 2035, supported by strong regulatory frameworks and engineering expertise. German carriers are deploying predictive maintenance, cybersecurity platforms, and integrated flight management systems to meet stringent European Union aviation standards. Airports across the country are prioritizing digital passenger handling, including biometric check-ins and automated baggage systems. Germany’s established industrial base supports partnerships with aerospace technology providers, enhancing its adoption pace. Germany’s emphasis on compliance and engineering-driven innovation ensures a stable market, where integration is seen not just as efficiency-oriented but also as a compliance necessity.

The airline technology integration market in the United Kingdom is projected to grow at a CAGR of 9.5% from 2025 to 2035, supported by investments in airport modernization, safety compliance, and digital passenger services. Heathrow and other major airports are implementing biometric boarding and automated check-in systems to improve passenger flow. Airlines are focusing on cybersecurity solutions and cloud-based integration to streamline flight operations. Collaboration with global technology providers is enabling faster adoption across both legacy and low-cost carriers. The UK’s integration efforts are largely focused on enhancing customer experience and compliance, creating a steady but moderate growth environment.

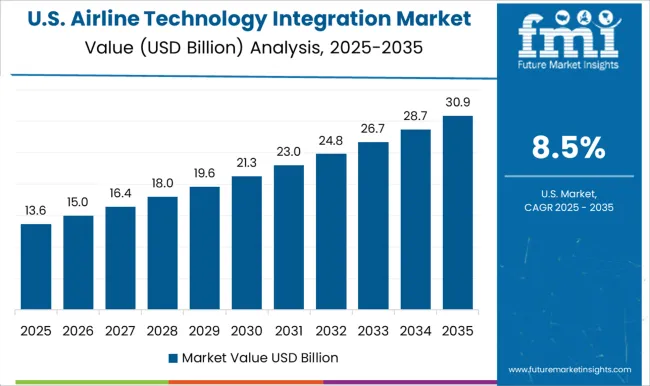

The airline technology integration market in the United States is projected to grow at a CAGR of 8.5% from 2025 to 2035, driven by retrofitting programs, aviation cybersecurity, and airline partnerships with global technology providers. Major airlines are prioritizing predictive analytics for fleet maintenance and digital communication systems for real-time flight management. Airports across the country are enhancing passenger-facing services such as biometric boarding and contactless check-ins. The mature infrastructure base makes adoption more gradual, with replacement demand dominating over greenfield projects. While the USA expands at a slower pace than Asia, its scale, technology leadership, and strong regulatory frameworks ensure it remains one of the most influential markets in the aviation technology landscape.

Competition in the airline technology integration market is shaped by digital system reliability, passenger service integration, and the ability to meet evolving safety and compliance standards. Airbus and Boeing lead the field by embedding integrated digital platforms into aircraft systems, driving predictive maintenance and connected flight operations. Collins Aerospace and General Electric strengthen their position with avionics, engine monitoring, and communication systems that form the backbone of modern airline technology. Honeywell plays a vital role with cockpit automation and real-time data solutions that enhance operational efficiency. Amadeus IT Group SA, Sabre, and SITA are influential in passenger service platforms, providing airlines with reservation systems, biometric boarding solutions, and cloud-based passenger management.

IBM and Oracle contribute with advanced analytics, AI frameworks, and cloud infrastructures, enabling predictive operations and seamless integration across stakeholders. SAP extends competitiveness through enterprise resource planning systems that connect back-end operations with frontline aviation processes. L3 Harris Corporation, Raytheon Technologies, and Thales Group dominate in aviation security, communication systems, and defense-grade integration solutions, ensuring compliance and resilience against cyber risks. Lufthansa Technik reinforces its position by offering MRO-driven integration, combining maintenance services with digital technologies to extend aircraft lifecycle performance. Competitive edge lies in players that combine core engineering expertise with digital ecosystems, offering end-to-end integration from the aircraft to passenger services.

| Item | Value |

|---|---|

| Quantitative Units | USD 26.6 Billion |

| Technology | Artificial Intelligence, Internet of Things, Cybersecurity, Advanced Analytics, Biometrics, Blockchain, Wearable Technology, and Others |

| Offering | Software and Hardware |

| Deployment | Cloud and On-premises |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Airbus, Amadeus IT Group SA, Boeing, Collins Aerospace, General Electrics, Honeywell, IBM, L3 Harris Corporation, Lufthansa Technik, Oracle, SAP, Raytheon Technologies Corporation, Sabre, SITA, and Thale Group |

| Additional Attributes | Dollar sales, share, regulatory impact, passenger tech adoption, airport partnerships, cybersecurity trends, competitive benchmarking, vendor ecosystems, cost structures, and regional growth patterns. |

The global airline technology integration market is estimated to be valued at USD 26.6 billion in 2025.

The market size for the airline technology integration market is projected to reach USD 69.0 billion by 2035.

The airline technology integration market is expected to grow at a 10.0% CAGR between 2025 and 2035.

The key product types in airline technology integration market are artificial intelligence, internet of things, cybersecurity, advanced analytics, biometrics, blockchain, wearable technology and others.

In terms of offering, software segment to command 62.4% share in the airline technology integration market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Airline Cyber Security Market Size and Share Forecast Outlook 2025 to 2035

Airline Crisis Management Software Market Size and Share Forecast Outlook 2025 to 2035

Airline Reservation Software Market Size and Share Forecast Outlook 2025 to 2035

Airline A-la-carte Services Market Analysis by Product Type, Carrier Type and Region from 2025 to 2035

Online Airline Booking Platform Market Size and Share Forecast Outlook 2025 to 2035

4K Technology Market Size and Share Forecast Outlook 2025 to 2035

5G technology market Analysis by Technology Type, Application, Vertical, and Region – Growth, trends and forecast from 2025 to 2035

8K Technology Market

Nanotechnology Photocatalysis Surface Coating Industry Analysis in AMEA Size and Share Forecast Outlook 2025 to 2035

Nanotechnology Packaging Market Size and Share Forecast Outlook 2025 to 2035

Key Players & Market Share in GDS Technology Market

GDS Technology Market Insights - Growth & Forecast 2025 to 2035

Nanotechnology for food packaging Market

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Smart-Technology Anti-Wrinkle Peptides Market Size and Share Forecast Outlook 2025 to 2035

Laser Technology Market Size and Share Forecast Outlook 2025 to 2035

Green Technology And Sustainability Market Size and Share Forecast Outlook 2025 to 2035

Camera Technology Market Analysis – Trends & Forecast 2025 to 2035

Battery Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Biotechnology Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA