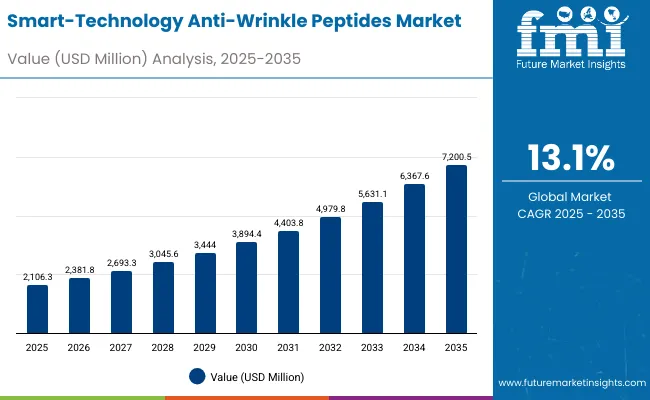

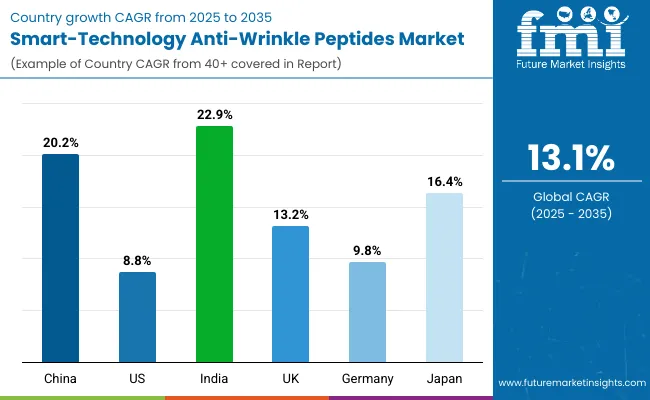

The Global Smart-Technology Anti-Wrinkle Peptides Market is expected to record a valuation of USD 2,106.3 million in 2025 and USD 7,200.5 million in 2035, with an increase of USD 5,094.2 million, which equals a growth of nearly 2.4X over the decade. The overall expansion represents a CAGR of 13.1%, supported by evolving delivery technologies such as encapsulated/time-release systems and dissolving microneedle patches.

Global Smart-Technology Anti-Wrinkle Peptides Market Key Takeaways

| Metric | Value |

|---|---|

| Global Smart-Technology Anti-Wrinkle Peptides Market Estimated Value in (2025E) | USD 2,106.3 million |

| Global Smart-Technology Anti-Wrinkle Peptides Market Forecast Value in (2035F) | USD 7,200.5 million |

| Forecast CAGR (2025 to 2035) | 13.1% |

During the first five-year period from 2025 to 2030, the market increases from USD 2,106.3 million to USD 3,894.4 million, adding USD 1,788.1 million, which accounts for over 35% of the total decade growth. This phase records steady adoption of peptide-infused serums and creams across dermatology clinics, pharmacies, and premium retail outlets. Serums dominate this period as they cater to over half of all applications, reflecting consumer preference for lightweight, highly absorbable formulations with clinical-grade validation.

The second half from 2030 to 2035 contributes USD 3,306.1 million, equal to nearly 65% of total growth, as the market jumps from USD 3,894.4 million to USD 7,200.5 million. This acceleration is powered by widespread deployment of advanced delivery formats such as dissolving microneedle patches and iontophoresis masks, alongside clean-label and fragrance-free claims that align with sustainability and health-conscious consumer behavior. Clinical-grade and dermatologist-tested products continue to strengthen brand trust, while Asia-Pacific countries like China (20.2% CAGR) and India (22.9% CAGR) emerge as key growth frontiers by 2035.

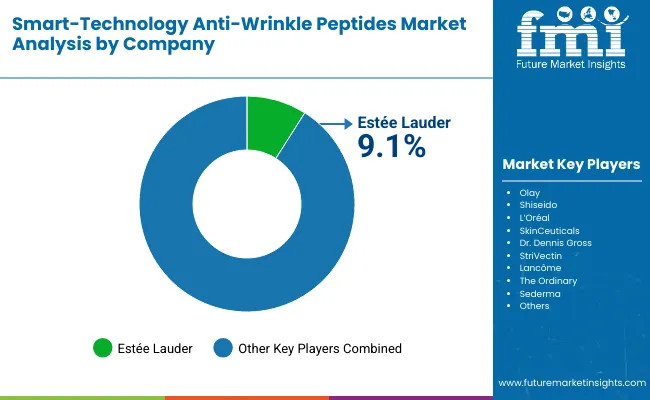

From 2020 to 2024, the Global Smart-Technology Anti-Wrinkle Peptides Market grew steadily, driven largely by hardware-equivalent innovation in peptide encapsulation and time-release formulations. During this period, the competitive landscape was dominated by multinational cosmetic giants, with Estée Lauder securing nearly 9.1% of global market share in 2025.

Competitive differentiation relied on clinical validation, dermatological testing, and the integration of neuropeptide analogues to address fine lines, while digital retail expansion accelerated brand penetration across global e-commerce channels. Service-based personalized skincare programs were limited in share but started gaining visibility, especially in North America and East Asia.

Demand for smart peptide-based skincare will expand to USD 2,106.3 million in 2025, and the revenue mix will gradually shift as advanced delivery technologies such as dissolving microneedle patches and iontophoresis masks gain adoption.

Traditional serum and cream leaders face rising competition from innovation-driven entrants leveraging biotechnology, AI-powered skin diagnostics, and cloud-based dermatology platforms. Major cosmetic players are pivoting toward hybrid portfolios that combine serums, patches, and ampoules to retain relevance. Emerging companies focused on clean-label, sustainable peptides are gaining share, with consumer trust moving away from brand reputation alone toward scientifically validated efficacy and personalized results.

Advances in peptide engineering and delivery systems have significantly improved absorption rates and stability, allowing for more efficient wrinkle reduction treatments across diverse demographics. Serums have gained dominance due to their fast penetration, lightweight texture, and strong consumer trust, while signal peptides have become central for stimulating collagen production. The rise of encapsulated and time-release peptide technologies has further enhanced results by providing prolonged skin contact and deeper layer penetration. The demand is further fueled by aging populations in Western markets and growing middle-class consumers in Asia, who prioritize preventive anti-aging solutions.

Expansion of premium dermatology clinics and pharmacy-based skincare channels has fueled market credibility, while e-commerce platforms are boosting accessibility to younger consumers worldwide. Innovations in microneedle patches and iontophoresis masks are expected to revolutionize peptide delivery, providing at-home professional-level results. Segment growth is expected to be led by serums, clinical-grade claims, and signal peptides, which are all projected to remain market leaders due to their proven efficacy and adaptability.

The Global Smart-Technology Anti-Wrinkle Peptides Market is segmented by delivery technology, peptide type, product type, distribution channel, claim, and region. Delivery technologies include encapsulated/time-release systems, microemulsions, dissolving microneedle patches, and iontophoresis masks, which represent the advanced mechanisms driving product efficacy. Peptide classifications encompass signal peptides, carrier peptides, neuropeptide analogues, and enzyme-inhibiting peptides, all serving distinct roles in collagen stimulation, antioxidant delivery, and wrinkle prevention.

Product types cover serums, creams, patches, and ampoules, designed to meet varying consumer preferences across textures and treatment intensities. Distribution channels include e-commerce, dermatology clinics, pharmacies, and premium beauty retail, highlighting the omnichannel nature of the market. Claims range from clinical-grade and dermatologist-tested to clean-label and fragrance-free, each aligning with consumer expectations of safety, performance, and sustainability. Regionally, the scope spans North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa, reflecting both developed beauty markets and high-growth emerging economies.

| Product Type | Value Share% 2025 |

|---|---|

| Serums | 52.3% |

| Others | 47.7% |

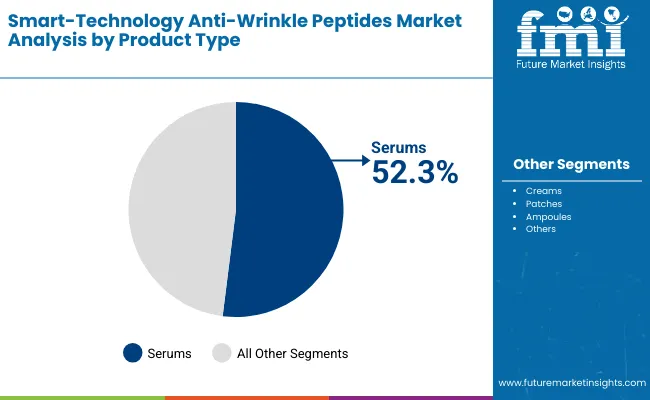

The serum segment is projected to contribute 52.3% of the Global Smart-Technology Anti-Wrinkle Peptides Market revenue in 2025, maintaining its lead as the dominant product category. This is driven by the strong consumer preference for lightweight, fast-absorbing formats that deliver high concentrations of peptides with visible results. Serums are often the first choice for anti-aging regimens, particularly because they can be layered with other skincare products, making them adaptable across routines. The dominance of serums is also supported by their positioning as clinical-grade and dermatologist-tested, which increases consumer trust and adoption across both premium retail and clinical settings.

The segment’s growth is further supported by advancements in encapsulated peptide technologies that improve stability and penetration. As dissolving microneedle patches and ampoules gain traction, serums continue to act as the “entry point” for most consumers due to their affordability, ease of use, and proven track record in delivering results. With new formulations focusing on signal peptides and neuropeptide analogues, serums are expected to retain their position as the backbone of the smart peptide skincare category throughout the forecast period.

| Peptide Type | Value Share% 2025 |

|---|---|

| Signal peptides | 49.9% |

| Others | 50.1% |

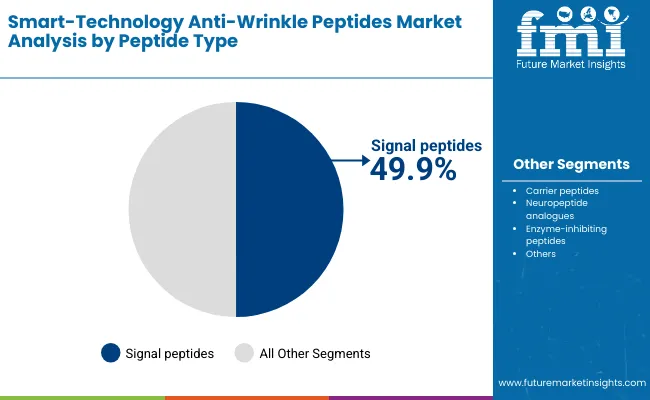

The signal peptides segment is forecasted to hold 49.9% of the market share in 2025, driven by their proven ability to stimulate collagen and elastin production. These peptides are widely recognized for targeting the underlying causes of wrinkle formation rather than providing superficial hydration, which has strengthened their role in advanced anti-aging formulations. Their adoption is particularly strong in serums and creams, where they act as hero ingredients marketed for visible improvements in skin firmness and elasticity.

Signal peptides are also favored for their compatibility with encapsulated/time-release technologies, enabling prolonged delivery and deeper penetration. Their role in dermatologist-tested and clinical-grade products enhances brand credibility, which resonates with both aging consumers and younger demographics seeking preventive care. As awareness of peptide science grows and clinical studies validate their efficacy, signal peptides are expected to remain the leading peptide type, supported by continuous innovations in bioactive formulations.

| Claim | Value Share% 2025 |

|---|---|

| Clinical-grade | 51.5% |

| Others | 48.5% |

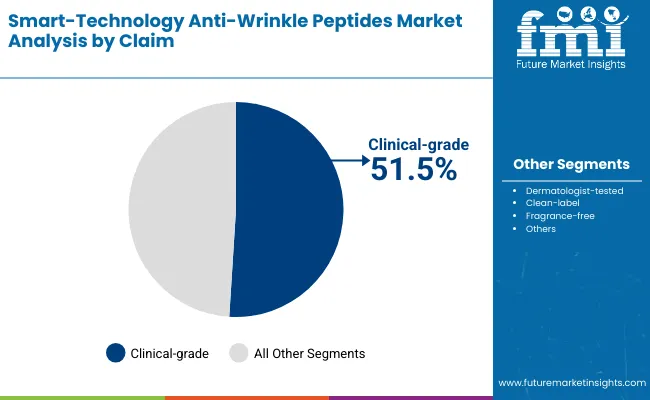

The clinical-grade segment is projected to account for 51.5% of the Global Smart-Technology Anti-Wrinkle Peptides Market revenue in 2025, highlighting the shift in consumer behavior toward products that demonstrate proven safety and efficacy. Clinical-grade claims are particularly influential in dermatology clinics and pharmacies, where medical endorsement enhances product credibility. This preference reflects the rising demand for skincare products that offer science-backed, measurable results rather than cosmetic-only benefits.

The growth of this segment is also supported by the premium positioning of clinical-grade products, which aligns with higher willingness to spend among affluent and aging populations in the USA, Europe, and Japan. In addition, younger consumers in Asia-Pacific markets are increasingly choosing clinical-grade options as part of preventive skincare routines. As biotechnology advances and brands continue to emphasize dermatological testing and transparency, clinical-grade claims are expected to remain the gold standard in consumer preference, sustaining their leadership across the decade.

Rising Demand for Advanced Delivery Systems in Anti-Aging

In 2025, smart delivery technologies like dissolving microneedle patches and iontophoresis masks are gaining traction due to their ability to deliver peptides deeper into the skin layers. Unlike traditional creams and serums, these formats bypass skin barriers and provide targeted release, which leads to measurable improvements in wrinkle reduction. The effect is twofold: consumers perceive faster results, while brands can command premium pricing for these innovations. As clinical studies demonstrate superior bioavailability of peptides in microneedle-based formats, manufacturers are investing heavily in R&D collaborations with biotech labs to refine delivery precision. This driver ensures that anti-aging solutions evolve beyond topical routines and move toward science-driven, minimally invasive technologies, reinforcing consumer trust in the category.

Expanding Middle-Class Skincare Consumption in Asia-Pacific

Between 2025 and 2035, China (20.2% CAGR) and India (22.9% CAGR) will become critical growth engines for smart-technology peptides. Rising disposable income, urbanization, and the social emphasis on youthful skin have accelerated premium skincare adoption. In these markets, consumers are more open to dermatologist-tested, clinical-grade claims and are increasingly shopping online through platforms like Tmall, Nykaa, and Lazada. The effect is a structural shift in the geographic balance of demand, with Asia-Pacific overtaking traditional Western markets in growth pace. Brands are responding by tailoring formulations to local preferences, such as lightweight serums for humid climates and fragrance-free solutions to meet rising sensitivity concerns. This driver solidifies Asia-Pacific as the frontier where the fastest innovations will be tested and scaled.

High Cost of Clinical Validation and Regulatory Hurdles

Smart peptide formulations, particularly those with novel delivery systems, face stringent regulatory pathways in regions like the EU and USA Clinical-grade validation requires multi-phase dermatological trials, which substantially increase product development costs. This restraint often excludes smaller players from competing, as they cannot sustain extended approval timelines or high upfront testing expenses. The effect is a market skewed toward large multinationals with deep pockets, which slows innovation from niche biotech startups. While the industry is adopting adaptive clinical testing models to reduce costs, regulatory rigor will remain a hurdle that restricts speed-to-market and limits consumer access to emerging peptide technologies.

Ingredient Stability and Manufacturing Complexity

Peptides are inherently unstable molecules, sensitive to light, temperature, and pH. Smart technologies like encapsulation help prolong shelf life, but they also raise manufacturing complexity and costs. For example, maintaining stability in dissolving microneedle patches requires precision polymer science and controlled storage environments. Smaller-scale producers often fail to meet these requirements, which results in product recalls or reduced efficacy. The effect is lower consumer trust when instability leads to inconsistent results. To counter this, firms are investing in AI-based formulation design and advanced encapsulation techniques. However, the challenge of balancing stability with scalability remains a significant restraint in broad-based adoption.

Integration of AI-Powered Skin Diagnostics with Peptide Formulations

A growing trend is the fusion of AI-driven skin analysis tools with personalized peptide-based skincare. Consumers can now use smartphone apps or in-store diagnostics to measure wrinkle depth, hydration, and elasticity, which then recommend customized peptide serums or patches. The effect is higher engagement, as consumers perceive tailored results supported by data. Brands like Estée Lauder and L’Oréal are investing in AI-based consumer-facing technologies that guide product recommendations, increasing conversion and loyalty. This trend is reshaping the competitive advantage-shifting it from mass-market formulations to intelligent, personalized peptide regimens.

Rise of Clean-Label, Fragrance-Free Smart Peptides

Consumers are increasingly demanding formulations that exclude synthetic fragrances, parabens, and irritants, particularly in Western Europe and Japan, where sensitive skin concerns are growing. The effect is a market shift where clean-label and fragrance-free claims become as important as clinical efficacy. Manufacturers are reformulating peptides with biodegradable carriers and botanical stabilizers, aligning with both sustainability and wellness trends. This evolution is not superficial it reflects a deeper trust-building exercise where brands must balance clinical-grade claims with transparency. As a result, clean-label smart peptides are becoming a defining feature of product launches, particularly in e-commerce and dermatology clinic channels.

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 20.2% |

| USA | 8.8% |

| India | 22.9% |

| UK | 13.2% |

| Germany | 9.8% |

| Japan | 16.4% |

China, India, and Japan stand out as the fastest-growing markets in the smart-technology anti-wrinkle peptides category. India leads with a projected 22.9% CAGR, driven by a rapidly expanding middle class, rising disposable incomes, and growing awareness of preventive skincare. The popularity of e-commerce platforms and the adoption of dermatologist-tested, clinical-grade products are fueling demand among younger demographics. China follows closely with a 20.2% CAGR, supported by strong consumer acceptance of premium skincare, government-backed biotech innovation, and a robust digital retail ecosystem that amplifies product reach. Japan, with a 16.4% CAGR, reflects a mature but innovation-driven beauty culture, where consumers value both clinical efficacy and clean-label peptide solutions. These Asian markets are not only expanding rapidly but also shaping global innovation trends, as brands increasingly launch microneedle patches, iontophoresis masks, and signal peptide serums first in Asia before global rollouts.

In comparison, Western markets like the USA (8.8% CAGR), Germany (9.8% CAGR), and the UK (13.2% CAGR) are growing more moderately, reflecting their already established anti-aging skincare sectors. The USA remains the largest revenue contributor, supported by high consumer spending on clinical-grade formulations and strong penetration of premium dermatology clinics. Germany and the UK show consistent demand growth, boosted by clean-label, fragrance-free trends and strong pharmacy retail channels. However, their relatively lower CAGR indicates a saturated market where growth is incremental rather than explosive. Overall, while North America and Europe anchor stability with scale and consumer loyalty, Asia-Pacific is clearly the innovation and growth engine of the decade, setting the pace for adoption of advanced peptide technologies worldwide.

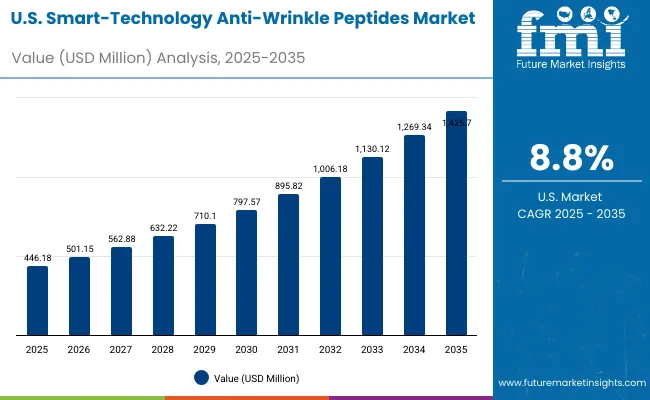

| Year | USA Smart-Technology Anti-Wrinkle Peptides Market (USD Million) |

|---|---|

| 2025 | 446.18 |

| 2026 | 501.15 |

| 2027 | 562.88 |

| 2028 | 632.22 |

| 2029 | 710.10 |

| 2030 | 797.57 |

| 2031 | 895.82 |

| 2032 | 1,006.18 |

| 2033 | 1,130.12 |

| 2034 | 1,269.34 |

| 2035 | 1,425.70 |

The USA market for smart-technology anti-wrinkle peptides is projected to grow at a CAGR of 8.8%, supported by strong consumer demand for clinical-grade serums and dermatologist-tested products. Adoption has been led by dermatology clinics and premium retail chains, where advanced formulations combine signal peptides with encapsulated time-release technologies. Serums already command 53.4% share in 2025, demonstrating consumer preference for lightweight and layered applications. Rising awareness of preventive anti-aging among younger demographics is further boosting demand. With microneedle patches and iontophoresis masks entering mainstream retail, the USA market will increasingly transition from topical-only treatments to science-backed, hybrid skincare solutions.

The UK market is expected to grow at a CAGR of 13.2%, supported by innovations in clean-label and fragrance-free peptide skincare. Consumers are increasingly demanding transparent ingredient lists, aligning with EU sustainability standards and dermatology-led product validation. High adoption is seen in premium beauty retail, where luxury peptide serums and ampoules are gaining traction among affluent buyers. Heritage skincare brands are also reformulating legacy lines with enzyme-inhibiting peptides to appeal to new generations. Growth is supported by public health campaigns around skin wellness and the integration of peptide-based skincare into wellness clinics.

India is witnessing rapid growth, forecast to expand at a CAGR of 22.9% through 2035 - the fastest among leading economies. Demand is fueled by urban middle-class consumers in tier-2 cities, who are increasingly accessing peptides through online channels. Domestic and international brands are launching affordable peptide serums to address preventive skincare needs of younger consumers, while dermatologist-tested and clinical-grade formulations are carving space in metropolitan clinics. Educational awareness campaigns and influencer-driven marketing have amplified peptide adoption among women in their 20s and 30s, signaling a shift toward early preventive skincare.

China is expected to grow at a CAGR of 20.2%, reflecting strong momentum in clinical-grade formulations and microneedle-based peptide delivery. The country’s digitally savvy consumers are driving purchases through platforms like Tmall and JD.com, where clinical-grade peptides already capture 51.8% of market share in 2025. Demand is reinforced by government support for biotech innovation and a growing middle class that prioritizes science-backed beauty products. Local firms are competitively pricing dissolving microneedle patches and encapsulated peptide serums, driving mass adoption across beauty retail and online channels. Cross-sector digitization - from AI skin analysis apps to personalized peptide regimens - is accelerating the sophistication of China’s peptide market.

| Countries | 2025 Share (%) |

|---|---|

| USA | 21.2% |

| China | 11.3% |

| Japan | 6.6% |

| Germany | 14.7% |

| UK | 8.1% |

| India | 5.0% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 19.8% |

| China | 12.3% |

| Japan | 9.4% |

| Germany | 12.8% |

| UK | 7.3% |

| India | 5.6% |

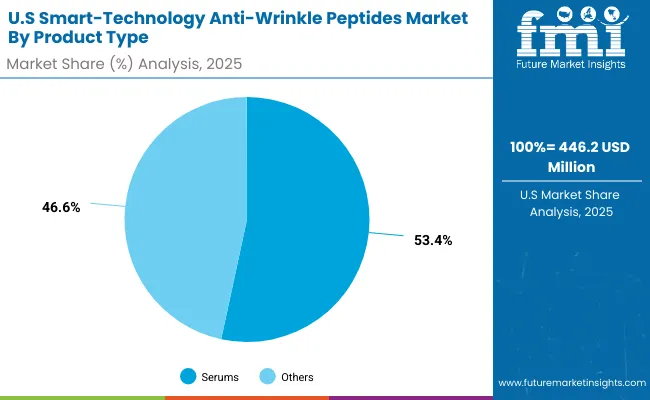

| USA by Product Type | Value Share% 2025 |

|---|---|

| Serums | 53.4% |

| Others | 46.6% |

The USA Smart-Technology Anti-Wrinkle Peptides Market is valued at USD 446.2 million in 2025, with serums leading at 53.4%. This dominance reflects the country’s consumer preference for lightweight, highly concentrated formulations backed by dermatologist validation. Serums are viewed as the most clinically effective entry point into peptide-based skincare, aligning with demand from dermatology clinics and premium retail chains. The segment also benefits from widespread layering practices in American skincare routines, where serums are applied alongside moisturizers and sunscreens.

This advantage positions serums as the backbone of USA anti-aging regimens, particularly among affluent urban populations willing to pay for clinical-grade and dermatologist-tested claims. Creams and patches continue to serve niche preferences, but serums maintain dominance due to their strong performance, trustworthiness, and adaptability across both preventive and corrective skincare routines. As hybrid formats such as microneedle patches gain traction, serums are expected to evolve with encapsulated and time-release peptide systems to sustain growth momentum.

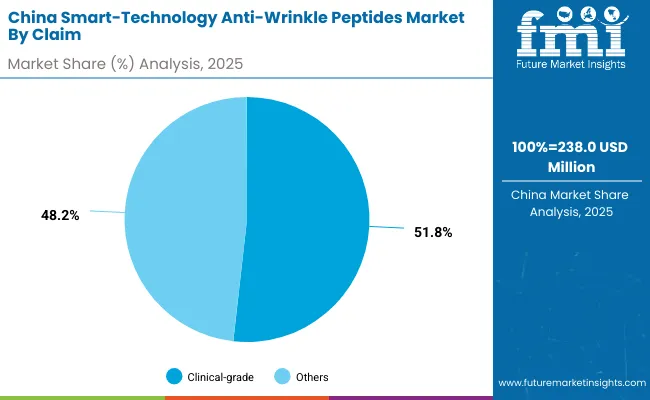

| China by Claim | Value Share% 2025 |

|---|---|

| Clinical-grade | 51.8% |

| Others | 48.2% |

The China Smart-Technology Anti-Wrinkle Peptides Market is valued at USD 238.0 million in 2025, with clinical-grade products leading at 51.8%. This dominance is a direct outcome of Chinese consumers’ heightened trust in science-backed and dermatologist-tested formulations, reflecting a strong cultural preference for evidence-based beauty solutions. The rise of biotech-driven skincare brands and collaborations with local dermatology associations have further reinforced this trend.

This advantage positions clinical-grade products as the most influential category in China, driving adoption not only in major cities but also in tier-2 and tier-3 markets through e-commerce platforms such as Tmall and JD.com. Clean-label and fragrance-free claims are expanding but remain secondary compared to clinical-grade dominance. With government support for biotech R&D and increasing consumer willingness to invest in premium skincare, China is emerging as one of the most dynamic peptide markets globally, expected to outpace Western markets in growth rate and digital penetration.

| Company | Global Value Share 2025 |

|---|---|

| Estée Lauder | 9.1% |

| Others | 90.9% |

The Global Smart-Technology Anti-Wrinkle Peptides Market is moderately consolidated, with multinational beauty leaders, premium skincare innovators, and niche peptide specialists competing across diverse distribution channels. Estée Lauder leads with a 9.1% global share, supported by its strong serum portfolio and clinical-grade peptide formulations marketed under its flagship and sub-brands. Its strategy emphasizes dermatologist endorsements, biotechnology partnerships, and premium positioning across global markets.

Other major players such as Olay, Shiseido, L’Oréal, SkinCeuticals, and Lancôme command significant influence through expansive retail footprints and marketing investment, particularly in serums and creams. Specialist brands like StriVectin, The Ordinary, and Dr. Dennis Gross cater to targeted demographics by focusing on neuropeptide analogues, clean-label claims, and advanced delivery systems such as microneedle patches. Ingredient supplier Sederma plays a pivotal upstream role, developing bioactive peptides for branded formulations worldwide.

Competitive differentiation is shifting from brand heritage alone toward ecosystems that integrate AI-driven skin diagnostics, clean-label transparency, and hybrid delivery technologies. Emerging entrants are capturing share by leveraging personalized skincare apps, sustainable packaging, and affordable clinical-grade solutions, indicating a competitive landscape that values science, accessibility, and consumer trust as much as luxury positioning.

Key Developments in Global Smart-Technology Anti-Wrinkle Peptides Market

| Item | Value |

|---|---|

| Quantitative Units | USD 2,106.3 million |

| Delivery Technology | Encapsulated/time-release, Microemulsions, Dissolving microneedle patches, Iontophoresis masks |

| Peptide Type | Signal peptides, Carrier peptides, Neuropeptide analogues, Enzyme-inhibiting peptides |

| Product Type | Serums, Creams, Patches, Ampoules |

| Distribution Channel | E-commerce, Dermatology clinics, Pharmacies, Premium beauty retail |

| Claims | Clinical-grade, Dermatologist-tested, Clean-label, Fragrance-free |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Estée Lauder, Olay, Shiseido, L’Oréal, SkinCeuticals, Dr. Dennis Gross, StriVectin, Lancôme, The Ordinary, Sederma |

| Additional Attributes | Dollar sales by peptide type and product category, adoption trends in microneedle patches and iontophoresis masks, rising demand for clinical-grade serums, sector-specific growth in dermatology clinics and e-commerce, segmentation by clean-label and fragrance-free claims, integration with AI-powered diagnostics and personalized skincare, regional demand shifts influenced by aging demographics and middle-class expansion, and innovations in encapsulated peptide delivery and neuropeptide analogues. |

The global Smart-Technology Anti-Wrinkle Peptides Market is estimated to be valued at USD 2,106.3 million in 2025.

The market size is projected to reach USD 7,200.5 million by 2035.

The market is expected to grow at a 13.1% CAGR between 2025 and 2035.

The key product types are serums, creams, patches, and ampoules.

In terms of peptide type, signal peptides are expected to command 49.9% share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tuna Peptides Market – Growth, Demand & Functional Benefits

Plant Peptides Market Size and Share Forecast Outlook 2025 to 2035

Animal Peptides Market Size and Share Forecast Outlook 2025 to 2035

Lupine Peptides Market Size and Share Forecast Outlook 2025 to 2035

Endocrine Peptides Test Market Size and Share Forecast Outlook 2025 to 2035

Cocoa-Derived Peptides For Skin Repair Market Size and Share Forecast Outlook 2025 to 2035

Fish Collagen Peptides Market Analysis by Source, Application and Region Through 2035

Antimicrobial Peptides Market

Vegan Collagen Peptides Market Size and Share Forecast Outlook 2025 to 2035

Collagen-Boosting Biomimetic Peptides Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA