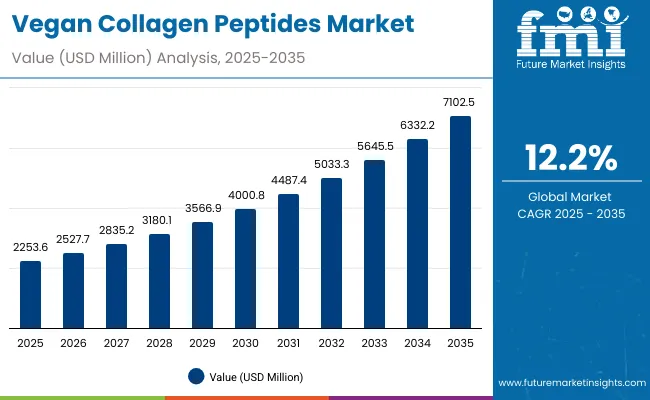

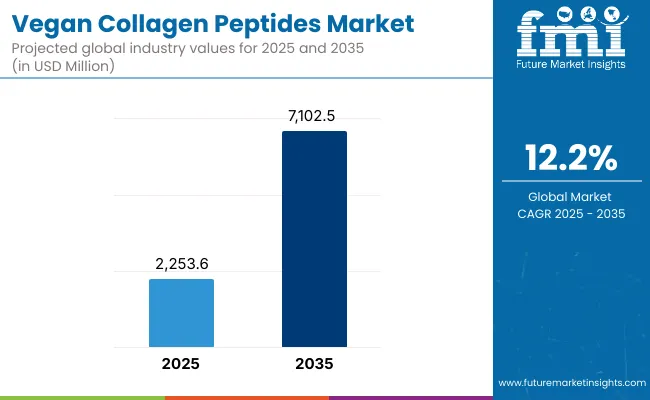

The global vegan collagen peptides market is expected to record a valuation of USD 2,253.6 million in 2025 and USD 7,102.5 million in 2035, with an increase of USD 4,848.9 million, which equals a growth of more than 193% over the decade. The overall expansion represents a CAGR of 12.2% and a more than 3X increase in market size.

Global Vegan Collagen Peptides Market Key Takeaways

| Metric | Value |

|---|---|

| Global Vegan Collagen Peptides Market Estimated Value in (2025E) | USD 2,253.6 million |

| Global Vegan Collagen Peptides Market Forecast Value in (2035F) | USD 7,102.5 million |

| Forecast CAGR (2025 to 2035) | 12.2% |

During the first five-year period from 2025 to 2030, the market increases from USD 2,253.6 million to USD 4,000.8 million, adding USD 1,747.2 million, which accounts for around 36% of the total decade growth. This phase records steady adoption in anti-aging skincare, masstige-tier beauty products, and wellness-focused capsules and powders, driven by demand for cruelty-free alternatives to animal collagen. Serums dominate this period as they cater to over 48% of product demand, particularly in beauty and dermatology applications where quick absorption and targeted performance are critical.

The second half from 2030 to 2035 contributes USD 3,101.7 million, equal to nearly 64% of total growth, as the market jumps from USD 4,000.8 million to USD 7,102.5 million. This acceleration is powered by widespread adoption of recombinant collagen peptides, algae-based innovations, and AI-driven personalization in direct-to-consumer (D2C) brand offerings.

Plant-based peptide formulations gain stronger regulatory acceptance, while premium-tier skincare and ingestibles capture rising consumer spending. By the end of the decade, e-commerce and D2C together account for the majority of channel value. Cloud-enabled traceability and biotech-driven fermentation methods also scale, enhancing transparency and sustainable positioning.

From 2020 to 2024, the global vegan collagen peptides market grew rapidly as biotech-driven innovation shifted focus toward cruelty-free alternatives. During this period, the competitive landscape was dominated by biotech manufacturers and ingredient suppliers controlling nearly all revenue, with leaders such as Geltor and DSM-Firmenich focusing on precision fermentation platforms. Competitive differentiation relied on purity, sustainability credentials, and claims such as vegan-certified and animal-free, while capsules and powders were marketed as supplements but less emphasized in premium skincare.

Demand for vegan collagen peptides will expand to USD 2,253.6 million in 2025, and the revenue mix will shift as skincare and wellness converge. Traditional biotech leaders face rising competition from cosmetic giants integrating vegan peptides into serums and creams. Major suppliers are pivoting to hybrid models, offering both B2B supply of raw peptides and branded B2C launches.

New entrants specializing in algae-based and recombinant platforms are gaining traction, and the competitive advantage is moving away from biotech process alone to ecosystem partnerships, brand trust, and regulatory approvals.

Advances in fermentation-derived biotech have improved purity, scalability, and affordability of vegan collagen peptides, allowing broader use across skincare, nutraceuticals, and healthcare applications. Anti-aging formulations have gained popularity due to their suitability for improving elasticity and wrinkle reduction without animal-derived collagen.

The rise of recombinant and algae-based technologies has contributed to enhanced functional properties and sustainable sourcing. Industries such as cosmetics, dermatology, and functional nutrition are driving demand for solutions that integrate seamlessly into existing product lines.

Expansion of D2C brands, masstige-tier skincare, and premium vegan beauty offerings has fueled market growth. Innovations in serums and capsules, alongside e-commerce and subscription-based retail models, are expected to open new application areas. Segment growth is expected to be led by anti-aging function, serums in product types, and masstige tier offerings, due to their precision, adaptability, and balance of affordability with luxury appeal.

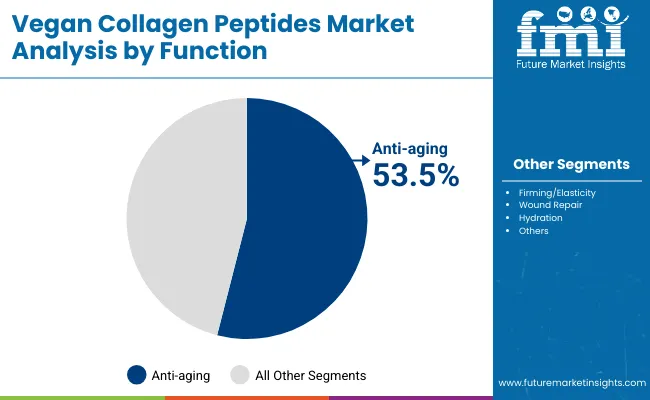

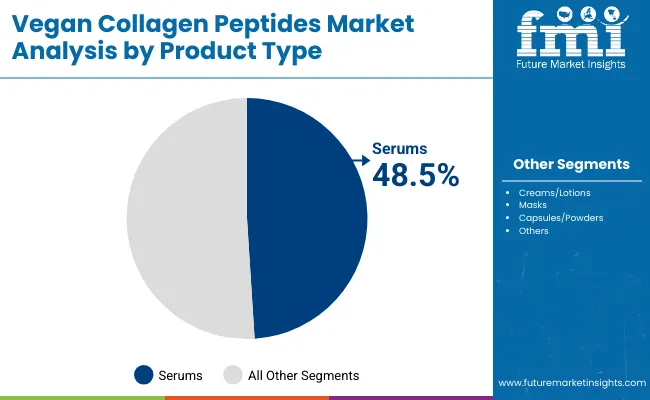

The market is segmented by source, function, product type, channel, tier, and region. Sources include fermentation-derived, plant peptides, algae-based, and recombinant, highlighting the diverse biotech pathways driving adoption. Function classification covers anti-aging, firming/elasticity, wound repair, and hydration to cater to varied consumer needs. Based on product type, the segmentation includes serums, creams/lotions, masks, and capsules/powders, which together define both skincare and ingestible applications.

In terms of channel, categories encompass e-commerce, D2C brands, specialty retail, and pharmacies, aligning with consumer access preferences. Tier segmentation spans mass, masstige, and premium, illustrating the market’s evolution across affordability and positioning. Regionally, the scope spans North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa, with key countries such as USA, China, India, Japan, UK, and Germany leading growth.

| Function | Value Share % 2025 |

|---|---|

| Anti-aging | 53.5% |

| Others | 46.5% |

The anti-aging segment is projected to contribute over USD 1,204.4 million in 2025, maintaining its lead as the dominant functional category. This is driven by ongoing consumer demand for wrinkle reduction, elasticity improvement, and preventative skincare in both mass and premium categories. The segment’s growth is also supported by its adoption in capsules and powders as consumers increasingly view anti-aging as both a topical and ingestible solution.

| Product Type | Value Share % 2025 |

|---|---|

| Serums | 48.5% |

| Others | 51.5% |

The serums segment is forecasted to hold nearly USD 1,090.9 million in 2025, led by its application in targeted skincare. Serums are favored for their high concentration of active peptides and ability to deliver quick results, making them ideal for premium and masstige-tier positioning. Their lightweight format and efficacy-driven marketing have facilitated widespread adoption in online and specialty retail channels.

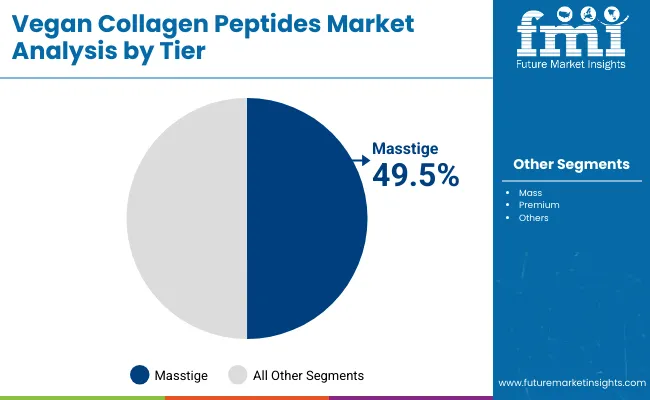

| Tier | Value Share % 2025 |

|---|---|

| Masstige | 49.5% |

| Others | 50.5% |

The masstige tier is projected to account for USD 1,114.1 million in 2025, striking a balance between affordability and aspirational branding. This segment caters to a wide consumer base seeking cruelty-free, effective vegan collagen without premium-level pricing. Growth is fueled by the rise of D2C labels and celebrity-backed skincare lines positioning themselves in this bracket.

Rising Consumer Shift Toward Vegan and Animal-Free Alternatives

One of the strongest drivers is the consumer rejection of animal-derived collagen due to ethical, environmental, and religious concerns. Millennials and Gen Z, who dominate beauty and wellness consumption, are increasingly vocal about cruelty-free, clean-label choices.

Traditional bovine and marine collagen markets face scrutiny because of animal-sourcing practices, creating a direct pull for biotech-driven vegan collagen peptides. In markets like the USA and Europe, ethical consumerism is reshaping skincare and nutraceutical categories, while in China and India, the preference aligns with cultural sensitivities around animal products. This shift ensures a consistent demand base for vegan peptides, especially in anti-aging serums and ingestible powders.

Biotech Advancements in Fermentation and Recombinant Production

A second critical driver is the scalability of fermentation-derived and recombinant collagen peptides. Companies like Geltor, DSM-Firmenich, and Evonik are not only improving yields but also enabling custom-designed collagen sequences that mimic or even outperform animal collagen in elasticity and hydration. These advancements reduce costs, enhance purity, and improve consistency compared to natural sources.

As costs decline with economies of scale, biotech collagen becomes accessible to both premium-tier brands and masstige D2C labels, fueling growth in skincare and wellness markets. The ability to design collagen with targeted bioactivity (for wound repair, hydration, elasticity) offers brands a strong differentiation strategy.

High Production Costs and Price Sensitivity in Mass Market

Despite strong demand, production costs remain significantly higher than traditional bovine or marine collagen. Fermentation and recombinant platforms require specialized facilities, high R&D investment, and strict regulatory compliance. This translates into premium product pricing, limiting accessibility in mass-market channels.

In countries like India and Southeast Asia, where affordability heavily influences buying decisions, penetration of vegan collagen peptides in everyday skincare remains low. This could delay adoption outside premium and masstige categories, especially for ingestible powders where alternatives are priced more competitively.

Limited Clinical Evidence Compared to Traditional Collagen

Another restraint lies in the comparatively limited clinical validation of vegan collagen peptides. While animal-based collagen has decades of published studies linking ingestion to skin, joint, and hair benefits, vegan versions are newer to the market.

Regulatory agencies, dermatologists, and even cautious consumers may hesitate until larger-scale, peer-reviewed human trials demonstrate equal or superior efficacy. This evidence gap slows acceptance in pharmacies and clinical-grade skincare lines, restraining growth in the short to mid-term, especially in regions like Europe where clinical substantiation is critical for consumer trust.

E-commerce and D2C Brands as Primary Growth Channels

The market is rapidly shifting toward online-first distribution. In 2025, e-commerce already represents nearly half of channel value, and D2C brands are scaling quickly. This trend is fueled by younger consumers who prefer subscription-based skincare and wellness solutions, often bundled with personalized recommendations.

In China, platforms like Tmall and Douyin are amplifying vegan collagen launches, while in the USA and Europe, indie D2C brands use social media and influencer campaigns to promote clean-label peptides. Over the next decade, subscription and refill models are expected to dominate, reducing reliance on traditional specialty retail.

Cross-Over of Skincare and Ingestible Collagen Solutions

A defining trend is the convergence of beauty-from-within and topical applications. Serums dominate today with nearly 48.5% market share, but capsules and powders are catching up, driven by consumer belief in holistic skin health. Brands are launching dual-format offerings (e.g., serum + powder kits) marketed as complete anti-aging solutions.

This cross-over trend is especially visible in Japan and Korea, where functional foods and nutricosmetics are culturally ingrained, and it is now spreading into Western markets. By 2035, ingestibles are projected to capture a much higher share, expanding beyond beauty into joint repair, post-surgery wound healing, and hydration supplements.

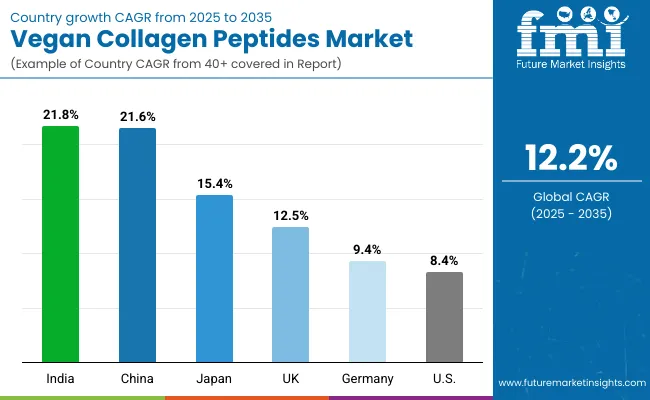

| Country | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 21.6% |

| USA | 8.4% |

| India | 21.8% |

| UK | 12.5% |

| Germany | 9.4% |

| Japan | 15.4% |

The country-wise CAGR analysis for the global vegan collagen peptides market (2025 to 2035) highlights a clear divide between emerging Asia-Pacific economies and mature Western markets. India (21.8%) and China (21.6%) are expected to record the highest growth rates, driven by rising middle-class consumer bases, cultural preference for plant-based and vegetarian solutions, and rapid expansion of e-commerce platforms that allow D2C beauty and wellness brands to scale quickly.

In these markets, affordability in the masstige tier will be critical, with consumers showing strong willingness to experiment with cruelty-free, anti-aging serums and functional powders. Japan (15.4%) follows as another high-growth market, where nutricosmetics and beauty-from-within products are deeply entrenched, and biotech-driven collagen aligns well with the country’s focus on advanced functional skincare and holistic health.

In contrast, Western markets show moderate yet steady growth trajectories. The USA (8.4%) is already the largest market in absolute value, where adoption is led by anti-aging and premium serums, supported by clinical positioning and dermatology-backed branding. However, saturation of the beauty market and price sensitivity in mass categories temper growth compared to Asia.

The UK (12.5%) and Germany (9.4%) reflect strong European interest in sustainable, vegan-certified skincare, but regulatory scrutiny and slower expansion of ingestibles hold back higher CAGR levels. Collectively, this country-level data suggests that Asia-Pacific will be the engine of growth, while North America and Europe will continue to anchor the market with size and stability, especially in premium and clinically validated product formats.

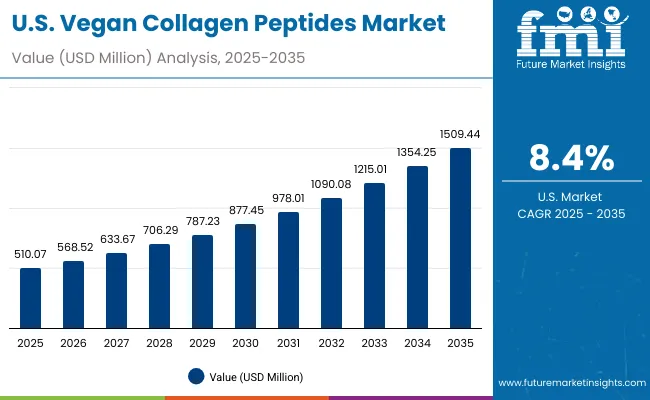

| Year | USA Vegan Collagen Peptides Market (USD Million) |

|---|---|

| 2025 | 510.1 |

| 2026 | 568.5 |

| 2027 | 633.7 |

| 2028 | 706.3 |

| 2029 | 787.2 |

| 2030 | 877.4 |

| 2031 | 978.0 |

| 2032 | 1090.1 |

| 2033 | 1215.0 |

| 2034 | 1354.2 |

| 2035 | 1509.4 |

The vegan collagen peptides market in the United States is projected to grow at a CAGR of 8.4%, led by the rising demand for anti-aging serums and premium skincare formats. Functional ingestibles such as capsules and powders are also gaining popularity, particularly in the wellness and nutricosmetics space. Dermatology clinics and pharmacies have increasingly introduced vegan-certified options, reflecting higher consumer trust in animal-free peptides.

Growth is further accelerated by the expansion of D2C brands and the strong role of online subscription platforms. High clinical validation requirements in the USA also position biotechnology-driven collagen as a premium, science-backed solution.

The vegan collagen peptides market in the United Kingdom is expected to grow at a CAGR of 12.5%, supported by applications across skincare, wellness, and nutricosmetics. Clean-label and sustainable positioning play a decisive role in consumer adoption, with masstige-tier skincare brands capturing significant traction.

Heritage beauty retailers and e-commerce platforms are expanding offerings of vegan-certified serums and creams. In addition, ingestible powders are marketed as part of holistic beauty-from-within regimes. Government-backed sustainability commitments, coupled with strong regulatory frameworks on ingredient labeling, continue to drive adoption and consumer trust.

India is witnessing rapid growth in the vegan collagen peptides market, forecast to expand at a CAGR of 21.8% through 2035. Rising disposable incomes and the growing preference for plant-based solutions are driving demand in both tier-1 and tier-2 cities. Affordable masstige skincare, supported by e-commerce and D2C channels, has accelerated adoption.

Ayurvedic and herbal beauty brands are integrating vegan peptides into anti-aging serums and hydration products, aligning with cultural acceptance of natural solutions. Educational outreach and influencer-driven marketing are further boosting awareness of vegan collagen as a safe, ethical, and effective alternative.

The vegan collagen peptides market in China is expected to grow at a CAGR of 21.6%, the highest among leading economies. This momentum is driven by biotech innovation, masstige-tier launches, and strong uptake of ingestible collagen supplements. Local brands are aggressively rolling out vegan collagen capsules and powders through Tmall, Douyin, and JD.com, enabling mass consumer access.

Municipal wellness initiatives and younger consumer preferences for sustainable products further enhance growth. Competitive pricing from domestic biotech firms is supporting expansion across skincare, wellness, and e-commerce sectors, creating a powerful base for long-term growth.

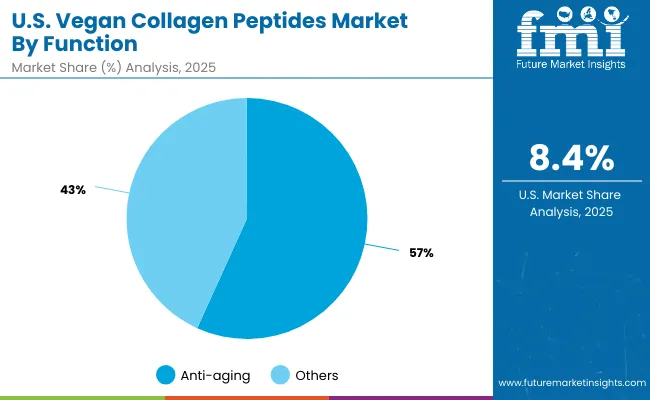

| USA by Function | Value Share % 2025 |

|---|---|

| Anti-aging | 56.8% |

| Others | 43.2% |

The vegan collagen peptides market in the USA is valued at USD 510.1 million in 2025, with anti-aging applications leading at 56.8%, translating to a market value of USD 290 million. This dominance reflects the maturity of the USA skincare sector, where anti-aging products are positioned as essential across both premium and masstige categories.

Dermatology-backed brands are actively integrating vegan-certified collagen into serums, supported by claims of elasticity restoration and wrinkle reduction. Ingestible capsules and powders are gaining traction, particularly in wellness and pharmacy retail, but topical anti-aging formulations remain the anchor of the market.

The strength of anti-aging formats in the USA positions this segment as a foundation for innovation, with biotech-derived vegan collagen peptides offering enhanced purity and consistent efficacy compared to animal-based collagen. E-commerce-driven D2C models, coupled with influencer endorsements, continue to amplify awareness. While hydration and wound repair functions contribute to the overall growth, their value remains secondary to anti-aging in the USA market landscape.

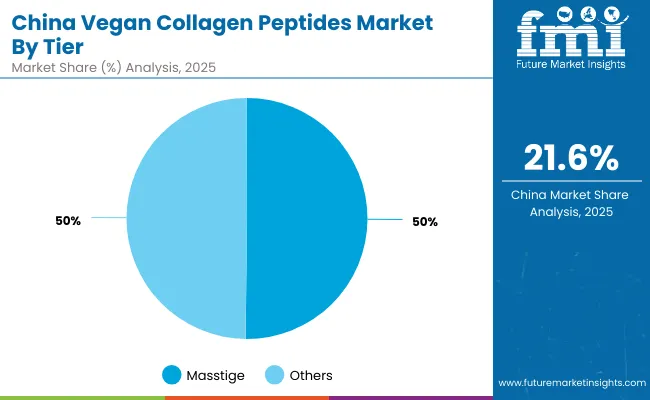

| China by Tier | Value Share % 2025 |

|---|---|

| Masstige | 50.2% |

| Others | 49.8% |

The vegan collagen peptides market in China is valued at USD 278.9 million in 2025, with the masstige tier leading at 50.2%, representing USD 140 million in sales. This leadership is closely tied to China’s consumer demographics, where younger, urban middle-class buyers prioritize affordable yet aspirational beauty solutions. Masstige-positioned brands dominate on Tmall, JD.com, and Douyin, offering vegan collagen serums and ingestibles at accessible price points.

The dominance of masstige reflects China’s e-commerce-driven retail ecosystem, where celebrity-endorsed and influencer-led campaigns rapidly scale new product formats. Premium-tier adoption is increasing, especially in tier-1 cities, but the wider middle-income consumer base ensures masstige retains majority share. By 2035, recombinant and algae-based vegan collagen formats are expected to accelerate uptake further, particularly in ingestible powders marketed for beauty-from-within and hydration.

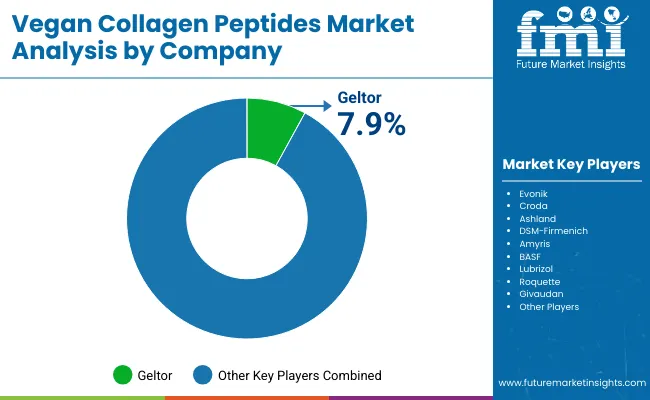

| Company | Global Value Share 2025 |

|---|---|

| Geltor | 7.9% |

| Others | 92.1% |

The global vegan collagen peptides market is moderately fragmented, with biotech pioneers, chemical giants, and specialty ingredient suppliers competing across skincare and wellness categories. Leading players such as Geltor, DSM-Firmenich, Evonik, and Croda hold notable market positions, driven by their capabilities in precision fermentation, recombinant technology, and scalable peptide production.

Their strategies emphasize clinical validation, sustainability certification, and integration into both B2B ingredient supply and B2C skincare brands.Established chemical majors, including BASF, Ashland, Lubrizol, and Givaudan, cater to the cosmetics and personal care sectors by supplying versatile collagen peptide formulations for creams, lotions, and serums. These companies leverage strong downstream partnerships with global cosmetic brands, enabling rapid commercialization across both premium and masstige tiers.

Specialized biotech innovators such as Amyris and Roquette focus on plant- and algae-derived peptide platforms, targeting wellness supplements and vegan ingestible formats. Their strength lies in customization and the ability to serve niche applications like hydration capsules and wound repair formulations.

Competitive differentiation is shifting away from traditional collagen claims toward holistic ecosystems that include sustainability positioning, AR/VR-enabled consumer education, subscription-based D2C skincare bundles, and cross-category offerings that combine topical and ingestible collagen.

| Item | Value |

|---|---|

| Quantitative Units | USD USD 2,253.6 million |

| Component | Hardware, 3D Scanners, Accessories, and Software |

| Range | Short-range scanners, Medium-range scanners, and Long-range scanners |

| Technology | Laser triangulation, Time-of-Flight ( ToF ), Structured light, Photogrammetry, and Laser pulse |

| Type | Laser scanners, Handheld, Stationary, Mobile, Structured light scanners, Optical scanners, Contact scanners, and Non-contact scanners |

| End-use Industry | Automotive, Aerospace & defense, Consumer electronics, Healthcare, Oil & gas, Energy and power, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | FARO Technologies, Inc., 3D Digital Corporation, 3D Systems, Inc., Autodesk, Inc., Artec 3D, Automated Precision, Inc. (API), Carl Zeiss Optotechnik GmbH, Creaform Inc., Direct Dimensions Inc., GOM GmbH, Hexagon AB, Konica Minolta, Inc., NextEngine Inc., Nikon Corporation, OGI Systems Ltd, and ShapeGrabber |

| Additional Attributes | Dollar sales by scanner type and end-use industry, adoption trends in reverse engineering and quality control, rising demand for handheld and portable 3D scanners, sector-specific growth in aerospace, automotive, and healthcare, software and services revenue segmentation, integration with AR/VR and digital twin technologies, regional trends influenced by digitization initiatives, and innovations in laser triangulation, structured light, and photogrammetry methods. |

The global Vegan Collagen Peptides Market is estimated to be valued at USD 2,253.6 million in 2025.

The market size for the Vegan Collagen Peptides Market is projected to reach USD 7,102.5 million by 2035.

The Vegan Collagen Peptides Market is expected to grow at a 12.2% CAGR between 2025 and 2035.

The key product types in Vegan Collagen Peptides Market are hardware, 3D scanners, accessories and software.

In terms of range, short-range scanners segment to command 48.5% share in the Vegan Collagen Peptides Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vegan Cheese Market Size and Share Forecast Outlook 2025 to 2035

Vegan Confectionery Market Size and Share Forecast Outlook 2025 to 2035

Vegan Steak Market Size and Share Forecast Outlook 2025 to 2035

Vegan Pasta Market Size and Share Forecast Outlook 2025 to 2035

Vegan Hyaluronic Acid Market Size and Share Forecast Outlook 2025 to 2035

Vegan Protein Powder Market Analysis - Size, Share, and Forecast 2025 to 2035

Vegan Tortillas Market Size and Share Forecast Outlook 2025 to 2035

Vegan Casing Market Size and Share Forecast Outlook 2025 to 2035

Vegan Dressing Market Size and Share Forecast Outlook 2025 to 2035

Vegan Cheese Sauce Market Size and Share Forecast Outlook 2025 to 2035

Vegan Dips Market Size and Share Forecast Outlook 2025 to 2035

Vegan Yogurt Market Size, Growth, and Forecast for 2025 to 2035

Vegan Meals Market Size, Growth, and Forecast for 2025 to 2035

Vegan Dog Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vegan Chocolate Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vegan Protein Bars Market Analysis – Size, Share & Trends 2025–2035

Vegan Vitamins and Supplements Market – Growth & Demand 2025 to 2035

Analysis and Growth Projections for Vegan Fast-Food Market

Vegan Flavor Market – Trends & Forecast 2025 to 2035

Vegan Sauces Market - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA