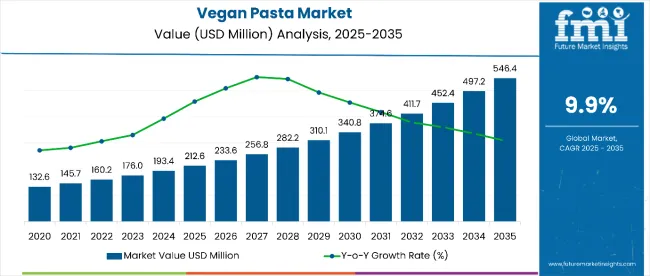

The vegan pasta market is estimated to be valued at USD 212.6 million in 2025 and is projected to reach USD 546.4 million by 2035, registering a CAGR of 9.9% over the forecast period. The market is projected to add an absolute dollar opportunity of USD 333.8 million over the period.

| Attributes | Details |

|---|---|

| Market Size Value in 2025 | USD 212.6 million |

| Market Forecast Value in 2035 | USD 546.4 million |

| Global Growth Rate (2025 to 2035) | 9.9% |

This reflects a 2.57 times growth at a compound annual growth rate of 9.9%. The market’s evolution is expected to be shaped by increasing consumer interest in plant-based diets, growing awareness of animal welfare and sustainability, and rising demand for clean-label and allergen-free products across both developed and emerging regions.

By 2030, the market is likely to reach approximately USD 340.8 million, accounting for USD 132.6 million in incremental value during the first half of the decade. The remaining USD 205.6 million is expected during the second half, suggesting a back-loaded growth pattern. Product diversification across gluten-free, legume-based, and fortified vegan pasta variants is gaining traction due to evolving consumer preferences and increased retail visibility in mainstream and specialty food channels.

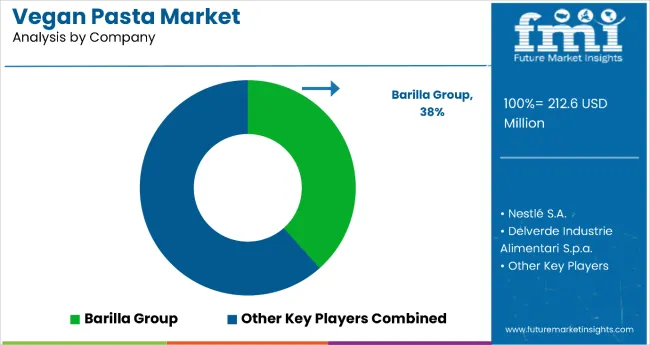

Companies such as Barilla Group holding a 38% market share, are strengthening their competitive positions through investment in sustainable sourcing, innovation in plant-based formulations, and organic certifications. Premium positioning strategies and expansion into health-conscious consumer segments are accelerating growth, especially through online platforms and natural food retailers. Market performance is expected to remain anchored in consumer education campaigns, supply chain efficiency, and product quality and transparency standards.

The vegan pasta market holds approximately 39% of the plant-based packaged food segment, driven by its health positioning, convenience, and increasing consumer shift toward meat-free diets. It accounts for around 33% of the plant-based carbohydrate sources market, supported by the growing adoption of alternative grains such as lentils, chickpeas, and brown rice in pasta formulations.

The market contributes nearly 26% to the gluten-free food segment, particularly among consumers seeking allergen-free and digestive-friendly staple options. It holds close to 21% of the organic packaged food market, where certified vegan pasta products command premium pricing among health-conscious and sustainability-driven shoppers. The share in the functional food products category reaches about 29%, reflecting demand for products fortified with plant proteins, fiber, and micronutrients.

The market is undergoing structural transformation driven by the rising popularity of vegan and flexitarian diets, along with the expanding presence of clean-label brands in retail and online channels. Innovative processing methodsincluding cold extrusion, vegetable-infused blends, and shelf-stable packaginghave enhanced texture, cooking performance, and convenience.

Manufacturers are introducing value-added offerings such as high-protein pasta, fortified formulations, and organic-certified options tailored to specific dietary needs. Strategic collaborations between ingredient suppliers, private-label retailers, and plant-based food startups are accelerating product development and expanding usage in both household consumption and foodservice channels.

Rising health consciousness and the global shift toward plant-based diets have positioned vegan pasta as a preferred alternative to traditional wheat- and egg-based pasta, fueling steady market growth. Increasing consumer awareness of the benefits of meat-free, dairy-free, and allergen-friendly diets is supporting regular consumption across health-conscious, vegan, vegetarian, and flexitarian demographics.

The market benefits from expanding applications in foodservice and retail channels, where vegan pasta is increasingly featured in meal kits, ready-to-eat dishes, and restaurant menus. Innovation in pasta formulations using ingredients like lentils, chickpeas, quinoa, and brown rice, along with advancements in texture, taste, and cooking performance, are broadening consumer appeal beyond niche health markets.

As consumers seek to manage lifestyle-related health issues and reduce environmental impact, vegan pasta aligns with growing demand for sustainable, clean-label, and functional food options. With increasing mainstream acceptance, support from sustainability narratives, and expansion in both developed and emerging markets, the outlook for the vegan pasta market remains highly favorable.

The market is segmented by category, nature, source, product, packaging, sales channel, and region. By category, the market is bifurcated into fresh and dried. Based on nature, the market is bifurcated into organic and conventional. In terms of source, the market is classified into wheat, rice, legumes, buckwheat, oats, and others (corn, quinoa, amaranth, and spelt).

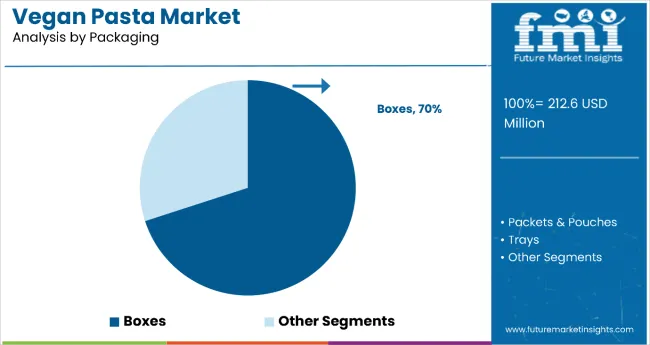

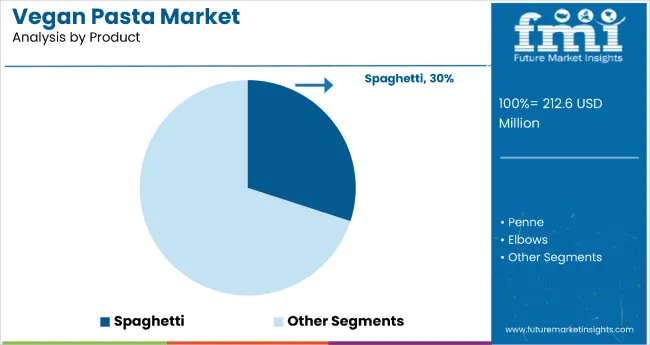

By product, the market is divided into penne, spaghetti, elbows, fettuccine & linguine, filled pasta, and other products (rotini, rigatoni, farfalle, and shells). By packaging, the market is classified into boxes, trays, and packets & pouches.

Based on sales channel, the market is divided into offline sales channel (supermarkets/hypermarkets, departmental stores, convenience stores, and other sales channels such as specialty retailers and discount stores) and online sales channel (company website and e-commerce platforms). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East & Africa.

The boxes segment dominates vegan pasta packaging with an estimated 70% share in 2025, reflecting its strong presence across global retail channels. As rigid, recyclable, and shelf-stable options, boxes provide superior protection during transport, shelf stacking, and storage, qualities valued by both retailers and consumers. Their robust structure preserves product integrity while offering ample branding space for clear labeling of health, organic, and vegan credentials. On the consumer side, boxes align with growing demand for sustainable fiber-based materials such as paperboard, which are widely recyclable and increasingly preferred amid tightening regulations on plastics.

Additionally, the stability and mass-production efficiency of paper-based boxes make them cost-effective for larger formats, such as family-size packs, enabling economies of scale. In contrast, alternatives like trays or pouches lag behind due to higher costs, lower rigidity, and limited branding potential, confirming boxes as the most lucrative and strategically advantageous packaging choice.

The spaghetti segment leads the vegan pasta market with approximately 30% of total revenue in 2025, driven by its versatility, familiar format, and widespread acceptance across both traditional and plant-based diets. Vegan spaghetti, often made from alternative ingredients such as chickpeas, lentils, brown rice, and quinoa, delivers enhanced nutritional value, appealing to health-conscious, gluten-free, and environmentally aware consumers.

Its adaptability to a wide range of sauces and cooking styles makes it a staple in both home kitchens and foodservice establishments, from quick weeknight meals to premium vegan dining. Spaghetti’s strong shelf presence and high purchase frequency reinforce its market dominance. With growing demand for clean-label, allergen-free, and protein-rich foods, spaghetti continues to outperform other shapes, securing its position as the most commercially lucrative format in the vegan pasta category.

From 2025 to 2035, rising consumer demand for plant-based foods and increased awareness of the environmental and health impacts of traditional animal-based diets are significantly influencing purchasing decisions in the global vegan pasta market. This shift positions manufacturers with clear plant-based credentials, clean-label formulations, and sustainability narratives as key beneficiaries of an expanding base of health-conscious, ethically-driven, and flexitarian consumers.

Plant-Based Lifestyle Adoption Drives Vegan Pasta Market Growth

The growing adoption of vegan, vegetarian, and flexitarian diets has emerged as the primary catalyst for the expansion of the vegan pasta market. By 2024, increased scrutiny of traditional dairy and egg-based pasta due to environmental and ethical concerns fueled consumer interest in plant-based alternatives. In 2025, vegan pasta became a dietary staple in urban, health-aware populations due to its cholesterol-free, low-allergen, and nutrient-dense composition.

Premium Product Innovation Creates Market Opportunities

In 2024, the market began seeing rising demand for value-added vegan pasta products, including formats made from legumes, ancient grains, and vegetables, as well as those featuring enhanced flavor profiles and quick-cook formats. By 2025, organic certification, non-GMO labeling, and sustainable packaging emerged as baseline expectations for premium shelf presence across high-value retail and online channels.

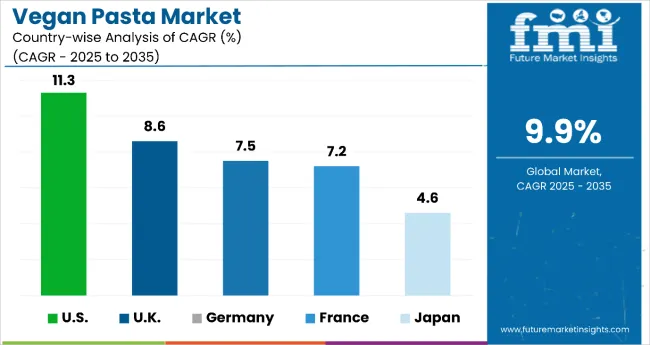

| Countries | CAGR |

|---|---|

| USA | 11.3% |

| UK | 8.6% |

| Germany | 7.5% |

| France | 7.2% |

| Japan | 4.6% |

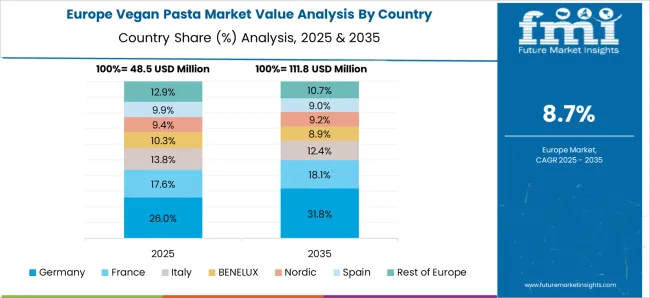

Among the top five countries, the USA leads the market with the highest projected CAGR of 11.3%, driven by advanced food technology, expanding plant-based consumer bases, and robust e-commerce penetration. The UK follows with a CAGR of 8.6%, supported by a strong flexitarian movement and retailer-driven innovation in gluten-free and organic ranges.

Germany, with a 7.5% CAGR, benefits from its highly structured food retail landscape and sustainability-driven consumption patterns. France trails slightly with 7.2%, overcoming traditional dietary norms through increased health awareness and vegan adoption in urban centers. Japan, while showing the lowest CAGR at 4.6%, is gradually developing due to rising urban demand, convenience-focused packaging, and a growing import market for premium organic options.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

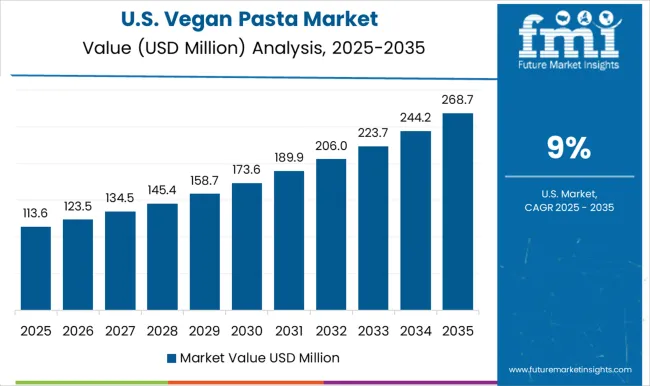

The USA vegan pasta revenue is expected to expand at a CAGR of 11.3% between 2025 and 2035. Rising health consciousness and dietary shifts toward plant-based proteins are fueling output growth across major USA pasta producers. There’s a significant move toward developing legume-based pasta using chickpeas, lentils, and quinoa to address protein and gluten concerns.

Technological innovation in extrusion and dehydration is improving texture and shelf life, helping brands reach broader consumer bases. E-commerce platforms and big-box retailers are enhancing their vegan product offerings. Moreover, regulatory support around plant-based nutrition and transparent labeling standards is boosting consumer confidence.

Startups and legacy brands alike are leveraging influencer marketing and social media to highlight clean ingredients and health benefits. The trend is particularly strong in urban and suburban settings where consumer preferences are shifting rapidly.

The UK vegan pasta market is projected to grow at a CAGR of 8.6% from 2025 to 2035. The country leads Europe in vegan pasta production, fueled by an expanding flexitarian population and increasing focus on plant-based health. Local manufacturers are investing in new production lines for gluten-free and protein-rich pasta made from legumes and ancient grains.

Supermarkets like Tesco and Sainsbury’s are enhancing their vegan assortments, particularly in private-label ranges. Demand is supported by government-backed health awareness campaigns, transparent food labeling policies, and strong consumer preference for clean-label alternatives.

Urban areas show heightened demand for quick-cook and organic options. Sustainability commitments are also influencing innovation in recyclable and biodegradable packaging. With continuous product launches and expanding shelf space, the UK market is set to sustain robust output growth throughout the forecast period.

Sales of vegan pasta in Germany are forecasted to grow at a CAGR of 7.5% during the 2025 to 2035 period. As one of the most structured and progressive plant-based food markets in Europe, Germany exhibits strong vegan pasta penetration in both urban and rural retail channels. Local manufacturers are innovating across source typesspelt, oats, legumesto cater to demand for clean-label, organic alternatives.

Cities like Berlin and Hamburg are driving adoption through health-conscious consumers and a vibrant vegan food scene. Demand for sustainability has influenced both packaging design and raw material sourcing. German consumers are highly aware of ingredient origins and transparency, leading to trust in ethically positioned vegan products. Vegan pasta is becoming a staple not only in health stores but also in mainstream supermarkets like REWE and Edeka.

Revenue from vegan pasta in France is projected to grow at a CAGR of 7.2% from 2025 to 2035. Despite traditional culinary preferences, France is witnessing a notable shift toward plant-based diets, particularly among younger, health-focused demographics. Vegan pasta is gaining popularity in urban areas, where demand for meat and dairy alternatives is increasing.

Retailers are introducing organic and gluten-free ranges, often produced locally and supported by clean-label claims. Growth is further supported by government health initiatives promoting reduced meat consumption. Vegan pasta is also gaining ground in the restaurant and catering segments, especially among modern French bistros and fast-casual dining.

Domestic manufacturers are investing in new lines to cater to growing interest in functional and allergen-free alternatives. Increased media coverage around sustainability and animal welfare is encouraging experimentation with vegan recipes across various consumer touchpoints.

Sales of vegan pasta in Japanare estimated to grow at a CAGR of 4.6% over the forecast period of 2025–2035. While still nascent compared to Western markets, Japan’s adoption of vegan pasta is being driven by a younger, urban demographic interested in health and sustainability. Consumers are drawn to innovative formulations using familiar ingredients like rice, konjac, and soy.

Smaller portion sizes and ready-to-eat packaging formats resonate with convenience-focused buyers. Imported premium brands with organic and clean-label certification are gaining traction in Tokyo and other metro centers. Retailers such as AEON and Ito-Yokado are beginning to diversify their plant-based portfolios, including vegan pasta options. Although domestic production is limited, interest in clean eating and functional foods is gradually expanding the market. Increasing popularity of vegan cafes and lifestyle shifts is expected to enhance urban penetration.

The market is moderately fragmented, with Barilla Group holding the dominant position, accounting for 38% market share through strong global distribution, brand heritage, and extensive innovation in plant-based pasta offerings. The company leverages vertical integration and a broad product portfolio including legume-based and gluten-free pasta to appeal to the growing health-conscious consumer base.

Key players include Nestlé S.A., Banza LLC, Explore Cuisine, De Cecco, Tolerant Foods, The Kraft Heinz Company, Jovial Foods Inc., Ancient Harvest, Seggiano, and Garofalo Pasta. These companies offer diverse vegan pasta solutions across multiple product types such as spaghetti, penne, elbows, filled pasta, and more targeting both mainstream consumers and niche dietary markets.

Market growth is driven by increasing veganism and flexitarian diets, rising demand for clean-label and high-protein foods, rapid expansion of online grocery platforms, and greater emphasis on sustainability and health particularly across North America and Western Europe. Players focused on innovation, functional nutrition, and ethical branding are best positioned to capitalize on the evolving market.

| Item | Value |

|---|---|

| Quantitative Units | USD 212.6 Million |

| Category | Fresh and Dried |

| Nature | Organic, Conventional |

| Source | Wheat, Rice, Legumes, Buckwheat, Oats, Others (Quinoa, Amaranth, Spelt) |

| Product Type | Penne, Spaghetti, Elbows, Fettuccine & Linguine, Filled Pasta, Others (Farfalle, Macaroni, Shells, Lasagna) |

| Packaging | Boxes, Trays, Packets & Pouches |

| Sales Channel | Offline (Supermarkets/Hypermarkets, Departmental Stores, Convenience Stores, Other Channels), Online (Company Website, E-commerce Platforms) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa, Australia and 40+ countries |

| Key Companies Profiled | Barilla Group, Nestlé S.A., Delverde Industrie Alimentari S.p.A., RFM Corporation, Grupo La Moderna, General Mills Inc., Pastas Gallo Company, Bionaturae LLC, Windmill Organics. |

| Additional Attributes | Rising demand for plant-based nutrition, increasing popularity of gluten-free diets, innovations in sustainable packaging |

The global vegan pasta market is estimated to be valued at USD 212.6 million in 2025.

The market size for the vegan pasta market is projected to reach USD 524.9 million by 2035.

The vegan pasta market is expected to grow at a 9.5% CAGR between 2025 and 2035.

The key product types in vegan pasta market are fresh and dried.

In terms of nature, organic segment to command 41.8% share in the vegan pasta market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vegan Pasta Sauce Market Expansion - Dairy-Free & Plant-Based Sauces 2025 to 2035

Vegan Vitamin D3 Supplements Market Size and Share Forecast Outlook 2025 to 2035

Vegan Cheese Market Size and Share Forecast Outlook 2025 to 2035

Vegan Confectionery Market Size and Share Forecast Outlook 2025 to 2035

Vegan Steak Market Size and Share Forecast Outlook 2025 to 2035

Vegan Hyaluronic Acid Market Size and Share Forecast Outlook 2025 to 2035

Vegan Collagen Peptides Market Size and Share Forecast Outlook 2025 to 2035

Vegan Collagen Skincare Market Size and Share Forecast Outlook 2025 to 2035

Vegan Protein Powder Market Analysis - Size, Share, and Forecast 2025 to 2035

Vegan Tortillas Market Size and Share Forecast Outlook 2025 to 2035

Vegan Casing Market Size and Share Forecast Outlook 2025 to 2035

Vegan Dressing Market Size and Share Forecast Outlook 2025 to 2035

Vegan Cheese Sauce Market Size and Share Forecast Outlook 2025 to 2035

Vegan Dips Market Size and Share Forecast Outlook 2025 to 2035

Vegan Yogurt Market Size, Growth, and Forecast for 2025 to 2035

Vegan Meals Market Size, Growth, and Forecast for 2025 to 2035

Vegan Dog Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vegan Chocolate Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vegan Protein Bars Market Analysis – Size, Share & Trends 2025–2035

Vegan Vitamins and Supplements Market – Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA