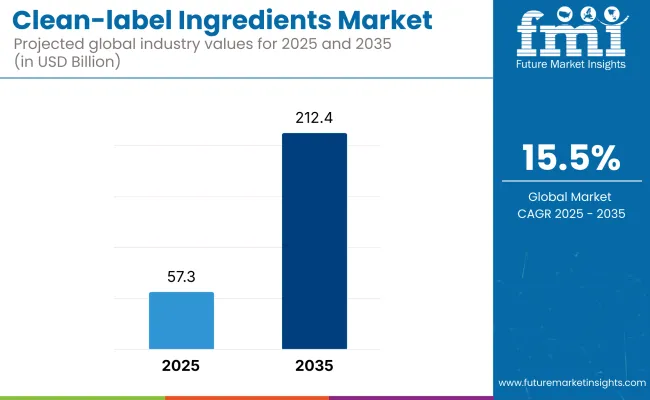

The clean-label ingredients market is estimated to account for USD 57.3 billion in 2025 and is projected to reach USD 212.4 billion by 2035, showcasing a strong CAGR of 15.5% during the forecast period.

| Attributes | Description |

|---|---|

| Estimated Global Clean-label Ingredients Market Size (2025E) | USD 57.3 Billion |

| Projected Global Clean-label Ingredients Market Value (2035F) | USD 212.4 Billion |

| Value-based CAGR (2025 to 2035) | 15.5% |

The United States emerges as the most lucrative country in terms of market size, driven by consumer inclination towards transparent ingredient labeling and rigorous regulatory frameworks supporting natural and minimally processed food products.

Furthermore, the fastest-growing region during this period is projected to be Europe, attributed to stringent regulations against artificial additives and significant consumer demand for natural, sustainable, and ethically sourced ingredients.

Market dynamics reflect a significant consumer shift towards ingredient transparency, driven by heightened health awareness, a desire for authenticity, and increased scrutiny on food safety standards. The growth is primarily driven by increasing consumer skepticism about artificial additives and synthetic preservatives. The demand surge for recognizable, simple, and natural ingredient lists strongly motivates food producers to reformulate products using clean-label solutions.

Nonetheless, high ingredient costs and formulation complexities can potentially restrain market expansion. The evolving consumer perception towards naturalness and environmental sustainability creates considerable momentum for plant-based and bio-derived ingredients, marking a critical trend in the market.

Industry players are actively engaging in strategic research, focusing on the development of innovative processing technologies to retain ingredient functionality while meeting consumer expectations for simplicity and purity.

lean-label ingredients market is anticipated to witness robust expansion driven by progressive consumer education, increasing regulatory mandates, and persistent innovation. Companies will likely adopt advanced extraction and minimal processing techniques, significantly enhancing product portfolios that align with consumer preferences for transparency and sustainability.

Intensified competitive pressure will prompt accelerated investment in R&D, particularly targeting clean-label preservatives, texturizers, and flavors. In addition, consumer-driven digital traceability solutions, leveraging blockchain and similar technologies, are expected to provide substantial differentiation, improving consumer trust and market acceptance significantly. The continued emphasis on sustainability and ethical sourcing is also anticipated to underpin long-term market growth, particularly in mature and highly regulated markets.

Export data for the last few years also reveals the steady growth of the clean-label ingredients market. From 2020 to 2024, exports stood at USD 500 million, increased by 10% in 2021 to reach USD 550 million, and rose further to USD 620 million in 2022.

The market also witnessed significant growth in 2023, with exports reaching USD 700 million, further evidence of growing demand for natural, transparent food ingredients. Exports rose to USD 800 million in 2024 as consumers demand healthier, clean-label products.

| Year | Exports (USD million) |

|---|---|

| 2020 | 500 |

| 2021 | 550 |

| 2022 | 620 |

| 2023 | 700 |

| 2024 | 800 |

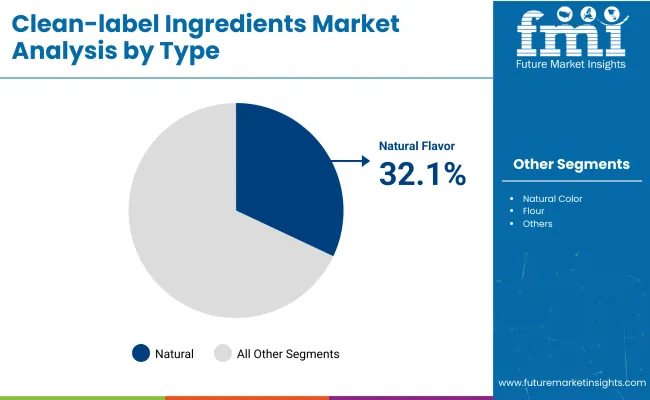

Natural flavoring agents are expected to hold a commanding 32.1% market share in 2025, reflecting their role as the largest segment in the global clean-label ingredients market. This dominance is projected to be sustained throughout the forecast period, supported by the overarching market CAGR of 15.5% between 2025 and 2035.

As consumer demand intensifies for minimally processed foods with recognizable ingredient lists, natural flavors have emerged as a sensory keystone in clean-label reformulations. Their strategic importance lies not only in flavor delivery but also in reinforcing brand narratives of transparency and authenticity.

The migration away from synthetic flavoring systems is no longer a trend but a fundamental requirement in most premium and health-conscious product categories. Formulators are increasingly leveraging natural flavor systems to bridge the gap between consumer expectation and manufacturing functionality, especially where sugar, fat, or artificial preservatives are being reduced or eliminated.

Despite regulatory complexities and sourcing challenges, particularly for standardized sensory profiles across geographies, the segment is expected to benefit from improved extraction technologies and fermentation-enabled solutions. As clean-label portfolios mature, natural flavors will play a pivotal role in brand differentiation, regulatory compliance, and sustainable procurement practices, positioning this segment as the most influential sensory lever in the global shift toward clean-label innovation.

Plant-based ingredients are projected to exhibit a CAGR exceeding 17% between 2025 and 2035, outpacing the overall clean-label ingredients market and signaling their evolution from niche to mainstream adoption.

This segment’s growth reflects a convergence of ethical consumption, environmental stewardship, and clean-label expectations. As consumers increasingly scrutinize ingredient origins, plant-based inputs have gained strategic favor not just for their natural profile but for their alignment with sustainability and animal welfare values.

Within the clean-label framework, plant-based alternatives are being prioritized for their multifunctionality-enabling developers to replace synthetic additives while enhancing nutritional density, textural integrity, and visual appeal. The segment’s relevance extends beyond health-focused consumers, increasingly attracting flexitarians and climate-conscious younger demographics.

However, the pathway to scale is not without constraints. Variability in crop yields, supply chain volatility, and performance limitations in certain processing conditions present formulation and cost hurdles. Nevertheless, advances in precision extraction, plant breeding, and protein functionality are mitigating such limitations.

With rising regulatory endorsement for sustainable sourcing and low-impact manufacturing, plant-based ingredients are poised to redefine the value proposition of clean-label product lines. As global brands double down on ESG-aligned portfolios, this segment is expected to anchor long-term innovation and consumer trust within the clean-label paradigm.

Increasing Consumer Demand for Transparency and Simplicity

The growing demand for transparency in food labeling is driving the market. Consumers are increasingly choosing products with natural, simple ingredients and avoiding artificial additives. Clean-label products, which feature minimal processing and clear, honest labels, are meeting this demand as shoppers seek more transparency in what they consume.

Health-Consciousness and Demand for Natural Ingredients

As people prioritize healthy eating and avoid synthetic additives, growing health consciousness is driving the need for clean-label foods. Clean-label products-which are usually natural, non-GMO, and devoid of artificial ingredients-are becoming more and more popular, which is driving growth in a number of food and beverage industries.

Shift Toward Sustainability and Ethical Consumption

The market for clean-label components is expanding due to sustainability concerns, as customers are increasingly selecting goods based on environmental effects and ethical origin. These ideals are reflected in clean-label ingredients, which are usually more natural and sustainably sourced, making firms that use them more appealing to consumers who care about the environment.

Rising Prices and Cost Sensitivity

Compared to traditional options, clean-label materials frequently require more time-consuming processing, stringent quality control, and cautious sourcing. For instance, because they require more work to develop and harvest, natural and organic ingredients are more expensive.

These items may also have a shorter shelf life without artificial preservatives, requiring more expensive packaging to ensure safety and freshness. Manufacturers may have to pay more for clean-label products as a result of these additional expenses, which could restrict market expansion in price-sensitive categories by raising retail pricing for consumers.

Sustainable Opportunities

Customers are choosing products with clean-label, sustainably sourced components because they are more conscious of the effects on the environment. Companies can benefit from this change by emphasizing environmentally friendly sourcing, packaging, and production methods. This will help them establish a reputation for environmental responsibility and satisfy consumers' increasing need for sustainable products.

Plant-Based and Vegan Ingredients

Customers are actively looking for goods created with clean-label, plant-derived components as veganism and plant-based diets gain popularity. As more people follow ethical eating guidelines and cut back on their use of animal products, this trend is predicted to pick up speed, opening up a market for plant-based, minimally processed substitutes that support sustainability and health objectives.

Transparency and Traceability

Customers are demanding more information about where their food comes from and how it is made, which is forcing businesses to source their ingredients transparently. Brands can boost consumer confidence by using the Blockchain technology or Third-party certifications to provide ingredient traceability, assuring that their goods adhere to quality and ethical standards.

Rising Demand for Organic Products and Free of Allergens

The market for clean-label ingredients is witnessing a significant trend in the growing demand for components that are plant-based and allergen-free. There is a discernible trend toward plant-based foods and components that omit common allergies like gluten, dairy, and nuts as people grow more conscious of their diet and health. The necessity for allergy-friendly choices, the rise of plant-based diets and veganism, and health concerns are the main forces behind this movement.

Clean-label ingredients, which are plant-based and devoid of artificial additives, satisfy these requirements, resulting in goods that are thought to be safer and more natural for people with food sensitivities. In order to satisfy the demands of health-conscious consumers, food manufacturers are consequently concentrating more on plant-based and allergen-free clean-label ingredients.

Shift Toward Transparency and Simplicity in Food Labeling

A major consumer trend in the clean-label ingredients market is the increasing demand for transparency and simplicity in food labeling. Consumers are favoring products with easily readable labels and listings of natural ingredients.

Customers want to exactly know the nature of components present before they purchase and are moving away from artificial substances, preservatives, and chemicals. Therefore, food manufacturers focus on standardizing the food processing stages and using simple and familiar ingredients to consumers. This shift has triggered businesses to pursue clean-labelling for products in the consumer sector.

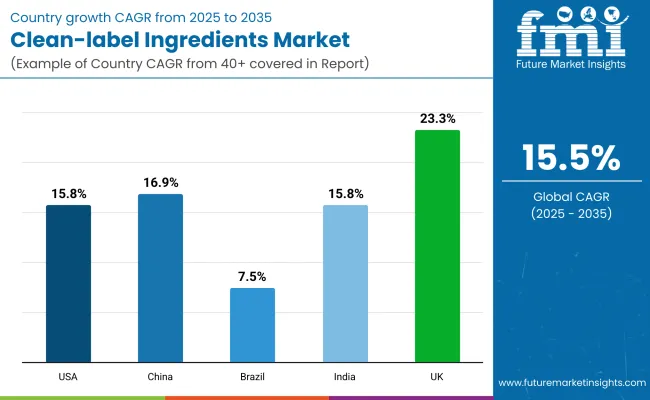

| Countries | CAGR |

|---|---|

| India | 15.8% |

| China | 16.9% |

| UK | 23.3% |

| USA | 15.8% |

| Brazil | 7.5% |

Global food trends, such as the need for natural and sustainably sourced ingredients, are having an increasing impact on Indian consumers, especially the younger generations. The market for clean-label components is expanding as a result of the expansion of veganism, plant-based diets, and a general interest in ethical and ecological consumerism.

In order to satisfy the needs of consumers who are ethically and health-conscious, Indian producers are launching more clean-label products as a result of a greater emphasis on sustainability and transparency in food production. Further propelling the market's growth is the ease with which consumers can now access clean-label options thanks to the advent of online shopping channels.

The China Clean-label Ingredients Market is poised to grow at 16.9% CAGR by 2035. Rising consumer demand for natural, minimally processed foods with transparent labels, in line with health-conscious trends and increased food safety awareness, are key drivers. Innovations in plant-based ingredients, clean proteins, organic additives, and the increasing adoption of sustainable practices will gain traction in the market.

Advancements in food processing technologies supports clean-label formulations. Rising government regulations surrounding food labeling will spur increased consumer confidence and positive market growth in China.

Food products that people believe will help prevent or manage chronic diseases, including obesity, diabetes, and heart disease, are becoming more and more popular in the United Kingdom. In line with their aim for healthier eating habits, many people are searching for cleaner, more natural food options.

Clean-label ingredients are thought to be safer and healthier options because they don't contain artificial chemicals or excessively processed additives. As customers increasingly look for foods that are thought to be better for their long-term health, this choice is pushing food manufacturers to include clean-label components in their product offerings.

The USA government, through the Food and Drug Administration (FDA) and other regulatory bodies, has implemented food labeling regulations that encourage greater transparency in food products. The clean-label movement is supported by the FDA's regulations for accurate and transparent food labeling, which include the need for ingredients, nutritional data, and allergen notifications to be included.

These rules help consumers make educated decisions by making it simpler for them to comprehend what is in their food. Additionally, with the rise of clean-label preferences, the government is also exploring and revising labeling standards for claims like "natural" and "organic" to ensure consistency and consumer confidence in clean-label products.

The Brazil clean-label ingredients industry is expected to witness a steady growth at 7.5% CAGR by 2035. The key trends driving this growth include the growing demand from consumers for healthier, more transparent food options free from artificial additives, preservatives, and chemicals. Natural, organic ingredients are in high demand among health-conscious and sustainability-focused Brazilian consumers.

The industry is also witnessing a shift towards plant-based alternatives, clean proteins, and functional ingredients. Increased awareness of food safety and stricter labeling regulations will drive innovations in food processing technologies and enhance clean-label product offerings.

A variety of major competitors in the clean-label ingredients industry are committed to offering natural, minimally processed products that satisfy customer desires for health-conscious and transparent components. Tate & Lyle PLC, Cargill, Inc., and Ingredion Incorporated are a few of the market's leading corporations.

These businesses have become industry leaders by providing clean-label products in various food and drink areas. For example, Ingredion helps manufacturers satisfy consumer demands for simplicity and transparency by providing a range of clean-label starches, sweeteners, and other ingredients.

Cargill recently expanded its product portfolio of clean-label options to include natural sweeteners, texturizers, and oils amid consumers' growing desire for less processed foods. These firms have used different growth strategies, such as diversification of their product offerings and better sustainability practices, to maintain and build their market share.

For instance, Tate & Lyle has concentrated on offering clean-label and sustainable products that support environmental and health objectives, such as natural fibers and sweeteners. Partnerships and acquisitions have also been essential; Ingredion and other large corporations have acquired smaller businesses focusing on plant-based and clean-label products.

Several startups have emerged in the clean-label ingredients market, offering innovative solutions that cater to the increasing consumer demand for transparency and natural ingredients.

PureCircle specializes in plant-based, stevia-derived sweeteners. Their growth strategy revolves around sustainability with a focus on growing stevia crops through responsible agricultural practices, which allows them to produce clean-label sweeteners that align with health and eco-conscious consumers. It has invested heavily in research and development to create new, innovative, clean-label sweeteners that cater to specific dietary preferences, such as low-sugar or non-GMO options.

NutraBloom focuses on offering clean-label functional ingredients such as plant-based proteins and superfoods. Their business approach focuses on meeting the need for clean-label components in the rapidly growing market for plant-based foods. NutraBloom works directly with suppliers to source high-quality, sustainable ingredients free of harmful additives and preservatives.

Transparency is also highly valued by the company, which provides clients with thorough information on ingredient sources, quality control methods, and certifications. NutraBloom is rapidly expanding its market share in the clean-label ingredients industry through direct-to-consumer sales and strategic partnerships with well-known food brands.

Putting Product Innovation First

Food companies are emphasizing transparency throughout the food production stages. By creating new clean-label ingredients, such as non-GMO, allergy-free, or functional options it enables the companies to better address consumer needs and offer them organic products. Besides, this approach also drives the perquisites for biodegradable food alternatives worldwide.

Blockchain Technology to Promote Transparency

Blockchain technology is crucial in enhancing authenticity through a secure, immutable, and a decentralized platform to track and verify the journey of ingredients from source to consumer. It accelerates traceability, verification, and integrated supply-chain to provide end-to-end real-time traceability, and also reduces potential fraud or misrepresentation of ingredient sourcing and quality.

Collaboration with Plant-Based and Health Brands

The surging demand for vegan and allergy-free foods has broadened the landscape for clean-label ingredients. In addition, plant-based products have gained a huge popularity mainly for their nutritive values. Emerging startup are now collaborating with established brands to comply with industry standards and effectively meet consumer demands.

The clean-label market is segmented by type into natural colors, natural flavors, fruit and vegetable ingredients, starch & sweeteners, flour, malt and others.

According to the form, the clean-label market is segmented into powder and liquid.

Segment of the clean-label ingredients according to the form includes prepared foods/ready meals, beverages, bakery & confectionary, dairy & frozen desserts, snacks & convenience foods, and others.

According to the region, the clean-label ingredients market is segmented into North America, Latin America, Western Europe, South Asia & Pacific, East Asia, Middle East & Africa.

The clean-label ingredients market is estimated to be USD 57.3 billion in 2025, projected to reach USD 212.4 billion by 2035.

The market is expected to grow at a CAGR of 15.5% from 2025 to 2035.

Major manufacturers include Tate & Lyle PLC, Cargill, Inc., and Ingredion Incorporated.

The USA is likely to create lucrative opportunities for clean-label market players.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ingredients Market for Plant-based Food & Beverages Size and Share Forecast Outlook 2025 to 2035

Bean Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Milk Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Malt Ingredients Market Analysis by Raw Material, Product Type, Grade, End-use, and Region through 2035

Aroma Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Dairy Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Pulse Ingredients Market Analysis – Size, Share, and Forecast 2025 to 2035

Smoke Ingredients for Food Market Analysis - Size, Share & Forecast 2025 to 2035

Bakery Ingredients Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Biotin Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Baking Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Almond Ingredients Market Size, Growth, and Forecast for 2025 to 2035

Savory Ingredients Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Examining Savory Ingredients Market Share & Industry Leaders

Energy Ingredients Market Analysis by Product Type and Application Through 2035

Perfume Ingredients Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Vitamin Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Alcohol Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Protein Ingredients Market Analysis - Size, Share, and Forecast 2025 to 2035

Caramel Ingredients Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA