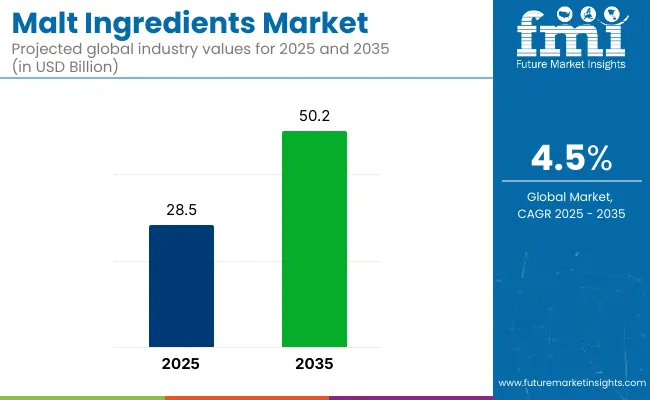

The global malt ingredients market is set to experience USD 28.5 billion in 2025. The industry is poised to witness 4.5% CAGR from 2025 to 2035, reaching USD 50.2 billion by 2035.

One robust reason for significant growth is consumer demand for natural and clean-label products across various levels of the industry, including foods, beverages, and pharmaceuticals. Mass producers are raising their volumes through adopting new malting technologies and creating new malted foods to meet changing industry needs.

From brewing to foodstuffs, many products in diverse applications use malt ingredients that provide flavor, texture and nutrition. In order to stay competitive, most of the dominant companies in the industry including Malteurop Group and others are focusing on capacity expansions and supply chain optimizations. Increasing demand for better malt types is bolstering the popularity of specialty malts with notable flavor intensity and odor intensity, stimulating companies to widen product spectrum.

The trend is stronger in the beverage sector, especially where malt extracts are used in production of craft beer, non-alcohol malt beverages and functional drinks. However, specifically craft beer has created a industry of higher-end malt varieties, and breweries are being driven to use better quality ingredients, which can provide complexity of flavor and differentiation of product.

Despite being an area of positive development potential, the malt ingredients industry is experiencing a more tempered atmosphere due to forces such as pressures on raw material prices and supply chain concerns. The industry’s dependence on barley and other grains leaves it vulnerable to agricultural stresses, including climate change and unreliable crop yields.

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 28.5 billion |

| Industry Value (2035F) | USD 50.2 billion |

| CAGR (2025 to 2035) | 4.5% |

The situation is further complicated for manufacturers that operate in several markets in light of increased scrutiny of food safety and labeling regulations. To find such challenges, companies need to focus more on sustainable sourcing, energy-efficient malting operations, and top-notch quality control methods. Partnerships with malt ingredient producers are reaping the benefits for companies across all food and beverage types.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 4.8% |

| H2 (2024 to 2034) | 5.0% |

| H1 (2025 to 2035) | 5.3% |

| H2 (2025 to 2035) | 5.4% |

The table above presents a comparative assessment of the variation in CAGR over six-month intervals for the base year (2024) and the current year (2025) for the global malt ingredients industry. This analysis highlights key performance shifts and provides insights into revenue realization trends, helping stakeholders better understand the market’s growth trajectory.

The first half of the year (H1) spans from January to June, while the second half (H2) covers July to December. During the initial half of the decade from 2025 to 2035, the industry is projected to grow at a CAGR of 4.8%, followed by an improved growth rate of 5.0% in the second half.

Moving forward, from H1 2025 to H2 2035, the CAGR is expected to rise to 5.3% in the first half and stabilize at 5.4% in the latter half. In H1, the sector saw an increase of 30 BPS, while in H2, the industry experienced a 10 BPS growth.

The market is segmented based on raw material, product type, grade, end use, and region. By raw material, the market is categorized into barley, wheat, rye, maize, rice, and oat. In terms of product type, it is segmented into malt extract (dry malt extract, liquid malt extract), malt flour, and others (malt syrup, malted barley, caramel malt, and roasted malt). Based on grade, the market is divided into specialty malt (caramelized malt, roasted malt), and standard malt. By end use, the market is classified into food & beverages industry, pharmaceutical industry, and personal care.

The food & beverages industry segment is further sub-divided into food and beverages, while the pharmaceutical industry segment includes medicines and nutraceuticals. Regionally, the market is segmented into North America, Latin America, Western Europe, Eastern Europe, Asia Pacific excluding Japan, Japan, and the Middle East & Africa.

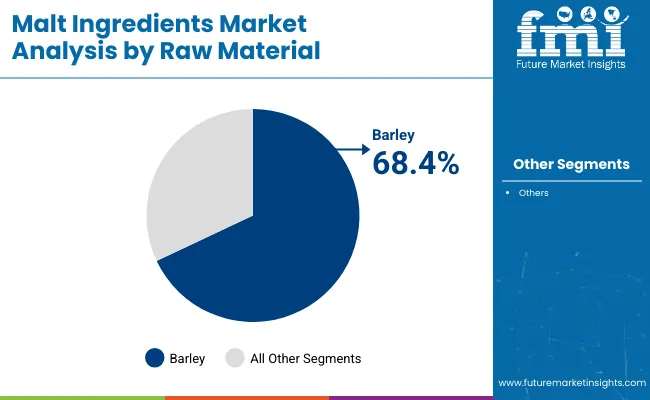

The barley segment is projected to dominate the raw material category in the malt ingredients market, accounting for a substantial 68.4% market share in 2025. Barley remains the most widely used grain in malt production due to its optimal enzymatic properties, high extract yield, and husk structure that supports efficient lautering. It serves as a foundational ingredient across breweries, distilleries, and food applications worldwide. Barley’s versatility in producing base and specialty malts has helped it retain a dominant position in beverage and bakery product formulations.

Leading malt manufacturers such as Malteurop, Boortmalt, and Simpsons Malt source barley globally to cater to growing demand from Asia Pacific and North America. With the rise of craft breweries, malted barley is also gaining momentum for its ability to deliver flavor depth and color diversity.

Moreover, clean-label trends and demand for natural ingredients are reinforcing barley’s use in malt-based nutritional products, cereal bars, and powdered supplements. Regional support for sustainable farming of barley and crop improvements through hybrid seeds continue to support long-term supply. Given its strong performance metrics and adaptability across product types, barley is expected to maintain its leadership in the malt ingredients supply chain from 2025 to 2035.

| Raw Material Segment | Market Share (2025) |

|---|---|

| Barley | 68.4% |

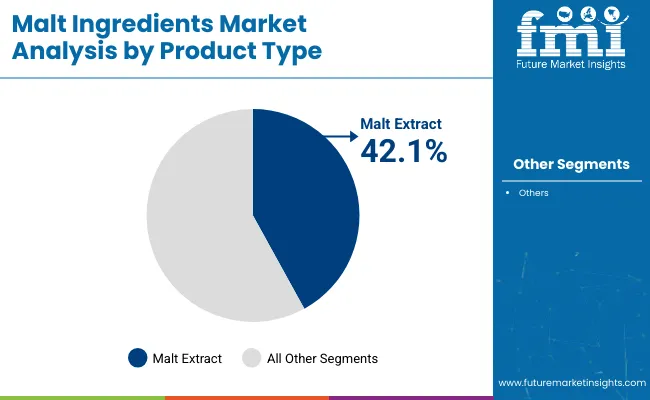

The malt extract segment is expected to lead the product type category in the malt ingredients market, holding approximately 42.1% of the global market share in 2025. Malt extract is widely utilized in food, beverages, and pharmaceuticals due to its rich nutrient profile, flavoring capability, and natural sugar content.

It is available in both dry and liquid formats, with applications spanning bakery, infant food, brewing, confectionery, and dairy products. Its inherent sweetness and color-enhancing properties make it a preferred substitute for artificial additives and high-fructose corn syrup in clean-label formulations. The segment is further supported by rising demand for plant-based energy sources and digestive wellness foods.

Major producers like Muntons, Briess Malt & Ingredients, and Imperial Malts are scaling up malt extract production to meet growing requirements in Asian and European markets. Innovations such as non-GMO, organic, and gluten-free malt extracts are also expanding product reach across health-conscious consumer segments.

The extract’s easy solubility and high fermentability continue to support its popularity in craft brewing and functional beverage innovations. With increasing demand for minimally processed, nutritious sweeteners and ingredients, malt extract is well-positioned to remain the dominant product format from 2025 to 2035.

| Product Type Segment | Market Share (2025) |

|---|---|

| Malt Extract | 42.1% |

The nutraceuticals segment is forecasted to grow at the highest CAGR of 7.2% from 2025 to 2035 in the malt ingredients market. Malt ingredients are gaining prominence in functional nutrition due to their high vitamin B complex content, natural sugar composition, and energy-enhancing properties.

They are increasingly being used in health drinks, protein bars, and wellness powders targeted at fitness enthusiasts, aging populations, and individuals with dietary sensitivities. Nutraceutical applications often utilize specialty malts and extracts for fortification, taste enhancement, and digestive benefits. As consumers become more health-conscious, demand for natural, non-synthetic nutrient sources is on the rise positioning malt ingredients as a key inclusion.

Companies like Kerry Group, Malt Products Corporation, and Agrana are leveraging clean-label and organic malt derivatives in their nutraceutical portfolios. The segment is further driven by the global shift toward preventive health and immune-boosting supplements, particularly post-pandemic.

Regulatory bodies in the USA and Europe are also expanding guidelines for functional ingredients in OTC products and fortified foods, opening the door for broader market penetration. With strong overlap between wellness trends and ingredient functionality, malt-based nutraceuticals are set to experience sustained growth during the forecast period.

| End Use Segment | CAGR (2025 to 2035) |

|---|---|

| Nutraceuticals | 7.2% |

The specialty malt segment is expected to grow at the highest CAGR of 6.8% from 2025 to 2035 in the malt ingredients market. This growth is fueled by the rising demand for unique flavor profiles, color differentiation, and functional benefits in food, beverage, and craft brewing industries.

Specialty malts are produced through controlled kilning and roasting processes to create distinctive characteristics such as nutty, chocolatey, or caramelized flavors, which are increasingly valued in premium bakery products, artisanal beers, and gourmet cereals. The growing craft beer movement across North America, Europe, and emerging parts of Asia has significantly expanded the use of specialty malts in small-batch and seasonal brews.

Additionally, food processors are incorporating these malts into snack bars, cookies, and nutritional supplements to enhance taste and appearance while adhering to clean-label demands. Key producers such as Weyermann, Simpsons Malt, and Malteurop are investing in customized roasting technologies and organic-certified specialty malt lines to cater to this niche but fast-growing segment.

As consumer preferences lean toward high-quality, indulgent, and natural ingredients, specialty malts are poised to outperform standard malt grades. Their functional versatility and alignment with premium product positioning make them a top investment area for manufacturers during the forecast period.

| Grade Segment | CAGR (2025 to 2035) |

|---|---|

| Specialty Malt | 6.8% |

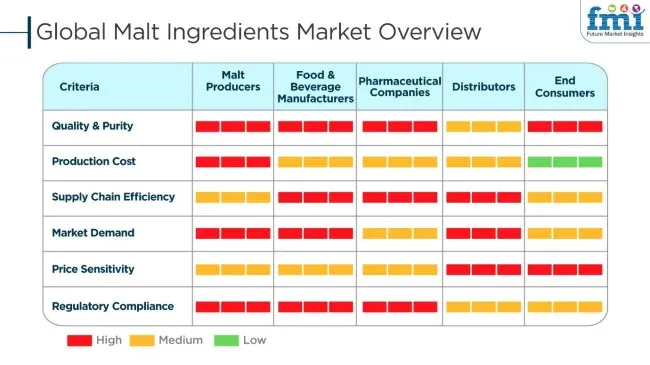

Global industry for malt ingredients is boosted by its applications across food, drinks, and drugs, where increased demand in breweries, bakery, and dairy operations is expanding the industry. Manufacturers of foods & beverages want to use malt extracts for adding flavors, colors, and nutrition to their products, especially beer brewing, malt beverages, and sweets.

Pharmaceuticals add malt ingredients in dietary supplements and medicinal syrups based on their nutritional advantages for the gut and as sources of energy. The distributors emphasize effective management of the supply chain to stabilize prices and supply products consistently into bulk and specialty markets.

Manufacturers are being encouraged by end-users' increasing interest in organic, gluten-free, and non-GMO malt options to adopt green and clean-label processing methods. Craft brewing and functional foods trends are also framing industry trends, as malt ingredients continue to be the focal point to new product formulating in most industries.

Rising Popularity of Ready-to-Eat and Convenient Nutrition

The global industry is witnessing a surge in demand driven by the increasing preference for ready-to-eat and convenient nutrition solutions. Consumers worldwide are shifting toward on-the-go food and beverage products that require minimal preparation, leading to higher adoption of malt-based ingredients in instant cereals, energy bars, and pre-packaged bakery goods.

Malt extracts and flours are being extensively utilized in snack formulations to enhance taste, texture, and shelf life. Additionally, malt-based beverages such as malted milk and functional energy drinks are gaining traction among health-conscious consumers seeking natural energy boosters.

The rising inclination toward protein-fortified products is further pushing the demand for malt ingredients in plant-based protein shakes and meal replacements. As busy lifestyles continue to reshape food consumption patterns, the incorporation of malt-derived ingredients in processed and packaged food categories is expected to expand, supporting the growth of the global malt ingredients industry.

Emphasis on Sustainability and Ethical Sourcing

Sustainability and ethical sourcing have emerged as core considerations in the global industry. Manufacturers are increasingly adopting environmentally friendly malting processes, optimizing water and energy consumption, and utilizing renewable energy sources to minimize their carbon footprint.

The shift toward regenerative agriculture and organic barley cultivation is being driven by growing consumer demand for clean-label and traceable ingredients. Companies are also emphasizing fair trade practices and building direct partnerships with farmers to ensure a sustainable supply chain. Transparency in sourcing has become a key competitive differentiator, with malt producers highlighting their sustainability initiatives to gain consumer trust.

Additionally, the use of recyclable and biodegradable packaging for malt-based products is being explored to align with global sustainability goals. As consumer awareness regarding ethical production practices continues to rise, manufacturers focusing on responsible sourcing and eco-friendly operations are expected to gain a competitive edge in the industry.

Advancement in Specialty and Functional Malt Innovations

Innovation in specialty and functional products is reshaping the global malt ingredients market. Manufacturers are focusing on developing malt extracts and flours with enhanced nutritional profiles, catering to the demand for fortified and functional food products. The emergence of enzyme-rich malts is supporting applications in bakery, brewing, and dairy alternatives, offering improved digestibility and enhanced fermentation processes.

Additionally, products infused with probiotics and dietary fibers are gaining popularity in gut health-focused products. The rising demand for gluten-free and plant-based formulations is prompting the introduction of alternative malt sources derived from rice, sorghum, and quinoa.

Moreover, unique flavor-enhancing malt varieties are being developed to cater to the premium craft beer and artisanal bakery segments. With continuous investment in research and development, the industry is expected to see a wave of new product innovations, aligning with evolving consumer preferences and dietary trends.

Risks in the malt ingredients market include difficulties in supply, climate changes, regulatory compliance, health concerns, and the dynamic consumer preferences. The availability and cost of products can be deeply affected by droughts, floods, and trade limitations; consequently, the supply of malt to food and beverage producers will be restrained.

Long-term prospects from climate change are because temperature variation increases as well as erratic and unpredictable rain can inhibit the quality of barley and wheat leading to the disturbance of the supply chain. This can obligate producers to look for supplies from other areas and thus incur more transportation expenses.

Regulatory compliance costs and rules differ across countries with institutions like FDA (USA), EFSA (EU), and FSSAI (India) which enforce rigorous food safety and labeling standards. Concerns regarding health and changing consumer preferences also come into play. The gluten-free and low-carb diet trends' popularity has led to the malting industry's contraction in some food categories, alternative maize products, for instance, rice, or sorghum malt which are now more prevalent.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.70% |

| UK | 2.30% |

| India | 5.30% |

| Japan | 2.60% |

| China | 4.10% |

FMI is of the opinion that the USA industry is slated to grow at 5.7% CAGR during the study period. Rising demand for malted items in craft brewing, health beverages, and functional food is creating business opportunities. Craft brewing continues to be the largest consumer of products, and small and independent breweries focus on premium and specialty malts to develop unique flavor profiles.

Growing demand for clean-label and plant-based ingredients fuels the applications of malt extracts in baked products, breakfast cereals, and nutrition supplements. Production is fueled by more usage of local and organic malt materials and greater investment in sustainable agriculture.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| Craft beer industry growth | Independent brewers look for premium malt for special flavors. |

| Clean-label demand | Food manufacturers incorporate malt extracts into cereals and baked items. |

| Organic malt demand | Creators invest in locally grown and sustainable ingredients. |

| Gluten-free malt substitute | Smaller but rising demand from consumers for sorghum and millet malt. |

As per FMI, the UK industry is slated to grow at 2.3% CAGR during 2025 to 2035, driven by increasing demand from the food and beverage industry. The trend of premium craft beer and artisanal bakery products continues to drive the use of products.

The increased consumer preference for organic and plant-based food items also impacts malt suppliers to launch new variants. Additionally, green source of malt ingredients remains a top priority since manufacturers align with regulatory and environmental demands.

Growth Factors in the UK

| Key Drivers | Details |

|---|---|

| Craft beer industry growth | Brewers use specialty malts to create distinctive beer flavor profiles. |

| Artisanal bakery development | Texture and taste in baked goods are boosted through malt. |

| Plant-based food phenomenon | Malt ingredients appear in meat and dairy alternatives. |

| Sustainable ingredient sourcing | Companies invest in sustainable malt production. |

As per FMI, India's malt ingredients market is projected to grow at a 5.3% CAGR during 2025 to 2035, with the growing beer industry and rising demand for malt-based health beverages driving the industry. Increasing disposable incomes and changing lifestyle patterns have encouraged the consumption of malt-based nutritional supplements and malted milk.

Malt-based liquids have been a favorite among young consumers seeking protein-rich, energy-giving beverages. The food industry employs products to add texture and flavor to bakery, dairy, and confectionery foods. An increasing number of microbreweries and microbreweries-turned-craft breweries also offer opportunities to malt suppliers.

With indigenous malt production experiencing growing investment and the installation of high-quality brewing technology, the Indian industry is expected to experience steady growth in the next decade.

Growth Factors in India

| Key Drivers | Details |

|---|---|

| Increase in beer industry | Higher beer production requires greater utilization of products. |

| Malted healthy beverages | Protein-fortified malt beverages are well-accepted by consumers. |

| Bakery and confectionery uses | Industrialists add texture and flavor with malt. |

| Microbrewery expansion | Growing demand for craft beer creates demand for specialty malts. |

FMI is of the opinion that the China industry is slated to grow at 4.1% CAGR during the study period due to growing demand for malt beverages such as malted health drinks and beer. The nation is still one of the largest beer consumers, and craft and premium beer segments are driving demand for specialty malts.

The food sector is introducing malt extracts in bakery and confectionery products, especially in traditional Chinese snack foods and pastries. Government encouragement for sustainable farming and local barley production is supporting the supply chain for the manufacture of malt. Rising consumer interest in natural and functional ingredients is compelling food firms to produce malt-based health foods and supplements.

Growth Factors in China

| Key Drivers | Details |

|---|---|

| Beer industry growth | Craft and premium beer categories drive malt demand. |

| Use of malt in conventional foods | Bakery and confectionery benefit from malt's texturizing characteristics. |

| Renewable production of barley | Domestic barley consumption is favored by government. |

| Malt foods for well-being | Functional and natural ingredients see broader acceptance. |

FMI is of the opinion that the Japan industry is slated to grow at 2.6% CAGR during the study period, aided by rising demand for malt food and beverage usage. Products are crucial to producing high-end beers, traditional Japanese sweets, and functional foods.

Clean-label and natural ingredient focus drives manufacturers to create malt formulations that respond to calls for healthier options that consumers choose. Furthermore, specialty malt uses in nutraceuticals and sports nutrition continue to dominate industry trends.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| Production of premium beer | Malt continues to be a primary material for Japan's brewing industry. |

| Traditional confectionery | Malt contributes to the quality of Japanese sweets. |

| Health-conscious consumers | Natural and clean-label malt products are nowadays permissible. |

| Malt ingredients demand | Sports and health supplements use malt ingredients. |

The competitive aspect of the global industry is an outcome of increasing demand among breweries, food manufacturers, and functional beverage brands. Leading Players Boortmalt, Malteurop, Cargill, Viking Malt, and GrainCorp dominate the market with large-scale production, extensive distribution networks, and strategic partnerships with brewers and food manufacturers.

Key offerings include base and specialty malts for brewing, as well as malt extracts and flour applications in bakery, confectionery, and healthy food usage.

The market is witnessing investment in highly water-efficient and renewable energy-integrated productive techniques and growing attraction in craft brewing and functional beverages. There is a high overall demand for specialty malts based on premiumization trends in beer and artisanal food products.

Companies focus on expansion of capacity in new emerging markets and acquisitions of regional malt-producing companies. Partnerships with breweries to develop custom malt profiles are also being encouraged. Other sustainability initiatives, such as carbon-neutral malting and traceable supply chains, will also become a major differentiator in the competitive landscape.

By raw material, the market is segmented into barley, wheat, rye, maize, rice, and oat.

By product type, the market is segmented into malt extract, malt flour, and others.

By grade, the market is segmented into specialty malt and standard malt.

By end-use, the market is segmented into the food & beverages industry, pharmaceutical industry, and personal care.

The market is segmented into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa (MEA).

The global market is expected to reach USD 50.2 billion by 2035, growing from USD 28.5 billion in 2025, at a CAGR of 4.5% during the forecast period.

The barley segment dominates the raw material category with a projected market share of 68.4% in 2025, owing to its optimal enzymatic activity, high yield, and wide application across beverages and bakery products.

Malt extract is expected to lead the product type segment with a 42.1% market share in 2025, driven by rising demand for natural sweeteners, clean-label food products, and functional beverages.

The nutraceuticals segment is forecast to grow at the fastest pace, registering a CAGR of 7.2% from 2025 to 2035, supported by increasing consumer focus on immunity, energy, and digestive wellness.

Leading companies include Malteurop Group, Boortmalt, Soufflet Group, Muntons PLC, Simpsons Malt, Cargill Incorporated, GrainCorp Malt, Viking Malt, Ireks GmbH, and Rahr Corporation, offering a wide range of specialty and standard malt solutions.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Malt Sprouts Market Size and Share Forecast Outlook 2025 to 2035

Malted Rye Flour Market Size and Share Forecast Outlook 2025 to 2035

Malted barley flour Market Size and Share Forecast Outlook 2025 to 2035

Ingredients Market for Plant-based Food & Beverages Size and Share Forecast Outlook 2025 to 2035

Malt Beverage Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Malted Milk Market Size and Share Forecast Outlook 2025 to 2035

Malt Market Trends and Forecast 2025 to 2035

Analysis and Growth Projections for Maltodextrin Business

Maltitol Market Analysis by form, end use industry and by region – Growth, trends and forecast from 2025 to 2035

Malted Milk Powder Market Trends - Growth & Industry Forecast 2025 to 2035

Malted Wheat Flour Market

Isomalt Market Analysis - Size, Share, and Forecast 2025 to 2035

Isomalt Industry Analysis in Western Europe – Size, Share & Forecast 2025 to 2035

Isomalt Industry in Japan – Growth & Industry Trends 2025 to 2035

Isomaltulose Market Growth - Size, Trends & Forecast 2025 to 2035

Isomalto-oligosaccharide Market Analysis by Form, Source, End-use Application and Region through 2035

Dry Malt Products Market

Bean Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Milk Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Aroma Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA