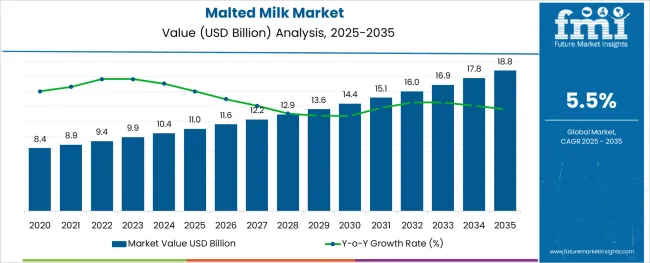

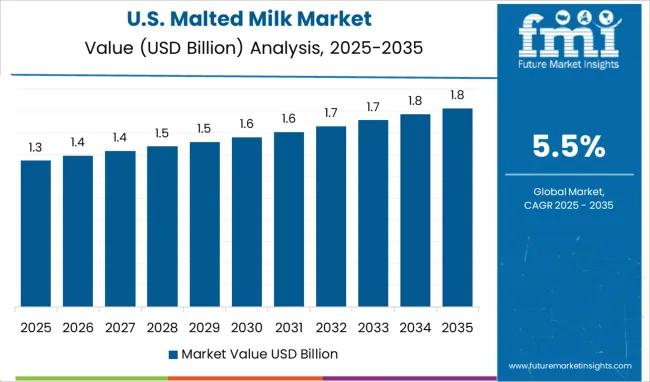

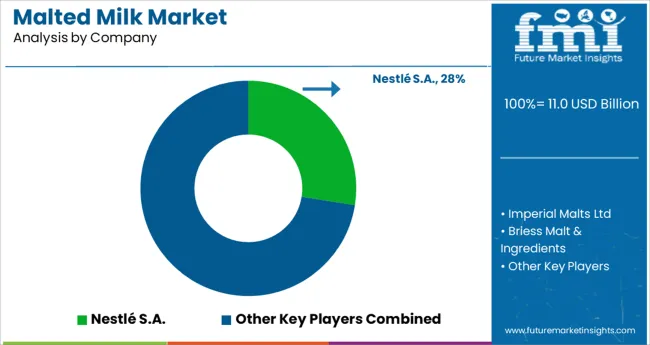

The Malted Milk Market is estimated to be valued at USD 11.0 billion in 2025 and is projected to reach USD 18.8 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

The malted milk market is growing steadily, driven by the rising consumer demand for nutritious and functional food ingredients. Malted milk has gained popularity as a source of natural energy and as a fortifying additive in various food products. Consumer awareness around health and wellness has encouraged the use of barley-based malted milk for its nutritional benefits including fiber content and vitamins.

Increasing use of malted milk in bakery, confectionery, and beverage sectors has also supported market growth. The food industry continues to adopt malted milk to enhance product texture and flavor profiles, while offering clean-label ingredient options.

Distribution channels have expanded with indirect sales through wholesalers and distributors playing a key role in reaching diverse food manufacturers and processors. Looking ahead, innovations in malted milk formulations and growing applications in health-focused food products are expected to sustain market momentum.

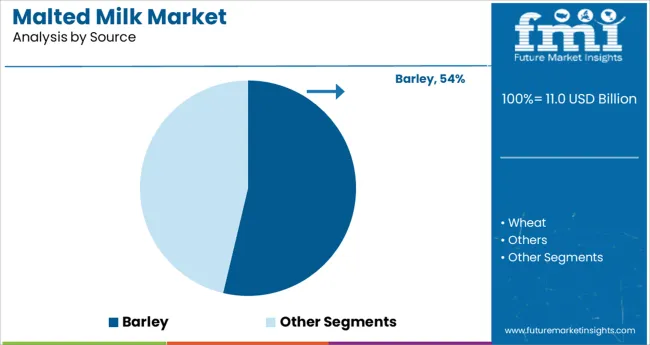

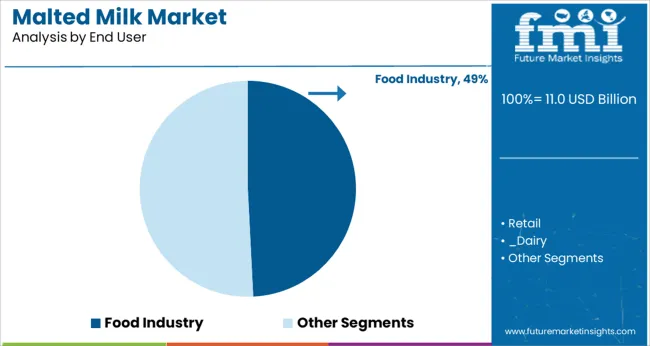

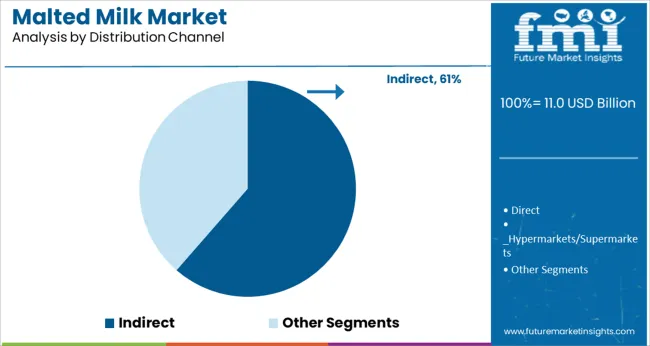

The market is segmented by Source, End User, Distribution Channel, and Packaging and region. By Source, the market is divided into Barley, Wheat, and Others. In terms of End User, the market is classified into Food Industry, Retail, and Others. Based on Distribution Channel, the market is segmented into Indirect, Direct, and Others. By Packaging, the market is divided into Carton packs, Jars, Tins, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Source, End User, Distribution Channel, and Packaging and region. By Source, the market is divided into Barley, Wheat, and Others. In terms of End User, the market is classified into Food Industry, Retail, and Others. Based on Distribution Channel, the market is segmented into Indirect, Direct, and Others. By Packaging, the market is divided into Carton packs, Jars, Tins, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Barley segment is projected to hold 53.7% of the malted milk market revenue in 2025, driven by barley’s nutritional advantages and wide availability. Barley’s natural composition of fiber and antioxidants has made it a preferred source for malted milk production. Producers have favored barley for its clean taste and ability to enhance the texture of malted food products.

Its role in supporting digestive health has increased consumer acceptance, especially among health-conscious buyers. The agricultural scalability and cost-effectiveness of barley have also contributed to its dominance.

These factors have solidified barley’s position as the leading raw material source in the malted milk market.

The Food Industry segment is expected to account for 49.2% of the malted milk market revenue in 2025, reflecting its extensive use in food manufacturing. Malted milk is widely utilized in bakery items, confectionery, beverages, and dairy-based products to improve taste and nutritional value.

Food manufacturers have integrated malted milk as a functional ingredient to cater to consumer demands for wholesome and flavorful products. The ingredient’s versatility across different food applications has driven its adoption.

Growth in packaged and convenience foods has further fueled demand within this segment. As consumer preference for fortified and functional foods rises, the Food Industry segment is anticipated to maintain its leading position.

The Indirect distribution channel segment is projected to contribute 61.4% of the malted milk market revenue in 2025, supporting the broad availability of malted milk ingredients. This channel includes sales through wholesalers, distributors, and agents who bridge manufacturers and food producers.

Indirect channels have facilitated efficient supply chain management, ensuring timely delivery and wide geographic reach. Food manufacturers often rely on these intermediaries for bulk purchases and consistent supply.

The established network of indirect distributors has helped penetrate diverse markets including emerging economies. As supply chain optimization continues to be a priority, the indirect distribution segment is expected to sustain its dominant share in the malted milk market.

Rising adoption of malted milk across diverse industries including food & beverages, confectionery, and bakery is a major factor providing impetus to the growth of malted milk market.

Over the years, malted milk has become a highly-sought after flavoring ingredient used in food and beverage industry due to its high nutritional profile. Malted milk is prepared from dried milk and malted cereals. It contains various essential nutrients (especially vitamins and miners) that provide various benefits ranging from boosting energy levels and enhancing bone health, to improving vision and promoting circulation.

Rapid expansion of food and beverage industry coupled with increasing usage of malted milk in preparing various food and beverage products is expected to push the demand for malted milk during the assessment period. Various food manufacturing companies are expanding their snack portfolios to meet the changing meal consumption and snacking patterns of consumers.

Similarly, rising awareness about the benefits of malted milk coupled with increasing consumption of snacks will create lucrative opportunities for the manufacturers in the future.

In addition to this, rising demand for high nutritional value bakery products, especially across developed regions like North America is expected to encourage manufacturers to use malted milk in their products, thereby expanding the global malted milk market size.

Although malted milk products are gaining wider popularity there are certain factors that are restraining the growth of malted milk market to some extent. Some of these factors include growing trend of veganism, rise in the number of lactose intolerant people, and false claims about the ill effects of malted milk-based drinks.

According to Future Market Insights, North America is expected to hold a significant share of the global malted milk market during the forecast period, owing to the increasing consumption of food products like bakeries, confectionery, snacks etc., presence of leading malted milk manufacturing companies, and continuous introduction of innovative product lines such as malted milk confectionery and bakery products.

Over the years, sales of malted milk have risen at a substantial across the USA due to thriving food and beverage industry, increasing consumer spending, and increasing penetration of online food platforms. According to the Economic Research Service of the USA Department of Agriculture (USDA), food spending by USA consumers, businesses, and government entities totaled D1.69 trillion in 2024 and this number is likely to further grow during the forthcoming years, thereby creating space for malted milk market growth.

Similarly, development of plant based malted milk products supported by rising consumer preference towards dairy alternatives will further expand the malted milk market size during the assessment period.

With rising consumption of diary-based food products due to rapidly growing population, increasing disposable income, and changing lifestyle, Asia Pacific market is set to grow at a robust pace during the forecast period.

Demand for malted milk is particularly rising across fast growing nations like China and India due to growing consumer preference for high nutritional foods and beverages. Many food manufacturing companies across Asia Pacific are using malted milk in their products to make them more nutritional and tastier.

Similarly, increasing penetration of online food delivery service platforms will further create opportunities for malted m ilk manufacturers in the region during the forthcoming years.

Some of the leading manufacturers of malted milk include Briess Malt & Ingredients, Nestlé S.A., Muntons plc, Imperial Malts Ltd., SSP Pvt Limited, Insta Foods, Family Cereal Sdn. Bhd., Food & Biotech Engineers India Private Limited., and King Arthur Flour Company, Inc., among others.

These leading players are increasingly adopting various strategies such as new innovative product launches, partnerships, acquisitions, collaborations, establishment of new facilities across attractive markets, etc. to gain a competitive edge in the global malted milk market.

Companies like Nestle and Imperial Malts have become global leaders in malted milk products. Their brands are being increasingly utilized by people due to better quality.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 5.5% from 2025 to 2035 |

| Projected Market Size (2035) | 12.2 Billion |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Source, End User, Distribution Channel, Packaging, Region |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; APEJ; Japan; Middle East and Africa |

| Key Countries Profiled | USA, Canada, Brazil, Argentina, Germany, UK, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASEAN, GCC, South Africa |

| Key Companies Profiled | Imperial Malts Ltd, Muntons plc, SSP Pvt Limited, Nestlé S.A., Insta Foods, Briess Malt & Ingredients, Family Cereal Sdn. Bhd., Food & Biotech Engineers India Private Limited., and King Arthur Flour Company, Inc. |

| Customization | Available Upon Request |

The global malted milk market is estimated to be valued at USD 11.0 billion in 2025.

It is projected to reach USD 18.8 billion by 2035.

The market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types are barley, wheat and others.

food industry segment is expected to dominate with a 49.2% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Malted Milk Powder Market Trends - Growth & Industry Forecast 2025 to 2035

Malted Rye Flour Market Size and Share Forecast Outlook 2025 to 2035

Malted barley flour Market Size and Share Forecast Outlook 2025 to 2035

Malted Wheat Flour Market

Milk Carton Market Size and Share Forecast Outlook 2025 to 2035

Milking Automation Market Size and Share Forecast Outlook 2025 to 2035

Milking Robots Market Size and Share Forecast Outlook 2025 to 2035

Milk Packaging Market Size and Share Forecast Outlook 2025 to 2035

Milk Clarifier Market Size and Share Forecast Outlook 2025 to 2035

Milk Homogenizer Machine Market Size and Share Forecast Outlook 2025 to 2035

Milk Pasteurization Machines Market Size and Share Forecast Outlook 2025 to 2035

Milk Sterilizer Machine Market Size and Share Forecast Outlook 2025 to 2035

Milk Powder Packaging Market Size and Share Forecast Outlook 2025 to 2035

Milk Powder Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Milk Protein Market - Size, Share, and Forecast 2025 to 2035

Milk Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Milk Mineral Concentrate Market Trends-Demand, Innovations & Forecast 2025 to 2035

Milk Thistle Market Analysis by Form, Distribution Channel and Region through 2035

Milk Powder Market Analysis by Type, Distribution Channel, Region and Other Applications Through 2035

Milk Tank Cooling System Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA