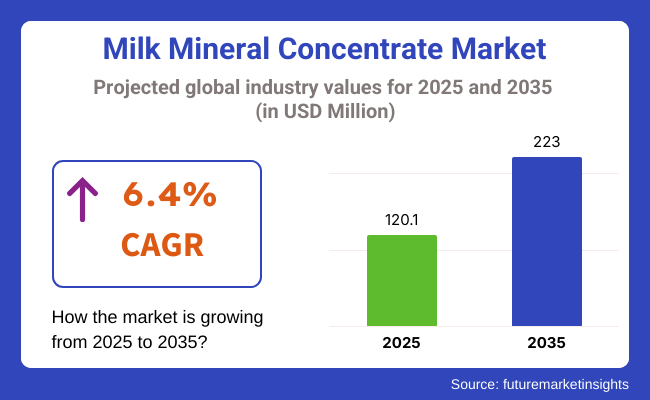

The milk mineral concentrate market is projected to reach a valuation of USD 120.1 million in 2025 and is anticipated to grow to USD 223 million by 2035. This growth trajectory represents a CAGR of 6.4% from 2025 to 2035. Rising consumer awareness of bone health, increasing calcium deficiency across populations, and the demand for natural calcium sources are contributing significantly to the steady expansion of this industry.

Milk mineral concentrate, derived from the mineral-rich whey permeate stream of dairy processing, offers a highly bioavailable source of calcium and other trace minerals, making it increasingly relevant in functional food and dietary supplement applications.

Demand is particularly robust in the nutraceutical and sports nutrition industries, where the concentrate is prized for its clean-label positioning and superior absorption compared to synthetic calcium alternatives. The shift toward preventive health and the aging global population are key macro drivers, with formulators incorporating milk-derived minerals into tablets, capsules, powdered beverages, and fortified snacks.

Furthermore, the industry is gaining traction as a reformulation tool in low-sodium and low-phosphate diets, aligning with regulatory pushes and clinical nutrition strategies in both hospital and home-care settings.

The industry is also benefiting from sustainable sourcing narratives, as manufacturers capitalize on valorizing dairy co-products, thereby reducing waste and improving operational efficiency. Advancements in membrane filtration technology and enhanced mineral standardization techniques are allowing for improved purity and concentration levels, further expanding the scope of applications.

Regulatory bodies have acknowledged the safety and efficacy of the concentrates, opening avenues for broader geographical approvals. As consumers increasingly seek natural, multifunctional health ingredients, the industry is expected to see enhanced demand from both formulators and end consumers in the coming decade.

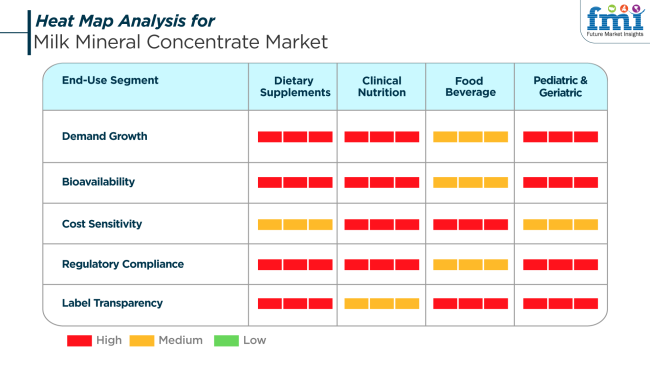

Analysis on the consumption trends includes purchasing criteria across key end-user segments. These include the dietary supplement industry, clinical and sports nutrition sectors, food and beverage fortification industries, and pediatric and geriatric nutrition applications. The demand is being fueled by the global shift toward preventive healthcare, growing awareness of bone and joint health, and the need for natural mineral supplementation. In all these end-use domains, milk mineral concentrate stands out for its superior bioavailability, minimal processing, and clean-label appeal compared to synthetic calcium and phosphate ingredients.

In the dietary supplement sector, manufacturers are increasingly opting for milk-derived mineral blends over traditional calcium carbonate or citrate due to better absorption and natural sourcing. Products like chewable tablets, effervescent powders, and gummies are now incorporating the concentrate as a preferred ingredient for calcium and phosphorus supplementation.

Clinical nutrition programs are leveraging this concentrate for recovery and bone regeneration therapies, particularly for elderly patients and post-operative care. In the sports nutrition and wellness segments, demand is driven by the need for mineral replenishment among athletes and active individuals, especially those on dairy-restricted or plant-based diets.

The food and beverage industry is also a rising consumer of the industry, using it to fortify baked goods, dairy alternatives, beverages, and cereals without altering taste or texture. Pediatric and geriatric nutrition, where mineral density and bone development or preservation are critical, show consistent demand for highly absorbable mineral sources.

Purchasing decisions are influenced by factors such as traceability, formulation compatibility, sensory neutrality, and regulatory compliance. Clean-label status and non-GMO certifications are key differentiators, especially in Europe and North America.

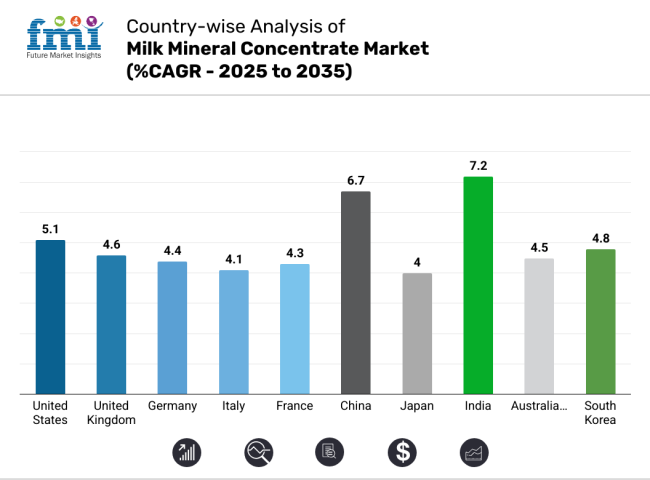

The milk mineral concentrate market study examines key developments across 30+ countries. Producers and suppliers can align their strategies with regional shifts in dairy-based functional ingredient demand, driven by health-conscious consumers and nutritional innovation. India registers the fastest growth rate, followed closely by China. The chart below highlights the growth prospects of the top ten markets through the forecast period.

The United States milk mineral concentrate market is anticipated to expand at 5.1% CAGR throughout the study. Being one of the most developed and organized dairy product industries, the USA maintains its supremacy in the milk mineral concentrate market by industry share.

This growth is fueled by rising health consciousness and a robust demand for calcium and fortified food items. This growth trend is expected to continue throughout the study. The availability of sophisticated dairy processing technologies and a well-developed food & beverage industry enables continuous product innovation and economies of large-scale production. Strong consumer affinity towards functional ingredients for sports nutrition, infant nutrition, and dietary supplements is underpinning the industry drive.

In addition, cooperation among dairy businesses and healthcare product companies is developing newer products with enriched nutritional content. The increasingly aging population is also playing a major role in industry demand owing to increased apprehension regarding bone health and osteoporosis. Clean-label products and regulatory standards also influence product offerings. Since the direction of consumer behavior is oriented towards premium health and wellness products, the USA is set to maintain the largest share internationally.

The United Kingdom milk mineral concentrate market is anticipated to grow at a 4.6% CAGR throughout the study. In recent years, the UK has seen a prominent trend towards the consumption of nutrition-centered food products such as milk mineral concentrates. It is driven by rising interest in preventive healthcare and increasing awareness of calcium deficiency in all age groups. The growing popularity of active lifestyles and increasing demand for protein-based supplements are also driving the industry upwards.

Although the industry is not as extensive as in the USA, the UK is full of potential with the growth of niche health food brands and milk mineral-based dairy alternatives. Consumer preference for functional dairy ingredients, particularly among young adults and athletes, is opening avenues for product diversification. In addition, UK food manufacturers are investing in reforming conventional dairy products into more functional and nutrient-dense variants. The regulatory landscape, which is pro-health-driven innovation, increases the potential for the concentrate application across product groups.

The milk mineral concentrate market in Germany is forecast to expand at 4.4% CAGR over the study period. Germany boasts a rich dairy culture and superior processing quality, and it is one of the primary drivers of the European milk mineral concentrate market. The country's established food production ecosystem offers a solid platform for innovation and adoption of milk-derived nutrients in end-products.

Increased demand for functional foods and dietary supplements, combined with growing awareness of mineral deficiencies and bone health among people, stimulates demand for the indsutry. German consumers are increasingly changing their dietary habits towards wellness-oriented formulas, especially among aging people and fitness enthusiasts. Moreover, German companies are making use of advances in extraction and purification technologies to improve the bioavailability and sustainability of these products. The nation's export-based dairy sector also makes it a central location for product distribution throughout other EU countries.

The Italian milk mineral concentrate market will be growing at 4.1% CAGR throughout the study. Strong dairy-based cuisine in Italy has a rich culture of dairy consumption that provides a solid but increasingly developing foundation for the uptake of milk mineral concentrates.

Although conventionally consumed dairy and dairy products such as milk and cheese continue to form the core of diets, an increasing awareness exists for the nutritional benefits of the concentrates, particularly considering aging populations and child nutrition. Demand is most notably being seen in urban markets, where functional food and dietary supplement products are increasing in popularity.

Italian food manufacturers are increasingly meeting this trend by developing enriched product offerings and enhancing supply chain transparency. The pace of the industry's growth is tempered, however, by a more gradual shift away from traditional to functional food offerings in relation to Northern Europe. Domestic firms' efforts to comply with the European Union's food fortification requirements and clean-label demands will propel future growth.

The milk mineral concentrate market in France is forecasted to expand at 4.3% CAGR over the forecast period. France has a well-established dairy culture with one of the highest per capita dairy consumption levels in Europe. Such culture aids the incorporation of milk mineral concentrates into daily food products such as yogurts, cheese, and infant formulas. The expansion of the industry is also fueled by people's awareness of nutrient deficiencies, particularly calcium, and their continued interest in disease prevention.

French companies are actively using fortified ingredients in dairy and non-dairy uses, and this has created product innovation combining heritage taste and contemporary health values. With the trend of customers moving towards organic and sustainable products, the products are being customized to fulfill these new needs. The robust presence of the country in world food exports further aids in spreading milk mineral-improved products.

China’s milk mineral concentrate market shall rise at 6.7% CAGR throughout the study period. With a fast-growing middle class and an intense focus on child nutrition and aging well-being, China is one of the most vibrant industries. The increase in awareness about calcium deficiencies and lactose intolerance has led to the consumption of fortified dairy substitutes and supplements.

China's local dairy industry is rapidly modernizing, driven by government efforts to improve nutritional levels across the age spectrum. Also, the demand for imported health and wellness products has spurred local manufacturers to improve product quality and expand product lines.

The pervasive use of e-commerce in food and supplement sales magnifies consumers' access to milk mineral-fortified products. Cross-border food trade policies and partnerships with overseas food technology companies are also growth accelerators in this arena.

Japan’s milk mineral concentrate market is expected to register a 4% CAGR between the study years. Japan is a developed functional food and supplement industry with a well-established consumer base valuing high-quality, science-endorsed health product. While the overall size of the industry is not increasing at a booming rate, the concentrates are increasingly being used in geriatric nutrition, particularly for bone health and osteoporosis prevention.

The nation's emphasis on population aging solutions corresponds favorably to the advantages of milk mineral concentrates. Japanese consumers have a strong trust in clinical evidence and technological advances, which facilitates the uptake of bioavailable and accurately formulated dairy derivatives. Domestic firms are using advances in nutritional science to advance formulations and enhance consumer acceptance. Cultural preferences for minimal dietary modification pose a moderate constraint on overall industry acceleration.

The Indian milk mineral concentrate market is anticipated to expand at 7.2% CAGR over the forecast period. India is the fastest-growing nation in the milk mineral concentrate market, driven by a huge population base, a growing middle class, and rampant malnutrition problems. Government initiatives for food fortification and school nutrition, coupled with rising public health consciousness, are fueling demand for mineral-fortified dairy products.

India's largest dairy industry globally has huge opportunities for product innovation in the traditional and modern space. The increasing penetration of organized retailing and the fast growth of urbanization have led to new consumption patterns that promote convenience and health-oriented products.

Indigenous players are making significant investments in R&D and integrating international best practices in processing and formulation. Though regulatory systems are still emerging, the potential of the industry is huge, especially in pediatric and maternal nutrition areas.

The Australia-New Zealand milk mineral concentrate market is projected to register a 4.5% CAGR through the forecast period. Both Australia and New Zealand are known for premium dairy exports, and both countries are hotspots for innovation for milk-based nutritional solutions. The region's clean-label, hormone-free, and pasture-raised reputation for dairy products makes it conducive to the inclusion of the concentrates in global supply chains.

Increasing consumer demand for functional nutrition and dairy formats that prioritize health, such as fortified yogurts, drinks, and supplements, boosts demand. Agricultural innovation and food safety are favored by both nations with robust government backing, assuring consistent product quality.

Increasing demand for exports in Asia and the Middle East further drives production growth and spurs ongoing innovation. As sustainability becomes a core consideration in consumer buying choices, manufacturers within the region are investing in environmentally friendly and traceable production practices.

The South Korean milk mineral concentrate market is anticipated to expand at 4.8% CAGR over the period of study. South Korea's advanced food processing facilities and trend-oriented consumer base provide fertile ground for milk mineral concentrates to grow. With increasing interest in bone health, muscle building, and immune well-being, the industry is gradually transforming towards sophisticated nutritional products.

The popularity of fortified beverages and ready-to-consume health snacks is particularly high among young adults and working professionals. Manufacturers are focusing on microencapsulation technologies to enhance nutrient delivery and product appeal.

Additionally, the country's digital-first retail landscape allows companies to industry new formulations to specific consumer segments effectively. As public interest in holistic wellness increases, demand for traceable, functional dairy products is expected to grow steadily.

The milk mineral concentrate market is dominated by several dairy multinationals, nutritional solution specialists, and dairy processor ingredient experts. Leading Tier 1 companies such as Friesland Campina DOMO and Glanbia PLC stand firmly atop the ladder of success with their vertically integrated business model, established research and development platform, and vast global distribution network.

These companies enjoy a stronghold over supplying infant formulas, sports nutrition, and medical nutrition.Tier 2 players like Arla Foods Ingredients Group and Armor Protéines are engaged in specialized nutritional endeavors. They are exploring the development of mineral concentration methodologies specifically calcium-rich blends and multifunctional dairy solutions. Their portfolios typically focus on traceability, standardized mineral levels, and clean-label compliance.

Tier 3 producers, like Lactal is Ingredients, specialize in cost-efficient formulations and local supply partnership arrangements, mostly aiming at growing industries and large-volume B2B agreements. These operators enjoy proximity to milk production centers and optimized drying facilities, facilitating scalable powdered concentrate manufacturing.

Market Share by Company (2025)

| Company Name | Estimated Market Share (%) |

|---|---|

| FrieslandCampina DOMO | 18% |

| Glanbia PLC | 16% |

| Arla Foods Ingredients Group P/S | 14% |

| Armor Protéines | 12% |

| Lactalis Ingredients | 10% |

| Others Combined | 30% |

In 2025, the milk mineral concentrate market indicates a stable concentration of key players, with FrieslandCampina DOMO and Glanbia PLC dominating a major share of global production. FrieslandCampina's success is based on its integrated value chain of milk-to-minerals and early development of bovine colostrum and calcium isolates. Glanbia PLC leads the way in providing performance-oriented powdered milk minerals with high solubility for international sports and wellness brands.

Arla Foods Ingredients has been gaining ground through the supply of clean-label, high-bioavailability concentrates designed for infant formula fortification and geriatric nutrition. It is also at the forefront of sustainable sourcing strategies and strategic partnerships with international dairy research institutes.

Armor Protéines and Lactalis Ingredients hold fortresses in Europe and North Africa, serving mineral-rich dairy derivatives with quick turnaround and high-volume output via flexible production systems. Their competitive advantage lies in rapid turnaround and high-volume production in contract manufacturing, typically in powdered and blend-ready forms.

Success in milk mineral concentrate is based on high standards of formulation accuracy, optimization of bioavailability, and high manufacturing efficiency. Companies with investment and expertise in membrane separation, spray drying, and controlled mineralization technologies stand a better chance to cater to the growing demand in infant, clinical, and functional nutrition sectors.

Regulatory alignment is therefore quite critical with the FDA, EFSA, and Codex Alimentarius for safety and compositional clarity, paramount in the pediatric and therapeutic arenas. Clean label positioning, traceable sourcing, and carbon-friendly production form other major differentiators. Brands that will propel the next wave of growth in the international milk mineral concentrate market are those that include nutritional science, sustainability credentials, and local customization.

The milk mineral concentrate market in 2025 is growing steadily due to the demand for bioavailable calcium, bone health, and functional food innovation. With increased adoption in infant nutrition, sports health, and clinical supplementation, vendors are looking into liquid and powdered forms of cow milk, goat milk, and bovine colostrum.

Sufficient shelf stability, ease of recipe formulation, and nutritional uniformity make powdered infant formula the best option for manufacturers. Strong regulatory support and increasing awareness of infant nutrition and ageing bone health serve as further enhancers for industry growth. Product innovation, sustainability, and precision formulation are the key parameters contributing to the success of continuous growth.

Cow milk prevails over the industry with a share of around 67% in terms of total production in 2025. It is widely available, has a consistent nutritional content, and is cost-effective, making it the choice source among large-scale industrial processors and food companies. Packed with calcium, phosphorus, and bioavailable micronutrients, cow milk-based concentrates are widely applied to infant formula, sports nutrition, and dairy fortification.

The standardized supply chain of cow milk guarantees consistent sourcing, which makes it suitable for liquid and powder concentrate forms. Furthermore, regulatory systems in prominent industries like the United States, Europe, and Oceania are highly congruent with ingredients derived from cow milk, promoting international trade and cross-border formulation.

Major manufacturers leverage technological breakthroughs in membrane filtration and spray-drying to maximize the concentration and stability of minerals derived from cow milk. Its leadership position is anticipated to be maintained through high acceptance across end-use industries and increasing demand for bone health-promoting dairy ingredients.

Infant formula is the single largest application segment in the milk mineral concentrate market, totaling some 38% of aggregate demand in 2025. This share is a result of the essential role milk mineral concentrates play in the enrichment of calcium and micronutrients vital to the bone growth of infants, the function of their neuromuscular system, and immune function.

Cow milk concentrates derived from milk are used extensively in formula products because of their bioavailable mineral composition and approval in major industries. With declining birth rates in developed nations and increasing birth rates in emerging industries, demand for high-end, fortified infant formulas remains on the rise.

Standardized usage through support from organizations such as Codex Alimentarius, FDA, and EFSA also helps. Makers are also adding milk minerals into organic and hypoallergenic products to respond to changing parental needs. With growing consumer interest in infant nutrition, the segment of infant formulas continues to be a major force behind industry growth and an area of prime interest for product development and clinical trials.

The powdered formis expected to capture around 53% of the international industry share in 2025. It is the format of choice for manufacturers in various types of applications. Its ability to have a long shelf life, its convenience for transport, and the flexibility of formulation make it especially ideal for use in infant formula, sports nutrition supplements, functional beverages, and fortified dairy.

Accurate dosing, balancing mineral profiles, and compatibility with a range of manufacturing processes from spray drying to dry blending enable the company to obtain far-reaching advantages in areas with little cold chain infrastructure, thus expanding distribution into the developing industries.

Hence, the powdered milk minerals broaden the stability of temperature and humidity fluctuations, with respect to discouraging spoilage. This is one of the much-acclaimed features of such food companies; it allows for a smooth incorporation into dry mix systems and reconstitution-ready applications. Consumer convenience-seeking products continue to clamour for that durability as well as resourceful nutrients, and powders, by all evidence, are not going to lose by any means.

The milk mineral concentrate market is growing as a result of increasing health consciousness and demand for calcium-fortified dairy supplements and clean-label offerings. Growth is driven by the growing application of functional dairy ingredients in infant formula and health-positioned foods. Despite this, the industry is faced with regulatory issues and competition from alternatives to dairy mineral concentrate, notably plant and synthetic sources of calcium. To maintain momentum, companies must focus on innovation, product compliance, and geographical consistency of quality.

Increasing Demand for Calcium-Rich Nutrition

Customer demand for natural sources of calcium has boosted demand for milk calcium powder. Due to the increase in osteoporosis and bone diseases, milk mineral concentrate for infant formula and geriatric populations is becoming increasingly relevant.

Asia Pacific takes the lead in global sales, largely spurred by progressively active government policies on food fortification and the expansion of the elderly population. Sports nutrition and fortified beverage applications continue to grow depending on developments in micronizing powder solubility. CXOs are riding the trends to connect to health-based consumer behavior and improve penetration across ages.

Regulatory and Sensory Challenges Halt Growth

Labeling regulation differences and global health supplement standards complicate compliance. Texture and taste of products remain challenges-some products have a chalky texture, reducing demand. The costs of production are high, particularly for the small manufacturers, with an impact on scalability.

Disruptions to supply chains pertaining to seasonal production of milk have an impact on stability. Consumer awareness about the functionality of dairy ingredients is still imperative, especially when consumers remain ignorant of the benefits of milk minerals.

Widening Applications Provide Opportunities for Growth

Growth potential derives from the increasing range of uses. Application for sports nutrition using milk mineral concentrate is on the rise in recovery beverages and health supplements. Inclusion in diet supplements, nutrient-fortified beverages, and geriatric nutrition products demonstrates cross-functional use. Many brands now explore partnerships with suppliers and food processors to improve integration across categories.

While flavor innovation drives sensory acceptance, direct-to-consumer channels, particularly e-commerce platforms, are increasing product availability. The rapidly growing industries of Southeast Asia and Latin America provide high-growth potential, further highlighting the importance of responsive distribution and product diversification.

Market Risks and Competitive Pressures Persist

There is sustained competitive pressure, with vegan trends leading to demand for plant-based alternatives to calcium. Man-made supplements also undermine the authenticity and effectiveness of dairy-based supplements. Unpredictable raw material prices and sustainability concerns over dairy sourcing uncertainty are added.

Additionally, erroneous declarations of the benefits can trigger regulatory responses. Industry saturation and economic recessions in developed industries mitigate consumer expenditures. To respond to these challenges, companies must invest in R&D, experiment withopen labeling, and establish confidence through traceable, science-based formulations.

By source, the concentrates are derived primarily from cow milk, goat milk, and bovine colostrum.

Key applications include infant formula, sports nutrition, functional beverages, and dairy fortification.

By concentration form, the concentrates are available in two primary forms liquid concentrate and powdered form.

By end users the industryincludesfood manufacturers, nutraceutical companies, and clinical nutrition providers.

By region, the industry includes North America, Europe, East Asia, South Asia & Oceania, Latin America and the Middle East & Africa.

The industry is slated to reach USD 120.1 million in 2025.

The industry is predicted to reach a size of USD 223 million by 2035.

Key companies include Fonterra Co-operative Group, Glanbia Nutritionals, FrieslandCampina, Arla Foods Ingredients, Saputo Inc., GII (Grassland Dairy Products Inc.), GMP Dairy Ltd., MEGGLE Group, Armor Protéines, Parmalat S.p.A., Tatua Co-operative Dairy Company, and Milei GmbH.

Its high bioavailability and natural dairy origin make it ideal for enriching calcium content in various products.

It is primarily used in functional foods, infant formula, sports nutrition, and dietary supplements.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Milk Carton Market Size and Share Forecast Outlook 2025 to 2035

Milking Automation Market Size and Share Forecast Outlook 2025 to 2035

Milking Robots Market Size and Share Forecast Outlook 2025 to 2035

Milk Packaging Market Size and Share Forecast Outlook 2025 to 2035

Milk Clarifier Market Size and Share Forecast Outlook 2025 to 2035

Milk Homogenizer Machine Market Size and Share Forecast Outlook 2025 to 2035

Milk Pasteurization Machines Market Size and Share Forecast Outlook 2025 to 2035

Milk Sterilizer Machine Market Size and Share Forecast Outlook 2025 to 2035

Milk Powder Packaging Market Size and Share Forecast Outlook 2025 to 2035

Milk Powder Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Milk Protein Market - Size, Share, and Forecast 2025 to 2035

Milk Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Milk Thistle Market Analysis by Form, Distribution Channel and Region through 2035

Milk Powder Market Analysis by Type, Distribution Channel, Region and Other Applications Through 2035

Milk Tank Cooling System Market Growth – Trends & Forecast 2025 to 2035

Milk Alternatives Market – Growth, Demand & Dairy-Free Trends

Milk Protein Hydrolysate Market Growth - Infant Nutrition & Functional Use 2024 to 2034

Milking Equipment Market

Milk Bottle Market Trends & Industry Growth Forecast 2024-2034

Milk Fat Fractions Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA