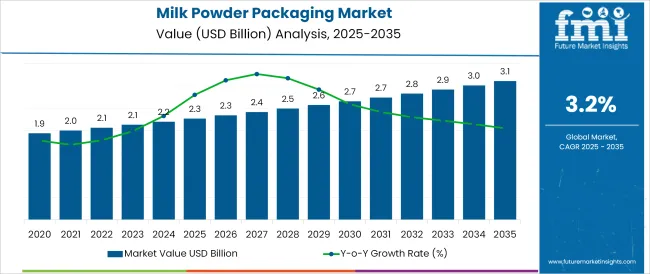

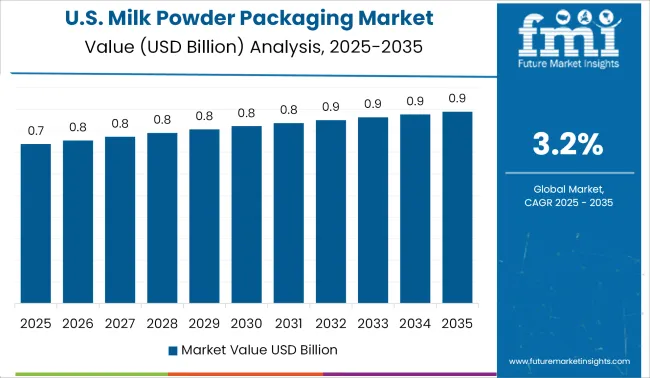

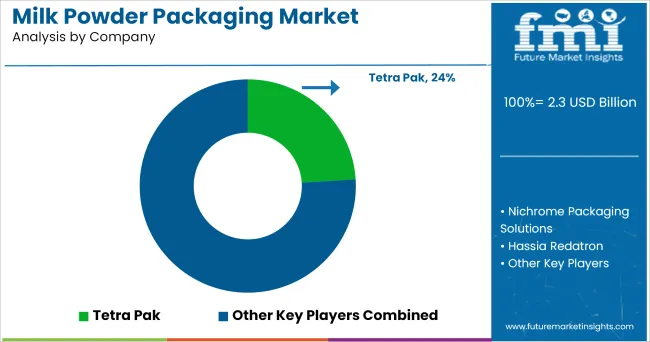

The Milk Powder Packaging Market is estimated to be valued at USD 2.3 billion in 2025 and is projected to reach USD 3.1 billion by 2035, registering a compound annual growth rate (CAGR) of 3.2% over the forecast period.

The milk powder packaging market is experiencing sustained momentum, supported by rising global demand for dairy-based nutrition, longer shelf-life requirements, and export-grade packaging standards. The shift from manual and semi-automated systems to fully automated solutions is being influenced by hygiene regulations, labor cost concerns, and the need for consistency in fill weight and seal integrity.

Increasing consumer preference for portion-controlled, tamper-evident, and moisture-resistant packaging formats is prompting investment in specialized machinery capable of high-speed and contamination-free operations.

Manufacturers are optimizing their production lines to accommodate varying batch sizes and multi-layer packaging formats that preserve freshness while reducing material waste. With a growing emphasis on traceability, digital integration, and sustainable packaging solutions, the market is expected to expand significantly in both developed and emerging dairy economies.

Advanced machines offering scalability, packaging accuracy, and process control are likely to see higher adoption as companies look to increase productivity and meet stringent food safety standards.

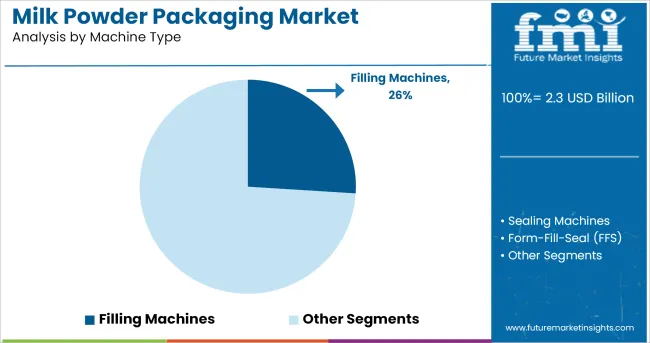

The market is segmented by Machine Type, Automation Type, Capacity Range, and Application and region. By Machine Type, the market is divided into Filling Machines, Sealing Machines, Form-Fill-Seal (FFS), Wrapping Machines, and Others (Weighing, Capping).

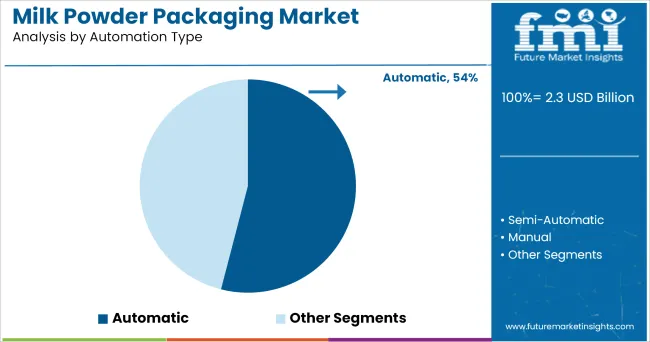

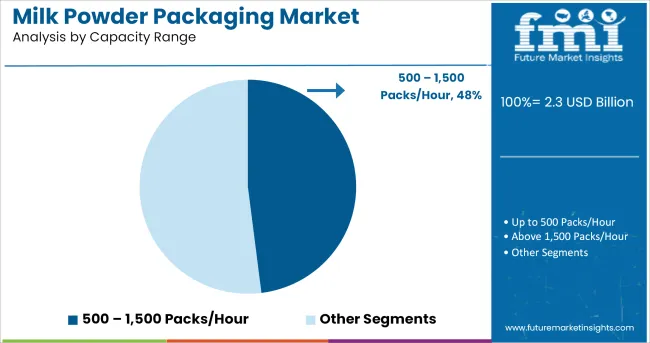

In terms of Automation Type, the market is classified into Automatic, Semi-Automatic, and Manual. Based on Capacity Range, the market is segmented into 500 - 1,500 Packs/Hour, Up to 500 Packs/Hour, and Above 1,500 Packs/Hour. By Application, the market is divided into Baby Milk Powder, Skimmed Milk Powder, Whole Milk Powder, and Dairy-Based Products.

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Filling machines are projected to contribute 26.0% of the total market revenue in 2025, making them the leading segment by machine type. This leadership is being driven by their critical role in ensuring precision dosing, contamination control, and efficient throughput in milk powder packaging.

These machines are capable of handling different powder consistencies and packaging types with high speed and accuracy, which is vital for maintaining consistent product quality and minimizing material loss.

Their adaptability to integrate with sealing, labeling, and nitrogen flushing systems makes them a key component in automated dairy packaging lines. The ability to meet international hygiene and traceability standards while supporting multi-format filling solutions further cements their relevance in both high-volume production and niche nutritional product packaging.

As demand increases for shelf-stable, travel-friendly dairy formats, the use of reliable and scalable filling machinery is expected to drive sustained investment in this segment.

The automatic segment is anticipated to dominate the milk powder packaging market with a 54.0% revenue share in 2025. This dominance is attributed to the rising need for precision, speed, and hygiene in dairy packaging operations.

Automatic systems enable reduced human intervention, which lowers contamination risk while enhancing operational efficiency and line throughput. These systems are equipped with programmable controls, real-time monitoring, and integrated cleaning mechanisms that comply with stringent food safety regulations.

Their ability to ensure consistency in pack weight, sealing quality, and label accuracy has made them a preferred choice among dairy producers operating in both bulk and retail packaging environments. The shift toward Industry 4.0 practices is further accelerating automation adoption, as stakeholders seek data-driven insights and predictive maintenance for minimizing downtime. As global demand for safe and convenient dairy packaging grows, automatic packaging solutions are expected to remain integral to modern dairy processing plants.

By capacity, the 500 - 1,500 packs/hour segment is projected to account for 48.0% of the milk powder packaging market revenue in 2025. This segment’s leadership reflects its suitability for mid-sized production facilities that balance speed with packaging precision.

Equipment in this range is often favored for its modularity, energy efficiency, and compatibility with various pouch, sachet, and canister formats used in dairy packaging. It offers an optimal solution for producers managing diverse product lines, batch sizes, and regional compliance standards.

The ability to deliver consistent output while minimizing material waste and downtime is a key driver of segment growth. Additionally, this capacity range supports automation upgrades and digital integration, enabling producers to meet fluctuating market demand without compromising quality.

As milk powder consumption continues to rise across institutional, retail, and export markets, this mid-capacity segment is positioned to attract strong investment from small to medium-sized dairy operators aiming to scale efficiently.

As the trend of powdered foods continue to make inroads in different regions across the globe, the demand for milk powder packaging has observed steady growth. The growing demand for milk powder is projected to have a direct impact on the global milk powder packaging demand.

Proper packaging of milk powder is crucial procedure since it affects the safety, marketing, and quality of the product. Milk powder is susceptible to lipid oxidation owing to its fat content and hygroscopicity, and hence must be packaged in order to avoid contact with oxygen, light, contaminants, and moisture.

On the basis of type, the sensor market has been bifurcated in to tins, flexible pouches, and others. Out of which, flexible pouches segment is anticipated to hold the larger share of the global market. Flexible pouches made of plastic film laminates or aluminum foil, are slowly and gradually replacing the tin cans.

This is owing to the fact that flexible packages aid in reducing the manufacturing and transportation costs. Moreover, as the packaging requires less material, they even help in minimizing the post-consumer waste. Hence, the flexible pouches segment is projected to continue its dominance over the forecast period.

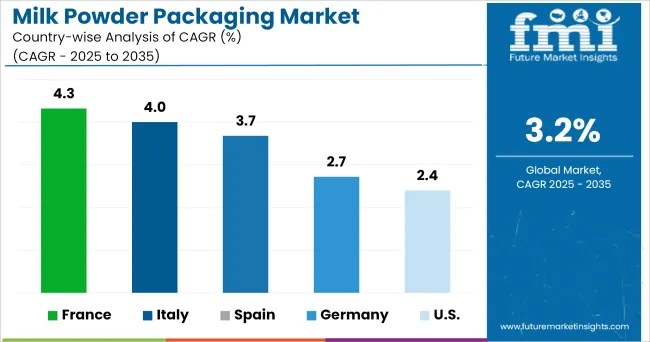

USA happens to be one of the largest markets for milk powder packaging across the globe. The growth in USA is attributed to the presence of established players coupled with changing consumer preferences towards powdered foods owing to the nutrition content being offered.

Moreover, the higher content of minerals and moisture in milk makes it very challenging for vendors to store it for a long period of time. This happens to be one of the major reasons driving the demand for milk powder, thereby driving the growth of milk powder packaging market.

In Europe, there has been a shift in consumer preferences towards powdered food products, owing to its abundant benefits is predominantly anticipated to boost the demand for milk powder packing in the region. Substantial rise in the convenience stores, supermarkets, hypermarkets, and specialty stores in the region is another major factor driving the growth of milk powder packing market.

Moreover, surge in disposable income of consumers combined with the changing lifestyles is further anticipated to drive the growth of the retail sector in the region, thereby driving the growth of milk powder packing packaging market.

Some of the leading providers of milk powder packaging include

With extensive research and development, the companies in the market are coming up with different and advanced solutions and technologies for packaging of milk powders. For instance, Arodo offers packaging of milk powder with the help of AROVAC vacuum technology.

The resulting packaging happens to offer more efficient production, compact bags, and stable stacked pallets that can be weighed with extreme accuracy. Furthermore, there is no need for more openings in the bags in order to allow excess air to escape. Products, such as milk powder, have a longer shelf life. Also, the company’s technology has an affirmative influence on the colour, smell, and taste of milk powder, thereby making it an ideal choice for packaging.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global milk powder packaging market is estimated to be valued at USD 2.3 billion in 2025.

The market size for the milk powder packaging market is projected to reach USD 3.1 billion by 2035.

The milk powder packaging market is expected to grow at a 3.2% CAGR between 2025 and 2035.

The key product types in milk powder packaging market are filling machines, sealing machines, form-fill-seal (ffs), wrapping machines and others (weighing, capping).

In terms of automation type, automatic segment to command 54.0% share in the milk powder packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Milk Powder Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Milk Carton Market Size and Share Forecast Outlook 2025 to 2035

Milking Automation Market Size and Share Forecast Outlook 2025 to 2035

Milking Robots Market Size and Share Forecast Outlook 2025 to 2035

Milk Clarifier Market Size and Share Forecast Outlook 2025 to 2035

Milk Homogenizer Machine Market Size and Share Forecast Outlook 2025 to 2035

Milk Pasteurization Machines Market Size and Share Forecast Outlook 2025 to 2035

Milk Sterilizer Machine Market Size and Share Forecast Outlook 2025 to 2035

Milk Protein Market - Size, Share, and Forecast 2025 to 2035

Milk Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Milk Mineral Concentrate Market Trends-Demand, Innovations & Forecast 2025 to 2035

Milk Thistle Market Analysis by Form, Distribution Channel and Region through 2035

Milk Tank Cooling System Market Growth – Trends & Forecast 2025 to 2035

Milk Alternatives Market – Growth, Demand & Dairy-Free Trends

Milk Protein Hydrolysate Market Growth - Infant Nutrition & Functional Use 2024 to 2034

Milking Equipment Market

Milk Bottle Market Trends & Industry Growth Forecast 2024-2034

Milk Fat Fractions Market

Milk Retentate Market

Milking Salve Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA