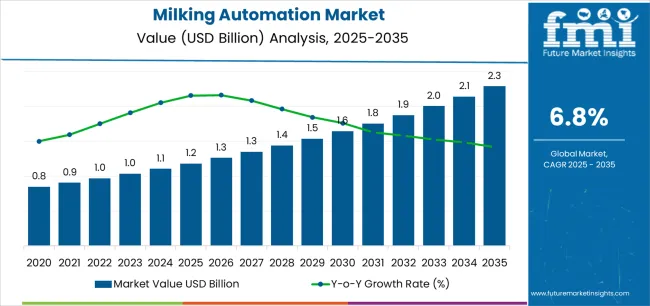

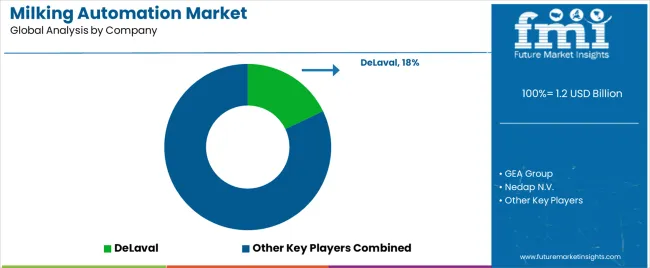

The Milking Automation Market is estimated to be valued at USD 1.2 billion in 2025 and is projected to reach USD 2.3 billion by 2035, registering a compound annual growth rate (CAGR) of 6.8% over the forecast period.

The milking automation market is expanding steadily, driven by the increasing need for operational efficiency, labor cost reduction, and productivity enhancement in dairy farming. Rising herd sizes and the global emphasis on sustainable dairy production are fostering strong adoption of automated milking systems. Technological advancements in sensors, robotics, and data analytics have improved milk yield accuracy and animal health monitoring, enhancing overall farm management efficiency.

Market growth is being reinforced by government initiatives promoting smart agriculture and digital integration across farm operations. The shift toward precision livestock farming and the focus on improving milk quality are further accelerating deployment.

Future outlook remains positive as the adoption of automation solutions continues to rise across both developed and emerging dairy markets Growth rationale is anchored on the ongoing modernization of dairy infrastructure, rising awareness of animal welfare, and the economic benefits derived from real-time performance tracking, which collectively ensure long-term market stability and technological progression.

| Metric | Value |

|---|---|

| Milking Automation Market Estimated Value in (2025 E) | USD 1.2 billion |

| Milking Automation Market Forecast Value in (2035 F) | USD 2.3 billion |

| Forecast CAGR (2025 to 2035) | 6.8% |

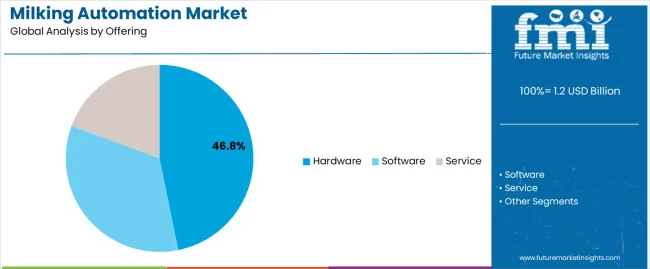

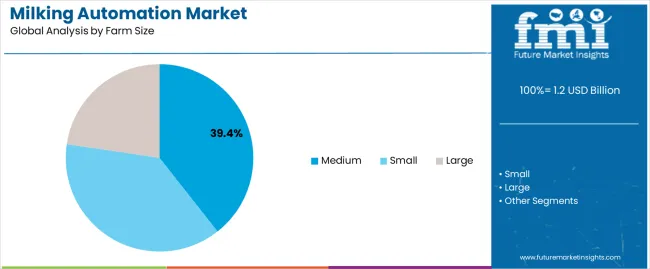

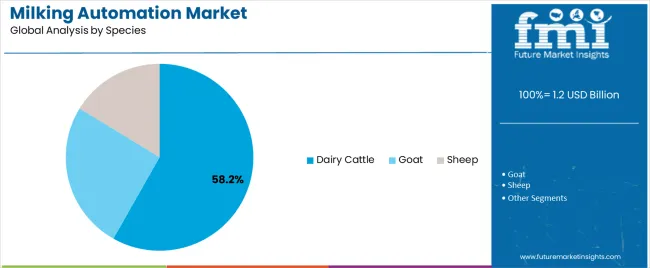

The market is segmented by Offering, Farm Size, and Species and region. By Offering, the market is divided into Hardware, Software, and Service. In terms of Farm Size, the market is classified into Medium, Small, and Large. Based on Species, the market is segmented into Dairy Cattle, Goat, and Sheep. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

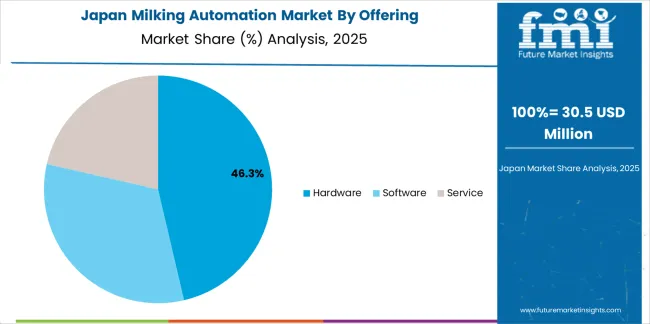

The hardware segment, accounting for 46.80% of the offering category, has been leading the market due to the high demand for milking robots, sensors, and control units that form the core of automation systems. Adoption has been propelled by the ability of advanced equipment to enhance milking precision, improve udder health, and reduce manual intervention.

Continuous innovation in hardware design has improved system durability and ease of maintenance, increasing the return on investment for farmers. The growing trend toward smart dairy farms equipped with IoT-based devices has strengthened the segment’s dominance.

Manufacturers are focusing on integrating automation hardware with software analytics to deliver comprehensive herd management solutions As a result, the hardware segment is expected to maintain its leadership position, supported by consistent technological upgrades and the scaling of automated systems in mid- and large-sized farms globally.

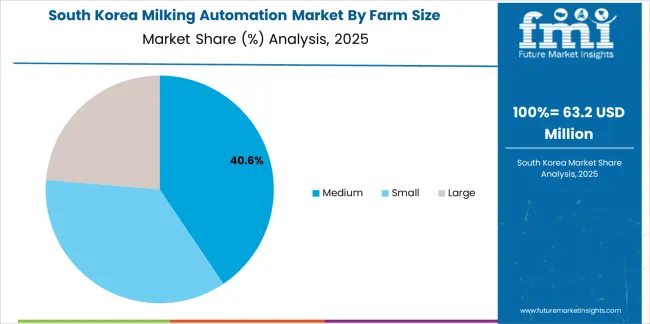

The medium farm segment, holding 39.40% of the farm size category, has emerged as the key adopter of milking automation systems owing to its balance between operational scale and investment capability. These farms are increasingly transitioning from manual to semi-automated and fully automated systems to enhance productivity and reduce dependency on skilled labor.

Cost optimization through efficient resource utilization and time savings has encouraged adoption. Manufacturers are tailoring automation solutions to fit medium-scale farm requirements, ensuring flexibility and scalability.

The availability of financing options and government subsidies has further facilitated technology integration As medium farms continue to modernize, they are expected to act as the pivotal growth drivers for market expansion, bridging the gap between small-scale and industrial dairy operations.

The dairy cattle segment, representing 58.20% of the species category, dominates the market due to the large-scale adoption of automated milking systems in bovine dairy production. Consistent milk demand, combined with the species’ high yield potential, has positioned dairy cattle as the primary focus of automation investments.

The segment benefits from mature technology ecosystems that include precision feeding, health tracking, and robotic milking solutions optimized for cattle physiology. Increasing focus on animal welfare and consistency in milking intervals has encouraged wider implementation across commercial farms.

Data-driven insights into milk composition and health indicators have enhanced production management, reinforcing farmer confidence in automated systems As dairy production scales up to meet rising global consumption, the dairy cattle segment is expected to retain its dominant market share through continued innovation and widespread technology integration.

Hardware drives the global market with a robust CAGR of 7.0% through 2035.

| Attributes | Details |

|---|---|

| Offering | Hardware |

| CAGR ( 2025 to 2035) | 7.0% |

This rising popularity is attributed to:

Based on farm size, small farms are subject to the global milking automation market, with a 6.8% CAGR from 2025 to 2035.

| Attributes | Details |

|---|---|

| Farm Size | Small |

| CAGR ( 2025 to 2035) | 6.8% |

This rising popularity is attributed to:

The section analyzes the global milking automation market by country, including the United Kingdom, the United States, China, South Korea, and Japan. The table presents the CAGR for each country, indicating the expected market growth through 2035.

| Countries | CAGR |

|---|---|

| South Korea | 9.7% |

| The United Kingdom | 8.1% |

| China | 8.0% |

| Japan | 7.7% |

| The United States | 7.5% |

South Korea is emerging as a global player and maintains its top position in the milking automation market, with a CAGR of 9.7% from 2025 to 2035.

South Korea's advanced agricultural sector and high-tech farming practices drive growth in the Milking Automation Market. Focusing on precision farming and sustainable agriculture, South Korean dairy farmers are embracing milking automation technologies to optimize milk production, enhance animal welfare, and reduce labor dependency.

Government support for agricultural innovation and technology adoption further incentivizes the deployment of milking robots across the country.

The United Kingdom is becoming a prominent global milking automation market player. With a CAGR of 8.1% projected through 2035, it is maintaining a steady pace of growth.

Efficiency and productivity are the buzzwords in the United Kingdom's dairy farming sector, and the milking automation market is experiencing growth as dairy farmers adopt technological innovation and precision agriculture.

The focus is on streamlining operations and optimizing milk production, and milking automation systems are helping farmers achieve these goals. The United Kingdom government's support for modernizing agricultural practices and improving farm profitability further incentivizes the nationwide adoption of milking automation technologies.

China is emerging as a global player in the milking automation market with a CAGR of 8.0% from 2025 to 2035.

As China's dairy industry seeks to modernize and scale up production to meet rising consumer demand, the Milking Automation Market is experiencing a surge in demand in China.

Chinese dairy farmers are investing in milking automation systems to boost efficiency, milk yield, and product quality. Government initiatives promoting agricultural mechanization and improving food safety standards are driving the adoption of milking robots across China.

Japan maintains its position in the global milking automation market, projecting a steady growth rate with a CAGR of 7.7%, which is expected to continue through 2035.

The Milking Automation Market is gaining traction in Japan as dairy farmers seek to address labor shortages and improve farm productivity. Japanese dairy farms use milking automation systems to streamline operations, minimize labor requirements, and ensure consistent milk quality.

Initiatives to revitalize rural economies and promote the adoption of advanced agricultural technologies are driving the uptake of milking robots across Japan.

The United States is steadily emerging as a significant contender in the worldwide milking automation market, with a projected CAGR of 7.5% expected to persist until 2035.

Driven by the country's large-scale dairy farming industry and a growing demand for operational efficiency and labor savings, the milking automation market in the United States is witnessing significant growth.

With a focus on farm mechanization and digitalization, United States dairy farmers are turning to milking automation solutions to enhance milk quality, reduce labor costs, and improve overall farm management.

Factors such as rising labor shortages, stricter regulations on labor practices, and a desire for greater flexibility in farm operations are accelerating the adoption of milking robots.

Major companies are investing in research and development, technological innovation, and market expansion initiatives to enhance their product offerings and meet the evolving needs of dairy farmers worldwide.

For example, they are developing advanced milking robots with cutting-edge sensors, artificial intelligence, and data analytics capabilities to improve milk quality, increase milking efficiency, and enhance animal welfare.

Manufacturers are focusing on expanding their presence in key geographic regions with significant growth potential, such as emerging markets in Asia-Pacific and Latin America, through partnerships, acquisitions, and distribution agreements.

Major players collaborate with industry stakeholders, including dairy associations, research institutions, and government agencies, to promote the benefits of milking automation and address regulatory and technical challenges.

They are participating in industry forums, workshops, and conferences to raise awareness about the advantages of automation in dairy farming and provide training and support to dairy farmers for the successful implementation of milking automation systems.

They are investing in customer service, technical support, and after-sales maintenance to ensure the reliability and performance of their milking automation solutions.

Recent Developments

The global milking automation market is estimated to be valued at USD 1.2 billion in 2025.

The market size for the milking automation market is projected to reach USD 2.3 billion by 2035.

The milking automation market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in milking automation market are hardware, _milk meters, _milking clusters, _milk point controllers, _pulsators, _smart feeding robots (tmr/pmr-based feeding robots), _smart camera-based facial recognition systems (biometric ids), software, _cloud-based, _pc-based, service, _maintenance and support and _data management and analytic.

In terms of farm size, medium segment to command 39.4% share in the milking automation market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Milking Robots Market Size and Share Forecast Outlook 2025 to 2035

Milking Equipment Market

Milking Salve Market

Cow Milking Machine Market Size and Share Forecast Outlook 2025 to 2035

Automation Testing Market Size and Share Forecast Outlook 2025 to 2035

Automation COE Market Insights by Organization Size, Service Type, End User Verticals, and Region through 2035

Lab Automation Market Growth – Size, Trends & Forecast 2025 to 2035

Home Automation Sensors Market Size and Share Forecast Outlook 2025 to 2035

Home Automation Market Analysis by Product, Application, Networking Technology, and Region Through 2035

Form Automation Software Market – Digitizing Workflows

Hyperautomation Market

Water Automation & Instrumentation Market Trends & Forecast by Process Stage, Automation Technology, Instrumentation, End-User and Region through 2035

Retail Automation Market Size and Share Forecast Outlook 2025 to 2035

Postal Automation Systems Market Size and Share Forecast Outlook 2025 to 2035

Process Automation and Instrumentation Market Size and Share Forecast Outlook 2025 to 2035

Network Automation Market - AI & Cloud Connectivity 2025 to 2035

Factory Automation And Industrial Controls Market Growth - Trends & Forecast 2025 to 2035

Machine Automation Controller Market Growth – Trends & Forecast 2025 to 2035

Medical Automation Market Analysis - Innovations & Forecast 2025 to 2035

Evaluating Process Automation and Instrumentation Market Share & Provider Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA