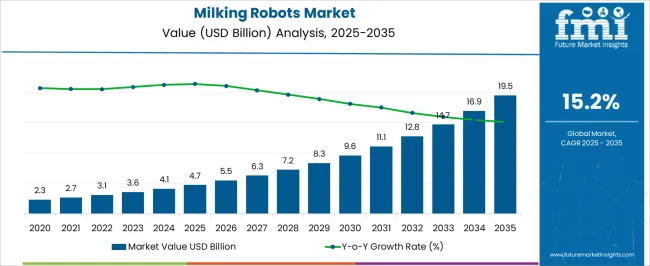

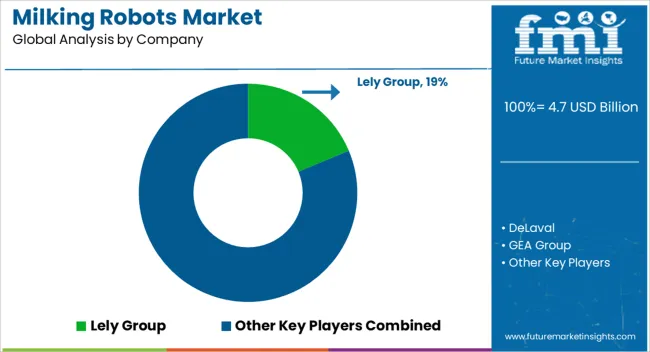

The milking robots market is estimated to be valued at USD 4.7 billion in 2025 and is projected to reach USD 19.5 billion by 2035, registering a compound annual growth rate (CAGR) of 15.2% over the forecast period. Farmers are increasingly integrating robotic milking systems to streamline herd management, monitor animal health, and optimize milking schedules, leading to better resource utilization and consistent production outcomes.

Technological advancements in robotics, sensor integration, and artificial intelligence are further supporting market growth by enabling real-time monitoring of milk composition, udder health, and overall animal well-being. The rising demand for dairy products, coupled with labor shortages in the agricultural sector, is accelerating investments in automated solutions across developed and emerging markets. Countries with large dairy industries, such as the United States, Germany, and India, are expected to account for substantial adoption of milking robots. Additionally, the trend toward precision livestock farming is increasing the deployment of smart farming systems, integrating milking robots with data analytics platforms to provide actionable insights for herd management. As efficiency, productivity, and animal welfare become key priorities, the market for milking robots is set to witness sustained growth across global dairy operations.

| Metric | Value |

|---|---|

| Milking Robots Market Estimated Value in (2025 E) | USD 4.7 billion |

| Milking Robots Market Forecast Value in (2035 F) | USD 19.5 billion |

| Forecast CAGR (2025 to 2035) | 15.2% |

The milking robots market is gaining momentum as dairy farms increasingly adopt automation to improve efficiency, reduce labor dependency, and enhance animal welfare. Rising operational costs and growing demand for high-quality milk are pushing farm owners toward robotic milking solutions that offer consistent yields and real-time monitoring of herd health.

Technological advancements in machine vision, sensors, and AI-integrated milking systems are transforming traditional dairy operations by enabling data-driven decisions. The global trend toward sustainable dairy farming is also contributing to adoption, as robotic systems can optimize feed management, reduce energy usage, and minimize animal stress.

As small- and mid-scale farms seek scalable solutions, the market outlook remains positive, with significant opportunities arising from emerging economies and ongoing government support for precision agriculture and agri-tech investments

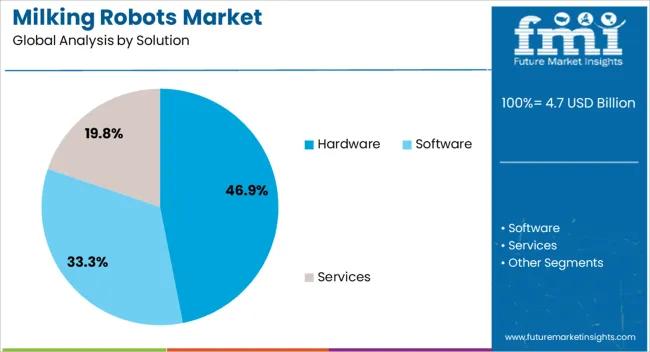

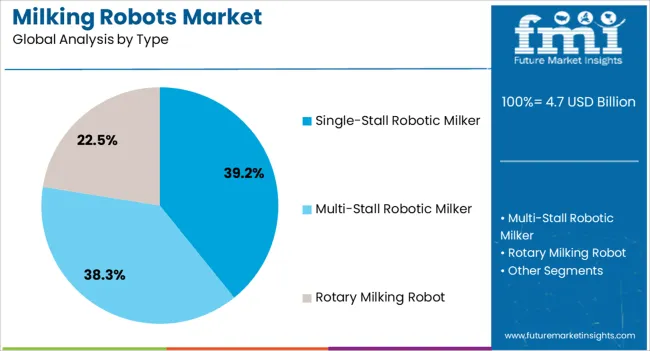

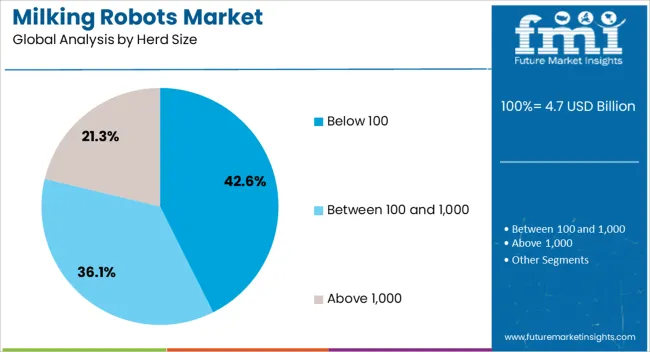

The milking robots market is segmented by solution, type, herd size, and geographic regions. By solution, milking robots market is divided into Hardware, Software, and Services. In terms of type, milking robots market is classified into Single-Stall Robotic Milker, Multi-Stall Robotic Milker, and Rotary Milking Robot. Based on herd size, milking robots market is segmented into Below 100, Between 100 and 1,000, and Above 1,000. Regionally, the milking robots industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hardware segment accounted for 47% of the milking robots market, establishing itself as the largest contributor within the solution category. This dominance stems from the high initial investment in physical robotic systems, including robotic arms, milking cups, sensors, and cow traffic control gates, which are essential to automate milking processes effectively.

These components form the core of operational infrastructure and are critical for ensuring precision, hygiene, and animal comfort during milking. Ongoing improvements in hardware durability, efficiency, and maintenance capabilities have made these systems more attractive for long-term cost savings.

As more farms transition from manual to automated systems, demand for advanced and customizable hardware configurations is expected to grow. The segment's strong performance is anticipated to continue, driven by innovations focused on increasing throughput and minimizing machine downtime

Single-stall robotic milkers represent 39% of the market by type, driven by their affordability and suitability for small to medium-sized dairy farms. These systems are designed to handle individual cows with minimal supervision, offering flexibility and ease of integration into existing barn layouts.

The segment’s popularity is fueled by lower capital requirements compared to multi-stall systems, making it a practical entry point for farms adopting automation for the first time. Moreover, improvements in sensor technology, automatic cleaning systems, and data tracking capabilities have enhanced the efficiency and appeal of single-stall units.

This segment continues to benefit from rising awareness of the long-term productivity gains and reduced labor reliance these systems provide. As dairy producers seek adaptable, space-efficient, and budget-conscious solutions, the single-stall robotic milker segment is expected to retain its relevance in the evolving dairy automation landscape

The below 100 herd size category leads the market with a 43% share, highlighting its importance in the global dairy sector where small- to mid-sized farms remain prevalent. Adoption in this segment is primarily driven by labor shortages and the rising need to improve milking efficiency without expanding herd size.

Smaller farms increasingly turn to robotic milking to manage operational costs and ensure consistent milk quality, especially in regions with aging farming populations and limited access to skilled labor. The scalability and modularity of modern robotic systems make them highly attractive to smaller operations seeking automation without overextending budgets or infrastructure.

This segment is expected to sustain steady growth as technological advancements make robotic milking more accessible and economically viable for a broader range of farm sizes

The global milking robots market is growing steadily as dairy farms increasingly adopt automation to improve productivity and operational efficiency. Robotic systems reduce reliance on manual labor, enhance herd management, and maintain consistent milk quality. Advanced sensors allow monitoring of milk output and animal health with precision. Farms can detect potential issues early, ensuring better animal care. Emerging regions with expanding dairy sectors are starting to implement robotic systems, driven by modernization and technological availability.

High initial investment and ongoing maintenance remain challenges, but continuous technological improvements and awareness about the benefits of automation are expected to support gradual market expansion globally. The adoption of milking robots is becoming a practical solution for farms aiming to combine efficiency with higher milk yields.

Labor Efficiency and Automation Acting as Key Market Drivers

Labor shortages and the rising demand for productivity are major drivers of the milking robots market. Automated systems allow farmers to manage larger herds efficiently while lowering operational costs and reducing dependency on manual labor. Robotic milking ensures uniform schedules, monitors udder health, and minimizes stress on animals, which improves milk yield and quality. Advanced robotics also provides alerts for irregularities in milk output or animal behavior, allowing farmers to take timely action. Increasing awareness of modern farming benefits, coupled with the need for consistent production, motivates dairy operators to invest in automation. Growing adoption in both developed and emerging regions highlights the global recognition of robotic milking as a practical solution for efficiency, animal care, and productivity, making labor optimization a critical market factor.

Emerging Dairy Markets Offering Lucrative Growth Opportunities Globally

Emerging regions, including Asia Pacific, Latin America, and parts of Eastern Europe, are presenting substantial growth opportunities for milking robots. Increasing milk consumption, modernization of dairy farms, and government programs supporting mechanization are motivating investments in automated systems. Small and medium-sized farms are gradually adopting robotic milking as technology becomes more accessible and affordable. Integration with AI and IoT allows predictive maintenance, monitoring animal health, and optimizing milking schedules. Collaborations between robotics manufacturers and local distributors help expand market penetration. The gradual modernization of farms and the increasing trend of precision farming in developing regions are expected to boost adoption. These factors make emerging markets a promising avenue for robotic milking expansion in the next decade.

AI and IoT Integration Shaping Current Trends in Dairy Farming

Milking robots are increasingly integrating AI and IoT technologies to enhance operational efficiency and animal management. These systems monitor milk yield, detect early signs of health issues, and maintain optimal milking schedules. Cloud connectivity allows farmers to track herd performance and system functionality remotely, improving decision-making and productivity. Wearable sensors for livestock enhance monitoring, while intuitive software interfaces make farm operations simpler and more precise. The combination of robotics with AI and IoT is reshaping farm management, ensuring higher milk quality, consistent output, and improved animal welfare. Farms adopting these technologies can optimize milking frequency and respond faster to health concerns, aligning automation with sustainable operational practices and modern dairy management trends worldwide.

High Investment and Maintenance Costs Restricting Market Expansion

High initial costs and ongoing maintenance expenses remain the main restraints for milking robots. The acquisition, installation, and setup of robotic systems require significant capital, making adoption challenging for small- and medium-sized farms. Additional costs include software updates, periodic maintenance, and access to technical support. Farm staff require training to operate and troubleshoot these systems efficiently, adding further operational demands. Environmental factors, herd composition, and farm size can influence the efficiency and return on investment, affecting adoption rates. Limited awareness of long-term benefits and concerns over cost recovery can slow market growth. Despite the advantages of automation in productivity and animal care, financial and operational challenges continue to restrict broader adoption, particularly in regions with low automation penetration.

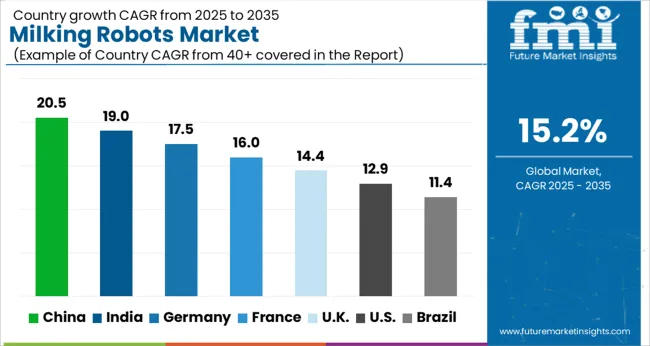

| Country | CAGR |

|---|---|

| China | 20.5% |

| India | 19.0% |

| Germany | 17.5% |

| France | 16.0% |

| UK | 14.4% |

| USA | 12.9% |

| Brazil | 11.4% |

The global milking robots market is growing at a CAGR of 15.2%, equivalent to a multiplication factor of 1.52 over a standard period. China leads at 20.5% (1.63x), followed by India at 19% (1.57x), both part of the BRICS group, driven by rising dairy demand, government incentives, and mechanization. Germany and France show moderate growth of 17.5% (1.53x) and 16% (1.48x), reflecting gradual automation in established European dairy sectors. The UK and USA record slower growth at 14.4% (1.44x) and 12.9% (1.39x) due to high investment costs and farm size differences. Brazil, also in BRICS, grows at 11.4% (1.34x), constrained by infrastructure and affordability challenges. In ASEAN countries, adoption is emerging at 13-14% (1.34-1.40x), influenced by modernizing dairy practices and labor efficiency needs. Factors driving global growth include labor shortages, demand for high-quality milk, technological innovation, farm productivity improvements, and regulatory support.

This report includes insights on 40+ countries, The top markets are shown here for reference.

China holds 20.5% of the global milking robots market, making it the largest single-country contributor. Adoption is highest in farms with herd sizes above 500 cows, which represent nearly 40% of commercial dairy operations in northern and eastern provinces. Robotic systems supplied by Lely and GEA Group are integrated with sensors tracking milk yield, cow activity, and feeding behavior. On average, automation reduces labor requirements by 25% and increases milk yield per cow by 8-10%. Farms implementing AI-driven predictive maintenance report up to 15% fewer milking delays. China’s robotic adoption rate is projected to increase by 12% annually through 2030, driven by large-scale farm expansion and technological integration. Real-time data monitoring ensures herd welfare, consistent milk quality, and operational efficiency across commercial operations.

India accounts for 19% of the global milking robots market. Adoption is concentrated in northern and western states, where 30% of dairy farms have herds exceeding 200 cows. Milking robots from DeLaval and Lely are installed in over 1,200 farms, with automation increasing per-cow milk yield by 6-9%. Labor savings average 20% per farm, and predictive maintenance reduces equipment downtime by 10%. Adoption is projected to grow at a CAGR of 11% through 2032 as farm mechanization rises. Robotic milking systems track feeding, health metrics, and milk production, enabling data-driven herd management. Medium-sized farms are integrating these systems to improve operational efficiency and maintain consistent milk quality, supporting both local consumption and commercial distribution.

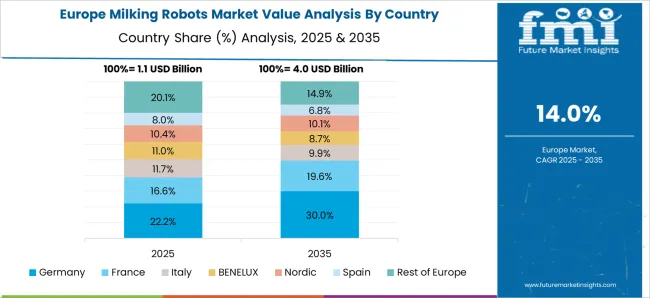

Germany represents 17.5% of the global milking robots market. Multi-stall robotic systems are used in 60% of medium and large dairy farms, where herds average 150-400 cows. Lely and GEA Group systems track milk composition, udder health, and cow activity. Automation reduces labor by 18% and improves per-cow milk yield by 7%. Predictive analytics optimize milking schedules, with farms reporting a 12% increase in operational efficiency. Adoption is concentrated in Bavaria and Lower Saxony, which together contribute 55% of robotic installations. Germany’s market is expected to grow at 8.5% CAGR to 2030, driven by regulatory focus on milk quality and herd welfare. Data-driven insights ensure consistent milk production while minimizing operational costs.

France holds 16% of the global milking robots market. Robotic adoption is concentrated in regions producing 60% of export-oriented milk, primarily Normandy and Brittany. Lely and BouMatic systems integrate sensors to track cow activity, feeding, and udder health. Farms report 20% labor cost savings and 7% improvement in milk yield per cow. Herds exceeding 200 cows are most likely to adopt robotics, representing 35% of commercial farms. Predictive analytics reduce maintenance-related downtime by 12%, while automated feeding schedules optimize nutrition. Growth is projected at 7.5% CAGR through 2032 as farms expand technology adoption for operational efficiency. Data-driven herd management supports consistent milk quality, improved animal welfare, and higher productivity.

The United Kingdom accounts for 14.4% of the global milking robots market. Adoption is focused on farms with herds exceeding 150 cows, which represent 40% of total dairy operations. Lely and GEA Group robotic systems track milk yield, cow activity, and feeding behavior. Average labor savings per farm are 17%, with a 6% increase in milk production per cow. Predictive maintenance reduces equipment downtime by 10%, while automated feeding improves nutrition management. Robotic adoption is concentrated in South West England and Yorkshire, where farm density and milk production are high. Market growth is projected at 9% CAGR to 2030 as technology adoption expands. Data-driven insights allow farms to maintain consistent milk quality and optimize operational efficiency.

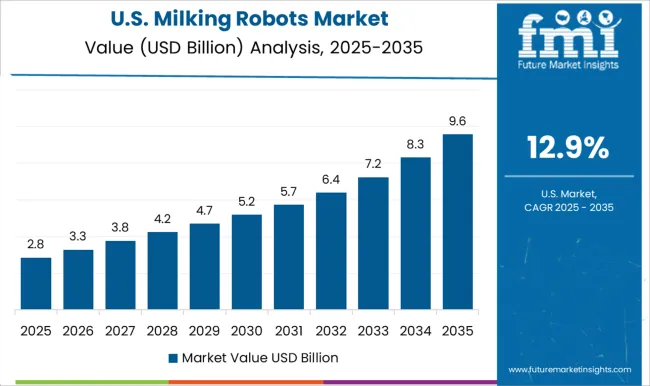

The United States holds 12.9% of the global milking robots market. Adoption is concentrated in Wisconsin, California, and New York, which collectively represent 65% of robotic installations. Herds average 300-600 cows per commercial farm, where automation reduces labor by 20% and improves milk yield by 8% per cow. Systems from DeLaval and Lely are integrated with sensors monitoring feed intake, activity, and udder health. Predictive analytics optimize milking schedules, reducing downtime by 12%. Adoption is projected to grow at 8.5% CAGR through 2030. Data-driven automation allows farms to maintain milk consistency, improve operational efficiency, and monitor herd health for high-volume production.

Brazil accounts for 11.4% of the global milking robots market. Adoption is concentrated in southern states like Rio Grande do Sul and Paraná, where 45% of dairy farms have herds exceeding 200 cows. Robotic systems from DeLaval and GEA Group track milk production, cow activity, and feeding patterns. Automation reduces labor by 18% and increases per-cow milk yield by 6-8%. Predictive maintenance lowers equipment downtime by 10%. Adoption is projected to grow at 10% CAGR through 2032 as farms expand technology integration. Data-driven monitoring enables consistent milk quality, efficient herd management, and improved operational efficiency. Commercial farms are increasingly adopting robotics to meet rising domestic and export demand.

The milking robots market is shaped by competition among established players, including Lely Group, DeLaval, GEA Group, BouMatic Robotics, Dairymaster, Milkline, AMS Galaxy, Agroserve, Insentec, Fullwood Packo, and FutureDairy. Innovation drives differentiation as each company introduces automated solutions designed to increase productivity and improve herd management. Precision milking systems, data-driven farm management, and cow comfort remain central to product design.

DeLaval robots are engineered for seamless integration with farm operations, providing smart teat preparation and milk quality monitoring. GEA Group focuses on gentle milking techniques and optimized cow movement through advanced sensors. Lely Astronaut systems are built for high efficiency and full herd management, supported by farm software. BouMatic delivers scalable solutions suitable for farms of varying sizes, while Dairymaster emphasizes operational efficiency alongside cow welfare. Insentec and AMS Galaxy provide monitoring systems for feeding and milking schedules. Fullwood Packo offers modular systems that can be adapted to different farm layouts, and FutureDairy integrates precision analytics for herd optimization.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.7 Billion |

| Solution | Hardware, Software, and Services |

| Type | Single-Stall Robotic Milker, Multi-Stall Robotic Milker, and Rotary Milking Robot |

| Herd Size | Below 100, Between 100 and 1,000, and Above 1,000 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Lely Group, DeLaval, GEA Group, BouMatic Robotics, Dairymaster, Milkline, AMS Galaxy, Agroserve Ltd., Insentec, Fullwood Packo, and FutureDairy |

The global milking robots market is estimated to be valued at USD 4.7 billion in 2025.

The market size for the milking robots market is projected to reach USD 19.5 billion by 2035.

The milking robots market is expected to grow at a 15.2% CAGR between 2025 and 2035.

The key product types in milking robots market are hardware, software and services.

In terms of type, single-stall robotic milker segment to command 39.2% share in the milking robots market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Milking Automation Market Size and Share Forecast Outlook 2025 to 2035

Milking Equipment Market

Milking Salve Market

Cow Milking Machine Market Size and Share Forecast Outlook 2025 to 2035

SLAM Robots Market Size and Share Forecast Outlook 2025 to 2035

Micro Robots Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Delta Robots Market

Mobile Robots Market Size and Share Forecast Outlook 2025 to 2035

Pharma Robots Market Size and Share Forecast Outlook 2025 to 2035

Nuclear Robots Market Size and Share Forecast Outlook 2025 to 2035

Kitting Robots Market Size and Share Forecast Outlook 2025 to 2035

Airport Robots Market Size and Share Forecast Outlook 2025 to 2035

Painting Robots Market Size and Share Forecast Outlook 2025 to 2035

Security Robots Market Size and Share Forecast Outlook 2025 to 2035

Military Robots Market Size and Share Forecast Outlook 2025 to 2035

Surgical Robots Market

Pipetting Robots Market Size and Share Forecast Outlook 2025 to 2035

Logistics Robots Market Size and Share Forecast Outlook 2025 to 2035

Inspection Robots Market Size and Share Forecast Outlook 2025 to 2035

Dispensing Robots Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA