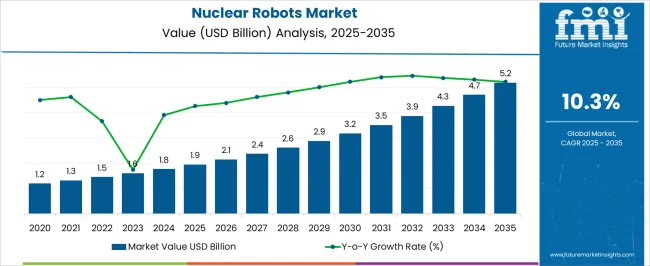

The nuclear robots market is valued at USD 1.9 billion in 2025 and is projected to reach USD 5.2 billion by 2035, growing at a CAGR of 10.3%. Over the first five years, from 2021 to 2025, the market is expected to expand from USD 1.2 billion to USD 1.9 billion, with annual increments reaching USD 1.3 billion, USD 1.5 billion, USD 1.6 billion, and USD 1.8 billion. This phase is driven by increasing demand for nuclear robots in hazardous environments, particularly in decommissioning and maintenance tasks for nuclear power plants. The need for remote-controlled robots to handle dangerous and radioactive materials boosts market growth. Between 2026 and 2030, the market is expected to strengthen from USD 1.9 billion to USD 3.5 billion, advancing through USD 2.1 billion, USD 2.4 billion, USD 2.6 billion, and USD 2.9 billion.

Growth during this period is supported by technological advancements in robotics, such as AI-driven automation and enhanced precision, making nuclear robots more efficient for real-time monitoring, repair, and waste management tasks in the nuclear sector. From 2031 to 2035, the market is expected to continue its upward trajectory, reaching a value of USD 5.2 billion. Intermediate values pass through USD 3.2 billion, USD 3.5 billion, USD 3.9 billion, and USD 4.3 billion, driven by continued demand from nuclear safety, facility upgrades, and the growing need for robots in nuclear waste disposal and environmental monitoring.

| Metric | Value |

|---|---|

| Nuclear Robots Market Estimated Value in (2025 E) | USD 1.9 billion |

| Nuclear Robots Market Forecast Value in (2035 F) | USD 5.2 billion |

| Forecast CAGR (2025 to 2035) | 10.3% |

The nuclear energy market is the largest contributor, accounting for approximately 40-45% of the market. Nuclear robots are increasingly used in hazardous environments within nuclear power plants for tasks such as inspection, maintenance, and decommissioning, where human intervention is not feasible due to radiation exposure. The robotics market contributes around 25-30%, as advancements in robotic technology are applied to nuclear operations, including the development of autonomous systems, drones, and manipulators that can safely perform complex tasks in radioactive environments.

The defense and military market holds about 15-18%, with nuclear robots being used for defense-related research and maintenance of nuclear weapons, reactors, and other sensitive equipment. The industrial automation market adds approximately 10-12%, as robots are deployed in heavy industries to manage radioactive materials and waste processing, ensuring safety and efficiency in these high-risk environments. Lastly, the healthcare and research market contributes about 5-8%, where nuclear robots are employed in medical research, particularly for imaging and radiotherapy procedures in oncology, where precision and safety are critical.

The nuclear robots market is witnessing steady expansion, driven by the increasing need for automation and remote operations in hazardous nuclear environments. The current market scenario is shaped by heightened safety regulations, decommissioning of aging nuclear plants, and rising complexity in nuclear waste management, all of which necessitate advanced robotic solutions.

Technological innovations, including enhanced precision, radiation resistance, and autonomous navigation, are further enabling robots to perform complex maintenance, inspection, and material handling tasks with minimal human intervention. Growth is being reinforced by both government-led initiatives and private sector investments aimed at extending the operational lifespan of nuclear facilities while minimizing worker exposure to high-risk zones.

The market outlook remains positive as ongoing nuclear energy projects and global decommissioning programs are expected to sustain demand. Furthermore, cost optimization and efficiency gains achieved through robotic deployment are anticipated to strengthen adoption, positioning nuclear robots as critical assets in the evolving nuclear industry landscape.

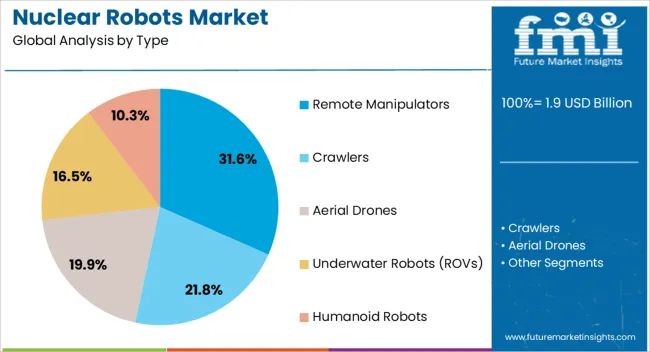

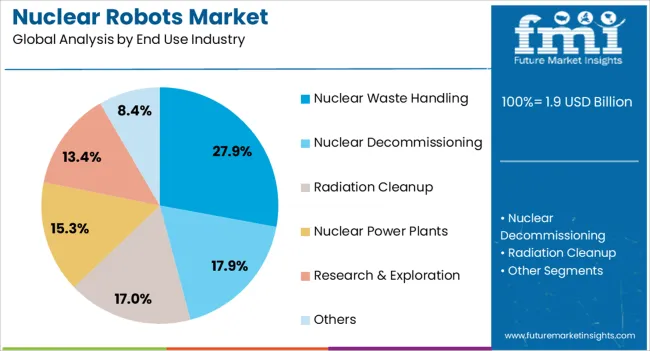

The nuclear robots market is segmented by type, end use industry, and geographic regions. By type, nuclear robots market is divided into Remote Manipulators, Crawlers, Aerial Drones, Underwater Robots (ROVs), and Humanoid Robots. In terms of end use industry, nuclear robots market is classified into Nuclear Waste Handling, Nuclear Decommissioning, Radiation Cleanup, Nuclear Power Plants, Research & Exploration, and Others. Regionally, the nuclear robots industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The remote manipulators segment accounts for approximately 31.6% of the nuclear robots market, making it the leading type in this sector. This segment’s prominence is attributed to its extensive application in performing precision tasks within high-radiation zones where human presence is unsafe. The ability of remote manipulators to handle complex assembly, maintenance, and inspection operations has made them indispensable in nuclear facilities.

Their design, incorporating radiation-hardened materials and high dexterity control systems, ensures reliability and accuracy under extreme conditions. Demand has been further strengthened by their adaptability to both operational and decommissioning environments, enabling facilities to maintain safety compliance while achieving productivity targets.

Integration with modern control interfaces and teleoperation systems has expanded their capabilities, allowing operators to manage critical functions from secure, distant locations. With ongoing nuclear infrastructure projects and intensified focus on safe waste management, the remote manipulators segment is expected to sustain its leadership position in the forecast period.

The nuclear waste handling segment leads the end use industry category with a share of approximately 27.9%, reflecting its critical role in the safe management of radioactive materials. The segment’s growth is primarily driven by the increasing volume of nuclear waste generated from power generation, medical applications, and research activities. Robots deployed in waste handling operations minimize human exposure to hazardous radiation levels, ensuring adherence to stringent safety protocols.

Advanced robotic systems used in this segment are capable of sorting, transporting, packaging, and disposing of nuclear waste with high precision and efficiency, thereby reducing operational risks. The adoption of automated solutions is further supported by government mandates for safe waste containment and the long-term environmental responsibility associated with nuclear operations.

Additionally, the development of specialized robots with enhanced load-bearing capacities and radiation resistance has expanded the operational scope of this segment. With global emphasis on sustainable nuclear waste management, this segment is projected to remain a priority investment area in the market.

The nuclear robots market is witnessing rapid growth as industries, particularly nuclear power plants, research facilities, and hazardous material handling sectors, increasingly adopt robotic technologies to ensure safety, efficiency, and precision in dangerous environments. Demand is primarily driven by the need to perform tasks such as inspection, maintenance, decommissioning, and radiation monitoring in environments unsafe for human workers. Challenges include high development and operational costs, limited battery life in hostile environments, and the complexity of robot designs required for specific nuclear applications. Opportunities lie in the development of radiation-resistant robots, autonomous inspection systems, and advanced AI-driven automation for real-time decision-making. Trends indicate the growing use of drones and remote-controlled robots in nuclear waste management, reactor inspections, and decommissioning projects.

Robotic systems are being deployed for a wide range of applications, including reactor inspections, decommissioning of outdated plants, and the handling of radioactive materials. The ability to operate in environments hazardous to human health such as within reactor cores or radioactive waste storage areas has significantly boosted the adoption of nuclear robots.Robots are essential for tasks such as maintenance of critical infrastructure, cleaning radiation-affected sites, and monitoring radiation levels in real time. As the nuclear industry seeks to ensure safety and minimize risks, the role of robots in hazardous environments is becoming more crucial, driving market growth.

Robotic systems designed for nuclear environments require high levels of radiation resistance, advanced materials, and specialized designs, which increases both R&D and production costs. Regulatory hurdles related to safety standards, radiation exposure limits, and compliance with nuclear industry protocols add complexity to the development and deployment of nuclear robots. The technical difficulty of designing robots that can operate efficiently in radioactive environments with limited battery life is another constraint. Suppliers are increasingly focused on creating long-lasting, energy-efficient systems that can withstand extreme conditions, comply with regulatory requirements, and deliver reliable performance in nuclear facilities worldwide.

Autonomous robots can inspect nuclear reactors, handle radioactive materials, and assess plant conditions without human oversight, thereby increasing operational safety and reducing labor costs. AI-driven robotics can enhance real-time decision-making, improving the efficiency of radiation monitoring, waste management, and plant decommissioning. As the nuclear industry increasingly embraces automation, the demand for robots with advanced sensors, AI-based diagnostics, and real-time reporting systems is growing. These innovations are opening up new market opportunities for robotic suppliers to address emerging needs in the nuclear sector and offer cutting-edge solutions for critical nuclear operations.

Drones equipped with radiation sensors and cameras are gaining traction for conducting aerial surveys of nuclear facilities, while remotely operated robots are being deployed to perform maintenance tasks in hazardous zones. Robotic systems designed for nuclear waste management are also seeing significant growth, as they provide more efficient, safer methods for handling and storing radioactive waste. These robots reduce human exposure to radiation and ensure that radioactive materials are managed safely. As the nuclear industry increasingly relies on automation for critical tasks, these trends are expected to shape the future of the nuclear robots market, offering new opportunities for technological innovation and improved safety protocols.

| Country | CAGR |

|---|---|

| China | 13.9% |

| India | 12.9% |

| Germany | 11.8% |

| France | 10.8% |

| UK | 9.8% |

| USA | 8.8% |

| Brazil | 7.7% |

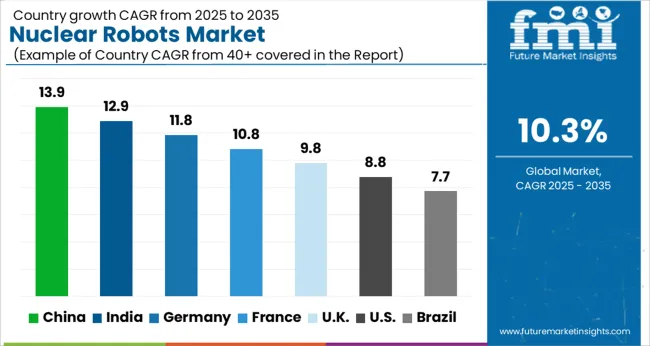

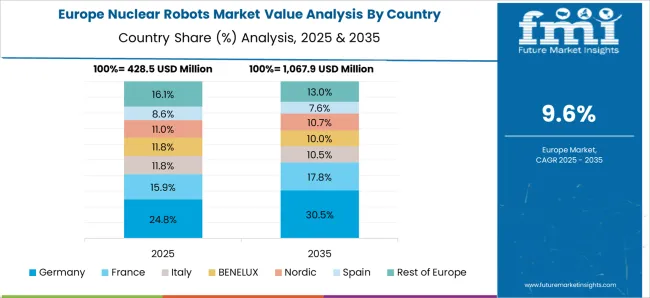

The global nuclear robots market is projected to grow at a CAGR of 10.3% from 2025 to 2035, with China leading the market at 13.9%, followed by India at 12.9% and Germany at 11.8%. The market is driven by the increasing need for advanced robotics in nuclear power plants to ensure safety, efficiency, and reduced human exposure to radiation. Government support for nuclear energy and technological advancements in automation and robotics are key factors contributing to market expansion. As nuclear energy continues to play a vital role in the global energy mix, the adoption of robotics technology will rise significantly across all regions. The analysis covers 40+ countries, with leading markets outlined below.

The nuclear robots market in China is expected to grow at a CAGR of 13.9% from 2025 to 2035, driven by the country’s significant investments in nuclear energy and technological advancements. As one of the largest consumers of energy, China is rapidly increasing its nuclear power capacity to meet rising demand while reducing dependence on fossil fuels. Nuclear robots are essential for maintaining and managing nuclear reactors, performing high-risk tasks such as inspections, repairs, and monitoring radiation levels. With China’s growing focus on nuclear energy and advanced robotics, the market for nuclear robots is expected to see considerable growth. The Chinese government’s emphasis on technological innovation and improving industrial safety is expected to support the adoption of robotic solutions in nuclear facilities. These robots help minimize human exposure to radiation and improve operational efficiency in nuclear power plants.

The nuclear robots market in India is projected to grow at a CAGR of 12.9% from 2025 to 2035, as the country continues to expand its nuclear energy sector. With the increasing focus on clean energy and the need for safer operations, nuclear robots are becoming vital in tasks such as maintenance, inspection, and decommissioning of nuclear reactors. India’s ambitious plans to increase its nuclear power capacity are expected to create significant demand for robotics technology to ensure safety and efficiency. The government’s commitment to improving energy security, coupled with the push for modernization of infrastructure, further accelerates the adoption of nuclear robots. As the industry expands, robotics will play a crucial role in enhancing operational efficiency and reducing human exposure to hazardous radiation.

The nuclear robots market in Germany is expected to grow at a CAGR of 11.8% from 2025 to 2035, driven by the country’s strong position in nuclear energy research and development. While Germany has made significant strides toward renewable energy, its nuclear facilities still require advanced technology for monitoring and maintaining operations. Nuclear robots are essential in performing high-risk tasks, including reactor inspections and radiation monitoring. As the German government prioritizes safety and efficiency in its nuclear plants, the demand for robotics technology will continue to rise. The ongoing technological advancements in automation and robotics are expected to further enhance the operational capabilities of nuclear robots in Germany.

The UK nuclear robots market is forecast to grow at a CAGR of 9.8% from 2025 to 2035, as the country continues to maintain and upgrade its nuclear power infrastructure. The UK’s nuclear sector is increasingly relying on robotics for tasks such as inspection, cleaning, and repairs in hazardous environments. The government’s initiatives to modernize the energy grid, coupled with a commitment to reducing carbon emissions, are expected to further spur the adoption of nuclear robots in the country. As the nuclear power plants age, there is a growing demand for automated solutions to ensure safety and efficiency.

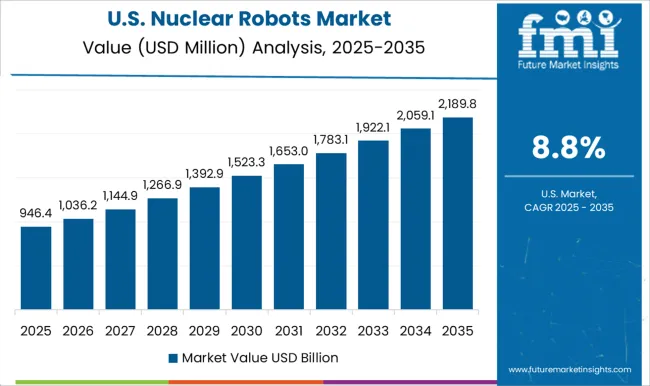

The USA nuclear robots market is expected to grow at a CAGR of 8.8% from 2025 to 2035, supported by ongoing advancements in nuclear energy and robotics. The USA is focusing on enhancing its nuclear power plants to improve efficiency, safety, and waste management. Nuclear robots play a key role in reducing human exposure to radiation and improving operational safety in nuclear facilities. The USA Department of Energy’s investments in clean energy technologies and the shift towards advanced robotics will drive market growth. As the country focuses on reducing carbon emissions, nuclear energy and robotic technologies will become integral to energy production and management.

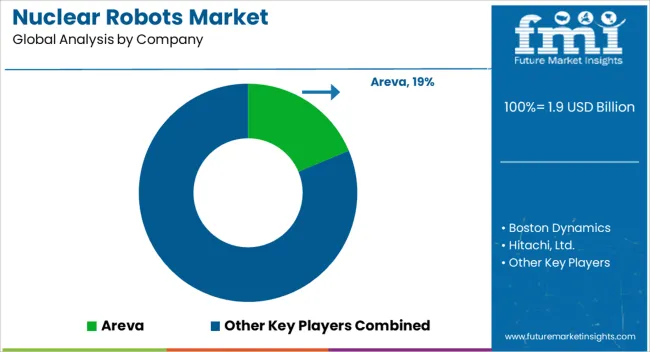

In the nuclear robots market, competition revolves around the ability to perform highly specialized tasks in hazardous environments, ensuring both safety and efficiency in nuclear power plants, decommissioning projects, and radioactive waste management. Areva, now part of Orano, competes with advanced robotic systems designed for maintenance and inspection tasks in nuclear reactors, leveraging its expertise in nuclear energy and reactor technology. Boston Dynamics offers highly mobile, agile robotic solutions with capabilities in remote monitoring and inspection, enhancing plant safety by reducing the need for human intervention in hazardous radiation zones. Hitachi, Ltd. provides robotic solutions focused on nuclear power plant operations, with a strong emphasis on reliability, precision, and automation, often integrating AI and sensors for enhanced decision-making.

James Fisher Technologies specializes in robotic systems for nuclear decommissioning and hazardous waste handling, offering a diverse range of remotely operated vehicles (ROVs) and manipulators for operations in radioactive environments. KUKA AG provides industrial robotic solutions, including those for nuclear applications, focusing on precision handling and assembly tasks in the nuclear power and waste management industries. Mitsubishi Heavy Industries offers nuclear robotic systems primarily for plant maintenance, inspection, and dismantling tasks, using its mechanical engineering expertise to ensure performance under extreme conditions.

QinetiQ develops robotic solutions for a range of industries, including nuclear, emphasizing advanced sensing and remote operation technologies to enhance safety and efficiency in nuclear facilities. Strategies in this market center around automation, safety, and integration with existing nuclear infrastructure. Companies like Areva and Mitsubishi leverage deep industry knowledge to provide specialized robotics for reactor maintenance and waste management. Boston Dynamics and KUKA differentiate with advanced mobility and adaptability, while QinetiQ and James Fisher focus on robotic systems for high-risk operations like decommissioning and disaster recovery. Product brochures highlight advanced sensors, radiation protection, long-duration operation capabilities, and AI-driven control systems, ensuring optimal performance and safety in the most dangerous nuclear environments.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.9 Billion |

| Type | Remote Manipulators, Crawlers, Aerial Drones, Underwater Robots (ROVs), and Humanoid Robots |

| End Use Industry | Nuclear Waste Handling, Nuclear Decommissioning, Radiation Cleanup, Nuclear Power Plants, Research & Exploration, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Areva, Boston Dynamics, Hitachi, Ltd., James Fisher Technologies, KUKA AG, Mitsubishi Heavy Industries, and QinetiQ |

| Additional Attributes | Dollar sales by robot type (inspection, maintenance, material handling), application (nuclear plant operations, decommissioning, waste management), and operational environment (high-radiation, hazardous, confined). Demand dynamics are driven by nuclear plant safety, efficiency in decommissioning, and regulations around reducing human exposure to radiation. Regional growth is prominent in North America, Europe, and Asia-Pacific, supported by large-scale nuclear projects and increasing investments in automation for safety and operational efficiency. |

The global nuclear robots market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the nuclear robots market is projected to reach USD 5.2 billion by 2035.

The nuclear robots market is expected to grow at a 10.3% CAGR between 2025 and 2035.

The key product types in nuclear robots market are remote manipulators, crawlers, aerial drones, underwater robots (rovs) and humanoid robots.

In terms of end use industry, nuclear waste handling segment to command 27.9% share in the nuclear robots market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nuclear Medicine Shielded Equipment Market Size and Share Forecast Outlook 2025 to 2035

Nuclear Engineering Service Market Size and Share Forecast Outlook 2025 to 2035

Nuclear Energy Consulting Service Market Size and Share Forecast Outlook 2025 to 2035

Nuclear Powered Merchant Vessel Market Size and Share Forecast Outlook 2025 to 2035

Nuclear Imaging Devices Market Size and Share Forecast Outlook 2025 to 2035

Nuclear Medicine Equipment Market Size and Share Forecast Outlook 2025 to 2035

Global Nuclear Imaging Equipment Market Insights – Trends & Forecast 2024-2034

Nuclear Export Inhibitor Drugs Market

Antinuclear Antibody Test Market

SLAM Robots Market Size and Share Forecast Outlook 2025 to 2035

Micro Robots Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Delta Robots Market

Mobile Robots Market Size and Share Forecast Outlook 2025 to 2035

Pharma Robots Market Size and Share Forecast Outlook 2025 to 2035

Kitting Robots Market Size and Share Forecast Outlook 2025 to 2035

Milking Robots Market Size and Share Forecast Outlook 2025 to 2035

Airport Robots Market Size and Share Forecast Outlook 2025 to 2035

Painting Robots Market Size and Share Forecast Outlook 2025 to 2035

Security Robots Market Size and Share Forecast Outlook 2025 to 2035

Military Robots Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA