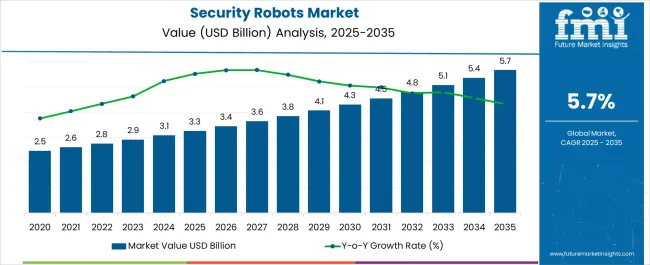

The Security Robots Market is estimated to be valued at USD 3.3 billion in 2025 and is projected to reach USD 5.7 billion by 2035, registering a compound annual growth rate (CAGR) of 5.7% over the forecast period.

| Metric | Value |

|---|---|

| Security Robots Market Estimated Value in (2025 E) | USD 3.3 billion |

| Security Robots Market Forecast Value in (2035 F) | USD 5.7 billion |

| Forecast CAGR (2025 to 2035) | 5.7% |

The security robots market is gaining momentum as technological advancements, heightened security requirements, and labor shortages in security services converge to accelerate adoption. Industry publications and company reports have emphasized the role of robotics in enhancing surveillance efficiency, reducing operational costs, and minimizing human exposure to high-risk environments.

Developments in artificial intelligence, autonomous navigation, and sensor integration have significantly broadened the capabilities of security robots, making them increasingly effective for both commercial and public safety applications. Governments and private sector stakeholders have been investing in robotic security systems to strengthen infrastructure resilience and improve incident response.

Press releases from leading technology companies have also noted an increasing focus on hybrid systems that integrate robotics with IoT platforms, enabling real-time monitoring and predictive analytics. Looking forward, market expansion is expected to be driven by the deployment of robots in outdoor environments, greater reliance on hardware innovation, and strong adoption of ground-based robotic platforms to address rising urban security challenges.

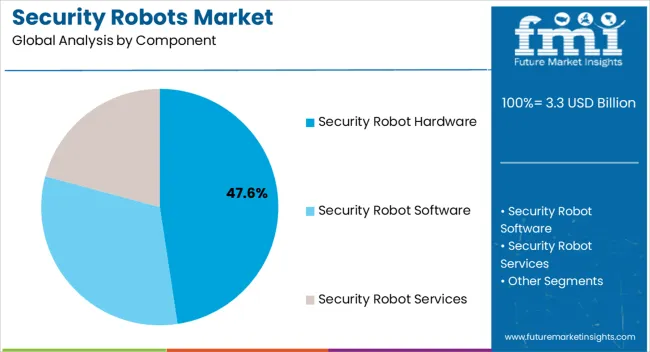

The Security Robot Hardware segment is projected to contribute 47.60% of the security robots market revenue in 2025, establishing itself as the largest component category. This leadership has been supported by the capital-intensive nature of robotic systems, where physical hardware such as cameras, sensors, mobility platforms, and protective casing account for a significant share of costs.

Industry disclosures and technology reviews have highlighted that advancements in hardware durability, miniaturization, and energy efficiency have enabled deployment in demanding security environments. Hardware innovations, including enhanced mobility features and long-range vision systems, have improved the effectiveness of security robots in diverse scenarios.

Additionally, manufacturers have invested in ruggedized designs to withstand adverse weather conditions and physical tampering, reinforcing hardware’s critical role. With continuous R&D into high-performance sensors and navigation modules, the Security Robot Hardware segment is expected to maintain its dominant contribution to market revenues.

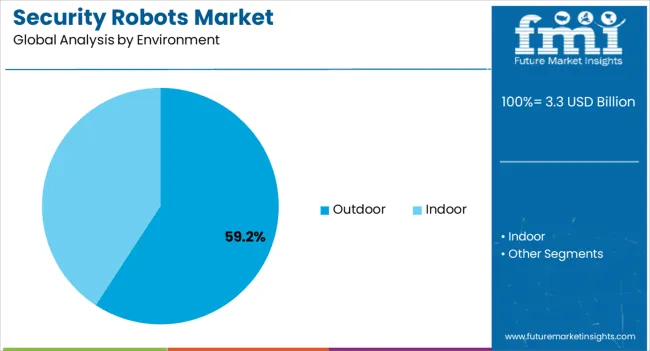

The Outdoor segment is projected to account for 59.20% of the security robots market revenue in 2025, reflecting its central role in surveillance and perimeter protection. Growth in this segment has been driven by the increasing need to secure large-scale facilities such as airports, industrial complexes, logistics hubs, and public venues.

Industry publications and investor briefings have emphasized that outdoor environments present unique challenges, including wide-area monitoring, weather variability, and exposure to vandalism, which robotic platforms are well-suited to address. The integration of advanced mobility solutions, thermal imaging, and autonomous patrol capabilities has further strengthened the adoption of outdoor robots.

Additionally, regulatory and defense initiatives aimed at safeguarding critical infrastructure have accelerated investment in outdoor robotic systems. As urban areas expand and security threats diversify, outdoor deployment is expected to remain the dominant environment category, supported by its scalability and adaptability.

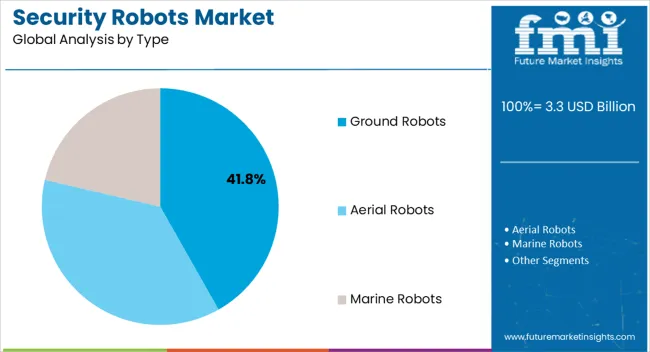

The Ground Robots segment is projected to capture 41.80% of the security robots market revenue in 2025, maintaining its leadership in type-based adoption. This segment’s growth has been underpinned by its versatility in navigating diverse terrains and its effectiveness in patrolling wide areas.

Ground robots have been deployed in commercial, industrial, and defense sectors to provide continuous surveillance, reducing the reliance on human patrols. Technical journals and product launch updates have documented ongoing improvements in ground robot mobility, battery life, and sensor payloads, enabling longer operational hours and more comprehensive coverage.

The cost-effectiveness of ground robots compared to aerial or marine alternatives has further cemented their leadership. Moreover, integration with AI-based threat detection and remote operation capabilities has expanded their role in modern security systems. With a growing focus on perimeter defense and scalable robotic patrols, the Ground Robots segment is expected to sustain its market dominance.

The market value of the security robots market increased at around 5.6% CAGR historically from 2020 to 2025 as per the security robots market research by Future Market Insights.

OneZero has issued a new report outlining the scope of data gathering, which include promotional materials and agreements between Knightscope and multiple city councils. Both demonstrate that the primary function of these robots is data collection, such as license plate scans, facial recognition scans, and the presence of nearby mobile devices. Only a machine can provide this level of surveillance.

In the forthcoming years, the market is likely to be driven by rising geopolitical instabilities and territorial conflicts, as well as an increase in the use of unmanned solutions by various military and defense forces. Furthermore, the remote sensing capabilities of these robots, as well as the growing need to patrol shopping malls, parking lots, and other public areas, are expected to drive the market in the coming years.

China is expected to account for the high market share of USD 5.7 million by the end of 2035. As per the United States intelligence reports, China succeeded in convincing Russia to delay its encroachment on Ukraine till after the Olympics in Beijing.

Moscow is expected to become Beijing's partner on the international stage, according to reports regardless of how the current Ukrainian crisis is resolved. There is no doubt that China has emerged as the United States' primary competitor.

According to sources, China demonstrated new artificial intelligence (AI) and robotics technologies critical to the current geopolitical tensions between the United States with China during the recent Beijing Olympics, emphasizing a specific threat. Further, advanced Chinese technology, ranging from driverless buses to 5G-powered high-speed rail, was prominently displayed.

China is doubling down on next-generation technology in general, and artificial intelligence in particular. The United States falls behind-to the point where the Pentagon's first chief software officer, Nicolas Chaillan, recently resigned in a protest of the country's slow pace of technological transformation. He is also claiming that the United States is poised to have no competing fighting chance against China in 15 to 20 years.

The number of active conflicts in the country has increased over the last decade, as has the number of terrorist attacks in public areas and universities. Due to geopolitical instabilities and territorial disputes, the country's demand for security robots has increased over the forecast period. As the country's terrorist activity grows, so will the use of robotic security guards.

The hardware segment is forecasted to expand at a significant CAGR of over 5.5% from 2025 to 2035. The Internet of Things Robot (IoTR) is a new paradigm that connects everyday robotic systems to ubiquitously embedded sensors and smart objects.

Recent advances in robotic system applications have demonstrated the utility of mobile robots in real-world applications like navigation and surveillance. Patrolling and gas leak detection are two of the mobile robots' important applications.

The robot detects gas leaks and broadcasts live video of the surrounding area, which can be tracked using Google Maps. Simultaneously, the robot can be controlled remotely through a website or mobile app, and it can proceed independently and avoid collisions.

The proposed work makes use of readily available and low-cost components and sensors to create a high-quality Internet of Things robot at a low cost.

The security robots market is projected to witness significant growth through Outdoor Environment, with a CAGR of over 5.4% from 2025 to 2035. Also, consumer drones are gaining popularity among manufacturers, buyers, enthusiasts, content creators, and cinematographers worldwide. This is because such drones are inexpensive and also provide elevated broad-range images.

Authorities in various parts of the world use surveillance drones for law enforcement and governance applications because of their compact size and service design. During the COVID-19 pandemic, governments increased their use of unmanned aerial vehicles (UAVs) for surveillance, spraying disinfectants in public places, crowd management, and identifying COVID-19 hotspots.

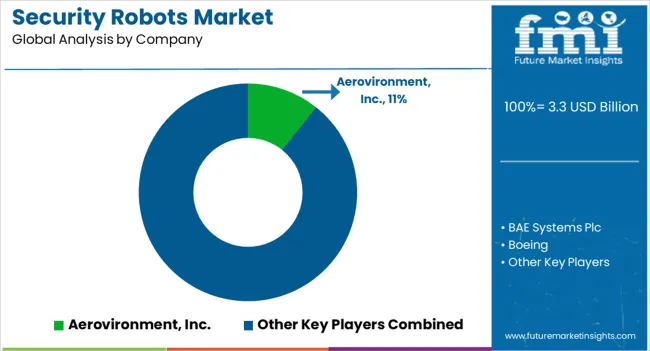

The leading manufacturers of security robots are Aerovironment, Inc., BAE Systems Plc, Boeing, Cobham Plc, and Elbit Systems Limited. To gain a competitive advantage in the industry, these market players are investing in product launches, partnerships, mergers and acquisitions, and expansions.

The Market growth is expected to be fueled by collaborations among current players to improve quality throughout the research period.

| Report Attributes | Details |

|---|---|

| Global Security Robots Market CAGR (2025 to 2035) | 5.7% |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Global Security Robots Market Size (2025) | USD 2.9 billion |

| Global Security Robots Market Size (2035) | USD 5.2 billion |

| Quantitative Units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Solution, Application, Region |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia & Pacific; East Asia;The Middle East & Africa (MEA) |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Poland, Russia, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC Countries, South Africa, Israel |

| Key Companies Profiled | Aerovironment, Inc.; BAE Systems Plc; Boeing; Cobham Plc; Elbit Systems Limited; SZ DJI Technology Co. Ltd.; SMP Robotics; Boston Dynamics; SAAB; ECA Group; Knightscope, Inc.; Kongsberg; Leonardo S.P.A.; Lockheed Martin Corporation; Northrop Grumman; Qinetiq; Thales |

| Customization | Available Upon Request |

The global security robots market is estimated to be valued at USD 3.3 billion in 2025.

The market size for the security robots market is projected to reach USD 5.7 billion by 2035.

The security robots market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in security robots market are security robot hardware, security robot software and security robot services.

In terms of environment, outdoor segment to command 59.2% share in the security robots market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Security Tape Market Size and Share Forecast Outlook 2025 to 2035

Security Alarm Communicator Market Size and Share Forecast Outlook 2025 to 2035

Security and Vulnerability Management Market Forecast and Outlook 2025 to 2035

Security Holograms Market Size and Share Forecast Outlook 2025 to 2035

Security Paper Market Size and Share Forecast Outlook 2025 to 2035

Security System Tester Market Size and Share Forecast Outlook 2025 to 2035

Security Advisory Services Market Size and Share Forecast Outlook 2025 to 2035

Security Room Control Market Size and Share Forecast Outlook 2025 to 2035

Security Cameras (IR Illuminator) Market Size and Share Forecast Outlook 2025 to 2035

Security Operation Centre as a Service Market Size and Share Forecast Outlook 2025 to 2035

Security Service Edge Market Size and Share Forecast Outlook 2025 to 2035

Security and Surveillance Equipment Market Size and Share Forecast Outlook 2025 to 2035

Security Orchestration Automation and Response (SOAR) Market Size and Share Forecast Outlook 2025 to 2035

Security Bags Market Size and Share Forecast Outlook 2025 to 2035

Security Screening Market Analysis - Size, Share, and Forecast 2025 to 2035

Security Bottles Market Size and Share Forecast Outlook 2025 to 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Security Labels Market Analysis by Product Type, Material, Pattern, Application, End-Use Industry, and Region Through 2035

Market Share Breakdown of Security Bags Manufacturers

Market Share Insights for Security Tape Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA