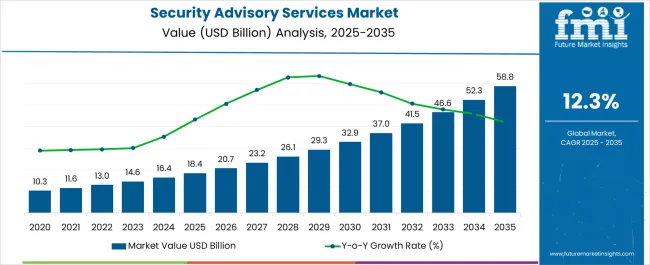

The Security Advisory Services Market is estimated to be valued at USD 18.4 billion in 2025 and is projected to reach USD 58.8 billion by 2035, registering a compound annual growth rate (CAGR) of 12.3% over the forecast period.

| Metric | Value |

|---|---|

| Security Advisory Services Market Estimated Value in (2025 E) | USD 18.4 billion |

| Security Advisory Services Market Forecast Value in (2035 F) | USD 58.8 billion |

| Forecast CAGR (2025 to 2035) | 12.3% |

The security advisory services market is expanding steadily as organizations face rising threats from cyberattacks, data breaches, and evolving compliance requirements. Enterprises across sectors are prioritizing proactive risk management and regulatory alignment, which has accelerated the adoption of specialized advisory solutions.

Growing digital transformation initiatives, the adoption of cloud environments, and the proliferation of connected devices are creating complex security challenges that require expert guidance. Investments are being directed toward advanced assessments, threat intelligence, and tailored consulting frameworks to safeguard digital assets and maintain customer trust.

With increasing scrutiny from regulators and stakeholders, the demand for security advisory services is expected to remain strong, supported by the need for ongoing resilience, data protection, and business continuity planning.

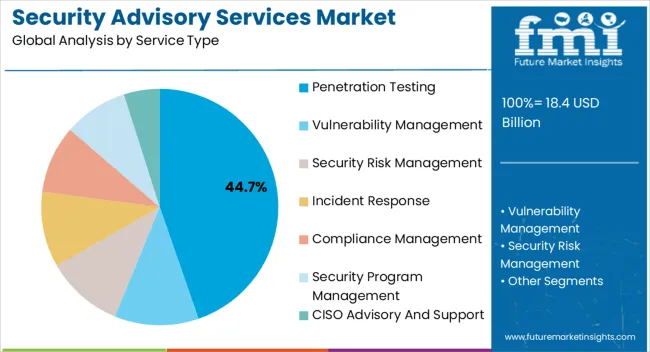

The penetration testing segment is expected to represent 44.70% of total market revenue by 2025 within the service type category, establishing it as the leading segment. Its dominance is attributed to the growing importance of identifying vulnerabilities before they are exploited by malicious actors.

Penetration testing enables organizations to strengthen their security posture by simulating real world attack scenarios, ensuring regulatory compliance, and prioritizing remediation efforts. Increasing adoption among both highly regulated industries and technology driven enterprises has further reinforced its market position.

As businesses continue to expand their digital ecosystems, penetration testing has emerged as a core service to evaluate resilience and minimize operational risk.

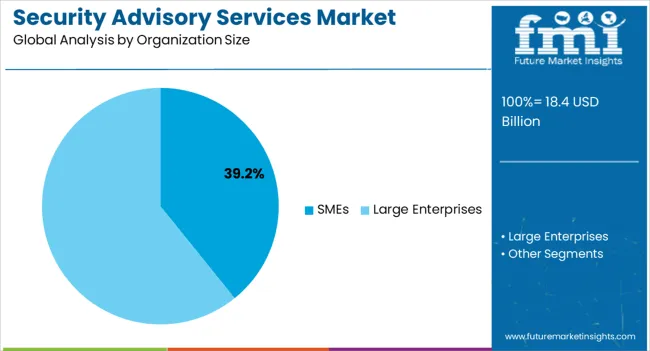

The SMEs segment is projected to account for 39.20% of market revenue by 2025 under the organization size category, making it the most significant segment. This growth is driven by the rising awareness among small and medium enterprises about the impact of cyber threats on business continuity and reputation.

Limited in house expertise and budget constraints have encouraged SMEs to outsource advisory services to strengthen their defenses. Increasing adoption of cloud services, e commerce platforms, and digital payment systems has exposed SMEs to higher risks, compelling them to prioritize affordable yet comprehensive security solutions.

Consequently, advisory services tailored for SMEs are experiencing rapid uptake, ensuring accessibility and scalability.

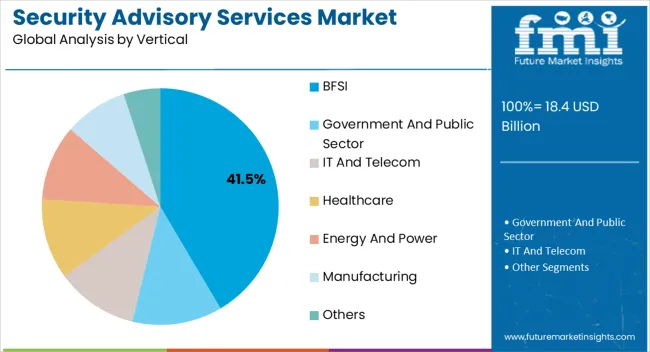

The BFSI segment is projected to hold 41.50% of total revenue by 2025 within the vertical category, highlighting its leadership in the market. This is primarily due to the highly sensitive nature of financial data and the stringent regulatory environment governing banking and financial institutions.

Frequent targeting of BFSI entities by cybercriminals has accelerated the adoption of security advisory services to safeguard operations and maintain trust. Advisory services play a crucial role in ensuring compliance with evolving standards, enhancing fraud prevention, and deploying advanced monitoring frameworks.

With increasing digitalization of financial services and the integration of fintech solutions, the BFSI sector continues to represent the most significant adopter of advisory services, reinforcing its position as the leading vertical in this market.

With the development of IT infrastructure every day, companies are implementing security advisory services aligned with their respective business models. Security advisory services help companies to identify and evaluate the potential threat in their system. Security advisory services enable organizations to frame the right security strategy against their business goals.

The rising demand for strong security regulations and compliance requirements is driving the security advisory market. Many companies implement periodic audits, which has anticipated fuelling the market expansion. The increase in demand for cloud solutions from enterprises to enhance performance is also driving the security advisory services market.

An effective cyberattack on a business can cause significant damage to the business. Security breaches in the company can cause financial, reputational, and legal consequences for them. A cyberattack in a company can cause the violation of private information of the customers, like their bank information and password.

Even companies are facing cyber-attacks and losing data related to their products and source codes, exposing the companies to larger financial risks. In order to tackle cyber-attacks, companies are implementing security advisory services for detecting and identifying if any breach is there or not in their system.

Security advisory services help companies identify potential risks, spot security weaknesses, and offer solutions to safeguard information and systems. The services and solutions against cyberattacks are driving the demand for security advisory services, fuelling the growth of the market. Furthermore, the developing IT infrastructure and technological advancement mayl also lead to the development of new malware and viruses, which mayl lead to the development of new security advisory services to tackle the effect of such malware, which mayl drive the growth of the security advisory services market in the coming years.

The increase in cyberattacks has motivated companies to invest in security advisory services. However, small and medium-sized enterprises are facing financial challenges to afford security advisory services to maintain security protocols. The high cost connected with security advisory services is restraining the market expansion.

The global security advisory services industry size developed at a CAGR of 10.2% from 2020 to 2025. In 2020, the global market size stood at USD 8,934.5 million. The market witnessed stunning growth in the following years, accounting for USD 13,200.3 million in 2025.

Security advisory services are used to protect and ensure a business's data integrity and security. Organizations use security advisory services to secure and protect data per industrial regulations. In addition, the adoption of cloud services is increasing among organizations, and new regulations are going to be formulated and enforced globally for data security in cloud services, which is expected to drive market expansion in the coming years.

The global security advisory services market is forecasted to record a CAGR of 12.3% and sales worth USD 46,753.3 million by the end of 2035. The United States is likely to continue to be the leading market for security advisory services throughout the analysis period accounting for over USD 9.8 billion absolute dollar opportunity in the coming 10-year epoch.

| Historical CAGR (2020 to 2025) | 10.2% |

|---|---|

| Forecasted CAGR (2025 to 2035) | 12.3% |

The lack of budget to hire a dedicated CISO is driving the adoption of CISO advisory and support services among the SMEs, which is driving the segment. It is one of the most economical methods for managing risk and maintaining the information in the security system. However, SMEs are availing the services of virtual CISO (vCISO) to cut down on expenses which are further fuelling the growth of the segment.

The BFSI vertical is prone to cyber-attacks as they hold data associated with financial transactions and private information. For instance, in November 2024, Robinhood Markets Inc. reported a data breach in its server and mentioned that about 7 million users' personal information was compromised, and the culprit demanded payment from the company. The increasing cyber-attacks are raising the demand for well-developed and advanced security advisory services in the BFSI vertical, which is driving the growth of the segment.

The penetration testing segment under service type is predicted to gain impeccable growth in the coming years. As per FMI, the penetration testing segment captured 18.1% of global market shares in 2025. To preserve the privacy and security of sensitive data, governments, and regulatory organizations have implemented several kinds of data protection and cybersecurity laws. Organizations must abide by these rules, which frequently call for regular security evaluations like penetration testing. As businesses try to comply with regulations, the need for penetration testing services rises.

The large enterprise segment dominates the global market and is predicted to continue leading the market during the forecast period. As per FMI, the large enterprises segment captured 72.2% of global market shares in 2025. The potential financial loss and reputational harm that security breaches might cause are of greater concern to large businesses. They are aware that a safety breach may cause business interruption, financial loss, reputational harm to the brand, and legal repercussions.

Large businesses use security consulting services to identify vulnerabilities, implement efficient security measures, and create incident response plans that minimize the effects of security incidents while preserving business continuity.

North America held the leading share of the security advisory services market in 2025. The government policies and regulations related to data security in organizations are fuelling market growth in the region. The adoption of new technologies and well-developed IT infrastructure is boosting the adoption of security advisory services in the IT sector in North America.

The adoption of security advisory services is at a good pace among IT & Telecom industries as they help to improve and protect the data, enhance the working of the enterprises, and help to tackle the companies from cyber-attacks, which is expected to boost the demand for security advisory services over the forecast period.

Security Advisory Services in the Asia Pacific is anticipated to grow at the fastest rate over the forecast period. The developing IT sector and the increasing number of companies in the IT sector is the key factor driving the security advisory services market in this region.

China holds the leading share of the security advisory services market in Asia Pacific. The increasing cyber-attacks in the business vertical have boosted the adoption of security advisory services among them. Furthermore, in November 2024, the Cyberspace Administration of China (CAC) released a draft regulation on Network Data Security Management for public comment.

The draft regulations may strengthen the existing three laws- the Cybersecurity Law (CSL), the Data Security Law (DSL), and the Personal Information Protection Law (PIPL).

The draft regulation is an opportunity to boost the adoption of security advisory services in China, and many key players are using this opportunity to expand their services in the country. The security advisory services market in China is expected to reach a valuation of USD 18.4 billion by the end of the forecast period. In 2025, China occupied 10.3% shares in the global market.

The security advisory services market in the United States was valued at around USD 16.4 billion in 2024 and surpassed a valuation of USD 18.16.4 billion in 2025 end. The United States captured 16.2% of global market shares in 2025. The well-developed IT sector and government regulations for data encryption is the key driver fuelling the security advisory service market in the United States.

For example, in the United States, the Federal Information Processing Standards (FIPS), which is implemented by the National Institute of Standards and Technology (NIST), is a computer security program in which specific levels of cryptographic security are required for particular types of data. These Federal standards are applicable to organizations who use cryptography-based security systems to protect their data. The market in the United States is anticipated to reach a valuation of USD 58.8 billion by the end of 2035.

| Countries | CAGR (2025) |

|---|---|

| United States | 16.2% |

| United Kingdom | 8.2% |

| China | 10.3% |

| Japan | 3.3% |

| India | 13.2% |

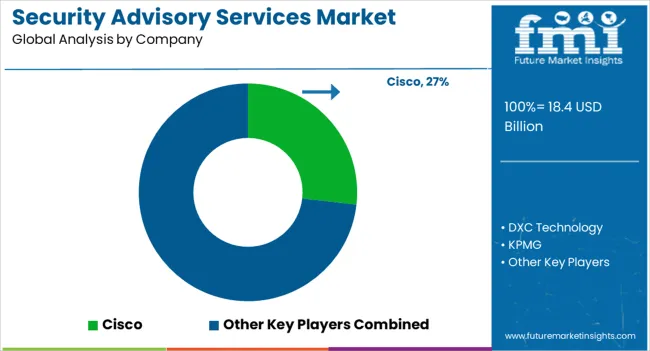

At present, security advisory services providers are developing new service offerings and expanding their existing service offerings with new tools and modules. The key companies operating in the security advisory services market include Cisco, DXC Technology, KPMG, Deloitte, PricewaterhouseCoopers (PwC), Tata Consultancy Services (TCS), Ernst & Young (EY), Verizon, Rapid7, Dimension Data, eSentire Inc., Kudelski Security, NTT Security, ePlus, Coalfire, Novacoast, Inc., Security Compass, Sage Data Security and Avalon Cyber.

Some recent developments by key providers of security advisory services are as follows:

Similarly, recent developments related to companies developing security advisory services have been tracked by the team at Future Market Insights, which is available in the full report.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD million for Value |

| Key Regions Covered | North America; Latin America; Europe; Asia Pacific; The Middle East & Africa (MEA) |

| Key Countries Covered | United States, Canada, Germany, United Kingdom, Nordic, Russia, BENELUX, Poland, France, Spain, Italy, Czech Republic, Hungary, Rest of EMEAI, Brazil, Peru, Argentina, Mexico, South Africa, Northern Africa, GCC Countries, China, Japan, South Korea, India, ASEAN, Thailand, Malaysia, Indonesia, Australia, New Zealand, Others |

| Key Segments Covered | Service Type, Organization Size, Vertical, Region |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Trend Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global security advisory services market is estimated to be valued at USD 18.4 billion in 2025.

The market size for the security advisory services market is projected to reach USD 58.8 billion by 2035.

The security advisory services market is expected to grow at a 12.3% CAGR between 2025 and 2035.

The key product types in security advisory services market are penetration testing, vulnerability management, security risk management, incident response, compliance management, security program management and ciso advisory and support.

In terms of organization size, smes segment to command 39.2% share in the security advisory services market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Security Tape Market Size and Share Forecast Outlook 2025 to 2035

Security Alarm Communicator Market Size and Share Forecast Outlook 2025 to 2035

Security and Vulnerability Management Market Forecast and Outlook 2025 to 2035

Security Holograms Market Size and Share Forecast Outlook 2025 to 2035

Security Paper Market Size and Share Forecast Outlook 2025 to 2035

Security System Tester Market Size and Share Forecast Outlook 2025 to 2035

Security Room Control Market Size and Share Forecast Outlook 2025 to 2035

Security Cameras (IR Illuminator) Market Size and Share Forecast Outlook 2025 to 2035

Security Operation Centre as a Service Market Size and Share Forecast Outlook 2025 to 2035

Security Robots Market Size and Share Forecast Outlook 2025 to 2035

Security Service Edge Market Size and Share Forecast Outlook 2025 to 2035

Security and Surveillance Equipment Market Size and Share Forecast Outlook 2025 to 2035

Security Orchestration Automation and Response (SOAR) Market Size and Share Forecast Outlook 2025 to 2035

Security Bags Market Size and Share Forecast Outlook 2025 to 2035

Security Screening Market Analysis - Size, Share, and Forecast 2025 to 2035

Security Bottles Market Size and Share Forecast Outlook 2025 to 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Security Labels Market Analysis by Product Type, Material, Pattern, Application, End-Use Industry, and Region Through 2035

Market Share Breakdown of Security Bags Manufacturers

Market Share Insights for Security Tape Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA