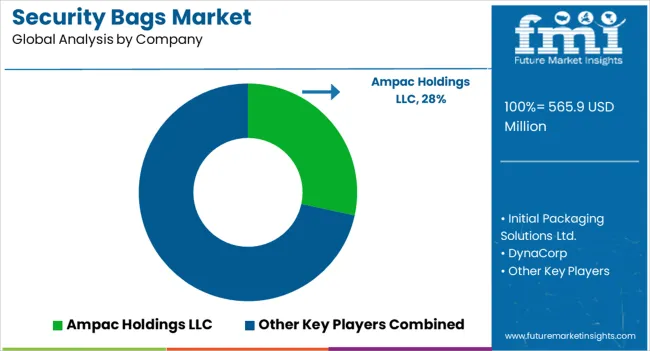

The Security Bags Market is estimated to be valued at USD 565.9 million in 2025 and is projected to reach USD 1072.3 million by 2035, registering a compound annual growth rate (CAGR) of 6.6% over the forecast period.

| Metric | Value |

|---|---|

| Security Bags Market Estimated Value in (2025 E) | USD 565.9 million |

| Security Bags Market Forecast Value in (2035 F) | USD 1072.3 million |

| Forecast CAGR (2025 to 2035) | 6.6% |

The security bags market is witnessing consistent expansion driven by the rising need for secure transportation of cash, confidential documents, and sensitive goods across financial institutions, logistics providers, and government organizations. Increasing concerns over theft, tampering, and regulatory compliance have accelerated the demand for durable and tamper evident packaging solutions.

The adoption of advanced polymer blends, biodegradable plastics, and digital tracking features has further enhanced the functionality of security bags. Growth is also being supported by the rise of e commerce, cash management services, and global trade activities, where secure packaging is essential for maintaining integrity during transit.

The market outlook remains strong as enterprises and regulatory bodies continue to emphasize security, accountability, and sustainability in packaging practices.

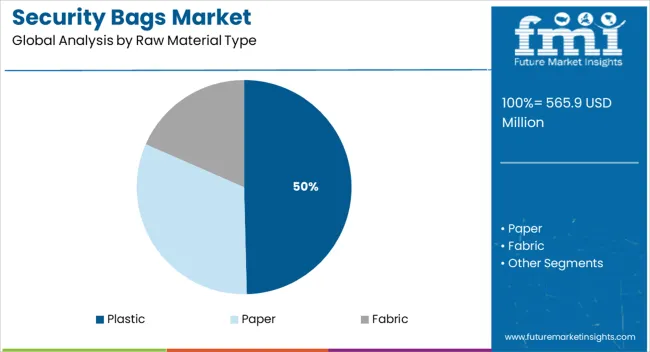

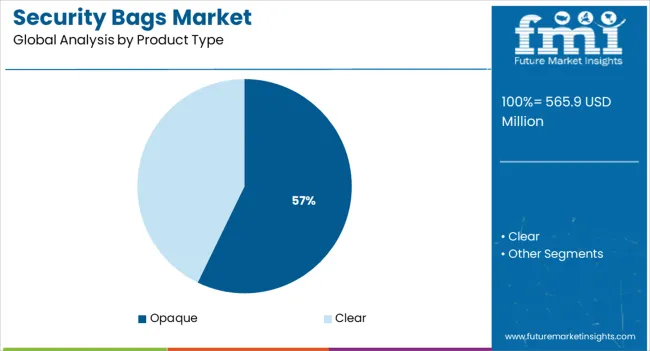

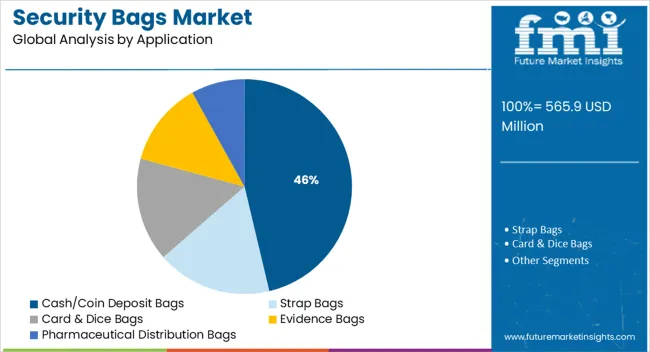

The market is segmented by Raw Material Type, Product Type, Application, and End-Use and region. By Raw Material Type, the market is divided into Plastic, Paper, and Fabric. In terms of Product Type, the market is classified into Opaque and Clear. Based on Application, the market is segmented into Cash/Coin Deposit Bags, Strap Bags, Card & Dice Bags, Evidence Bags, and Pharmaceutical Distribution Bags. By End-Use, the market is divided into Financial Institutions, Hospitals, Casinos, Hotels, National Retail Companies, Government Organizations, Courier Services Companies, and Academic Institutions. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The plastic segment is projected to represent 49.60% of total revenue by 2025 within the raw material type category, establishing it as the leading material choice. Its dominance is attributed to cost efficiency, durability, and the ability to incorporate tamper evident seals and features.

Plastic based security bags provide flexibility, strength, and moisture resistance, which are critical for safeguarding contents during transit.

Ongoing innovation in eco friendly and recyclable plastic solutions is also contributing to sustained adoption across industries.

The opaque segment is expected to account for 57.20% of market revenue by 2025 within the product type category, positioning it as the most dominant format. This is driven by its capability to conceal contents, reducing theft risks and ensuring higher confidentiality.

Opaque security bags have become a preferred choice for banks, government agencies, and courier services where discreet and tamper evident solutions are essential.

Their protective characteristics and strong alignment with regulatory compliance have reinforced their widespread utilization.

The cash and coin deposit bags segment is anticipated to hold 46.30% of total market revenue by 2025 within the application category, making it the largest application area. This growth is being supported by increasing cash handling activities across banks, retail, and cash in transit services.

Security bags designed for this purpose ensure safe transfer, reduce operational risk, and comply with stringent banking regulations.

Their tamper resistant features and ease of use continue to drive demand, solidifying the segment’s leadership in the application category.

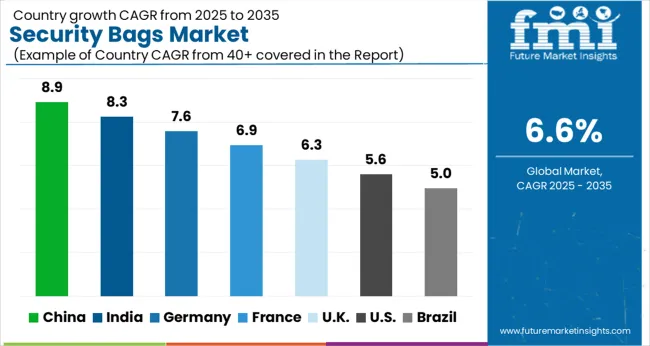

FMI projects the global security bags sector to expand at a lower rate of 6.6% CAGR between 2025 and 2035, in comparison to the CAGR of 8.6% registered between 2020 and 2025. The decline in growth rate is linked to consumers' choice of digital payments. It is anticipated to hurt the demand for security bags for cash and coins.

| Particulars | Details |

|---|---|

| Jan to Jun (H1), 2024 (A) | 9.1% |

| Jan to Jun (H1), 2025 Projected (P) | 9.3% |

| Jan to Jun (H1), 2025 Outlook (O) | 9.5% |

| BPS: H1,2025 (O) - H1,2025 (A) | 40 |

| BPS: H1,2025 (O) - H1,2024 (A) | 20 |

Growing demand for sustainable packaging solutions in the pharmaceutical industry is expected to fuel the growth of the market. Due to this, the market showed an amazing jump from USD 411.1 million in 2020 to USD 565.9 million in 2025.

During the COVID-19 crisis, sales of security bags for pharmaceutical distribution were propelled, as these bags significantly reduced the risk of contamination while shipping and handling pharmaceutical items.

Short-term growth (2025 to 2029): Demand for strap bags and pharmaceutical distribution bags is expected to increase owing to the tamper evidence feature offered by them.

Medium-term growth (2035 to 2035): Leading security bag manufacturers are shifting from plastic to the most sustainable raw materials. As they aim for reducing their carbon footprint, the sales of fabric and paper security bags are likely to increase.

Long-term growth (2035 to 2035): The market is anticipated to grow significantly, reaching a value of USD 1072.3 million by 2035 due to usage in law enforcement departments to ensure that the evidence is not tampered with or infringed by any new fingerprints.

The rapid expansion of the eCommerce industry, along with the increasing adoption of online retail channels by small and medium-scale enterprises, is propelling demand for tamper-proof security bags for courier services.

A significant market growth factor is the increasing adoption of tamper-proof security bags in many industries, including retail, healthcare, banking and finance, postal services, and others.

As they can increase the protection and safety of important things, tamper-proof security bags are in greater demand. The growing emphasis on product, document, and financial security is anticipated to further fuel industry expansion.

Manufacturers operating in the security bags market are gradually shifting to biodegradable materials to create multifunctional and sustainable courier bags. For instance, Mega Fortis offers security tamper-evident bags for various applications, including couriers and postal services.

The tampering on these bags can be detected at a glance, and safe delivery of contents is ensured. These bags are manufactured with highly-recyclable plastic material for enhanced durability while rough handling and are user-friendly.

The growing need for the safe handling of delicate items, such as evidence components, in forensics and law enforcement agencies is propelling sales of security bags. Law enforcement agencies use evidence bags to securely store prisoners' belongings, crime scene evidence, and other components that are crucial for the investigation.

These bags provide tamper-evident features to ensure that the evidence is safe and not violated by additional fingerprints, dirt, and environmental factors while handling. Companies are also manufacturing breathable evidence bags to safely store liquid evidence. Growing applications of security bags in police departments, forensic teams, and criminal investigation departments continue pushing sales of security bags.

In addition to this, surging demand for flexible, lightweight, tamper-evident, and durable packaging solutions is expected to further boost sales of security bags. Shifting preference from rigid to flexible packaging solutions is a chief factor driving demand for security bags. This trend is anticipated to continue over the forecast period.

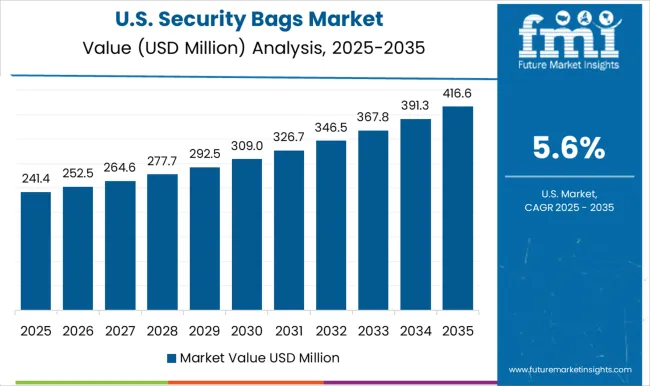

Growing demand for secure packaging in the pharmaceutical industry is expected to boost demand for security bags in the United States. As per FMI, the United States dominated the market with a share of 20.4% and a worth of USD 565.9 million in 2025.

The United States is home to a robust pharmaceutical industry that also exports medicines and other medical equipment to various countries. Such products are vulnerable to tampering and require advanced security measures to preserve the product’s integrity.

Stringent regulatory standards implemented to standardize pharmaceutical packaging in the United States are also compelling pharmaceutical companies to invest in security bags.

Besides this, cities such as Las Vegas and Atlantic City in the United States are home to multiple casinos that require card & dice bags. These cities are famous for their casinos and regularly experience an influx of tourists every year. This factor is also expected to provide impetus to card and dice security bag sales over the assessment period.

| Attributes | Statistics |

|---|---|

| United Kingdom Market Value 2025 | USD 12.6 million |

| United Kingdom Market Value 2035 | USD 23.0 million |

| United Kingdom Market CAGR (2025 to 2035) | 6.9% |

Rising preference for sustainable security bags for retail packaging, forensics, airport baggage handling, and item storage in hotels and resorts is fueling the demand for security bags in the United Kingdom.

Owing to growing concerns regarding carbon emissions, the European Union (EU) has imposed stringent regulations. These regulations are compelling manufacturers across various industries to develop sustainable security bags.

Consumers and organizations in the United Kingdom also prefer flexible and sustainable security bags as opposed to rigid ones. For instance, passengers show higher consciousness about the environmental impact of single-use plastics and generally refrain from using single-use plastic bags for security screening purposes.

This has resulted in various initiatives in the United Kingdom, encouraging the sales of security bags. For instance, in 2020, London City Airport launched an eight-week challenge for innovators to create a new sustainable and sealable security bag for use at the airport. This is expected to remain a chief growth driver of the United Kingdom's security bags market.

Such developments are indicative of lucrative growth prospects for existing players and new entrants in the security bags sector in the United Kingdom over the assessment period.

| Attributes | Statistics |

|---|---|

| China Market Value 2025 | USD 40.2 million |

| China Market Value 2035 | USD 71.1 million |

| China Market CAGR (2025 to 2035) | 6.5% |

China is anticipated to hold a dominant share of the East Asia security bags market over the assessment period. Growth can be attributed to the expansion of the e-commerce sector in the country, along with the rapid development of financial institutions and hospitals.

Apart from this, the easy availability of raw materials in China is enabling manufacturers to develop different variants of security bags to suit various end-use requirements. Owing to this factor, security bag manufacturers are planning to expand their production facilities in China to strengthen their product portfolios.

During the forecast period, it is anticipated that India's demand for security bags is likely to increase at a CAGR of 6.5% significantly. This is a result of people and organizations in the nation having more security concerns.

In India, the use of security bags is necessary due to the rise in cybercrime, theft, and fraud. To safeguard the security of data and documents, the government is also implementing a variety of policies and regulations.

This is anticipated to further accelerate the country's security bag market expansion, and encourage the market to expand from USD 19 million in 2025 to USD 1072.3 million by 2035.

The market for security bags in India is also anticipated to expand as a result of the rising need for organized packaging solutions.

The demand for plastic security bags is anticipated to remain high over the assessment period, with a share of 76.5%, based on raw material type. Security bags are composed of materials that are tough and provide a high level of protection against environmental factors and wear and tear.

Hence, security bags made from plastic are widely being adopted in various end-use sectors. PVC security bags are tough and waterproof and offer adequate protection during handling and transit.

In addition to this, security bags made from LDPE plastic are 100% recyclable. As consumers are preferring sustainable packaging solutions, sales of LDPE plastic security bags are expected to increase at a remarkable pace over the assessment period.

In terms of application, the pharmaceutical distribution segment is expected to hold a dominant share of the global security bags sector. Pharmaceutical drugs are meant for human consumption, and they require optimal care while handling and transit.

Security bags are made from strong materials that can withstand harsh environmental conditions and protect the contents of the bag from getting contaminated. This is expected to continue propelling sales of security bags for pharmaceutical distribution over the forecast period.

FMI has projected demand for opaque security bags to rise at a significant pace through 2035. Opaque security bags are used to visually conceal the contents of the bag. The polyethylene material used to compose opaque security bags can also be recycled after use, which helps companies achieve their sustainability goals.

Common applications of opaque security bags include crime scene evidence, storage and transportation of confidential documents, personal items of hospital patients, playing cards and dice for casinos, and valuables stored in hotel vaults.

Demand for security bags in financial institutions for cash and coin deposit is expected to increase over the forecast period, opines FMI. It is expected to have a share of 30.3% in the global market. Banks and credit unions prefer tamper-evident security bags for transporting essential banking supplies and reducing cash loss.

Although traditional cash bags are reusable, they lack many security features. Hence, tamper-evident security bags are the ideal solution for banks. Tamper-evident security bags offer excellent security, as it is difficult to hide any tampering, even if a skilled burglar breaches the bag. Thieves can't steal cash without a trace.

Owing to these factors, the financial institution's segment continues to exhibit high demand for security bags through 2035.

The entry of new companies into the market is fueling the expansion of security bags. Innovative goods and services offered by new businesses on the market appeal to a wide range of consumers. As a result, prices are falling and there is more competition in the market, which increases market penetration.

Leading players operating in the global security bags market are aiming to strengthen their distribution channels through mergers, acquisitions, collaborations, and partnerships. Apart from this, players are launching new products to improve their product portfolios to gain a competitive edge in the market.

Recent Developments

The global security bags market is estimated to be valued at USD 565.9 million in 2025.

The market size for the security bags market is projected to reach USD 1,072.3 million by 2035.

The security bags market is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in security bags market are plastic, _hdpe, _ldpe, _pvc, _others, paper and fabric.

In terms of product type, opaque segment to command 57.2% share in the security bags market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Breakdown of Security Bags Manufacturers

Security Tape Market Size and Share Forecast Outlook 2025 to 2035

Security Alarm Communicator Market Size and Share Forecast Outlook 2025 to 2035

Security and Vulnerability Management Market Forecast and Outlook 2025 to 2035

Security Holograms Market Size and Share Forecast Outlook 2025 to 2035

Security Paper Market Size and Share Forecast Outlook 2025 to 2035

Security System Tester Market Size and Share Forecast Outlook 2025 to 2035

Security Advisory Services Market Size and Share Forecast Outlook 2025 to 2035

Security Room Control Market Size and Share Forecast Outlook 2025 to 2035

Security Cameras (IR Illuminator) Market Size and Share Forecast Outlook 2025 to 2035

Security Operation Centre as a Service Market Size and Share Forecast Outlook 2025 to 2035

Security Robots Market Size and Share Forecast Outlook 2025 to 2035

Security Service Edge Market Size and Share Forecast Outlook 2025 to 2035

Security and Surveillance Equipment Market Size and Share Forecast Outlook 2025 to 2035

Security Orchestration Automation and Response (SOAR) Market Size and Share Forecast Outlook 2025 to 2035

Security Screening Market Analysis - Size, Share, and Forecast 2025 to 2035

Security Bottles Market Size and Share Forecast Outlook 2025 to 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Security Labels Market Analysis by Product Type, Material, Pattern, Application, End-Use Industry, and Region Through 2035

Market Share Insights for Security Tape Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA