The Security and Surveillance Equipment Market is estimated to be valued at USD 20.5 billion in 2025 and is projected to reach USD 32.7 billion by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period.

| Metric | Value |

|---|---|

| Security and Surveillance Equipment Market Estimated Value in (2025 E) | USD 20.5 billion |

| Security and Surveillance Equipment Market Forecast Value in (2035 F) | USD 32.7 billion |

| Forecast CAGR (2025 to 2035) | 4.8% |

The security and surveillance equipment market is experiencing strong momentum, supported by rising global concerns over safety, infrastructure security, and public monitoring needs. Increasing urbanization, growth in smart city projects, and heightened geopolitical tensions are driving demand for advanced surveillance technologies. The integration of artificial intelligence, cloud storage, and real-time analytics into surveillance equipment is enabling more proactive threat detection and operational efficiency.

Government initiatives to strengthen border control, traffic management, and public safety are accelerating adoption across multiple regions. On the commercial side, industries are deploying surveillance systems for asset protection, employee safety, and compliance with regulatory standards. Advances in camera hardware, sensor technologies, and wireless connectivity are enhancing coverage and performance, making systems more cost-effective and scalable.

The ability to combine hardware with intelligent software platforms is creating new opportunities for predictive analytics and incident response management As demand for comprehensive monitoring solutions increases, the market is expected to expand significantly, with ongoing innovation and investment in smart surveillance ecosystems driving long-term growth.

The security and surveillance equipment market is segmented by product type, application, end use, and geographic regions. By product type, security and surveillance equipment market is divided into Cameras, Audio Surveillance Equipment, Signal Tracking, Signal Interception, and Computer Surveillance Software’s. In terms of application, security and surveillance equipment market is classified into Safety and Security Check, Damage Detection, Structural Health Monitoring System in Aerospace, Structural Health Monitoring System in Automotive Industry, Structural Health Monitoring System in Naval, Structural Health Monitoring System in Civil, and Others. Based on end use, security and surveillance equipment market is segmented into Government, Industrial, Commercial, and Military. Regionally, the security and surveillance equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The cameras product type segment is projected to account for 27.8% of the security and surveillance equipment market revenue share in 2025, making it the leading product category. This leadership is being supported by continuous improvements in imaging quality, miniaturization, and connectivity that enable cameras to serve as the central component of surveillance systems. Growing use of high-resolution cameras with night vision, wide dynamic range, and AI-enabled features such as facial recognition and motion detection is enhancing their adoption.

Cost reductions in camera production and the availability of modular designs that can be integrated with both cloud-based and on-premises management platforms are reinforcing their position. Rising deployment of IP cameras in public infrastructure, transportation hubs, and enterprise facilities is contributing significantly to segment growth.

In addition, advancements in wireless transmission and edge computing capabilities are allowing cameras to process data locally, reducing latency and improving reliability With their versatility and compatibility across various end-use applications, cameras are expected to maintain their leading role within the market.

The safety and security check application segment is anticipated to represent 22.9% of the security and surveillance equipment market revenue share in 2025, positioning it as the leading application area. This dominance is being driven by increased investments in airport security, public infrastructure monitoring, and access control systems. Rising threats related to terrorism, organized crime, and cross-border smuggling are encouraging the deployment of sophisticated surveillance equipment for real-time safety checks.

The integration of AI-based analytics, biometric recognition, and advanced scanning systems into security checkpoints is enhancing accuracy and operational efficiency. Governments and private operators are focusing on rapid identification and threat prevention, which has increased the reliance on surveillance equipment in these environments.

Furthermore, the push toward contactless and automated screening processes, accelerated by global health and safety concerns, is reinforcing adoption The ability of safety and security check systems to provide comprehensive monitoring while maintaining compliance with strict regulatory standards is expected to continue driving growth in this application segment.

The government end use segment is expected to hold 37.9% of the security and surveillance equipment market revenue share in 2025, establishing itself as the leading end-use category. This leadership is being reinforced by the increasing need for public safety initiatives, national security measures, and law enforcement support. Governments across the globe are investing heavily in surveillance systems for urban monitoring, critical infrastructure protection, and border control.

The ability of advanced equipment to provide real-time intelligence, facial recognition, and situational awareness is enabling authorities to respond more effectively to security challenges. Rising urban population density and the expansion of smart city projects are creating additional demand for government-led surveillance deployments.

In addition, national defense strategies and counterterrorism programs are accelerating the integration of high-performance surveillance systems With governments prioritizing investments in resilient and interconnected monitoring networks, this end-use segment is projected to remain the largest contributor to market growth, further supported by increasing public funding and international security collaborations.

The security and surveillance equipment market is estimated to be valued at USD 19,549.8 million in 2025 and is projected to register a CAGR of 4.8% in the forecast period from 2025 to 2035. The market is projected to reach USD 31,243.2 million in 2035.

The rising global security concerns, theft prevention, and safety assurance have been increasing the demand for surveillance and security equipment. The market is experiencing significant growth, propelled by the increasing need to safeguard people and property. This equipment acts as a digital guardian, continuously monitoring premises and public spaces for any suspicious activity.

Surveillance and security equipment encompasses a wide range of technologies, from high-definition cameras to advanced access control systems. These solutions enable the observation of people's behavior and activities, deterring potential threats and ensuring across-the-board safety.

The market flourishes due to the substantial losses businesses and governments face from theft and fraud. By strategically deploying security and surveillance equipment, these entities can significantly reduce such losses. For instance, security cameras can deter shoplifting and provide valuable evidence in case of theft. Similarly, access control systems restrict unauthorized entry to sensitive areas, minimizing the risk of asset loss or damage.

The market offers a proactive approach to security, empowering businesses and governments to create safer environments. This growing demand for comprehensive security solutions is propelling the market forward.

| Attributes | Details |

|---|---|

| Security and Surveillance Equipment Market Size (2025E) | USD 19,549.8 million |

| Security and Surveillance Equipment Market Projected Size (2035F) | USD 31,243.2 million |

| Value CAGR (2025 to 2035) | 4.8% |

Innovations in data management and analysis are transforming the demand for security and surveillance systems. Modern technology is ushering in a new era of security and situational awareness by revolutionizing how data is gathered, examined, shared, and retained.

The surveillance and security trend is particularly apparent in the development of smart cities. The urban centers are being meticulously designed with security and surveillance equipment at their core. From high-definition cameras to sophisticated sensor networks, these solutions provide a comprehensive view of city activity. Such endeavors allow authorities to proactively address potential threats and ensure public safety.

The influence of surveillance and security equipment extends far beyond smart cities. Government buildings, critical infrastructure, transportation hubs, and even private enterprises are increasingly relying on these systems. They offer a powerful deterrent against criminal activity, while also enabling real-time monitoring and response.

Furthermore, traffic control and management are being significantly enhanced by equipment. Cameras and sensors strategically placed throughout roadways can monitor traffic flow, identify congestion points, and optimize traffic light patterns. This translates to smoother traffic flow, reduced accidents, and ultimately, safer roads.

The widespread adoption of video surveillance equipment in educational institutions and government offices further underscores the market's growth. These entities recognize the value of security equipment in safeguarding their premises and ensuring the well-being of occupants.

The demand for security and surveillance equipment is expanding because of its capacity to use cutting-edge technology to provide complete security solutions. The sector is expected to develop even more as demand for security and safety rises.

The global pandemic sent shockwaves through the surveillance and security equipment market, disrupting its previously robust growth trajectory. The global economic slowdown triggered by the virus had a ripple effect, with many businesses forced to close and unemployment rates soaring. While larger companies felt the strain, smaller businesses in the security equipment space were particularly hard-hit.

The market faced a confluence of challenges. Supply chains became tangled, hindering the flow of raw materials vital for manufacturing security equipment. Lockdowns and social distancing measures forced industry closures, further stalling production.

Additionally, sales networks faced unprecedented obstacles, with in-person interactions limited and consumer spending priorities shifting. These factors combined to temporarily dash the growth expectations of the security and surveillance equipment market.

The United States' demand for security and surveillance equipment is flourishing due to a powerful combination of factors. A key aspect is the nation's well-established IT infrastructure. The robust foundation provides the technological backbone for advanced security solutions, allowing for seamless integration of surveillance and security equipment.

The United States boasts a thriving commercial sector. Businesses across various industries, from retail to manufacturing, are increasingly recognizing the value of robust security measures.

The presence of leading global manufacturers within the United States also boost the market development. These companies are at the forefront of technological innovation, developing cutting-edge security and surveillance equipment. Having the manufacturers headquartered in the United States not only stimulates domestic production but also simplifies distribution channels, ultimately leading to strong sales figures in the United States.

The strengthening commercial and industrial sectors of China are driving a boom in the market for security and surveillance systems. The demand for strong security solutions rises with the size of enterprises.

The installation of surveillance systems in various industries is rising because of increased awareness. Businesses understand how important security and surveillance tools are for preserving property, defending workers, and discouraging illegal conduct. Businesses may operate in a more secure environment because of surveillance systems' remote monitoring, threat detection, and quick incident response capabilities.

China's industrial sector is experiencing a surge in surveillance system adoption, particularly in sensitive facilities that are vulnerable to theft or sabotage. The growing emphasis on security in China's business landscape is creating a favorable environment for the security and surveillance equipment market. As businesses and industries prioritize safety and security, the demand for these solutions is expected to continue growing.

The security and surveillance sector of India is transforming due to a growing demand for eco-friendly products. The trend is driven by the growing environmental consciousness of consumers and businesses, prompting manufacturers to develop sustainable options to minimize their products' environmental impact.

Security businesses are using blockchain, AI, and machine learning to build cutting-edge solutions in the security and surveillance equipment sector in India, which is witnessing a spike in technical innovation.

Real-time analysis of CCTV footage using AI-powered video analytics makes it possible to identify suspicious activities more quickly. Blockchain safeguards data storage and access within surveillance systems, while machine learning algorithms anticipate possible security risks.

By integrating cutting-edge technology, the market in India is anticipated to continue to lead the world in developments in surveillance and security equipment development.

The security and surveillance equipment market is thriving due to increased public awareness of theft, crime prevention, and the need for public safety, which is fueled by the increasing demand for security cameras.

Security cameras provide a cost-effective deterrent against crime, making them attractive in developing countries, where the market is growing due to rapid urbanization and infrastructural development, offering optimal security at an accessible price.

The demand for security cameras extends beyond residential use to high-risk sectors like military, defense, and aerospace, with government initiatives and organizations prioritizing security through CCTV camera installation in business settings driving the market for advanced surveillance equipment.

The retail sector is increasingly adopting security camera technology, with features like IR illuminators improving visibility. The decreasing average selling price of IP-based cameras, ease of installation, and growing popularity of smart security cameras make these solutions more accessible.

Technological improvements are transforming the security and surveillance equipment market, offering scalable, customizable, and cost-effective video surveillance options. Improved night vision capabilities and seamless integration of security cameras with smart home devices and access control systems represent a future where security is not only effective but also intelligent and interconnected.

Growing consumer awareness of public safety issues and a growing demand for personal and property protection are driving a boom in the demand for security and surveillance systems. Because they increase overall security, provide homes and businesses peace of mind, and discourage crime, security cameras, alarms, and other surveillance solutions have a strong value case.

The expansion of the industry is also supported by technological developments. With features like smart integrations and remote monitoring, security cameras have become easier to operate and more reasonably priced. Furthermore, surveillance gear is getting more powerful, with capabilities like advanced analytics and facial recognition.

Increased security concerns, technical improvements, and affordability are driving growth in the market, showing ongoing innovation and broad acceptance of security solutions.

The security and surveillance equipment market is characterized by a high degree of consolidation. A select group of major players dominate the market, holding the largest share of sales. The leading companies understand the vital role of innovation in this ever-evolving space. They dedicate significant resources to research and development, constantly pushing the boundaries of security technology.

The focus extends beyond just core security equipment. Companies are actively developing and integrating advanced features such as digital monitoring services and sophisticated alarm systems into their surveillance and security equipment offerings. The comprehensive approach caters to the evolving needs of security-conscious consumers and businesses.

To stay ahead of the curve, key players in the security and surveillance equipment market employ a few strategies such as product expansion and mergers and acquisitions. Companies are constantly innovating and augmenting the surveillance product lines to encompass the latest technologies and cater to diverse security needs.

Additionally, strategic mergers and acquisitions allow them to acquire new technologies, expertise, and market share, further solidifying their positions within the market. The emphasis on innovation and strategic expansion ensures that these leading players remain at the forefront of the market.

The industry is segmented into cameras, audio surveillance equipment, signal tracking, signal interception, and computer surveillance software’s, based on the product type.

Based on the application, the industry is categorized as safety and security check, damage detection, structural health monitoring system in aerospace, structural health monitoring system in automotive industry, structural health monitoring system in naval, structural health monitoring system in civil, and others.

On the basis of end use, the industry is characterized into industrial, commercial, government, and military.

As per region, the industry is divided into North America, Latin America, Europe, Asia-Pacific, and the Middle East and Africa.

| Country | CAGR |

|---|---|

| China | 6.5% |

| India | 6.0% |

| Germany | 5.5% |

| France | 5.0% |

| UK | 4.6% |

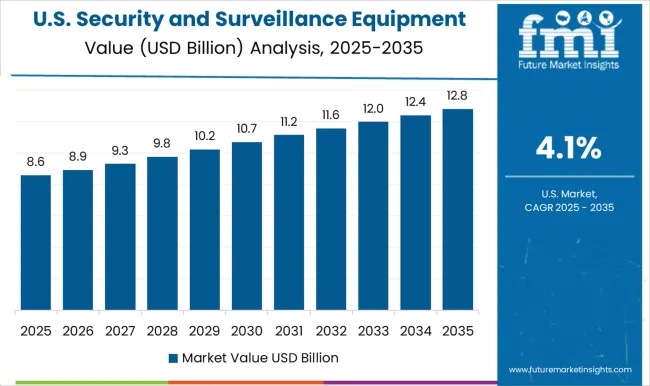

| USA | 4.1% |

| Brazil | 3.6% |

The Security and Surveillance Equipment Market is expected to register a CAGR of 4.8% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 6.5%, followed by India at 6.0%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 3.6%, yet still underscores a broadly positive trajectory for the global Security and Surveillance Equipment Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 5.5%. The USA Security and Surveillance Equipment Market is estimated to be valued at USD 7.4 billion in 2025 and is anticipated to reach a valuation of USD 11.1 billion by 2035. Sales are projected to rise at a CAGR of 4.1% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 1.1 billion and USD 602.4 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 20.5 Billion |

| Product Type | Cameras, Audio Surveillance Equipment, Signal Tracking, Signal Interception, and Computer Surveillance Software’s |

| Application | Safety and Security Check, Damage Detection, Structural Health Monitoring System in Aerospace, Structural Health Monitoring System in Automotive Industry, Structural Health Monitoring System in Naval, Structural Health Monitoring System in Civil, and Others |

| End Use | Government, Industrial, Commercial, and Military |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Hikvision (China), Dahua Technology (China), Axis Communications AB (Sweden), Panasonic (Japan), Honeywell Security (USA), Hanwha (South Korea), Tyco (USA), Bosch Security Systems (Germany), Pelco (USA), Samsung (South Korea), Uniview (China), and Flir Systems, Inc. (USA) |

| Additional Attributes |

The global security and surveillance equipment market is estimated to be valued at USD 20.5 billion in 2025.

The market size for the security and surveillance equipment market is projected to reach USD 32.7 billion by 2035.

The security and surveillance equipment market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in security and surveillance equipment market are cameras, audio surveillance equipment, signal tracking, signal interception and computer surveillance software’s.

In terms of application, safety and security check segment to command 22.9% share in the security and surveillance equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Physical Security Equipment Market Analysis – Growth & Trends 2017-2027

Security Tape Market Size and Share Forecast Outlook 2025 to 2035

Security Alarm Communicator Market Size and Share Forecast Outlook 2025 to 2035

Security and Vulnerability Management Market Forecast and Outlook 2025 to 2035

Security Holograms Market Size and Share Forecast Outlook 2025 to 2035

Security Paper Market Size and Share Forecast Outlook 2025 to 2035

Security System Tester Market Size and Share Forecast Outlook 2025 to 2035

Security Advisory Services Market Size and Share Forecast Outlook 2025 to 2035

Security Room Control Market Size and Share Forecast Outlook 2025 to 2035

Security Cameras (IR Illuminator) Market Size and Share Forecast Outlook 2025 to 2035

Security Operation Centre as a Service Market Size and Share Forecast Outlook 2025 to 2035

Security Robots Market Size and Share Forecast Outlook 2025 to 2035

Security Service Edge Market Size and Share Forecast Outlook 2025 to 2035

Equipment Management Software Market Size and Share Forecast Outlook 2025 to 2035

Security Orchestration Automation and Response (SOAR) Market Size and Share Forecast Outlook 2025 to 2035

Security Bags Market Size and Share Forecast Outlook 2025 to 2035

Equipment cases market Size and Share Forecast Outlook 2025 to 2035

Security Screening Market Analysis - Size, Share, and Forecast 2025 to 2035

Security Bottles Market Size and Share Forecast Outlook 2025 to 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA