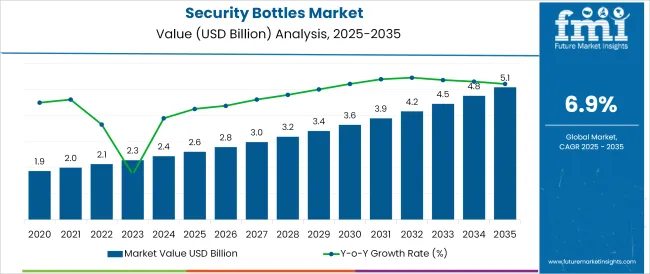

The Security Bottles Market is estimated to be valued at USD 2.6 billion in 2025 and is projected to reach USD 5.1 billion by 2035, registering a compound annual growth rate (CAGR) of 6.9% over the forecast period.

The security bottles market is gaining momentum as regulatory compliance, product safety, and brand integrity become critical across industries such as pharmaceuticals, chemicals, and food. Rising incidents of counterfeiting and contamination have placed pressure on manufacturers to adopt packaging solutions that offer tamper resistance, leak prevention, and traceability.

Security bottles, particularly those incorporating advanced sealing mechanisms and serialization features, are being prioritized in both domestic and export markets. Growth in global pharmaceutical distribution, coupled with digitization in supply chain management, is also enhancing the relevance of secure packaging formats.

Material advancements and precision molding techniques are enabling the production of durable, lightweight bottles that meet both performance and sustainability benchmarks. The market is poised to benefit further from government mandates and the expansion of e-commerce distribution channels, where integrity during transit is paramount.

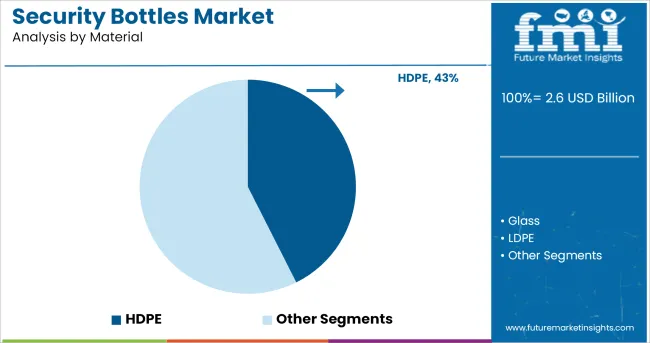

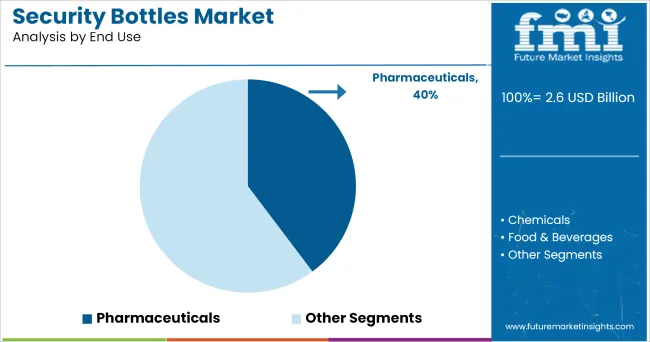

The market is segmented by Material and End Use and region. By Material, the market is divided into HDPE, Glass, LDPE, and Others. In terms of End Use, the market is classified into Pharmaceuticals, Chemicals, Food & Beverages, Cosmetics & Personal Care, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

High-density polyethylene (HDPE) is projected to account for 42.6% of the total revenue share in the security bottles market in 2025, making it the leading material. This dominance is being driven by HDPE’s favorable properties, including excellent impact resistance, high durability, and strong chemical compatibility.

HDPE's lightweight and recyclable nature also aligns with sustainability goals while maintaining secure barrier protection for sensitive contents. Its ease of processing through blow molding allows manufacturers to integrate tamper-evident bands, locking mechanisms, and custom closures directly into bottle designs.

As safety and compliance requirements intensify particularly in pharmaceuticals and hazardous goods HDPE has emerged as the preferred choice due to its performance under varied storage conditions. Furthermore, its availability in medical-grade and food safe variants strengthens its position in regulated applications where security, hygiene, and environmental safety intersect.

The pharmaceuticals segment is expected to hold a 39.8% revenue share in the security bottles market by 2025, positioning it as the leading end-use category. This leadership is being shaped by the sector’s stringent packaging compliance requirements, which emphasize tamper evidence, contamination prevention, and traceability.

Pharmaceutical companies are prioritizing container formats that ensure product integrity throughout extended supply chains and controlled environments. Security bottles enable compliance with global regulations such as FDA, EMA, and WHO guidelines, while offering flexibility for various dosage forms including liquids, syrups, and suspensions. The rise of over-the counter and direct-to-patient delivery models is further driving demand for secure, user-friendly bottles that reduce dosing errors and deter unauthorized access.

With patient safety, authentication, and cold chain stability remaining key priorities, pharmaceutical manufacturers are increasingly adopting advanced packaging solutions that combine material performance with integrated security features.

A variety of industrial & commercial liquid products need safe containers due to numerous reasons such as the liquid being hazardous, expensive, evaporative, etc. Demand for security bottles has been increasing due to its critical function of providing protection and storage to such liquids. These bottles are easy to handle as compared to large containers, often portable and come in many shapes and sizes depending on the end use application.

The bottles find immense utilization in personal care & cosmetics sector. From expensive cosmetics to perfumes that evaporate when in contact with air, these bottles find widespread application in this domain. Also, security bottles are widely used for alcohol storage.

These bottles come with different securing facilities such as caps, locks, stoppers, tags, and more. Hence, the customer gets a range of security options to choose from according to the liquid product and the amount of safety required.

New developments are being made in the market of this commodity. For example, bottles with built in electronic article surveillance tags to help reduce product theft from manufacturer factories and retail stores are being produced.

Such bottles have a tag, placed in a pocket that is formed in the outside wall of the bottle and is hidden by applied label. Because the tag is outside the bottle, there is no possibility of product contamination. Such new product developments are projected to further boost the market of security bottles.

Chemicals must be handled with care and cannot be stored in generic bottles. Security bottles accommodate toxic and hazardous chemicals. Bottles for chemicals are specially manufactured and are chemically resistant. They have low expansion; possess mechanical strength and are resistant to thermal shock, hence making them perfect containers for chemicals.

Furthermore, these bottle can be used to store medicines, nutritional supplements and other pharmaceuticals as well, providing wide scope for growth of security bottles industry in these end use sectors.

The Asia-Pacific region is anticipated to have the largest security bottles market share for this product. This region is developing and industrializing. The chemical as well as pharmaceutical sector of many countries in this region including India and China is expanding at a rapid rate. Rise in the quantity of chemicals, medicines, other pharmaceuticals produced will in turn urge the requirement of security bottles to hold them.

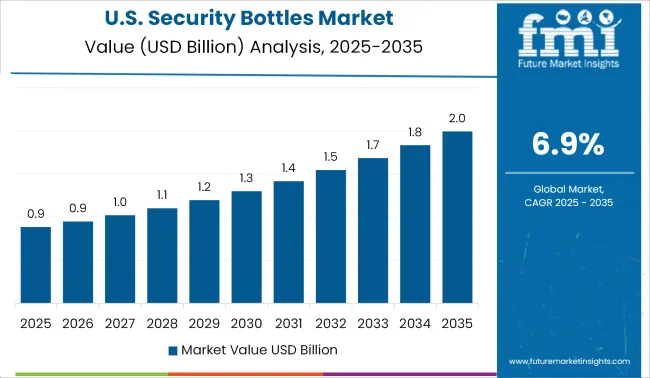

The market in the North American region is expected to grow at a steady pace, driven by the chemical, pharmaceutical and personal care sector. This shall be owing to the presence of many top key players from these target end use industries that procure security bottles for their products. Companies are innovating and creating additions to security bottle features, which will lead to robust growth in the demand for this product in the forecast period.

Demand in the European region would be driven by the personal care sector to a great extent. The research & development centres of key manufacturers based in the region require such bottles for safekeeping their experimental liquids. Hence, the sales for these bottles in this region will be immense and the market will grow at steady rate.

Some of the key players operating in the global security bottle market are

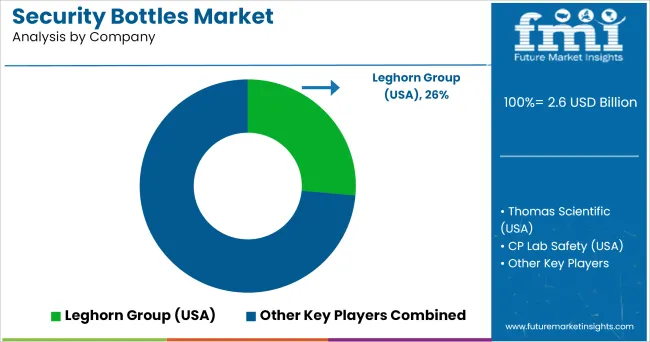

Companies like The Leghorn Group are manufacturing and providing bottle products with numerous features like narrow openings, square bottom bottles, and more. These innovations are contributing to the robust growth in security bottle demands.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global security bottles market is estimated to be valued at USD 2.6 billion in 2025.

The market size for the security bottles market is projected to reach USD 5.1 billion by 2035.

The security bottles market is expected to grow at a 6.9% CAGR between 2025 and 2035.

The key product types in security bottles market are hdpe, glass, ldpe and others.

In terms of end use, pharmaceuticals segment to command 39.8% share in the security bottles market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Competitive Breakdown of Security Bottles Manufacturers

Security Tape Market Size and Share Forecast Outlook 2025 to 2035

Security Alarm Communicator Market Size and Share Forecast Outlook 2025 to 2035

Security and Vulnerability Management Market Forecast and Outlook 2025 to 2035

Security Holograms Market Size and Share Forecast Outlook 2025 to 2035

Security Paper Market Size and Share Forecast Outlook 2025 to 2035

Security System Tester Market Size and Share Forecast Outlook 2025 to 2035

Security Advisory Services Market Size and Share Forecast Outlook 2025 to 2035

Security Room Control Market Size and Share Forecast Outlook 2025 to 2035

Security Cameras (IR Illuminator) Market Size and Share Forecast Outlook 2025 to 2035

Security Operation Centre as a Service Market Size and Share Forecast Outlook 2025 to 2035

Security Robots Market Size and Share Forecast Outlook 2025 to 2035

Security Service Edge Market Size and Share Forecast Outlook 2025 to 2035

Security and Surveillance Equipment Market Size and Share Forecast Outlook 2025 to 2035

Security Orchestration Automation and Response (SOAR) Market Size and Share Forecast Outlook 2025 to 2035

Security Bags Market Size and Share Forecast Outlook 2025 to 2035

Security Screening Market Analysis - Size, Share, and Forecast 2025 to 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Security Labels Market Analysis by Product Type, Material, Pattern, Application, End-Use Industry, and Region Through 2035

Market Share Breakdown of Security Bags Manufacturers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA