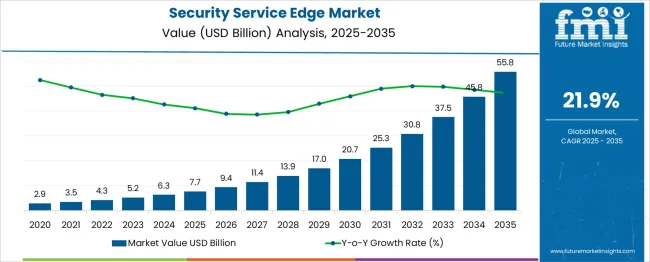

The global security service edge market is estimated to grow from USD 7.7 billion in 2025 to approximately USD 55.8 billion by 2035, recording an absolute increase of USD 48.1 billion over the forecast period. This translates into a total growth of 622.1%, with the market forecast to expand at a compound annual growth rate (CAGR) of 21.9% between 2025 and 2035. The overall market size is expected to grow by nearly 7.22X during the same period, supported by the rising adoption of cloud-first security architectures and increasing demand for integrated network and security convergence across global enterprises.

Between 2025 and 2030, the security service edge market is projected to expand from USD 7.7 billion to USD 25.3 billion, resulting in a value increase of USD 17.6 billion, which represents 36.6% of the total forecast growth for the decade. This phase of growth will be shaped by accelerating digital transformation initiatives, increasing remote work adoption, and growing demand for cloud-native security architectures. Organizations are expanding their security service edge implementations to address the growing complexity of hybrid work environments and distributed network infrastructures.

From 2030 to 2035, the market is forecast to grow from USD 25.3 billion to USD 55.8 billion, adding another USD 30.5 billion, which constitutes 63.4% of the overall ten-year expansion. This period is expected to be characterized by widespread adoption of zero trust security models, integration of artificial intelligence and machine learning capabilities, and comprehensive deployment of software-defined perimeter solutions across diverse industry verticals. The growing implementation of edge computing and 5G networks will drive demand for more sophisticated security service edge platforms and enhanced threat protection capabilities.

Between 2020 and 2025, the security service edge market experienced rapid acceleration, driven by increasing cybersecurity threats and growing recognition of traditional perimeter security limitations. The market developed as organizations recognized the need for cloud-delivered security services and integrated network access solutions. Enterprise adoption and vendor innovation have begun supporting the deployment of security service edge, improving security posture while enabling flexible work environments.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 7.7 billion |

| Forecast Value (2035) | USD 55.8 billion |

| Forecast CAGR (2025–2035) | 21.9% |

Market expansion is being supported by the fundamental shift toward cloud-first architectures and the corresponding need for integrated security and networking solutions that protect distributed workforces. Modern enterprises rely on security service edge platforms to provide consistent security policies, secure network access, and threat protection regardless of user location or device type. Even basic network connectivity requires comprehensive security integration to maintain optimal protection against evolving cyber threats.

The growing complexity of hybrid work environments and increasing sophistication of cyber attacks are driving demand for advanced security service edge platforms and integrated threat intelligence from certified security providers. Enterprise security teams are increasingly adopting comprehensive security service edge solutions to reduce complexity and improve security effectiveness. Regulatory compliance requirements and industry security standards are establishing integrated security frameworks that require cloud-delivered security services and centralized policy management.

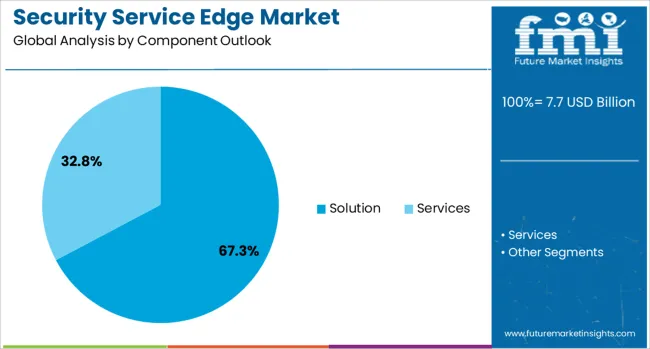

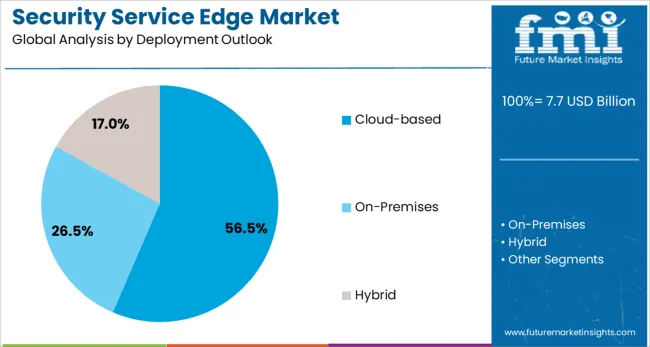

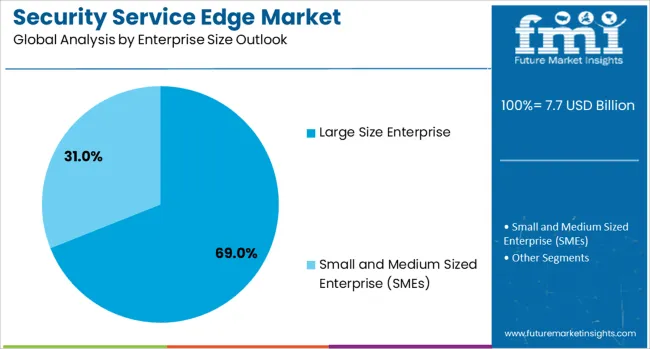

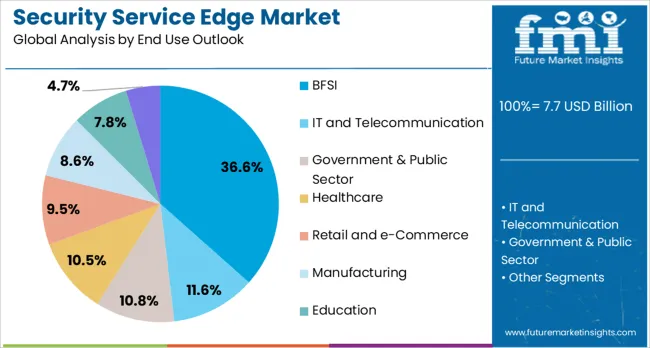

The market is segmented by component, deployment, enterprise size, end use, and region. By component, the market is divided into solution and services. Solution components include secure web gateway, cloud access security broker, zero trust network access, firewall-as-a-service, data loss prevention, and remote browser isolation. Services encompass professional services and managed services. Based on deployment, the market is categorized into cloud-based, on-premises, and hybrid. In terms of enterprise size, the market is segmented into large size enterprises and small and medium sized enterprises. By end use, the market is classified into BFSI, IT and telecommunication, government and public sector, healthcare, retail and e-commerce, manufacturing, education, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

Solution components are projected to account for 67.3% of the security service edge market in 2025. This leading share is supported by the core functionality and comprehensive security capabilities that solution components provide within security service edge architectures. Solution components including secure web gateways, cloud access security brokers, and zero trust network access form the foundation of security service edge deployments. The segment benefits from continuous innovation and expanding feature sets that address evolving security requirements.

Cloud-based deployment is expected to represent 56.5% of security service edge deployment demand in 2025. This dominant share reflects the cloud-native architecture of security service edge solutions and the scalability benefits of cloud-delivered security services. Cloud-based deployments provide global reach, automatic updates, and elastic capacity that align with modern enterprise requirements. The segment benefits from reduced infrastructure costs and simplified management compared to traditional on-premises security solutions.

Large size enterprises are projected to contribute 69% of the market in 2025, representing organizations with complex security requirements and substantial IT budgets for security service edge implementation. These enterprises typically deploy comprehensive security service edge platforms that integrate multiple security functions and support thousands of users across global locations. Large enterprises benefit from advanced threat protection capabilities and centralized security policy management. The segment is supported by growing focus on digital transformation and cloud security consolidation.

Banking, financial services, and insurance organizations are projected to hold a 36.6% market share in 2025. This dominance reflects the critical security requirements and regulatory compliance obligations within the financial services industry. BFSI organizations require comprehensive data protection, advanced threat detection, and secure remote access capabilities that security service edge platforms provide. The segment benefits from substantial security investments and growing adoption of cloud-first security architectures.

The security service edge market is advancing rapidly due to increasing cybersecurity threats and growing recognition of cloud-native security benefits. The market faces challenges including integration complexity, skills shortage for security service edge implementation, and varying compliance requirements across different industry verticals. Vendor consolidation and platform standardization continue to influence solution development and market adoption patterns.

The growing implementation of zero trust security models is driving demand for security service edge platforms that provide identity-based access controls and continuous verification capabilities. Zero trust architectures require integrated security functions that validate every access request regardless of user location or network connection. These approaches are particularly valuable for organizations with distributed workforces and cloud-first application strategies.

Modern security service edge platforms are incorporating artificial intelligence and machine learning technologies that enable automated threat detection and response capabilities. Advanced analytics provide real-time threat intelligence and behavioral analysis that improve security effectiveness while reducing false positive alerts. Machine learning algorithms also support adaptive security policies and predictive threat identification across diverse attack vectors.

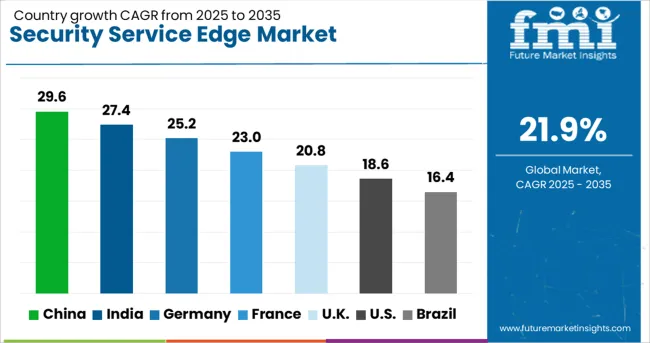

| Country | CAGR (2025-2035) |

|---|---|

| China | 29.6% |

| India | 27.4% |

| Germany | 25.2% |

| France | 23.0% |

| United Kingdom | 20.8% |

| United States | 18.6% |

| Brazil | 16.4% |

The security service edge market is experiencing exceptional growth, with China leading at a 29.6% CAGR through 2035, driven by massive digital transformation initiatives, expanding cloud adoption, and government cybersecurity modernization programs. India follows at 27.4%, supported by rapid enterprise digitization, growing cybersecurity awareness, and expanding IT services sector requirements. Germany grows steadily at 25.2%, focusing industrial cybersecurity integration and comprehensive data protection compliance. France records 23.0%, focusing on data sovereignty requirements and enterprise security modernization. The United Kingdom shows strong growth at 20.8%, prioritizing financial services security and government cybersecurity initiatives. The United States maintains steady growth at 18.6%, while Brazil demonstrates emerging market potential at 16.4%. China and India emerge as the leading drivers of the global security service edge market expansion.

The report covers an in-depth analysis of 40+ countries; seven top-performing OECD countries are highlighted below.

Revenue from security service edge solutions in China is projected to exhibit the highest growth rate with a CAGR of 29.6% through 2035, driven by massive government investment in digital infrastructure and comprehensive cybersecurity modernization initiatives across public and private sectors. The country's rapid cloud adoption and expanding digital economy are creating significant demand for integrated security and networking solutions. Major technology companies and international security vendors are establishing comprehensive security service edge platforms to support the growing enterprise population requiring advanced cybersecurity capabilities.

Revenue from security service edge solutions in India is expanding at a CAGR of 27.4%, supported by accelerating enterprise digitization, growing cybersecurity awareness, and expanding IT services sector security requirements. The country's large enterprise population and increasing cloud adoption are driving demand for scalable security service edge platforms. Technology companies and cybersecurity providers are gradually establishing capabilities to serve diverse enterprise populations requiring comprehensive security and networking integration.

Demand for security service edge solutions in Germany is projected to grow at a CAGR of 25.2%, supported by the country's focuses on industrial cybersecurity requirements and comprehensive data protection compliance frameworks. German enterprises are implementing integrated security service edge platforms that meet stringent regulatory requirements and support Industry 4.0 initiatives. The market is characterized by focus on manufacturing cybersecurity, advanced threat protection, and compliance with comprehensive data privacy regulations.

Demand for security service edge solutions in France is expanding at a CAGR of 23.0%, driven by data sovereignty requirements and comprehensive enterprise cybersecurity modernization initiatives. French enterprises are establishing integrated security frameworks that maintain data residency requirements while enabling cloud adoption and digital transformation. The market benefits from coordinated cybersecurity policies and systematic security service edge deployment across public and private sectors.

Demand for security service edge solutions in the United Kingdom is expanding at a CAGR of 20.8%, driven by financial services sector security requirements and government cybersecurity leadership initiatives. British enterprises are implementing comprehensive security service edge frameworks that support regulatory compliance and advanced threat protection across diverse industry sectors. The market benefits from coordinated national cybersecurity strategies and systematic security modernization programs.

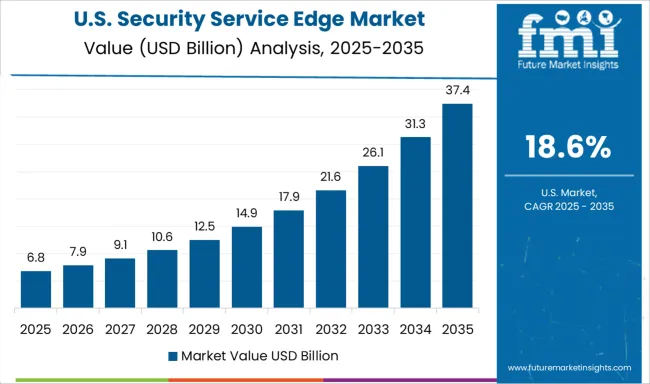

Demand for security service edge solutions in the United States is projected to grow at a CAGR of 18.6% through 2035, supported by established cybersecurity infrastructure and comprehensive regulatory frameworks for enterprise security. American enterprises are implementing sophisticated security service edge platforms that integrate with existing security operations and compliance management systems. The market is characterized by advanced threat intelligence capabilities, established vendor ecosystems, and comprehensive security certification programs.

Revenue from security service edge solutions in Brazil is expanding at a CAGR of 16.4%, driven by growing enterprise security awareness and increasing recognition of cybersecurity investment benefits. Brazilian enterprises are gradually establishing security service edge capabilities that serve diverse business requirements across urban and regional markets. The country's expanding digital economy and increasing cyber threat awareness are creating opportunities for cybersecurity providers to expand their market presence.

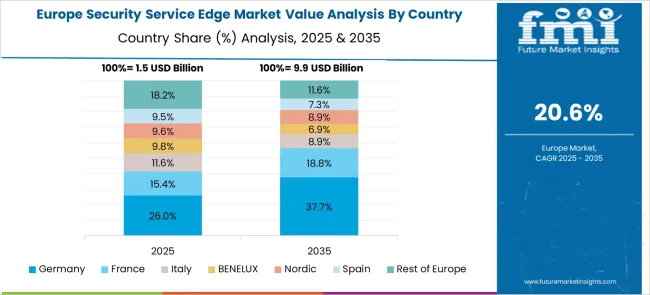

The European security service edge (SSE) market is projected to grow from USD 1.85 billion in 2025 to USD 13.42 billion by 2035, at a 21.6% CAGR. Germany leads with 31.2%, driven by advanced enterprise cybersecurity and industrial standards. The UK (26.8%) focuses on financial services and government modernization, while France (18.9%) focusing data sovereignty and cloud security. The Nordic region (9.4%) leads in innovation and coordinated cybersecurity strategies. Spain (6.7%) and Italy (5.1%) grow via cloud adoption and manufacturing sector security. BENELUX (3.9%) and Rest of Europe (8.0%) expand through integrated frameworks, cross-border collaboration, and government digitization initiatives.

The security service edge market is defined by competition among established cybersecurity vendors, cloud security specialists, and network infrastructure providers. Companies are investing in platform integration, artificial intelligence capabilities, threat intelligence services, and global infrastructure expansion to deliver comprehensive, scalable, and effective security service edge solutions. Strategic partnerships, technology acquisitions, and market expansion are central to strengthening solution portfolios and competitive positioning.

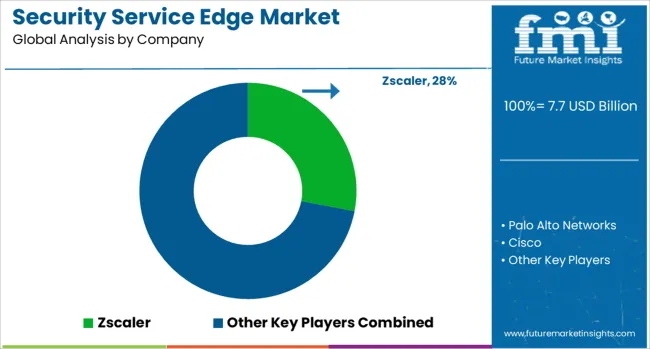

Zscaler, USA-based, offers comprehensive cloud-native security service edge platforms with focus on zero trust architecture, scalable cloud delivery, and integrated threat protection capabilities. Palo Alto Networks provides advanced security platforms with focuses on artificial intelligence integration and comprehensive threat intelligence. Cisco delivers integrated networking and security solutions with focus on enterprise infrastructure and hybrid deployment models. Fortinet focusing performance optimization and comprehensive security feature integration.

Netskope offers cloud access security broker solutions with advanced data protection and threat detection capabilities. Cato Networks provides software-defined wide area network integration with comprehensive security service edge functionality. Proofpoint delivers email security and threat protection with security service edge integration. Barracuda Networks, Menlo Security, Cloudflare, Forcepoint, Skyhigh Security, Axis Security, VMware, and Akamai offer specialized security service edge expertise, innovative threat protection technologies, and comprehensive security solutions across global and regional enterprise markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.7 Billion |

| Component | Solution (secure web gateway, cloud access security broker, zero trust network access, firewall-as-a-service, data loss prevention, remote browser isolation), services (professional services, managed services) |

| Deployment | Cloud-based, on-premises, and hybrid |

| Enterprise Size | Large size enterprises and small and medium sized enterprises |

| End Use | BFSI, IT and telecommunication, government and public sector, healthcare, retail and e-commerce, manufacturing, education, and others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Germany, India, China, United Kingdom, Japan, Brazil, France |

| Key Companies Profiled | Zscaler, Palo Alto Networks, Cisco, Fortinet, Netskope, Cato Networks, Proofpoint, Barracuda Networks, Menlo Security, Cloudflare, Forcepoint, Skyhigh Security, Axis Security, VMware, Akamai |

| Additional Attributes | Dollar sales by component, deployment model, enterprise size, and end use sector, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established cybersecurity vendors and emerging cloud security specialists, enterprise preferences for integrated platforms versus best-of-breed solutions, integration with existing security operations and network infrastructure, innovations in zero trust architecture and artificial intelligence-driven threat detection, and adoption of cloud-native security architectures with advanced analytics and automated response capabilities for enhanced enterprise protection. |

The global security service edge market is estimated to be valued at USD 7.7 billion in 2025.

The market size for the security service edge market is projected to reach USD 55.8 billion by 2035.

The security service edge market is expected to grow at a 21.9% CAGR between 2025 and 2035.

The key product types in security service edge market are solution, secure web gateway (SWG), cloud access security broker (CASB), zero trust network access (ZTNA), firewall-as-a-service (FWAAS), data loss prevention (DLP), remote browser isolation (RBI), services, professional services and managed services.

In terms of deployment outlook, cloud-based segment to command 56.5% share in the security service edge market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Security Tape Market Size and Share Forecast Outlook 2025 to 2035

Security Alarm Communicator Market Size and Share Forecast Outlook 2025 to 2035

Security and Vulnerability Management Market Forecast and Outlook 2025 to 2035

Security Holograms Market Size and Share Forecast Outlook 2025 to 2035

Security Paper Market Size and Share Forecast Outlook 2025 to 2035

Security System Tester Market Size and Share Forecast Outlook 2025 to 2035

Security Room Control Market Size and Share Forecast Outlook 2025 to 2035

Security Cameras (IR Illuminator) Market Size and Share Forecast Outlook 2025 to 2035

Security Robots Market Size and Share Forecast Outlook 2025 to 2035

Security and Surveillance Equipment Market Size and Share Forecast Outlook 2025 to 2035

Security Orchestration Automation and Response (SOAR) Market Size and Share Forecast Outlook 2025 to 2035

Security Bags Market Size and Share Forecast Outlook 2025 to 2035

Security Screening Market Analysis - Size, Share, and Forecast 2025 to 2035

Security Bottles Market Size and Share Forecast Outlook 2025 to 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Security Labels Market Analysis by Product Type, Material, Pattern, Application, End-Use Industry, and Region Through 2035

Market Share Breakdown of Security Bags Manufacturers

Market Share Insights for Security Tape Providers

Competitive Breakdown of Security Bottles Manufacturers

Market Share Distribution Among Security Paper Manufacturers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA