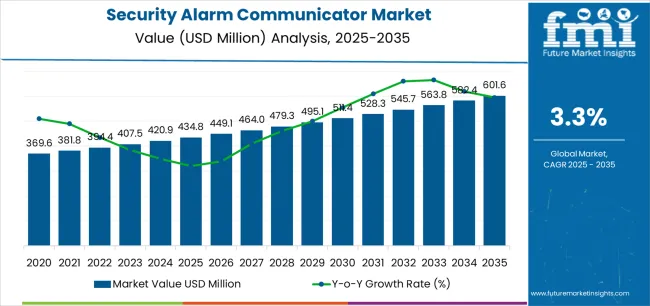

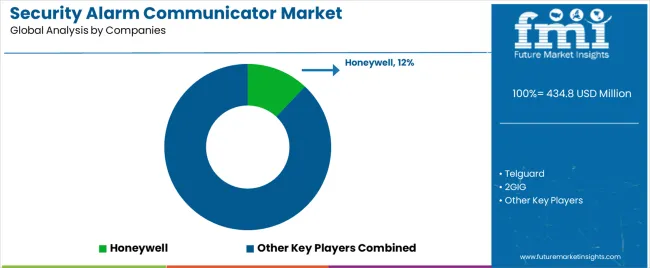

The global security alarm communicator market is valued at USD 434.8 million in 2025. It is slated to reach USD 601.6 million by 2035, recording an absolute increase of USD 166.7 million over the forecast period. This translates into a total growth of 38.3%, with the market forecast to expand at a compound annual growth rate (CAGR) of 3.3% between 2025 and 2035. The overall market size is expected to grow by nearly 1.38X during the same period, supported by increasing demand for reliable alarm signal transmission, growing adoption of cellular and internet protocol communication in security systems, and rising emphasis on redundant communication pathways across diverse commercial security installations, residential alarm systems, and critical infrastructure protection applications.

Between 2025 and 2030, the security alarm communicator market is projected to expand from USD 434.8 million to USD 495.1 million, resulting in a value increase of USD 60.3 million, which represents 36.2% of the total forecast growth for the decade. This phase of development will be shaped by increasing transition from legacy landline systems to cellular and IP-based communication, rising smart home and connected security adoption driving networked alarm systems, and growing demand for dual-path and multi-path communication ensuring signal reliability and backup capabilities. Security system integrators and alarm monitoring companies are expanding their communicator capabilities to address the growing demand for reliable and technology-advanced communication devices that ensure alarm signal delivery and system supervision.

From 2030 to 2035, the market is forecast to grow from USD 495.1 million to USD 601.6 million, adding another USD 106.4 million, which constitutes 63.8% of the overall ten-year expansion. This period is expected to be characterized by the expansion of 5G network deployment enabling enhanced security communication, the development of artificial intelligence-enabled communicators with self-diagnostics and predictive maintenance, and the growth of specialized applications for IoT-integrated security systems, cloud-managed platforms, and cybersecurity-hardened communication devices. The growing adoption of subscription-based monitoring services and managed security offerings will drive demand for security alarm communicators with enhanced connectivity and remote management capabilities.

Between 2020 and 2025, the security alarm communicator market experienced steady growth, driven by landline network retirement and cellular network expansion creating migration necessity, and growing recognition of alarm communicators as critical security system components for ensuring reliable signal transmission and monitoring station connectivity in diverse residential, commercial, and institutional security applications. The market developed as security professionals and property owners recognized the potential for modern communicator technology to improve alarm reliability, enable remote management, and support system supervision while meeting insurance and regulatory requirements. Technological advancement in cellular communication and encryption protocols began emphasizing the critical importance of maintaining secure and reliable alarm signal transmission in evolving telecommunications environments.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 434.8 million |

| Forecast Value in (2035F) | USD 601.6 million |

| Forecast CAGR (2025 to 2035) | 3.3% |

Market expansion is being supported by the increasing global demand for reliable alarm signal transmission driven by landline network phase-out, cellular network advancement, and security system modernization requirements, alongside the corresponding need for robust communication devices that can ensure alarm delivery, enable remote monitoring, and maintain system supervision across various commercial buildings, residential properties, industrial facilities, and critical infrastructure applications. Modern security installers and property owners are increasingly focused on implementing alarm communicator solutions that can improve signal reliability, provide communication redundancy, and ensure consistent connectivity in diverse network environments.

The growing emphasis on smart building integration and connected security ecosystems is driving demand for alarm communicators that can support IP connectivity, enable cloud platform integration, and ensure comprehensive system interoperability. Security system users' preference for communication solutions that combine reliability excellence with remote accessibility and cyber protection is creating opportunities for innovative alarm communicator implementations. The rising influence of insurance requirements and regulatory compliance is also contributing to increased adoption of alarm communicators that can provide supervised communication without compromising signal integrity or monitoring capabilities.

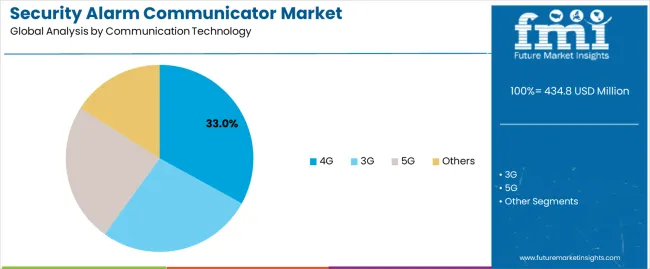

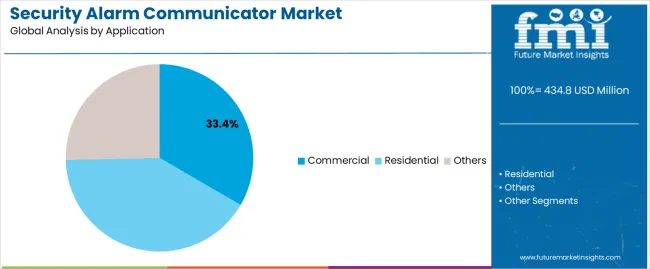

The market is segmented by communication technology, application, and region. By communication technology, the market is divided into 3G, 4G, 5G, and others. Based on application, the market is categorized into commercial, residential, and others. Regionally, the market is divided into East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, and Eastern Europe.

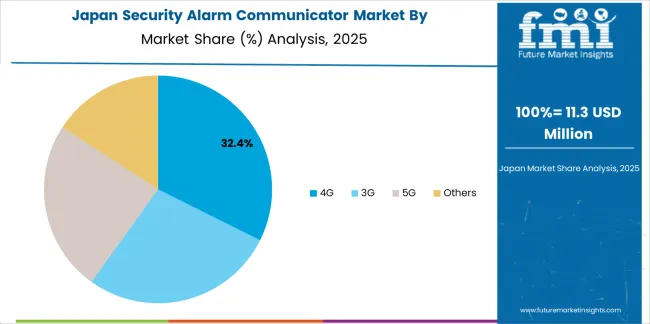

The 4G segment is projected to maintain its leading position in the security alarm communicator market in 2025, reaffirming its role as the preferred communication technology for reliable alarm signal transmission and industry-standard cellular connectivity. Security system integrators and monitoring companies increasingly utilize 4G communicators for their optimal balance of network coverage, proven operational reliability, and established effectiveness in transmitting alarm signals while maintaining cost-effectiveness and broad carrier support. 4G technology's proven effectiveness and widespread network availability directly address operational requirements for dependable alarm communication and monitoring station connectivity across diverse installation environments and geographic regions.

This communication technology segment forms the foundation of modern cellular alarm communication, as it represents the technology with the greatest network maturity and established performance record across multiple security applications and installation types. Security industry investments in cellular communication infrastructure continue to strengthen 4G adoption among alarm companies and security integrators. With operational requirements demanding reliable connectivity and proven network stability, 4G communicators align with both technical objectives and economic considerations, making it the central component of comprehensive alarm communication strategies.

The commercial application segment is projected to represent 33.4% market share of security alarm communicator demand in 2025, underscoring its critical role as the primary driver for alarm communicator adoption across retail stores, office buildings, warehouses, financial institutions, and commercial facilities. Commercial property owners and facility managers prefer alarm communicators for security systems due to insurance requirements, liability considerations, and ability to ensure monitored protection while supporting business continuity and asset protection. Positioned as essential equipment for commercial security infrastructure, alarm communicators offer both reliability advantages and compliance benefits.

The segment is supported by continuous commercial construction activity and the growing requirement for monitored security systems with reliable communication ensuring rapid emergency response and documentation. Additionally, commercial property owners are investing in communication redundancy to support increasingly stringent insurance requirements and demand for uninterrupted monitoring service. As commercial security standards evolve and monitoring expectations increase, the commercial application will continue to dominate the market while supporting comprehensive security strategies and risk mitigation approaches.

The security alarm communicator market is advancing steadily due to increasing demand for reliable alarm signal transmission driven by landline retirement, cellular network maturity, and security monitoring requirements necessitating robust communication technologies providing enhanced reliability characteristics and connectivity benefits across diverse commercial security, residential alarm, and critical infrastructure applications. However, the market faces challenges, including network technology transitions creating upgrade requirements and obsolescence risks, cybersecurity concerns regarding connected security devices, and competition from integrated security panels with built-in communication capabilities. Innovation in dual-path communication and encryption technologies continues to influence product development and market expansion patterns.

The global telecommunications transition away from legacy copper landline networks combined with cellular network expansion and improvement is driving mandatory migration from traditional phone-line based alarm communication to cellular and IP-based technologies ensuring continued monitoring capabilities. Security systems dependent on landline communication face connectivity loss as telephone companies discontinue POTS (Plain Old Telephone Service) infrastructure requiring proactive communicator replacement. Security companies are increasingly recognizing the operational advantages of cellular communicators for providing supervised communication, eliminating line-cut vulnerabilities, and enabling remote diagnostics, creating opportunities for dual-path systems combining cellular and internet connectivity specifically designed for mission-critical security applications.

Modern alarm communicator manufacturers are incorporating dual-path and multi-path communication architectures combining cellular and internet protocol connectivity to enhance signal reliability, provide automatic failover, and support comprehensive communication redundancy through diverse network paths and automatic switching mechanisms. Leading companies are developing intelligent communicators with automatic path selection, implementing real-time network monitoring, and advancing communication protocols that ensure alarm delivery regardless of individual network failures. These innovations improve system reliability while enabling new capabilities, including faster signal transmission, bi-directional communication, and over-the-air programming. Advanced redundancy integration also allows security operators to support comprehensive uptime objectives and service level agreements beyond traditional single-path communication approaches.

The expansion of 5G network deployment, IoT ecosystem maturation, and edge computing capabilities is driving development of next-generation alarm communicators with enhanced bandwidth, lower latency, and massive device connectivity supporting sophisticated security applications. These advanced communication platforms enable video verification transmission, AI-powered analytics integration, and comprehensive security system management, creating premium market segments with differentiated capabilities and expanded functionality. Manufacturers are investing in 5G technology adoption and IoT platform integration to serve emerging smart building applications while supporting innovation in intelligent security systems and predictive maintenance capabilities.

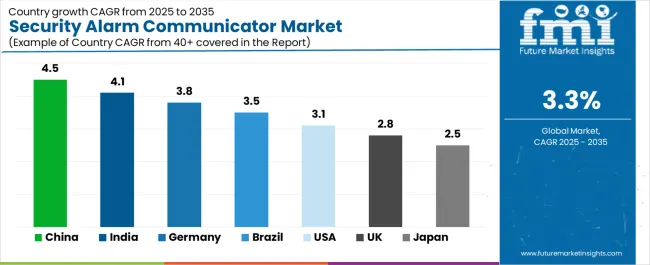

| Country | CAGR (2025-2035) |

|---|---|

| China | 4.5% |

| India | 4.1% |

| Germany | 3.8% |

| Brazil | 3.5% |

| United States | 3.1% |

| United Kingdom | 2.8% |

| Japan | 2.5% |

The security alarm communicator market is experiencing solid growth globally, with China leading at a 4.5% CAGR through 2035, driven by rapid urbanization, expanding commercial construction, and growing security consciousness creating demand for monitored alarm systems with reliable communication. India follows at 4.1%, supported by growing organized retail sector, expanding commercial real estate, and increasing security awareness among businesses and affluent homeowners. Germany shows growth at 3.8%, emphasizing quality security systems, insurance requirements, and building automation integration. Brazil demonstrates 3.5% growth, supported by security concerns, commercial facility protection, and monitored alarm system adoption. The United States records 3.1%, focusing on landline replacement, smart home integration, and commercial security modernization. The United Kingdom exhibits 2.8% growth, emphasizing monitored security systems and alarm communication reliability. Japan shows 2.5% growth, focusing on quality security equipment and aging infrastructure replacement.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

Revenue from security alarm communicators in China is projected to exhibit exceptional growth with a CAGR of 4.5% through 2035, driven by massive urbanization creating commercial and residential security demand and rapidly expanding security monitoring services industry supported by telecommunications infrastructure development and growing security consciousness. The country's comprehensive construction activity and increasing investment in security infrastructure are creating substantial demand for alarm communicator solutions. Security equipment manufacturers and monitoring service providers are establishing production and service capabilities to serve both domestic markets and export opportunities.

Revenue from security alarm communicators in India is expanding at a CAGR of 4.1%, supported by expanding organized retail sector requiring monitored security, growing commercial real estate development, and increasing security awareness among businesses and high-net-worth individuals driving monitored alarm system adoption. The country's comprehensive economic development and urbanization are driving sophisticated security system market growth throughout metropolitan and emerging cities. Security companies and equipment distributors are establishing capabilities to address growing alarm communication requirements.

Revenue from security alarm communicators in Germany is expanding at a CAGR of 3.8%, supported by the country's emphasis on quality security systems, strong insurance requirements for commercial properties, and sophisticated building automation integration requiring reliable alarm communication. The nation's technological sophistication and quality standards are driving premium alarm communicator capabilities throughout commercial and industrial applications. Security system integrators and equipment manufacturers are investing extensively in advanced communication technologies and system integration capabilities.

Revenue from security alarm communicators in Brazil is expanding at a CAGR of 3.5%, driven by persistent security concerns creating demand for monitored alarm systems, commercial facility protection requirements, and growing professional security monitoring industry. Brazil's security market development and monitoring service growth are supporting alarm communicator adoption. Security companies and equipment suppliers are establishing service networks for alarm communication solutions.

Revenue from security alarm communicators in the United States is expanding at a CAGR of 3.1%, supported by the country's ongoing landline network retirement creating communicator replacement necessity, established security monitoring industry, and growing smart home security adoption driving IP and cellular communication. The nation's mature security market and technology advancement are driving alarm communicator modernization. Security companies and manufacturers are investing in next-generation communication technologies and service platform development.

Revenue from security alarm communicators in the United Kingdom is growing at a CAGR of 2.8%, driven by the country's established monitored security culture, insurance company requirements, and emphasis on alarm communication reliability ensuring emergency response. The United Kingdom's mature security industry and quality consciousness are supporting investment in reliable communication equipment. Security installers and monitoring companies are establishing comprehensive communicator deployment programs.

Revenue from security alarm communicators in Japan is expanding at a CAGR of 2.5%, supported by the country's emphasis on quality security equipment, aging security infrastructure requiring modernization, and technological sophistication requiring advanced communication capabilities. Japan's quality standards and security consciousness are driving demand for premium alarm communicator products. Security companies and equipment manufacturers are investing in high-quality communication devices for demanding applications.

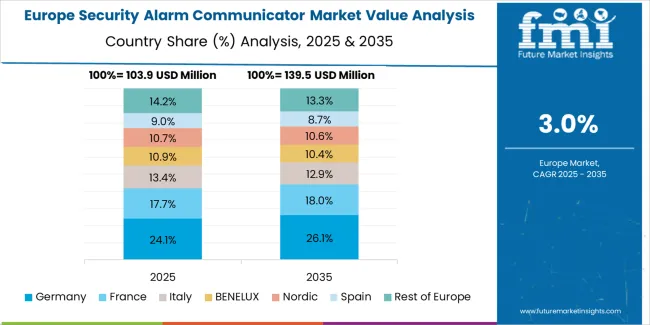

The security alarm communicator market in Europe is projected to grow from USD 112.1 million in 2025 to USD 149.6 million by 2035, registering a CAGR of 2.9% over the forecast period. Germany is expected to maintain leadership with a 26.2% market share in 2025, moderating to 25.9% by 2035, supported by quality security systems, insurance requirements, and commercial security infrastructure.

The United Kingdom follows with 18.8% in 2025, projected at 18.5% by 2035, driven by monitored security culture, insurance compliance, and communication reliability emphasis. France holds 16.2% in 2025, rising to 16.4% by 2035 on the back of commercial security development and monitoring service growth. Italy commands 13.4% in 2025, reaching 13.6% by 2035, while Spain accounts for 10.6% in 2025, rising to 10.8% by 2035 aided by commercial construction and security adoption. The Netherlands maintains 7.4% in 2025, up to 7.6% by 2035 due to smart building integration and quality security systems. The Rest of Europe region, including Nordics, Central & Eastern Europe, and other markets, is anticipated to hold 7.4% in 2025 and 7.2% by 2035, reflecting steady development in monitored security and communication technology adoption.

The security alarm communicator market is characterized by competition among specialized alarm communication equipment manufacturers, integrated security system providers, and telecommunications-focused security companies. Companies are investing in cellular network technology advancement, dual-path communication development, cybersecurity enhancement, and cloud platform integration to deliver reliable, secure, and feature-rich alarm communicator solutions. Innovation in 5G communication capabilities, AI-enabled diagnostics, and IoT platform integration is central to strengthening market position and competitive advantage.

Honeywell leads the market with 12% share, offering comprehensive security solutions including alarm communicators with focus on reliability, integration capabilities, and diverse communication technologies. Telguard provides specialized cellular alarm communication systems with emphasis on commercial applications and dual-path solutions. 2GIG delivers residential and light commercial security equipment including communicators with focus on ease of installation and smart home integration. DSC (Digital Security Controls) offers commercial-grade security systems and communicators with emphasis on reliability and professional installation. Resideo provides residential security solutions including communicators for consumer and professional markets. Alula focuses on cellular communication for security applications.

Bosch Security Systems delivers commercial security equipment including alarm communication solutions. Interlogix offers security system components and communicators. Qolsys provides smart security panels with integrated communication. Visonic delivers wireless security systems with communication capabilities. WeBoost focuses on cellular signal enhancement for security applications. Napco Security Technologies offers commercial security communicators and monitoring solutions. Paradox Security Systems provides alarm communication equipment for diverse applications. DMP (Digital Monitoring Products) delivers professional-grade security communicators for commercial installations.

Security alarm communicators represent a critical infrastructure component within security systems and monitoring services, projected to grow from USD 434.8 million in 2025 to USD 601.6 million by 2035 at a 3.3% CAGR. These essential communication devices—primarily utilizing cellular and IP-based technologies—serve as vital signal transmission equipment in commercial security systems, residential alarm installations, and critical infrastructure protection where reliable alarm delivery, monitoring station connectivity, and communication supervision are essential. Market expansion is driven by landline network retirement, cellular network advancement, smart security adoption, and rising demand for supervised communication across diverse commercial, residential, and institutional security segments.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 434.8 million |

| Communication Technology | 3G, 4G, 5G, Others |

| Application | Commercial, Residential, Others |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | Honeywell, Telguard, 2GIG, DSC (Digital Security Controls), Resideo |

| Additional Attributes | Dollar sales by communication technology and application categories, regional demand trends, competitive landscape, technological advancements in cellular communication, dual-path system development, cybersecurity enhancement, and 5G integration |

The global security alarm communicator market is estimated to be valued at USD 434.8 million in 2025.

The market size for the security alarm communicator market is projected to reach USD 601.6 million by 2035.

The security alarm communicator market is expected to grow at a 3.3% CAGR between 2025 and 2035.

The key product types in security alarm communicator market are 4g, 3g, 5g and others.

In terms of application, commercial segment to command 33.4% share in the security alarm communicator market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Security and Vulnerability Management Market Forecast and Outlook 2025 to 2035

Security Holograms Market Size and Share Forecast Outlook 2025 to 2035

Security Paper Market Size and Share Forecast Outlook 2025 to 2035

Security System Tester Market Size and Share Forecast Outlook 2025 to 2035

Security Advisory Services Market Size and Share Forecast Outlook 2025 to 2035

Security Room Control Market Size and Share Forecast Outlook 2025 to 2035

Security Cameras (IR Illuminator) Market Size and Share Forecast Outlook 2025 to 2035

Security Operation Centre as a Service Market Size and Share Forecast Outlook 2025 to 2035

Security Robots Market Size and Share Forecast Outlook 2025 to 2035

Security Service Edge Market Size and Share Forecast Outlook 2025 to 2035

Security and Surveillance Equipment Market Size and Share Forecast Outlook 2025 to 2035

Security Orchestration Automation and Response (SOAR) Market Size and Share Forecast Outlook 2025 to 2035

Security Bags Market Size and Share Forecast Outlook 2025 to 2035

Security Screening Market Analysis - Size, Share, and Forecast 2025 to 2035

Security Bottles Market Size and Share Forecast Outlook 2025 to 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Security Labels Market Analysis by Product Type, Material, Pattern, Application, End-Use Industry, and Region Through 2035

Market Share Breakdown of Security Bags Manufacturers

Market Share Insights for Security Tape Providers

Competitive Breakdown of Security Bottles Manufacturers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA