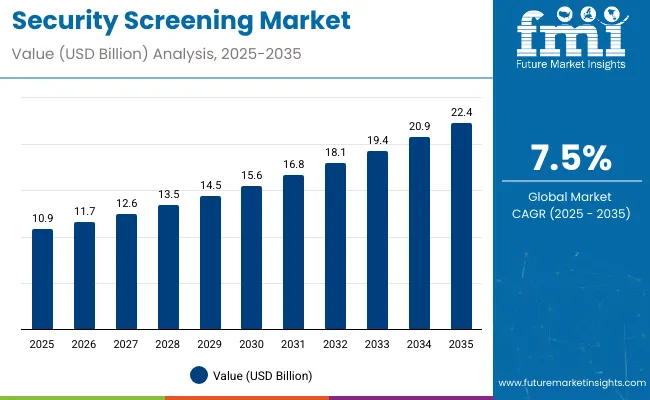

The global security screening market is valued at USD 10.9 billion in 2025 and is projected to reach USD 22.4 billion by 2035, expanding at a CAGR of 7.5% during the forecast period. In 2024, the market stood at USD 10.1 billion, with sales expected to record a year-on-year growth of 7.5% in 2025.

The growing number of terrorist activities, smuggling, and illegal trafficking has increased the need for advanced systems. Governments across the globe are imposing strict security protocols at transportation centers, public facilities, and high-risk areas like airports, government offices, and event spaces.

Security agencies are introducing AI-driven screening technologies, biometric verification, and automated threat detection to enhance security and reduce human error. Additionally, geopolitical tensions and border disputes are encouraging nations to spend on next-generation security technologies.

The need for quick, effective, and accurate threat detection systems has spurred non-stop innovation, propelling the industry forward. As threats evolve, security screening solutions are becoming a central aspect of global counter-terrorism and public safety efforts.

The market encompasses technologies and solutions used to inspect people, baggage, cargo, and infrastructure to detect threats such as weapons, explosives, narcotics, and contraband. It comprises scanning technologies such as X-ray scanners, metal detectors, biometrics, trace explosive detection, and millimeter-wave scanners.

Use of biometric screening technology, face recognition, and artificial intelligence-enabled security systems concerns not only about privacy but also about data safety. Compliance directives from regulatory platforms like the GDPR in Europe and other international data protection legislation severely curtail bulk rollout of the same.

Concern for privacy and misuse is progressively building up in areas of misuse of private data and likely break-in of sensitive biometric information. Public concern regarding the invasion of privacy, particularly when it comes to facial recognition-based screening at airports and other public places, has led to resistance against such solutions.

Ethical concerns, storage threats to data, and the risk of algorithmic bias in AI-driven screening are also issues that challenge the use of technologies, thus presenting a major growth hindrance.

In 2025, demand in the security screening market is being driven by three concrete shifts: biometric border modernization, CT-based cabin baggage screening, and governance for AI-enabled identity systems.

First, Europe’s border ecosystem is moving to biometric-by-default. The EU Entry/Exit System (EES) begins progressive operations on 12 October 2025, introducing mandatory facial and fingerprint capture for non-EU travellers at external borders and requiring new kiosks, enrolment stations, and secure data pipelines across air, land, and sea checkpoints. ETIAS will follow in late 2026, reinforcing pre-travel vetting and identity verification needs. These timelines are prompting airports and border authorities to budget for biometric kits, secure enrolment software, and queue-management integrations through 2025–2026.

Second, aviation screening continues to pivot from 2-D X-ray to computed tomography and ECAC-validated systems. The European Civil Aviation Conference’s Common Evaluation Process (CEP) maintains a public list of Explosive Detection Systems for Cabin Baggage (EDSCB), updated 25 April 2025, which many regulators reference when approving checkpoint technology—accelerating C3-class adoption that supports more permissive liquids policies. In the United States, TSA has been rolling out CT scanners and automated screening lanes at major airports, a program underscored by official deployments and public updates. Together, these actions lift demand for high-throughput scanners, automated tray returns, and advanced threat detection algorithms configured for airports, the largest application segment.

Third, buyers are standardizing how they procure and audit AI-enabled biometrics. NIST’s Face Recognition Technology Evaluation (FRTE) provides fresh, ongoing accuracy benchmarks used by government and enterprise evaluators, while ISO/IEC 19795 defines how to test and report biometric performance, including a 2024 part focused on variation across demographic groups. In parallel, the NIST AI Risk Management Framework (and its 2024 generative-AI profile) is widely adopted as a voluntary governance playbook for model assurance, data quality, and monitoring. These frameworks are now appearing in 2025 RFP language for biometric systems, video analytics, and automated threat detection.

Outside aviation and borders, public-venue screening remains mixed. U.S. K-12 data show daily metal-detector use is uncommon (about 2% of schools), with most institutions prioritizing cameras and access control shaping a steadier but narrower demand profile for walkthrough detectors and handhelds in education compared to transport hubs.

Globally, the industry is chiefly prompted by the ever-increasing need for modern technology in threat detection for a diverse range of applications such as aviation, defense, public areas, and critical infrastructure.

The aviation and transportation sectors focus on detection performance, rapid screening procedures, and the use of AI to identify threats, which makes the security work smoothly without passenger flow delay. In the case of government and defense-related applications, the combination of AI and analytics is the key to preemptive threat handling, although their governing regulations often complicate matters.

Shopping malls, stadiums, and office spaces, as commercial and public areas, focus on low-cost solutions that require fast processing to ensure crowd security. Conversely, industrial and critical assets would have durable features plus extended security that will improve the operation significantly by detecting the possible risks inside.

The growing prevalence of biometric screening, explosive detection systems, and AI-based surveillance is projected to visibly increase sales, making the products available to improve the global security level.

Based on available information, here is a summary of notable contracts and releases for 2024 and 2025

| Company | Contract Value (USD Million) |

|---|---|

| TSA & Smiths Detection | Approximately USD 100 - 120 |

| Leidos | Approximately USD 80 - 95 |

| Rapiscan Systems & EU Border Control | Approximately USD 60 - 75 |

| OSI Systems | Approximately USD 50 - 65 |

In 2024 and early 2025, the industry has seen significant contract activity, with major deals focused on improving airport, border, and cargo security. The TSA’s contract with Smiths Detection, valued between USD 100 - 120 million, highlights the growing investment in advanced CT scanners for aviation security.

Similarly, Leidos and Rapiscan Systems have secured strategic agreements aimed at integrating AI-based threat detection and automated screening in key transportation hubs. These contracts underscore the global push toward more efficient and technologically advanced security solutions to enhance threat detection capabilities across critical infrastructure.

Between 2020 and 2024, there was steady growth due to rising global travel, growing security threats, and technological advancements in screening. Advanced X-ray scanners, metal detectors, and biometric systems were implemented by airports, government buildings, and public places to improve threat detection and passenger flow efficiency. AI-powered image recognition and automated threat detection improved accuracy and reduced false alarms.

The COVID-19 pandemic has driven demand growth for contactless screening technology like facial recognition and thermal imaging. Due to challenges like high installation costs and privacy, manufacturers focused on improving scanning speed, accuracy, and user-friendliness. In the period 2025 to 2035, screening driven by artificial intelligence, multi-sensor fusion, and hand-held security solutions will drive growth.

AI-driven systems will enable real-time threat detection and adaptive screening by passenger behavior and risk profiles. Multi-sensor fusion combining X-ray, millimeter-wave, and chemical detection will enhance accuracy and broaden threat detection.

Handheld, portable screening systems will enable simple deployment in congested and off-grid locations. Blockchain-secured identity verification and biometric authentication will provide security and passenger flow. Energy-efficient design and sustainable materials will support environmental goals and reduce operating costs.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Stricter security measures were implemented globally due to increasing geopolitical tensions and heightened terrorism threats. Aviation, border security, and public infrastructure saw expanded screening requirements. | AI-driven, automated, and biometric-based screening becomes mandatory at high-risk locations. Governments drive for touchless, frictionless screening technology to improve efficiency and minimize passenger hassle. |

| The emergence of AI-augmented threat detection, computed tomography (CT) scanners, and real-time data analytics improved the accuracy of screening. Machine learning-based implementation of anomaly detection increased threat detection. | Quantum computing and AI-powered security analytics refine real-time threat assessments. The growth of smart security ecosystems combines blockchain for secure information sharing and compatibility across various screening systems. |

| The increase in air travel after the pandemic resulted in increased investments in checkpoint automation, facial recognition, and baggage scanning equipment to handle increased passenger traffic. Border control employed advanced scanning technologies for the detection of illegal contraband. | Automated airports use biometric boarding, AI-powered scanning tunnels, and sophisticated passenger risk profiling. Border security employs drones and autonomous screening checkpoints to enhance surveillance and minimize human intervention. |

| Increasing concerns over mass events, sports events, and concerts led to enhanced screening by the use of millimeter-wave scanners and facial recognition. Crowd monitoring based on AI was integrated into event security measures. | AI-based mass surveillance and screening are applied in public spaces in smart cities. Contactless and non-intrusive security checkpoints take the place of conventional physical screenings to optimize high-traffic event management. |

| Escalation in international trade and smuggling issues prompted heightened deployment of non-intrusive inspection (NII) equipment, X-ray scanners, and chemical trace detectors at ports. | Ports use AI-based predictive analytics to scan goods in real time. Supply chain security is strengthened by digital twin technology through modeling of potential security vulnerabilities and optimization of screening protocols. |

| Facial and fingerprint recognition technologies were applied in airports, border control, and corporate access control systems. AI-driven behavioral analytics enhanced anomaly detection. | AI-driven biometric systems provide near-instant authentication with iris and gait recognition. Secure multi-modal authentication that integrates facial recognition with voice biometrics is used for sophisticated security applications. |

| Initial investments in energy-efficient scanners and AI-driven threat detection lowered operating costs and enhanced sustainability. However, widespread sustainable uptake remained in check. | Green screening technology, including energy-efficient X-ray scanners and AI-driven software optimization, reduces carbon emissions. Governments initiate green security infrastructure development incentives. |

| Pandemic-related supply chain bottlenecks impacted scanner manufacturing, adding cost and deployment time. Firms localized production to minimize reliance on global supply chains. | Robust, AI-based supply chain strategies facilitate uninterrupted manufacturing and deployment of screening devices. 3D printing on-demand facilitates fast manufacturing of screening parts, diminishing supply chain weaknesses. |

| Elevating global security threats, an increase in air travel, and government mandates sped up the adoption of screening technology. Spending on AI-based solutions and biometric screening grew. | Expansion of smart cities, AI-driven predictive security measures, and the need for autonomous security solutions drive growth. Security-as-a-service (SaaS) models emerge, enabling flexible security infrastructure adoption across industries. |

At a global level, there are several challenges of regulatory compliance, privacy problems, cybersecurity dangers, and the exceptionally high costs of the necessary equipment to run them smoothly. Worldwide governments enforce stringent security rules and data protection laws, and failing to comply with these laws may lead to legal fines and loss of reputation.

Cybersecurity threats are the actual danger, with connected screening systems being targets for hacking and data breaches. Infiltration into facial recognition databases or baggage screening systems without permission can compromise security and cause financial losses.

The limited use of advanced detection equipment such as X-ray machines and explosive detection systems in the developing regions is due to the high cost of these devices. The other factors are maintenance and the technical issue of obsolescence, which needed to decrease costs in the long term through the assignment of funds for renewal and enhancement.

Tier 1 Companies like Smiths Detection Group Ltd., Leidos Holdings Inc., and OSI Systems, Inc. are categorized as Tier 1 due to their expansive global operations, extensive product offerings, and dominant shares. These corporations provide a wide range of screening solutions, including X-ray scanners, metal detectors, CT-based imaging systems, and biometric verification technologies, catering to sectors such as aviation, border security, and critical infrastructure.

Their strong research and development capabilities drive continuous innovation, enabling them to adapt to emerging threats and regulatory requirements. Additionally, their well-established global distribution networks and strategic partnerships with governments and security agencies enhance their ability to deploy and maintain advanced solutions effectively across multiple regions.

Tier 2 Companies like 3DX-RAY Ltd., Teledyne Technologies Inc., and Analogic Corporation are classified as Tier 2 due to their strong presence and expertise in specialized technologies. These companies focus on developing advanced imaging, sensing, and detection solutions tailored for specific applications, such as portable X-ray scanners, computed tomography (CT) security systems, and high-resolution imaging for threat detection.

Their investment in cutting-edge technologies, such as AI-based threat detection and automated screening, positions them as key players in niche industries. While they may not have the same global reach as Tier 1 companies, their ability to innovate and provide customized security solutions enables them to remain competitive in the evolving security landscape.

Tier 3 Companies like Astrophysics Inc., Gilardoni S.p.A., Vanderlande Industries B.V., and Westminster International Ltd. are categorized as Tier 3 due to their specialized focus on certain segments or regional security needs. These companies develop tailored solutions, such as baggage screening systems, cargo inspection scanners, and screening services for critical infrastructure.

While they may have a limited global presence compared to Tier 1 and Tier 2 companies, they maintain a strong foothold in their respective industries by offering cost-effective, high-performance security solutions. Their focus on regional compliance, customer-centric innovations, and specialized security applications makes them key contributors to the broader industry.

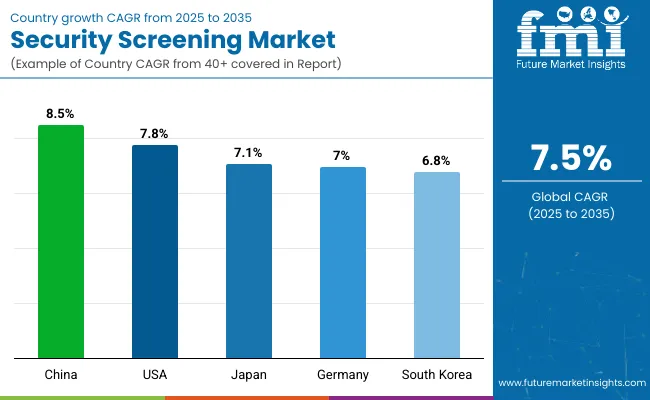

| Countries | CAGR |

|---|---|

| The USA | 7.8% |

| The UK | 6.5% |

| France | 6.2% |

| Germany | 7.0% |

| Italy | 5.8% |

| South Korea | 6.8% |

| Japan | 7.1% |

| China | 8.5% |

| Australia | 6.0% |

| New Zealand | 5.5% |

The USA is growing at a CAGR of 7.8% over the forecast period. Innovation is led by American companies incorporating sophisticated technologies such as biometrics and artificial intelligence into screening machines. USA companies spend heavily on R&D to create high-performance screening machines that comply with stringent federal and state regulations.

Local brands like Rapiscan Systems are leaders in developing and installing next-generation screening technology. Investors drive the growth by financing projects to improve security facilities at airports, transportation hubs, and key government buildings. Pro-activeness in response to emerging threats drives the growth, and firms innovate to offer quick, effective, and economical solutions.

The American industry is adopting data analytics and digitalization to improve threat detection to be accurate, make operations seamless, and reduce delays, developing a fertile ground for sustained technological development and customer-driven solutions.

Firms actively engage with technology startup firms and research institutions to spur innovative breakthrough screening technologies. Enhanced public-private partnerships and enhanced government expenditures strengthen the overall security infrastructure. Urban areas are evidence of quick modernization of infrastructure, and strong regulatory support ensures security standards are not compromised.

The focus for manufacturers is efficiency and sustainability as they create systems that can keep up with changing threats. Players focus on local as well as global projects to ensure that innovation and growth are the primary drivers. This thriving ecosystem provides a competitive platform where quality, reliability, and superior capabilities continue to raise new industry standards.

The CAGR of the UK from 2025 to 2035 is 6.5%. British companies formulate a competitive environment by embracing digital innovations and creating improved screening technologies. British companies spend money on new equipment that integrates traditional screening with cutting-edge digital analysis. World-famous companies such as Smiths Detection are founded here and have set high standards when it comes to offering integrated solutions to airports, stadiums, and government buildings.

The sector is supported by a strong regulatory system that calls for top-notch performance and security standards. The British industry aggressively seeks strategic alliances on a competitive basis, and producers drive technology limits to enable screening systems to respond to emerging security threats rapidly. The rapidly evolving environment supports a culture of rapid innovation, and investment in next-generation sensors and threat analysis based on data drives high growth.

Stakeholders are interested in increasing operational efficiency using smart analytics and cloud monitoring technologies. A research focus and cooperation enable British companies to bring innovative products that meet both domestic and international standards. Improved border protection, growing air transport, and growing public security issues test producers to strive towards sophisticated but user-friendly products.

Government-backed schemes financing technology advancement and stimulating security research also fuel the industry. This strategic emphasis stimulates the UK's leadership in security technology and lays a strong foundation for the future growth.

Over 2025 to 2035, France is expected to grow at a CAGR of 6.2%. French firms direct innovation and technical prowess toward providing cutting-edge screening solutions that integrate digital imaging, sensor fusion, and real-time threat assessment. Local brands such as Thales drive the creation of customized solutions for high-density public spaces, transport hubs, and mass gatherings.

French players focus on quality and accuracy through strict regulatory compliance and affordability. Active engagement of local producers, along with government incentives and substantial investment in infrastructure, pushes towards slow growth. Firms lead efforts to replace traditional screening systems with intelligent technology that raises detection levels and improves efficiency. France is focused on human-centric design and the smooth incorporation of new technology into current security systems.

The country's focus on technological excellence encourages manufacturers to employ sophisticated data analysis and machine learning for threat prediction and risk evaluation. Pilot programs for new screening technologies at key transportation hubs are funded by private and public sources, supporting an environment that encourages innovation.

French engineering and design tradition offers the ideal platform to tackle changing security issues in a timely manner, with the ability to implement newer technologies quickly. Ongoing technological advancements in system interoperability and efficiency drive the industry, and France has become a focal region for the development of global screening technologies.

Over 2025 to 2035, Germany is expected to grow at a 7.0% CAGR. German firms utilize their engineering accuracy and expertise, which are globally famous, to create robust screening solutions. Firms such as Rohde & Schwarz lead product innovation, creating systems that combine sophisticated sensor technology and real-time analysis. German manufacturers vigorously compete to improve quality and reliability with the implementation of stringent EU and national standards.

The economy is underpinned by collaborative industrial alliances and an entrepreneurial culture that encourages constant product innovation. German industries pursue a visionary strategy by introducing advanced scanning technology at airports, rail terminals, and border crossings in response to the growing demand for total security. This dynamic strategy leads to systems providing rapid threat detection and low false alarms, which is in line with the country's focus on operational excellence.

Companies invest in cutting-edge research facilities that investigate developments in sensor technology, digitalization, and automation. Solid home economy foundation and concentration on quality drive investments into screening hubs.

Enterprises cooperate with tech companies to complement their portfolios by adding cloud computing and big data analysis, lowering operation costs while maximizing efficiency. This supports growth in the marketplace and boosts Germany as an international source of advanced security solutions. Manufacturers continue to dominate product durability, user-driven design, and high performance, keeping the industry responsive and adaptable to new security threats.

Italy's CAGR from 2025 to 2035 is expected to be 5.8%. Italian manufacturers combine innovative design with technology innovation to create screening systems that meet varied security needs. Businesses seek to develop small, slender, and elegant devices ideal for airport, public building, and border crossing point applications. Local players like ItalGuard Technologies are at the forefront of using innovative technology that fuses local handiwork with sophisticated digital means.

The demand in the local industry fuels the growth by prioritizing energy efficiency, ergonomics, and simple integration of intelligent sensors. Domestic companies pride themselves on providing tailor-made products that meet the unique needs of local and local security agencies. The industry relies on a heritage of design excellence and can sustain product durability and performance through partnerships with technology startups.

The industry sustains steady expansion as producers replace existing systems with updated technology. Italian enterprises continuously participate in cooperative research activity with universities and industry specialists in order to achieve peak screening performance and system response.

Customer experience emphasis and product versatility enable the sector to align with changing operating and regulatory demands. Investment in digitalization, intelligent analytics, and integrated control systems leads to better threat detection and better user interfaces. This strategy keeps the Italian security screening sector competitive regionally and globally, blending innovation, design allure, and high performance to provide cutting-edge solutions.

South Korea is expected to grow at a CAGR of 6.8% over the forecast period. South Korean firms aggressively use cutting-edge technology in screening equipment, fueling the growth using advances in sensor technology, automation, and artificial intelligence-driven analytics. Domestic players such as Hanwha Techwin innovate through the provision of compact yet high-performance screening equipment to suit the demands of busy transport points, government institutions, and commercial zones.

The market is an expression of the country's aspiration for technological superiority and accelerated digitalization. Domestic producers invest in producing devices that are precise in threat detection, minimize false alarms, and optimize security procedures.

A visionary regulatory framework and strong government support further encourage investments in sophisticated security infrastructures. Companies align their strategy with global standards while making product modifications to address local security needs, emphasizing performance as well as dependability.

The industry is propelled by immense R&D investments that aim to combine intelligent analytics and hardware solutions. Domestic companies partner with research institutions and tech firms to create futuristic systems that come equipped with machine learning and Internet of Things (IoT) connectivity. Growth in urbanization and heightened public security issues fuel demand for future-proof screening technologies in transport and key infrastructure.

The players in the industry invest in modular and scalable solutions that can easily adjust to evolving security risks. With cross-industry collaboration between the public and private sectors to create safety features, the changing nature of the industry fuels ongoing product enhancement and development, further positioning South Korea as the leader in ground-breaking technologies.

Over 2025 to 2035, Japan is expected to grow at a CAGR of 7.1%. Japanese companies leverage their precision engineering and robotics expertise to provide screening systems that are fast and accurate. Local players like NEC Corporation and other technology leaders innovate relentlessly by combining intelligent imaging sensors, robots, and smart software into security systems.

The industry draws strength from the depth of Japan's technology base and its emphasis on close quality control. Local producers consistently develop systems in a bid to streamline airport security processes and events within urban environments so that threats can be detected faster and safety upgraded. Reliability, efficiency, and simplicity are values that make companies achieve local regulatory standards.

The country invests in robust R&D initiatives that integrate robotics with artificial intelligence and sensor technology. This emphasis leads to systems that improve operation effectiveness and minimize the potential for human error while conducting threat analysis. Japanese manufacturers strongly collaborate with technology startups and research institutions to make their products always cutting-edge.

The emphasis on cyber-physical integration, data analytics, and automation enables the development of security solutions that are not only adaptive but also resilient. Firms leverage cutting-edge technologies to provide end-to-end solutions that constantly evolve against emerging threats, solidifying Japan's leadership in security screening.

The Chinese security screening market will grow at a CAGR of 8.5% over the forecast period. Chinese firms propel fast growth through the adoption of cutting-edge technologies and rationalized production at scale. Domestic leading brands like Hikvision are moving ahead with the roll-out of intelligent cameras, AI-enabled analytics, and sophisticated sensor networks into security screening technology.

There is a high growth as companies concentrate on low-cost, high-volume production, meeting domestic and international demand. The wave of urbanization, increasing transportation infrastructure, and increasing focus on public security drive investment in advanced screening equipment.

Home-grown companies stress technology convergence and interoperability for screening equipment to rapidly respond to changing security risks. Aggressive R&D expenditure is the strength behind the industry's capacity for introducing disruptive innovations based on speed, accuracy, and reliability.

The government finances modernization initiatives and infrastructure upgrades that integrate next-generation screening technology in key airports, railroad terminals, and public areas. Companies take advantage of the nation's sophisticated digital environment and strong manufacturing capacity to reduce costs and enhance product quality.

The competitive environment propels ongoing innovation in system design and performance, and companies invest in the implementation of big data analytics and cloud computing into their offerings. With the industry reacting to mounting security challenges, Chinese companies have established new standards for innovation and operational excellence. This dynamic marketplace positions China as a focal point for the innovation and export of advanced security screening technologies.

Australia is expected to grow at a CAGR of 6.0% over the forecast period. Australian firms wholeheartedly adopt innovation by incorporating advanced technologies like digital imaging, intelligent sensors, and automated screening equipment into their product lines. Local rivals like SafeGuard Australia drive expansion by emphasizing clean, intuitive solutions for dealing with the specific security needs present in crowded transit points, airports, and border checkpoints.

The industry grows steadily as operators upgrade antiquated systems and invest in secure facilities. Australian manufacturers emphasize product reliability, fast threat detection, and ease of integration with existing security. Robust state support, in addition to increased public awareness of security, spurs investments in the latest screening technology. Businesses further gain from coherent rules of regulation and incentives for R&D of cutting-edge security technology.

The industry capitalizes on domestic engineering and digital technology skills to import systems that manage city and country security challenges. Industry players actively partner with technology companies and research institutions to roll out intelligent analytics and IoT-enabled devices that enhance performance and lower operating expenses.

Workforce development and technology refresh investments enable strong ecosystems to address changing customer needs and regulatory requirements. This vision-driven strategy enables Australian businesses to leverage new opportunities, push export boundaries, and dominate cutting-edge security screening technologies.

New Zealand is expected to grow at a CAGR of 5.5% during 2025 to 2035. The industry in New Zealand gains momentum gradually as domestic businesses create niche screening solutions for airports, seaports, and border terminals. New local brands like KiwiSecure Innovations start innovations that integrate conventional screening practices with innovative digital features.

The market specializes in minimalistic designs and budget-friendly solutions that suit small-scale and large security projects. Domestic producers seek to upgrade installed bases to obtain upgraded safety solutions, including intelligent sensors and analytics to enhance detection effectiveness.

Businesses tenaciously pursue new practices that combine cloud-based monitoring and automated threat evaluation into security screening processes. Industry players emphasize customer-focused solutions tuned to regional issues to ensure international standards of security.

Synergy, by virtue of robust local technical competence, government policies, and partner alliances, propels a buoyant environment for security technology innovation. As New Zealand continues to strengthen its reputation as a secure source of adaptable and dependable screening technologies, the market stands poised to capitalize on future innovations in a changing global security environment.

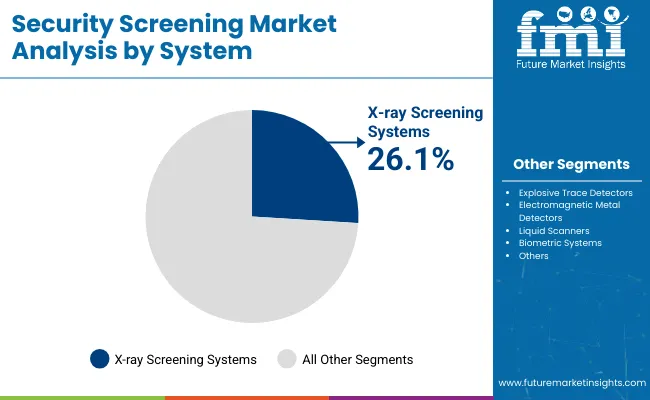

| System | Share (2025) |

|---|---|

| X-Ray Screening Systems | 26.1% |

The industry is predominantly characterized by the use of x-ray screening systems, which occupied a 26.1% share in 2025 owing to the large-scale deployment of these devices at aviation checkpoints, border security terminals, and critical infrastructure protection facilities. Systems used for this purpose offer high-resolution imaging to detect weapons, explosives, narcotics, and other contraband, ensuring adherence to international security measures.

Airports are the largest adoption segment, and regulatory bodies, including the TSA, IATA, and ICAO, impose comprehensive screening protocols. Advancements in dual-energy X-ray technology and computed tomography (CT) scanning that can more effectively identify threats are also driving demand.

Explosive Trace Detectors accounted for 18.4% of the market in 2025 as they are increasingly used for the detection of trace explosives on persons, baggage, and cargo. These devices are ubiquitous, found in airports, government buildings and border checkpoints amid increased fears about terrorism and smuggling.

To enhance aviation security, regulatory bodies such as the USA Department of Homeland Security (DHS) and the European Civil Aviation Conference (ECAC) call for the implementation of ETD.

The increasing acceptance of powered and handheld ETD devices is primarily due to innovative solutions by leading manufacturers like Smiths Detection, Rapiscan, and Bruker, which integrate machine-learning powered detection algorithms to deliver more accurate and efficient results. The increasing use of ETDs in military, defense, and law enforcement is also fueling rapid growth, especially as governments channel funds into automated and AI system-based solutions for security screening.

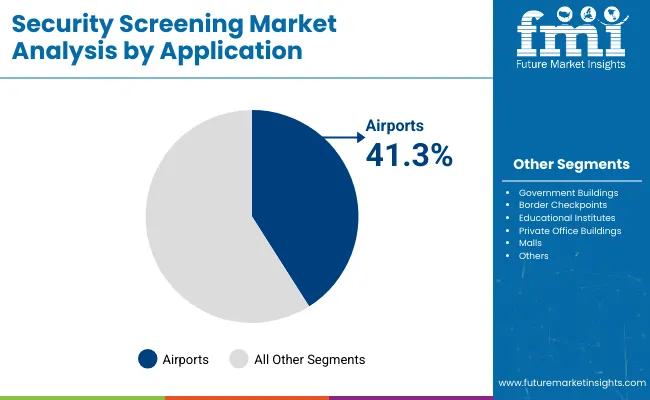

| Application | Share(2025) |

|---|---|

| Airports | 41.3% |

With the increasing global air passenger traffic, new types of security threats find themselves growing its extensive set of regulatory requisites; the airport security screening segment is observed to capture the largest share of 41.3% in 2025.

To enhance safety and operational efficiency, regulatory authorities (i.e., TSA (USA), IATA and ICAO) require full-body scanners for the screening of passengers, advanced screening techniques like computed tomography (CT) scanners for the screening of checked bags and artificial intelligence (AI) powered automated screening lanes.

Due to time-consuming conventional X-ray screenings leading to increased passenger wait times, airports, including Heathrow, JFK, and Dubai International, have turned towards advanced security infrastructure investments in next-generation scanning solutions to better balance the imperative of lowering passenger wait times while further boosting detection accuracy. The importance of airport security is only set to increase with the increasing implementation of biometric authentication and AI-driven threat detection systems such as facial recognition and behavior analysis.

Border security screening will represent 29.6% of the total segment in 2025 and achieve a CAGR of 7.7% against all security screening markets. Increasing cross-border trade, migration, and geopolitical tensions are fueling investments in X-ray cargo scanners, Non-intrusive inspection (NII) systems, and biometric verification technologies.

Governments worldwide, from USA Customs and Border Protection (CBP) to the European Border and Coast Guard Agency (Frontex), are introducing AI-optimized monitoring and automation to help keep borders safe through threat Identification systems.

The Security Screening Market is expanding at a rapid rate because these governments have adopted AI-powered threat detection, automated screening, and biometric authentication technologies in transportation hubs and critical infrastructure facilities. Rising global security threats and stricter regulatory mandates have increased demand for advanced X-ray systems, millimeter-wave scanners, and real-time analytics solutions in airports, border control, and high-security locales.

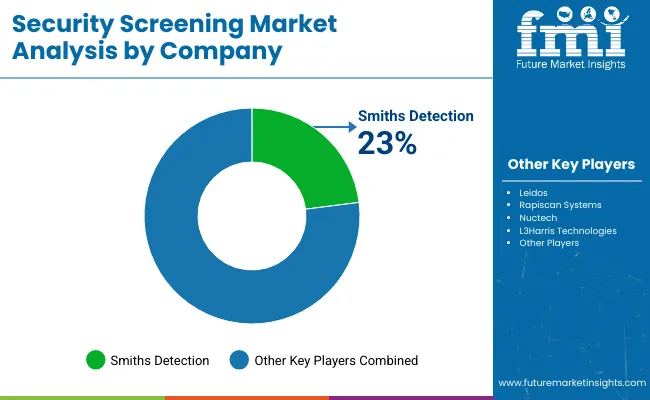

Major players in the domain include Smiths Detection, Leidos, Rapiscan Systems, Nuctech, and L3Harris Technologies-all being well entrenched by comprehensive portfolios within security screening, AI imaging innovations, as well as strong government contracts. Incoming players would focus mostly on biometric authentication, machine learning-based anomaly detection, and compact mobile screening solutions to gain some share in the competition.

Advancing 3D CT scans and AI heightening object recognition, as well as the threat assessment platforms integrated into the cloud would make the evolutionary market. The development of automated screening lanes, remote security monitoring, and non-intrusive inspection technologies would advance efficiencies alongside passenger throughput.

The strategic aspects driving competitive actions include compliance with the matrix of ever-changing security regulations, proliferation into important, at-risk public spaces, and integrated AI and IoT-enabled security systems. Any firm investing in next-generation detection capability, cybersecurity integration, and collaborative partnerships with regulatory agencies has strategic potential. They would park themselves in a competitive nook within this vibrant security-actioned landscape.

| Company Name | Estimated Market Share (%) |

|---|---|

| Smiths Detection Group Ltd. | 20-25% |

| Leidos Holdings Inc. | 15-20% |

| Rapiscan Systems | 10-15% |

| Nuctech | 8-12% |

| L3Harris Technologies | 5-10% |

| Other Companies (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Smiths Detection Group Ltd. | Leading provider of airport baggage screening, explosive detection systems, and AI-powered threat detection. |

| Leidos Holdings Inc. | Specializes in automated security checkpoints, real-time AI-based screening solutions, and government security contracts. |

| Rapiscan Systems | Focuses on baggage and cargo screening, people screening, and radiation detection solutions. |

| Nuctech | Develops X-ray imaging, baggage scanning, and advanced trace detection technologies. |

| L3Harris Technologies | Provides high-speed explosive detection systems, perimeter security, and AI-driven scanning solutions. |

Smiths Detection Group Ltd. (20-25%)

Industry leader in threat detection using AI, explosives screening, and aviation security solutions.

Leidos Holdings Inc. (15-20%)

The company leads in automated checkpoint solutions and AI-based screening solutions and specializes in government security and border protection contracts.

Rapiscan Systems (10-15%)

Rapiscan is engaged in baggage, cargo, and radiation detection solutions for airports and border security.

Nuctech (8-12%)

Nuctech leads the industry in baggage scanning, cargo inspection, and trace detection technology, mainly in Asian markets.

L3Harris Technologies (5-10%)

L3Harris offers explosive detection, perimeter protection, and swift screening technologies for government agencies and transport hubs.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 10.9 billion |

| Projected Market Size (2035) | USD 22.4 billion |

| CAGR (2025 to 2035) | 7.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and thousand units for volume |

| Systems Analyzed (Segment 1) | X-ray Screening Systems, Explosive Trace Detectors, Electromagnetic Metal Detectors, Liquid Scanners, Biometric Systems (Face Recognition, Voice Recognition, Fingerprint Recognition, Iris Recognition) |

| Applications Analyzed (Segment 2) | Airports, Government Buildings, Border Checkpoints, Educational Institutes, Private Office Buildings, Malls, Others |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players influencing the Security Screening Market | Smiths Detection Group Ltd., Leidos Holdings Inc., Rapiscan Systems, Nuctech, L3Harris Technologies, OSI Systems Inc., 3DX-RAY Ltd., Teledyne Technologies Inc., Analogic Corporation, Astrophysics Inc., Gilardoni S.p.A., Vanderlande Industries B.V., Westminster International Ltd. |

| Additional Attributes | Airport security investment expansion, Integration of biometric solutions for seamless travel, Adoption of AI and threat detection algorithms in real-time, Evolving privacy regulations and standards for public screening, Regional risk exposure influencing scanning system demand |

| Customization and Pricing | Customization and Pricing Available on Request |

By system, the market is segmented into X-ray screening systems, explosive trace detectors, electromagnetic metal detectors, liquid scanners, and biometric systems (face recognition, voice recognition, fingerprint recognition, and iris recognition).

By application, the market includes airports, government buildings, border checkpoints, educational institutes, private office buildings, malls, and others.

In terms of region, the market spans North America, Latin America, Europe, Asia Pacific, and the Middle East and Africa.

The security screening industry is slated to reach USD 10.9 billion in 2025.

The industry is predicted to reach a size of USD 22.4 billion by 2035.

Key companies include Smiths Detection Group Ltd., Leidos Holdings Inc., OSI Systems, Inc., 3DX-RAY Ltd., Teledyne Technologies Inc., Analogic Corporation, Astrophysics Inc., Gilardoni S.p.A., Vanderlande Industries B.V., and Westminster International Ltd.

China, slated to grow at a CAGR of 8.1% during the forecast period, is poised for the fastest growth.

X-ray screening systems are among the most widely used security screening systems.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by System, 2019 to 2034

Table 4: Global Market Volume (Units) Forecast by System, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 6: Global Market Volume (Units) Forecast by Application, 2019 to 2034

Table 7: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 8: North America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by System, 2019 to 2034

Table 10: North America Market Volume (Units) Forecast by System, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 12: North America Market Volume (Units) Forecast by Application, 2019 to 2034

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: Latin America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 15: Latin America Market Value (US$ Million) Forecast by System, 2019 to 2034

Table 16: Latin America Market Volume (Units) Forecast by System, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 18: Latin America Market Volume (Units) Forecast by Application, 2019 to 2034

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 21: Western Europe Market Value (US$ Million) Forecast by System, 2019 to 2034

Table 22: Western Europe Market Volume (Units) Forecast by System, 2019 to 2034

Table 23: Western Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 24: Western Europe Market Volume (Units) Forecast by Application, 2019 to 2034

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 27: Eastern Europe Market Value (US$ Million) Forecast by System, 2019 to 2034

Table 28: Eastern Europe Market Volume (Units) Forecast by System, 2019 to 2034

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 30: Eastern Europe Market Volume (Units) Forecast by Application, 2019 to 2034

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2019 to 2034

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by System, 2019 to 2034

Table 34: South Asia and Pacific Market Volume (Units) Forecast by System, 2019 to 2034

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 36: South Asia and Pacific Market Volume (Units) Forecast by Application, 2019 to 2034

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 38: East Asia Market Volume (Units) Forecast by Country, 2019 to 2034

Table 39: East Asia Market Value (US$ Million) Forecast by System, 2019 to 2034

Table 40: East Asia Market Volume (Units) Forecast by System, 2019 to 2034

Table 41: East Asia Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 42: East Asia Market Volume (Units) Forecast by Application, 2019 to 2034

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2019 to 2034

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by System, 2019 to 2034

Table 46: Middle East and Africa Market Volume (Units) Forecast by System, 2019 to 2034

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 48: Middle East and Africa Market Volume (Units) Forecast by Application, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by System, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Application, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 5: Global Market Volume (Units) Analysis by Region, 2019 to 2034

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 8: Global Market Value (US$ Million) Analysis by System, 2019 to 2034

Figure 9: Global Market Volume (Units) Analysis by System, 2019 to 2034

Figure 10: Global Market Value Share (%) and BPS Analysis by System, 2024 to 2034

Figure 11: Global Market Y-o-Y Growth (%) Projections by System, 2024 to 2034

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 13: Global Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 16: Global Market Attractiveness by System, 2024 to 2034

Figure 17: Global Market Attractiveness by Application, 2024 to 2034

Figure 18: Global Market Attractiveness by Region, 2024 to 2034

Figure 19: North America Market Value (US$ Million) by System, 2024 to 2034

Figure 20: North America Market Value (US$ Million) by Application, 2024 to 2034

Figure 21: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 23: North America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 26: North America Market Value (US$ Million) Analysis by System, 2019 to 2034

Figure 27: North America Market Volume (Units) Analysis by System, 2019 to 2034

Figure 28: North America Market Value Share (%) and BPS Analysis by System, 2024 to 2034

Figure 29: North America Market Y-o-Y Growth (%) Projections by System, 2024 to 2034

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 31: North America Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 34: North America Market Attractiveness by System, 2024 to 2034

Figure 35: North America Market Attractiveness by Application, 2024 to 2034

Figure 36: North America Market Attractiveness by Country, 2024 to 2034

Figure 37: Latin America Market Value (US$ Million) by System, 2024 to 2034

Figure 38: Latin America Market Value (US$ Million) by Application, 2024 to 2034

Figure 39: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 44: Latin America Market Value (US$ Million) Analysis by System, 2019 to 2034

Figure 45: Latin America Market Volume (Units) Analysis by System, 2019 to 2034

Figure 46: Latin America Market Value Share (%) and BPS Analysis by System, 2024 to 2034

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by System, 2024 to 2034

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 49: Latin America Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 52: Latin America Market Attractiveness by System, 2024 to 2034

Figure 53: Latin America Market Attractiveness by Application, 2024 to 2034

Figure 54: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 55: Western Europe Market Value (US$ Million) by System, 2024 to 2034

Figure 56: Western Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 57: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 62: Western Europe Market Value (US$ Million) Analysis by System, 2019 to 2034

Figure 63: Western Europe Market Volume (Units) Analysis by System, 2019 to 2034

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by System, 2024 to 2034

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by System, 2024 to 2034

Figure 66: Western Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 67: Western Europe Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 70: Western Europe Market Attractiveness by System, 2024 to 2034

Figure 71: Western Europe Market Attractiveness by Application, 2024 to 2034

Figure 72: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 73: Eastern Europe Market Value (US$ Million) by System, 2024 to 2034

Figure 74: Eastern Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by System, 2019 to 2034

Figure 81: Eastern Europe Market Volume (Units) Analysis by System, 2019 to 2034

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by System, 2024 to 2034

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by System, 2024 to 2034

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 85: Eastern Europe Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 88: Eastern Europe Market Attractiveness by System, 2024 to 2034

Figure 89: Eastern Europe Market Attractiveness by Application, 2024 to 2034

Figure 90: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 91: South Asia and Pacific Market Value (US$ Million) by System, 2024 to 2034

Figure 92: South Asia and Pacific Market Value (US$ Million) by Application, 2024 to 2034

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by System, 2019 to 2034

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by System, 2019 to 2034

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by System, 2024 to 2034

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by System, 2024 to 2034

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 106: South Asia and Pacific Market Attractiveness by System, 2024 to 2034

Figure 107: South Asia and Pacific Market Attractiveness by Application, 2024 to 2034

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 109: East Asia Market Value (US$ Million) by System, 2024 to 2034

Figure 110: East Asia Market Value (US$ Million) by Application, 2024 to 2034

Figure 111: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 116: East Asia Market Value (US$ Million) Analysis by System, 2019 to 2034

Figure 117: East Asia Market Volume (Units) Analysis by System, 2019 to 2034

Figure 118: East Asia Market Value Share (%) and BPS Analysis by System, 2024 to 2034

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by System, 2024 to 2034

Figure 120: East Asia Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 121: East Asia Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 124: East Asia Market Attractiveness by System, 2024 to 2034

Figure 125: East Asia Market Attractiveness by Application, 2024 to 2034

Figure 126: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 127: Middle East and Africa Market Value (US$ Million) by System, 2024 to 2034

Figure 128: Middle East and Africa Market Value (US$ Million) by Application, 2024 to 2034

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by System, 2019 to 2034

Figure 135: Middle East and Africa Market Volume (Units) Analysis by System, 2019 to 2034

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by System, 2024 to 2034

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by System, 2024 to 2034

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 139: Middle East and Africa Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 142: Middle East and Africa Market Attractiveness by System, 2024 to 2034

Figure 143: Middle East and Africa Market Attractiveness by Application, 2024 to 2034

Figure 144: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Security Tape Market Size and Share Forecast Outlook 2025 to 2035

Security Alarm Communicator Market Size and Share Forecast Outlook 2025 to 2035

Security and Vulnerability Management Market Forecast and Outlook 2025 to 2035

Security Holograms Market Size and Share Forecast Outlook 2025 to 2035

Security Paper Market Size and Share Forecast Outlook 2025 to 2035

Security System Tester Market Size and Share Forecast Outlook 2025 to 2035

Security Advisory Services Market Size and Share Forecast Outlook 2025 to 2035

Security Room Control Market Size and Share Forecast Outlook 2025 to 2035

Security Cameras (IR Illuminator) Market Size and Share Forecast Outlook 2025 to 2035

Security Operation Centre as a Service Market Size and Share Forecast Outlook 2025 to 2035

Security Robots Market Size and Share Forecast Outlook 2025 to 2035

Security Service Edge Market Size and Share Forecast Outlook 2025 to 2035

Security and Surveillance Equipment Market Size and Share Forecast Outlook 2025 to 2035

Security Orchestration Automation and Response (SOAR) Market Size and Share Forecast Outlook 2025 to 2035

Security Bags Market Size and Share Forecast Outlook 2025 to 2035

Security Bottles Market Size and Share Forecast Outlook 2025 to 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Security Labels Market Analysis by Product Type, Material, Pattern, Application, End-Use Industry, and Region Through 2035

Market Share Breakdown of Security Bags Manufacturers

Market Share Insights for Security Tape Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA